Create Free Online Invoices with Our Easy Template Maker

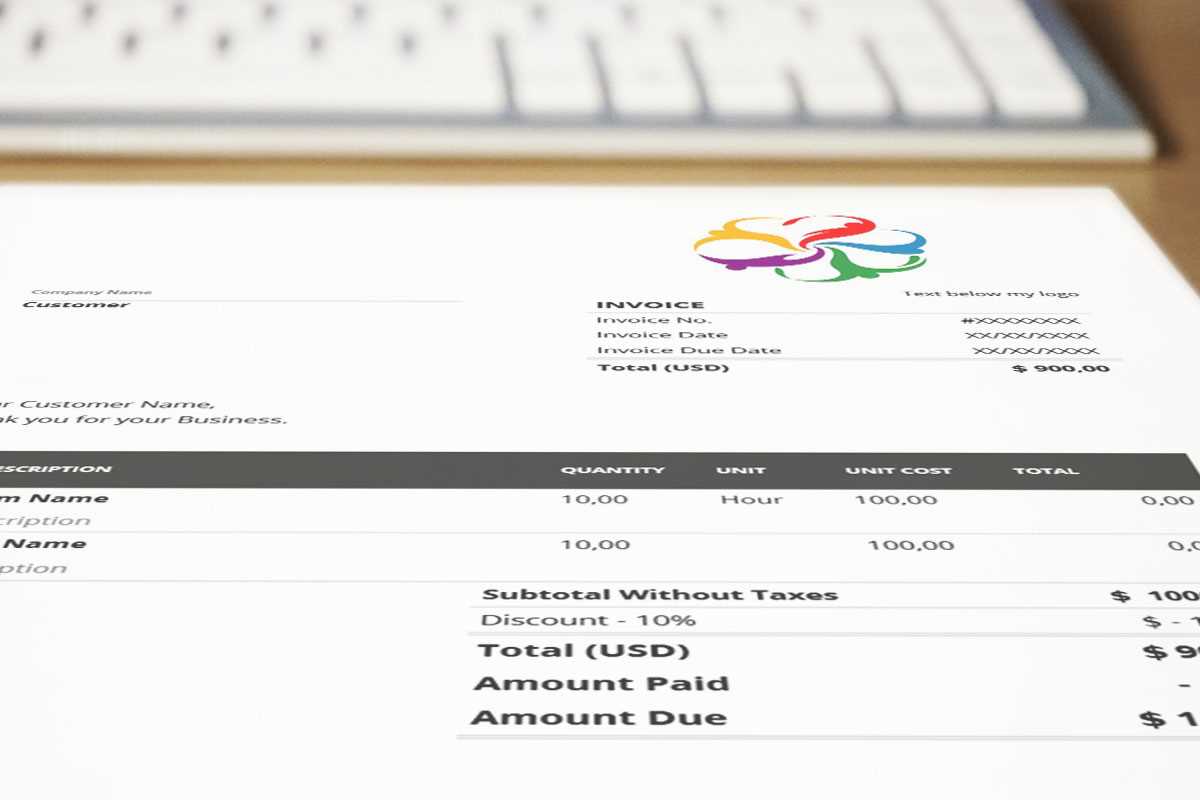

Managing your business finances can be time-consuming, especially when it comes to creating documents for payments. A simple yet effective solution allows you to generate professional, customized bills in just a few steps. These tools eliminate the need for complicated software or manual formatting, providing a straightforward way to ensure your clients receive accurate, polished records every time.

With the right tool, you can tailor each document to suit your business needs, from adjusting the layout to adding your brand’s logo. Whether you’re a freelancer or a small business owner, having access to flexible options makes it easy to stay organized and maintain a consistent professional image. Say goodbye to the hassle of starting from scratch each time you need to request payment.

Instead of focusing on tedious details, you can prioritize what really matters: delivering high-quality services and managing client relationships. With a user-friendly platform, creating payment requests becomes a task you can complete quickly and confidently, ensuring a smoother workflow for your business.

Why Use an Online Invoice Maker

Generating professional payment requests doesn’t need to be complicated or time-consuming. Using a specialized tool designed for creating financial documents offers a more efficient and streamlined approach to managing your billing needs. These platforms provide easy-to-use features that help you quickly produce polished statements, saving you valuable time and reducing the risk of errors in your records.

Efficiency and Convenience

One of the key reasons to use a digital platform for creating payment requests is the convenience it offers. Traditional methods often involve complicated formatting or the need for additional software, but with a dedicated tool, the process is simplified. You can produce a finished document in just a few clicks.

- Fast document generation

- Customizable features to suit your business

- No need for complex design skills

- Instant access from any device

Accuracy and Professionalism

With a well-designed platform, you eliminate the risk of common mistakes that can occur when creating documents manually. These tools automatically format content, making sure the layout is consistent and professional-looking. This ensures your clients receive high-quality statements that reflect well on your business.

- Pre-built layouts reduce errors

- Automatic calculation of totals and taxes

- Consistent design across all documents

Benefits of Customizable Invoice Templates

The ability to modify payment documents to fit your unique business needs can make a significant difference in the way you manage your finances. Customizable options allow you to adapt the design, layout, and content, ensuring that each bill reflects your brand and specific requirements. This flexibility not only saves time but also helps create a more professional image in the eyes of your clients.

Brand Consistency

One of the major advantages of customizable documents is the ability to incorporate your business’s visual identity. By adding your company logo, selecting specific fonts, and adjusting color schemes, you can create a cohesive look that aligns with your overall branding. This consistent appearance boosts credibility and fosters trust with your clients.

- Enhances brand recognition by featuring your logo and colors

- Improves professionalism through well-crafted and personalized layouts

- Strengthens client relationships by maintaining a cohesive business image

Flexibility and Control

Another key benefit is the flexibility to adjust each document as needed. Whether you want to include detailed breakdowns of services, offer discounts, or add personalized notes, customizable tools give you full control over the content. This means you can tailor each request to reflect the specifics of every transaction, making it easier to communicate important details to your clients.

- Complete control over layout and content

- Easy adjustments for different types of clients and projects

- Clear presentation of payment terms and additional notes

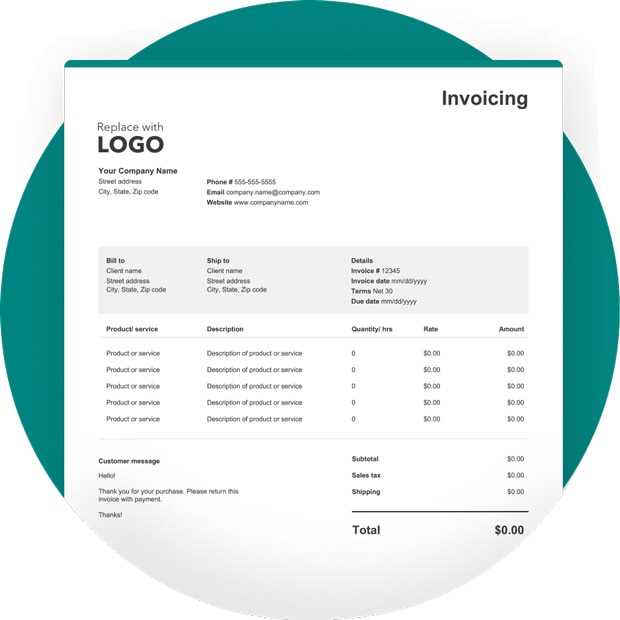

How to Create Invoices in Minutes

Creating a polished billing document quickly is easier than you might think. With the right tools, the entire process can be streamlined to ensure you spend less time on paperwork and more time focusing on your business. By following a few simple steps, you can generate a professional statement in just a few minutes, regardless of your design or technical skills.

Here’s a step-by-step guide to help you create accurate and attractive payment requests quickly:

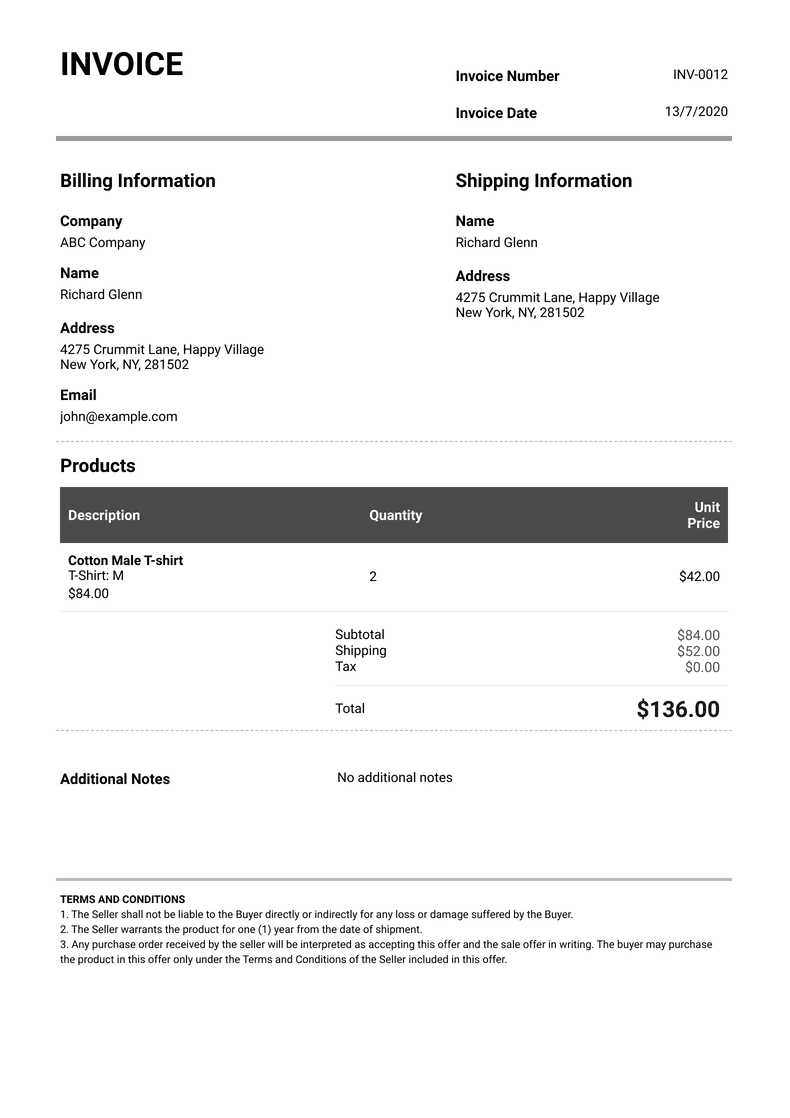

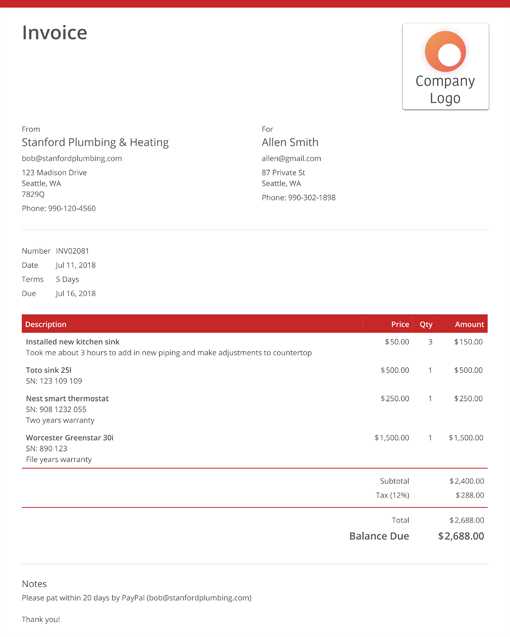

| Step | Description |

|---|---|

| 1. Select a Pre-designed Layout | Choose a simple, clean layout that suits your needs. Most tools offer a variety of options to get you started. |

| 2. Input Business Information | Fill in your company name, contact details, and payment instructions. This ensures that all necessary information is clear to the recipient. |

| 3. Add Client Details | Enter your client’s name, address, and contact info. Personalizing this part ensures clarity and accuracy. |

| 4. List Products or Services | Detail the items or services provided, along with their individual prices and quantities. |

| 5. Calculate Totals | The system automatically calculates the total amount due, including taxes and any discounts. |

| 6. Review and Customize | Check for any errors, and make any adjustments needed. You can also add notes or payment terms here. |

| 7. Save and Send | Once everything looks good, save the document and send it to your client via email or your preferred method. |

By following these simple steps, you can generate a professional, clear request for payment in just minutes. The process is designed to be intuitive, allowing you to focus on delivering great service without getting bogged down in paperwork.

Save Time with Free Invoice Tools

Time is a valuable resource, and using the right tools to streamline administrative tasks can make a significant difference in how efficiently you run your business. Instead of spending hours manually creating bills or financial statements, digital tools allow you to generate documents quickly with minimal effort. These platforms are designed to simplify the process, saving you time and allowing you to focus on other important tasks.

By eliminating the need for complex software or manual calculations, these tools help you produce polished documents in a fraction of the time. You don’t have to worry about formatting or keeping track of due dates manually. With just a few clicks, you can create and send detailed billing statements that are both accurate and professional.

Key Time-Saving Features

- Pre-made designs: Start with a ready-to-use structure that requires only minor adjustments.

- Automatic calculations: The system instantly totals amounts, applies taxes, and calculates any discounts.

- Customizable fields: Quickly add or remove items, services, and additional information as needed.

- Instant saving and sending: Save documents with ease and send them directly to clients without delays.

- Cloud access: Access your billing documents anytime, anywhere, from any device.

These time-saving features ensure that you spend less time on administrative tasks and more time growing your business. By using simple, effective tools, you can handle your financial documentation with ease, making your workflow more efficient and your operations smoother.

Top Features of Invoice Template Makers

Creating professional documents for business transactions is crucial, and having the right tools to generate them quickly and efficiently can make a significant difference. These tools offer a wide range of functionalities designed to simplify the process of preparing financial records, ensuring that they are both accurate and visually appealing. The features included in such platforms can streamline your workflow and save you valuable time.

Customization Options are one of the most valuable aspects of these tools. Users can tailor the layout, colors, and overall design to match their branding. This flexibility ensures that each document aligns with a business’s unique identity, while still maintaining a professional appearance.

Automatic Calculations eliminate the need for manual arithmetic, reducing the chances of errors. Most tools include built-in formulas that automatically compute totals, taxes, discounts, and other essential figures, which helps save time and improve accuracy.

Multiple Format Support is another key feature. Users can download their completed documents in a variety of formats, such as PDF, Word, or Excel, depending on their needs. This adaptability makes sharing and printing documents easy and ensures compatibility with various systems.

Cloud Storage Integration allows users to store their documents securely and access them from anywhere. This feature is especially useful for businesses that need to maintain records over time and across multiple devices.

Pre-built Designs offer ready-made layouts that can be further adjusted to suit individual requirements. These designs are professionally crafted, making it easy for users to produce high-quality documents without needing graphic design expertise.

Client Management features allow businesses to keep track of customer information and transaction history. This helps users generate personalized documents quickly by recalling past details, saving time on data entry and reducing mistakes.

Incorporating these features into a single tool can significantly enhance the efficiency and effectiveness of document generation, helping businesses stay organized and professional with minimal effort.

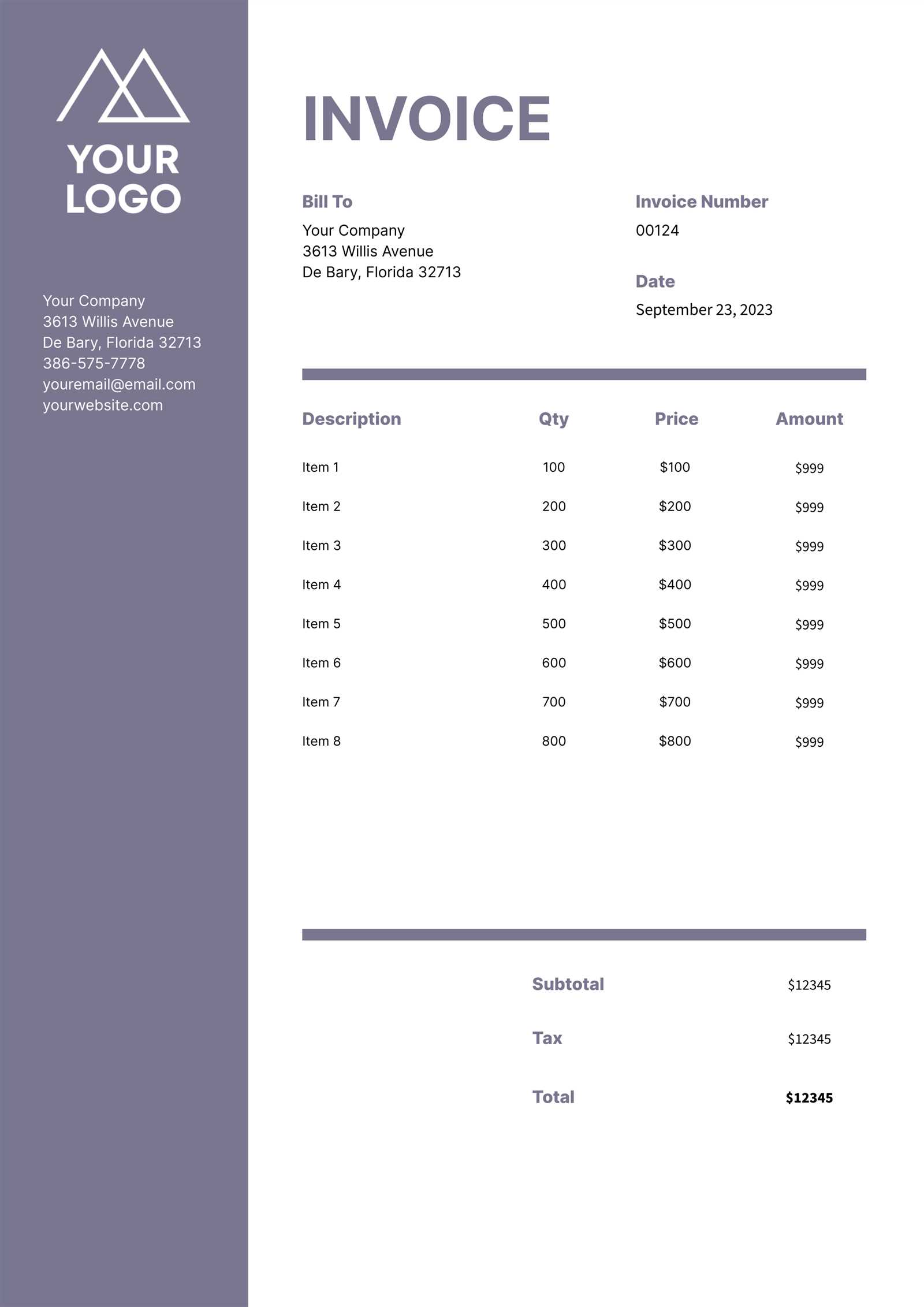

Choosing the Right Invoice Design

Selecting an appropriate design for your business documents is essential for creating a professional and consistent appearance. A well-chosen layout not only helps convey important financial details clearly but also reinforces your brand identity. The right design can leave a lasting impression on clients and foster trust in your business. There are several factors to consider when making this decision, from the aesthetic appeal to the functional aspects that suit your particular needs.

Key Elements to Consider

- Clarity and Simplicity: The layout should be easy to read and understand. Avoid cluttered designs that could confuse or overwhelm the recipient. A clean, minimalist approach often works best for conveying key details effectively.

- Brand Consistency: Your design should reflect your company’s visual identity. Incorporating your logo, color scheme, and fonts can help ensure the document aligns with your overall branding.

- Spacing and Organization: Proper use of space between sections, headings, and data points will make the document more navigable. Prioritize logical flow and ensure that important information is easy to locate.

- Professional Appearance: Whether you choose a modern or traditional style, the design should convey professionalism. Avoid overly casual or decorative elements that could detract from the seriousness of the content.

Customizing the Layout

- Pre-designed Layouts: Many platforms offer pre-designed layouts that you can easily customize to suit your needs. These designs are created by professionals and provide a good starting point for those who need a polished look without much effort.

- Flexible Sections: Depending on the type of transaction, you may need different sections (e.g., item descriptions, terms, or payment instructions). Choose a design that allows easy modification to include or remove certain elements as necessary.

- Use of Color: Colors can play a key role in enhancing readability and drawing attention to key areas. Use contrasting shades to differentiate between sections and highlight critical information like total amounts or due dates.

In the end, the right choice depends on your specific business needs and the impression you wish to make. A clean, well-organized document design that is easy to navigate and aligns with your brand will always have a positive impact on clients and customers.

Free vs Paid Invoice Template Services

When it comes to generating business documents, there are two main options: using no-cost platforms or opting for paid services. Each option offers its own advantages and disadvantages, depending on the user’s needs, budget, and long-term goals. While free platforms can be a quick and cost-effective solution, paid services often provide a broader range of features and higher levels of customization. Understanding the key differences between these two choices can help you make an informed decision for your business.

Advantages of No-Cost Platforms

- Cost-Efficiency: As expected, the main benefit of using free services is the absence of financial commitment. Small businesses or startups with limited budgets can take advantage of these platforms without worrying about subscription fees or hidden charges.

- Ease of Use: Free services often feature simple and intuitive interfaces, making them easy to navigate for users who need quick solutions without technical expertise.

- Basic Features: Many no-cost platforms offer enough essential functionality to generate basic documents efficiently, with standard layouts and simple formatting options.

Benefits of Paid Platforms

- Advanced Customization: Paid services generally allow greater control over design elements. You can customize fonts, colors, and layouts to create a document that perfectly reflects your brand’s identity.

- Additional Features: Paid solutions often include valuable features such as automated calculations, client management tools, and integration with accounting software. These features streamline your workflow and help manage multiple tasks more efficiently.

- Customer Support: With a paid subscription, you usually gain access to priority customer support, ensuring that you can resolve issues quickly and without hassle.

- Increased Security: Paid platforms often offer better data protection and security measures, providing peace of mind when handling sensitive financial information.

Ultimately, the choice between free and paid services comes down to your specific needs. If you only require basic functionality and have limited financial resources, free platforms may be the ideal choice. However, if you need a more robust, professional solution with added features, investing in a paid service can provide long-term value for your business.

Easy Invoice Editing and Customization

The ability to quickly edit and personalize business documents is a crucial feature for any company. Whether you’re adjusting a few details or fully redesigning a layout, having intuitive and flexible tools makes the process more efficient. Simple customization options allow businesses to align their documents with their brand and adjust them to meet unique needs without unnecessary complexity.

- Simple Interface: Most platforms provide user-friendly interfaces that allow for quick edits, enabling users to change text, adjust layouts, or add new sections without technical knowledge.

- Drag-and-Drop Functionality: Many tools offer drag-and-drop features, making it easy to rearrange sections or insert new elements like logos, payment terms, or item descriptions with just a few clicks.

- Pre-set Styles and Fonts: Built-in styles and font options enable quick formatting, allowing businesses to match their documents to their brand’s identity without needing graphic design skills.

- Real-Time Previews: Instant previews of changes ensure you can see exactly how the document will appear, helping avoid mistakes and ensuring everything is correct before finalizing.

- Flexible Fields: Editable fields allow for the easy inclusion of specific details, such as client information, dates, or transaction descriptions, giving users full control over what is displayed.

These customization tools not only save time but also help create documents that are both professional and reflective of your brand’s unique style, all while maintaining a streamlined and efficient editing process.

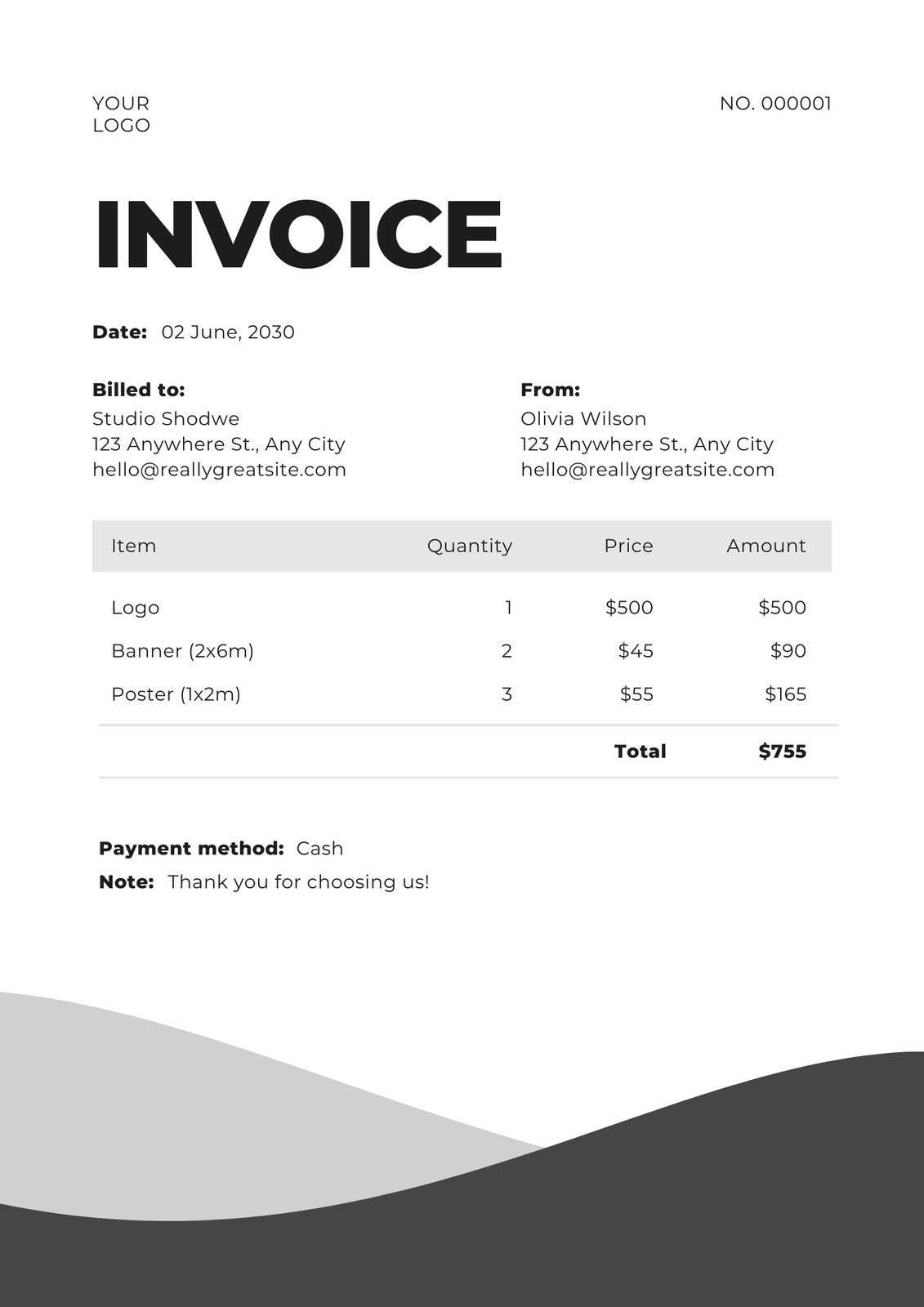

How to Add Your Branding to Invoices

Incorporating your company’s branding into business documents is an essential way to reinforce your identity and create a professional impression. By adding consistent visual elements, such as logos, color schemes, and fonts, you help ensure that your communications align with your brand. Customizing these documents not only makes them stand out but also increases your brand’s recognition and credibility with clients.

Here are several ways to add your branding to documents:

| Brand Element | How to Add It |

|---|---|

| Logo | Place your company logo at the top of the document, typically in the header section. This ensures it’s the first thing the client sees and immediately associates the document with your brand. |

| Color Scheme | Match the colors of the document’s headings, borders, and background to your company’s color palette. This consistency helps strengthen brand recognition. |

| Typography | Use fonts that align with your company’s style guide. This includes selecting the appropriate typeface for headings, body text, and any other elements that require text. |

| Footer or Contact Information | Add your company’s contact details, social media handles, and website link in the footer to provide clients with easy access to your information while maintaining a professional look. |

With these simple additions, you can elevate the look of your business documents and ensure that each communication reflects the unique identity of your brand, giving it a more polished and cohesive appearance.

Managing Multiple Clients with Invoices

Handling business documents for several clients at once can be a daunting task, especially when managing a variety of services, payment schedules, and unique details for each client. Effective organization and streamlined processes are essential for keeping everything on track. Properly managing these documents helps ensure timely payments, reduces errors, and maintains strong professional relationships. By using the right tools and approaches, you can simplify the process and stay on top of your transactions.

Here are a few tips for managing multiple clients effectively:

- Organize by Client: Keep separate records for each client, with clearly labeled files for each project or transaction. This way, you can quickly find past documents and track payment history.

- Use Unique Identifiers: Assigning unique reference numbers or codes to each transaction makes it easier to match payments with their corresponding documents, especially when managing numerous clients.

- Set Clear Terms: Ensure that your payment terms, due dates, and other conditions are clearly outlined for each client. This reduces confusion and helps maintain consistency across all your dealings.

- Automate Reminders: Use reminders for upcoming due dates, ensuring that clients receive timely notifications about payments. Many platforms offer automatic notification systems, making follow-ups easier and more consistent.

- Track Payments: Keep a record of payments as they come in. This will help you avoid confusion about outstanding balances and identify any overdue amounts quickly.

By implementing these strategies, you can manage multiple clients with greater ease and ensure that all financial transactions are handled efficiently, professionally, and without oversight.

Exporting Invoices for Quick Payments

To accelerate payment processes and ensure that your business remains financially stable, it’s important to have an efficient system for generating and sharing financial documents. The ability to quickly export and send these documents in the correct format can significantly reduce delays, streamline communication with clients, and increase the likelihood of prompt payments. With the right tools, exporting your documents is simple and can be done in just a few steps.

Here are the key reasons why exporting documents efficiently is essential for faster payments:

- Multiple File Formats: Exporting documents in formats like PDF, Word, or Excel allows clients to choose the most convenient option for reviewing and processing payments. PDFs are especially useful as they preserve formatting and are easy to share.

- Instant Delivery: Once exported, documents can be sent directly via email, making it easy to communicate with clients in real-time. This eliminates the need for physical mailing, reducing delays and ensuring quick access to the document.

- Professional Appearance: Exported files maintain a polished, consistent layout, which helps maintain your brand’s professional image and encourages clients to treat the payment request seriously.

- Easy Tracking: Many tools allow you to track whether a client has received and viewed the document. This provides you with peace of mind and makes it easier to follow up when necessary.

- Integration with Payment Systems: Some platforms enable integration with various payment gateways. This means that once the document is exported and sent, clients can directly pay via links or buttons included within the document itself.

By utilizing quick export features, you can ensure that your financial documents reach clients without delay, making the payment process smoother and quicker. This approach helps maintain cash flow, reduces administrative work, and keeps your business running efficiently.

How Online Invoices Simplify Billing

Billing can often be a time-consuming and error-prone task, but using digital tools to manage business documents can significantly streamline the process. By automating key aspects of billing, businesses can reduce administrative overhead, improve accuracy, and speed up payments. The convenience of generating, customizing, and sending these documents with just a few clicks makes the whole process more efficient and less stressful.

Here are some of the ways digital documents simplify billing:

- Automated Calculations: Digital tools automatically calculate totals, taxes, and discounts, reducing the risk of human error and saving valuable time.

- Pre-designed Formats: Ready-to-use formats allow businesses to create professional-looking documents quickly, without needing design expertise or formatting skills.

- Quick Customization: Adjusting details like client information, service descriptions, or payment terms is simple and fast, ensuring that each document is personalized to suit the recipient’s needs.

- Instant Delivery: Sending documents via email or integrated payment systems allows for immediate delivery, speeding up the entire billing cycle.

- Tracking and Notifications: Many tools allow users to track whether a client has received and viewed the document, offering peace of mind and enabling timely follow-ups when necessary.

- Payment Integration: Some platforms enable clients to pay directly from the document through integrated payment links or buttons, further simplifying the process and encouraging faster payments.

By leveraging digital document solutions, businesses can focus more on growth and customer satisfaction, while billing becomes an efficient, automated part of the workflow. This simplification not only saves time but also enhances the overall professionalism of your operations.

Secure Your Invoices with Password Protection

When handling financial documents, confidentiality and security are of the utmost importance. Sending sensitive information without proper protection could expose your business to risks such as fraud or unauthorized access. Password protecting your documents adds an extra layer of security, ensuring that only the intended recipient can access and view the content. This simple step can provide peace of mind, especially when dealing with valuable or private financial details.

Why Password Protection Matters

- Data Confidentiality: Password protection helps prevent unauthorized individuals from accessing sensitive business and client information, such as payment amounts or service details.

- Secure File Sharing: Whether sharing via email or cloud storage, password protection ensures that only recipients with the correct credentials can open the document, reducing the likelihood of leaks or errors.

- Compliance: For businesses that must adhere to regulations around data privacy (such as GDPR), password-protecting documents is a vital step in maintaining compliance and safeguarding personal data.

- Client Trust: Clients will feel more confident working with you when they know their sensitive information is protected, which can strengthen your business relationships and improve customer satisfaction.

How to Implement Password Protection

- Choose Secure Software: Use tools that offer built-in encryption and password protection features. These tools will allow you to easily set up passwords when creating or exporting documents.

- Set Strong Passwords: Ensure that the password is complex, using a combination of numbers, letters, and special characters. This will make it more difficult for unauthorized parties to guess or crack the password.

- Share Passwords Safely: Avoid sending passwords along with the document in the same communication. Use secure methods, such as separate emails or encrypted messaging, to share the password with your clients.

- Set Expiration Dates: Some tools allow you to set expiration dates for document access. This is particularly useful for limiting access to time-sensitive information.

By implementing password protection, you can ensure that your business remains secure while still delivering essential documents efficiently and professionally. This simple step helps protect both your company and your clients from potential security threats.

Integrating Online Invoices with Accounting Tools

Integrating your business documents with accounting systems can significantly streamline your financial operations. When your documents are directly connected to tools that track income, expenses, and taxes, it reduces the need for manual entry, minimizes errors, and speeds up your workflow. Seamless integration between invoicing systems and accounting software ensures that all financial data is updated in real time, improving accuracy and efficiency across your business processes.

Benefits of Integration

- Reduced Manual Data Entry: By connecting your billing documents with accounting platforms, you eliminate the need to manually input the same information into both systems. This saves time and reduces the risk of human error.

- Real-Time Updates: Whenever a document is generated or a payment is made, your accounting software is automatically updated, providing an accurate and up-to-date view of your financial status without extra effort.

- Improved Financial Reporting: Integrated systems can automatically categorize transactions and generate detailed reports, helping you track your revenue, expenses, and profit margins with ease.

- Better Cash Flow Management: Real-time tracking of payments and overdue amounts allows you to manage cash flow more effectively and follow up on outstanding balances quickly.

- Automated Tax Calculations: Integration can automatically calculate sales tax or VAT, reducing the time spent on preparing tax filings and ensuring compliance with tax regulations.

How to Set Up Integration

- Choose Compatible Tools: Ensure that your invoicing platform and accounting software are compatible with each other. Many popular accounting systems, like QuickBooks or Xero, offer integration with a variety of billing tools.

- Link Your Accounts: Most platforms provide easy-to-follow steps to connect your accounts. This usually involves providing API keys or authorizing access between systems.

- Test the Integration: Before relying on the integration, test it with a few sample documents to ensure that data is being transferred correctly between systems.

- Monitor and Adjust Settings: Regularly check your integration settings to ensure that data is syncing properly. Make adjustments as needed to fit your business workflow.

Integrating your documents with accounting software not only saves time but also enhances the accuracy of your financial data, making it easier to manage your business’s finances and focus on growth.

Common Mistakes to Avoid When Invoicing

Creating business documents is an essential task, but it’s easy to make mistakes that can lead to delays in payments or confusion with clients. Whether it’s a minor oversight or a larger error, incorrect details or poor formatting can result in misunderstandings or even lost revenue. Being aware of common errors and taking steps to avoid them ensures that your billing process runs smoothly and efficiently.

- Incorrect Client Details: Double-check client information such as names, addresses, and contact details. Even small errors can cause delays or confusion, especially when dealing with multiple clients.

- Missing Payment Terms: Always include clear payment terms, such as due dates, late fees, and accepted payment methods. Failing to specify these details can lead to misunderstandings and late payments.

- Wrong Calculations: Incorrectly calculating totals, taxes, or discounts can lead to incorrect amounts being billed. This mistake can frustrate clients and may require re-sending corrected documents, delaying payment.

- Lack of a Unique Reference Number: Including a unique reference number or invoice code helps with tracking payments and identifying transactions, especially when dealing with multiple clients or projects.

- Unprofessional Design: While creativity is important, avoid overly complex or hard-to-read designs. A cluttered or unprofessional layout can reduce the credibility of your documents and create confusion for the client.

- Omitting Item Descriptions: Provide clear descriptions for each product or service provided. Without these, clients may question what they are being charged for, leading to delays in payment.

- Not Following Up: Once a document is sent, don’t assume it’s automatically paid. Be sure to follow up with clients who have not made payments by the due date to avoid overdue accounts.

- Not Keeping Records: Always maintain a copy of each document and track payments. This will help you manage your cash flow, resolve disputes, and keep your financial records accurate for tax purposes.

By being mindful of these common mistakes, you can ensure that your billing process runs smoothly and that your clients have the correct information to process payments promptly. A little attention to detail can save time and enhance your professional reputation.