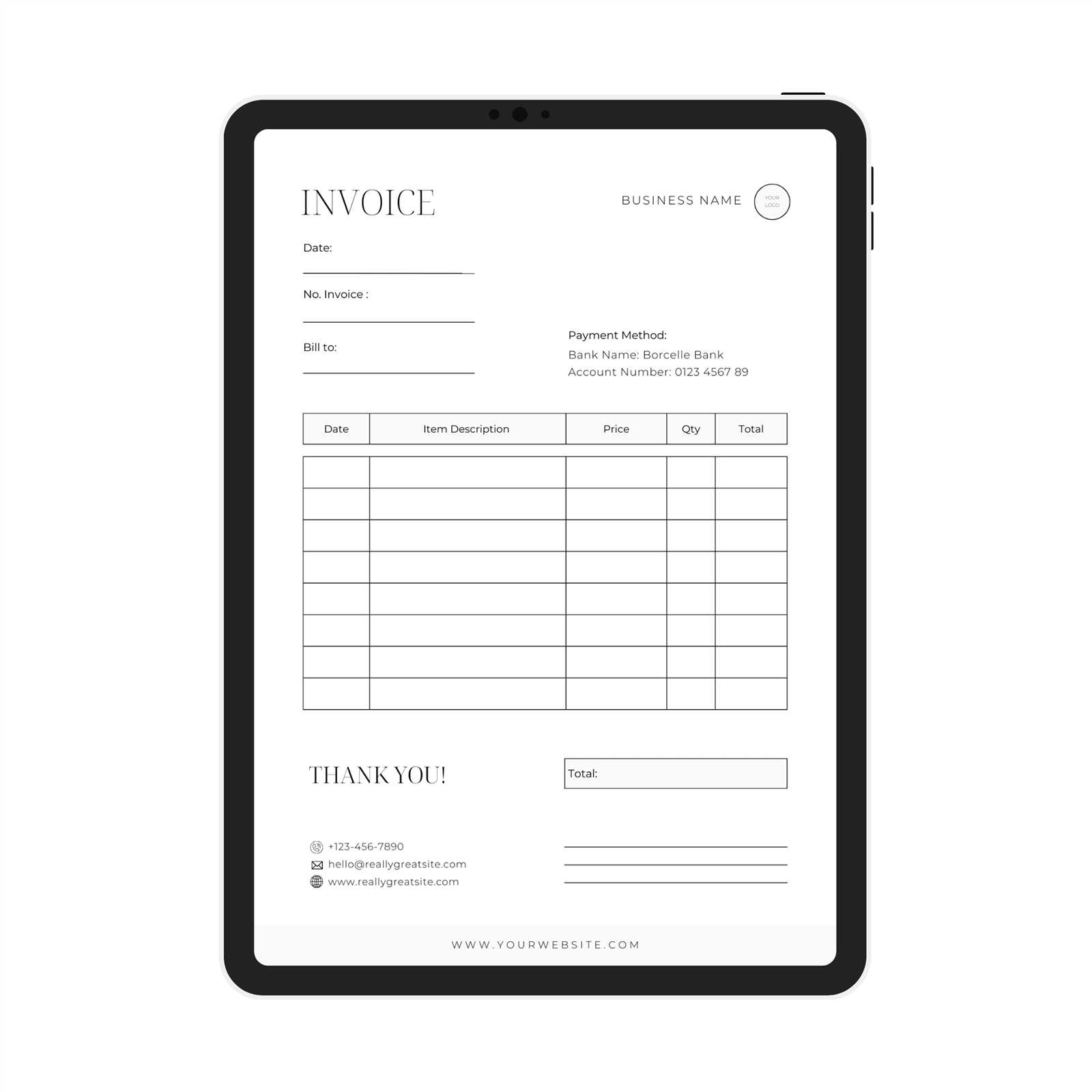

Free Notary Invoice Template for Simplified Billing

Managing financial records can be a daunting task, especially when it comes to creating detailed billing documents. Having a pre-designed format at your disposal simplifies this process, allowing you to focus more on your core responsibilities rather than administrative duties.

Using a prepared document format ensures that all essential details are consistently captured, minimizing the risk of errors. This approach not only saves time but also enhances professionalism in your financial dealings.

With easy-to-edit forms, you can swiftly tailor the content to suit specific transactions, ensuring clarity and precision. These tools are designed to meet various business needs, making them a valuable asset for anyone seeking to maintain clear and organized financial records.

Creating Professional Invoices for Notary Services

Generating comprehensive billing documents is a critical component of maintaining a reputable and organized practice. A well-structured format ensures clarity, professionalism, and accuracy in your financial transactions.

To craft an effective billing record, it is important to include all necessary elements such as the service details, charges, and payment terms. Consistency and attention to detail are key in presenting a polished and reliable document.

Adopting a clear layout not only simplifies the payment process for clients but also fosters trust and transparency. By utilizing a structured format, you ensure that each transaction is properly documented, reducing potential disputes and enhancing overall efficiency.

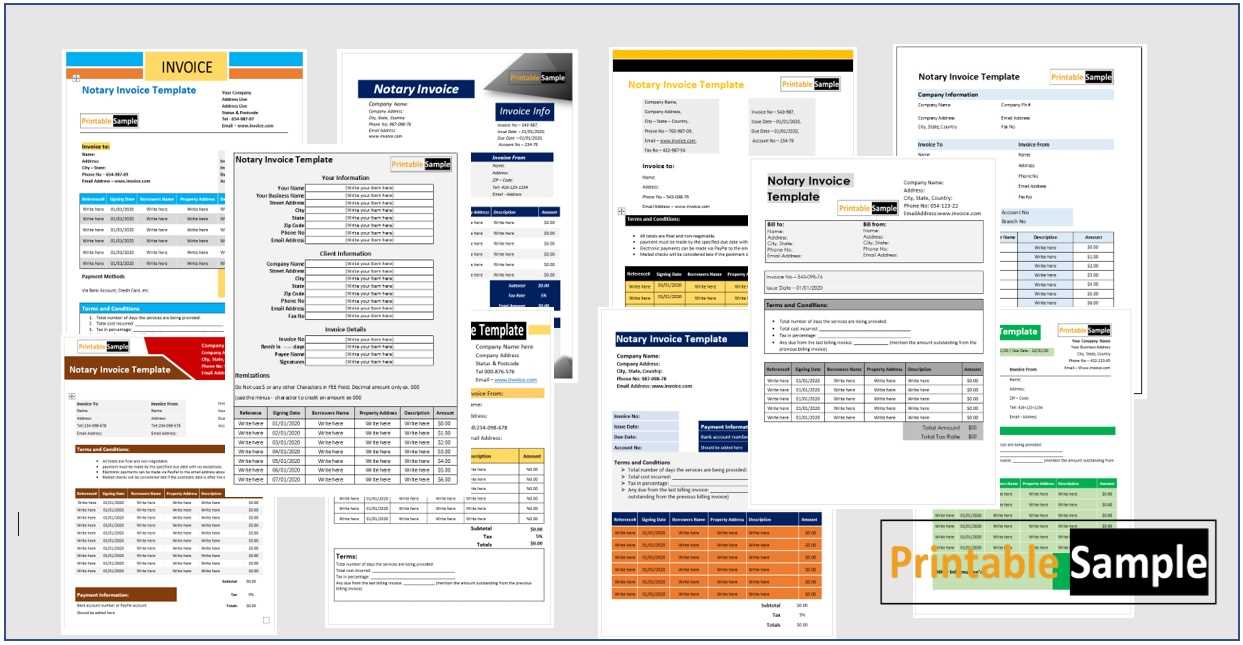

Benefits of Using a Customizable Invoice Template

Adopting a flexible billing format brings numerous advantages to your business operations. It allows for easy adaptation to various client needs, ensuring that each transaction is accurately and clearly recorded.

Here are some key benefits:

| Advantage | Description |

|---|---|

| Efficiency | Speeds up the process of creating detailed financial records by providing a ready-made structure. |

| Customization | Enables adjustments to fit specific services or requirements, ensuring relevance and accuracy. |

| Consistency | Maintains uniformity across all documents, enhancing professional presentation and reducing errors. |

| Time-Saving | Reduces the time spent on administrative tasks, allowing more focus on core business activities. |

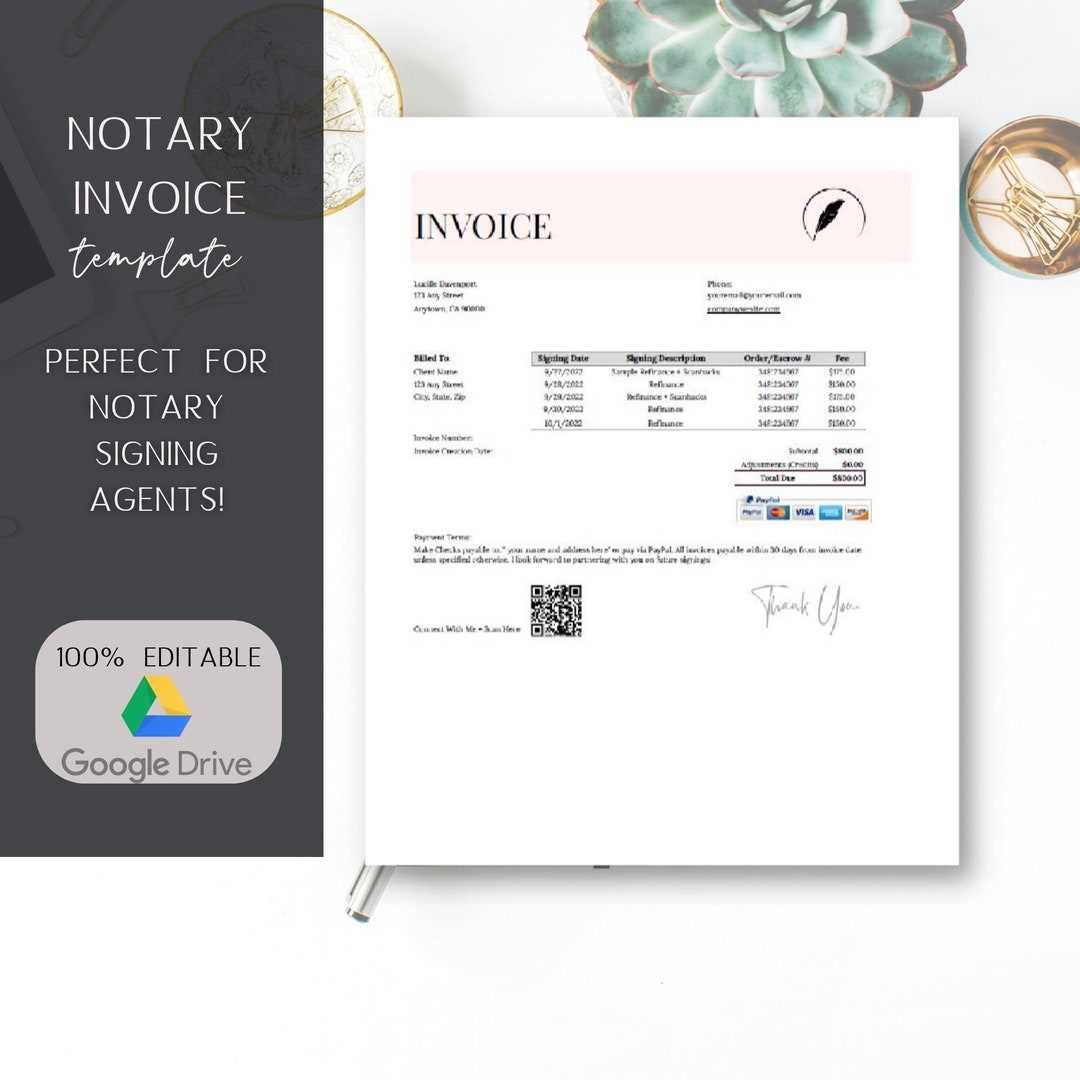

How to Personalize Your Notary Billing Document

Creating a personalized billing document is essential for reflecting your unique business identity while ensuring all necessary details are accurately presented. Customizing these documents enhances clarity and professionalism, making them more effective for both you and your clients.

Incorporating Your Business Identity

Start by adding your company logo, name, and contact details. This not only makes the document visually appealing but also reinforces your brand identity. Consistent use of colors and fonts aligned with your brand guidelines further enhances the professional look.

Tailoring the Content

Ensure the document includes specific fields relevant to your services. Adjust the descriptions and charges to accurately reflect the tasks performed. Including personalized notes or messages can also help in building stronger client relationships and fostering trust.

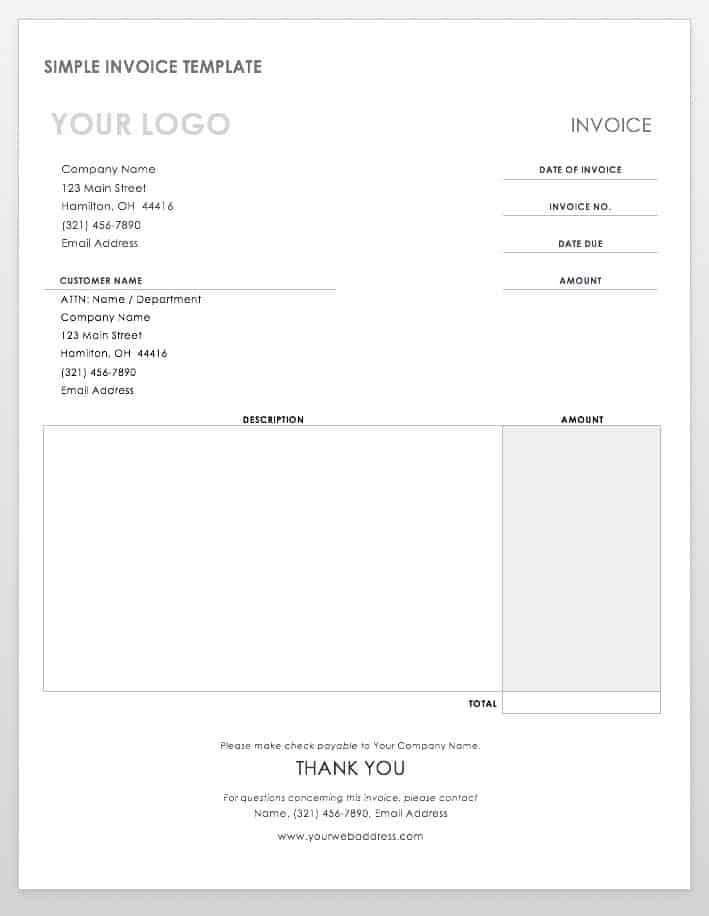

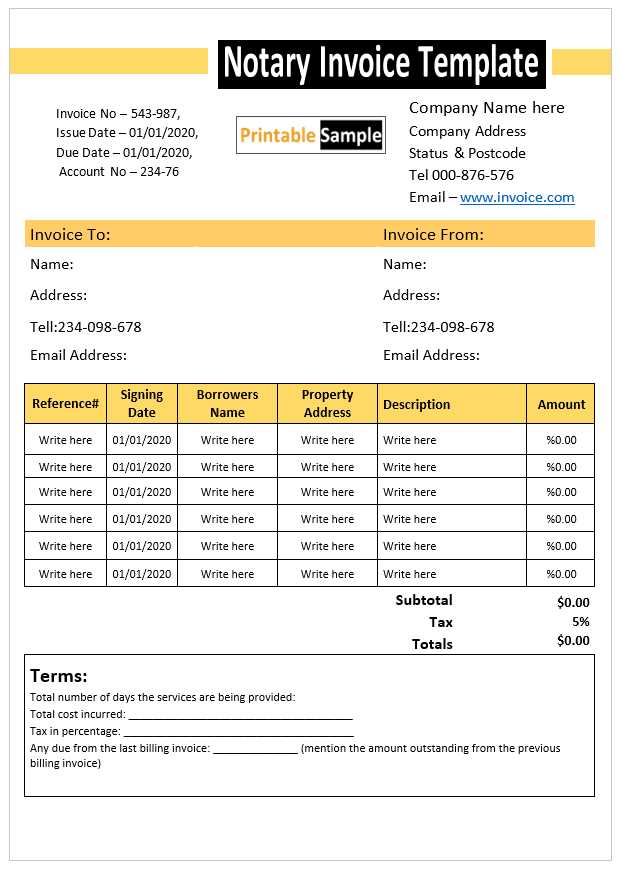

Key Components of an Effective Invoice

An effective billing document should clearly outline the details of the transaction, ensuring both parties have a mutual understanding of the services provided and the associated costs. Including the right elements helps prevent misunderstandings and facilitates smooth financial interactions.

First, include your business name and contact information at the top, along with the client’s details. This makes it easy to identify the involved parties. Next, list the services provided with a brief description, quantity, and rate. This section should be as detailed as necessary to avoid any confusion about the charges.

Additionally, provide a clear breakdown of the total amount due, including any taxes or additional fees. Ensure the payment terms are stated, specifying the due date and accepted methods of payment. Finally, adding a unique document number helps in tracking and referencing the transaction for future communication.

Legal Considerations in Notary Billing

Ensuring compliance with legal requirements is crucial when preparing billing documents for professional services. Adhering to the appropriate regulations not only safeguards your business but also builds trust with clients by demonstrating transparency and accountability.

Essential Legal Elements

- Accurate Service Description: Clearly outline the services rendered to avoid disputes and ensure both parties have a clear understanding of the transaction.

- Tax Compliance: Include applicable taxes as required by law, and ensure accurate calculations to remain compliant with tax regulations.

- Privacy Protection: Safeguard client information by following data protection laws and including necessary confidentiality clauses.

Documentation and Record-Keeping

- Retain Copies: Keep detailed records of all billing documents for a specified period as mandated by local laws to facilitate audits or legal reviews.

- Provide Clear Payment Terms: State payment deadlines and consequences for late payments to avoid legal disputes and maintain clear expectations.

Tips for Accurate Record Keeping

Maintaining precise records is essential for the smooth operation of any business. Accurate documentation ensures you can track transactions, comply with regulations, and quickly resolve any discrepancies. Here are some effective strategies for keeping your records organized and up-to-date.

Organizing Your Documents

- Use Digital Tools: Leverage software to store and manage your records. This helps reduce the risk of losing important documents and makes it easier to search and retrieve information.

- Label Files Clearly: Ensure that each document is appropriately labeled with essential details such as date, client name, and service type. This will help you quickly locate specific records when needed.

- Maintain Consistency: Keep a consistent format for all records. This will simplify the process of organizing and reviewing your files.

Regular Review and Updates

- Review Records Periodically: Set aside time to review your records regularly. This helps ensure all documents are accurate and up-to-date, and that no important information is overlooked.

- Backup Data: Regularly back up your digital records to prevent data loss due to technical issues or unforeseen circumstances.

- Stay Compliant: Keep track of changes in regulations and update your records accordingly to remain compliant with local laws and tax requirements.

Managing Payment Terms and Deadlines

Effectively managing payment terms and deadlines is key to ensuring timely payments and maintaining a smooth business operation. Clear terms help both parties understand their responsibilities and reduce the likelihood of delays or misunderstandings.

Setting Clear Payment Expectations

- Specify Payment Methods: Clearly state which payment methods are acceptable, whether it’s credit card, bank transfer, or another option.

- Include Due Dates: Always include a specific due date for payments, making it clear when the payment is expected.

- Outline Late Fees: If applicable, include information on any late fees or penalties for overdue payments to encourage timely compliance.

Tracking Payments and Managing Delays

- Monitor Payment Status: Keep a record of payment statuses to quickly identify overdue payments and take necessary actions.

- Send Reminders: Consider sending reminders before and after the due date to prompt clients to settle their balance on time.

- Be Flexible When Necessary: If a client faces financial difficulties, work with them to agree on new terms to ensure payment is still received.

Common Mistakes in Notary Invoicing

When preparing billing documents, even small errors can lead to confusion, delayed payments, or legal complications. Being aware of common mistakes can help professionals avoid issues and ensure that payments are processed smoothly and promptly.

Frequent Errors in Billing

- Incorrect Service Descriptions: Failing to clearly outline the services provided can lead to misunderstandings and disputes. Always ensure that each service is described accurately and in detail.

- Missing Contact Information: Neglecting to include essential contact details, such as phone numbers or email addresses, may delay communication and payment processing.

- Omitting Payment Terms: Not specifying payment due dates or methods can result in confusion about when and how the payment should be made.

Potential Consequences of Errors

- Delayed Payments: Inaccurate or incomplete information can cause delays in payment processing as clients may hesitate to pay until everything is clarified.

- Legal Disputes: Failure to comply with contractual terms or unclear documentation could lead to disputes or legal action.

- Reputation Damage: Frequent errors in billing may damage your professional reputation, causing clients to question your reliability.

Improving Client Communication Through Clear Billing

Clear and transparent billing documents not only ensure timely payments but also foster trust and strengthen communication with clients. By providing easy-to-understand and detailed financial statements, you demonstrate professionalism and reduce the likelihood of disputes.

Enhancing Clarity in Billing Statements

- Break Down Charges: Clearly list each charge separately so clients can easily understand what they are being billed for.

- Provide Detailed Descriptions: Offer detailed descriptions of services rendered, making sure clients know exactly what they are paying for.

- State Payment Terms: Clearly indicate when payments are due, what methods are acceptable, and any late fees that may apply.

Building Stronger Relationships with Clients

- Foster Transparency: Keep clients informed about their balance and provide updates if there are any changes to their account.

- Respond to Inquiries Promptly: Address any questions or concerns regarding the charges to build confidence and trust.

- Offer Flexible Payment Options: Make it easy for clients to pay by providing a variety of accepted payment methods.

Tracking Income with a Billing Document

Accurate record-keeping is essential for managing your earnings and maintaining financial stability. By organizing payments and services provided in a structured manner, you can easily monitor income and ensure proper documentation for future reference or tax purposes.

| Service Date | Client Name | Amount Received | Payment Method | Status |

|---|---|---|---|---|

| 01/05/2024 | John Doe | $100 | Credit Card | Paid |

| 01/10/2024 | Jane Smith | $150 | Bank Transfer | Pending |

| 01/15/2024 | Michael Johnson | $200 | Cash | Paid |

Why Digital Invoices Are Essential

In today’s fast-paced world, adopting electronic documents for financial transactions is not just a convenience, but a necessity. Going digital provides numerous benefits that streamline processes, reduce errors, and offer better organization, making it easier for both providers and clients to manage their financial records efficiently.

Efficiency and Speed

Digital documents allow for quicker generation, delivery, and tracking of payments. Automated features like templates and payment integration ensure timely transactions and reduce the chances of manual mistakes.

Better Organization and Accessibility

With electronic documents, you can store and organize records securely, making it easier to retrieve them at any time. This accessibility is invaluable for managing a growing client base and ensuring compliance with financial regulations.

Using Software to Automate Your Invoicing

Modern software solutions have revolutionized the way financial records are managed, offering tools that automate the entire billing process. By utilizing automated systems, you can significantly reduce manual effort, minimize errors, and streamline your financial workflows, all while saving time and ensuring consistency in your transactions.

Time-Saving and Efficiency

Automation software helps eliminate the repetitive task of manually creating and sending documents. With features like pre-set templates, recurring billing, and automatic calculations, you can generate accurate records quickly and easily, giving you more time to focus on other aspects of your work.

Enhanced Accuracy and Compliance

Automation reduces the likelihood of human error, ensuring that the details of each transaction are correct and consistent. Additionally, many tools are designed to comply with industry standards, making it easier to stay up-to-date with financial regulations and avoid potential issues.

Steps to Ensure Timely Payments

Ensuring that payments are received on time is essential for maintaining cash flow and a smooth operation. By setting clear expectations, implementing efficient processes, and leveraging technology, you can encourage prompt payment and reduce delays.

Clear Payment Terms

Always establish clear terms upfront, including due dates, payment methods, and any late fees. This will help your clients understand their responsibilities and the timeline they must adhere to, preventing any confusion or misunderstandings.

Consistent Follow-ups

Sending timely reminders and following up consistently ensures that clients are aware of their outstanding balance. You can automate reminders through software, so you never miss a deadline and your clients are prompted to pay promptly.

How to Handle Disputes Over Invoices

Disagreements over payment requests are a common challenge that can arise in any business transaction. Whether it’s due to misunderstandings, discrepancies in amounts, or a delay in service, it is important to address disputes with a clear, professional approach. Resolving issues swiftly and efficiently can help maintain strong client relationships and avoid negative consequences.

Reviewing the Details

Before engaging in a discussion, ensure that all the details are accurate and that the service or product was provided as agreed. Confirm that all terms, including amounts and payment deadlines, were clearly communicated. By having clear records, you can present your case effectively.

Communication and Resolution

Reach out to the client to discuss the dispute in a calm and professional manner. Listen to their concerns, provide any clarifications, and work together to find a mutually acceptable resolution. If the issue is related to misunderstandings, offer evidence or documentation to support your position.

| Step | Action |

|---|---|

| 1 | Review the details of the agreement and service provided. |

| 2 | Communicate with the client to understand their concerns. |

| 3 | Offer solutions or alternatives, such as payment plans if necessary. |

| 4 | Document the resolution and follow up to confirm agreement. |

Staying Organized with Billing Documents

Maintaining a well-structured system for billing documents is essential for any professional or business. By using predefined formats and organizing tools, you can streamline the process, minimize errors, and ensure consistency in your records. This approach helps save time and reduces the risk of mistakes, making it easier to track payments and manage client relations effectively.

Efficiency is one of the main advantages of using organized billing formats. These documents often come with fields that automatically adjust to the relevant details, such as amounts, due dates, and service descriptions. With clear, easy-to-follow structures, you can quickly create, update, and store your records.

Additionally, having a standardized system in place allows you to maintain professionalism with clients. The uniformity in your communication helps create trust and reinforces your credibility. It also ensures that your clients understand the terms clearly, reducing potential misunderstandings.

Enhancing Client Trust Through Transparent Billing

Building and maintaining trust with clients is essential for any professional service. One effective way to achieve this is by ensuring that your payment documentation is clear and easy to understand. When clients can easily see what they are being charged for, it reduces the chance of confusion and strengthens your credibility.

Transparency in billing involves providing detailed breakdowns of charges, including services rendered, rates applied, and any additional fees. This clarity allows clients to understand exactly what they are paying for and why. By avoiding hidden costs or ambiguous terms, you create an atmosphere of openness and fairness.

Clear communication through transparent records also shows that you value your clients’ trust and are committed to a professional, straightforward approach. This not only helps prevent disputes but also fosters long-term relationships and positive referrals.