Free Labor Invoice Template for Easy Customization and Professional Billing

Creating accurate and well-structured payment requests is crucial for businesses in any industry. A simple, organized document can streamline the billing process, ensure timely payments, and help maintain a professional relationship with clients. The right tool can make all the difference when it comes to presenting charges clearly and concisely.

Using a well-designed document format allows you to focus on the work at hand while still adhering to the best practices of financial documentation. With easy-to-edit options available, even small business owners or freelancers can produce polished, professional documents that meet their specific needs. These resources simplify calculations, reduce errors, and save valuable time.

In this article, we will explore various ways to enhance your billing process with customizable resources. Whether you are just starting out or looking to improve your existing practices, understanding the key components of an effective billing document will help you manage transactions smoothly and efficiently.

Free Labor Invoice Template for Businesses

For businesses of all sizes, having a streamlined method for generating billing documents is essential. A consistent and professional approach to creating payment requests ensures clarity, reduces disputes, and expedites payment collection. With the right tools, even small companies can produce professional-looking financial documents that align with industry standards and client expectations.

Providing customizable and easy-to-use options allows businesses to tailor each document to their unique needs. From adjusting pricing structures to adding company-specific information, these solutions can be modified to suit different industries and services. This flexibility not only saves time but also ensures accuracy, creating a smoother process for both service providers and clients alike.

By using simple, yet effective resources for creating billing documents, businesses can present charges in a clear and organized format. This can improve cash flow, reduce misunderstandings, and foster strong client relationships. Whether you’re managing a one-person operation or a growing enterprise, an efficient billing system is a key part of a successful business strategy.

Why Use a Labor Invoice Template

Having a standardized method for creating payment requests can significantly improve the way businesses manage their finances. A well-structured document allows you to present charges clearly, ensuring that clients understand the services provided and the amounts owed. This simple tool can reduce confusion and increase the likelihood of timely payments.

Consistency and Professionalism

Using a predefined structure for your billing documents ensures consistency across all transactions. This professional approach not only builds trust with clients but also reflects positively on your business. It shows that you are organized, detail-oriented, and committed to providing a high level of service.

Time-Saving and Efficiency

Rather than starting from scratch each time, having a ready-made format helps you save valuable time. You can focus on the core aspects of your work, knowing that the billing process will be quick and efficient. With easy-to-edit options, updating information, adding new services, or adjusting rates becomes hassle-free, letting you manage your financial tasks more efficiently.

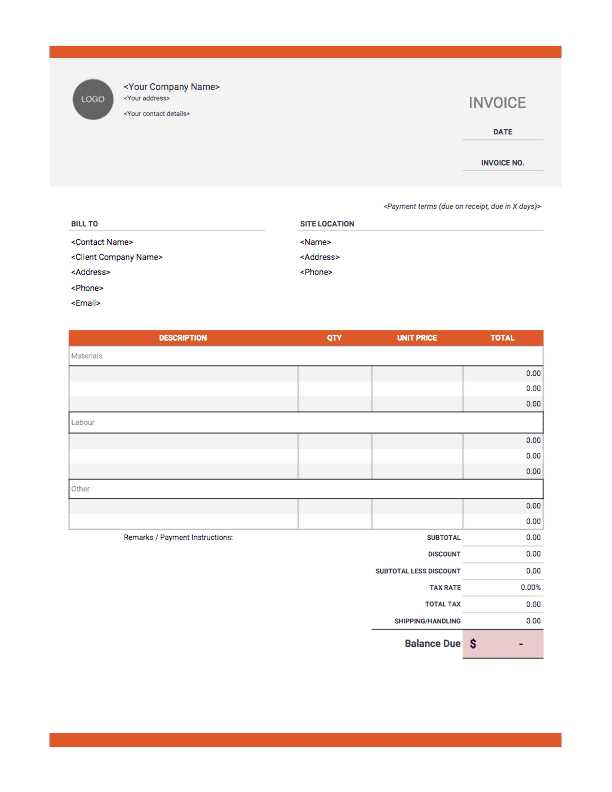

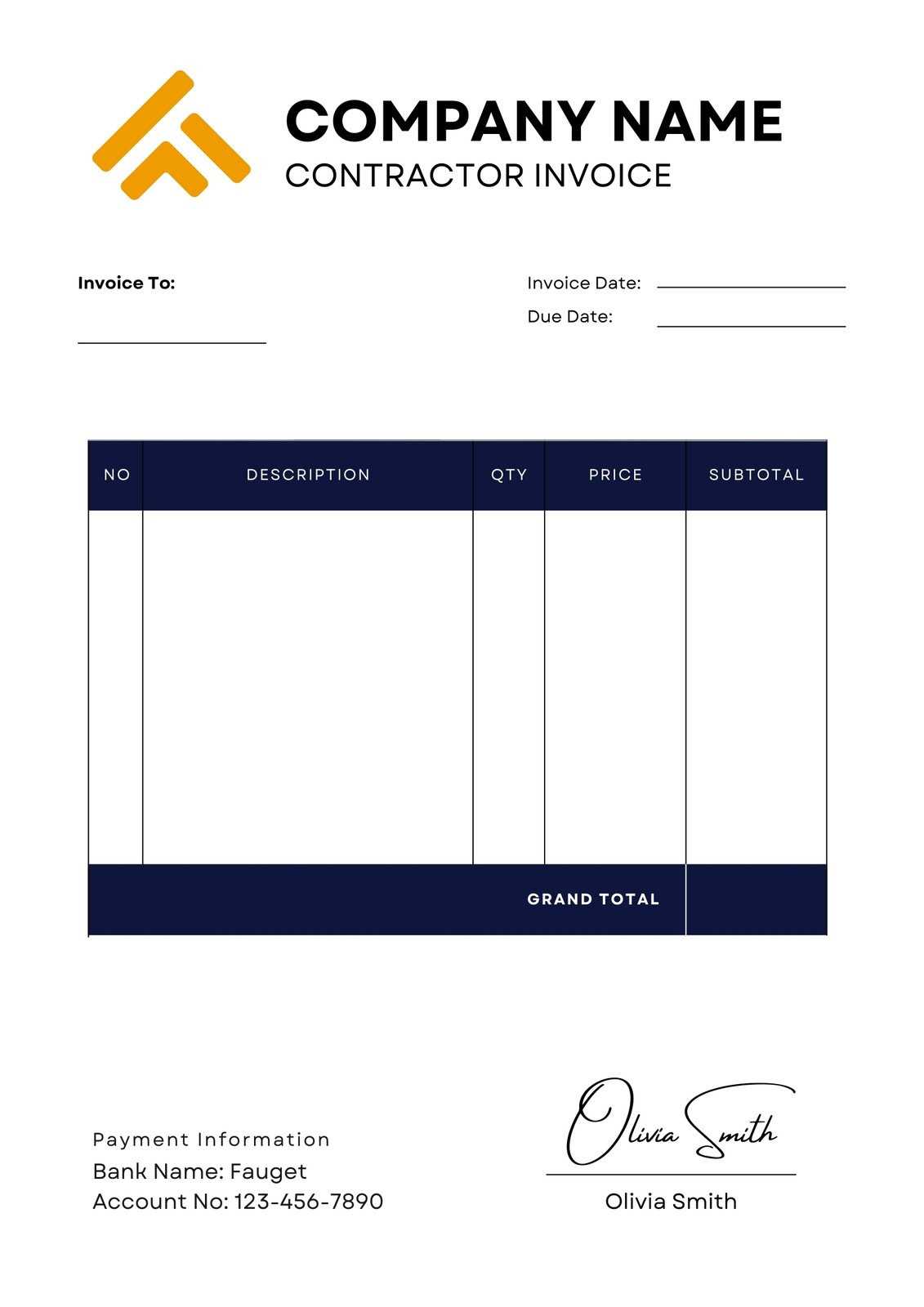

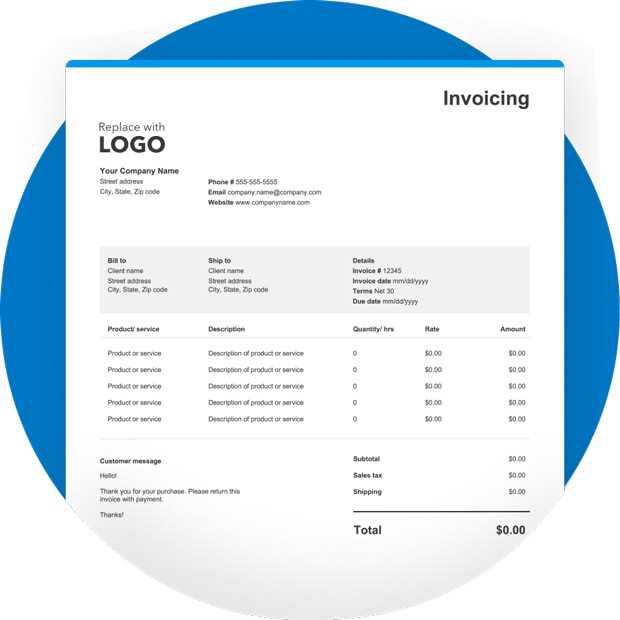

How to Customize Your Invoice Template

Personalizing your billing document is essential to ensure that it accurately reflects your business and the services you offer. Customization not only makes your requests look professional, but it also helps to provide clients with clear and relevant information. Whether you’re updating company details or adjusting pricing, there are several ways to make the process fit your unique needs.

Key Elements to Edit

When customizing your billing document, there are several key elements that you should focus on to ensure the document is comprehensive and professional:

- Business Information: Include your company name, logo, address, and contact details at the top of the document.

- Client Information: Make sure to add your client’s name, address, and any relevant contact details.

- Description of Services: Clearly outline the work completed, including any applicable dates or hours worked.

- Pricing: Customize the pricing structure based on your services, including rates per hour, fixed prices, or other applicable charges.

- Payment Terms: Specify payment due dates, accepted methods, and any penalties for late payments.

Simple Adjustments to Fit Your Business

Adjusting the overall look of your document can also help align it with your business branding. Changing font styles, adding a color scheme, or modifying the layout are all simple ways to personalize the document. These tweaks can make a big impact on how professional and organized your billing process appears.

Additionally, if your pricing changes or you offer new services, updating the document is a quick and easy way to reflect those updates in your payment requests without starting from scratch every time.

Benefits of Free Labor Invoice Templates

Using a ready-made billing document can provide significant advantages for businesses, especially when it comes to saving time and ensuring accuracy. These resources allow businesses to create professional, polished payment requests without the need for starting from scratch each time. This not only helps streamline the process but also ensures that all necessary information is included in every document.

Time and Effort Savings

One of the most obvious benefits of using a pre-designed document is the time it saves. Rather than spending valuable hours designing and formatting each payment request, you can simply fill in the details and send it out. This allows you to focus more on your core business activities while still ensuring that your financial documentation is up to standard.

Accuracy and Professionalism

These ready-made resources typically follow industry best practices, ensuring that all important fields and sections are included. This minimizes the chances of errors or omissions, which can cause misunderstandings or delays in payments. By using a well-structured document, businesses present a more professional image to their clients, fostering trust and promoting a smooth financial transaction process.

Additionally, using these tools ensures that you stay consistent in your billing practices. Whether you’re managing a small business or a growing enterprise, having a standardized system in place helps maintain a high level of professionalism and reduces the chances of confusion or disputes.

Key Information to Include in an Invoice

To ensure smooth financial transactions, it is essential to include specific details in your payment requests. Clear, comprehensive documents not only help clients understand the charges but also reduce the likelihood of delays or disputes. Including all necessary information ensures that both parties are on the same page regarding payment terms and service delivery.

Essential Details to Add

Here are the key components that should always be included in your billing documents:

- Business and Client Information: Always include your company name, address, and contact information, along with your client’s details. This creates a clear record of who the transaction is between.

- Unique Reference Number: Assign a unique number to each document for easy tracking and future reference.

- Dates: Include both the date of the transaction and the due date for payment. This ensures clarity regarding the timeline for the services provided.

- Description of Services: List the services rendered, including details such as hours worked, materials used, or any other relevant information related to the work done.

- Pricing and Total Amount: Clearly outline the rates, quantities, and total amount due, ensuring the client knows exactly what they are being charged for.

- Payment Terms: Specify any relevant payment instructions, including methods of payment, due dates, and any late fees that may apply.

Additional Considerations

While the above information covers the basics, you may also want to include additional details such as discounts, tax information, or notes about warranties or guarantees, depending on your industry and the nature of the work provided. Always review the document for accuracy before sending it out to avoid any misunderstandings later on.

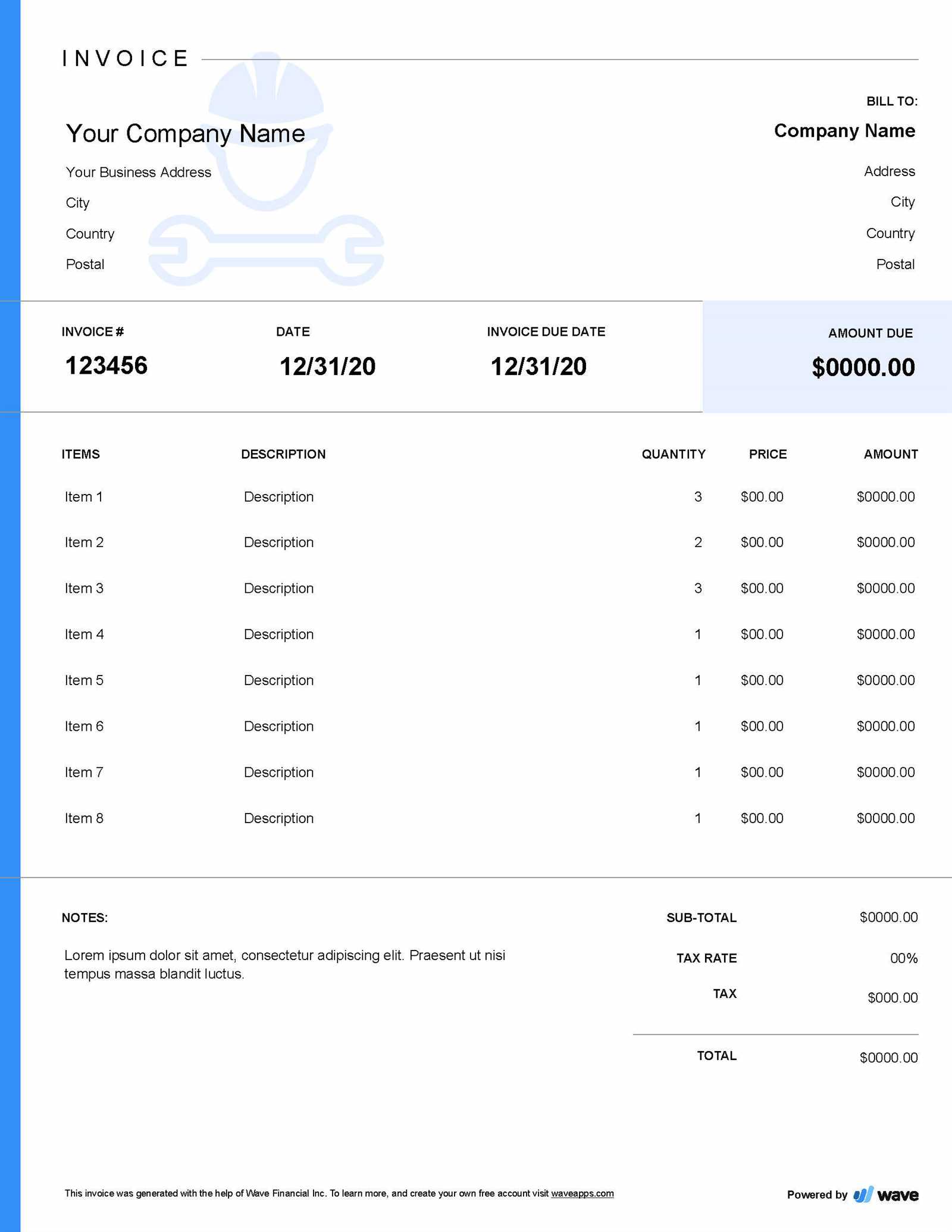

Where to Download Free Templates

When looking for a ready-made solution for creating professional billing documents, many reliable platforms offer downloadable formats that can be easily customized. These resources are often available in various file formats, such as Word, Excel, or PDF, making them accessible and easy to use for businesses of all sizes. Whether you need a simple design or a more detailed layout, these sources can help you get started quickly without needing to create a document from scratch.

Recommended Platforms

Here is a list of some trusted websites where you can find downloadable resources suitable for your business needs:

| Platform | File Formats | Features |

|---|---|---|

| Template.net | Word, PDF, Excel | Wide range of customizable designs for various industries |

| Canva | PDF, PNG | Easy-to-use online editor with customizable templates |

| Microsoft Office Templates | Word, Excel | Simple and professional designs, integrated with Office tools |

| Google Docs | Google Docs, Google Sheets | Free online templates with real-time collaboration |

| Invoiced | Word, PDF | Pre-designed templates optimized for small businesses |

These platforms offer various templates that you can adapt to suit your specific needs. From basic designs to more intricate options, you can find the right style for your business. Additionally, most of these services allow for easy editing, making it quick and convenient to personalize the document before sending it to your clients.

Creating Professional Invoices with Ease

Generating polished and professional payment requests doesn’t have to be a time-consuming task. With the right tools and a clear structure, businesses can create documents that not only reflect the quality of their work but also streamline the payment process. By following a few simple steps and utilizing readily available resources, you can ensure that every billing document is accurate, clear, and well-organized.

Simple Steps for Crafting Professional Documents

Creating effective billing statements involves more than just filling in numbers. To make your documents stand out and look professional, follow these basic steps:

- Choose the Right Format: Pick a design that suits your business style and is easy to understand. A clean, organized layout goes a long way in creating a positive impression.

- Customize Key Information: Include your business details, client information, and specific payment terms. The more personalized and accurate your document is, the better.

- Break Down Charges Clearly: Provide a detailed list of services rendered or products sold, making sure the cost is transparent and easy to understand.

- Set Clear Payment Terms: Clearly state due dates, payment methods, and any late fees. This reduces the risk of confusion or missed payments.

Time-Saving Features to Look For

Many modern tools and resources offer built-in features that make creating billing documents faster and more efficient. From auto-calculating totals and taxes to offering customizable designs, these tools can help businesses generate high-quality documents with minimal effort. Some platforms even allow for automatic reminders and recurring billing, reducing manual tasks and ensuring that you never miss a payment deadline.

By utilizing these time-saving features and following a straightforward process, you can easily create professional documents that reflect your business’s commitment to quality and professionalism.

Common Mistakes to Avoid in Invoices

Creating accurate and clear billing documents is crucial to maintaining a professional reputation and ensuring timely payments. However, many businesses make simple mistakes that can lead to confusion, delayed payments, or even disputes with clients. By being aware of these common errors, you can ensure that your financial requests are always clear, correct, and easy to process.

Missing or Incorrect Details

One of the most frequent mistakes in billing documents is failing to include essential information or providing incorrect details. This can cause delays in payments and lead to misunderstandings. Some common errors to watch out for include:

- Incorrect Client Information: Always double-check the client’s name, address, and contact details before sending the document.

- Missing Dates: Ensure both the transaction date and payment due date are clearly listed. This helps clients understand the timeline for payment.

- Unclear Descriptions: Provide detailed and transparent descriptions of services or products to avoid confusion. A vague description may leave clients unsure about the charges.

Calculation Errors

Another critical area to focus on is the accuracy of your pricing and totals. Mistakes in calculations can lead to significant issues and undermine trust. Be sure to:

- Double-Check Totals: Always verify the final amount, including taxes and any additional fees, before sending the document.

- Clear Breakdown of Charges: Clearly list hourly rates, quantities, and individual costs to avoid any discrepancies.

By paying close attention to these details, you can avoid common pitfalls and ensure that your billing process runs smoothly, professionally, and without complications.

How Labor Invoices Improve Cash Flow

Properly structured billing documents play a key role in maintaining healthy cash flow for businesses. They ensure that payments are processed promptly, reducing the time between service delivery and payment receipt. By providing clear, accurate, and timely requests for payment, businesses can avoid delays and streamline their financial operations.

Ensuring Timely Payments

One of the main ways that well-crafted payment requests improve cash flow is by setting clear expectations around due dates and payment terms. When clients know exactly when and how much they need to pay, they are more likely to pay on time, minimizing the risk of late payments. Including concise terms such as early payment discounts or late fees can also encourage clients to settle their balances quickly.

Tracking Outstanding Payments

Having a standardized approach to billing helps businesses track unpaid balances more effectively. By issuing consistent documents with unique reference numbers and payment due dates, businesses can easily monitor which payments are overdue and follow up promptly. This organization reduces the likelihood of missed payments and improves cash flow by ensuring that outstanding debts are quickly addressed.

Ultimately, creating clear and professional payment requests not only facilitates quicker payments but also fosters trust with clients. This trust, combined with improved payment collection processes, directly contributes to a healthier and more predictable cash flow for your business.

Best Practices for Labor Invoicing

Creating clear and accurate payment requests is essential for maintaining strong business relationships and ensuring timely payments. Adhering to best practices in billing not only promotes professionalism but also helps avoid errors and misunderstandings that could delay payments. Implementing a few simple strategies can streamline the process and contribute to better financial management for your business.

Key Strategies for Effective Billing

To ensure your financial documents are effective and efficient, consider the following best practices:

- Be Clear and Detailed: Always provide a detailed breakdown of the services rendered or products delivered. Include information such as dates, hours worked, and specific tasks to avoid confusion.

- Use Professional Formatting: A clean, organized document with easy-to-read fonts and a consistent layout creates a positive impression. A well-structured document shows clients that you take your business seriously.

- Double-Check Accuracy: Review all information before sending the document. Ensure that client details, payment amounts, and due dates are correct to prevent unnecessary revisions or disputes.

- Set Clear Payment Terms: Clearly state payment due dates, late fees, and accepted methods of payment. This helps to set expectations and avoid delays.

- Include Unique Reference Numbers: Assign a unique identifier to each payment request. This makes it easier to track and reference invoices, especially when dealing with multiple clients or transactions.

Maintain Consistency and Follow Up

Maintaining consistency across all billing documents is crucial. Using a standardized format helps both you and your clients stay organized. Additionally, don’t hesitate to follow up with clients if payment hasn’t been received by the due date. Sending polite reminders can help ensure that outstanding payments are addressed promptly.

By following these best practices, you can improve the efficiency of your billing process, reduce errors, and enhance the overall client experience. Proper invoicing contributes directly to a healthy cash flow and fosters long-term business success.

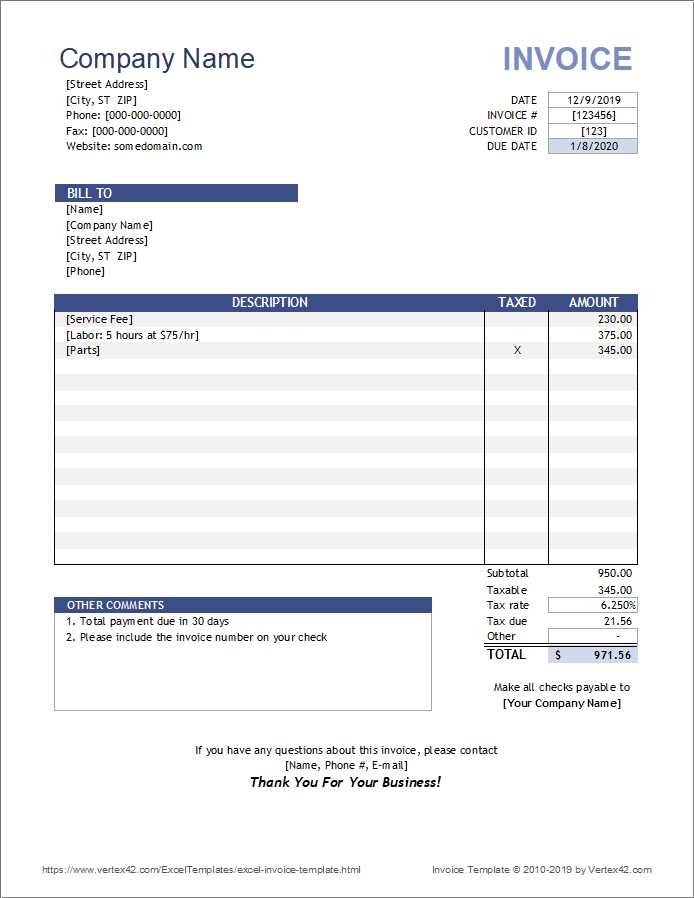

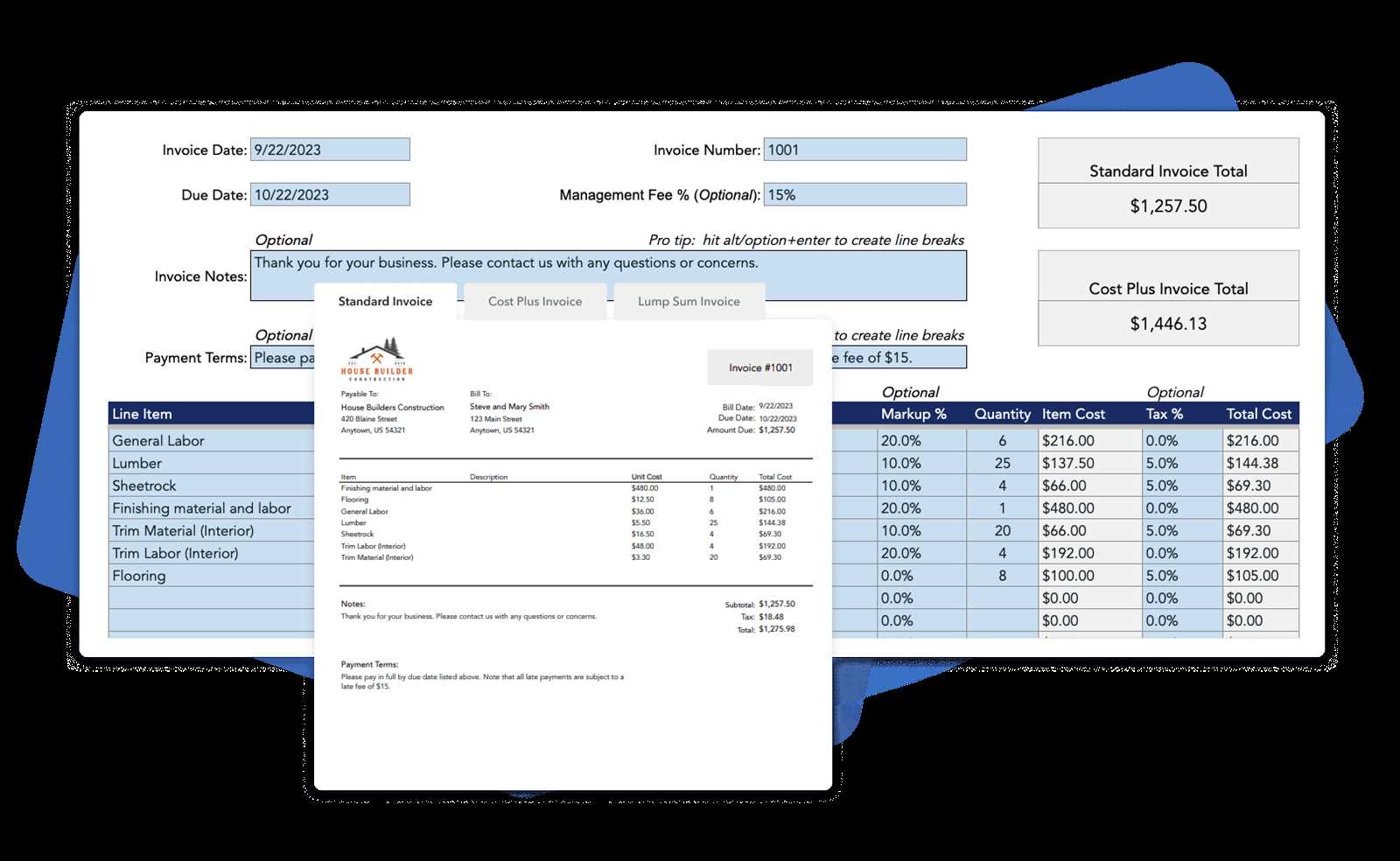

How to Calculate Labor Costs on Invoices

Accurately calculating the cost of work performed is crucial for creating fair and transparent billing documents. Whether you charge hourly, by project, or based on another pricing model, it’s essential to have a clear method for determining the total amount owed for services rendered. By calculating labor costs correctly, you ensure that both you and your client are on the same page regarding the final amount.

Hourly Rate Calculation

If your business operates on an hourly rate, calculating labor costs is relatively straightforward. Here’s how to calculate the total cost for work performed:

- Step 1: Determine your hourly rate. This is the amount you charge per hour of work.

- Step 2: Track the number of hours worked on the project or service provided. This can include time spent on-site or remote work.

- Step 3: Multiply the hourly rate by the total number of hours worked to find the total labor cost.

Example: If your hourly rate is $50 and you worked 8 hours on a project, the total cost for the labor would be $50 × 8 = $400.

Project-Based or Fixed Fee Calculation

For businesses that offer fixed pricing for certain projects or services, the calculation can be more complex but is often more predictable for clients. In these cases, the cost is determined by the scope of work rather than the number of hours worked.

- Step 1: Estimate the total cost of the project, considering factors like materials, time, and any additional overhead.

- Step 2: Include a detailed breakdown of what’s included in the project fee, such as specific tasks, deadlines, and expected outcomes.

- Step 3: Add any additional costs, such as travel or materials, and make sure they are clearly outlined for the client.

By being transparent and clear about your pricing, you not only ensure that your labor costs are correctly calculated but also foster trust with your clients, which can lead to future business opportunities.

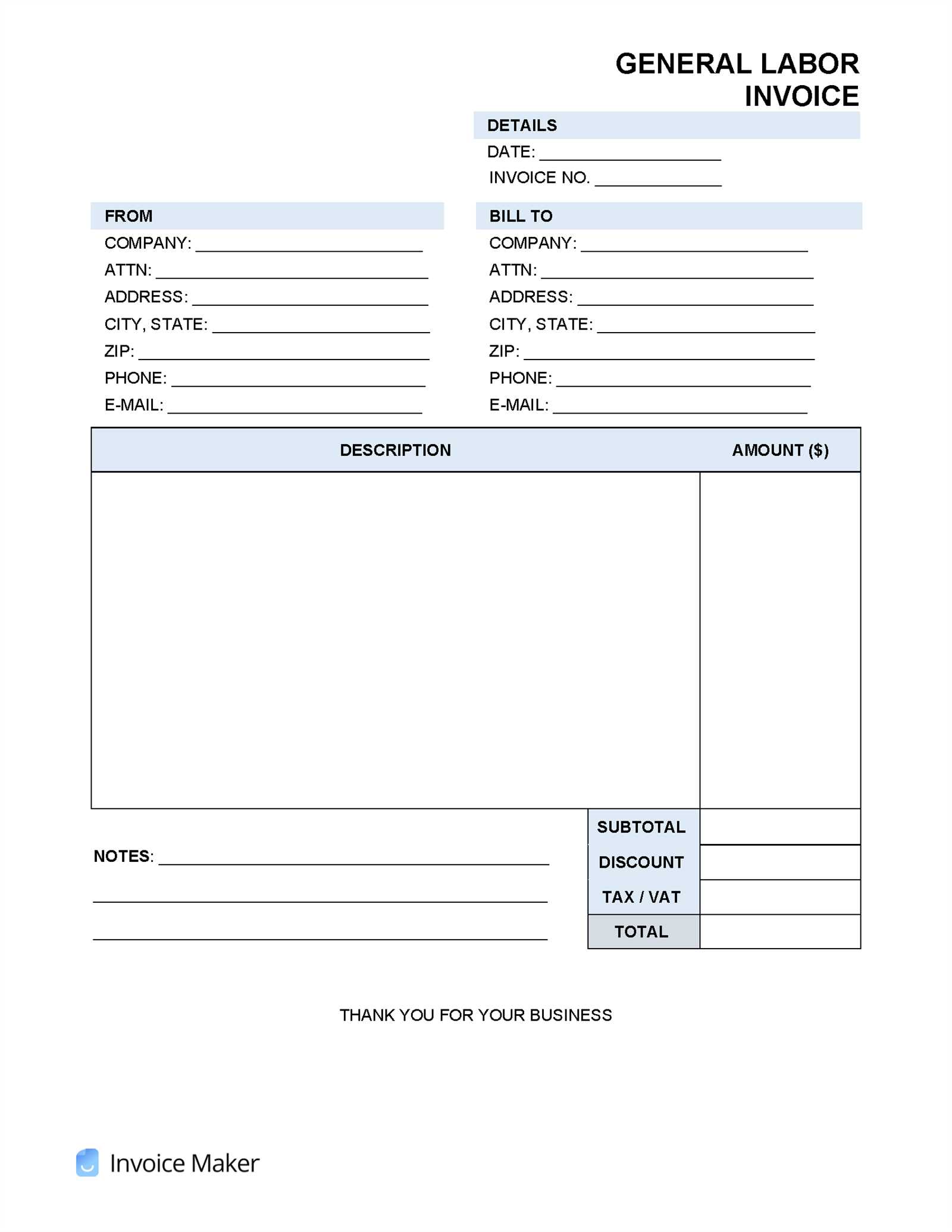

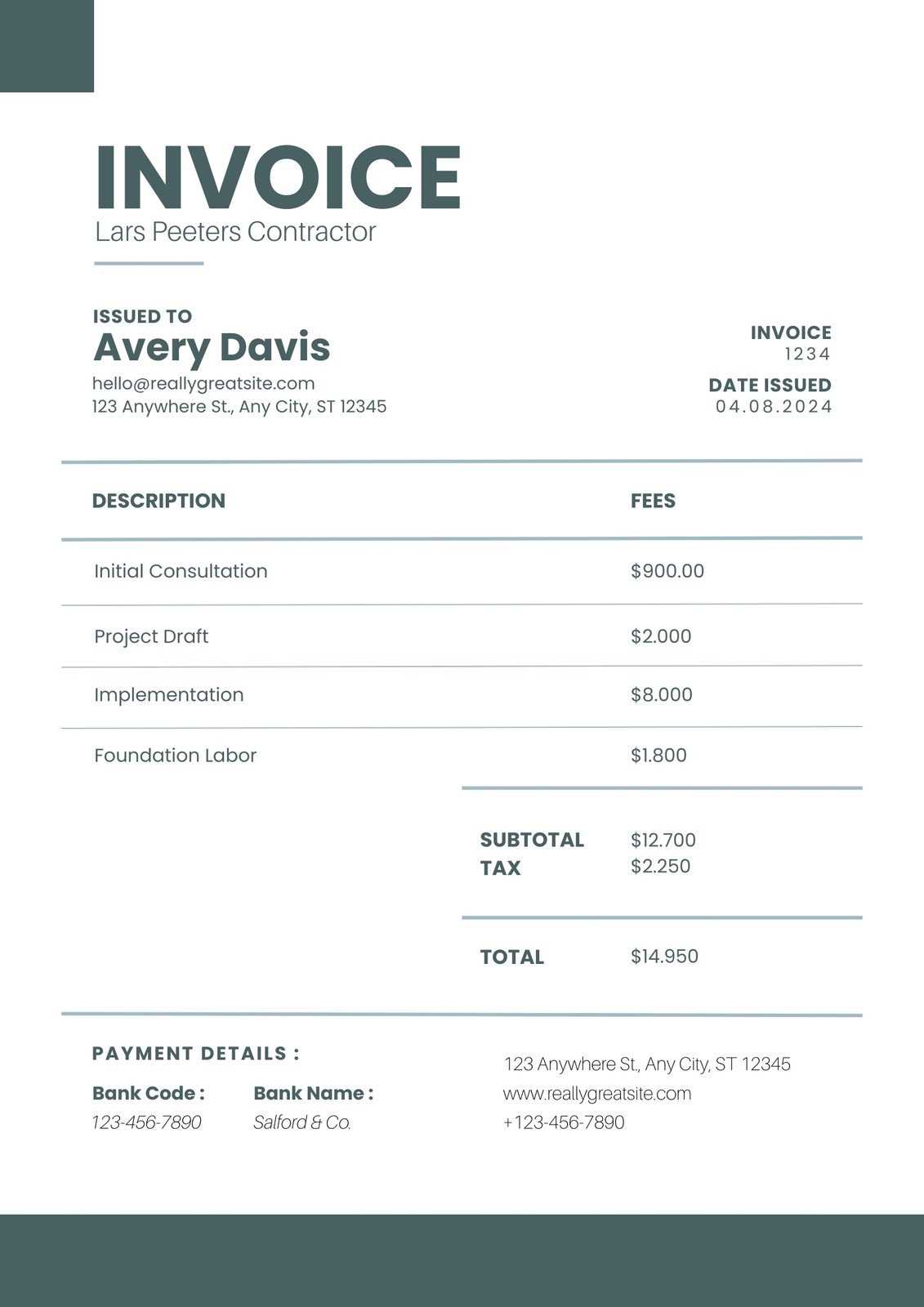

How to Format Labor Invoices Properly

Creating a well-structured billing document is essential for ensuring clarity and professionalism. A properly formatted statement not only facilitates easier payments but also helps avoid confusion and disputes. By following a few key guidelines, you can ensure that your payment requests are clear, organized, and reflect the value of your services accurately.

Key Elements to Include

When formatting a billing document, it’s important to include specific details in a clear and logical order. Below are the essential elements that should always be part of your document:

- Business and Client Information: Include your business name, address, and contact information, as well as your client’s details. This ensures that both parties are clearly identified.

- Document Number: Assign a unique reference number to each payment request. This makes it easier to track and manage your records.

- Dates: Always include the date the document is issued and the payment due date. This sets clear expectations for when payment should be made.

- Description of Services: List each service or task completed, including any relevant details, such as time spent or materials used. This provides transparency and helps clients understand what they are paying for.

- Costs and Total: Include the cost for each service or item, and clearly state the total amount due. If applicable, break down any taxes or additional fees.

- Payment Instructions: Specify acceptable payment methods (e.g., bank transfer, credit card) and any relevant payment terms such as discounts for early payment or penalties for late payments.

Formatting Tips for Clarity

In addition to the content, the visual layout of your document plays a significant role in making it easy to read and professional. Here are a few formatting tips:

- Use Clear Headings: Use bold headings to separate sections and make the document easier to navigate.

- Align Information Consistently: Align text in a way that is easy to follow. For example, ensure that the date, due date, and payment amount are aligned in a consistent format.

- Keep It Simple: Avoid clutter. Use white space to separate sections and make the document visually appealing.

- Use a Readable Font: Choose a simple, professional font such as Arial or Times New Roman in a size that is easy to read (usually 10–12 point).

By following these guidelines, you will ensure that your billing documents are not only professional but also functional and easy for your clients to understand, ultimately

Tips for Faster Invoice Payments

Getting paid promptly is essential for maintaining a healthy cash flow in any business. However, clients may sometimes delay payments due to unclear terms, lack of reminders, or other factors. By implementing a few practical strategies, you can encourage quicker payments and reduce the likelihood of overdue accounts.

Strategies to Accelerate Payment Processing

To ensure that payments are processed quickly, consider incorporating the following tips into your billing process:

- Set Clear Payment Terms: Clearly state payment due dates and accepted methods of payment right from the beginning. Include this information in every document to avoid confusion.

- Offer Multiple Payment Options: Provide clients with various payment methods, such as credit cards, online transfers, or checks, to make the process more convenient for them.

- Send Invoices Promptly: Don’t delay sending out payment requests. The sooner you send the document after completing a service or delivering a product, the sooner you’ll receive payment.

- Use Early Payment Discounts: Offering a discount for early payment can motivate clients to pay ahead of the due date. This strategy benefits both parties: clients get a small reduction, and you get quicker access to funds.

- Set Up Automatic Reminders: If a payment deadline is approaching, send a gentle reminder. Many accounting tools allow you to schedule automated reminders, so you don’t have to manually follow up.

Building Strong Client Relationships

In addition to these tips, building and maintaining positive relationships with clients can encourage faster payments. Be proactive in communicating, keep your clients informed about payment terms, and be courteous when following up on overdue payments. A professional, transparent approach fosters trust and can lead to more prompt payments in the future.

By implementing these strategies and maintaining open communication with clients, you can improve your chances of receiving payments on time and streamline your cash flow management.

Understanding Labor Invoice Legal Requirements

When creating billing documents for services rendered, it’s crucial to understand the legal requirements that govern these transactions. Whether you’re an independent contractor or a business owner, ensuring your payment requests meet legal standards helps protect both you and your clients. Compliance with these rules not only safeguards your business but also fosters professionalism and transparency in your financial dealings.

Essential Legal Elements to Include

There are several key elements that should be included in all billing documents to ensure they are legally compliant and enforceable:

- Business Information: Always include your business name, address, and contact information, as well as the client’s details. In some regions, this is a legal requirement to ensure both parties are clearly identified.

- Unique Reference Number: Assign a unique reference number to each document. This helps with tracking and ensures that records are properly maintained.

- Dates: Clearly state the date the work was completed and the date the payment is due. Many jurisdictions require specific timeframes for payment, and this information helps ensure compliance.

- Detailed Breakdown of Charges: List the services provided and associated costs. Including a clear description of the work ensures that both you and the client are on the same page regarding the terms of the agreement.

- Payment Terms: Be sure to include the terms under which payment is due, such as the accepted payment methods, any applicable late fees, and the payment due date. These terms can be important if a payment dispute arises.

Compliance with Local Laws

Different regions and industries may have specific legal requirements regarding billing practices. For instance, some jurisdictions require businesses to include certain tax information, such as VAT numbers or tax registration numbers, on their billing documents. Additionally, in some countries, there may be strict rules regarding the language used or how certain fees are disclosed. It’s important to research the specific legal obligations for your business to avoid potential legal issues.

By ensuring your payment requests are fully compliant with relevant laws and regulations, you can protect your business, reduce the risk of disputes, and improve the professionalism of your financial transactions.

How to Track Outstanding Invoices

Effectively tracking unpaid bills is essential for maintaining a healthy cash flow and ensuring that payments are made on time. Without a clear system for monitoring outstanding balances, businesses may struggle to identify overdue accounts, which can lead to delays in payment and financial instability. Implementing a reliable tracking system will help you stay organized and follow up with clients as needed.

Methods for Tracking Unpaid Bills

There are several strategies to track unpaid balances and ensure that overdue amounts are addressed promptly. Here are a few methods you can use:

- Spreadsheet or Accounting Software: Use tools like Excel, Google Sheets, or accounting software to create a simple record of each payment request, along with details like the due date, payment status, and any follow-up actions required.

- Automated Reminders: Many accounting platforms offer automated reminders. These systems can send out notifications when payment is approaching or overdue, helping you stay proactive without manual effort.

- Manual Tracking System: If you prefer a more hands-on approach, a physical ledger or file system can help you keep track of outstanding balances. Ensure you log each document clearly, noting the date, amount due, and any communication with the client regarding payment.

Creating a Simple Tracking Table

To help you visualize your outstanding payments, you can create a simple table that includes essential details about each transaction. Below is an example of what such a table might look like:

| Client Name | Amount Due | Due Date | Status | Follow-up Date |

|---|---|---|---|---|

| ABC Corp | $1,200 | 2024-10-15 | Overdue | 2024-11-01 |

| XYZ Ltd | $850 | 2024-10-20 | Paid | N/A |

| 123 Services | $500 | 2024-11-05 | Pending | 2024-11-12 |

By maintaining a table like this, you can quickly identify which clients have outstanding balances and take action accordingly. The key to success is regular monitoring and following up in a timely manner to prevent overdue payments from becoming a recurring issue.

Free Invoice Templates for Different Professions

Different industries and professions have unique billing requirements. Whether you’re a consultant, contractor, or service provider, having a billing document that is tailored to your specific needs ensures clarity and professionalism. Various versions of billing forms are available for different professions, each designed to reflect the type of work done and the expectations for payment. These customized forms streamline the payment process and reduce confusion between you and your clients.

Invoice Versions for Various Industries

Below are examples of how different professions can benefit from customized billing forms:

| Profession | Key Features of Billing Form | Details Included |

|---|---|---|

| Consultants | Hourly rate, project description | Time spent, project milestones, total due |

| Freelance Writers | Word count, article rate | Article title, word count, client name, payment due |

| Contractors | Material and labor costs | Hourly rates, material fees, project scope, due date |

| Photographers | Package rates, session details | Event type, number of photos, editing fees, payment terms |

| Designers | Flat rate or hourly rate | Design specifications, revisions, total hours worked, final cost |

Choosing the Right Format for Your Profession

When selecting a billing form for your profession, it’s important to customize the document based on the specific nature of your services. Some industries may require more detailed descriptions of the work done, while others may focus on simple rates or quantities. Tailoring the billing document to suit your needs not only ensures that clients understand the charges but also provides a professional image that can help with payment processing.

By using the appropriate billing form, professionals from various fields can ensure smooth transactions, build stronger client relationships, and maintain financial organization.