Free Invoice Templates for Fast and Easy Billing

Handling business transactions can be a challenging task, especially when it comes to generating bills for clients. For entrepreneurs, freelancers, and small business owners, maintaining a smooth and efficient payment cycle is essential. However, creating billing documents from scratch each time can be time-consuming and prone to errors.

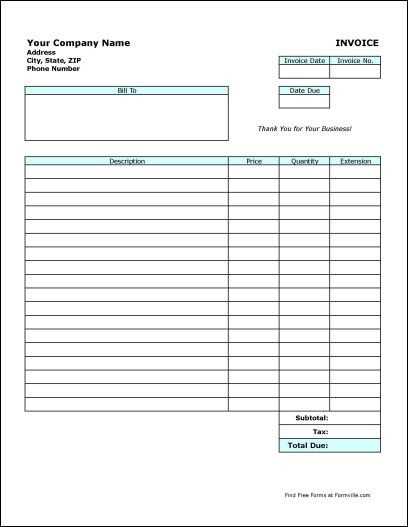

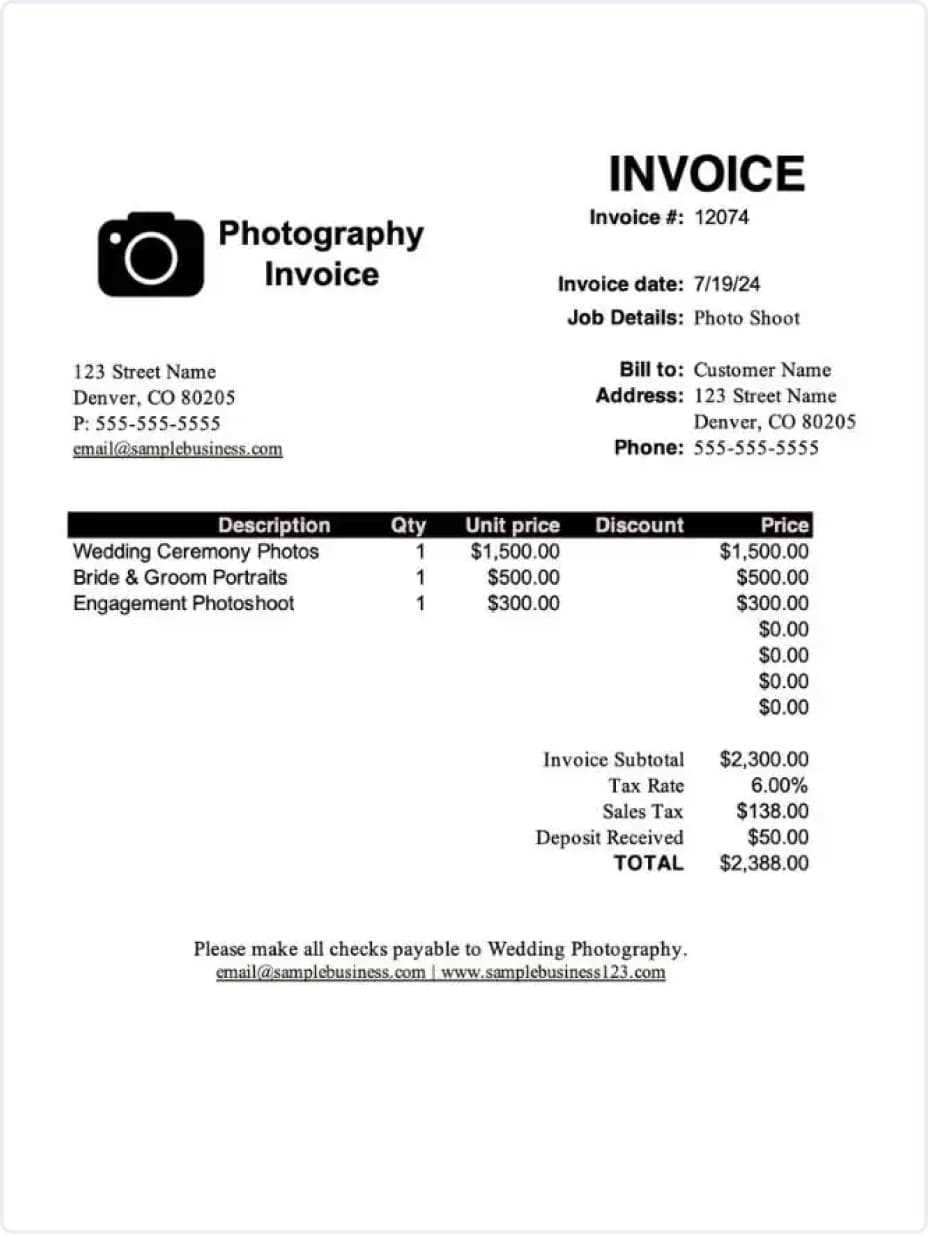

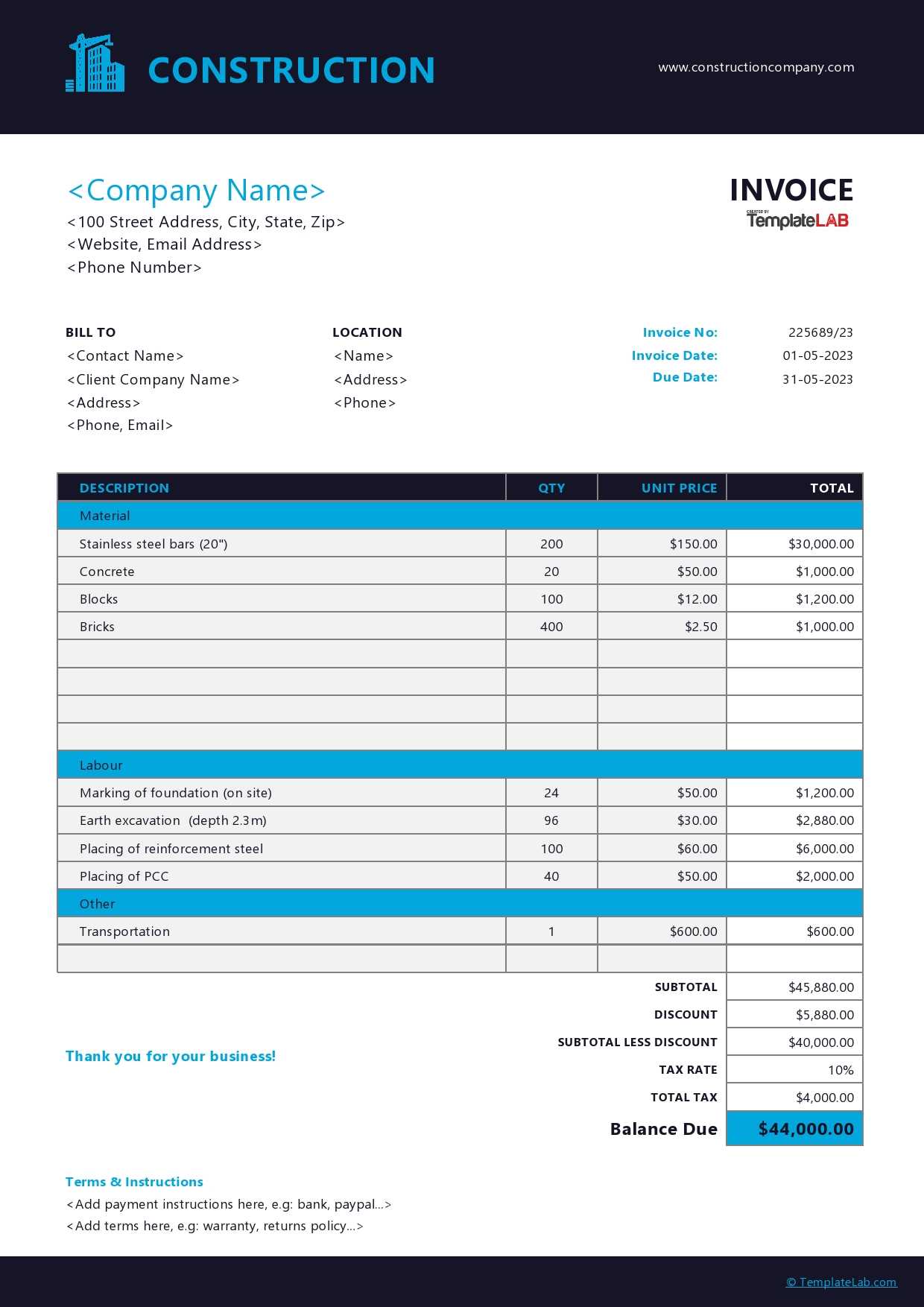

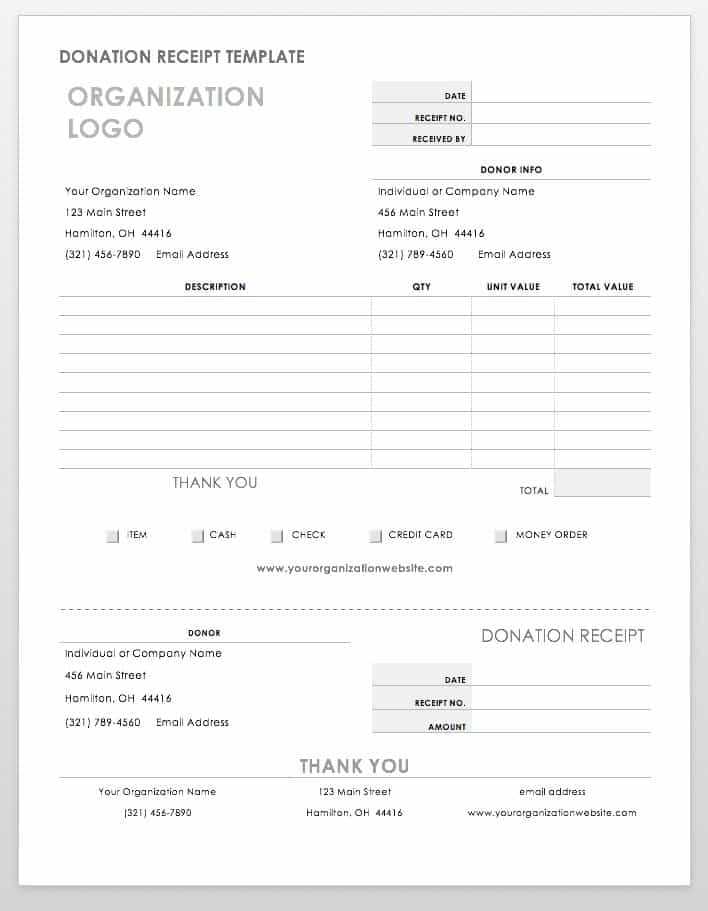

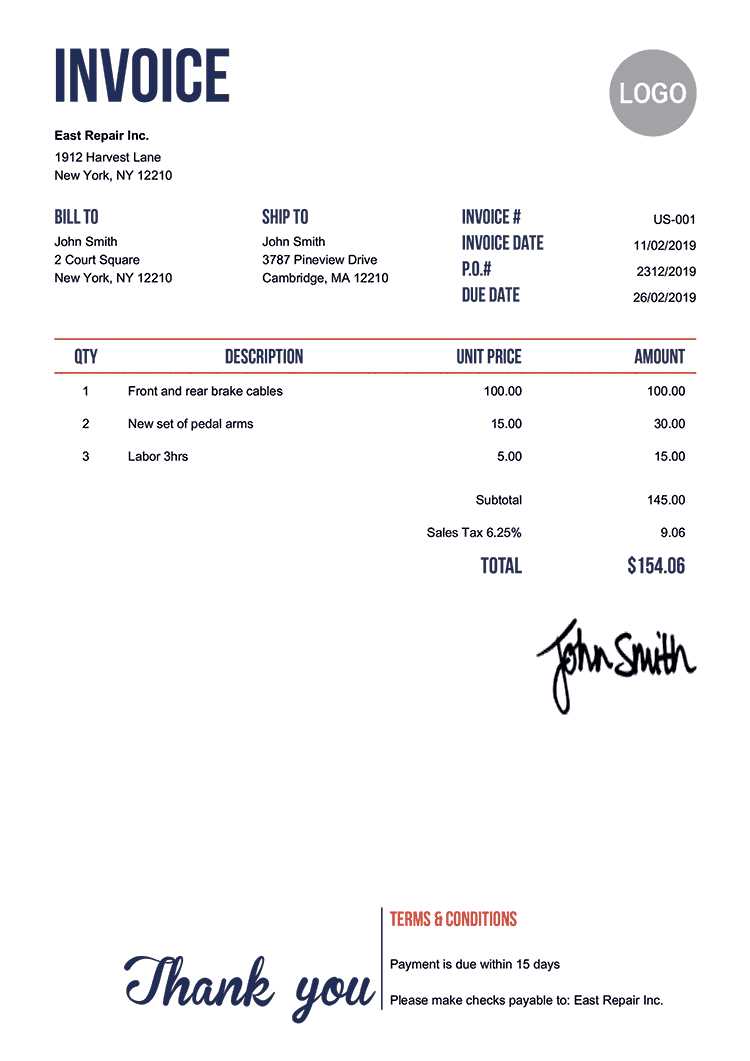

Fortunately, ready-made formats for billing documents can simplify this process, helping you focus more on your core business activities. These structured layouts come with predefined sections, allowing you to quickly fill in details such as payment amounts, due dates, and contact information. With a clear structure, these resources make it easier to maintain organized records and enhance the professionalism of your business.

Whether you’re looking to save time or improve accuracy, premade layouts offer a flexible solution. Accessible across various platforms, these formats are designed to be intuitive and customizab

Best Ready-to-Use Billing Formats for Small Businesses

Managing financial transactions can be a complex task for small businesses, where efficient processes are key to maintaining smooth cash flow. Having structured formats for payment requests not only saves time but also adds a professional touch to your financial communications. With the right selection of layouts, businesses can streamline their administrative tasks and focus on growth.

These formats are especially useful for small companies with limited resources, allowing them to manage accounts easily without investing in costly software. Here are some of the top options that small businesses can use to create clear and well-organized payment records.

Popular Formats for Different Needs

| Format Type | Best For | Benefits | |||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic Layout | Startups and freelancers | Easy to use, minimal setup | |||||||||||||||||||||||||||||||||||||||||||||

| Detailed Breakdown | Consultants and service providers

How to Choose the Right Invoice FormatFinding the right billing format is essential for ensuring accurate and efficient financial transactions. A well-organized document not only simplifies payment collection but also creates a professional impression on clients. Different formats cater to various business needs, so selecting the most suitable option is crucial for seamless workflow and clear communication. Consider these key factors to help you decide which layout aligns best with your business requirements: Identify Your Business Needs

|