Free Invoice Templates Online for Easy and Professional Invoicing

Creating professional documents for payments can be time-consuming, but with the right tools, it becomes a quick and efficient task. Whether you’re running a small business or managing freelance work, having a reliable and customizable solution can save you valuable time. A variety of options are available to help you generate documents that look professional and are easy to manage, ensuring accuracy and clarity in every transaction.

With these practical resources, you can focus more on your work and less on paperwork. From simple designs to more complex layouts, the right tool can accommodate your unique needs. These resources are accessible at no cost, offering everything you need to keep your financial records organized without the hassle of starting from scratch each time.

Efficiency and simplicity are key. No need to worry about complex formatting or missing details–these solutions make it easy to stay consistent and professional in your financial dealings. With a few clicks, you can generate the necessary documents and continue with your business activities.

Free Invoice Templates Online for Every Need

Every business or individual engaged in financial transactions requires a simple and efficient way to create clear and professional payment documents. Whether you’re a freelancer, small business owner, or running a large corporation, having access to customizable solutions can make managing financial matters easier. These tools offer flexibility, allowing you to adjust each document according to specific requirements, ensuring accuracy and professionalism in every deal.

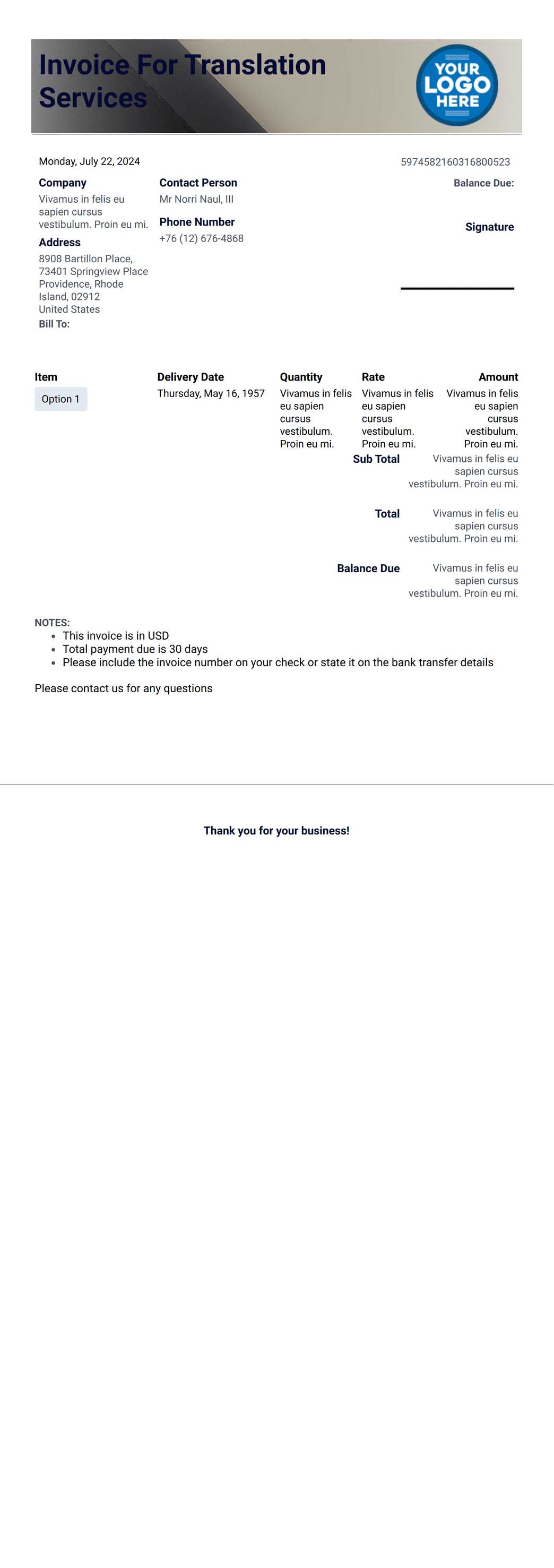

From basic formats for small-scale projects to more complex designs for detailed transactions, there are options suitable for every situation. You can easily adapt them to different industries, whether you’re providing services, selling products, or managing long-term contracts. The ability to personalize these documents with your brand logo, contact details, and payment terms ensures that they align with your business identity, creating a cohesive and polished look.

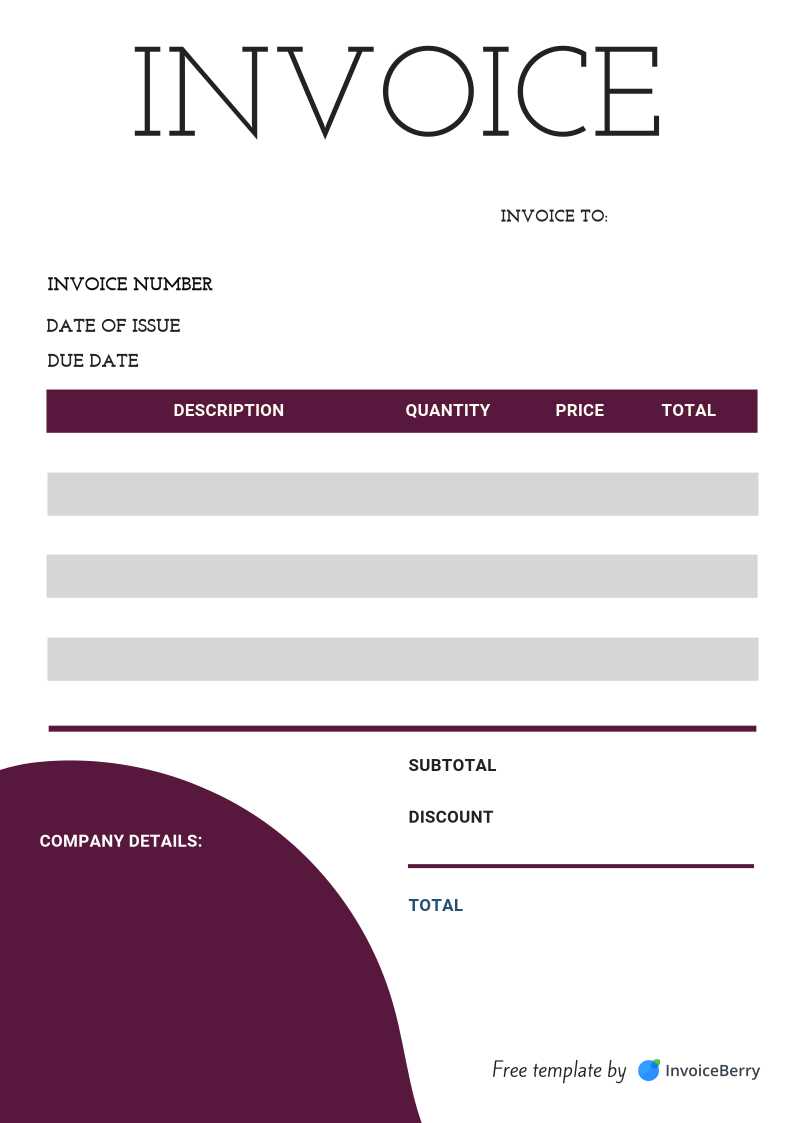

Variety is essential when it comes to choosing the right option for your needs. These resources cater to a wide range of styles and preferences, offering both minimalist designs and more comprehensive layouts. Efficiency is built into these solutions, as they save you time on formatting and layout, allowing you to focus on your core work while ensuring that your financial records remain clear and professional.

Why Choose Free Invoice Templates?

Opting for ready-made solutions to create payment documents can save both time and effort, making it an attractive choice for small businesses and freelancers alike. These resources are designed to simplify the process of generating professional records without requiring specialized software or advanced design skills. With a wide range of customizable formats available, you can easily find a style that fits your needs and enhances the overall appearance of your business communications.

Cost-Effective and Accessible

One of the main advantages of using these resources is that they are cost-effective, allowing you to access professional-grade designs without having to invest in expensive software or hire external help. Most of these tools are available for immediate download, offering high-quality formats without any hidden fees or long-term commitments. Whether you’re just starting out or need a quick solution for a one-time project, these options make it easier to handle financial documentation without any additional costs.

Easy Customization and Flexibility

Another significant benefit is the ease of customization. These ready-made solutions allow you to adjust various elements, such as contact details, payment terms, and currency symbols, to align with your specific requirements. This flexibility ensures that every document you create accurately reflects your brand and meets the standards of your industry. By using these adaptable resources, you maintain control over the layout and content while ensuring that each document looks polished and professional.

Time-saving and convenient, these options provide an efficient way to handle your financial paperwork, making them an ideal choice for anyone looking to streamline their administrative tasks.

How to Download Free Invoice Templates

Getting access to professional payment documents has never been easier. Many platforms provide simple and convenient ways to download customizable solutions that meet your specific needs. Whether you’re looking for basic designs or more detailed formats, the process is straightforward and doesn’t require much effort. By following a few easy steps, you can have your desired document ready for use in just a few minutes.

To begin, identify a trusted source that offers a range of options for creating financial documents. These websites typically allow you to browse through various styles and formats, ensuring you find the one that best suits your business or personal preferences. Once you’ve selected the right option, the download process is as simple as clicking a button, and the document will be saved to your device in a ready-to-use format.

Many platforms also allow you to preview the design before downloading, giving you the ability to make sure the format fits your needs. After downloading, you can easily edit and customize the document according to your requirements, adding specific details like your company name, payment terms, and other relevant information. This flexibility ensures that each document is tailored to your exact specifications and ready for use without delay.

Benefits of Using Invoice Templates

Utilizing pre-designed documents for payment requests offers several advantages that can greatly improve the efficiency of your financial processes. These ready-made solutions eliminate the need for creating records from scratch, allowing you to focus on your core business activities. By choosing a reliable resource, you can ensure consistency, professionalism, and accuracy in every transaction.

Time and Effort Savings

One of the primary benefits is the significant amount of time saved. Instead of spending valuable hours designing a document or worrying about formatting, you can quickly download a pre-made option and customize it in minutes. This helps you streamline your administrative tasks and dedicate more attention to growing your business or delivering services. The simplicity and accessibility of these resources make them ideal for busy professionals.

Consistency and Professionalism

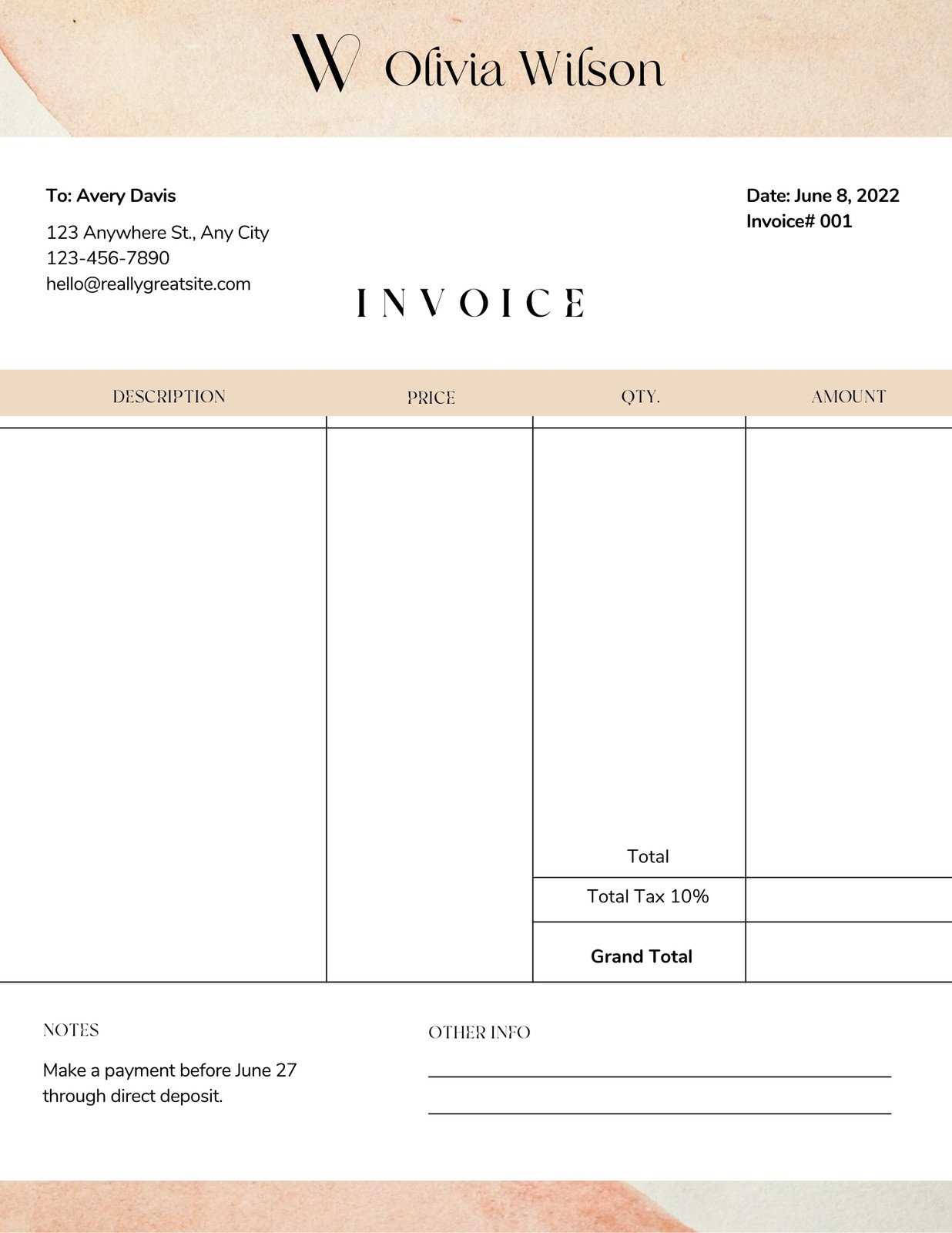

Another key advantage is the consistent look and feel of these ready-to-use documents. Using a standardized design ensures that every communication with clients or partners maintains a professional appearance. Whether you’re working with a handful of clients or managing a larger customer base, maintaining a polished and consistent style is crucial for building trust and credibility. The customizable fields allow you to add your company’s branding, ensuring that each document aligns with your business identity.

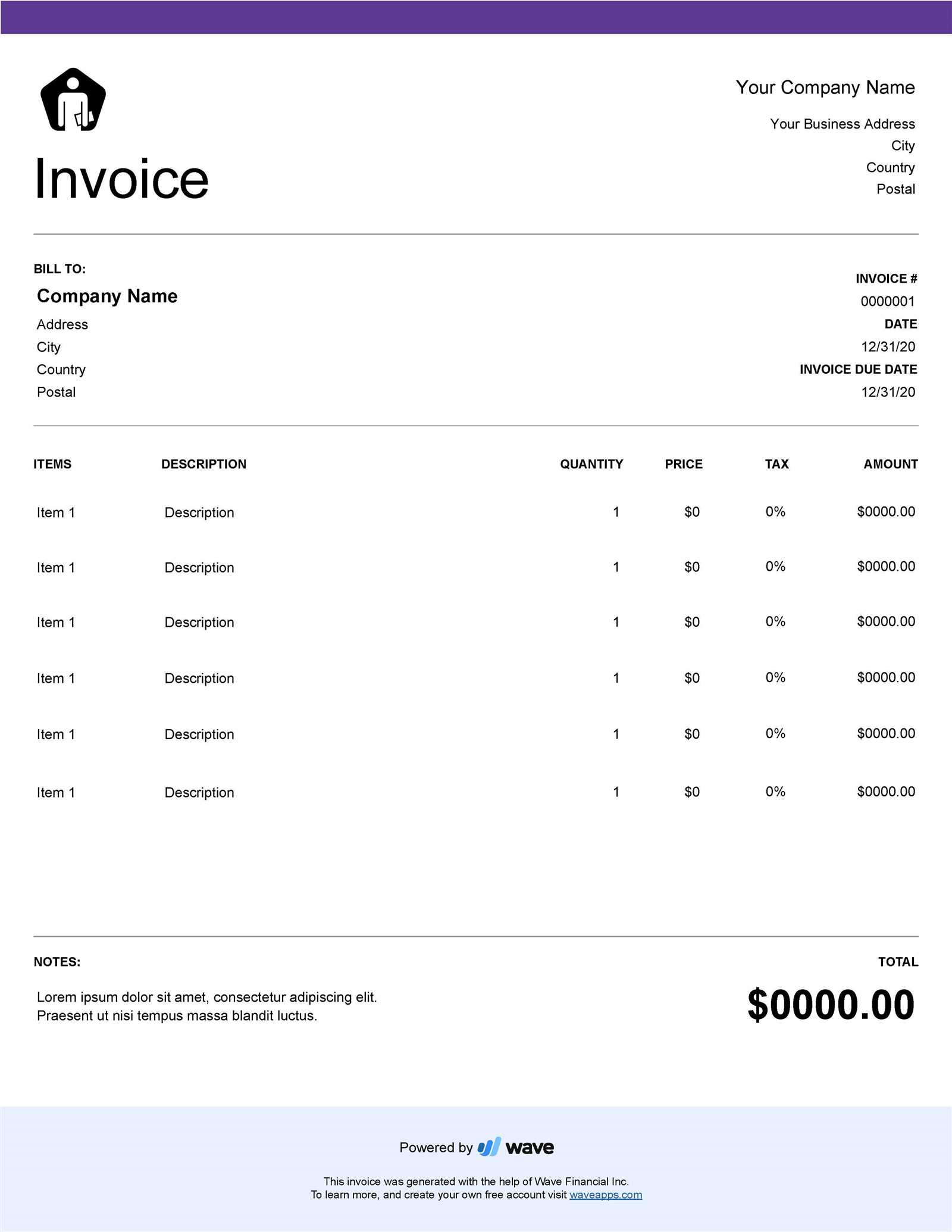

Accuracy is also improved by using these solutions, as most formats are designed to meet standard requirements, reducing the chances of overlooking essential details such as payment terms, due dates, or item descriptions. This helps prevent mistakes and ensures that your documents are clear, precise, and easy for recipients to understand.

Customizing Your Invoice Templates

Personalizing your financial documents is an essential step in creating a professional and consistent brand image. With the right tools, you can easily modify various elements to match your specific needs and business style. Customization not only enhances the look of your records but also ensures that all necessary details are included, making the process more efficient and accurate for both you and your clients.

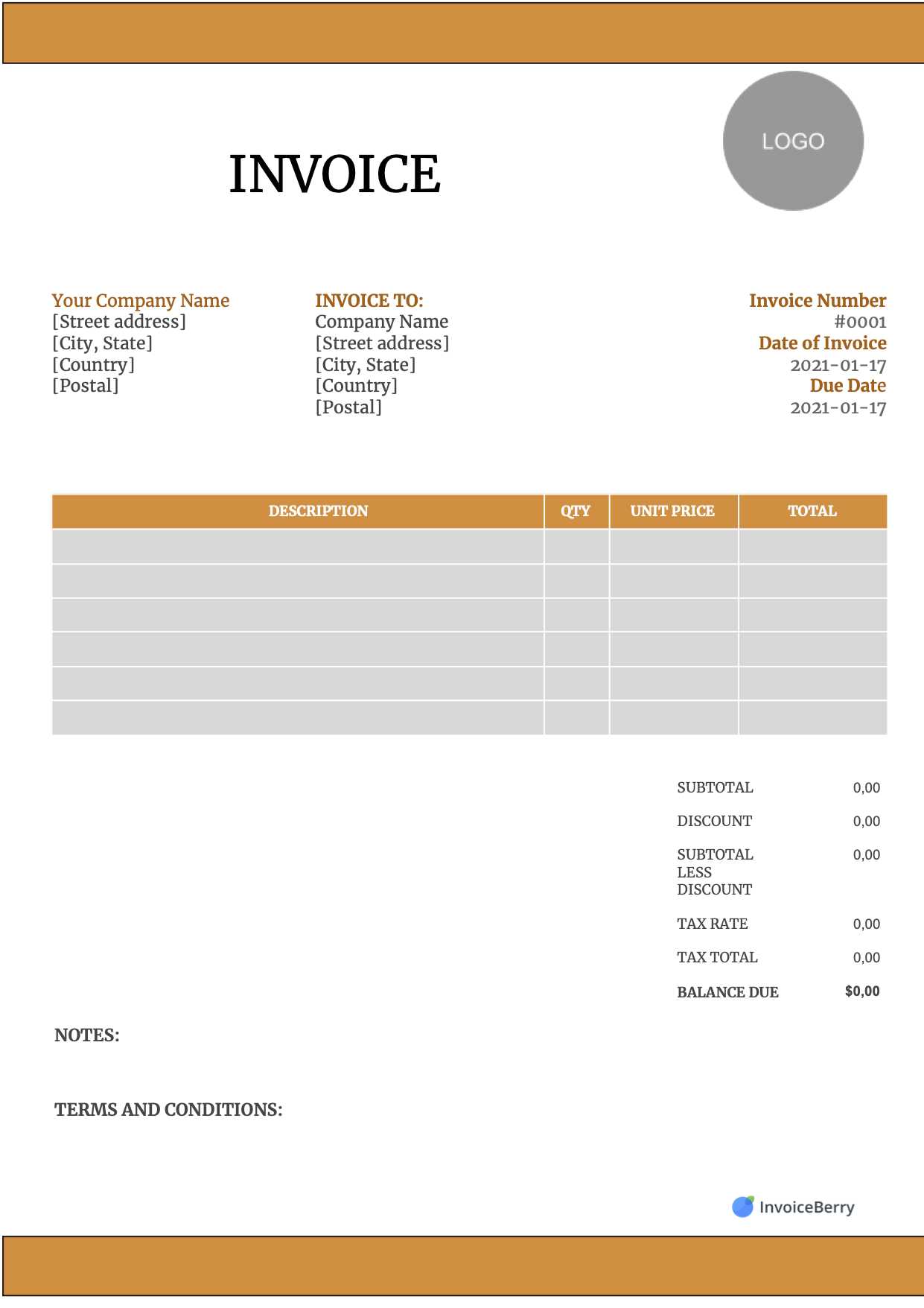

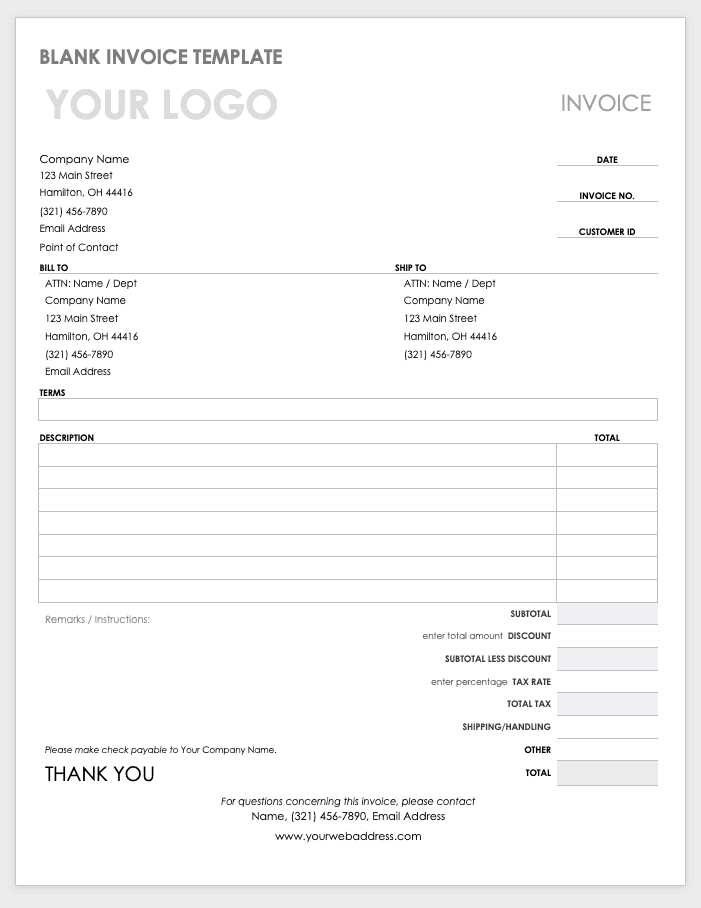

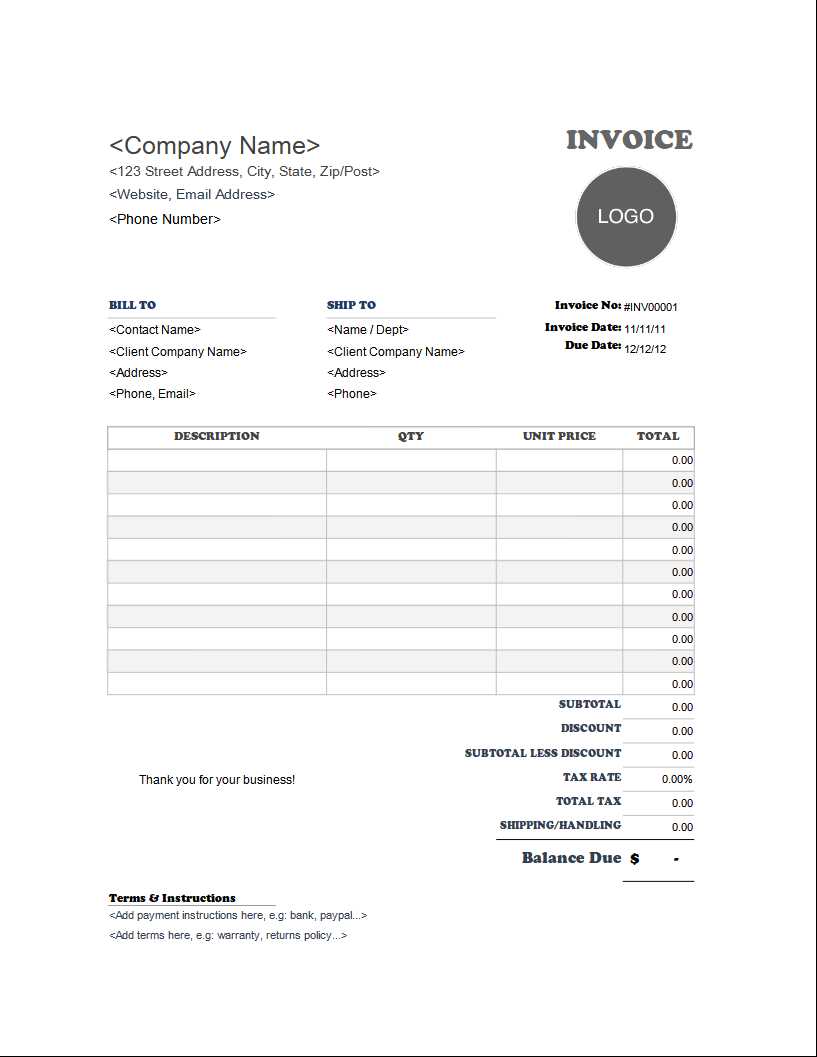

One of the first aspects you can adjust is the header section, where you can add your company’s name, logo, and contact information. This helps to establish a clear identity and ensures that your clients know exactly who the document is from. Additionally, you can customize the color scheme, fonts, and layout to reflect your brand’s personality, creating a cohesive look across all your business communications.

Other customizable fields include payment terms, due dates, itemized lists of services or products, and tax details. These sections can be tailored to fit each transaction, ensuring clarity and preventing any misunderstandings. By having these options available, you can create a document that suits every unique situation while maintaining a high level of professionalism and consistency in your business dealings.

Types of Free Invoice Templates Available

When it comes to creating payment records, there is a wide variety of pre-designed formats to choose from, catering to different needs and industries. These options offer various layouts, styles, and features that can be customized to suit specific business requirements. Understanding the different types available allows you to pick the right solution for your particular situation, making it easier to stay organized and maintain professionalism.

- Basic Payment Record: Simple and straightforward, this format is ideal for individuals or small businesses that need a no-frills document for basic transactions.

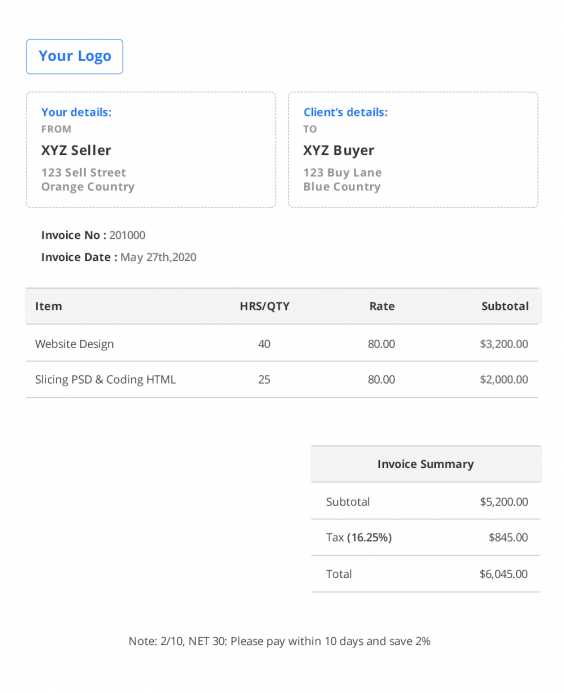

- Detailed Service Record: Suitable for service providers, this version includes additional fields to outline services provided, hourly rates, and the number of hours worked.

- Itemized Sales Record: Perfect for businesses that sell physical products, this layout allows you to list items, quantities, and prices, making it easier for clients to see exactly what they’re paying for.

- Recurring Payment Document: Designed for businesses with subscription or membership models, this format helps outline recurring charges with specified billing cycles.

- Customizable Professional Record: For businesses that require a more personalized approach, this option allows full flexibility in layout, fields, and design elements to suit unique needs.

Each of these options can be modified to include essential details like tax rates, payment terms, and due dates. By selecting the type that best fits your industry and transaction style, you can ensure that every document you create is clear, accurate, and easy to understand for both you and your clients.

Best Websites for Free Invoice Templates

When looking for professional documents to handle financial transactions, it’s important to rely on trusted sources that offer a wide range of customizable options. Several websites provide high-quality, ready-to-use designs that are both practical and easy to modify, allowing you to quickly generate the required paperwork for your business. These platforms offer various formats that suit different industries, making it easier to find the right solution for your needs.

Top Platforms to Explore

Below is a list of the best websites that offer customizable resources for generating billing documents. These sites are known for their ease of use, diverse styles, and accessibility. Choose the one that fits your specific needs and business style.

| Website | Key Features | Best For | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Canva | Easy-to-use design tools, multiple templates, drag-and-drop customization | Small businesses, freelancers, creatives | ||||||||||||

| Zoho | Cloud-based, automatic calculation of taxes, multi-currency support | Businesses with international clien

Common Features in Invoice TemplatesWhen choosing a document design for financial transactions, it’s important to consider the key elements that make the record both functional and professional. Most ready-made solutions offer a set of core features that ensure clarity, accuracy, and ease of use. Understanding these common elements can help you create well-structured and consistent documents for any business need. Essential Information Fields

The majority of formats include sections to capture the most important details of a transaction. These fields typically cover:

Layout and Design FeaturesBeyond essential fields, most solutions also offer a clean and structured layout that enhances readability and helps avoid confusion. Key design elements include:

Consistency in design and content ensures that each document is easily understood by both the sender and recipient, minimizing the chances of errors or disputes. These common features contribute to creating accurate and professional records that align with your business practices. How to Add Branding to Your InvoiceAdding your brand elements to payment records is an important step in creating a cohesive business identity. Customizing these documents ensures they reflect your company’s style and professionalism. A well-branded document not only reinforces your identity but also enhances credibility and trust with clients. Fortunately, there are several simple ways to integrate your branding into every record you issue. Key Elements to PersonalizeHere are some essential elements you can customize to align the document with your brand:

Additional Customization TipsIn addition to the basics, there are a few other ways to further personalize your financial documents:

By making these adjustments, you ensure that your business records How to Save Time with Invoice TemplatesCreating financial records from scratch can be time-consuming and repetitive. Fortunately, ready-made solutions are available that significantly speed up the process. By using pre-designed formats, you can skip the tedious steps of formatting, layout adjustments, and organizing essential information. This allows you to focus more on your core business tasks while ensuring that every transaction is documented accurately and professionally. One of the biggest time-savers is the ability to simply fill in the necessary details–such as client information, itemized costs, and payment terms–without needing to design the document each time. With customizable fields already in place, you can quickly adjust the data and generate a finished document in just a few clicks. This eliminates the need to reinvent the wheel for each new client or project. Efficiency is also improved with features that automatically calculate totals, taxes, or discounts, removing the potential for human error and saving additional time. By integrating all necessary sections into one ready-to-use format, these solutions reduce the risk of missing crucial information and ensure consistency across your financial records. Moreover, once you’ve customized a few documents to your business needs, you can save and reuse them as templates for future transactions. This further streamlines your workflow, as you no longer need to start from scratch each time you need a new record. By automating and standardizing the process, you can manage your financial documentation with ease, freeing up more time for other important aspects of your work. What to Include in Your InvoiceWhen creating a payment document, it’s important to ensure that all the necessary details are included for clarity and accuracy. A well-structured record not only ensures you get paid on time, but also helps maintain professionalism and transparency in your business transactions. Whether you’re providing a service or selling a product, there are key components that should always be part of your document to avoid confusion and potential disputes. Here are the main elements that should be included in any financial document:

|