Free Lawn Maintenance Invoice Template for Easy Billing

Managing the financial side of your outdoor service business can be challenging, but having a structured method for documenting payments and charges simplifies the process. Organizing your charges not only saves time but also helps maintain professionalism and clarity with clients. Whether you’re working on regular contracts or one-time projects, the right approach can keep your operations running smoothly.

With the right format, creating detailed statements for your work becomes straightforward. A well-organized document ensures all necessary information is included, allowing both you and your clients to stay on the same page. By using customizable options, you can align your paperwork with the specific needs of your business and customers.

Taking the time to choose the right format can improve payment accuracy and expedite the entire invoicing process. This helps you focus more on providing quality service rather than worrying about managing complex financial documentation.

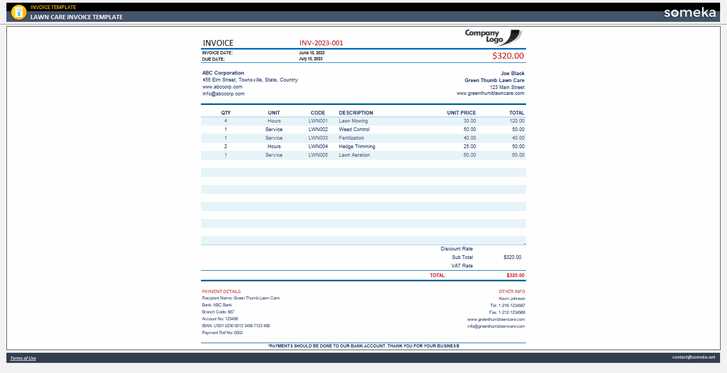

Free Lawn Maintenance Invoice Template

For those offering outdoor care services, having a well-structured document to summarize work completed and charges owed is essential. This allows for clear communication between service providers and clients, ensuring that all aspects of the job are accurately captured. A professional, easy-to-understand layout not only reflects the quality of service but also improves client trust and ensures timely payments.

Using a flexible format allows you to customize the information displayed, tailoring it to specific tasks or customer needs. It ensures you can include critical details such as service descriptions, costs, dates, and payment terms, all while maintaining a polished appearance. Having the right structure in place can eliminate confusion and avoid misunderstandings down the line.

Organizing the details clearly is key to streamlining financial transactions. Whether it’s a one-time job or a recurring service, a well-designed form allows you to quickly create accurate documents without hassle. With various options available for personalization, it’s easy to adapt the document to match the style and branding of your business.

Why Use an Invoice Template

Having a structured document to summarize completed tasks and payment expectations offers many advantages for service providers. By utilizing a predefined format, you ensure that all necessary details are included and presented clearly, reducing the chances of errors or omissions. This approach also helps create a professional image for your business and improves client satisfaction.

Here are some reasons why using a well-organized document format is beneficial:

- Efficiency: Predefined structures make it quick and easy to generate accurate records.

- Consistency: Using the same format for every job ensures uniformity and minimizes confusion.

- Clarity: A clear, organized format helps both the provider and the client understand what’s being charged and why.

- Professionalism: A polished document enhances the overall perception of your business and fosters trust.

- Customization: The ability to adjust the document to fit specific jobs, services, or clients makes it versatile.

With a well-structured format, you can streamline administrative tasks and focus more on providing top-quality service to your clients.

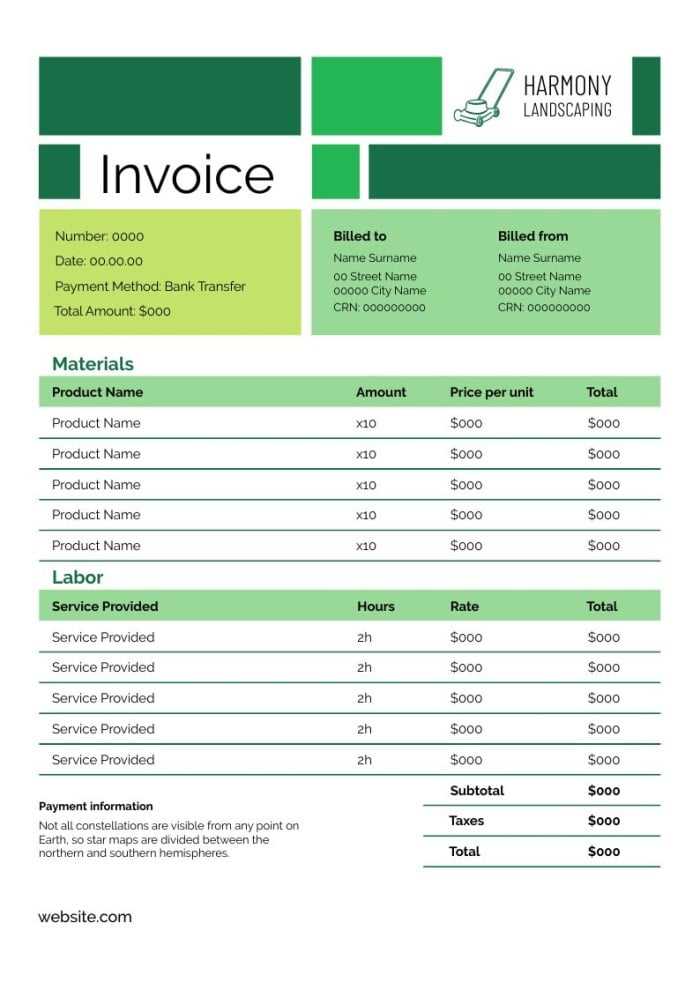

Key Features of a Good Invoice

To ensure clarity and accuracy, a well-designed document should include several essential elements. These features not only help maintain professionalism but also ensure smooth transactions between service providers and clients. A good document provides all the necessary information while being easy to read and understand, reducing the potential for errors or confusion.

Essential Information to Include

Each record should contain key details that make it easy to identify the work performed, the costs involved, and the payment terms. Below are the most important elements to include:

| Feature | Description |

|---|---|

| Contact Information | Include your business name, phone number, email, and physical address, as well as your client’s contact details. |

| Detailed Service Descriptions | Clearly describe the work completed, the dates it was carried out, and any relevant materials or equipment used. |

| Payment Terms | Specify when payment is due, accepted payment methods, and any late fees or discounts. |

| Itemized Charges | Break down the cost for each service or product provided to ensure transparency. |

| Unique Identifier | Assign a unique number to each document for easy tracking and reference. |

Formatting for Clarity

The layout of the document should be clean and organized. Use clear headings, legible fonts, and enough spacing between sections to make it easy for the client to understand the charges. The more organized and transparent the document, the less likely any misunderstandings or disputes will occur.

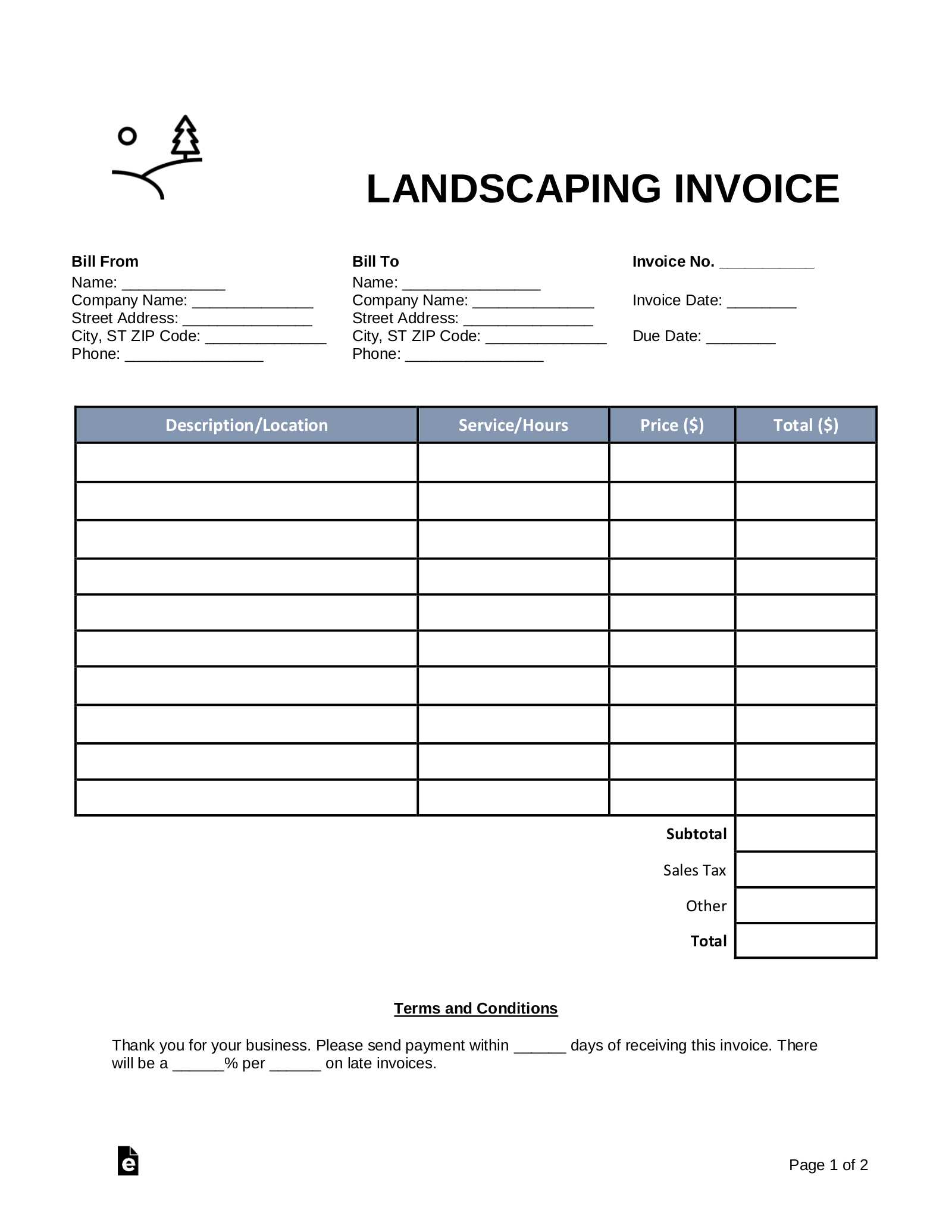

How to Customize Your Template

Customizing your document format is a simple yet effective way to ensure that it fits your specific needs and reflects your brand. Adjusting the layout, including relevant information, and tailoring it to each job or client will help maintain clarity and professionalism. A personalized structure also enhances the efficiency of your billing process, making it easier for both you and your clients to track details and payments.

Here are some key steps to consider when personalizing your document:

| Step | Description |

|---|---|

| Choose Your Design | Select a clean and simple layout that aligns with your business style. Avoid clutter and use clear headings for each section. |

| Adjust Contact Information | Ensure that your business name, contact details, and client’s information are correctly entered and clearly visible. |

| Set Payment Terms | Clearly define payment expectations, including due dates, accepted methods, and any applicable discounts or penalties for late payments. |

| Include Detailed Descriptions | Provide a thorough breakdown of the services provided, including quantities, rates, and specific dates to avoid confusion. |

| Adjust for Different Clients | For each job, modify the content to reflect the specifics of that service or project, ensuring accurate and relevant information for the client. |

By customizing each record, you not only improve your workflow but also make the document more personalized for your clients, fostering stronger relationships and clear communication.

Benefits of Professional Invoices

Using a well-organized, professional document for billing offers numerous advantages for service providers. It not only ensures that clients receive clear and concise information, but also boosts the overall perception of your business. A polished approach to financial documentation contributes to smoother transactions and better relationships with clients.

Here are the main benefits of using a professional billing system:

- Enhanced Credibility: A clean, professional document enhances the trust your clients place in your business.

- Clarity and Transparency: Clearly defined charges and services make it easier for clients to understand what they’re paying for.

- Reduced Disputes: Well-structured documents minimize the chances of misunderstandings or conflicts over charges.

- Time-Saving: Preformatted templates allow for quicker document generation, saving time for both you and your client.

- Improved Cash Flow: Clear payment terms and due dates help ensure timely payments, reducing delays.

- Brand Consistency: Using a uniform format aligns with your business’s branding, reinforcing your professionalism and reliability.

Overall, investing time in creating professional documentation helps to streamline your operations, improve client satisfaction, and maintain a strong business image.

Free Template vs Paid Options

When choosing a document format for your billing needs, you’ll often find both no-cost and paid options available. Each has its advantages, but the right choice depends on your specific business requirements. While free versions can be a great starting point, paid solutions often provide enhanced features and greater customization to meet the needs of growing businesses.

Advantages of Free Options

Free formats are a popular choice for those just starting or working on a tight budget. These options offer basic functionality that allows you to create clear and professional-looking records without any upfront cost.

- Low or No Cost: Perfect for small businesses or one-time users who want to avoid upfront costs.

- Simplicity: Basic layouts that are easy to fill out and use, ideal for simpler billing needs.

- Quick Setup: Free options can often be downloaded or used immediately without complicated installation or configuration.

Advantages of Paid Options

On the other hand, paid options often provide additional features that can help streamline your billing process and improve the overall efficiency of your business.

- Customization: Paid solutions often allow for more personalization, including custom branding and flexible layout choices.

- Advanced Features: Some paid tools include integrations with accounting software, automatic calculations, and recurring billing.

- Professional Support: Access to customer support or tutorials to help you navigate any challenges or questions.

- Regular Updates: Paid versions typically offer frequent updates, ensuring your documents remain compatible with current business standards.

In the end, your choice will depend on your specific business needs and how much flexibility and customization you require in your billing documents.

Tips for Accurate Billing

Ensuring accuracy in billing is essential for maintaining trust with your clients and ensuring that your business operates smoothly. Mistakes or discrepancies in your records can lead to confusion, delayed payments, and damaged relationships. By following a few best practices, you can ensure that your charges are clear, precise, and easy to understand.

Here are some tips to help you create accurate and transparent billing documents:

- Double-Check All Details: Always verify client names, dates, services provided, and payment terms to avoid any errors.

- Itemize Charges: Break down all services or products into individual line items with clear descriptions and prices to prevent misunderstandings.

- Be Specific with Dates: Include the exact date or time period when the work was completed. This helps avoid any confusion about the billing period.

- Ensure Consistency: Use the same format for all of your documents to maintain consistency in how charges are displayed and calculated.

- Check for Hidden Fees: Make sure to include any additional charges such as taxes, service fees, or delivery costs, and clearly explain them to your client.

- Set Clear Payment Terms: Specify payment due dates, methods of payment, and any penalties for late payments to prevent delays.

- Use Professional Language: Keep the tone formal and clear to reinforce the professionalism of your business and avoid ambiguity.

By following these tips, you can reduce errors, increase your chances of timely payments, and strengthen your reputation as a reliable and professional service provider.

Common Mistakes to Avoid

When creating billing documents, small mistakes can lead to significant problems, such as payment delays, misunderstandings with clients, or a damaged reputation. Identifying and avoiding common errors ensures that your documents are clear, accurate, and professional. Here are several key mistakes to watch out for when preparing your records.

Common Errors in Billing Documents

- Missing Client Information: Failing to include essential contact details, such as the client’s name, address, or email, can lead to confusion and missed payments.

- Incorrect Dates: Errors in dates, especially when documenting the service period, can cause disagreements over payment timelines and may delay transactions.

- Unclear Descriptions: Vague or unclear descriptions of the services or products provided can lead to misunderstandings and disputes. Always be specific about what was done and when.

- Omitting Payment Terms: Leaving out payment due dates, methods, or penalties for late payments can make it difficult for your client to know when and how to pay, leading to delays.

- Calculation Mistakes: Simple errors in adding up charges, taxes, or discounts can lead to inaccurate totals and affect client trust.

Formatting and Design Pitfalls

- Poor Layout: A cluttered or hard-to-read design makes it difficult for clients to understand the document, potentially delaying payments or causing confusion.

- Inconsistent Formatting: Using different fonts, sizes, or styles within the same document can create a disorganized appearance, detracting from the professionalism of your business.

- Missing or Incorrect Branding: Not including your business logo or name, or using inconsistent branding elements, can make your document appear unprofessional and may reduce client confidence.

Avoiding these common mistakes will help ensure that your billing process runs smoothly, reducing the likelihood of disputes and ensuring timely payments from clients.

Essential Information to Include

To ensure your billing documents are clear, professional, and legally sound, it’s important to include all the necessary details. By providing complete and accurate information, you help avoid confusion and reduce the likelihood of disputes with clients. Here are the key elements that should always be included in your records.

Basic Client and Service Details

- Business Information: Include your business name, address, phone number, and email for easy contact.

- Client Information: Ensure the client’s full name, address, and contact details are correct to avoid any misunderstandings.

- Service Description: Clearly describe the service or product provid

Formatting Your Lawn Service Invoice

Creating well-organized and easy-to-read documents is crucial for maintaining professionalism in your business. A clean and structured format helps clients quickly understand the charges and details, streamlining the payment process. Proper formatting ensures clarity and enhances the overall experience for both you and your clients.

Key Elements of a Well-Formatted Document

To achieve a professional appearance, certain elements should always be in place. These include clear headings, logical organization, and easy-to-read fonts. By following a consistent format, you make it simple for clients to review and process payments on time.

- Business and Client Information: Clearly separate your business contact details and the client’s information at the top of the document for easy reference.

- Service Breakdown: Use a table to list each service provided, with corresponding costs, dates, and a brief description. This makes it easier for clients to understand what they are paying for.

- Clear Total Amount: Make the total amount due stand out by placing it at the bottom of the page in a bold or larger font size.

- Payment Instructions: Ensure payment terms and methods are clearly outlined so clients know how to proceed once they have reviewed the document.

Formatting Tips for a Professional Look

- Use Consistent Fonts: Stick to one or two simple, professional fonts throughout the document for a clean and uniform look.

- Align Items Properly: Ensure that all text, especially numerical data, is aligned correctly to avoid confusion.

- Leave White Space: Avoid cluttering the document. Use adequate spacing between sections to make the content more readable and visually appealing.

By following these formatting guidelines, you create an invoice that is easy to understand, professional, and efficient, helping you maintain a strong relationship with your clients and streamline the payment process.

How to Save Time with Templates

Efficiency is key in running a successful business, and having the right tools can make a big difference. By using pre-designed documents, you can save time and reduce the effort spent on creating new files from scratch. This allows you to focus more on growing your business while maintaining a professional appearance for every transaction.

Streamlining Your Workflow

Instead of drafting each document from the beginning, you can quickly fill in the necessary details with pre-made formats. This consistency not only saves you time but also ensures that your documents are always accurate and professional. Here are some ways you can streamline your workflow:

- Consistency: Using the same structure every time ensures your documents are easy to understand and maintain a consistent professional tone.

- Quick Customization: With a template, you can quickly input client information, service details, and payment terms without having to reformat or restructure your document each time.

- Reduced Errors: Pre-designed formats help eliminate common mistakes like missing fields or incorrect alignment, ensuring each document is accurate.

Maximizing Efficiency in Your Business

- Automate Repetitive Tasks: Set up templates for recurring jobs, allowing you to focus on more important aspects of your work.

- Save on Design Time: Since the layout is already designed, you avoid spending time on formatting and can instead focus on the content and client relationships.

- Ease of Use: Many templates are user-friendly, with simple fields to update, making it easy to get documents ready without advanced technical skills.

Using pre-designed formats can make your workflow more efficient, allowing you to focus on what truly matters while maintaining a high level of professionalism and accuracy.

Creating Recurring Billing Invoices

Setting up automatic billing for regular services or subscriptions is an excellent way to save time and maintain consistent cash flow. With recurring charges, you can ensure clients are billed at regular intervals without having to manually create a new document each time. This process simplifies your business operations while ensuring that payments are timely and predictable.

Key Steps to Set Up Recurring Billing

Creating documents for repeated charges requires a few adjustments compared to one-time transactions. Here are the key steps to follow:

- Identify Recurring Services: Determine which services or products you provide on a regular basis. This can include weekly, monthly, or annual offerings.

- Set a Fixed Payment Schedule: Decide how often clients will be billed, whether weekly, monthly, or quarterly. Make this schedule clear and consistent.

- Use Automatic Payment Systems: Set up a system to automatically generate and send out bills based on the pre-established intervals to reduce the manual effort.

- Adjust Amounts as Needed: If your services have fluctuating costs, make sure the recurring document is flexible enough to reflect any price changes.

Best Practices for Recurring Billing

- Clear Communication: Ensure that the payment schedule and amounts are communicated clearly to your clients upfront to avoid any confusion.

- Offer Multiple Payment Methods: Make it easy for clients to pay by offering different payment options like bank transfers, credit cards, or online payment systems.

- Provide Detailed Statements: Even with recurring billing, ensure that each statement includes a clear breakdown of services rendered and the charges incurred.

- Monitor and Update: Regularly review your recurring charges to ensure that they are accurate and up to date, especially if there are any changes in service or pricing.

By creating recurring billing arrangements, you can automate your processes, ensuring clients are consistently billed while freeing up time for other important tasks. This approach simplifies financial management and helps maintain a steady stream of revenue for your business.

Legal Considerations for Lawn Services

Running a service-oriented business involves more than just providing quality work; it also requires understanding and adhering to legal requirements. From ensuring clear agreements with clients to complying with local regulations, being aware of the legal landscape is essential for avoiding disputes and protecting both your business and your clients. Here are some key legal considerations for service providers in this industry.

Contracts and Agreements: Before beginning any work, it’s important to have a written agreement in place. This contract should clearly outline the scope of services, payment terms, and any other relevant details. A clear contract helps set expectations and provides legal protection for both parties in case of disagreements.

Liability and Insurance: Ensuring you have the right insurance coverage is crucial in this line of work. Accidents can happen, and having liability insurance can protect your business in case of property damage or injuries during the service. Clients often expect proof of insurance before agreeing to work, making this an important factor in securing contracts.

Taxes and Compliance: Make sure you’re compliant with tax regulations and that you properly track all earnings and expenses. Depending on your location, you may need to collect sales tax or report specific types of income. Consulting with an accountant or tax professional can help ensure you’re meeting legal requirements.

Workers’ Rights and Employment Laws: If you have employees, it’s important to adhere to labor laws, such as paying fair wages, providing proper benefits, and following safety regulations. Being aware of employee rights helps prevent potential legal issues and fosters a positive work environment.

Permits and Licensing: Depending on where you operate, certain permits or licenses may be required to provide specific services. It’s essential to research local laws and regulations to ensure that your business is legally permitted to operate within your area.

By staying informed and following legal protocols, you can build a strong, reputable business while minimizing the risks associated with potential legal issues. Understanding your responsibilities will allow you to focus on providing excellent services while ensuring compliance with the law.

Incorporating Taxes and Discounts

When billing for services, it’s important to ensure that taxes and discounts are handled correctly to maintain transparency and comply with legal requirements. Properly accounting for taxes ensures you’re meeting obligations to tax authorities, while offering discounts can help attract clients and build loyalty. Below are key considerations for incorporating both taxes and discounts in your billing process.

Managing Taxes

Taxes are a common addition to service bills, and handling them properly can help you avoid legal and financial issues. Here’s how to include them effectively:

- Understand Local Tax Regulations: Different regions may have different tax rates or requirements. Research local laws to ensure you apply the correct tax rate to your services.

- Include Taxes Clearly: Taxes should be itemized separately on your bills, showing both the service total and the tax amount. This transparency makes it clear to clients how much they are being charged.

- Collect the Right Amount: Ensure that you’re charging the correct tax rate based on your location and the nature of your services. Consulting with a tax professional can help clarify this.

Applying Discounts

Offering discounts can be a great way to incentivize customers, but it’s important to apply them correctly to maintain profitability and clarity. Here are some key tips:

- Set Clear Discount Terms: Define the conditions under which clients can receive a discount. This could include early payment, repeat business, or large orders.

- Apply Discounts Consistently: Make sure you apply discounts consistently across your business to avoid confusion and ensure fairness to all clients.

- Highlight the Discount on the Bill: Clearly show the discount on the final bill, specifying the amount or percentage being reduced. This adds transparency and assures the client they are receiving the benefit as promised.

By carefully incorporating taxes and discounts into your billing, you not only stay compliant with regulations but also offer added value to your clients. These steps help ensure that your billing practices are professional, transparent, and beneficial for both your business and your clients.

How to Send Lawn Service Bills

Once your work is completed and you’re ready to collect payment, the next step is to send a clear and professional bill to your client. The method of delivery, content, and timing are crucial to ensure prompt payment and maintain positive client relationships. Here’s how to send your bills effectively and professionally.

Choosing the Best Delivery Method

There are several ways to send a bill, and each has its advantages. Below are the most common methods for sending service charges:

- Digital Delivery: Sending bills via email is quick and efficient. You can attach the bill as a PDF or send it directly through an invoicing platform.

- Postal Mail: For clients who prefer traditional methods, sending a printed copy by mail remains an option. Be sure to include enough time for the delivery process.

- In-Person Delivery: If you have a close relationship with the client, delivering the bill in person is a personal touch that may be appreciated.

Essential Information to Include

Regardless of how you send your bill, make sure it includes all necessary details to avoid confusion and ensure the client understands the charges. Key information to include:

- Client and Service Provider Information: Always include both your and your client’s contact information to make it clear who the bill is from and who it’s addressed to.

- Itemized List of Services: Break down the services provided, along with their respective costs, so the client can easily see what they are being charged for.

- Payment Due Date: Clearly state the due date for payment to avoid misunderstandings. It’s helpful to include your payment terms as well, such as “due upon receipt” or “net 30 days.”

- Payment Methods: Provide a range of options for payment, such as bank transfers, checks, or online payment systems.

By following these guidelines, you ensure that your billing process is smooth and professional, leading to faster payments and more satisfied clients. Choose the delivery method that works best for you and your customers, and always provide complete and clear information in your bills.

Tracking Payments and Late Fees

Accurately tracking payments and managing overdue balances is an essential aspect of any service-based business. Not only does it ensure that you receive the compensation you’re entitled to, but it also helps maintain transparency and trust with your clients. By implementing an effective tracking system and setting clear guidelines for late payments, you can streamline your billing process and reduce the likelihood of overdue accounts.

To begin with, it’s important to maintain detailed records of each transaction. This includes noting the amount, payment date, and any outstanding balances. For added clarity, use a consistent system for marking payments as received, such as a checkmark or payment status indicator.

Setting Up a Payment Tracker

Having a reliable payment tracking system is vital for staying organized and avoiding confusion. Here are some steps to consider:

- Use Accounting Software: Many invoicing and accounting tools allow you to track payments in real-time and send reminders to clients who have not paid by the due date.

- Spreadsheet Tracking: For those who prefer a more hands-on approach, using a simple spreadsheet to track payment status, including payment amounts and due dates, can be very effective.

- Manual Logs: If digital tools are not an option, a physical ledger can serve as an alternative for recording payments and managing late fees.

Late Fees and Payment Reminders

Late fees help incentivize timely payments and compensate for the inconvenience caused by delayed transactions. Here are some guidelines to implement late fees effectively:

- Clearly Define Terms: Specify the due date for payments and outline the late fee structure upfront in your agreements. For example, you can charge a fixed percentage of the total amount or a flat fee for every day past the due date.

- Send Payment Reminders: After a payment becomes overdue, sending a polite reminder can encourage your clients to take action. A reminder should clearly state the amount due, any penalties for lateness, and the revised due date.

- Consider Waiving Fees in Special Cases: If your client has a strong track record and a valid reason for the delay, consider waiving the late fee as a goodwill gesture. However, ensure that this decision is documented and agreed upon by both parties.

By staying organized and consistent with your payment tracking and late fee policies, you create a more predictable revenue stream

How to Use Invoices for Recordkeeping

Proper documentation is crucial for managing your business finances and ensuring smooth operations. By utilizing detailed records for each transaction, you can track expenses, monitor cash flow, and maintain transparency with your clients. Keeping accurate documentation also simplifies tax filing and helps prevent discrepancies in financial reporting.

Invoices serve as essential tools for maintaining accurate records of all business transactions. They provide a written confirmation of services rendered, payment amounts, and due dates, offering a clear trail for your financial activities. Whether you’re using physical copies or digital records, these documents are vital for organizing and tracking payments.

Benefits of Using Invoices for Recordkeeping

Here are several advantages to incorporating detailed records in your financial management process:

- Improved Financial Tracking: Each document serves as a snapshot of a transaction, making it easier to track the status of payments and outstanding balances.

- Tax Compliance: Keeping well-organized records of your transactions simplifies the preparation of your tax returns and helps you avoid potential audits.

- Transparency with Clients: Providing your clients with clear, itemized records promotes trust and reduces the likelihood of misunderstandings regarding charges.

- Efficient Reporting: Accurate records make it simpler to generate financial reports for your business, whether for internal use or to share with potential investors or stakeholders.

How to Organize Your Records

Maintaining an effective filing system is key to managing your business’s financial records. Here are some best practices for organizing your records:

- Digital Storage: Use cloud-based storage or accounting software to organize your files. This will help you access and update records quickly and reduce the risk of losing important documents.

- Physical Filing: If you prefer paper records, consider using labeled folders to store each month’s transactions or categorizing files by client or service type.

- Monthly Reconciliation: Set aside time each month to review your records and ensure all transactions have been logged accurately. This will also help identify any discrepancies early on.

By incorporating well-organized records into your routine, you’ll be able to maintain a more structured and efficient workflow, ensuring both your business and your clients stay on track.

Improving Client Relationships with Invoices

Clear communication and professionalism are essential for fostering strong client relationships. One way to build trust and credibility with your customers is by providing accurate, transparent, and timely documentation for services rendered. Detailed records not only streamline payment processes but also show clients that you value their business and are committed to clarity in all aspects of your work.

Invoices serve as more than just a request for payment; they are an opportunity to reinforce your brand and showcase your attention to detail. When clients receive organized, itemized records, it demonstrates a level of professionalism that can lead to better satisfaction and repeat business. A well-structured document also provides an easy reference for both parties, ensuring that both you and your clients have a clear understanding of the services provided and the corresponding fees.

Furthermore, personalized or customized records can further enhance client relationships. Including relevant details such as service dates, specific tasks completed, or any unique considerations related to the client’s preferences can show that you are attentive to their individual needs. By providing this level of service, you help build loyalty and encourage positive feedback, which can lead to long-term business success.