Free Office Invoice Template for Effortless Billing

Managing business transactions can be a time-consuming task, but with the right resources, it becomes easier and more organized. Having a structured format to record payments and charges not only saves time but also ensures accuracy and professionalism in financial dealings. Many businesses, regardless of size, benefit from using a ready-made document that streamlines this process.

With the help of customizable designs, it is possible to create neat, clear, and effective records that reflect your business needs. These tools are highly adaptable, allowing you to modify fields to fit specific requirements, whether you’re dealing with recurring clients or one-time customers. Using such solutions can also improve the consistency of your paperwork and help build trust with your clients.

In this article, we’ll explore various options available for streamlining your billing process. From simple solutions for freelancers to more advanced formats for large enterprises, you’ll find the ideal tool to make your financial documentation easier and more efficient.

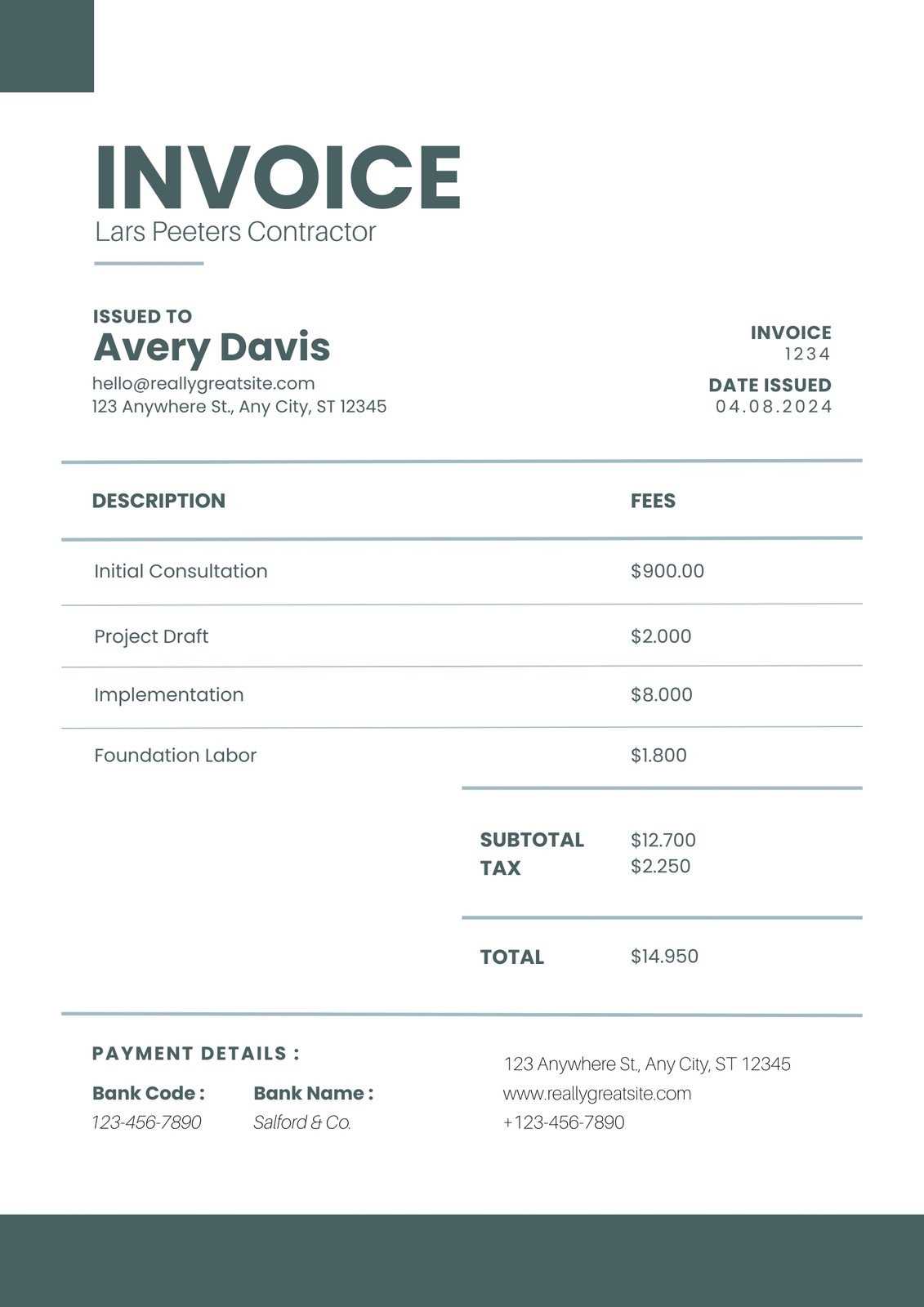

Free Office Invoice Template Overview

Many businesses need a straightforward way to document transactions with clients. Whether you’re a freelancer or running a larger enterprise, having a structured format to capture payment details ensures clarity and professionalism. The use of ready-made, customizable documents helps save time and effort while maintaining consistency in financial reporting.

These tools are designed to be simple and adaptable, allowing businesses to easily record and communicate payment terms, itemized charges, and due dates. With a variety of options available, you can select one that best fits your business needs, saving you from having to create a document from scratch every time. Here’s an overview of some of the most common features that these resources offer:

| Feature | Description |

|---|---|

| Customizable Fields | Modify sections to suit different client needs, such as payment terms or itemized services. |

| Professional Design | Ensure your documents look polished and clear to create a lasting impression with clients. |

| Editable Amounts | Easily adjust charges or add discounts, taxes, or other fees as needed for each transaction. |

| Simple Layout | Ensure clarity by including only essential details in a straightforward, easy-to-read format. |

| Time-Saving | Streamline your business operations by eliminating the need to create new documents from scratch. |

By utilizing these efficient solutions, businesses can ensure that they maintain an organized approach to billing and avoid potential errors. Whether you need a quick, simple document or a more detailed record, these tools can help you meet your goals with minimal effort.

Why Use a Free Invoice Template

In any business, accurate documentation of transactions is crucial for maintaining financial clarity and professionalism. Using pre-designed formats to capture details such as payment amounts, services rendered, and due dates can significantly streamline the process. These resources help save time by providing a structured layout, allowing you to focus on the content rather than formatting each time you need to send a bill.

One of the key benefits of utilizing ready-made documents is the reduction in human error. With consistent structures, the risk of missing critical information or making mistakes is minimized. Additionally, these tools often include all necessary sections, ensuring that nothing important is overlooked. By standardizing your approach to billing, you can create a more organized and reliable process, which ultimately leads to smoother business operations and greater trust with clients.

Moreover, these resources are often fully customizable. This means that while you benefit from a structured layout, you can still adjust the details to meet your specific needs. Whether you’re working with a long-term client or handling a one-off project, the flexibility to personalize key fields ensures that each document is tailored to fit the situation at hand.

Key Features of Office Invoice Templates

When choosing a pre-made document for recording business transactions, it’s important to consider the features that make the format both efficient and user-friendly. A well-designed solution should balance structure with flexibility, allowing you to document key details while ensuring clarity and professionalism. Below are the main features to look for in such tools:

Customizability

The ability to tailor each document is essential for businesses with varying needs. A good format allows you to easily modify sections such as the client’s information, services provided, or payment terms. Key aspects to customize include:

- Client and business contact details

- Payment due dates

- Itemized lists of services or products

- Tax and discount calculations

- Unique reference numbers for easy tracking

Professional Layout

Even though the focus is on functionality, presentation matters. A clean and well-organized structure can enhance the overall appearance of your documents, making them easy to read and ensuring all necessary details are clearly visible. Common design elements include:

- Clear headings and section divisions

- Readable fonts and appropriate spacing

- Logo placement for brand identity

- Consistent font size and color schemes

By choosing a solution with these features, you ensure that your transaction records are not only accurate but also look polished and professional, enhancing your business image in the eyes of your clients.

How to Customize an Invoice Template

One of the key advantages of using pre-designed formats for billing is the ability to adjust them to fit your specific needs. Customizing a document allows you to ensure that the relevant details are accurately captured and that the layout reflects your business’s style. Whether you’re adding client-specific information or tweaking the design, here are some key steps to help you get the most out of these tools.

Adjusting the Layout

The first step in personalizing any billing document is to make sure that the layout matches your preferences and business requirements. Here are a few areas you can modify:

- Positioning of key information such as your company’s name, logo, and contact details.

- Adding or removing sections based on the services you offer, such as product descriptions or service summaries.

- Formatting the date, payment terms, and other critical details to suit your preferred style.

- Incorporating your branding colors and fonts to ensure the document reflects your business identity.

Updating Key Details

Once the design is in place, the next step is to update the specific details relevant to the transaction. Customize these fields for each client or job:

- Client’s name, address, and contact information.

- Description of the goods or services provided, along with quantities and rates.

- Applicable taxes, discounts, or additional charges.

- Due date and payment instructions, such as bank account details or online payment options.

By tailoring both the visual aspects and the content, you ensure that each document is relevant, accurate, and professional, enhancing your client relationships and streamlining your billing process.

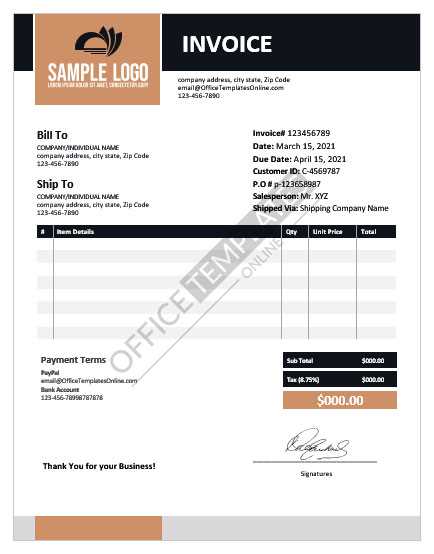

Choosing the Right Template for Your Business

Selecting the appropriate format for documenting payments and transactions is an important step for any business. The right solution should not only meet your specific needs but also align with your industry requirements and the expectations of your clients. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, the right document can streamline your operations and help you maintain professionalism.

When choosing a suitable solution, consider factors such as the nature of your products or services, the complexity of your billing structure, and the preferred format of your clients. Below is a comparison of different document types to help you make the right choice for your business:

| Business Type | Recommended Features | Example Format |

|---|---|---|

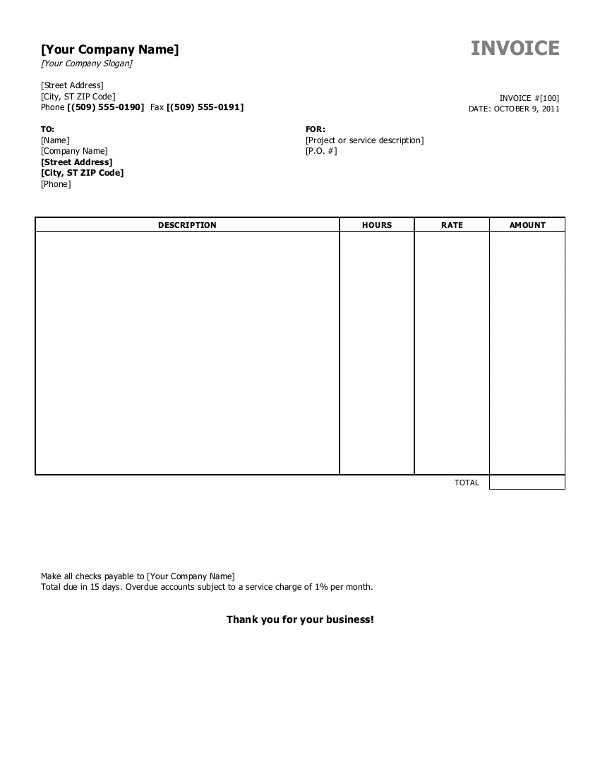

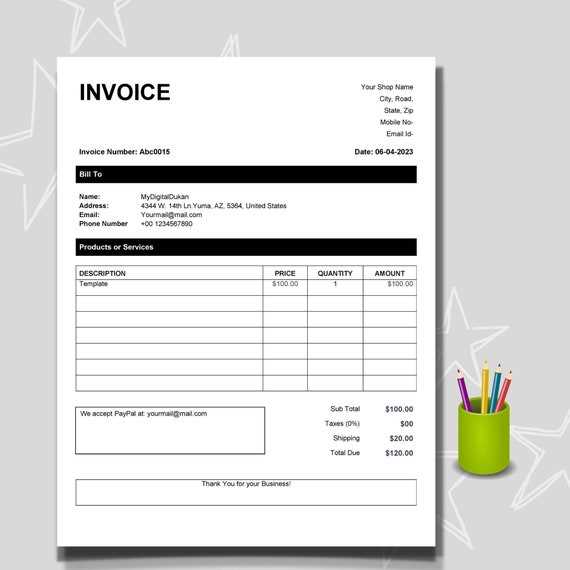

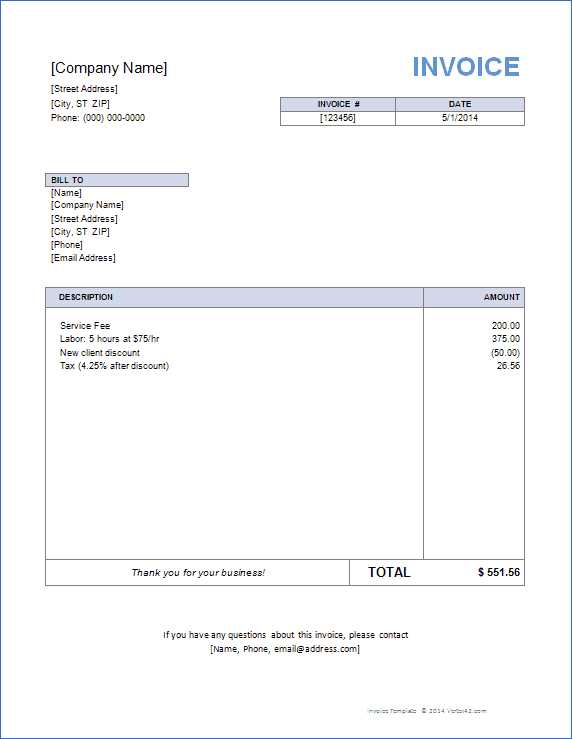

| Freelancers and Consultants | Simple layout, customizable sections for hourly rates or project-based work, clear payment terms | Basic, single-page design with clear headings |

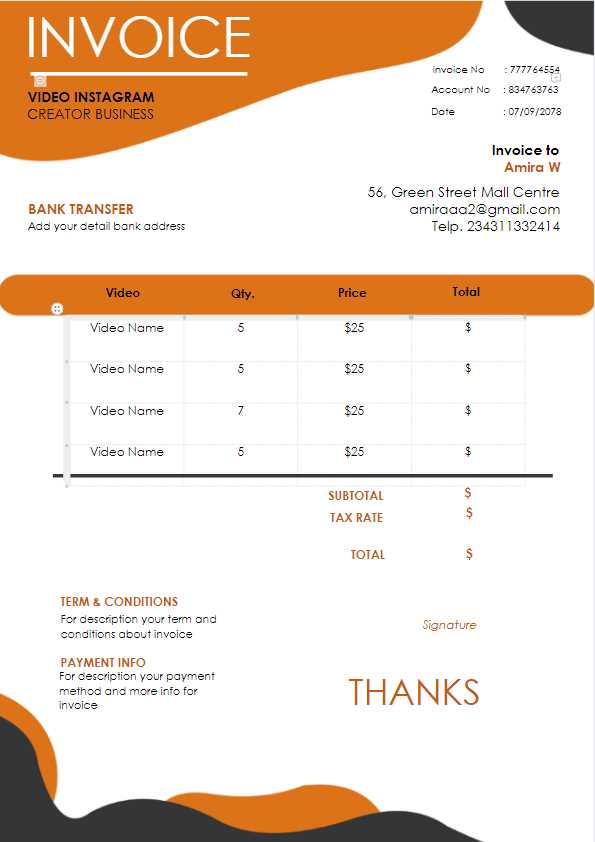

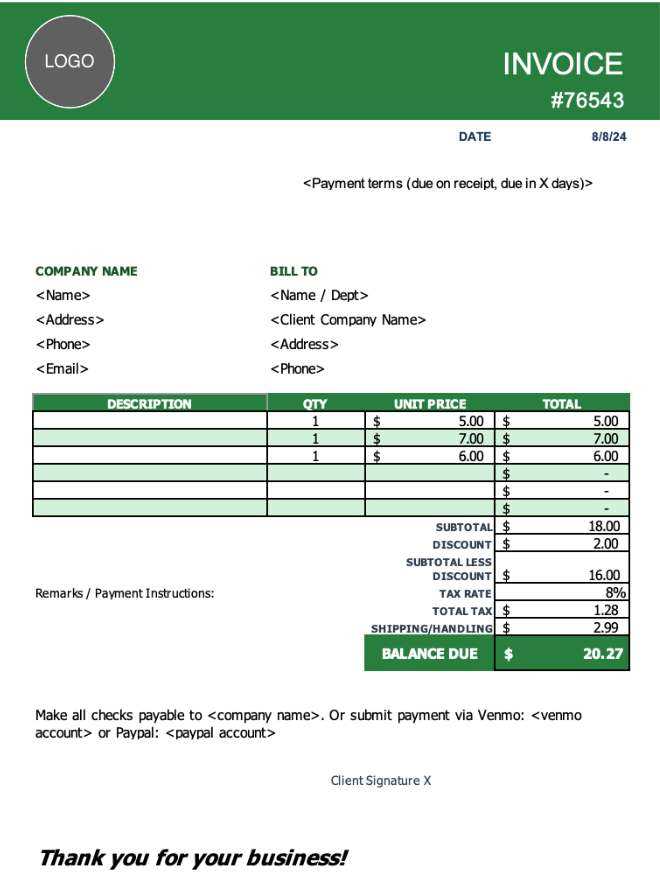

| Small Businesses | Professional branding, section for multiple items/services, tax calculations | Multi-section format with space for discounts, taxes, and itemized lists |

| Large Enterprises | Advanced tracking features, detailed payment history, multiple client contact fields | Comprehensive document with company logo, multiple service columns, and tracking information |

Choosing the right solution is crucial for maintaining a consistent and efficient workflow. Consider your needs carefully, and select a format that allows you to tailor documents easily while keeping them clear, professional, and aligned with your business practices.

Step-by-Step Guide to Creating Invoices

Creating a well-structured billing document is an essential part of running any business. A clear and professional document helps ensure timely payments and reduces the risk of errors. While there are various ways to approach the process, following a straightforward method can help you stay organized and ensure you include all the necessary details. Below is a simple guide to help you create accurate and professional documents for your clients.

1. Include Your Business Information

The first step is to provide your own company details so the client can easily identify the sender. This should include:

- Your business name and logo

- Business address, email, and phone number

- Your business registration number (if applicable)

2. Add Client Details

Next, include the client’s information so they know the document is intended for them. This should include:

- Client’s full name or company name

- Client’s address, email, and phone number

3. Assign a Unique Reference Number

To keep track of payments, it’s important to include a unique reference number for each document. This can be a sequential number or a custom format, depending on your preference.

4. List the Services or Products Provided

Clearly outline the goods or services you’ve provided. Be specific, and include as much detail as necessary for the client to understand what they are being billed for:

- Product or service description

- Quantity or hours worked

- Rate or price per unit

5. Calculate the Total Amount Due

After listing the products or services, calculate the total cost. Be sure to include any additional charges, such as taxes or shipping fees. Then, provide a subtotal before calculating the final total.

6. Add Payment Terms and Due Date

Let the client know when the payment is due and any payment instructions. Include any late fees or early payment discounts if applicable.

- Due date for payment

- Accepted payment methods (e.g., bank transfer, PayPal, credit card)

- Late payment penalties or discounts for early payment

7. Review and Send

Before sending the document, double-check all the details to ensure everything is correct. Once you’re confident the information is accurate, you can send it to the client via email, post, or through an online platform.

By following these simple steps, you can create clear, professional documents that facilitate smooth transactions and ensure that your

Benefits of Using Digital Invoice Templates

In today’s fast-paced business environment, managing financial transactions efficiently is crucial for maintaining smooth operations. Digital solutions for creating billing documents offer several advantages over traditional paper-based methods. These tools not only save time but also help streamline your workflow, reduce errors, and enhance the overall client experience.

Time and Cost Efficiency

One of the main advantages of using digital solutions is the time saved in creating and sending documents. Pre-designed formats eliminate the need to start from scratch for each transaction. Here’s how:

- Quick customization: Edit essential fields with just a few clicks.

- Automatic calculations: Taxes, totals, and discounts can be calculated instantly.

- No printing or mailing: Save on paper, ink, and postage costs.

Enhanced Accuracy and Organization

Digital formats help minimize common errors found in manual billing. By using predefined fields and automatic calculations, you reduce the chances of making mistakes that could affect your revenue. Additionally, these solutions help you stay organized:

- Easy storage: Digital files can be saved, organized, and backed up without the need for physical storage space.

- Instant retrieval: Retrieve past records in seconds using search functions.

- Clear format: A well-structured layout ensures no critical information is missed.

Overall, digital billing documents not only enhance your efficiency but also help maintain a professional image, ensuring that your transactions are smooth, timely, and accurate.

Common Mistakes to Avoid in Invoices

Creating billing documents may seem straightforward, but small mistakes can lead to confusion, delayed payments, or even financial losses. It’s important to ensure that every detail is accurate and clear. Understanding the common pitfalls and how to avoid them can help you maintain professionalism and improve your cash flow.

1. Missing or Incorrect Client Information

One of the most common mistakes is failing to provide accurate client details. This can cause confusion or delays in payments, as the recipient may not recognize the document as theirs or may not be able to reach out for clarifications. Be sure to double-check:

- Client’s full name or business name

- Correct contact information, including address, phone number, and email

- Accurate billing details to avoid sending the document to the wrong party

2. Incorrect Payment Amounts or Calculations

Another frequent error is entering incorrect amounts or failing to properly calculate totals. Whether it’s forgetting to add taxes or entering an incorrect unit price, these mistakes can cause discrepancies. To avoid errors, always:

- Double-check unit prices, quantities, and totals

- Ensure that taxes, discounts, and additional fees are correctly applied

- Use automated calculations whenever possible to reduce human error

3. Failing to Include Payment Terms

Omitting payment terms can lead to misunderstandings about when the payment is due or how it should be made. It’s crucial to clearly specify:

- The due date for payment

- The accepted methods of payment (e.g., credit card, bank transfer)

- Late fees or penalties for overdue payments

4. Lack of Unique Reference Number

Without a unique reference number, it can be difficult to track payments or resolve disputes. Always assign a distinct number to each document, especially for repeat clients, to help you easily match payments with invoices.

5. Inconsistent or Unprofessional Format

Finally, the design and layout of your billing document should be professional and easy to read. Disorganized, cluttered, or hard-to-read documents can leave a poor impression on clients and increase the chances of errors. Keep your format simple and consistent by:

- Using clear, readable fonts and a clean layout

- Including well-defined sections with headings

- Ensuring all important information is easy to locate

By avoiding these common mistakes, you can improve the accuracy, efficiency, and professionalism of your billing process, ensuring smooth transactions and timely payments.

How to Save Time with Invoice Templates

Time is a precious resource, especially when managing the administrative aspects of your business. By using pre-designed formats for generating financial documents, you can save valuable hours that would otherwise be spent manually creating each document from scratch. These ready-to-use solutions streamline the billing process, making it faster and more efficient while maintaining accuracy and consistency.

1. Eliminate Repetitive Tasks

With a pre-built structure, you can avoid the need to rewrite the same information over and over. Most billing documents include standardized fields such as your business name, client details, payment terms, and item descriptions. By using a consistent format, you only need to fill in the unique information for each transaction, which greatly reduces the amount of time spent on each task.

2. Automate Calculations

Many digital solutions allow you to input figures like unit prices and quantities, while automatically calculating totals, taxes, and discounts. This automation ensures that all financial figures are accurate, reduces manual errors, and saves time compared to doing these calculations manually.

By leveraging these tools, you not only speed up the process but also ensure your records are more precise, helping you stay organized and focused on other important aspects of your business.

Free vs Paid Invoice Templates: What’s Best

When it comes to choosing a solution for creating financial documents, businesses often face a choice between free and paid options. While both types offer convenience and structure, they come with different features, flexibility, and levels of customization. Understanding the benefits and limitations of each can help you decide which option is best suited for your business needs.

Benefits of Free Options

Free solutions can be a great starting point for small businesses or freelancers who are just getting started. These options typically offer basic features and are easy to access. Here’s what free formats generally provide:

- Cost-effective – No upfront investment required.

- Simple designs – Ideal for straightforward billing needs.

- Quick setup – Most free solutions are easy to download and use without a steep learning curve.

- Basic customization – Some free formats allow for limited edits, such as adding business details and adjusting payment terms.

Benefits of Paid Options

On the other hand, paid solutions tend to offer more advanced features, greater flexibility, and enhanced support. While they come with a price tag, many businesses find the investment worthwhile. Here’s what paid formats typically offer:

- Advanced customization – More control over design, layout, and content to match your brand.

- Automated calculations – Features like tax rates, discount application, and total cost calculations that save time and reduce errors.

- Integrated payment options – Many paid solutions allow clients to pay directly through the document, which can speed up the payment process.

- Enhanced support – Access to customer service and troubleshooting resources if needed.

Which Option Is Best for You?

Ultimately, the choice between free and paid options depends on the complexity of your business needs and the level of customization you require. If you have a simple business model with minimal billing needs, a free solution may be sufficient. However, if you’re looking for advanced features, greater flexibility, or additional support, a paid solution could be the better choice.

By carefully considering your requirements, you can choose the option that will save you time, improve your processes, and contribute to your business’s success.

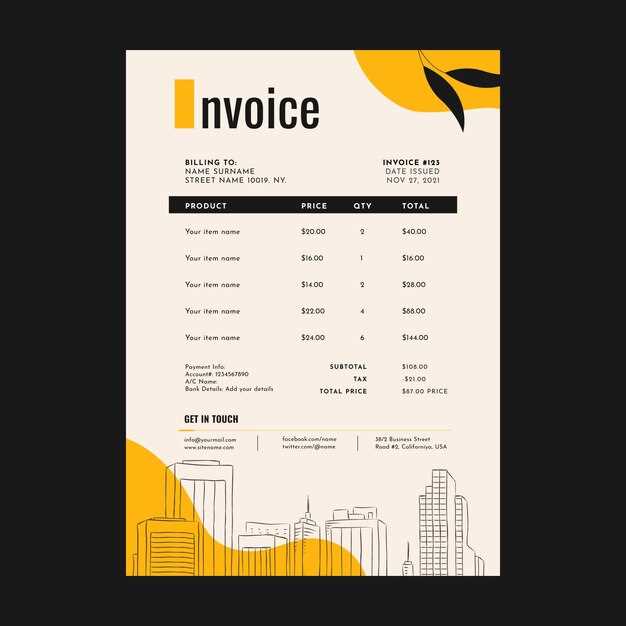

How to Make Your Invoices Look Professional

Creating professional-looking documents is essential for building credibility and trust with your clients. A well-designed billing document reflects the quality of your business and can leave a lasting impression. By focusing on layout, clarity, and brand consistency, you can ensure that your transactions are not only efficient but also polished and impressive.

1. Use a Clean and Simple Layout

A cluttered or overly complex document can confuse clients and make it harder for them to find important details. A clean, well-organized layout helps clients easily understand the charges, due date, and payment instructions. Focus on:

- Clear section headings for client information, services provided, and payment terms.

- Ample white space around text and sections to avoid overcrowding.

- A logical flow of information, from the most critical details at the top to the payment instructions at the bottom.

2. Maintain Consistent Branding

Your billing documents should reflect your company’s brand identity. Consistent use of your logo, colors, and fonts will help reinforce your brand’s professionalism and make your documents easily recognizable. Make sure to include:

- Your company logo at the top or in the header.

- Brand colors for headings, borders, and accent areas.

- Fonts that align with your overall branding and are easy to read.

By focusing on clarity, simplicity, and branding, you’ll ensure that your financial documents convey professionalism and make a positive impact on your clients.

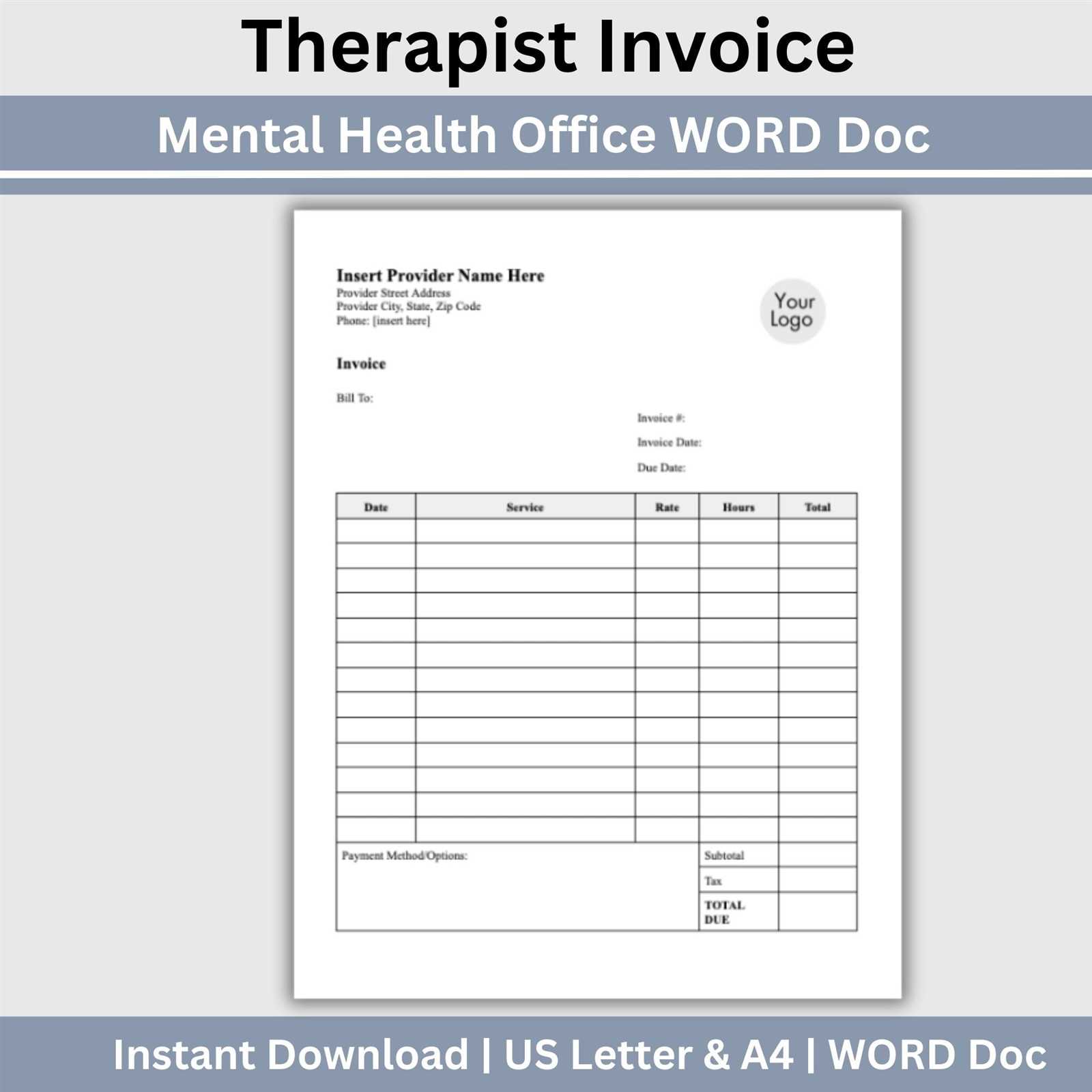

Top Free Invoice Templates for Small Businesses

For small businesses, having a simple yet professional way to document transactions is essential. Using pre-designed billing formats can help streamline the process and ensure accuracy. These options are great for businesses looking to save time while maintaining a polished image. Below are some of the top choices for businesses that want easy-to-use, effective solutions for generating financial documents.

Here are some of the best options for small businesses to consider:

- Basic Service Invoice – A straightforward format ideal for freelancers or service-based businesses. It includes space for client details, a breakdown of services provided, and clear payment terms.

- Itemized Billing Document – Perfect for businesses that offer multiple products or services. It provides space to list each item individually, including pricing, quantity, and subtotals.

- Minimalist Layout – A simple, no-frills document that focuses on key information such as contact details, total charges, and payment instructions. Ideal for those who need something quick and easy.

- Customizable Professional Format – This design allows for greater flexibility, offering spaces for logos, branding, and additional notes. It’s great for businesses that want to maintain a consistent brand image across all documents.

- Time-Based Billing Statement – A specialized document for businesses that bill by the hour. It includes spaces for the number of hours worked, hourly rate, and total time spent on each project.

These pre-designed formats are an excellent resource for small businesses that want to stay organized, maintain a professional appearance, and avoid spending time creating documents from scratch. Choose the one that best fits your business model and customize it to suit your specific needs.

Printable Invoice Templates for Offline Use

While many businesses rely on digital tools for creating and sending billing documents, there are still times when offline solutions are necessary. Whether you’re meeting clients in person or need to provide a hard copy for your records, having printable formats on hand is crucial. These pre-designed documents offer a simple way to create accurate, professional records without needing an internet connection or specialized software.

Advantages of Printable Documents

Printable billing documents are beneficial for businesses that need to provide physical copies for clients or maintain offline records. Here are a few advantages:

- Instant access: No internet connection required, allowing you to print documents anytime, anywhere.

- Easy customization: These formats are simple to fill out and print, allowing you to tailor them to your specific needs.

- Professional appearance: Even without digital tools, you can create clear, organized documents that reflect well on your business.

Popular Printable Formats

Here are a few popular choices for printable billing formats that businesses can use for offline purposes:

| Document Type | Best For | Key Features |

|---|---|---|

| Simple Billing Statement | Freelancers or solo service providers | Clear breakdown of services and rates |

| Itemized List | Businesses selling physical goods | Detailed listing of items with quantities and prices |

| Hourly Rate Document | Consultants or contractors | Sections for recording hours worked and hourly rates |

| Customizable Professional Layout | Businesses seeking a branded look | Space for company logo and client branding |

With these offline options, you can create professional documents anytime without needing access to an online platform or specialized software. Simply print them out, hand them to your client, and keep a copy for your records.

How to Organize Your Invoices Efficiently

Keeping track of your billing documents is essential for maintaining financial accuracy and ensuring smooth operations. An organized system not only helps you stay on top of payments but also makes it easier to locate important records when needed. By setting up a simple and efficient method for managing your documents, you can save time, reduce errors, and avoid missed payments.

1. Create a Categorized Filing System

Organizing your records into clear categories will help you quickly find the information you need. Start by creating folders for each client or project, and consider grouping them by month or year for easy reference. Digital tools can also help you organize documents by creating folders based on:

- Client names or business names

- Dates or billing periods

- Status of payment (e.g., paid, pending, overdue)

By maintaining these categories, you can quickly search for specific documents and avoid clutter. It’s important to keep things consistent and regularly update your filing system to ensure nothing is overlooked.

2. Implement a Numbering System

One of the most effective ways to keep track of your records is by assigning each document a unique identifier. A sequential numbering system helps you organize your billing records logically and makes it easier to reference a specific document when needed. Make sure to:

- Use a consistent format (e.g., #001, #002, #003).

- Assign a number based on the date or project.

- Link numbers to clients or specific transactions for quick identification.

By implementing a numbering system, you will ensure that your documents are ordered correctly and easy to access at any time, streamlining both record-keeping and communication with clients.

Invoice Templates for Different Industries

Each industry has unique requirements when it comes to documenting financial transactions. Whether you’re a freelancer, a contractor, or running a larger business, the billing structure can vary greatly based on the services or products you offer. Choosing the right format tailored to your specific industry can help you maintain professionalism, ensure accuracy, and provide clarity to your clients.

1. Service-Based Industries

For service providers such as consultants, freelancers, or contractors, the key is to clearly outline the services rendered, time spent, and hourly rates or flat fees. A well-structured document should include:

- Detailed breakdown of services provided

- Hourly or fixed rates depending on the service model

- Space for notes or additional terms (e.g., late fees, payment plans)

These formats should be simple yet detailed enough to ensure both parties understand the scope of work and the payment expected.

2. Product-Based Businesses

For businesses that sell physical or digital products, the billing record needs to include itemized lists with quantities, descriptions, and prices. Key features for product-based billing include:

- Columns for product description, unit price, and quantity

- Subtotals and taxes

- Space for any shipping or handling fees

These documents help ensure that customers can verify what they are being charged for, which is crucial for maintaining trust in retail or e-commerce environments.

By using a specialized format for your industry, you can improve the accuracy and clarity of your billing documents, which will lead to smoother transactions and stronger client relationships.

Integrating Invoice Templates with Accounting Software

As businesses grow, managing financial records becomes increasingly complex. Combining your billing documents with accounting systems can streamline your workflow, improve accuracy, and save time. By integrating pre-designed financial forms with your accounting software, you can ensure seamless data transfer, automatic updates, and real-time tracking of payments and expenses.

Benefits of Integration

Integrating your billing documents with accounting software offers several advantages for businesses of all sizes. Here’s how it can improve your financial management:

- Time Efficiency: Automatically generate records from your billing system without the need for manual data entry.

- Consistency: Ensures that your financial data is consistently formatted and stored in a central location.

- Real-Time Updates: Payment information, taxes, and other financial details are updated instantly, providing an accurate overview of your finances.

- Reduced Errors: By automating the transfer of data, you can eliminate common errors that occur with manual input.

How to Integrate Your Documents

Integrating your billing documents with accounting software is typically straightforward and can be done in several ways. Most accounting platforms allow you to import documents, either through manual uploads or direct syncing with various file types. Here are a few steps to consider when setting up integration:

- Choose software that supports document imports or synchronization with popular billing formats.

- Customize your software settings to automatically pull information such as client details, payment terms, and pricing.

- Ensure that your accounting software allows you to generate reports directly from the integrated records for tax filing and financial analysis.

By linking your billing documents to your accounting system, you create a more efficient and accurate financial process, ultimately saving time and reducing the chances of mistakes in your records.

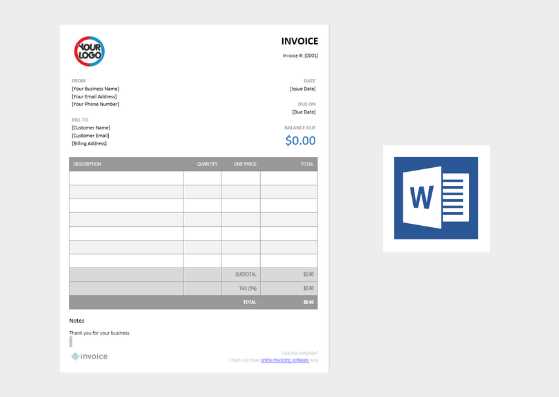

How to Download and Use a Free Template

Finding and using a pre-designed document layout is an excellent way to save time while ensuring professional presentation. With just a few simple steps, you can quickly download a layout, customize it to your business needs, and start using it right away. Whether you’re working on a single transaction or managing multiple clients, these ready-made options provide a fast solution for generating accurate billing records.

Steps to Download a Layout

To get started, follow these basic steps to find and download a suitable format:

- Search for a reliable source: Look for reputable websites that offer ready-to-use documents. Ensure they are customizable and suitable for your specific needs.

- Choose the right design: Select a format that matches the type of business you run. Pay attention to the layout and functionality to ensure it fits your requirements.

- Download the file: After selecting the desired format, click on the download link and save the file to your device. Most sites offer formats like Word, Excel, or PDF.

How to Customize and Use the Document

Once you’ve downloaded your desired layout, it’s time to tailor it to your business. Here’s how to proceed:

- Edit key details: Replace placeholders with your business name, client details, item descriptions, and payment terms.

- Adjust for your needs: Modify columns, rows, or sections as needed to fit your billing structure or specific services.

- Save and print: Once all information is filled in, save the document and either print it for physical delivery or send it digitally to your client.

By following these simple steps, you can easily incorporate ready-made solutions into your workflow and ensure your billing process runs smoothly.