Free Invoice Templates for Efficient Billing

Managing financial transactions efficiently is a key aspect of running a successful business. One of the most important tasks is creating clear and professional records for payments. Having the right structure in place can save you time, reduce errors, and ensure timely payments from clients.

Using pre-designed forms for tracking financial exchanges can greatly simplify this process. These resources offer a reliable framework to organize payment details, making it easier to maintain consistency and accuracy. With the right format, you can easily customize each document to suit your needs, while maintaining a professional appearance.

Whether you are an entrepreneur, freelancer, or small business owner, adopting these ready-made solutions can improve your workflow. Instead of starting from scratch each time, you can focus on more important tasks, knowing that your records are organized and easy to understand.

Why You Need Invoice Templates

Efficient financial management is crucial for any business, and having a structured approach to documenting payments is a key part of this. With the right system in place, you can reduce mistakes, save time, and ensure that all details are accurately recorded. This process becomes even more essential when dealing with clients and customers, where clarity and professionalism are paramount.

Save Time and Effort

Creating a payment record from scratch every time can be time-consuming. Pre-made forms allow you to skip the repetitive steps and focus on filling in the necessary information. This not only speeds up the process but also ensures consistency across all documents, which is important when managing multiple transactions.

Maintain Professionalism

Having a standardized method for documenting transactions shows clients that you are organized and professional. A polished layout enhances credibility and can contribute to building trust with customers. Whether you’re handling a single client or multiple accounts, using a uniform approach can make a positive impression.

Benefits of Using Free Templates

Adopting pre-designed structures for managing payments offers numerous advantages, particularly for small businesses and freelancers. These ready-made solutions eliminate the need for creating documents from scratch, allowing for a faster and more organized approach to billing. With a variety of options available, users can find the ideal design to match their professional needs without additional costs.

- Time-Saving: Pre-designed formats significantly cut down the time spent on document creation. You can quickly fill in details without worrying about formatting, saving valuable hours that can be used for other tasks.

- Consistency: Using a set format ensures uniformity in your records. This helps maintain a clean and professional appearance across all documents, making your financial processes more organized.

- Customization: These tools often allow for customization, so you can adjust the layout to match your brand’s style. Whether you need to change colors or add a logo, you can make these adjustments with ease.

- Reduced Errors: By using a structured design, the risk of missing important details or making formatting mistakes is minimized, leading to more accurate documentation.

- No Additional Costs: Accessing these resources typically comes at no cost, allowing businesses to save on creating specialized tools or hiring external help for document creation.

How to Choose the Right Template

Selecting the appropriate document design is an essential step in streamlining your billing and record-keeping processes. The right format can help ensure clarity, enhance professionalism, and make managing payments more efficient. However, with various options available, it’s important to consider your business’s unique needs before making a choice.

Consider Your Business Type

The first factor to consider when choosing a design is the nature of your work. If you’re a freelancer, a simpler layout with space for personalized details may be ideal. On the other hand, if you run a larger company, you might require a more detailed format that accommodates multiple items, taxes, and payment methods. Ensure the structure you select fits your specific workflow.

Look for Customization Options

While simplicity is key, flexibility also plays a crucial role. Choose a design that can be customized to reflect your branding, such as adding your logo or adjusting the color scheme. The ability to personalize the document makes it look more professional and aligned with your business identity, contributing to a more cohesive presentation.

Where to Find Free Invoice Templates

There are numerous resources available online for accessing ready-made billing documents that can be customized to fit your needs. These sources provide a wide variety of options, from simple designs to more detailed formats suitable for businesses of all sizes. Finding the right place to obtain these tools can help streamline your operations and save time on document creation.

Popular Online Platforms

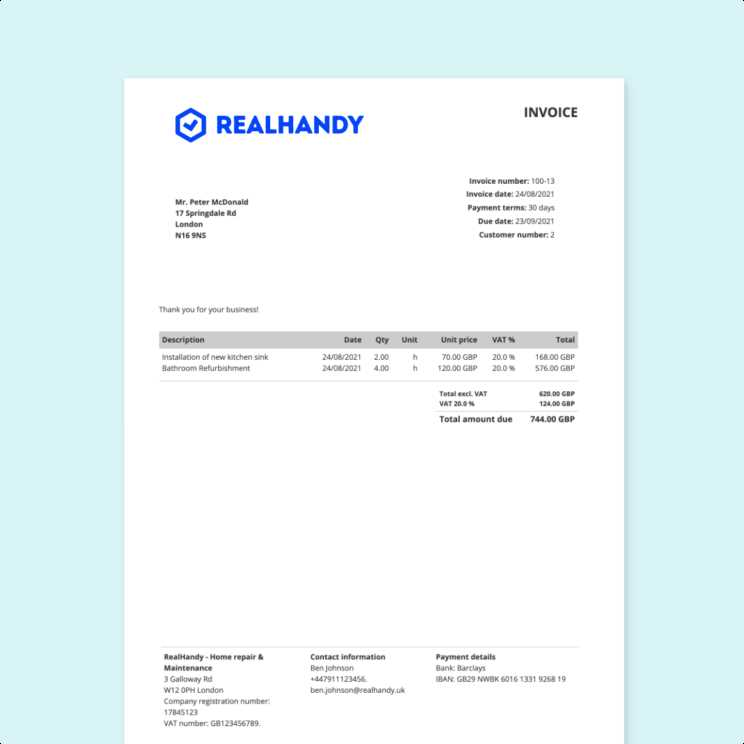

Many websites offer a selection of pre-made solutions for users looking to simplify their billing process. Some of the most common platforms include:

- Microsoft Office Online: Offers various downloadable files for easy editing with popular software.

- Google Docs: Provides cloud-based, customizable designs that can be accessed from any device.

- Canva: Features templates with design flexibility for businesses looking to add a personal touch.

- Template.net: A dedicated platform with a wide variety of downloadable files for multiple industries.

Check Business Tools and Software

Many accounting software programs also include ready-made solutions for creating professional billing documents. Platforms like:

- Wave Accounting: Offers a variety of customizable billing options as part of their free plan.

- Zoho Books: Includes customizable designs within its suite of business tools.

- FreshBooks: Provides pre-designed forms that integrate seamlessly with its invoicing system.

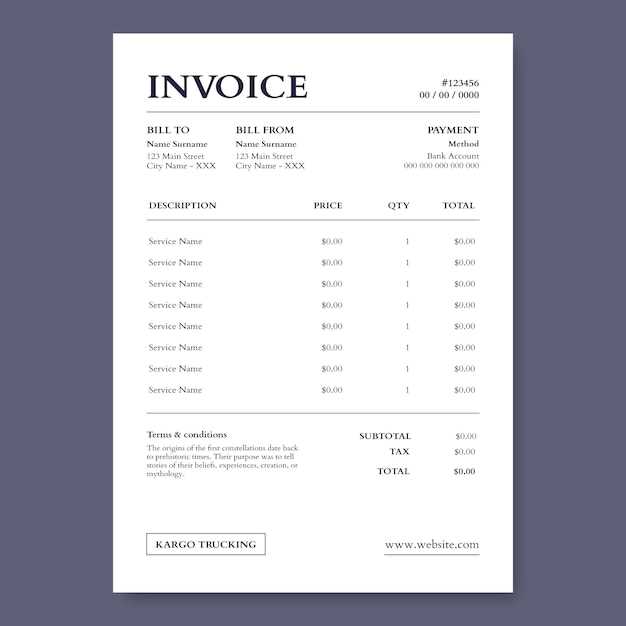

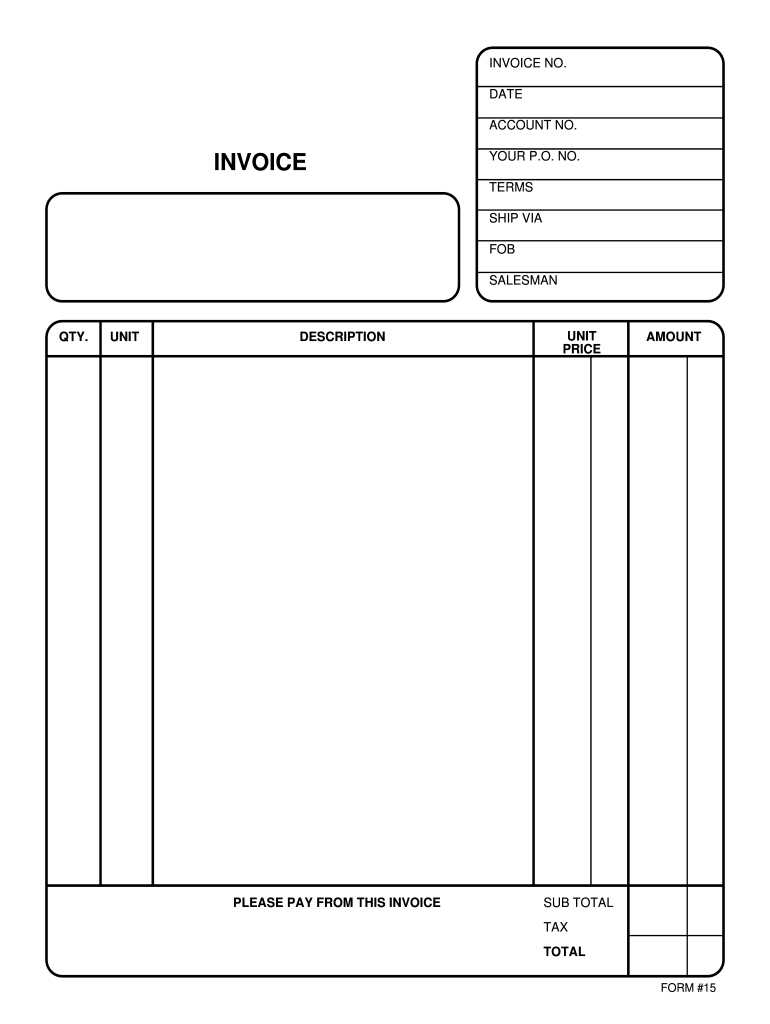

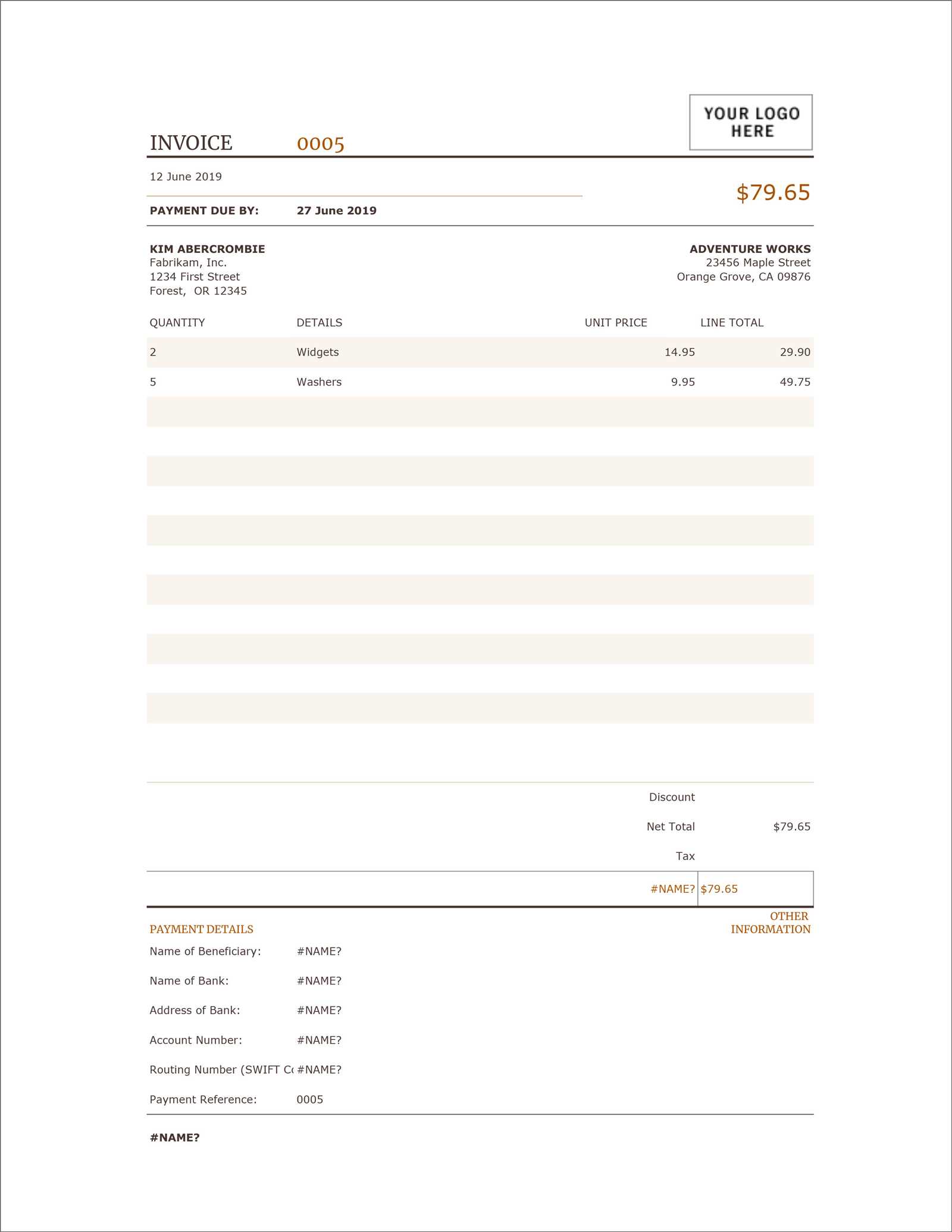

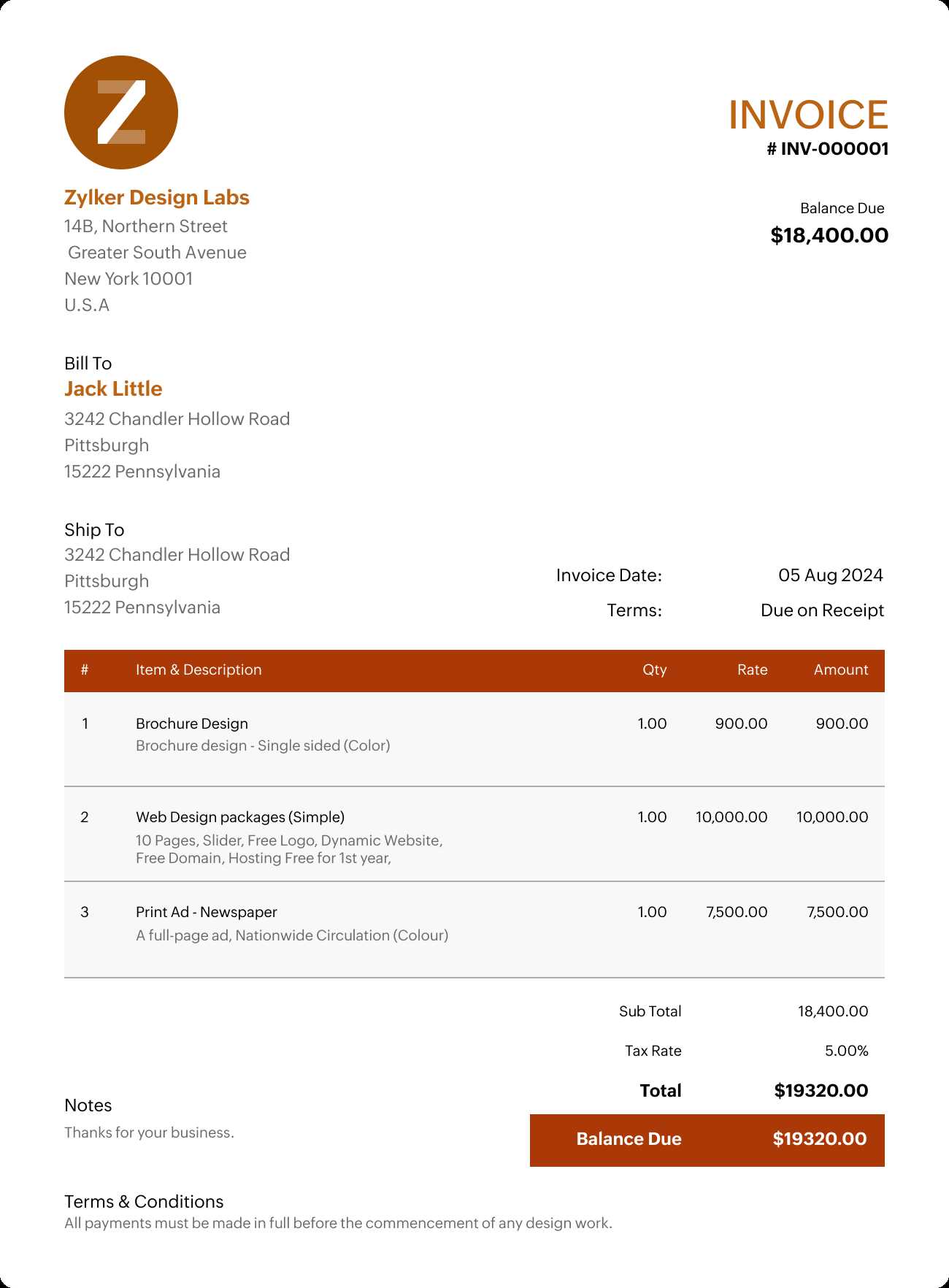

Common Features of Invoice Templates

When selecting a document for managing financial transactions, it’s important to ensure that it includes all necessary elements for clarity and professionalism. Most pre-designed options include common features that help organize the details effectively, ensuring that both the business and the client can easily understand the terms of the transaction.

Essential Information Fields

One of the most important aspects of any document is the inclusion of essential information. Common fields you’ll typically find include:

- Business and Client Details: Fields for the business name, contact information, and client’s details ensure both parties are clearly identified.

- Unique Identification Number: A specific reference number for each transaction helps keep records organized and easy to track.

- Date and Payment Terms: Clearly stating the issue date and payment due date is essential for timely processing.

Itemized Lists and Calculations

Another common feature is the ability to list services or products along with their costs. This provides transparency and makes it easier to calculate totals, including taxes and discounts.

- Product/Service Descriptions: Clear itemization allows clients to see exactly what they are being charged for.

- Tax Calculations: Many formats include fields to automatically calculate applicable taxes based on pre-set rates.

- Total Amount Due: A final total, including all charges and deductions, is clearly highlighted to avoid confusion.

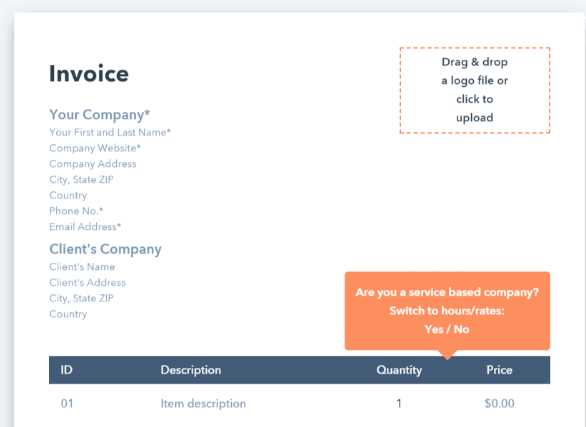

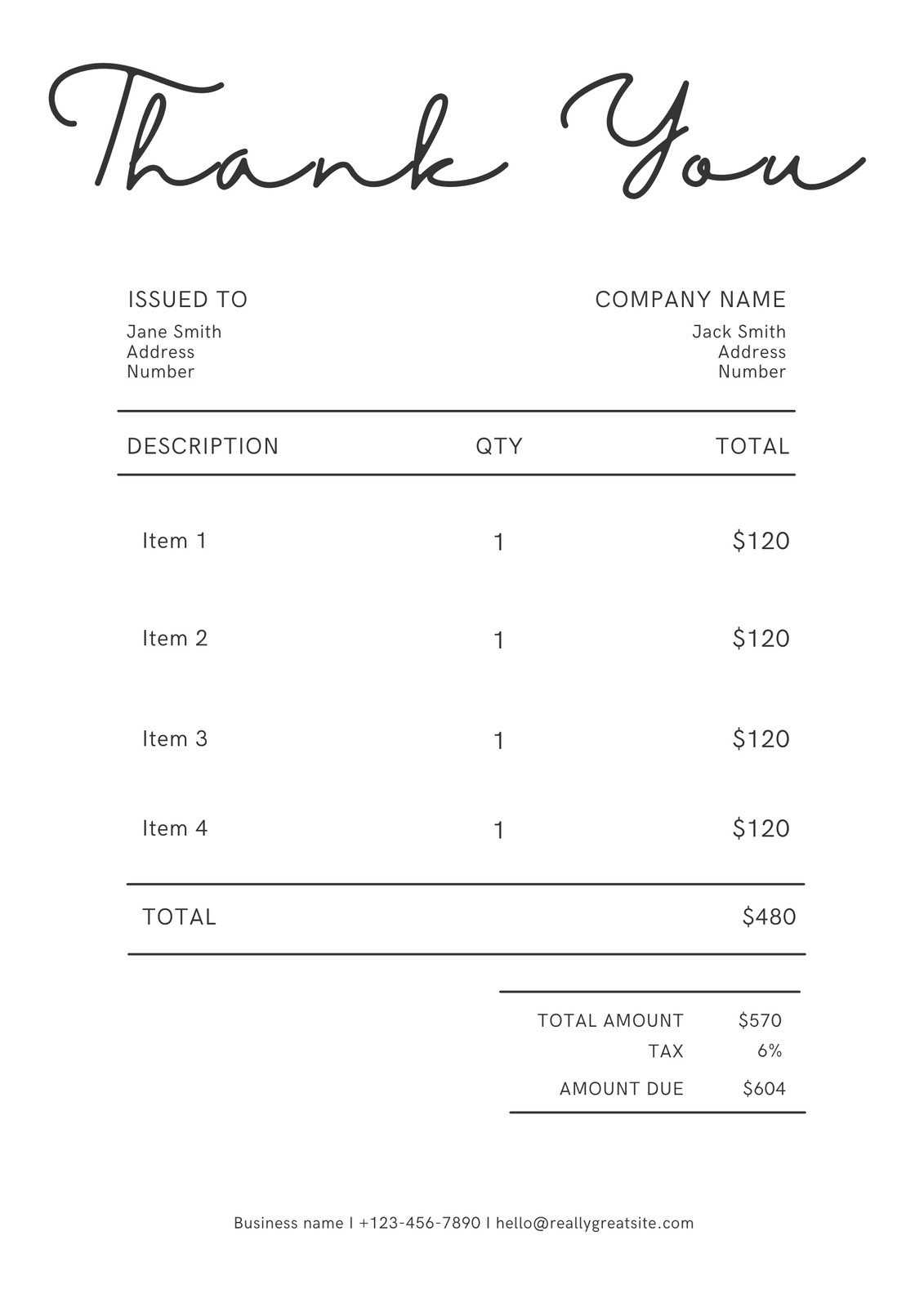

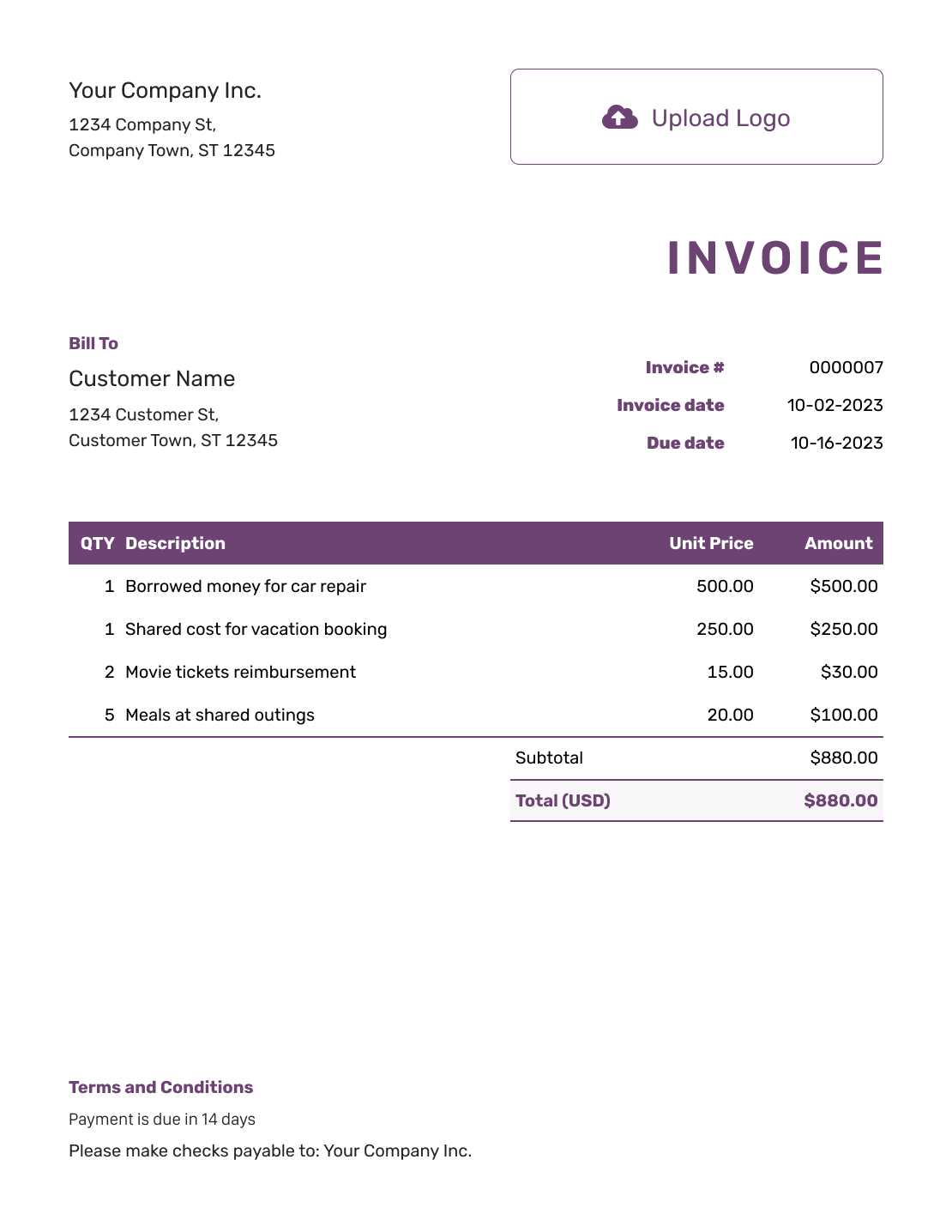

Customizing Templates for Your Business

Personalizing your financial documents to align with your brand and business needs is an essential step in creating a professional image. Customization allows you to adjust the design and content to better reflect your business identity, while also ensuring that the document meets your operational requirements. Whether you’re adding logos, adjusting layouts, or modifying the information fields, personalization can significantly enhance your documents’ effectiveness and appearance.

Branding Your Documents

Incorporating your brand’s visual elements into your documents makes them look more professional and cohesive. Some common ways to personalize your forms include:

- Logo Placement: Adding your company’s logo helps reinforce your brand’s identity and gives the document a professional look.

- Color Scheme: Adjusting colors to match your branding creates a consistent visual experience for your clients.

- Font Styles: Using company-specific fonts or a professional font style can make the document more polished and easier to read.

Adjusting Content for Specific Needs

Customizing your document also involves tailoring the content to fit your specific business model. This can include:

- Payment Terms: Modifying payment instructions and due dates based on your preferred terms of service.

- Service or Product List: Including relevant categories and descriptions of the goods or services you provide.

- Additional Charges: Adding sections for extra fees, such as shipping or handling, to ensure full transparency.

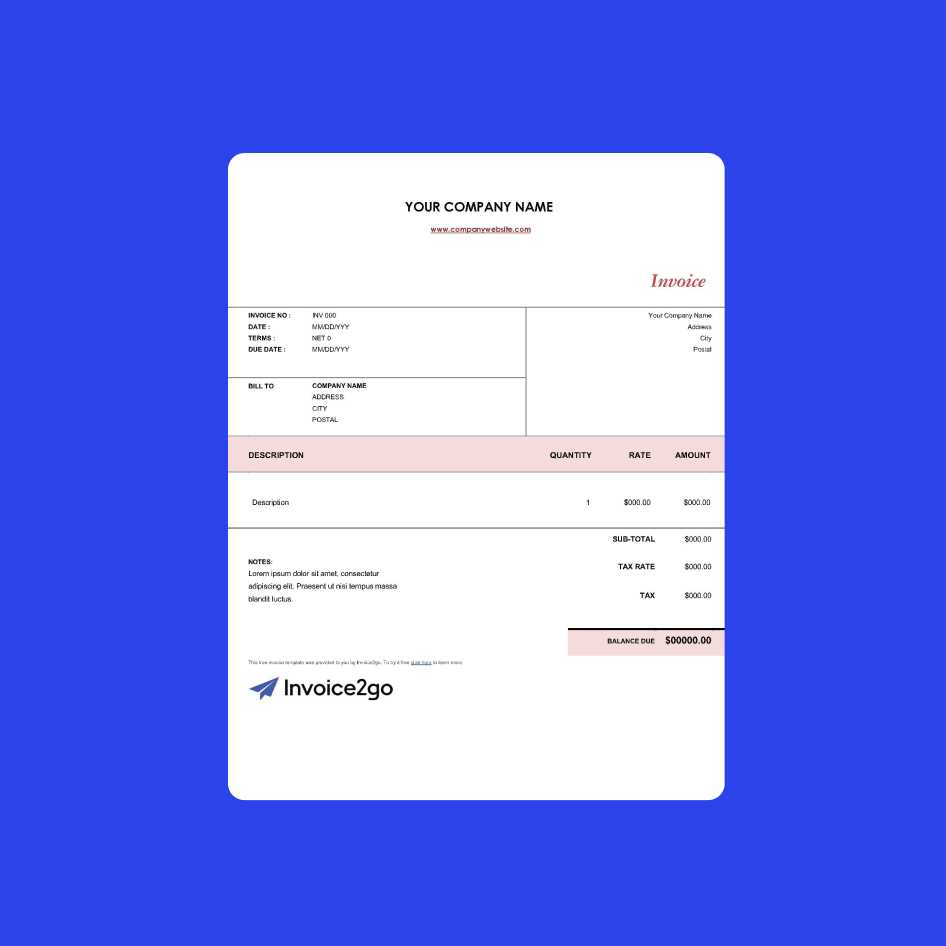

How to Fill Out an Invoice Template

Filling out a billing document may seem straightforward, but it’s important to ensure that all details are accurate and complete to avoid confusion or delays in payments. By following a systematic approach, you can efficiently fill out each section, ensuring clarity for both your business and your client. Below are the key steps to follow when completing a billing document.

1. Include Your Business Information: Start by entering your company name, address, phone number, and email. This establishes the source of the document and provides your client with the necessary contact details.

2. Add Client Details: Next, include the name and contact information of the recipient. Be sure to confirm these details with the client beforehand to ensure accuracy.

3. Assign a Unique Number: Each document should have a unique reference number. This helps track and organize your transactions, making it easier to retrieve or reference past records.

4. Specify the Date: Clearly state the date the document is issued, as well as the due date for payment. This helps set expectations for timely payments and avoids any confusion regarding deadlines.

5. Detail the Goods or Services Provided: List the products or services offered, along with their respective quantities and unit prices. This section should be as clear and detailed as possible to prevent disputes over what was purchased.

6. Include Payment Terms and Methods: Indicate how payments should be made (e.g., bank transfer, check) and specify any payment terms, such as discounts for early payment or late fees for overdue amounts.

7. Review and Double-Check: Once all information has been filled in, carefully review the document to ensure everything is accurate, including pricing, dates, and contact details. A quick check will help avoid costly mistakes.

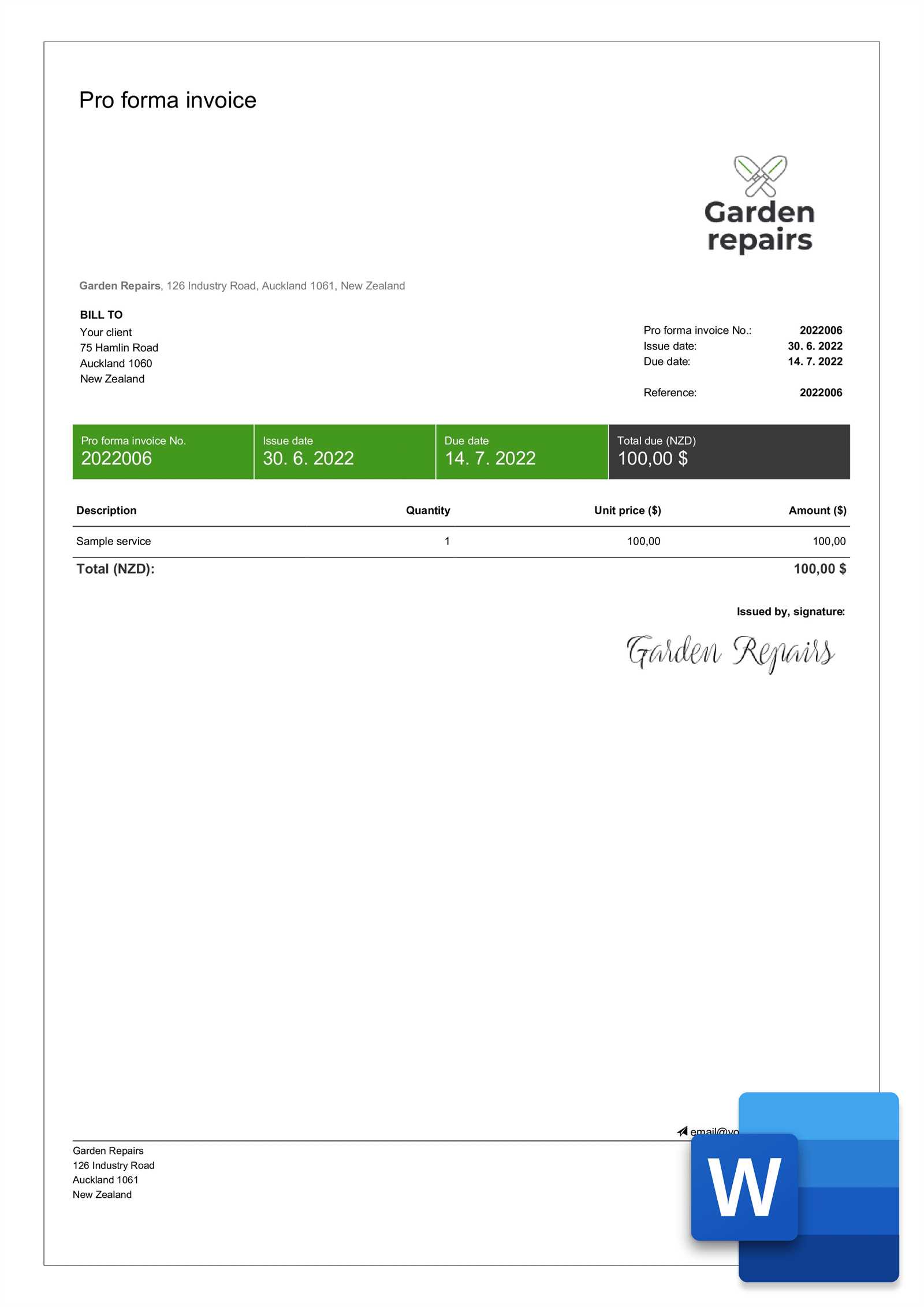

Understanding the Different Invoice Types

There are several types of financial documents used by businesses, each designed to serve a specific purpose. Understanding the differences between these formats is important to ensure that the right one is chosen for each transaction. By selecting the correct document type, businesses can streamline their accounting processes and maintain clear records of all financial dealings.

Common Invoice Variations

Each type of document has its own structure and intended use, depending on factors such as payment terms, delivery, and project scope. Below are some of the most commonly used formats:

| Invoice Type | Description | When to Use |

|---|---|---|

| Standard | A basic format that includes itemized services or products and the total amount due. | Used for one-time purchases or services rendered. |

| Proforma | Issued before the actual sale to provide a preliminary estimate. | Ideal for quotes or estimates that may change before final billing. |

| Recurring | Used for regular, repeated payments like subscriptions or memberships. | Perfect for businesses with ongoing client relationships. |

| Credit | Issued when a customer is owed money due to overpayment or returned goods. | For situations where adjustments or refunds are necessary. |

| Debit | Used to charge a customer more than the original amount due to added costs or changes. | For additional charges or corrections in previously issued documents. |

Choosing the Right Document

By understanding the various types of documents available, businesses can select the one that best fits their specific transaction. Whether you need to issue a one-time payment request or manage regular billing, choosing the right format ensures that both you and your client are on the same page, minimizing confusion and facilitating smooth financial interactions.

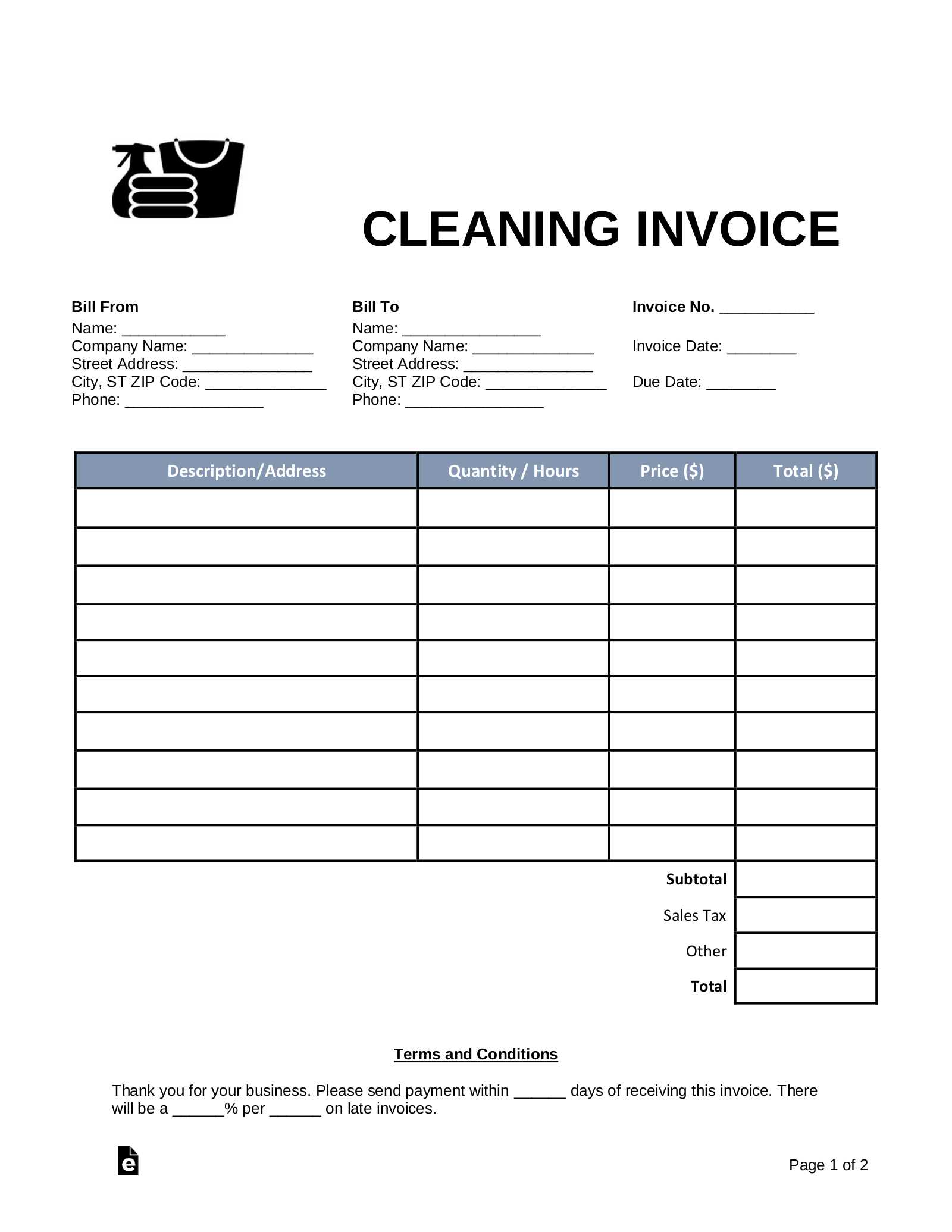

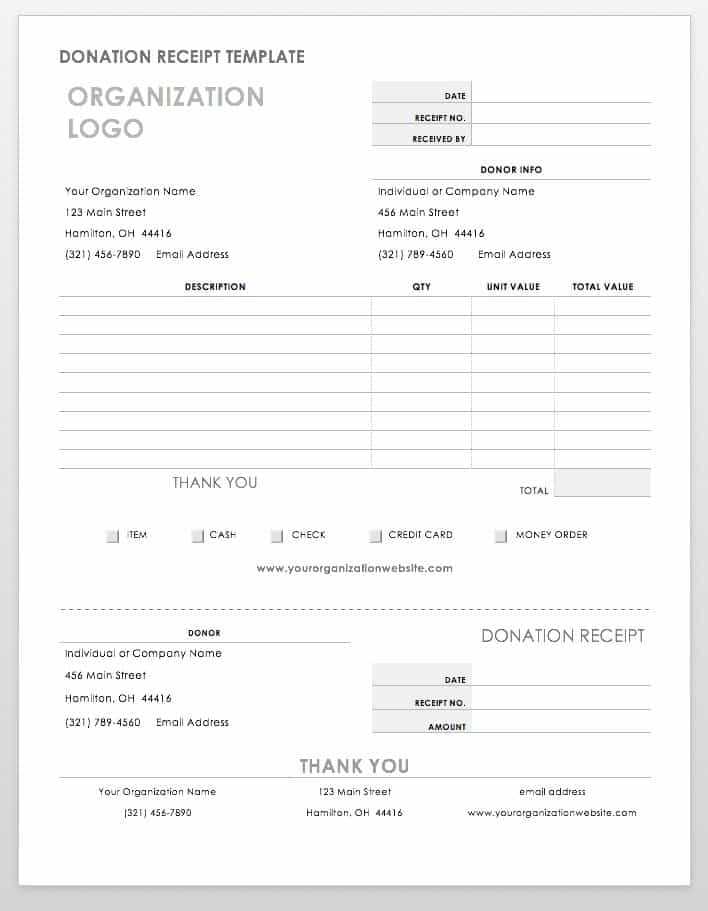

Free Templates for Freelancers and Contractors

Independent professionals, such as freelancers and contractors, often require formal documents to request payment for services rendered. These documents serve as an essential tool for organizing billing information and ensuring clear communication between the service provider and client. Having ready-made formats tailored for specific needs can simplify the billing process and save time, allowing professionals to focus on their work rather than administrative tasks.

Essential Features for Independent Professionals

For freelancers and contractors, the ideal document should include specific fields that reflect the nature of their work. These may include:

- Hourly or Project Rate: A clear breakdown of charges based on time spent or a fixed project fee helps clients understand the costs.

- Scope of Work: A description of the services or tasks completed ensures that both parties are aligned on what has been delivered.

- Payment Terms: Clearly defined payment due dates, methods, and any late fees provide a transparent framework for financial exchanges.

How Customization Can Help You Stand Out

While many professionals use standard documents, customizing them to fit the specific nature of their services can make a significant impact. Adding your logo, adjusting the layout for readability, and including personalized payment instructions can help create a more professional and branded experience for your clients. Customizing your document shows attention to detail and reinforces your business identity.

Creating Professional Invoices with Ease

Creating polished and well-structured billing documents is crucial for maintaining a professional image and ensuring smooth financial transactions. With the right approach, the process of generating these documents can be quick and efficient. A well-designed document not only communicates your professionalism but also makes it easier for clients to understand the services rendered and the payment expectations.

Steps to Craft a Professional Billing Document

Follow these simple steps to create a professional document that covers all necessary details:

- Include Your Business Information: Ensure that your name, logo, address, and contact details are clearly visible at the top.

- Provide Client Information: List your client’s name, address, and other relevant contact information to ensure clarity.

- Describe the Services or Products: Break down the services or items provided, along with their quantities, rates, and total costs.

- Specify Payment Terms: Include payment due dates, acceptable payment methods, and any terms related to late fees or discounts.

- Number the Document: Assign a unique identifier or reference number to track and organize your records.

Tools for Streamlining the Process

Using software or pre-built tools can significantly speed up the process of creating professional documents. Many online platforms offer user-friendly interfaces with customizable features, allowing you to generate and send your documents in just a few minutes. Automation tools can also help with recurring transactions, saving you time and ensuring consistency across all your financial documents.

How to Save Time with Templates

Streamlining administrative tasks is essential for boosting productivity, especially when it comes to managing financial records. One of the most effective ways to save time is by using pre-structured documents that can be quickly filled out and customized for each transaction. By eliminating the need to start from scratch each time, professionals can focus on their core work and reduce repetitive tasks.

Benefits of Pre-Formatted Documents

Using ready-made structures for financial documents offers several advantages, including:

- Speed: With a set format, the time spent filling in details such as client information, services provided, and payment terms is reduced.

- Consistency: Having a standardized format ensures that all records are uniform, reducing the chance of errors or omissions.

- Customization: Many platforms allow for easy modifications, so you can adjust each document to meet specific client needs while keeping the structure intact.

- Reduced Stress: Having a reliable format to use decreases the mental load of having to remember or recreate details from scratch each time.

Practical Tips for Maximizing Efficiency

To get the most out of pre-made documents, consider the following strategies:

- Save Frequently Used Information: Store common client details and services to minimize the time spent entering recurring data.

- Automate Repetitive Tasks: Use tools that allow you to automate billing and send reminders, ensuring that no steps are overlooked.

- Regularly Review and Update: Make sure that your format stays relevant and accurate by reviewing it periodically, ensuring that your processes evolve with your business.

Integrating Templates with Accounting Software

Efficiently managing financial documents becomes even easier when they are integrated with accounting software. By connecting pre-structured documents with digital accounting tools, businesses can automate many aspects of the financial process, saving time and reducing the chance of human error. This seamless connection helps ensure that data flows smoothly from one system to another, making record-keeping and reporting much more manageable.

Benefits of Integration

Integrating structured documents with accounting software brings several advantages to your business:

- Automatic Data Entry: Information entered into the document can be directly transferred to the accounting system, reducing the need for manual input and the possibility of mistakes.

- Streamlined Reporting: Integration ensures that your financial records are consistently updated, making it easier to generate accurate reports for tax purposes, audits, or internal analysis.

- Real-Time Tracking: With integration, you can monitor payments, outstanding amounts, and other key financial data in real time, helping to maintain better cash flow management.

- Efficiency and Time Savings: By reducing repetitive tasks, integration allows you to focus more on your business and less on administrative work.

How to Set Up the Integration

To set up the connection between your structured documents and accounting software, follow these steps:

- Choose Compatible Tools: Ensure that your accounting software supports the import or export of formatted files that align with your document layout.

- Connect the Platforms: Many accounting tools offer integrations with document management systems. Follow the setup instructions to link both platforms seamlessly.

- Test the System: Before fully relying on the integration, test it with a few transactions to make sure that the data transfers accurately and efficiently.

Printable vs. Digital Invoice Templates

When it comes to creating billing documents, businesses often face the decision between physical and electronic formats. Each option offers distinct advantages, depending on the nature of the business, client preferences, and the need for flexibility. While traditional printed documents are still widely used, digital solutions are gaining popularity due to their speed, accessibility, and ease of integration with other systems. Understanding the key differences between the two can help you choose the right approach for your business needs.

Comparison of Printable and Digital Formats

Here’s a breakdown of the advantages and challenges associated with both options:

| Feature | Printable Format | Digital Format |

|---|---|---|

| Accessibility | Requires physical presence to access and review. | Accessible from anywhere with an internet connection. |

| Delivery Time | May require mailing or personal delivery, which can take time. | Instant delivery via email or online platform. |

| Environmental Impact | Paper use increases waste and environmental footprint. | More environmentally friendly with no paper waste. |

| Security | Can be lost, damaged, or stolen. Requires secure physical storage. | Data can be encrypted, reducing risk of loss or theft. |

| Customization | Limited customization unless manually adjusted. | Highly customizable with software for automated fields and calculations. |

Choosing the Right Format for Your Business

Deciding between a printed or digital format depends on your client base and operational needs. If you work with clients who prefer paper records or operate in industries where physical documents are required, printed versions may be ideal. However, for businesses that require fast, secure, and easily trackable transactions, digital formats may be the better choice. Ultimately, it’s important to evaluate how each format aligns with your business goals and client preferences.

Legal Considerations for Invoice Templates

When creating billing documents, it is crucial to ensure that they meet the legal requirements of your jurisdiction. Inaccurate or incomplete records can lead to disputes, tax issues, or non-compliance with financial regulations. Whether you are working with clients locally or internationally, understanding the legal considerations surrounding these documents can help prevent potential complications and safeguard your business interests. This section will highlight key elements you should include to ensure your documents comply with relevant laws.

Essential Legal Elements for Billing Documents

Certain details are legally required to ensure that the document is valid and can be used in case of disputes or audits. Here is a list of mandatory elements to include:

| Element | Description |

|---|---|

| Business Information | Include the name, address, and contact details of both parties (your business and the client). |

| Unique Identification Number | Each document should have a unique identification number to avoid confusion or duplication. |

| Date | Clearly indicate the date the document was created, as well as the payment due date. |

| Itemized List of Services or Goods | Provide a clear description of the services or goods provided, along with the corresponding cost. |

| Tax Information | If applicable, include tax identification numbers and the amount of tax applied to the total cost. |

Understanding Local and International Legal Requirements

While the above details are generally applicable, legal requirements can vary depending on your country or region. For example, some jurisdictions may require specific language or additional disclaimers on financial documents. If you do business internationally, it is important to understand the invoicing regulations of the countries you operate in to ensure full compliance. Always check with a legal or tax professional to ensure that your documents meet the necessary legal standards for your location and industry.

How to Track Payments Using Templates

Efficiently monitoring payments is crucial for maintaining a steady cash flow and ensuring that all financial transactions are properly recorded. By utilizing organized documents, you can easily track outstanding balances, payment statuses, and overdue amounts. This section explains how to use well-structured documents to simplify the tracking process and ensure you stay on top of your financial records.

When managing your financial transactions, it’s important to record every payment clearly. With organized documents, you can quickly see which payments have been made, which are pending, and which need follow-up. Here’s how you can streamline payment tracking:

1. Include Clear Payment Details

Each document should clearly specify the total amount due, the payment terms, and the due date. Including a section for payment updates or status will allow you to easily track whether the amount has been settled or if it’s still pending.

2. Use a Payment Status Column

Adding a payment status column to your document can help you visually track the status of each transaction. Use simple categories like Paid, Pending, and Overdue to clearly indicate the payment’s current status. This makes it easy to identify what needs attention at a glance.

- Paid: Payments that have been fully received.

- Pending: Payments that are yet to be made but are due soon.

- Overdue: Payments that have passed their due date.

3. Add Payment History

Including a section to track partial payments or any changes in the amount owed over time can help provide a complete payment history. This is especially useful for businesses that accept installments or multiple payment methods.

By implementing these tracking strategies within your financial documents, you’ll be able to stay organized and ensure timely payments from clients. Regularly reviewing and updating your records will keep your cash flow healthy and help you maintain positive relationships with customers.

Maximizing Efficiency with Invoice Templates

Streamlining financial documentation is key to saving time and maintaining accurate records. By using well-structured, reusable formats, businesses can reduce manual effort and minimize the chances of errors in their financial processes. This section explores how using organized formats can increase efficiency, reduce administrative burden, and ensure consistency across your business operations.

Having a reliable and easily customizable document format allows you to generate professional records quickly. Instead of creating each document from scratch, you can fill out predefined fields with specific data, speeding up the process and ensuring that every detail is consistent. Here’s how you can optimize your workflow:

1. Reduce Repetitive Work

By using standardized formats, you eliminate the need to manually write out similar information every time. Common fields like client details, payment terms, and item descriptions can be pre-filled, which reduces the time spent on each new record. You can create templates with fields for all the necessary details, so you only need to update the unique parts.

2. Improve Accuracy and Consistency

With a clear, structured format, you ensure that all required information is included, reducing the risk of missing or incorrect data. Consistent design and organization also enhance the professionalism of your documents, contributing to a more positive business image. Using a reliable format ensures that every document follows the same standards, avoiding discrepancies and ensuring uniformity in your records.

| Benefit | Explanation |

|---|---|

| Time-saving | Filling out repetitive fields once and reusing them reduces the amount of time spent on each record. |

| Increased Accuracy | Predefined fields help avoid errors, ensuring the correct information is always used. |

| Consistency | Using the same format for all records maintains a professional and uniform appearance across all documentation. |

By integrating these practices into your workflow, you can significantly boost efficiency and productivity, allowing your business to focus more on growth and customer relationships, and less on administrative tasks.

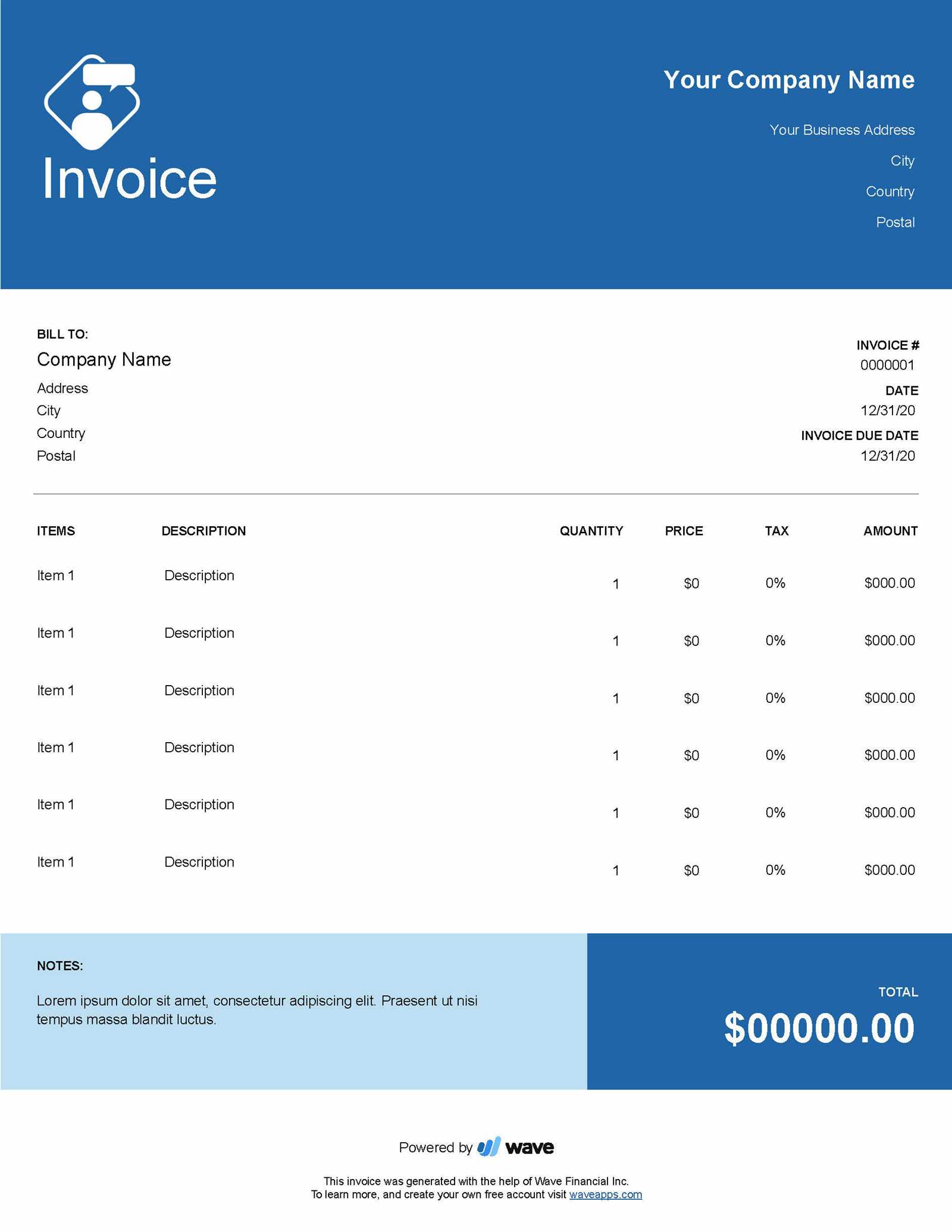

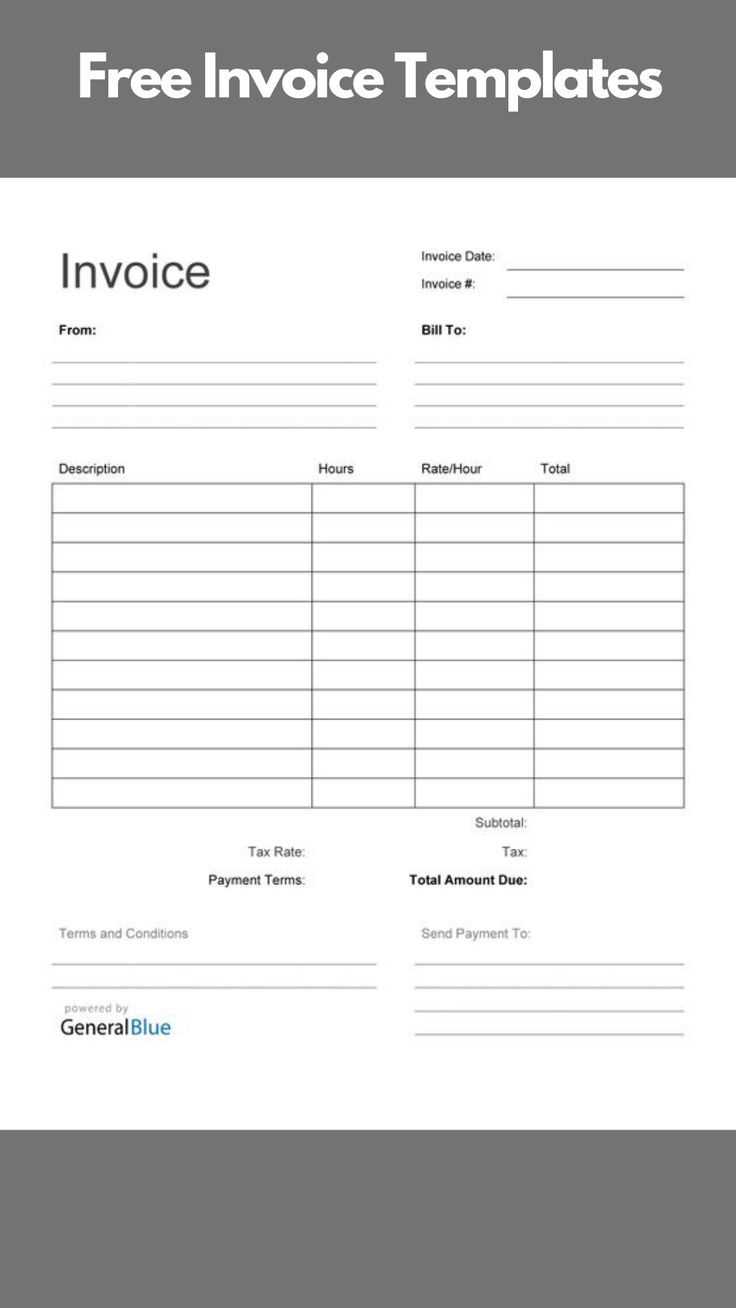

Free Resources for Invoice Template Designs

Finding high-quality, customizable design resources can make a significant difference in creating polished and professional documents for your business. There are numerous platforms that offer both free and paid design assets, allowing you to select the most suitable styles for your needs. This section outlines various resources where you can access well-crafted document formats for a variety of professional purposes.

When selecting a design resource, it’s essential to ensure the layout meets both your business requirements and your brand image. Below are some of the top platforms where you can access designs that fit your needs:

- Canva – Known for its user-friendly interface, Canva offers a wide range of customizable document designs, including those suited for business purposes like receipts, quotations, and purchase orders.

- Microsoft Office Templates – Microsoft provides a variety of pre-made document formats that are easy to modify, offering both traditional and modern designs to suit different industries.

- Google Docs – Google’s suite of applications offers simple, effective, and customizable document templates that can be quickly accessed and edited from any device with internet connectivity.

- Template.net – A platform that offers various ready-made layouts designed for different business scenarios, with both free and premium options available for download.

- HubSpot – HubSpot provides free, customizable business forms and documents, including several options designed specifically for companies that frequently deal with financial transactions.

Each of these resources provides accessible, customizable options, so you can find the design that best suits your business style and requirements. Whether you need something simple or more intricate, these platforms allow you to tailor each document to your exact specifications.