Free Printable Invoice Templates for Easy and Efficient Billing

Managing transactions efficiently is essential for any business, whether large or small. Having a standardized way to document payments, services, and goods provided can save both time and effort. These essential business tools help professionals create clear, accurate records and ensure they get paid promptly. Adopting a simple, yet effective method of documenting sales and services is a smart approach for anyone looking to maintain financial order.

There are numerous resources available that allow you to craft personalized payment records suited to your specific needs. With a wide range of design options and customization features, you can create professional documents that reflect your brand identity. Whether you’re an entrepreneur, freelancer, or part of a larger team, these documents can be quickly tailored to suit any transaction, ensuring a smooth billing process every time.

Utilizing these ready-made solutions offers flexibility without compromising professionalism. Not only do they allow for swift creation and modification, but they also eliminate the need for time-consuming manual processes. With just a few clicks, you can generate accurate and polished payment summaries that meet your exact specifications.

Free Printable Invoice Templates for Businesses

For businesses, having a reliable and efficient way to document transactions is crucial to maintaining smooth operations. The ability to create accurate and professional records quickly can greatly improve cash flow and reduce administrative workload. Instead of starting from scratch with every new transaction, businesses can leverage ready-made solutions to streamline the billing process, saving both time and effort while ensuring consistency across all records.

Benefits of Ready-Made Billing Solutions

Using customizable billing documents offers several advantages for businesses of all sizes. These tools can be tailored to reflect the specific needs of a company, whether it’s a small startup or a large enterprise. With a variety of layouts and designs, companies can create clean, organized records that are easy for clients to understand. Efficiency is a key benefit, as these solutions allow businesses to produce professional-looking receipts, without needing extensive design skills or software knowledge.

How These Documents Help Streamline Operations

Automating the creation of payment records helps businesses reduce human error and improve accuracy. With fields that are easy to update and modify, these tools ensure that all necessary details are captured. Whether it’s adding a client’s information or adjusting the list of items or services provided, businesses can quickly update and customize their documentation. Consistency is also improved as templates help maintain the same format, making it easier for clients to review and understand their financial statements.

Why Use Free Invoice Templates?

Adopting standardized methods for documenting transactions offers numerous benefits, especially for businesses and individuals managing multiple clients. Instead of creating new documents from scratch for every deal, ready-made solutions provide a quick, efficient way to ensure consistency and accuracy. These tools eliminate the need for complex software, allowing anyone to generate professional and clear records with minimal effort.

Cost-Effective and Time-Saving

One of the primary reasons to use these tools is their cost-effectiveness. Many businesses, particularly small startups or freelancers, operate on tight budgets and need to minimize expenses. By using these free resources, companies can save money that would otherwise be spent on expensive software or design services. Additionally, these solutions significantly reduce the time spent on creating records, allowing business owners to focus on other essential tasks.

Consistency and Professionalism

Using a structured format for every transaction promotes consistency, which is crucial for building trust with clients. A well-organized document conveys professionalism and attention to detail, leaving a positive impression. These solutions offer the flexibility to add custom elements to suit specific business needs while maintaining a polished, uniform presentation across all records.

Top Benefits of Printable Invoice Templates

Using pre-designed billing solutions can significantly enhance the efficiency of your transaction processes. These tools offer numerous advantages, allowing businesses to streamline their operations, ensure accuracy, and maintain professionalism. Whether you’re a small business owner or a freelancer, these resources can help simplify the creation of detailed and organized payment records, all while saving valuable time and effort.

Efficiency and Time Savings

One of the most significant benefits is the time saved by using structured formats. Instead of manually designing each payment document or starting from scratch, businesses can rely on ready-made solutions to fill in the required fields quickly. This ensures faster processing of transactions and allows business owners to focus on other crucial tasks, such as customer service or product development.

Accuracy and Professional Appearance

Another advantage is the accuracy these systems provide. With all the necessary fields and sections already defined, it’s easier to ensure that no important details are missed, reducing the chances of errors. Furthermore, using consistent, polished documents helps maintain a professional image, which is essential for building trust with clients.

| Benefit | Description |

|---|---|

| Time Efficiency | Quickly create well-organized records without starting from scratch. |

| Consistency | Maintain uniformity across all transaction records. |

| Professionalism | Deliver clean, easy-to-read documents that leave a positive impression. |

| Customization | Adapt documents to reflect your business style and needs. |

How to Customize Your Invoice Template

Customizing your billing documents is an essential step in making them fit your specific business needs. Whether you want to add your company logo, adjust the layout, or include custom fields, personalization allows you to create a document that truly represents your brand. Tailoring your records not only improves their appearance but also ensures they include all the necessary details for your clients and for your own financial tracking.

Steps to Personalize Your Document

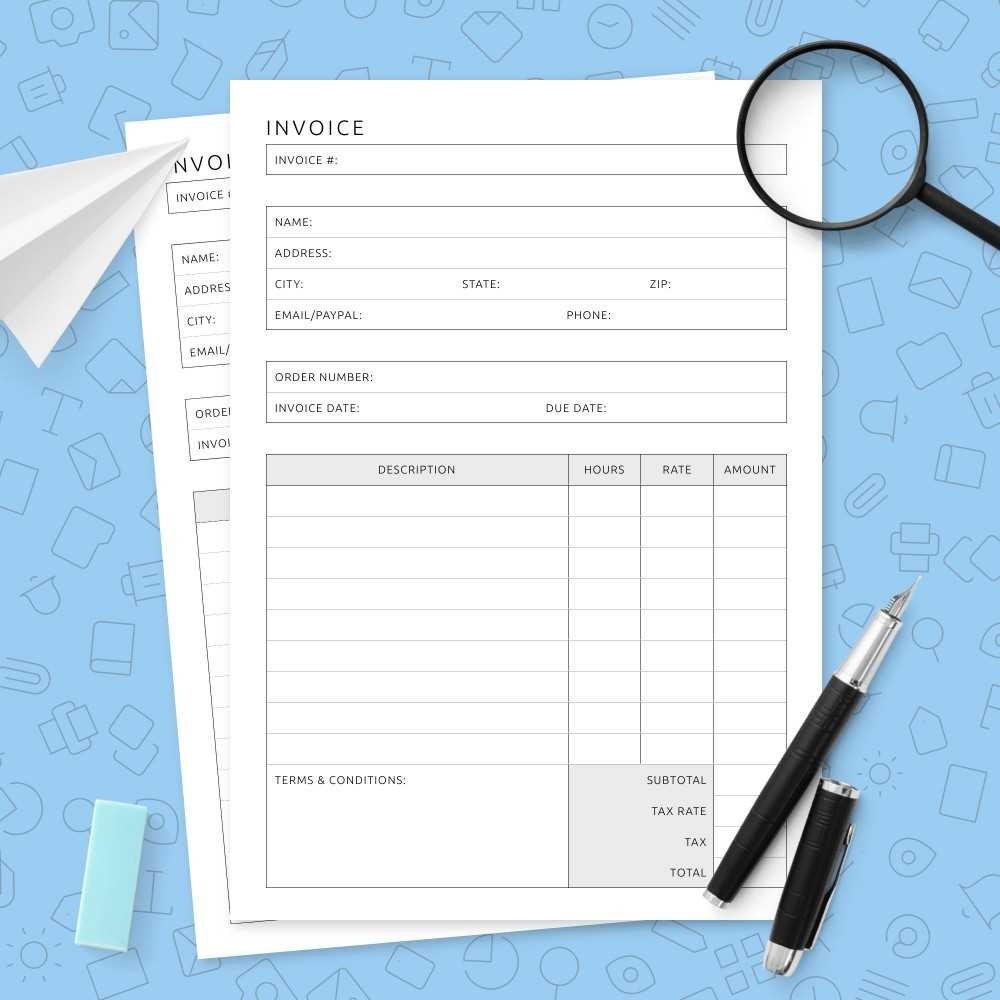

Most pre-designed solutions offer a user-friendly interface that makes customization simple. First, you can add your business name, address, and contact details at the top to ensure clients know who they’re dealing with. Next, adjust the layout to include any specific fields that are important to your business, such as tax rates, payment terms, or discounts. Finally, you can upload your company logo to reinforce your branding and give the document a professional touch.

Advanced Customization Options

If you need even more flexibility, many platforms allow for advanced changes. You can modify the color scheme to match your brand’s style guide or choose from different font options to make the document easier to read. Additionally, you may want to create custom sections, such as notes or payment instructions, to ensure clarity and reduce confusion for your clients. Tailoring every detail ensures that your document is both functional and visually appealing.

Best Invoice Template Formats for Freelancers

For freelancers, having a clear and professional way to document services rendered is essential for maintaining good client relationships and ensuring timely payments. Choosing the right format can make a significant difference in how your records are perceived. The ideal format should be simple to fill out, yet comprehensive enough to include all the necessary details. Below are some of the best formats that work particularly well for freelancers.

Simple and Clean Layouts

- Basic Details Format: A straightforward design that includes key fields like service description, amount due, and payment terms. This layout is perfect for freelancers who work on a per-project or hourly basis and want to keep things simple.

- Itemized Format: For freelancers offering multiple services, this layout allows each task or project to be listed separately, making it easy for clients to understand what they are paying for.

- Minimalist Format: A clean, no-frills design that includes only essential details. This is ideal for freelancers who prefer quick and easy documentation without unnecessary details.

Formats for Creative Professionals

- Design-Focused Layout: Ideal for designers, photographers, and other creative freelancers, this format includes a section for portfolio items or visual work. It allows clients to see examples of work completed while also tracking payments.

- Branding Integration Format: Perfect for those who want to incorporate their business branding. This layout allows for custom color schemes, fonts, and logos, offering a more personalized and professional touch.

Choosing the right structure depends on your workflow and the type of services you offer. Whether you need a simple document or one that showcases your creative work, the right format helps maintain clarity and professionalism in your transactions.

Where to Find Free Invoice Templates

Finding the right resources to create professional payment records doesn’t have to be a costly or time-consuming task. There are numerous platforms that offer pre-designed solutions, which can be easily customized to suit your needs. Whether you’re looking for a simple format or something more advanced, these resources provide a wide range of options that can streamline your transaction documentation process.

Online Platforms and Websites

Many websites offer free access to a variety of ready-made solutions. Popular platforms like Canva, Microsoft Office, and Google Docs provide a selection of templates that can be downloaded or directly edited online. These platforms often allow for easy customization, enabling you to add your business details, logo, and any specific fields relevant to your services. Customization options range from simple text editing to changing colors and fonts to match your branding.

Software and Accounting Tools

If you’re already using accounting or invoicing software, many of these platforms also offer pre-built documents as part of their service. Tools like Wave or Zoho Books provide free access to professional billing formats that automatically integrate with your accounting system, helping to maintain consistency and accuracy in your financial records.

These platforms make it easy to find the right solution without the need for advanced design skills or software. By leveraging the resources available online, you can quickly create clean and professional records that suit your business’s needs.

Tips for Professional Invoices

Creating clear and professional billing documents is essential for maintaining good relationships with clients and ensuring timely payments. A well-organized document not only provides transparency but also enhances your credibility as a business. Whether you’re a freelancer or a small business owner, following a few key guidelines can help you craft effective records that reflect your professionalism.

Include All Essential Details

Make sure to include all the necessary information to avoid confusion or delays. This should include the client’s contact information, a breakdown of services or products provided, the total amount due, payment terms, and due date. A clear description of the work performed or goods delivered will help your clients understand exactly what they are paying for, reducing the chances of disputes.

Keep the Design Clean and Simple

The design of your documents plays a crucial role in how they are perceived. Opt for a clean and organized layout that makes it easy for clients to read and understand the details. Avoid cluttered sections or unnecessary graphics. Use headings and bullet points to break up information and make it visually appealing. A professional appearance shows that you care about the quality of your work and the client’s experience.

By focusing on these key elements, you can create documents that not only look polished but also provide all the essential information for a smooth transaction process. A well-crafted document helps build trust with clients and ensures that payments are processed promptly and without complications.

How Printable Invoices Save Time

Using pre-designed billing documents significantly reduces the time spent on generating and sending out payment records. Instead of manually creating each document from scratch, businesses can use structured formats that only require filling in specific details. This streamlined approach allows business owners and freelancers to process transactions much faster, leaving more time to focus on other important tasks.

Quick Setup and Customization

- Pre-filled Fields: Many ready-made formats come with predefined sections for key information such as client names, service descriptions, and amounts due. This reduces the need to re-enter the same details repeatedly.

- Easy Adjustments: These resources allow for fast customization, letting users modify fields or add extra sections with just a few clicks. Changes can be made in minutes, saving valuable time compared to designing a document from the ground up.

- Instant Formatting: Ready-made solutions automatically adjust the layout, ensuring all text fits neatly into place and the document looks polished without manual formatting.

Streamlined Workflow Integration

- Consistency: With a standardized format, you reduce the risk of errors, ensuring every document is the same every time. This means you spend less time reviewing each record.

- Faster Delivery: Once the details are entered, these resources allow for quick printing or digital distribution, so you can send out payments without delays.

By using efficient tools to generate accurate and professional records, you save both time and effort, allowing your business to operate more smoothly and increase overall productivity.

Choosing the Right Template for Your Business

Selecting the appropriate structure for documenting transactions is crucial to ensuring your business runs smoothly and professionally. The right format can make it easier to manage your financial records, enhance your brand image, and improve client relationships. When choosing a layout, consider the nature of your business, the complexity of your services, and how much customization you need for each transaction.

Consider the Nature of Your Business

Different businesses have different needs. For example, freelancers may need a simple layout that highlights hours worked and rate per hour, while a product-based company may require a more detailed structure that includes itemized lists and quantities. Understanding your business model will help you choose a format that caters to your specific requirements. A clear and tailored approach ensures that your records are both accurate and relevant to your clients.

Customization and Flexibility

Look for a solution that offers the level of customization you need. If your business regularly offers discounts, special pricing, or custom terms, it’s essential to select a layout that allows you to easily adjust these fields. Additionally, if you plan to include your logo or specific branding elements, choose a format that supports these customizations. Flexibility is key to making sure the document reflects your business’s unique style and needs.

By considering your business’s specific requirements and ensuring that the format you choose can easily adapt, you’ll create records that are both functional and professional. The right format can save you time, reduce errors, and leave a positive impression on your clients.

Common Mistakes When Using Invoices

Even though using pre-designed documents for recording transactions can be a huge time-saver, there are common mistakes that many businesses make, which can lead to confusion or delays in payment. Understanding and avoiding these errors will help ensure that your payment records are clear, accurate, and professional, ultimately making the process smoother for both you and your clients.

Missing or Inaccurate Details

One of the most frequent errors is failing to include essential information or making mistakes in the details provided. Missing client contact information, incorrect pricing, or failing to specify payment terms can cause confusion and delay payments. Always double-check that the correct amounts, dates, and descriptions are filled out properly. Even small errors can lead to misunderstandings and the need for revisions, which waste valuable time.

Unclear Payment Terms

Vague or ambiguous payment instructions can lead to delays. Whether it’s the due date, accepted payment methods, or late fees, it’s crucial to specify clear terms. Avoid ambiguity by clearly outlining when and how payments are expected. If your payment terms are not easily understood, clients may delay payment or ask for clarification, leading to unnecessary back-and-forth.

By paying close attention to these details and avoiding common mistakes, you ensure that your records are professional, accurate, and effective in facilitating smooth financial transactions with your clients. A simple, clear approach can prevent delays, improve client relationships, and ensure timely payment.

How to Make Your Invoices Stand Out

In a competitive business world, having well-crafted billing documents can help you leave a lasting impression on clients. A visually appealing and clearly structured record not only makes it easier for clients to understand the details of a transaction but also enhances your business’s professionalism. By incorporating a few design and content strategies, you can ensure that your documents stand out and reflect your brand’s identity.

Focus on Professional Design

- Use Your Branding: Incorporate your company logo, colors, and fonts to make the document feel cohesive with your overall brand identity. This reinforces your professionalism and helps clients easily recognize your business.

- Minimalist Layout: Avoid clutter. A clean, easy-to-read design with enough white space allows clients to find key information quickly. Use headings and bullet points to organize content logically.

- Clear Typography: Choose legible fonts with enough contrast against the background. Fonts should be professional and easy to read, ensuring that the most important information, like payment due date and total amount, stands out.

Enhance the Content with Details

- Provide Additional Value: Include a personalized message or a thank-you note at the bottom of your document to show appreciation for the client’s business.

- Detailed Descriptions: Ensure each service or product is clearly explained. Clients are more likely to pay promptly when they understand exactly what they are being charged for.

- Incorporate Payment Instructions: Make it easy for clients to pay by providing clear, concise payment instructions and options, such as bank details or online payment links.

By combining a clean design with detailed, client-focused content, you can create billing records that not only stand out but also help you build stronger relationships with clients. Making your documents easy to navigate and professional in appearance can enhance trust and make the payment process smoother for everyone involved.

Legal Considerations for Invoicing

When creating billing documents for your business, it’s crucial to ensure that they comply with legal requirements. These records not only serve as a tool for tracking payments but also have legal implications, particularly when it comes to tax obligations and dispute resolution. Understanding the key legal considerations can help you avoid costly mistakes and protect both your business and your clients.

Compliance with Tax Regulations

One of the most important legal aspects of documenting transactions is ensuring that you follow the appropriate tax laws. This includes properly listing your business’s tax identification number, applying the correct tax rates, and clearly outlining any taxes due on the goods or services provided. Keeping accurate records of taxes collected is also critical for filing tax returns and avoiding potential penalties from tax authorities. Make sure to include tax information whenever necessary, especially if you’re operating in regions where sales tax or VAT is applicable.

Clear Payment Terms and Legal Protection

Another key legal consideration is the inclusion of clear payment terms. Define payment due dates, late fees, and any additional charges for overdue payments in a manner that aligns with your business’s policies. These terms provide a legal foundation should any disputes arise over late payments or non-payment. Additionally, always include your business’s full contact details and any disclaimers about your payment policies, as this helps resolve any potential issues quickly and professionally. Legal terms help protect both you and your client in case of disagreements.

By being mindful of these legal requirements, you can ensure that your transaction records not only help streamline your business operations but also stand up in the event of legal scrutiny or disputes.

How to Track Payments with Invoices

Keeping track of payments is a critical part of managing a business’s finances. By using well-structured billing documents, you can easily monitor outstanding balances, received payments, and due dates. This ensures timely follow-ups and helps prevent missed payments. A systematic approach to tracking payments helps you stay organized and maintain healthy cash flow for your business.

Record Payment Dates and Amounts

One of the most effective ways to track payments is by clearly marking when each payment is made and how much has been paid. Each document should have a section where the payment status is updated, indicating whether the payment is partial or fully paid. For partial payments, note the remaining balance. This practice helps prevent confusion and provides a clear history of transactions with each client.

Utilize a Payment Schedule

Having a payment schedule included in your documents can make tracking easier. This schedule should outline agreed-upon milestones, payment due dates, and any penalties for late payments. By referring to this schedule, you can track whether payments are being made according to the original plan. Using a digital tool or accounting software that integrates with your billing system can further simplify tracking and ensure that no payments are overlooked.

By using organized tracking methods and maintaining clear, updated records, you can stay on top of your financials, minimize errors, and keep your business running smoothly.

Integrating Invoices into Your Workflow

Incorporating billing documents into your daily operations can significantly improve your business’s efficiency and help you maintain consistent cash flow. By making this process a seamless part of your workflow, you can streamline transactions, reduce errors, and improve client relationships. Effective integration ensures that payments are tracked and processed on time, without disrupting other aspects of your work.

Automating the Process

- Use Accounting Software: Many software tools offer automatic generation and sending of documents, saving you time and reducing manual errors. These tools also help track payments and manage client records in one place.

- Set Up Recurring Billing: For clients with regular payments, automating the generation of recurring documents can save a significant amount of time. This ensures timely delivery and consistency for repeat clients.

- Integration with Payment Systems: Linking your billing process with digital payment systems or platforms (like PayPal or Stripe) allows for faster payments and automatic updates to your accounting records.

Maintain Consistency in Your Workflow

- Standardize Billing Practices: Create a uniform process for when and how you send records. For example, set specific days of the week for sending out payment requests or invoices to ensure consistency and prevent overdue payments.

- Track Deadlines and Follow-ups: Integrate reminders and follow-up processes to make sure you don’t miss payment deadlines. This helps ensure that clients pay on time and that you remain organized throughout the process.

By integrating your billing system into your daily operations, you save time, reduce the chance of errors, and maintain a smooth, organized workflow. This allows you to focus on growing your business while keeping your finances in order.

Printable vs Digital Invoices: Which to Choose?

When deciding between physical or electronic records for documenting transactions, businesses must weigh the benefits of each option. Both formats offer unique advantages depending on the nature of the business and client preferences. Understanding the pros and cons of each approach can help you make an informed decision about which method best fits your workflow and improves your efficiency.

Advantages of Printable Documents

- Tangible Record: A physical document can provide a sense of formality and permanence. Some clients may prefer receiving a printed copy for their own record-keeping or accounting purposes.

- Client Preferences: In certain industries, especially those that involve in-person transactions, clients may appreciate having a physical document that they can immediately take home or file.

- Less Reliance on Technology: For businesses that work with clients in remote areas or those less tech-savvy, physical documents may be more reliable and straightforward.

Advantages of Digital Documents

- Faster Delivery: Sending digital files is nearly instantaneous. This can speed up the billing and payment process, especially for businesses dealing with remote or international clients.

- Cost-Effective: With digital documents, there are no printing, paper, or postage costs involved, making it a more affordable option in the long run.

- Ease of Storage and Organization: Digital records are easier to store, search, and organize. Cloud storage and accounting software can help you manage your files more efficiently without taking up physical space.

- Environmentally Friendly: By opting for digital documents, you reduce paper waste, contributing to a more sustainable business model.

Ultimately, the choice between printed and digital records comes down to the needs of your business and your clients. For businesses with clients who prefer hard copies or require them for legal reasons, printed documents may be the best choice. However, for those seeking

Creating Custom Fields in Invoice Templates

Custom fields are essential for businesses that require specific information not typically included in standard billing records. By adding personalized sections to your documents, you can ensure they cater to the unique needs of your business, clients, or industry. Customization allows for flexibility and ensures that every transaction is clearly documented with all relevant details.

Why Customize Fields?

- Industry-Specific Requirements: Different industries may need to include specific data, such as project codes, purchase order numbers, or shipping details. Custom fields allow you to meet these requirements without overcrowding the standard fields.

- Enhanced Clarity: Adding extra sections can help clarify payment terms, discounts, or special conditions that may apply to a particular client or project, making the document more informative.

- Personalization for Clients: Custom fields enable you to add client-specific notes, preferences, or special instructions, fostering a more personalized and professional relationship.

Common Custom Fields to Consider

- Project or Job Numbers: If your business handles multiple projects or tasks for a client, including a project code or job number can help organize and track transactions easily.

- Discounts and Promotions: Include fields for special discounts or promotional offers, ensuring they’re clearly noted for both you and the client.

- Payment Methods: If your business accepts a variety of payment methods (e.g., credit card, PayPal, wire transfer), add a custom field to specify the available options.

- Tax Exemptions: Some clients may be exempt from certain taxes. Including a space for tax-exempt status helps avoid confusion and ensures compliance.

By adding custom fields, you tailor the record to better serve your business needs, improve communication with clients, and streamline the financial documentation process. Whether it’s for internal tracking or legal requirements, personalizing the document structure will help maintain clarity and professionalism.

How to Ensure Invoice Accuracy

Ensuring the accuracy of your billing documents is crucial for maintaining good client relationships and smooth financial operations. Errors can lead to delays, confusion, and even payment disputes. To avoid these issues, it’s important to establish processes that verify all the details before sending out records. By carefully checking all aspects of your documents, you can maintain professionalism and build trust with your clients.

Steps to Guarantee Accuracy

- Double-Check Client Information: Verify that the client’s name, address, and contact information are correct. Any mistake in this area can cause confusion and delay payments.

- Review Product or Service Details: Ensure that the description, quantity, and price for each item or service are accurate. Cross-reference these details with your records or agreement to prevent discrepancies.

- Verify Payment Terms: Double-check payment due dates, late fees, and discounts. Make sure these match the terms you have agreed upon with the client.

- Accurate Tax Calculations: Ensure that taxes are applied correctly according to your local tax regulations. This includes using the correct tax rate and listing it clearly on the document.

- Proofread for Errors: Always proofread your billing documents for spelling, grammar, or formatting mistakes. Even small errors can impact the professionalism of your business.

Automate to Reduce Mistakes

- Use Accounting Software: Leverage digital tools that automate calculations and populate client details, reducing the risk of manual errors.

- Create Standardized Formats: Establish a consistent format for all documents to ensure no information is overlooked and that all necessary sections are included.

By following these steps and taking extra care when creating your billing records, you can ensure that the documents you send are accurate, professional, and clear, fostering better relationships and smoother payment processes with your clients.