Download Free Invoice Word Template for Easy Billing

Managing payments efficiently is essential for any business, and having a structured method to send out requests for payment can save both time and effort. A well-designed document can help ensure clarity, professionalism, and accuracy in all your transactions.

With a customizable format, creating billing documents becomes an easy task. Whether you are a freelancer or run a small company, having a reliable and editable structure is crucial for maintaining smooth financial operations. Adjusting fields to fit specific needs can be done quickly, making the process seamless.

Customizable formats can be tailored to fit your particular requirements, allowing for flexible adjustments based on your business’s demands. This method can enhance productivity and ensure a streamlined workflow, leaving more time for growing your business.

Free Invoice Word Template Guide

Creating professional billing documents is a key part of managing financial transactions. Using an easily editable structure can make this process faster and more efficient. By selecting a simple format that fits your business needs, you can ensure consistency and accuracy every time you send a payment request.

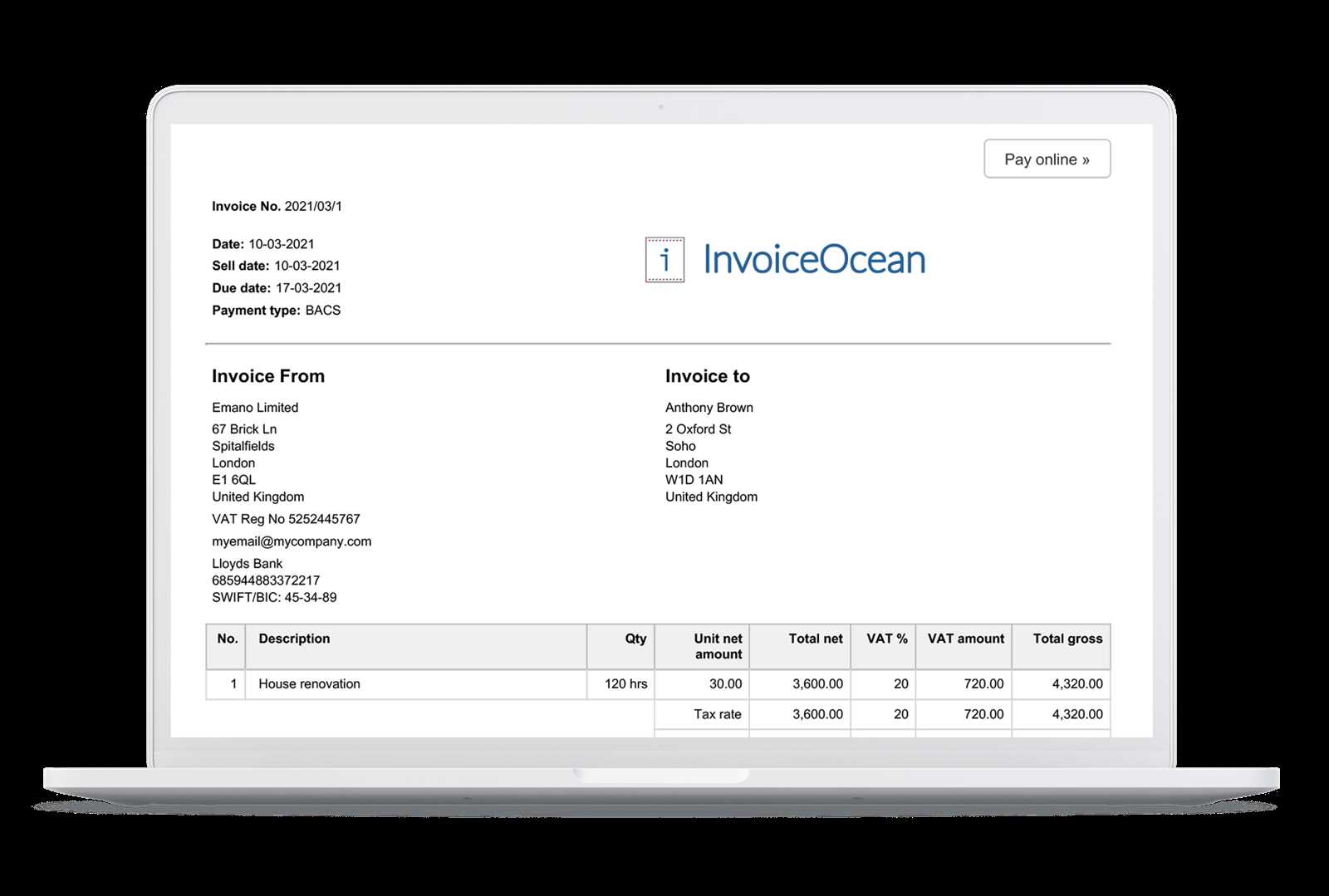

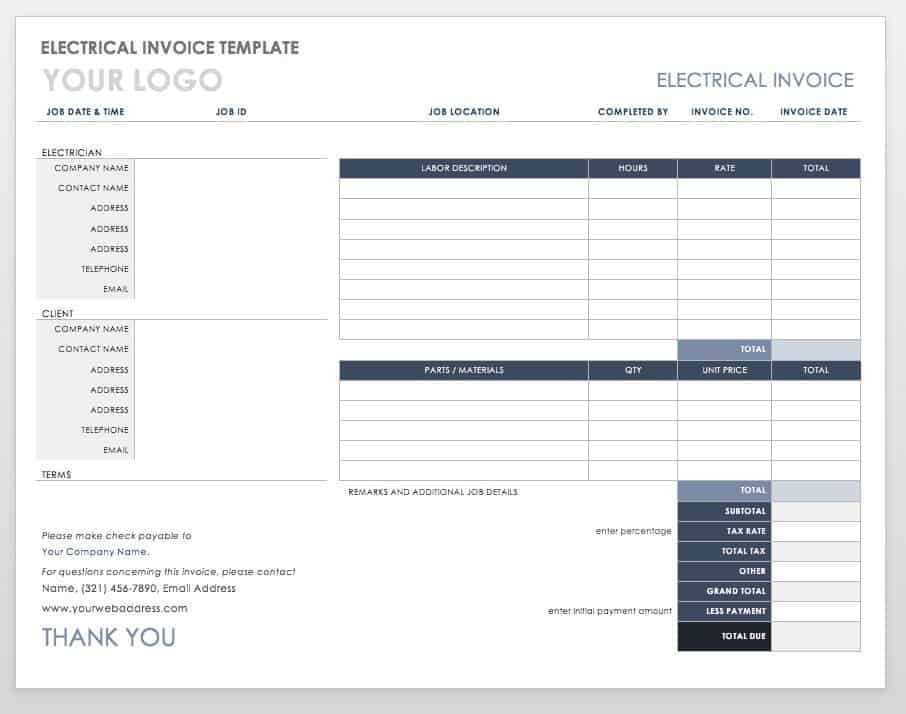

To start, it’s essential to choose a format that allows for customization. A document that can be tailored to include your business logo, client details, services provided, and payment terms will not only make your records more organized but also present your business in a professional manner. The ability to modify these fields ensures that your document meets the specific requirements of each transaction.

Setting up the structure is another critical step. A clear, logical order of information–such as listing services, costs, and payment terms–helps avoid confusion. Moreover, by incorporating consistent fonts and styles, you can further enhance readability and provide a polished look.

Lastly, ensure that your document is saved in a format that can be easily shared and printed. An editable structure allows you to adjust each document as needed while maintaining a uniform appearance for every billing cycle.

Why Use a Free Invoice Template

Having a ready-made, customizable document for managing financial transactions can greatly simplify the billing process. It provides a streamlined approach to documenting services provided and amounts due, ensuring that important details are always included and presented professionally.

Using such a tool eliminates the need to design each document from scratch. A structured layout ensures that you don’t overlook essential elements, such as client contact information, payment terms, or itemized charges. This consistency enhances both the speed and accuracy of your billing process.

Efficiency is another significant benefit. Rather than spending time creating a new document every time you need to send a payment request, you can use a ready-made format and simply adjust the necessary fields. This allows for faster preparation and less room for error.

Additionally, these documents can be easily customized to fit the specific needs of your business, whether it’s including tax rates or customizing payment methods. The flexibility ensures that you maintain control over your billing process without the hassle of reinventing the wheel for every transaction.

How to Customize Your Invoice Template

Personalizing your billing document is a crucial step in ensuring it meets the specific needs of your business. A customizable structure allows you to tailor the content to reflect your brand, services, and payment terms, ensuring each document is both functional and professional.

The first step in customization is to add your business logo and contact information at the top of the document. This helps to establish your brand’s presence and makes it easier for clients to reach you. Be sure to include all relevant details, such as your business name, address, email, and phone number.

Next, focus on adjusting the content fields according to your specific requirements. For example, you can modify sections for itemized services, add discounts, or specify tax rates. Customizing these fields ensures that the document accurately reflects the products or services provided, as well as any applicable charges.

Additionally, setting payment terms, such as due dates, late fees, or accepted payment methods, is essential for clear communication. By adjusting these sections, you can establish clear expectations with your clients and streamline your payment collection process.

Advantages of Word Over Other Formats

When it comes to creating and managing business documents, choosing the right format is essential for efficiency and ease of use. A widely accessible text processor offers several benefits compared to other formats, allowing for easy customization and versatile editing options.

Ease of Editing and Flexibility

One of the main advantages of using a text processor is the simplicity with which you can edit and adjust the document. Unlike more rigid formats, this type of file allows for quick changes to text, layout, and structure. You can easily add or remove fields, update information, and adjust styles, making it ideal for businesses that require frequent updates or specific customizations.

Wide Compatibility and Accessibility

Another significant benefit is the broad compatibility with different devices and software. Files created with this tool can be opened on almost any computer or operating system without the need for specialized software. This universal accessibility ensures that you can send your documents to clients and collaborators without worrying about formatting issues or software limitations.

Best Practices for Creating Professional Invoices

Creating well-structured payment requests is crucial for maintaining professionalism in your business dealings. A carefully crafted document not only ensures clear communication but also helps to expedite payment processing. Adhering to best practices can make a significant difference in how clients perceive your business and streamline your financial operations.

Clear and Organized Layout

Start by ensuring your document has a clear and logical structure. Organize the content in a way that allows clients to quickly find key information, such as the services provided, costs, and payment terms. Using well-defined sections and headings can help improve readability and reduce confusion. A clean layout with appropriate spacing enhances the overall professional look of the document.

Essential Information to Include

Be sure to include all necessary details that are vital for both clarity and legal purposes. This includes your business name, contact information, client details, a unique reference number for the transaction, and a clear breakdown of the charges. Make sure to clearly state the payment due date and any applicable late fees. Providing such details ensures transparency and helps to avoid any misunderstandings with clients.

Common Mistakes in Invoice Creation

Creating payment requests may seem simple, but many businesses overlook crucial details that can lead to confusion, delayed payments, or even disputes. Understanding common errors and taking steps to avoid them is essential for maintaining a smooth billing process.

Missing Key Information

One of the most frequent mistakes is failing to include critical details that ensure clarity and prompt payment. These can include:

- Client contact information: Make sure you list the correct name, address, and contact details.

- Payment terms: Specify the due date, accepted payment methods, and any applicable late fees.

- Itemized services: Include a breakdown of the goods or services provided, with clear descriptions and costs.

Formatting Errors

Improper formatting can make your document hard to read, causing confusion and delaying payment. Some common formatting mistakes include:

- Inconsistent fonts: Using too many font styles can make the document appear unprofessional.

- Poor alignment: Information such as dates, totals, and contact details should be aligned consistently for easy reading.

- Unclear headings: Ensure that all sections are clearly labeled, such as “Services Provided” or “Total Amount Due.”

Where to Download Free Invoice Templates

Finding reliable and customizable documents for creating payment requests can significantly improve your workflow. Many platforms offer easily accessible formats that can be downloaded and adapted to suit your business needs, saving time and effort when preparing transaction records.

Popular websites that provide such tools often offer a variety of options, allowing you to choose the one that best fits your style and requirements. These sources usually include both basic designs and more advanced layouts, giving you flexibility based on your preferences.

Online platforms such as Microsoft Office templates or Google Docs allow you to download editable documents that can be tailored to your specific needs. Additionally, many business-focused websites also offer downloadable resources that cater to various industries, making it easier to find a format that suits your particular field.

Additionally, certain websites specialize in providing customizable options that include built-in features for calculating totals or adding tax rates. These can help streamline the process further, reducing manual work and potential errors.

How to Add Your Business Logo

Including your company’s logo in payment documents is a simple yet effective way to promote your brand and establish a professional appearance. A well-placed logo can make your documents more recognizable and improve the overall presentation.

Steps to Add Your Logo

Adding your business logo to a document is a straightforward process. Follow these basic steps:

- Choose the right logo file: Ensure that your logo is of high quality and saved in a format that is easy to use, such as PNG or JPEG.

- Insert the image: Most editing tools allow you to insert images directly. Simply navigate to the “Insert” menu, select “Picture,” and choose your logo file.

- Position the logo: Place your logo in a prominent location, typically at the top of the page. You can center it or align it to the left, depending on your design preference.

- Resize if necessary: Ensure your logo isn’t too large or too small. Resize it proportionally so it fits neatly without overpowering the rest of the content.

Maintaining Consistency

It’s important to maintain consistency in the placement and size of your logo across all documents. Using the same logo placement helps reinforce your brand’s image and creates a uniform appearance in all your communications.

Formatting Tips for Clear Invoices

Properly formatted payment documents are essential for ensuring that both you and your clients can easily understand and process the information. A well-organized document promotes professionalism and helps avoid confusion, leading to faster payments and fewer disputes.

Maintain a Logical Structure

Start by structuring the content in a clear and logical order. Each section should be easy to locate, with sufficient space between headings and content. A typical layout includes:

- Header: This should contain your business name, contact details, and any other essential information such as a logo.

- Client information: Include the client’s name, address, and other relevant contact details.

- Details of services/products: A concise breakdown of what was provided, including quantities, prices, and descriptions.

- Total amount due: Clearly state the total amount, including any taxes or discounts.

Use Readable Fonts and Spacing

Choose fonts that are simple and easy to read. Stick to standard fonts such as Arial or Times New Roman, and avoid overly decorative styles. Ensure that the text is appropriately sized and well-spaced. Important sections, such as the total amount due, should stand out with bold or slightly larger text. Proper line spacing and margins also contribute to a cleaner, more professional appearance.

Essential Fields for Every Invoice

To ensure that your payment documents are clear and professional, there are several key elements that must be included. These fields provide vital information that helps your clients understand the details of the transaction and ensures that payment is processed smoothly and without confusion.

Key Information to Include

Here are the most important fields to include in every document:

- Your business details: Include your business name, address, phone number, and email address. This makes it easy for clients to contact you if needed.

- Client details: Always include the recipient’s name, company name, address, and contact information for easy reference.

- Unique reference number: This is essential for tracking purposes. Assign a unique number to each document to easily identify and reference past transactions.

- Description of goods or services: Provide a clear and detailed description of the items or services you provided, including quantities, rates, and any relevant specifications.

- Total amount due: Clearly display the total cost, including any taxes, discounts, or other charges. It should be easy to spot, often highlighted in bold or a larger font size.

- Payment terms: Include the payment due date, accepted payment methods, and any late payment penalties or fees, if applicable.

Additional Helpful Information

In some cases, adding extra fields may help streamline your payment process. For example, you can include:

- Bank details: If payments are being made via bank transfer, it’s helpful to list your account information.

- Purchase order number: If the transaction was based on a client’s purchase order, include that number for easier reference.

How to Include Tax Information Properly

Including tax details accurately in your payment requests is essential for both legal compliance and clarity. Properly displaying tax rates and calculations ensures that your clients understand the charges and allows them to process payments without confusion. Here’s how to include tax information in a clear and professional way.

Key Tax Information to Include

Ensure that the following tax-related details are clearly stated:

- Tax rate: Specify the percentage or fixed rate applied to the goods or services.

- Tax amount: Display the exact amount of tax being charged based on the rate and value of the goods or services.

- Total amount with tax: Show the final amount due after adding the tax to the original price.

Presenting Tax Information in a Table

One of the most effective ways to display tax-related details is through a table. This ensures clarity and allows clients to easily verify the amounts. Here’s an example:

| Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Product/Service 1 | $100.00 | 10% | $10.00 |

| Product/Service 2 | $50.00 | 10% | $5.00 |

| Total | $150.00 | $15.00 |

By using a table, you clearly highlight the tax calculations, making the document easy to read and ensuring that the amounts are transparent to your clients.

Using Templates for Recurring Invoices

For businesses that need to send payment requests on a regular basis, using a pre-designed document structure can significantly simplify the process. A consistent and reusable format allows you to save time while ensuring that all necessary information is included each time. This approach not only improves efficiency but also maintains a professional appearance with every transaction.

By creating a set structure that you can quickly update, you eliminate the need to manually enter the same details repeatedly. This is particularly useful for subscriptions, memberships, or any service that requires periodic payments. With such a system in place, you can easily adjust the relevant fields, such as the date, amount, or any additional charges, while leaving the rest of the content unchanged.

Additionally, having a standard format ensures that your clients always receive a document that looks familiar and professional, making it easier for them to process payments promptly. Whether it’s monthly, quarterly, or annually, using a pre-prepared structure can make recurring transactions more streamlined and hassle-free for both parties.

Why Choose Word for Invoice Design

When it comes to creating professional-looking payment requests, selecting the right tool is essential. Using a document editor like Microsoft’s platform offers a range of benefits that make it an ideal choice for many businesses. Its accessibility, ease of use, and versatility allow anyone, regardless of technical expertise, to craft polished and clear payment documents without needing specialized software.

This method provides you with full control over the layout and formatting, enabling you to tailor your documents to suit your business needs. From adjusting fonts and colors to inserting logos and custom fields, a word processing platform gives you the flexibility to create a personalized design that maintains professionalism while aligning with your branding.

Advantages of Using Word for Payment Documents

Here are some key reasons why this option is often preferred:

- Ease of use: With intuitive tools, even beginners can quickly create structured, error-free documents.

- Customization: Customize the layout, fonts, and overall appearance without needing advanced design skills.

- Compatibility: Easily share your document with clients through various platforms, ensuring they can view or edit it without technical issues.

- Professional output: Create clean, well-organized payment requests that inspire confidence and clarity.

Example of a Simple Layout

Here’s an example of how you can structure a basic document using this platform:

| Description | Amount | Tax | Total |

|---|---|---|---|

| Service Provided | $100 | $10 | $110 |

| Total | $100 | $10 | $110 |

As shown in the table, the simplicity of the layout combined with the flexibility of the editor makes it easy to create and present payment documents in a clear and professional manner.

How to Save and Share Invoices Easily

Managing payment requests effectively requires a system that allows both easy storage and seamless sharing with clients. Once your document is ready, saving it in a well-organized manner ensures that you can quickly retrieve it for future reference or follow-ups. Sharing it should also be as hassle-free as possible, enabling you to send it to clients through multiple channels, ensuring they receive it promptly.

There are various ways to save and distribute your document depending on your needs. Digital formats provide convenience, and with the right tools, you can keep all your records secure while making them accessible for quick updates or adjustments. Whether you prefer to save your document in cloud storage, email it directly, or share it via secure links, ensuring compatibility with various devices and platforms will make the process efficient and user-friendly.

Saving Your Document Efficiently

Here are some tips on how to save your document for easy access:

- Cloud storage: Using services like Google Drive or Dropbox ensures that your files are easily accessible from any device with an internet connection.

- Organized folders: Create specific folders for each client or project to keep your records neatly sorted and easy to find.

- Version control: Keep track of any revisions by saving updated versions of the document with clear naming conventions, such as “Client_Name_Invoice_001” or “Invoice_July_2024.”

Sharing Your Payment Documents

Once your payment request is ready, sharing it can be done through various methods:

- Email: Directly attach the document to your email and send it to the client with a brief message confirming the details.

- Shared links: If stored on a cloud platform, share a link to the document, ensuring the recipient has the necessary permissions to view or download it.

- Fax or physical copies: Although digital formats are preferred, certain industries or clients may still require a hard copy or faxed version. Keep this in mind when preparing your document.

By utilizing these methods, you ensure that both saving and sharing your payment requests is quick, straightforward, and reliable, streamlining your entire process.

Tips for Invoicing Small Businesses

Creating and managing payment requests can be particularly challenging for small businesses. With limited resources, it’s important to ensure your billing process is efficient, clear, and professional. By following some key guidelines, you can streamline your approach, avoid common pitfalls, and build a system that promotes timely payments and positive client relationships.

Invoicing is more than just a way to ask for payment–it’s an important aspect of maintaining your brand’s image and ensuring smooth financial operations. For small businesses, having a well-structured payment request system helps ensure that all the necessary details are clear and concise, reducing confusion and delays. Here are some essential tips to make the process easier and more efficient.

Include All Necessary Information

Ensure that every document contains the following details to avoid confusion:

| Information | Description |

|---|---|

| Business Information | Include your business name, contact details, and any legal registration numbers if applicable. |

| Client Details | Clearly list your client’s full name or business name, along with their contact information. |

| Payment Terms | Set clear terms for when payment is due, such as “due within 30 days” or “payment required upon receipt.” |

| Services Provided | Break down the services or products provided, including quantities and prices, to avoid ambiguity. |

Set Clear Payment Terms

For smooth transactions, ensure your payment terms are well defined. This includes specifying:

- Due date: Always mention when payment is expected to avoid confusion.

- Late fees: If you apply fees for late payments, make sure they are clearly stated upfront.

- Accepted payment methods: Inform your clients of the available payment options, whether through bank transfer, check, or other methods.

By clearly outlining the necessary information and terms, small businesses can improve their invoicing process, ensuring that payments are processed on time and accurately.

How to Invoice International Clients

Billing international clients requires additional attention to detail compared to domestic transactions. Differences in currency, tax regulations, and payment methods must all be considered to ensure a smooth transaction and avoid potential misunderstandings. By taking a structured approach, businesses can effectively manage international payments and maintain positive relationships with their global clients.

When dealing with clients from different countries, it’s essential to adjust your billing process to accommodate their specific needs and preferences. Here are some key points to consider when preparing billing documents for clients abroad:

Account for Currency Differences

- Use the local currency: Ensure that you specify the correct currency for international clients to avoid confusion. Currency symbols and codes (e.g., USD, EUR, GBP) should be clearly stated.

- Consider currency conversion: If you need to convert the amount, use a reliable and up-to-date exchange rate. Specify whether the rate is fixed or subject to change.

Clarify Tax Information

- Research local tax laws: Different countries have varying tax regulations, and it’s crucial to understand how these apply to your services or products.

- Include VAT or sales tax: Depending on your client’s location, you may need to apply the appropriate value-added tax (VAT) or sales tax. Make sure this is clear on the document.

Choose the Right Payment Method

- Offer multiple payment options: To accommodate international clients, provide various payment methods, such as bank transfers, PayPal, or credit cards, which are commonly accepted in their region.

- Account for transaction fees: International payments often come with higher transaction costs. Ensure you discuss these fees with your client upfront, so they are aware of any additional charges.

By addressing these factors, businesses can create a more seamless and transparent billing experience for international clients, ensuring that both parties are satisfied with the terms and process.

Legal Considerations When Using Invoice Templates

When creating billing documents, it’s essential to ensure that they comply with local and international legal requirements. The use of standardized formats for invoicing can simplify the process, but certain legal aspects must be taken into account to avoid potential issues with tax authorities or clients. Ensuring accuracy and transparency is vital for protecting both the business and the client.

Here are some legal factors to consider when utilizing templates for billing documents:

Compliance with Tax Regulations

- Correct tax identification: Make sure that your tax ID number or VAT registration number is included if required by law in your jurisdiction. This is often necessary for both domestic and international transactions.

- Proper tax rates: Ensure that the correct tax rates, such as VAT or sales tax, are applied based on the service or product being offered and the location of the transaction.

Clear Payment Terms

- Specify payment deadlines: Clearly state the payment due date. Payment terms, such as “due upon receipt” or “net 30,” should be included to avoid misunderstandings.

- Late payment penalties: If your business policy includes penalties for overdue payments, make sure these terms are outlined in the document. This could include interest rates or fixed late fees.

Intellectual Property and Licensing

- Use of licensed content: If you are incorporating logos, images, or other elements that are not your own, ensure you have the necessary licenses to use them legally.

- Protect your business details: Avoid using pre-designed templates that may be too generic or not fully secure. Ensure that the template or format you use is customized for your business and its unique needs.

Data Protection and Privacy

- Handle personal data responsibly: If your invoices contain personal information, such as addresses or payment details, make sure they are securely stored and shared in accordance with data protection laws.

- Secure digital sharing: When sending digital documents, consider encryption or password protection to safeguard sensitive information from unauthorized access.

By addressing these key legal considerations, businesses can ensure that their billing documents are legally compliant and help avoid potential disputes or complications. Understanding the regulations in your jurisdiction and adapting your invoicing practices accordingly is critical for maintaining professionalism and trust with clients.

How to Track Payments with Word Templates

Managing financial transactions effectively is crucial for any business. Using customizable documents for tracking payments can help streamline the process, ensuring all payments are recorded and monitored accurately. A well-organized approach can simplify the task of keeping track of due and received amounts, helping avoid confusion or missed payments.

Here are some tips for efficiently tracking payments using customizable documents:

Set Up a Payment Tracking System

- Include payment status: Use clear markers for tracking the status of each payment, such as “Paid,” “Pending,” or “Overdue.” This helps quickly identify which transactions need attention.

- Use payment reference numbers: Assign unique reference numbers to each payment for easier identification. This is particularly useful when payments are processed manually or by multiple methods.

Maintain a Payment History Log

- Document payment dates: Record the date when each payment is received. This creates a reliable payment history, which can be used for financial reporting and future reference.

- Track partial payments: For clients who make partial payments, ensure that the remaining balance is updated accordingly. This will help maintain clarity about the amount due.

Automate Payment Reminders

- Set reminders for overdue payments: If a payment is overdue, mark the due date in the document and set an alert or reminder to follow up. This ensures that no payments are missed.

- Include due dates and terms: Ensure that due dates and payment terms are clearly stated in the document to prevent confusion and encourage timely payments.

Generate Reports for Tracking

- Create summary reports: Summarize payment statuses periodically to gain a quick overview of outstanding balances, completed transactions, and overall financial health.

- Export data for further analysis: If using advanced tracking methods, consider exporting payment details to spreadsheets or accounting software for more detailed analysis and record-keeping.

By organizing payments in a structured manner, businesses can enhance financial tracking and avoid payment discrepancies. Customizable documents are a simple yet effective way to ensure that all payments are accurately monitored and recorded, leading to better financial management and improved cash flow.