Free Lawn Care Invoice Template for Your Business

Running a successful landscaping business requires not only skilled work but also effective organization and clear billing practices. An efficient billing system helps you manage client accounts smoothly, ensuring that your services are properly recorded and payments are made on time. For small businesses in particular, an easy-to-use billing format can save valuable time and make the entire process more transparent.

Using a well-structured billing document allows you to communicate clearly with clients. By organizing details like service descriptions, costs, and payment terms, you create a professional image and avoid misunderstandings. Additionally, a structured document helps you keep track of finances and plan for future projects more accurately.

With the right approach to billing, you can focus more on your work and less on administrative tasks. A customizable format gives you the flexibility to adjust details based on specific client needs, whether for one-time services or recurring projects. This approach not only supports your business’s

Free Lawn Care Invoice Template

When managing payments for outdoor maintenance services, having an organized and straightforward billing structure is essential. With a clear and detailed document, you can efficiently summarize tasks performed, pricing, and other relevant information for clients, ensuring transparency and professionalism. This not only aids in keeping financial records straight but also simplifies the payment process for everyone involved.

Key Components of an Effective Billing Document

Creating a well-rounded payment record involves several essential details to maintain clarity and professionalism. Below are the core components that every effective document should include:

- Client Details: Include the name, address, and contact information of your client to ensure proper record-keeping.

- Service Summary: Provide a brief but clear description of each task performed, helping clients understand the scope of work.

- Pricing Information: List the cost for each service, making sure to highlight any applicable taxes or discounts.

- Payment Terms: Specify the due date and accepted payment methods, creating a mutual understanding of timelines and procedures.

Free Lawn Care Invoice Template

When managing payments for outdoor maintenance services, having an organized and straightforward billing structure is essential. With a clear and detailed document, you can efficiently summarize tasks performed, pricing, and other relevant information for clients, ensuring transparency and professionalism. This not only aids in keeping financial records straight but also simplifies the payment process for everyone involved.

Key Components of an Effective Billing Document

Creating a well-rounded payment record involves several essential details to maintain clarity and professionalism. Below are the core components that every effective document should include:

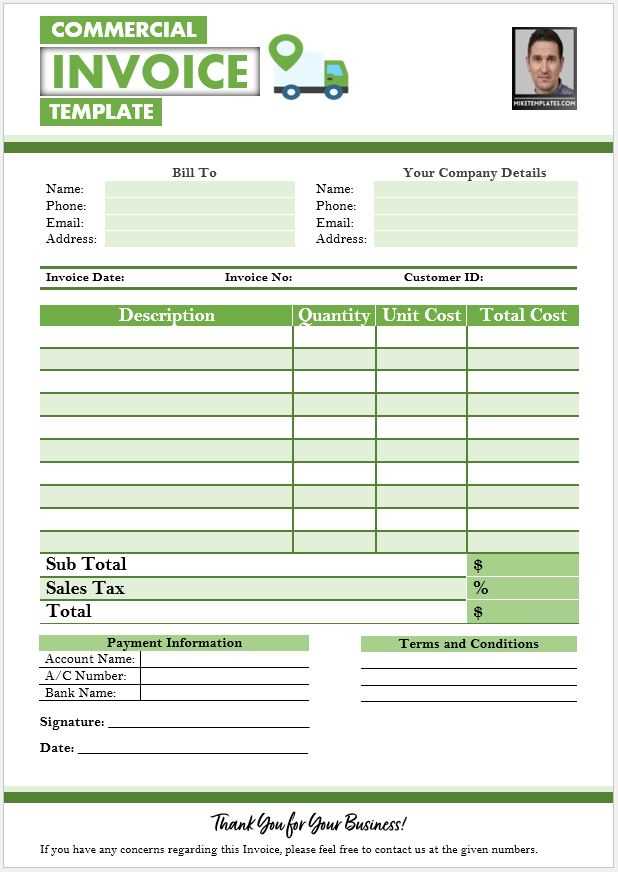

Steps to Customize Your Billing Format

Tailoring your billing structure allows you to align it more closely with your brand and client expectations. Here’s how to get started:

- Adjust the Layout: Modify sections to suit your services, adding or removing fields as needed for clarity.

- Incorporate Branding: Include your logo and business name to make the document look more professional and memorable.

- Use Consistent Terminology: Use familiar terms that your clients recognize, which can help avoid confusion and promote trust.

By following these steps, you ensure that your payment records are both functional and visually appealing, leaving a positive impression on your clients and supporting a smoother financial workflow.

How to Use an Invoice Template

Organizing billing documents efficiently can streamline your business’s financial tasks and simplify the process of managing client payments. Using a ready-made format can save time, ensuring that each record is comprehensive, clear, and professional. Here’s a step-by-step guide to effectively set up and utilize your billing structure.

Steps for Filling Out Your Document

Follow these steps to complete your billing format accurately:

- Input Client Information: Start by adding your client’s name, contact details, and address to make sure all documents are prop

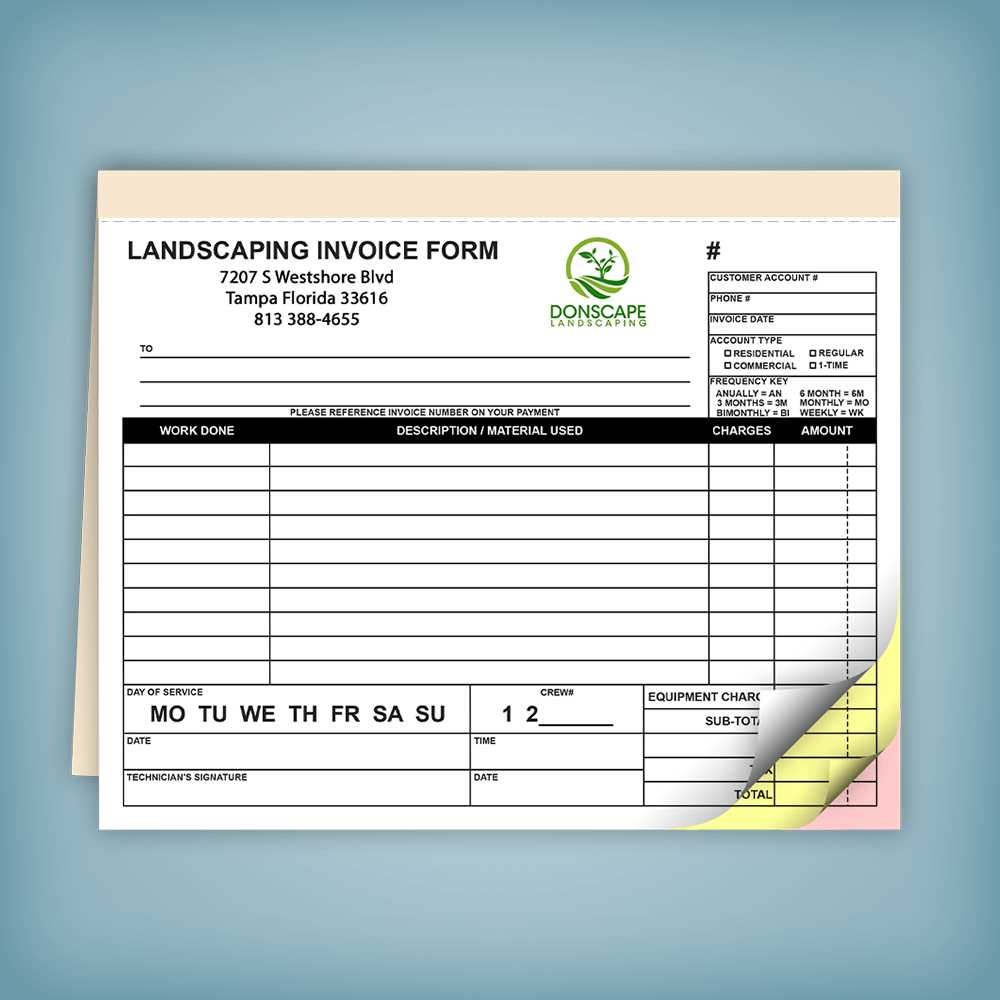

Essential Elements in Lawn Care Invoices

Creating a comprehensive document for services provided requires attention to key details. This ensures both the service provider and the client have a clear understanding of the work performed and the agreed-upon charges. To ensure clarity and transparency, it’s important to include specific information in any bill or statement related to outdoor maintenance tasks.

Below are the primary components that should be included:

- Service Provider Information: Name, address, contact details, and any relevant licensing or business numbers.

- Client Details: Customer’s name, address, and contact information to avoid confusion.

- Service Description: A detailed breakdown of the work done, including specific tasks, dates of service, and duration.

- Pricing Information: Clear and concise listing of charges for individual services, with a total amount due at the bottom.

- Payment Terms: Specify due dates, accepted payment methods, and any late fees or discounts that may apply.

- Date of Issue: When the statement was generated and the due date for payment.

These elements ensure that both parties are fully informed, leading to smoother transactions and clearer agreements on future work.

Tips for Writing Clear Invoices

When creating documents to request payment for services rendered, clarity is key. A well-structured document not only helps avoid misunderstandings but also fosters professionalism. To ensure both the service provider and client are on the same page, it’s important to keep the information organized and easy to understand.

Be Specific and Detailed: Avoid vague terms. List each task performed with corresponding charges, including any applicable taxes or discounts. Providing a clear breakdown helps the client understand exactly what they are paying for.

Use Simple Language: While technical terms may be necessary in some cases, aim for straightforward, easy-to-read wording. This ensures the client is not confused by complex jargon or unclear explanations.

Keep Formatting Consistent: Consistency in fonts, headings, and layout makes the document visually organized and easy to follow. Use bold text for headings or important details, and ensure there is enough space between sections for easy reading.

Clearly State Payment Terms: Specify the due date, any late fees, and accepted payment methods. This helps to avoid delays and confusion over how and when payment should be made.

Double-Check for Errors: Review the document for spelling or calculation mistakes before sending it. Even small errors can undermine the professionalism of the document and lead to misunderstandings.

Benefits of Using Free Invoice Templates

Utilizing pre-designed documents can significantly streamline the process of requesting payment for services. These ready-made formats provide structure and save time, allowing businesses to focus on delivering quality work rather than spending hours designing paperwork. Moreover, they ensure consistency across all transactions.

Time Efficiency: Ready-made designs reduce the time spent on creating documents from scratch. By filling in relevant details, you can quickly generate professional-looking records without the need for complex software or design skills.

Consistency: Using a standard format ensures uniformity in all your billing documents. This consistency promotes professionalism and makes it easier for clients to recognize and understand your records, which can improve payment processing.

Cost-Effective: Many pre-designed options are available without charge, eliminating the need to purchase expensive accounting software or hire graphic designers for document creation. This cost-effective solution benefits small businesses and freelancers alike.

Customization: While pre-made formats are structured, they also allow for customization. You can adjust the design and content to suit your specific needs, ensuring the document reflects your brand or service style.

Accuracy: Most pre-designed documents are created with built-in fields that guide you through the essential information. This reduces the likelihood of errors, ensuring important details like payment terms and charges are correctly listed.

Customizing Invoices for Your Business

Tailoring payment requests to reflect your brand and specific services can greatly enhance your professionalism and customer experience. By personalizing the structure and content of your documents, you not only ensure clarity but also make a lasting impression on clients. Customization allows you to create records that align with your business’s identity and operational needs.

Incorporate Branding Elements: Adding your logo, company colors, and contact details helps reinforce your brand identity. This makes the document instantly recognizable and gives your business a polished, consistent look.

Adjust Layout and Design: Customizing the layout can improve the visual appeal and readability. You can choose to highlight important sections, such as payment terms or due dates, and create a layout that best suits the nature of your work.

Tailor Payment Terms: Depending on your business model, you might need to adjust payment terms. For example, if you offer discounts for early payments or charge late fees, these details should be clearly outlined in your custom document to avoid any confusion.

Include Relevant Service Details: Personalizing your document to include a comprehensive list of tasks performed or materials used will help clients understand exactly what they are being charged for. This can also serve as a reference for future projects, ensuring both parties are clear on the scope of work.

Additional Custom Sections: Consider adding custom sections such as a thank-you note, a referral request, or terms for recurring services. These personal touches can enhance the relationship with your clients and create opportunities for future business.

How to Track Lawn Care Payments

Effectively monitoring payments for services provided is crucial for maintaining healthy cash flow and ensuring that clients meet their financial obligations. Implementing a systematic approach to track payments not only helps avoid missed or delayed payments but also ensures transparency and organization in financial record-keeping.

Here are some effective methods to track payments:

- Maintain a Payment Log: Create a detailed record of each transaction, including the date, amount paid, method of payment, and client details. This can be done manually or with software tools to simplify the process.

- Use Accounting Software: Many accounting platforms offer automated payment tracking. These tools can help generate reports, send reminders, and update payment statuses in real time.

- Set Payment Reminders: Ensure clients are aware of upcoming due dates by setting automatic reminders. This can be done via email or text message and helps avoid late payments.

- Issue Receipts: After each payment is received, provide a receipt to the client, confirming the transaction details. This not only helps clients keep track but also gives you a clear record of payments made.

- Follow Up on Unpaid Balances: If a payment is overdue, follow up with the client promptly. Send a polite reminder and keep a record of all communication related to overdue payments.

- Track Payment History: Keep a record of all transactions over time to identify patterns in client payments. This can help you plan future work and spot any potential issues with clients who regularly delay payments.

By implementing these methods, you can ensure smooth and timely financial transactions, fostering better client relationships and improving your overall business management.

Common Mistakes in Billing Clients

When requesting payment for services rendered, it’s important to avoid common errors that can lead to confusion, delayed payments, or damaged client relationships. A well-structured and accurate payment request ensures that clients are clear on the charges and that payment is processed smoothly. Below are some frequent mistakes to watch out for when managing financial documents.

1. Failing to Provide Clear Details: Vague descriptions of services or tasks performed can lead to misunderstandings. Ensure each service is clearly outlined with specific charges to avoid confusion or disputes later.

2. Incorrect Pricing or Calculation Errors: Mistakes in pricing or math errors can result in clients paying less than expected or questioning the charges. Double-check all figures and ensure the total is correct before sending the document.

3. Not Including Payment Terms: Without clear payment terms, such as due dates, accepted payment methods, and late fees, clients may delay payments or misinterpret when payment is expected. Always include these details to set clear expectations.

4. Missing Contact Information: Omitting your business name, address, or contact information can make it difficult for clients to reach you if there are any issues. Always include all necessary details so clients can easily get in touch with questions or concerns.

5. Forgetting to Issue Receipts: Failing to provide a receipt or confirmation of payment can create confusion, especially if the client needs a record for their own financial tracking. Issue a receipt for every payment received to maintain transparency.

6. Not Following Up on Overdue Payments: Ignoring late payments or failing to follow up can negatively impact your cash flow. Establish a system for s

Top Tools for Invoice Management

Efficient management of financial documents is essential for maintaining a smooth workflow and ensuring timely payments. Whether you are a freelancer or a small business owner, using the right tools can streamline the process of creating, sending, and tracking payments. Below are some of the top tools designed to make managing financial records easier and more organized.

1. QuickBooks: QuickBooks is one of the most widely used accounting software tools, offering a range of features such as creating customizable billing documents, tracking payments, and generating financial reports. Its user-friendly interface makes it easy for business owners to manage their finances with minimal effort.

2. FreshBooks: FreshBooks is a cloud-based solution ideal for small businesses and freelancers. It allows users to generate professional-looking documents, track payments, set up recurring billing, and even automate reminders for overdue balances.

3. Zoho Books: Zoho Books provides comprehensive accounting features including the ability to create customized statements, track expenses, and manage payments. It integrates seamlessly with other Zoho applications and supports multi-currency billing, making it perfect for international businesses.

4. Wave: Wave is a free accounting tool that offers invoice creation, payment tracking, and basic financial reporting. It’s a great option for small businesses or freelancers who are just starting out and need an easy, cost-effective solution.

5. Xero: Xero is a robust accounting software designed for small to medium-sized businesses. With features like customizable billing documents, real-time collaboration, and integrated payment options, it simplifies financial management and improves business efficiency.

6. PayPal: PayPal isn’t just a payment gateway–it’s also a useful to

Organizing Client Information Efficiently

Properly organizing client details is a crucial aspect of running a successful business. Keeping accurate records not only helps streamline communication but also ensures that payments, projects, and customer inquiries are managed effectively. A well-organized system allows for easy access to information and avoids confusion or delays.

1. Centralize Your Client Data

One of the most important steps in managing client information is creating a centralized location where all details can be accessed quickly. Using digital tools such as customer relationship management (CRM) software or even a simple spreadsheet can make it easier to track client interactions, contact information, service history, and payment status.

2. Categorize Client Information

Organizing your client base by categories–such as active clients, prospects, or past clients–helps keep the data more manageable. You can also sort by service types, regions, or payment schedules, depending on your business needs. This organization enables you to quickly locate specific details when needed and prioritize tasks accordingly.

3. Maintain Regular Updates: Ensure that your client records are regularly updated. This includes adding new contact details, recording completed transactions, or noting any special requests. Keeping everything current reduces the risk of errors and ensures that all stakeholders have the most accurate information.

4. Use Cloud Storage for Easy Access: Cloud-based storage systems, such as Google Drive or Dropbox, allow you to store and organize client information securely while providing easy access from any location. This flexibility is especially helpful for businesses with remote teams or those that need to access data while on the go.

By organizing client information efficiently, you not only improve the workflow within your business but also enhance your overall client service. A well-maint

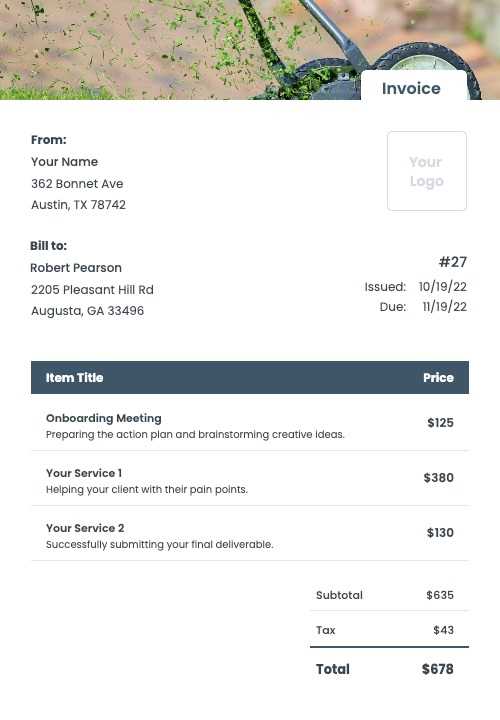

Creating a Professional Invoice Format

Establishing a professional and clear structure for your payment requests is essential for building credibility with your clients. A well-designed document not only ensures that the details are easy to understand but also reflects your business’s professionalism. Crafting a format that is both functional and aesthetically pleasing can go a long way in creating a positive impression.

1. Include Essential Information

A professional document should start with the most important details. These typically include:

- Business name and contact information: Make sure your company’s name, address, phone number, and email are clearly visible at the top.

- Client’s name and contact information: Include the recipient’s name, address, and other relevant contact details to personalize the document.

- Unique identifier: Assign a reference number for easy tracking and future reference. This helps keep records organized for both you and the client.

- Date: Clearly state the date the document is issued as well as the due date for payment.

2. Organize the Breakdown of Charges

Breaking down the cost in a detailed and structured manner helps prevent confusion. List each service or product provided along with its respective cost. This allows the client to see exactly what they are paying for, which enhances transparency.

3. Clear Payment Terms: Ensure that your payment terms are unambiguous. Include the due date, accepted payment methods, and any late fees or discounts for early payments. This sets expectations and encourages timely transactions.

4. Consis

Making Invoices Easy to Understand

Ensuring that your payment requests are clear and simple to understand is key to maintaining positive relationships with your clients. A document that is easy to read reduces the likelihood of misunderstandings and delays in payment. Clarity in your billing helps clients know exactly what they are paying for, which can lead to quicker and more accurate transactions.

- Use Simple Language: Avoid using jargon or overly complex terms. Be straightforward in describing the services or products provided, so the client can quickly grasp the details.

- Break Down Charges: List each item or service with its corresponding price. This transparent approach prevents confusion and gives the client a detailed understanding of the total cost.

- Highlight Important Information: Key details such as payment due dates, terms, and total amount should stand out. Use bold text or a larger font to draw attention to these points.

- Avoid Clutter: Keep the layout simple and well-organized. Use plenty of white space and divide the document into clear sections so clients can easily navigate through it.

- Be Consistent: Consistent formatting in terms of fonts, colors, and alignment makes the document easier to follow. Stick to one or two font styles and a clear, readable font size.

By keeping your requests simple and straightforward, you reduce the chances of confusion or error. Clear communication in your payment requests not only improves your clients’ experience but also ensures that your business runs smoothly and professionally.

Streamlining Payment Collection Process

Efficiently managing the process of collecting payments is vital for maintaining healthy cash flow and reducing administrative tasks. By simplifying and automating the steps involved in receiving payments, you can minimize delays, reduce errors, and ensure that clients are clear about their obligations. Streamlining this process not only saves time but also enhances client satisfaction and promotes timely settlements.

1. Offer Multiple Payment Methods

Providing clients with several ways to pay can make the process more convenient and increase the likelihood of timely payments. Some common options include:

- Online payments: Utilize payment platforms like PayPal, Stripe, or Square to allow clients to pay directly online.

- Bank transfers: For larger payments, clients may prefer direct bank transfers, which can be automated for regular transactions.

- Credit and debit cards: Accepting card payments is often preferred for its convenience and speed.

- Checks: Although less common, offering the option for check payments may still be beneficial for certain clients.

2. Automate Reminders and Follow-Ups

Automating reminders can help ensure that clients are aware of their payment deadlines. Many accounting software systems and payment platforms allow you to set up automatic notifications that can be sent to clients before the due date or if payment is overdue. These reminders keep clients on track an