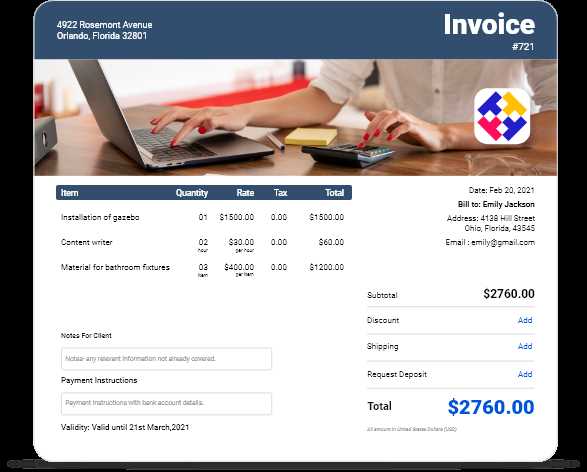

Free Itemized Invoice Template for Accurate Billing

Keeping track of billing details is essential for efficient financial management. When each charge is clearly laid out, both the provider and the client gain a better understanding of the services and costs involved. A well-organized bill reduces misunderstandings and improves trust, making the entire process smoother for everyone involved.

Whether you’re a small business owner, freelancer, or part of a larger company, having a standardized method for presenting charges can streamline operations. Clarity in billing also speeds up payment processing, as clients appreciate the transparency and can quickly review each element of their balance.

Using a ready-to-go document for billing details can be a huge time-saver. With just a few customizations, these pre-set formats allow you to focus more on your work and less on administrative tasks. Let’s explore how to create effective, professional-looking bills that cover all essential information, allowing you

Free Itemized Invoice Template for Businesses

Effective financial documentation is crucial for any company, providing a clear record of transactions and charges. Using a structured billing document simplifies the process of organizing costs for services or products offered, giving both the business and its clients a transparent view of each transaction.

Advantages of a Pre-Formatted Billing Document

For businesses, a standardized billing form saves time and reduces errors. By having a consistent format, you ensure each statement includes all necessary information, which improves accuracy and minimizes client inquiries. This approach also fosters professionalism, showing clients that your company values clarity and attention to detail in its financial dealings.

How Clear Documentation Strengthens Client Relationships

Organized bills can help strengthen trust and communication with clients. When each line item is clearly outlined,

Why Use an Itemized Invoice Template

Organizing financial records effectively is a key component of any successful business operation. Clear documentation of services or products provided, along with their respective costs, enhances transparency and reduces potential disputes. A structured approach to billing can simplify financial tracking and improve the experience for both business owners and clients.

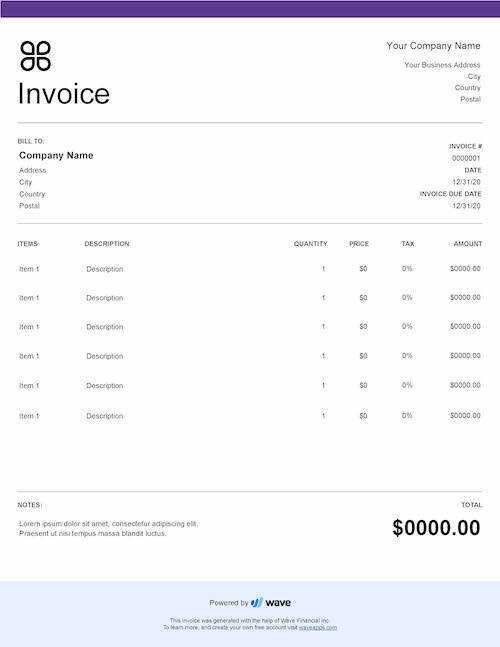

Enhanced Clarity and Transparency

When charges are laid out in a structured format, clients can see exactly what they are paying for, which helps to avoid misunderstandings. This level of clarity is particularly beneficial for businesses offering multiple services or products, as it breaks down costs and shows value in a straightforward way. This approach also reduces time spent answering client queries about charges.

Time-Saving and Professionalism

Utilizing a pre-designed form for billing can streamline your workflow, allowing you to spend less time on administrative tasks. Standardized billing forms help ensure that

How to Create Detailed Invoices Easily

Preparing comprehensive billing documents doesn’t have to be complicated. A well-organized layout that captures all essential details can help both you and your clients keep track of transactions effortlessly. By following a few steps, you can create clear, professional billing records that cover all necessary information.

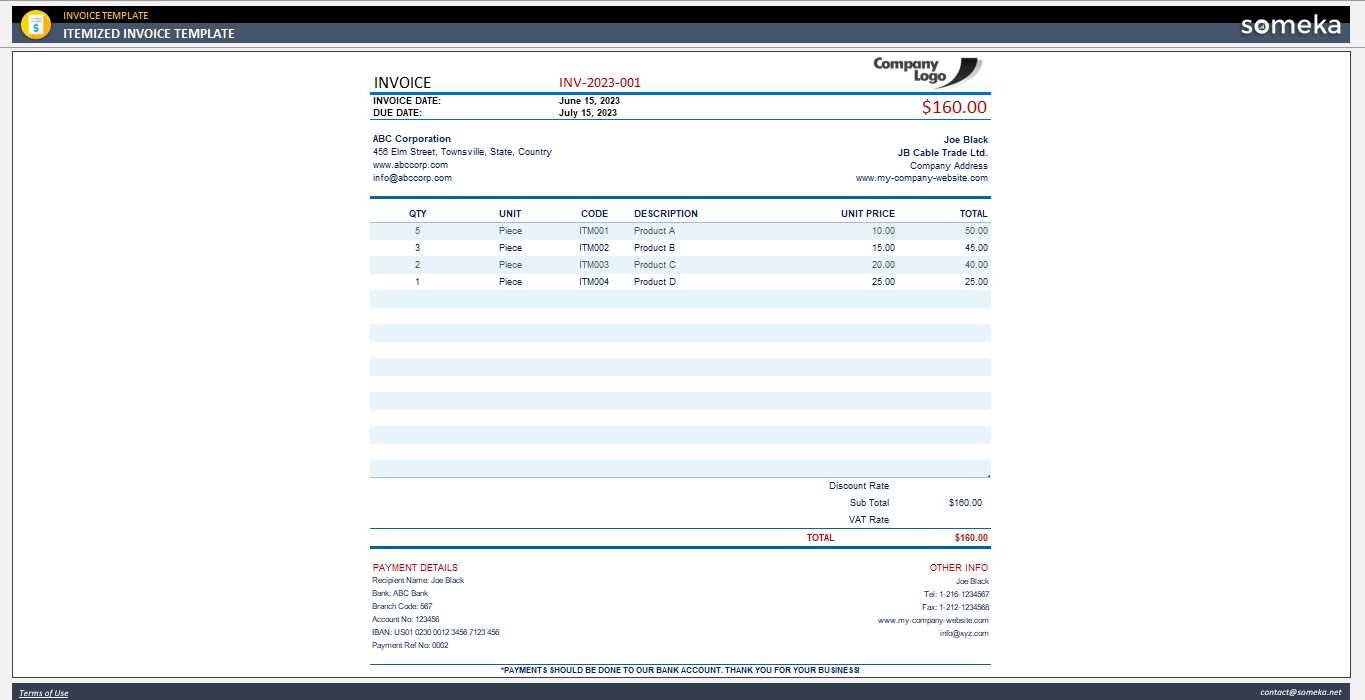

Essential Elements to Include

To ensure accuracy and clarity, each billing document should include specific sections that outline the work provided, associated costs, and terms of payment. Below is a basic structure to guide you:

| Description | Quantity | Unit Price | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service or Product Name | 1

Top Benefits of Itemized BillingBreaking down charges into clear sections offers significant advantages for both businesses and clients. Providing an organized summary of all services or products, along with their respective costs, promotes transparency and enhances client trust. This method can simplify accounting and improve communication, making it a valuable approach in various industries. Enhanced Transparency

Improved Financial Management

|