Download Free Office Cleaning Invoice Template for Easy Billing

Managing payments and keeping track of financial transactions is a crucial part of running any business. Whether you’re offering janitorial services or other maintenance work, organizing your financial paperwork is essential for smooth operations. Having a structured document to request payment from clients can save time and ensure professionalism in your business dealings.

By using a well-structured format, you can ensure all necessary details are clearly communicated. These documents are designed to help service providers maintain consistent records and streamline the payment process. A clear and precise layout can make a significant difference in both your business efficiency and your client’s experience.

Customizable solutions allow you to easily adapt the form to your needs, ensuring it fits your specific service requirements. From date and contact information to the breakdown of charges, every section can be tailored to suit your business operations. With a standardized document, you can build trust with clients while keeping accurate financial records for future reference.

Free Office Cleaning Invoice Template

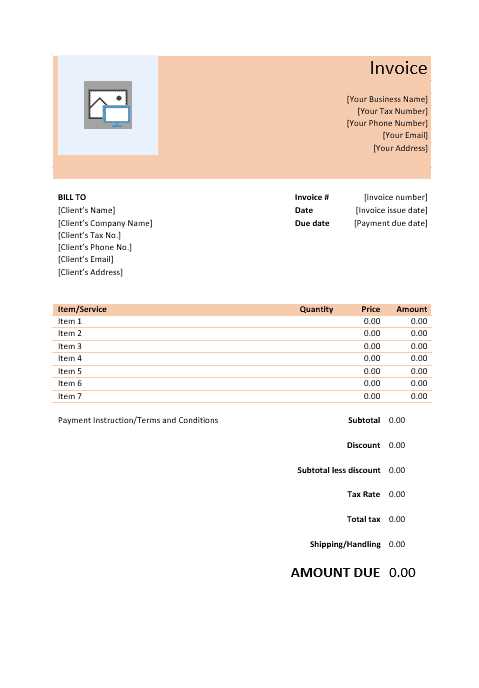

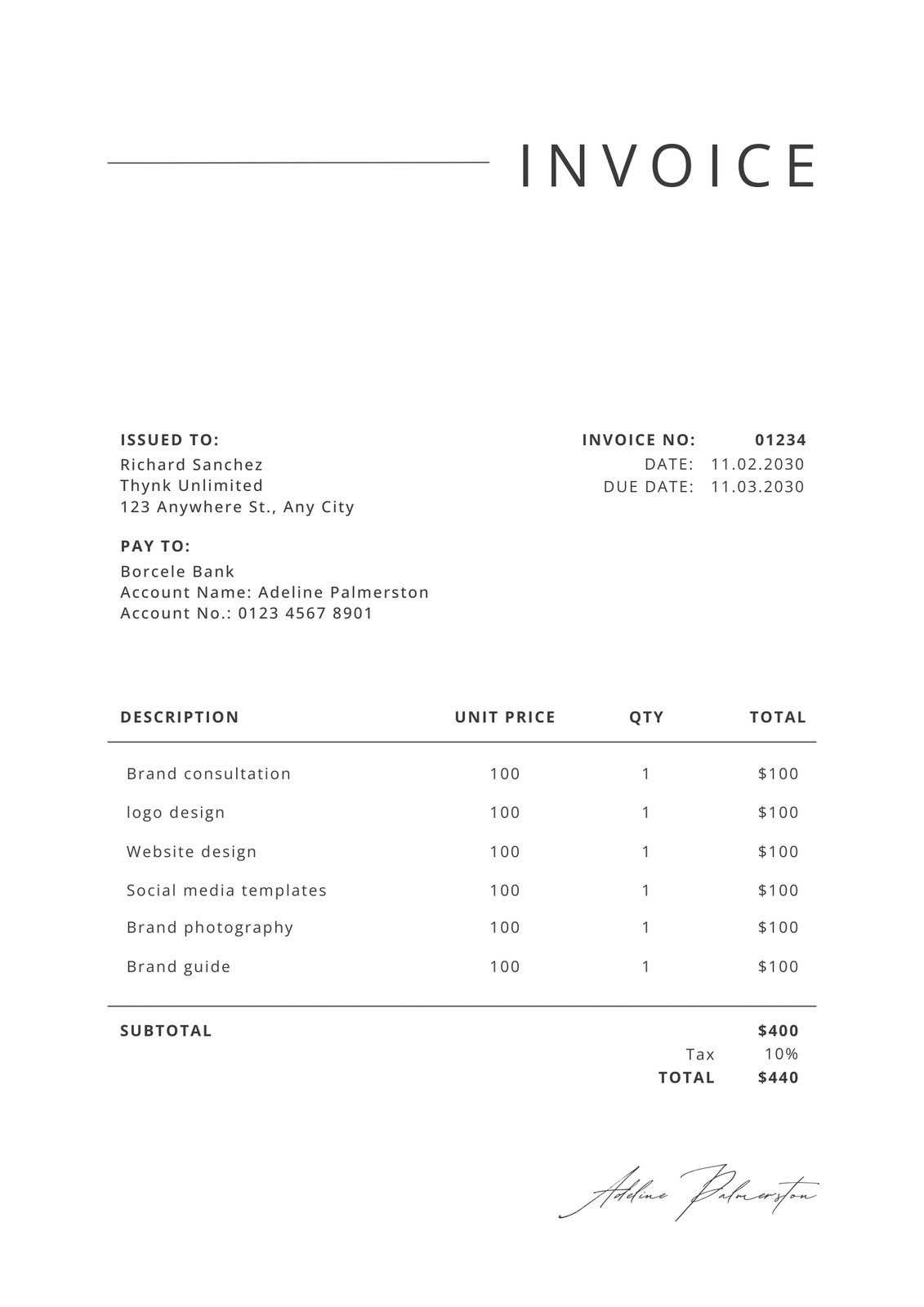

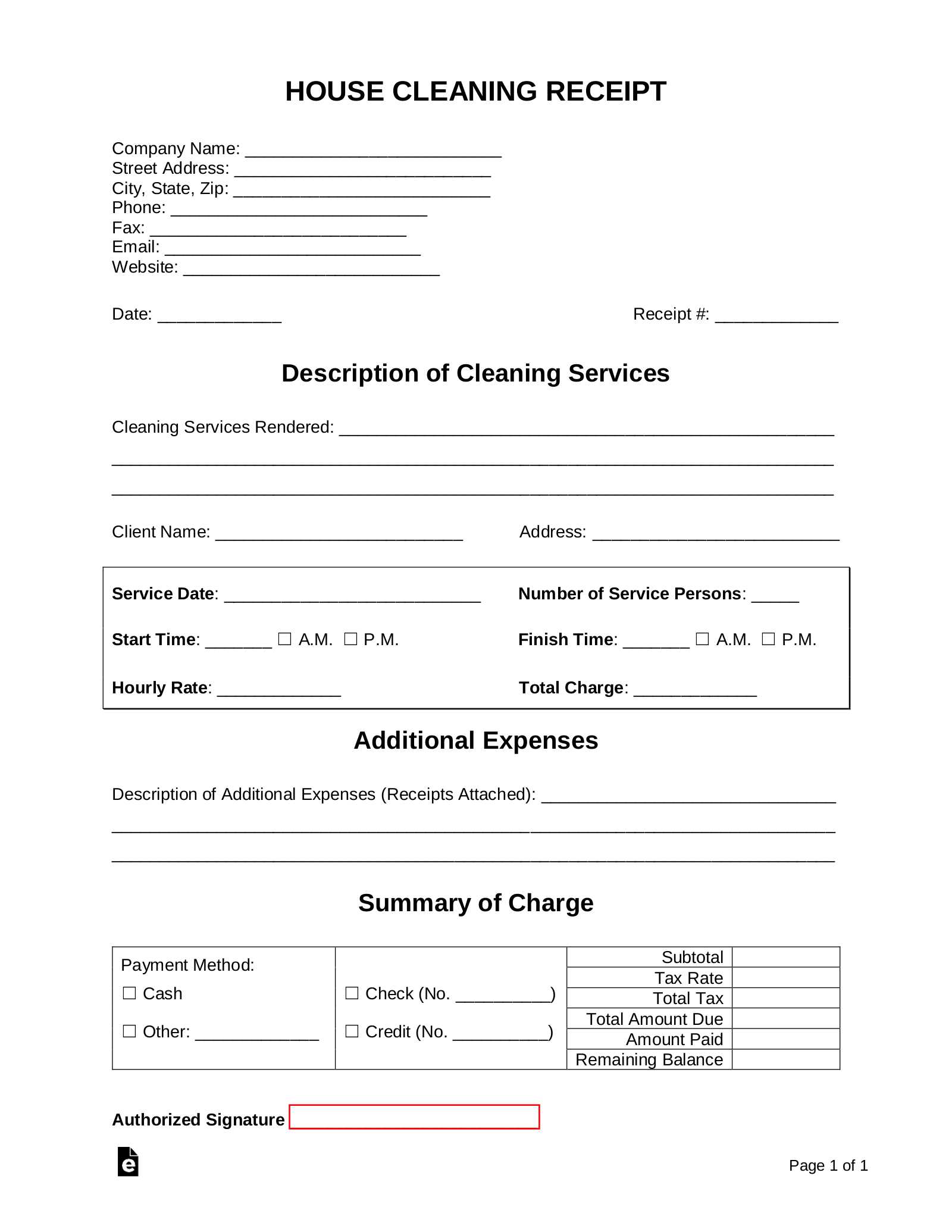

For businesses offering maintenance services, having an organized way to request payment is essential. An effective document for billing allows you to clearly outline the services provided, payment terms, and any additional charges, helping clients understand their financial obligations. A well-structured document also ensures that all necessary details are captured, reducing the chance of confusion or disputes.

Using a simple, customizable format can streamline the payment process and save time. The document should include basic sections such as the service provider’s contact information, the client’s details, a breakdown of the charges, and payment instructions. Additionally, incorporating a clean design ensures the document remains professional and easy to read.

| Service Description | Quantity | Rate | Total |

|---|---|---|---|

| General maintenance | 2 hours | $25/hr | $50 |

| Specialized cleaning | 1 hour | $30/hr | $30 |

| Total | $80 |

With all the necessary sections in place, such a document makes it easier to keep financial records organized. Clients can quickly review the charges and proceed with payment, while businesses can track outstanding balances. Whether you’re a freelancer or part of a larger service team, this method simplifies the billing process and ensures transparency on both sides.

Why You Need an Invoice Template

In any service-based business, having a consistent and professional way to request payment is essential for maintaining clear communication and ensuring smooth financial transactions. A structured billing document helps avoid misunderstandings and ensures both the service provider and client are on the same page regarding payment expectations. Without a standard format, businesses may face delays in receiving payments or encounter confusion over charges.

Using a pre-designed structure allows you to:

- Save time by avoiding manual creation each time a payment is due.

- Ensure consistency in your billing process, making it easier to manage records.

- Provide clients with clear, easy-to-understand documentation of services rendered and amounts due.

Additionally, a well-organized document builds trust with clients and shows professionalism, which can lead to repeat business and long-term relationships. Keeping everything standardized also simplifies accounting, tax filing, and other administrative tasks.

In short, using a pre-made format is not just about convenience, but also about creating an efficient system that supports your business growth and financial stability.

Benefits of Using a Free Template

Adopting a pre-designed format for billing provides numerous advantages, especially for businesses looking to save time and ensure accuracy. Rather than starting from scratch with every new client or service, you can rely on an established layout that includes all essential details, reducing the likelihood of errors or omissions. This efficient approach allows you to focus more on your work and less on administrative tasks.

Time-saving: One of the most significant benefits is the time you save. By utilizing an already prepared format, you can quickly input specific details without needing to create a new document every time you bill a client.

Professional appearance: A standardized document gives your business a polished and consistent look, which helps build credibility and trust with clients. A clear, easy-to-read form presents a professional image that encourages repeat business.

Customization: Many formats are customizable, allowing you to tailor the content to fit your specific business needs. You can easily adjust the layout, add or remove sections, and update pricing as necessary without the need for specialized software or skills.

Consistency and accuracy in billing help keep your finances organized, ensuring that each transaction is documented properly for future reference, whether for bookkeeping or tax purposes. In the end, using a pre-made solution boosts both your productivity and business reputation.

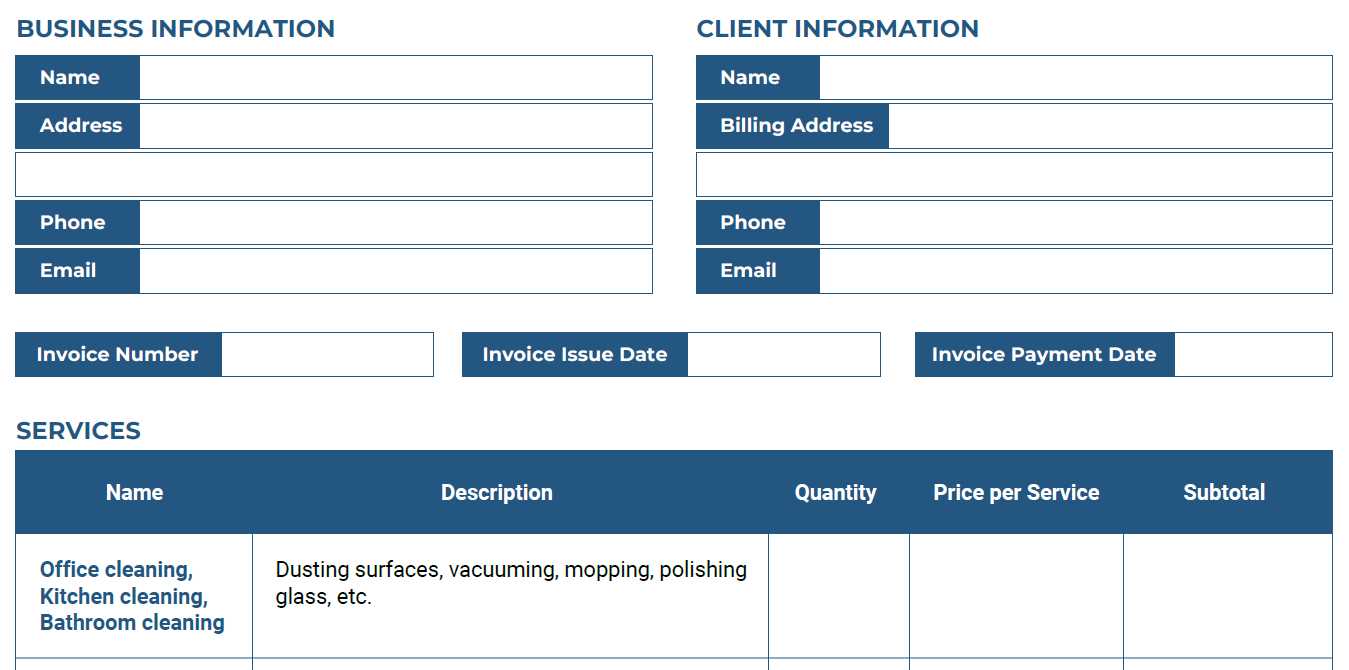

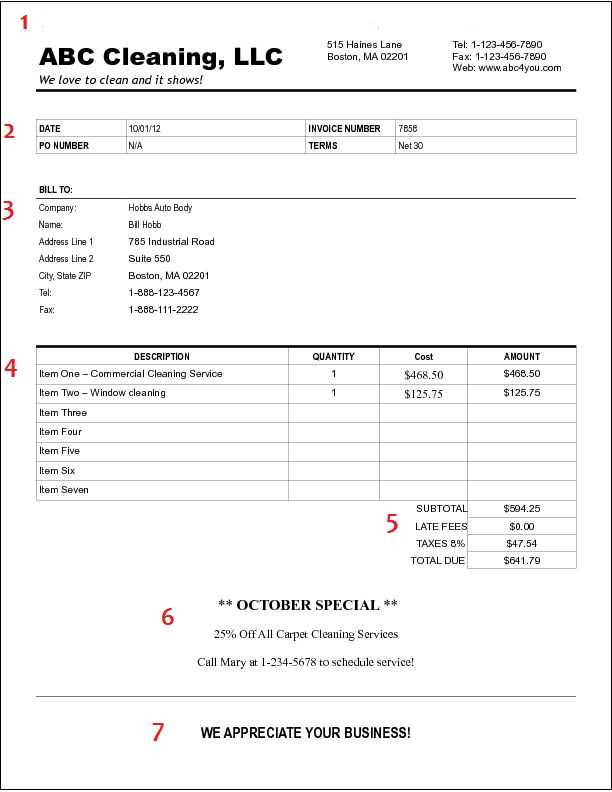

How to Customize Your Invoice

Adapting a standard billing format to meet your specific needs is a straightforward process that ensures your business accurately reflects its services and pricing. Customization allows you to include all relevant details such as your business name, contact information, client details, and the breakdown of charges, ensuring that everything is clearly presented to your customers.

Adjusting Key Sections

Start by editing the key sections that are unique to your services. For instance, include your company logo, a personalized message, or specific service descriptions. Customize the payment terms and include any additional information that may be relevant, such as discounts, taxes, or late payment fees. Being clear and precise in these areas will make it easier for your clients to understand their obligations.

Formatting for Clarity

While customizing the content, ensure that the layout remains clear and easy to read. You may want to adjust the font size, organize sections in a logical order, and make sure there is enough space between each part for clarity. By keeping the design simple and organized, you improve the document’s readability, making it easier for clients to review and process payments quickly.

Through these customizations, you create a document that is not only tailored to your needs but also professional in appearance, enhancing the overall client experience.

Essential Elements of an Invoice

When creating a document to request payment for services rendered, it is crucial to include all necessary details to ensure both clarity and accuracy. A well-structured document not only helps the client understand what they are being charged for, but also protects your business by maintaining clear records. Below are the essential components that should be included in any billing document.

- Business and Client Information: Include your company name, address, phone number, and email, as well as the client’s contact details. This helps to identify both parties involved in the transaction.

- Unique Identification Number: Assign a unique number to each bill for easy tracking and referencing. This helps with record-keeping and avoids confusion with previous transactions.

- Date of Service: Clearly state when the service was provided or when the work was completed. This ensures both parties know when the transaction took place.

- Itemized List of Services: Break down the services provided, including a detailed description, quantity, rate, and the total cost for each item. This makes it easier for clients to see exactly what they are paying for.

- Payment Terms: Outline the payment expectations, including the due date and accepted payment methods. If applicable, include any late fees or discounts for early payments.

- Total Amount Due: Clearly highlight the total amount owed, ensuring there is no confusion over the final payment amount.

By including these key elements, you create a professional and transparent document that simplifies the payment process and improves communication with clients.

Choosing the Right Template for Your Business

Selecting the right format for billing is an essential step in ensuring your business communicates professionalism and clarity. The right document can reflect your brand identity, streamline your processes, and make financial transactions more efficient. Whether you are a small startup or an established company, choosing a solution that fits your needs is crucial for maintaining smooth operations.

Consider your services: Think about the complexity of your offerings. If your work involves various tasks with different rates or customization, you’ll need a format that allows you to itemize services clearly. A simple, straightforward layout may suffice for businesses with standard offerings, but a more detailed layout may be required for those providing customized services.

Keep your brand in mind: The layout and design should align with your business’s branding. Choose a document style that complements your company’s logo, colors, and general aesthetic. This consistency not only creates a professional image but also reinforces your business identity with clients.

Adaptability and ease of use: Make sure the format you choose is easy to adapt to different clients and scenarios. It should be simple to modify, update, or adjust the terms, rates, or descriptions when necessary. An easy-to-use format saves you time and reduces the risk of errors.

By carefully selecting the right structure for your needs, you ensure that every transaction is clear, accurate, and professional, reinforcing your business’s credibility and helping to build trust with clients.

How to Save Time with Templates

Using a pre-designed structure for your billing process can drastically reduce the amount of time spent on administrative tasks. Instead of creating new documents from scratch each time you need to request payment, a standard layout allows you to quickly input client-specific details and send out requests. This streamlined approach not only saves time but also ensures consistency across all your transactions.

Speed Up the Creation Process

When you use a reusable format, you eliminate the need to start from zero every time. By having essential sections already in place, such as service descriptions, pricing, and payment terms, you can quickly adjust the details specific to the current transaction. This drastically reduces the time spent on creating each document.

- Simply input client and service details.

- Adjust the pricing or add additional charges as needed.

- Finalize and send with minimal effort.

Reduce Errors and Overhead

With a consistent layout, there’s less room for error. Every section is standardized, making it easier to avoid missing important information, such as contact details or payment instructions. Additionally, by using a pre-built format, you won’t have to worry about formatting inconsistencies that could lead to confusion or delays in payment.

By adopting a ready-made structure for your billing needs, you ensure faster, more accurate processing, allowing you to focus on growing your business rather than spending time on repetitive tasks.

Free Resources for Invoice Templates

There are numerous resources available online that provide pre-designed documents to simplify the billing process for businesses of all sizes. These platforms offer a wide range of formats that can be easily customized to meet specific business needs. By using these resources, you can quickly access professional layouts that save time and ensure accuracy without needing to create documents from scratch.

Online Platforms with Customizable Formats

Several websites offer a variety of templates for download or direct use. These platforms typically provide options that allow for quick edits and easy customization, which is ideal for businesses looking to save time and maintain consistency. Most of these services allow you to input your own details, modify the design, and download the completed document in various file formats.

- Canva: Offers a wide selection of customizable billing layouts with easy drag-and-drop functionality.

- Microsoft Office: Provides free formats through Word and Excel, which can be easily adapted to your business needs.

- Google Docs: Allows for quick customization of free pre-designed layouts, accessible from anywhere with an internet connection.

Benefits of Using Online Resources

These free resources not only help you save time but also offer the flexibility to choose a style that best matches your brand. By leveraging these options, you ensure that your billing process is both professional and consistent, without the need for expensive software or time-consuming design work.

With the right online tools, you can quickly generate professional documents that meet your specific needs while keeping overhead costs low.

What to Include in Cleaning Service Invoices

When providing services that involve maintaining spaces or performing janitorial tasks, it is essential to have a well-detailed document to request payment. This document should outline the services rendered, the total cost, and the necessary terms for both parties. By ensuring that all key elements are included, you can streamline your business operations and prevent misunderstandings with clients.

Key Information for Clear Billing

To create a clear and professional billing document, be sure to include the following details:

- Client and Service Provider Information: Include both parties’ names, addresses, and contact details for easy identification.

- Service Description: Break down the tasks performed, such as the areas cleaned, tasks completed, or time spent. This makes it clear what the client is paying for.

- Charges and Fees: List the rates for services rendered, including any additional charges such as travel fees or special requests.

- Payment Terms: Specify the due date, accepted payment methods, and any penalties for late payments.

- Unique Reference Number: Assign a reference number to each document for easy tracking and future reference.

Additional Considerations for Professionalism

Formatting and Clarity: Make sure that your document is easy to read, with sections clearly defined. A well-organized layout helps avoid confusion and ensures that clients can quickly review the details.

By including all these essential elements, you create a transparent and professional document that promotes trust and smooth financial transactions.

Invoice Design Tips for Professionalism

Creating a polished and organized document for billing not only helps ensure that all details are clear but also conveys professionalism to your clients. A well-designed layout reflects your attention to detail and makes it easier for clients to understand the breakdown of services and costs. By focusing on certain design aspects, you can elevate the quality of your financial documents and leave a lasting positive impression.

Focus on readability: A clean and simple design makes the document easy to read and understand. Use ample white space, clear fonts, and well-structured sections. Clients should be able to quickly locate important information, such as the total amount due and payment terms.

| Tip | Explanation |

|---|---|

| Consistent Font | Choose one easy-to-read font for all text. Avoid using multiple styles as they can create confusion. |

| Bold Important Details | Highlight key sections like the total amount due or payment deadlines by using bold or larger text. |

| Clear Section Headers | Break down the document into logical sections such as “Service Details” and “Payment Terms” for easier navigation. |

Incorporate your branding: Including your business logo and using your brand’s color scheme can make your document feel more personal and cohesive with your other marketing materials. Consistency across all forms of communication helps reinforce your brand identity.

Keep it simple: While design is important, avoid overcomplicating the document with too many colors, fonts, or graphics. A clean and professional look will make a much stronger impact than something that is overly busy or difficult to follow.

By following these design tips, you can create a visually appealing document that reinforces your business’s professionalism and ensures clarity for your clients.

How to Track Payments Effectively

Efficiently managing and monitoring payments is critical for maintaining healthy cash flow in any business. By keeping track of incoming payments and ensuring that all transactions are properly documented, you can avoid confusion, reduce errors, and ensure that all dues are settled in a timely manner. Adopting effective tracking methods can also help you spot overdue payments quickly and take necessary actions without delay.

Use a Simple System for Tracking

A straightforward system, whether it’s a spreadsheet, accounting software, or a physical ledger, can provide clarity. Each payment should be logged with details such as the amount, client name, payment method, and the date received. This allows you to easily reference past transactions and track whether payments have been received as agreed.

- Spreadsheets: Create a table to log every payment, including relevant details such as the client’s name, service provided, amount paid, and the date.

- Accounting Software: Consider using software that automatically tracks and categorizes payments, offering reports and reminders for overdue accounts.

- Physical Ledger: For businesses that prefer manual tracking, a physical ledger or paper-based system can still be effective if well-maintained.

Set Clear Payment Terms

Having clear terms for payment deadlines, late fees, and preferred payment methods helps reduce misunderstandings and ensures clients know exactly what is expected. Clearly stating these terms on the document used to request payment, as well as in follow-up communications, will encourage prompt payment.

Automate Reminders for Late Payments

Automating payment reminders can save time and reduce the need for manual follow-ups. Many online accounting tools offer this feature, sending reminders automatically to clients when payments are due or overdue. This feature helps ensure that payments are tracked without requiring constant manual oversight.

By implementing a simple and organized tracking system, you can ensure your business stays on top of payments, reduce the risk of missed or delayed payments, and improve overall financial management.

Common Invoice Mistakes to Avoid

When requesting payment for services rendered, it’s crucial to ensure all details are accurate and clear. Small errors in the billing process can lead to confusion, delayed payments, or even disputes with clients. By being aware of the most common mistakes and taking steps to avoid them, you can streamline your financial operations and maintain professionalism in your business dealings.

Missing or Incorrect Details

One of the most common mistakes is failing to include essential information or making errors in the details provided. This can include incorrect contact details, service descriptions, or payment terms. Always double-check the following before sending:

- Client Information: Ensure that the name, address, and contact details of the client are accurate.

- Service Description: Be clear about what services were provided and any associated costs.

- Payment Terms: Double-check payment deadlines, accepted methods, and any late fee policies.

Unclear Payment Instructions

Failure to provide clear payment instructions can cause delays. If the client isn’t sure how to make a payment or where to send it, it can create unnecessary back-and-forth. To avoid this, always include clear instructions regarding:

- Payment Methods: Indicate whether payments can be made via credit card, bank transfer, or another method.

- Bank Account Details: If accepting payments by bank transfer, provide all necessary details including account number and routing information.

- Due Dates: Clearly state when payment is expected and any penalties for overdue payments.

Overlooking Taxes and Additional Charges

It’s easy to forget to add taxes or other fees, especially if they change based on the type of service or the location of the client. Always include these additional costs in your billing documents to avoid any confusion or misunderstandings. Additionally, ensure that the tax rates you use are up-to-date and in line with local regulations.

By avoiding these common mistakes, you can create more professional and efficient billing processes that ensure timely payments and help maintain good relationships with your clients.

How to Handle Late Payments

Late payments can be a significant challenge for businesses, affecting cash flow and potentially causing frustration with clients. It’s essential to have a clear plan in place for handling overdue balances. By maintaining professionalism and adhering to well-defined procedures, you can minimize the impact of late payments and encourage clients to pay on time in the future.

Send Friendly Reminders

One of the first steps in addressing overdue payments is sending a friendly reminder. Sometimes, clients simply forget or overlook the due date. A polite follow-up can help ensure the payment is processed without creating tension.

- Timing: Send a reminder a few days after the due date. This shows you’re keeping track of payments while still being understanding.

- Clear Communication: Be clear about the amount due and any late fees that may apply. Keep the tone professional and friendly.

- Offer Assistance: If necessary, offer assistance or flexibility with payment methods or extensions.

Establish a Late Payment Policy

Having a late payment policy in place will set expectations for both you and your clients. Clearly outlining your terms can help prevent misunderstandings and encourage timely payments. This should include:

- Late Fees: Specify any fees that will be added after the payment deadline, and ensure your clients are aware of this upfront.

- Payment Extensions: Define how long clients have to pay before taking additional actions, such as charging interest or suspending services.

- Consequences: Be transparent about the steps you’ll take if payments continue to be overdue, such as involving collections or legal action.

Stay Professional in All Communications

It’s important to remain courteous and professional in all correspondence regarding overdue payments. Even when dealing with difficult situations, keeping a calm and respectful tone can maintain a positive relationship with clients. A solution-focused approach often leads to quicker resolutions and minimizes conflict.

By proactively managing overdue payments and setting clear expectations, businesses can reduce the frequency of late payments and improve their overall financial stability.

Digital vs. Paper Invoices: What to Choose

When managing business transactions, one of the key decisions is choosing the right method for sending payment requests. With various options available, it’s important to weigh the benefits and drawbacks of both digital and physical methods. The choice can influence efficiency, costs, and how clients interact with your business.

Advantages of Digital Formats

Digital methods of sending payment requests offer a range of benefits that align with modern business needs. These formats tend to be faster, more environmentally friendly, and easier to track.

- Speed: Sending electronic requests allows for immediate delivery, ensuring that clients receive their bills quickly and can process payments sooner.

- Cost Efficiency: With digital methods, you can save on printing, paper, and postage costs, making it a more economical choice in the long run.

- Convenience: Clients can view and pay through a secure online portal at their convenience, making the entire process seamless and efficient.

- Easy Record Keeping: Digital records are easy to store, organize, and retrieve, helping you maintain accurate financial records without the risk of lost or damaged paperwork.

Benefits of Paper Bills

While digital options are on the rise, paper documents still have a place in many businesses. For some clients, receiving a physical bill can be more tangible and trustworthy, providing a sense of security.

- Personal Touch: Some customers may feel more comfortable with a physical document, which feels more formal and personal. This can help establish trust in certain industries.

- Reliability: For clients who may not be tech-savvy or lack reliable internet access, physical documents ensure that they can still receive and review their bill in a way they understand.

- Professional Appearance: Paper bills can sometimes feel more official and formal, which can be beneficial when working with certain sectors or high-profile clients.

Choosing the Best Option

The decision between digital and physical methods ultimately depends on your business type, customer preferences, and operational requirements. If you’re focused on speed and cost-saving, digital may be the way to go. However, if you have clients who value the tangible aspect of paperwork, offering both options may be the most versatile solution.

Consider your customer base and the practicality of each method to ensure you’re providing the best experience for both your clients and your business.

Best Practices for Sending Invoices

Sending payment requests is an essential part of maintaining a successful business operation. To ensure timely payments and a smooth financial process, it’s crucial to follow best practices that enhance clarity, professionalism, and efficiency. Whether you’re a freelancer or a large company, implementing effective strategies can make a significant difference in your cash flow and client relationships.

Clear and Accurate Information

Providing accurate and detailed information is the cornerstone of an effective payment request. When all necessary details are clear, clients are more likely to understand the terms and settle their payments on time.

- Include Complete Contact Details: Always include your full contact information, including your business name, address, phone number, and email. This ensures clients can easily reach you if there are any questions or issues.

- Break Down Charges Clearly: Itemize services, products, or hours worked. This provides transparency and helps clients see exactly what they’re paying for.

- Specify Payment Terms: Clearly state the payment due date and any late fees that may apply. This helps avoid misunderstandings and ensures both parties know their responsibilities.

Timely and Consistent Delivery

Sending your payment requests in a timely manner is vital for maintaining a smooth cash flow. Being consistent in your approach to sending out payment reminders is also essential for reducing delays.

- Send Promptly: Send your request as soon as the service or product is delivered. Waiting too long to send it can lead to delays in payment and create confusion.

- Use Automated Systems: Consider using automated tools to send payment requests on a regular schedule. This ensures you don’t forget to send out invoices and can help you maintain consistency.

- Follow Up Politely: If a payment is overdue, send a friendly reminder. Politely following up ensures clients don’t forget their obligations and helps you maintain a professional relationship.

Provide Multiple Payment Methods

Offering various payment methods can make it easier for clients to pay promptly. The more options available, the more likely it is that clients will pay on time.

- Offer Online Payment Options: Allow clients to pay through online platforms like PayPal, credit cards, or bank transfers. This can speed up the payment process and reduce administrative work.

- Support Checks and Bank Transfers: For clients who prefer traditional payment methods, always offer a bank transfer or check option.

- Hourly Rates: Charging by the hour is common, especially for smaller jobs. This method allows you to account for the exact amount of time spent on each task.

- Flat Rates: For recurring services or standard tasks, offering a fixed price may be more convenient for both parties. Flat rates work well when you can estimate the amount of time and effort involved.

- Supplies: The cost of consumables, such as cleaning products, should be included in the pricing structure. You may want to charge clients based on the types and amounts of products used during a service.

- Travel and Equipment: If traveling long distances or using specialized equipment, these costs should also be considered. It’s important to factor these into your rates to maintain profitability.

- Sequential Numbering: Ensure that your numbers follow a clear, sequential order. This will help you quickly identify missing or duplicate documents.

- Year-Based Numbers: Including the year in the numbering system (e.g., 2024-001) can help you categorize and manage records over multiple years.

- Cloud Storage: Storing your records in the cloud ensures they are easily accessible and safely backed up. You can access them from any device, anywhere, and share them securely with clients or collaborators.

- Accounting Software: Software like QuickBooks or FreshBooks offers comprehensive features that allow you to generate, track, and categorize billing documents. These platforms often come with integrated payment tracking and reporting tools.

- Business Identification: Include your business name, address, contact details, and registration number (if applicable). This verifies the legitimacy of the service provider.

- Client Information: Clearly state the client’s full name or company name and their contact details. This ensures there’s no confusion regarding the parties involved in the transaction.

- Description of Services: A detailed breakdown of services performed should be included. This allows clients to understand exactly what they are being charged for, reducing the risk of disputes.

- Terms and Conditions: Make sure to include any terms regarding payment deadlines, late fees, or other applicable conditions. This sets clear expectations and protects your interests legally.

- Tax Rates: Ensure that the appropriate tax rates are applied to your charges based on your location and the nature of the services provided.

- Tax Identification Number: Some regions require businesses to display their tax identification number (TIN) or VAT number on payment documents. This provides legal proof of registration and ensures compliance.

- Retention of Records: Depending on local laws, businesses may be required to store billing records for a certain number of years. Ensure you retain copies of all payment requests, receipts, and related correspondence.

- Clear Documentation of Payments: For every transaction, keep track of payments made, outstanding amounts, and any related communications. This helps avoid confusion and ensures you can referenc

How to Calculate Cleaning Service Rates

Determining the right pricing for services is a critical step in running a successful business. Accurate rates ensure profitability while remaining competitive in the market. To set the right price, it’s important to consider various factors, from the type of tasks performed to the time spent and resources used.

The first step in calculating rates is to understand the scope of work required for each job. This involves assessing the area size, the frequency of service, and the complexity of the tasks involved. For instance, deep cleaning will usually require more time and specialized equipment compared to routine upkeep. Understanding these factors allows you to price services based on the effort and resources involved.

Factor in Time and Labor

One of the most significant components when determining service rates is labor. The time spent on a job should be calculated based on the size of the area or the number of tasks that need to be completed. Factor in the hourly wage of the personnel, along with any additional overtime costs if necessary.

Include Operational Costs

Beyond labor, you must also account for any operational costs involved in the service. This could include transportation costs, cleaning supplies, equipment maintenance, and other overheads. These expenses should be factored into the pricing model to ensure that your business remains financially sustainable.

Research the Market

While your rates should reflect the unique aspects of your services, it’s also important to remain competitive within your local market. Researching what competitors charge for similar services can give you valuable insight into industry standards and help you set fair yet competitive pricing.

By understanding your costs, labor requirements, and the market, you can confidently set a pricing structure that is both competitive and sustainable for your business. Always ensure t

How to Stay Organized with Invoices

Keeping track of financial documents is crucial for any business to run smoothly and ensure accurate accounting. A well-organized system allows you to manage payments efficiently, avoid errors, and maintain transparency with clients. Proper organization helps prevent delays and misunderstandings, enabling you to focus on growing your business rather than spending time sorting through paperwork.

Utilize a Consistent Numbering System

One of the easiest ways to stay organized is by implementing a consistent numbering system for all your billing documents. Assign a unique number to each document, starting from a fixed point (e.g., 001 or 1001). This makes it easier to track and reference specific documents, especially when dealing with multiple clients or projects.

Digital Tools and Software

Digital solutions are invaluable when it comes to organizing financial records. Using accounting software or cloud-based tools can help you automate many of the processes associated with billing and document management. These tools often come with features like reminders, automatic calculations, and secure storage, all of which save time and reduce the risk of errors.

By keeping your financial records organized, you’ll ensure that you have a clear overview of your transactions, making it easier to manage cash flow and stay on top of payments. Whether you choose digital tools or traditional methods, the key is consistency and regular maintenance of your system.

Legal Considerations for Cleaning Invoices

When managing payment requests for services provided, it’s essential to ensure that your documents comply with relevant legal requirements. Following the correct procedures not only protects your business but also helps build trust with clients. Understanding the legal aspects of billing documents is critical to avoid disputes and ensure smooth transactions.

Include Essential Information

To maintain transparency and avoid potential legal issues, it’s important that every request for payment contains specific details that are legally required in your jurisdiction. These key elements protect both parties and prevent misunderstandings.

Comply with Tax Requirements

Many jurisdictions require businesses to adhere to specific tax rules when charging for services. This can include value-added tax (VAT) or sales tax, depending on where you operate. Failure to comply with tax laws can result in penalties or legal action.

Maintain Accurate Recordkeeping

Keeping accurate and organized records is not only good business practice but also a legal obligation in many regions. Documentation of all transactions will help protect you in case of audits or legal disputes.