Free Invoice Template for QuickBooks

Managing finances efficiently is crucial for any business, and having a streamlined process for generating and customizing payment requests is key to maintaining a professional image. The right tools can save time and reduce errors, ensuring that you remain focused on your core operations.

Optimizing your billing workflow involves selecting the right resources that allow for easy customization and consistency. By using accessible resources that integrate well with your accounting systems, you can maintain a smooth and accurate billing process. This approach reduces manual work, minimizes the risk of mistakes, and helps you stay organized.

Whether you are running a small startup or managing a larger enterprise, having a structured and effective way to create payment requests can make a significant difference. The ability to quickly adapt these documents to meet specific needs or client requirements is essential for ensuring efficiency and professionalism in every transaction.

Free Invoice Template for QuickBooks

Having a structured document to request payments is essential for businesses of all sizes. These ready-to-use documents not only save time but also ensure consistency and accuracy across all transactions. With the right resources, creating such documents becomes a seamless part of your financial workflow, giving you more time to focus on growing your business.

When looking for customizable options, it is important to find one that fits your specific needs. These tools allow you to modify the content as needed while ensuring that every detail aligns with your branding and business requirements. With an intuitive setup, you can quickly generate payment requests for clients, track payments, and maintain a professional image throughout your business operations.

| Feature | Description |

|---|---|

| Customizable Fields | Adjust client, service, and payment details easily |

| Professional Layout | Ensure all documents have a consistent and clear format |

| Time-saving | Generate documents quickly with pre-designed structures |

| Compatibility | Integrate seamlessly with your accounting systems |

Why Use an Invoice Template

Creating payment requests manually can be time-consuming and prone to errors. Using a structured document to manage billing processes ensures that you maintain consistency, accuracy, and professionalism in every transaction. This approach streamlines your workflow, allowing you to focus more on core business activities while saving time and resources.

By adopting an organized method, businesses can ensure that all essential details are captured correctly. A ready-to-use structure helps prevent overlooking important elements and reduces the chances of miscommunication with clients. Additionally, this method enhances the credibility of your business and supports smoother financial operations.

Key Benefits of Structured Billing Documents

| Benefit | Description |

|---|---|

| Consistency | Ensure every payment request follows the same professional format |

| Accuracy | Minimize the risk of errors with pre-filled fields and clear structure |

| Time Efficiency | Speed up the billing process without sacrificing quality |

How It Enhances Business Operations

Streamlining your financial processes with a well-structured document helps maintain organized records, making it easier to track transactions and manage client information. This approach ensures that your business stays on top of payments, reduces administrative workload, and provides a more efficient way to handle finances.

Benefits of QuickBooks Integration

Integrating financial management tools into your business processes offers numerous advantages that simplify accounting tasks and improve overall efficiency. By synchronizing various aspects of your business, from generating payment requests to tracking expenses, you can maintain a more organized and accurate record system. This integration ensures smoother operations and better decision-making through real-time insights and automated workflows.

One of the key benefits of such integration is the seamless connection between your accounting system and other business functions. This allows for quick updates, easy access to financial data, and enhanced reporting capabilities. The ability to automate routine tasks reduces manual input, freeing up valuable time for more strategic activities.

Streamlined Financial Tracking

Automated updates and real-time syncing help keep all financial records up-to-date without manual intervention. This reduces the risk of discrepancies and ensures that your business is always working with the most current information.

Improved Accuracy and Efficiency

By eliminating the need for repetitive data entry, integrating these tools reduces the likelihood of human error. As a result, your accounting process becomes more accurate, leading to fewer mistakes and ensuring compliance with financial regulations.

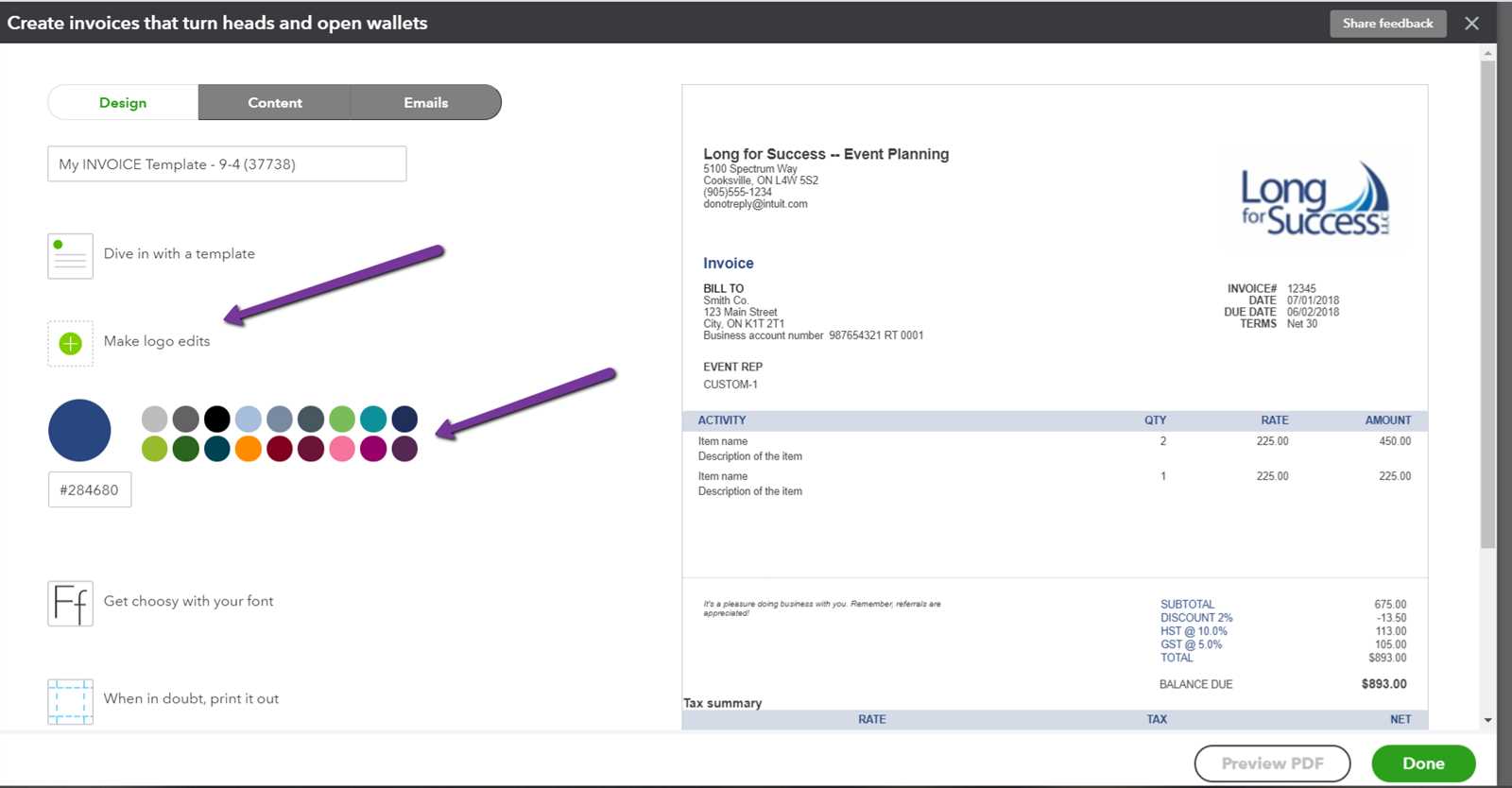

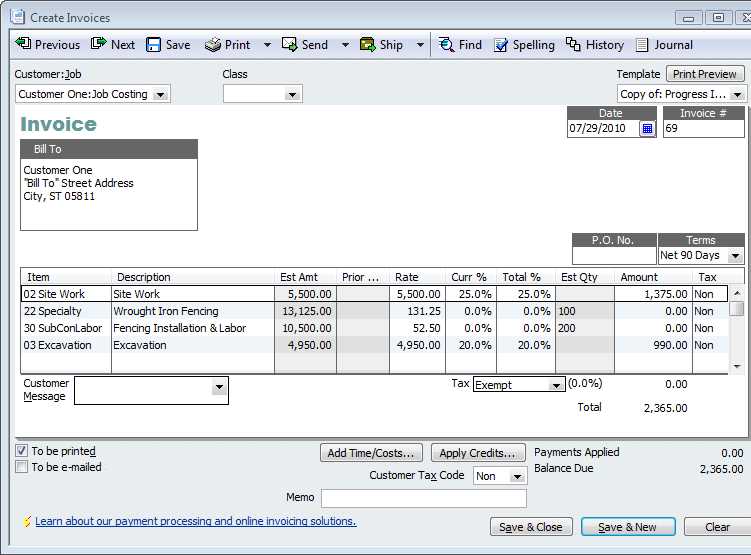

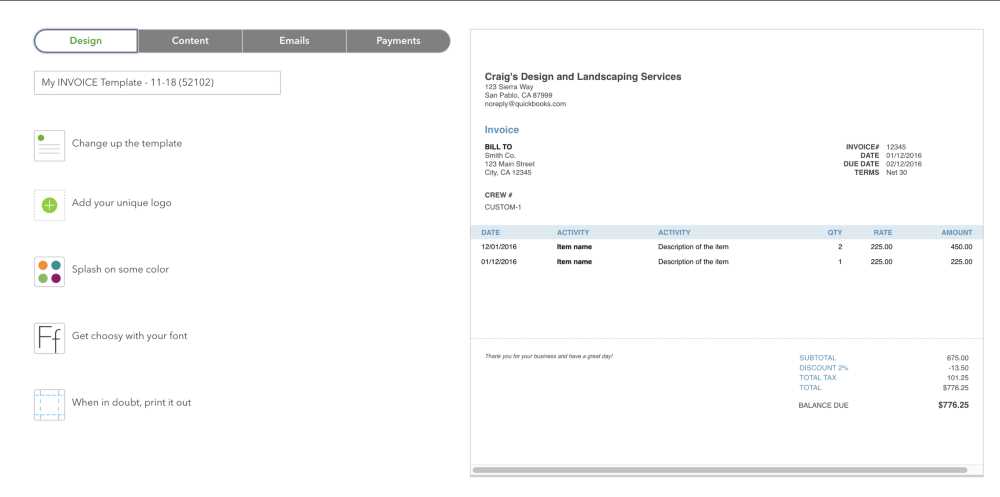

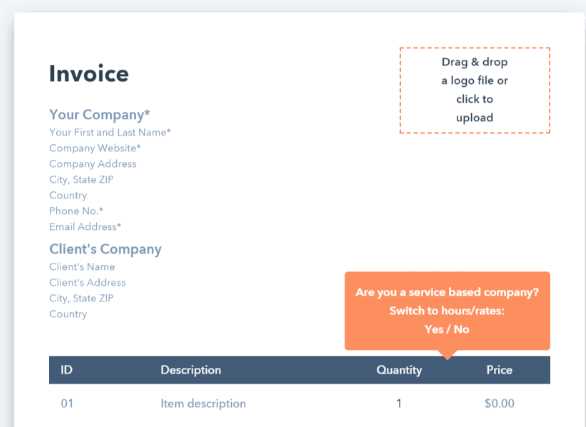

Customizing Your Free Template

Tailoring your documents to suit your specific business needs ensures that they reflect your brand and maintain professionalism in all transactions. Customizing your payment request structure allows you to adjust key elements such as company details, client information, and payment terms, ensuring that every communication is both clear and aligned with your business style.

With an easy-to-use customization process, you can modify various sections to match the unique requirements of each client or project. This flexibility enables you to create documents that not only meet legal standards but also maintain a personal touch that enhances client relationships and builds trust.

Key Elements to Customize

Focus on areas such as company logo, payment terms, and contact details. These elements ensure that your documents are professional and personalized, making it easier for clients to recognize your brand and understand your payment expectations.

Why Customization is Important

Adjusting the design and content of your documents helps maintain consistency across all client interactions. A well-branded payment request can enhance your business’s credibility and make the payment process smoother for both you and your clients, ultimately improving cash flow and client satisfaction.

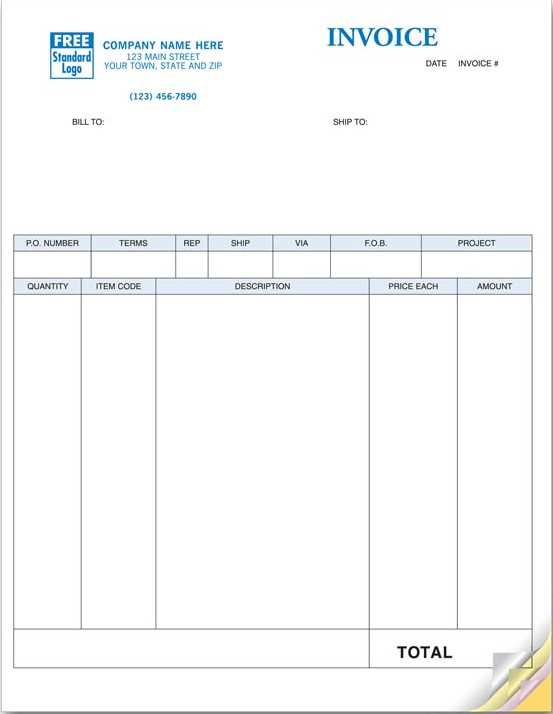

How to Download an Invoice Template

Accessing and downloading the right document structure for your business needs is a simple process that can save you a lot of time. With the right resource, you can quickly obtain a professional layout to start managing your billing. These tools are designed to streamline the creation of payment requests and ensure consistency across all your financial communications.

To get started, all you need is an internet connection and the right platform where these resources are offered. Once you have access, downloading the document is straightforward and typically involves selecting the version that fits your requirements, followed by a simple click to save it to your device.

Steps to Download the Document

| Step | Description |

|---|---|

| 1. Choose Your Format | Select the format that best suits your needs, such as PDF, Excel, or Word. |

| 2. Select Template Type | Pick the appropriate design or layout for your specific business needs. |

| 3. Click Download | Once you’ve chosen, simply click the download button to save it to your device. |

| 4. Open and Customize | Open the file and personalize it with your company and client details. |

Choosing the Right Document for Your Business

When selecting a document, consider the style and functionality you need. Some options offer more complex features, such as automatic calculations or built-in tax fields, while others provide simple and clean layouts for basic billing needs. Choose the one that fits your current business structure and adjust it as your needs evolve.

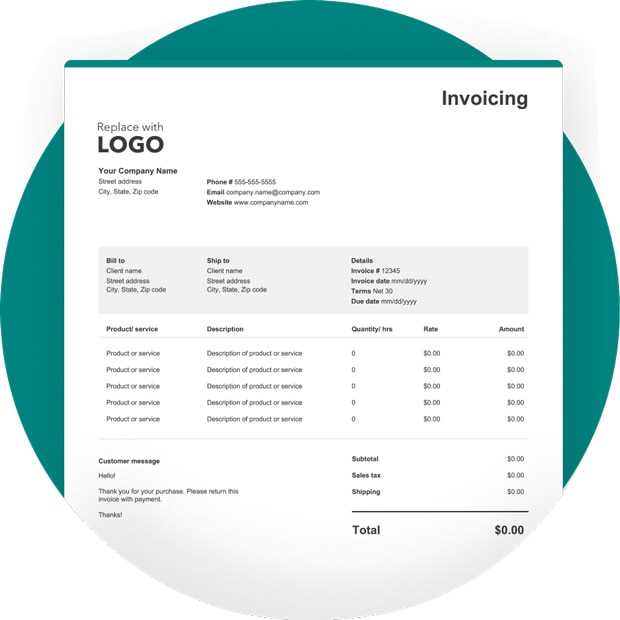

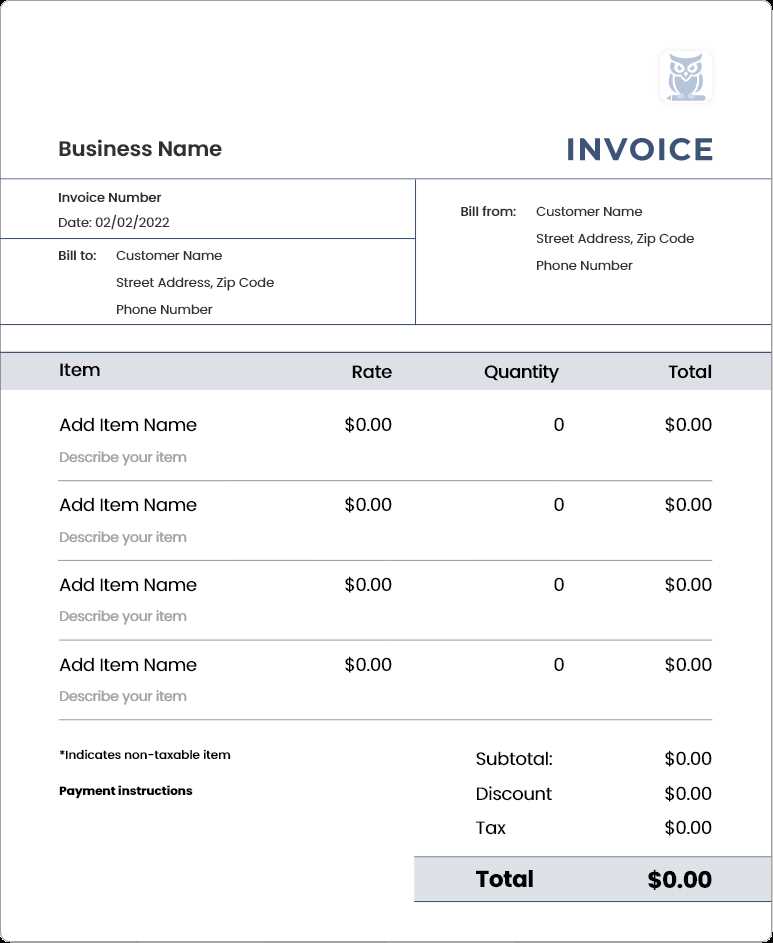

Key Features of a Good Template

When selecting a structured document for managing payment requests, it’s essential to consider several important factors that ensure functionality and professionalism. A well-designed layout will not only look appealing but will also support efficiency by providing all the necessary fields and features. These characteristics contribute to smoother business operations and enhance the client experience.

A good document structure should be easy to customize, ensuring that it aligns with your brand identity and business processes. It should also facilitate quick updates and minimize the risk of errors. Moreover, the inclusion of key details like payment terms, client information, and service descriptions are crucial for clear communication and effective financial management.

Essential Features to Look For

| Feature | Description |

|---|---|

| Clear Layout | Simple, organized design that highlights key information |

| Customizable Fields | Ability to easily update details such as client name, services, and terms |

| Professional Branding | Option to add your company logo and branding elements |

| Automated Calculations | Incorporate tax rates, discounts, and totals automatically |

How These Features Improve Your Process

The integration of these features streamlines your financial workflows by reducing the amount of manual input required. Automated calculations save time, while customization options help maintain a consistent and professional appearance across all documents. With these tools in place, you can manage your transactions more efficiently and ensure that your client communications are clear and accurate.

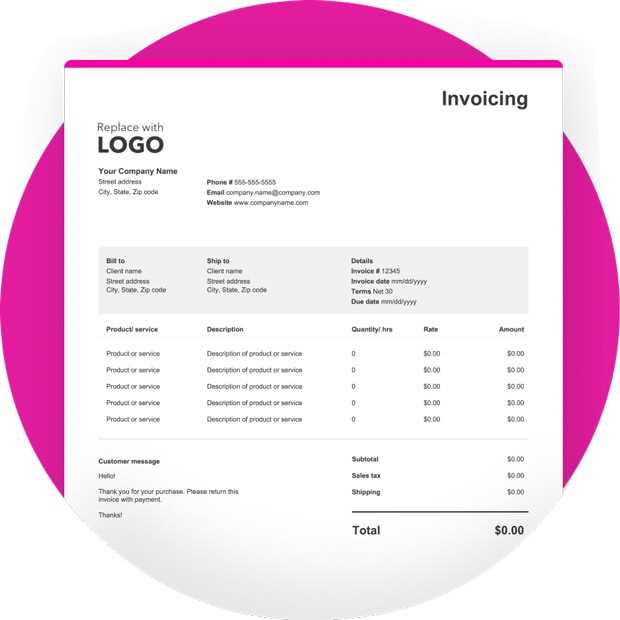

Creating Professional Invoices in Minutes

Generating high-quality payment requests quickly is essential for maintaining a smooth cash flow and ensuring professional interactions with clients. The process doesn’t need to be complicated. With the right tools, you can produce polished, accurate documents in just a few simple steps. The key is to streamline the workflow and use resources that make the process efficient without sacrificing quality.

Customizing your payment documents is easier than ever, thanks to pre-designed structures that allow you to input necessary details swiftly. These resources typically feature intuitive layouts, making it simple to fill in client information, payment terms, and itemized services. This eliminates the need for manually designing each document from scratch, saving valuable time.

Once you’ve set up your format, creating and sending professional payment requests can be done in minutes. The ability to adjust fields as needed ensures flexibility, while automatic calculations ensure accuracy. Whether you’re invoicing a single client or managing multiple transactions, these tools support quick, consistent, and error-free billing.

Saving Time with Pre-designed Templates

Efficiency is crucial when managing business finances, and utilizing ready-made documents can significantly reduce the time spent on creating payment requests. Pre-designed layouts streamline the process, enabling you to focus on more important aspects of your business. With these tools, you don’t need to spend valuable time formatting or adjusting each document manually. Instead, you can use a structured format that’s already optimized for your needs.

By using these layouts, you eliminate the need for repetitive tasks like entering company details, calculating totals, or adjusting design elements. This time-saving approach ensures that you can quickly generate accurate and professional documents, reducing the administrative burden and speeding up the overall process.

How Pre-designed Layouts Help

These resources come with pre-filled sections for client names, services, prices, and terms, allowing for rapid customization. You simply input the specific details for each transaction, and the document automatically updates to reflect the new information. This not only saves time but also minimizes errors.

Streamlining Routine Tasks

Automating repetitive tasks, such as calculations and formatting, makes the process smoother and more consistent. This helps maintain accuracy in your financial records and ensures that every document you generate is professional and reliable, all while saving you precious time.

Top Mistakes to Avoid in Invoices

When preparing financial documents for your clients, small mistakes can lead to confusion, delayed payments, or even damage to your business reputation. Ensuring accuracy in all aspects of the payment request is crucial for maintaining professional relationships and keeping your financial processes smooth. Avoiding common errors can help ensure timely payments and a positive client experience.

One of the most frequent mistakes is failing to clearly outline payment terms, including the due date and accepted payment methods. Without clear instructions, clients may miss deadlines or be unsure of how to pay, leading to unnecessary delays. Additionally, not double-checking for accuracy in pricing, taxes, or services can result in discrepancies that cause frustration or disputes.

Another common error is the lack of proper contact information or missing details about the services provided. Without this clarity, clients may be confused about what they’re being charged for, or may struggle to reach you for any queries. It’s essential to make sure that all key fields are filled in completely and correctly to avoid unnecessary back-and-forth communication.

How QuickBooks Improves Billing Accuracy

Accurate financial records are essential for any business, and managing payment requests efficiently is a key part of that process. Tools that automate calculations and data entry can reduce the chances of human error, ensuring that the documents you send to clients are precise and error-free. These tools not only streamline your workflow but also help in maintaining consistent billing practices that prevent costly mistakes.

By automating key aspects of billing, such as tax calculations, totals, and discounts, you eliminate manual errors that can arise from complex math or data entry. This level of automation ensures that every payment request is correct before it’s sent out, significantly reducing the chances of disputes or delayed payments due to inaccurate charges.

Streamlined Data Entry

One of the main benefits of using such a tool is its ability to pull relevant information directly from your financial records. This means that client details, pricing, and other important data are automatically filled in, minimizing the risk of oversight or mistakes. With real-time updates, your documents always reflect the most current information, reducing the chance of errors due to outdated or incorrect data.

Consistent and Reliable Billing

Using automated tools ensures that your business maintains a consistent approach to billing. Every document generated follows the same format and includes all the necessary details, improving the professionalism of your financial communications. This consistency helps you maintain trust with clients and ensures smooth financial operations in the long run.

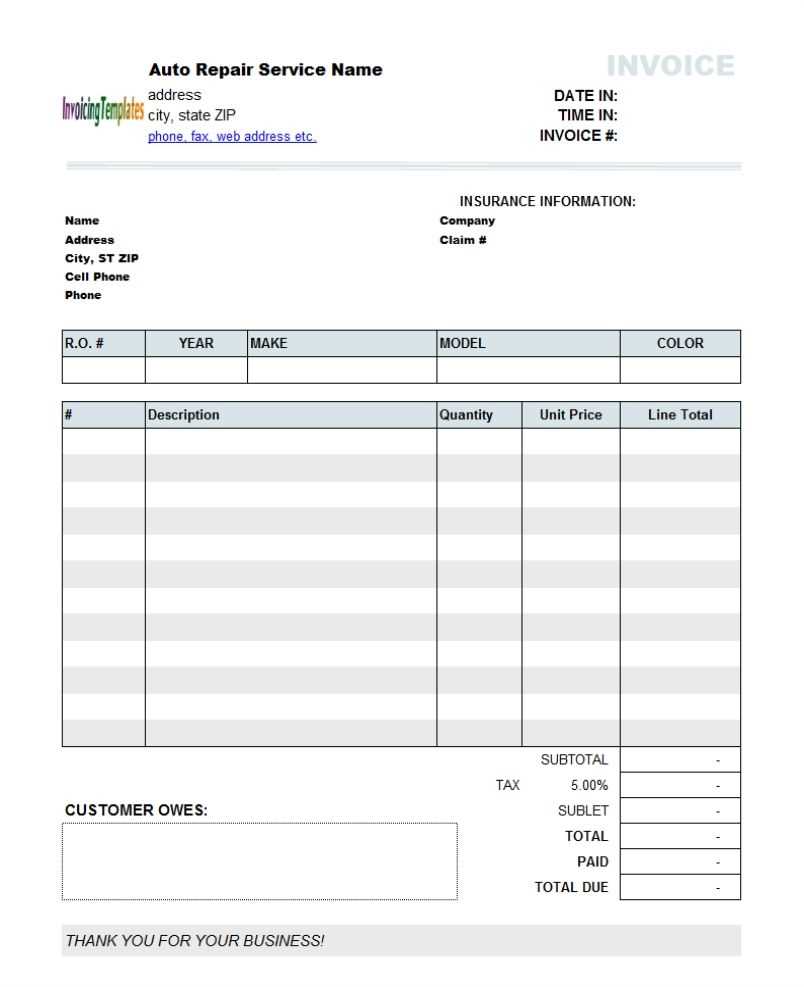

Invoice Template for Small Businesses

For small businesses, managing finances efficiently is crucial to maintaining healthy cash flow and ensuring timely payments. Having a well-structured document for client billing can help streamline this process, offering a professional and consistent way to request payments. A customizable format makes it easier for small business owners to quickly adapt to varying client needs while keeping their business operations organized and transparent.

With the right layout, small businesses can ensure that each request is clear and easy to understand. This includes adding all essential information like service descriptions, payment terms, and total costs. The ability to generate accurate and professional documents without extensive time investment allows business owners to focus more on growth and client relations.

Key Features for Small Business Billing

- Simple and clean design that’s easy to read and understand

- Customizable fields for services, prices, and client details

- Automatic calculations for taxes, totals, and discounts

- Professional branding with your company logo and contact information

- Clear payment terms to avoid confusion and delayed payments

Benefits for Small Business Owners

Utilizing a structured format for payment requests brings numerous advantages for small business owners. These include:

- Time savings: Generate billing documents quickly and without error.

- Improved professionalism: Ensure all communications with clients are clear and consistent.

- Accuracy: Automate calculations to prevent manual errors and ensure correct charges.

- Branding: Customize with your business identity to maintain a professional image.

Free Templates vs Paid Alternatives

When choosing the right tools for generating business documents, small business owners often face the dilemma of deciding between free and paid options. Each approach offers its own set of benefits and drawbacks, depending on the specific needs and goals of the business. Free options can be a good starting point, but they may lack advanced features and customization that paid solutions offer. On the other hand, paid alternatives typically provide more robust functionality and professional support, but they come with a cost.

Understanding the differences between these two choices is important to make the best decision for your business. While free resources might be suitable for small operations or those just starting out, paid solutions can offer greater flexibility, enhanced security, and additional features that may become necessary as the business grows.

Advantages of Free Options

- Cost-effective: Ideal for businesses with limited budgets or those just starting.

- Quick setup: Most free resources are easy to access and start using right away.

- Simple and straightforward: Great for basic needs without the complexity of more advanced tools.

- Basic customization: Often customizable to a certain degree, allowing businesses to adjust layouts and fields.

Benefits of Paid Solutions

- Advanced features: Paid options often include enhanced capabilities, such as automated calculations, professional templates, and easy integration with other business tools.

- Better customization: More flexibility to tailor documents to fit your brand identity and client needs.

- Customer support: Paid services often come with dedicated support teams to assist with issues or provide guidance.

- Increased security: Paid solutions typically offer better security features to protect sensitive data and financial information.

Which is Right for Your Business?

Ultimately, the choice between free and paid options depends on your business’s size, budget, and the level of customization you require. If you’re a small business or a startup with limited resources, starting with free tools might be sufficient. However, as your business grows and requires more sophisticated functionality or higher security, investing in a paid solution could provide significant long-term value.

Managing Multiple Invoices with QuickBooks

For businesses handling numerous payment requests each month, organizing and tracking financial documents can become overwhelming. However, using efficient tools designed for bulk management can simplify this process. With the right software, businesses can easily monitor multiple transactions, ensuring each document is correctly processed, tracked, and followed up on without manual oversight.

By leveraging an integrated solution, business owners can streamline their workflow, reduce errors, and maintain accurate records. Managing many requests for payment at once becomes more manageable when tasks like generating, sending, and tracking are automated. This helps save time and avoid mistakes that can lead to delayed payments or lost revenue.

Benefits of Using Automated Tools for Multiple Payments

- Time-saving: Automate the creation and sending of multiple documents in just a few clicks.

- Organization: Keep all records organized in one place, accessible whenever needed.

- Improved accuracy: Reduce human errors in calculations and document creation.

- Convenient tracking: Track payments, overdue accounts, and balances effortlessly with built-in reports.

Managing Different Payment Schedules

For businesses offering different payment terms or schedules, handling multiple payment requests can be tricky. Using specialized software allows users to set varying due dates, payment intervals, and reminders for each customer. This ensures no payment is forgotten and clients are notified when their next installment is due.

- Set Custom Due Dates: Tailor payment schedules based on agreements with individual clients.

- Automated Reminders: Set up automated payment reminders to keep clients informed of upcoming due dates.

- Payment Status Tracking: Monitor the status of each payment, from pending to fully paid.

- Consolidated Reporting: Generate reports that provide an overview of all outstanding payments, helping with cash flow management.

Updating Your Template for New Clients

When you onboard new customers, it’s essential to ensure that your documentation reflects their unique needs and your updated business processes. Customizing your documents for each client not only helps maintain a professional image but also ensures that all necessary details are included. Whether it’s updating contact information, payment terms, or service descriptions, tailoring these records can foster better client relationships and smoother transactions.

As your business grows and diversifies, it’s important to stay flexible with your document formats. Keeping templates up to date for new clients ensures that you meet their expectations and avoid potential misunderstandings. Regular updates can include adjusting branding elements, terms, or even the layout to align with your evolving business practices.

Personalizing Your Documents for New Clients

- Client-Specific Details: Ensure that all relevant contact information, billing addresses, and service descriptions are correctly reflected.

- Custom Terms: Adapt payment terms, delivery schedules, and discounts according to the specific needs of each client.

- Branding Consistency: Update logos, color schemes, and fonts to match your company’s current branding guidelines.

- Service Customization: Modify document sections to suit the particular products or services provided to each client.

Maintaining Accuracy and Professionalism

It’s crucial to ensure that every document sent to clients is accurate and professional. A well-organized and consistent format demonstrates your attention to detail and helps build trust with clients. Regularly reviewing and refining your document setup can ensure that you’re always presenting the most relevant and up-to-date information.

- Review for Accuracy: Double-check all client information before sending documents to avoid errors.

- Professional Formatting: Maintain a clean, consistent format across all documents to ensure clarity.

- Automate Updates: Use software that allows for easy updating of multiple documents with minimal effort.

Why Templates Are Ideal for Startups

For new businesses, time and resources are often in short supply. Streamlining operations with pre-designed documents helps to reduce the burden of administrative tasks, enabling entrepreneurs to focus more on growth and client relationships. Using structured formats for essential business functions like billing, contracts, or proposals allows startups to quickly establish a professional image while minimizing time spent on repetitive tasks.

Templates are especially beneficial for small businesses that need to keep costs low and efficiency high. They offer a cost-effective solution for creating consistent and high-quality documents without the need for expensive software or design services. These ready-to-use formats are an ideal choice for businesses looking to establish themselves without unnecessary complexity or investment.

Advantages for New Businesses

- Time Savings: Pre-designed formats allow for quick document creation, eliminating the need to start from scratch each time.

- Professional Presentation: Templates ensure a polished and consistent appearance, building credibility with clients and partners.

- Cost-Effective: Templates eliminate the need for expensive software or design work, making them ideal for businesses on a budget.

- Easy Customization: Ready-made formats can be easily adapted to suit the unique needs of each client or project.

Building Efficiency and Consistency

One of the key benefits of using pre-built formats is the ability to maintain consistency across all documents. For a startup, presenting a cohesive and uniform style helps establish brand identity and strengthens the business’s professional image. With templates, every document sent out will look organized and trustworthy, allowing new businesses to make a strong first impression on clients, suppliers, and partners.

- Uniform Branding: Templates ensure that all documents adhere to the company’s visual style and brand guidelines.

- Reduced Errors: With a set structure in place, the likelihood of missing crucial information or making formatting mistakes decreases.

- Streamlined Processes: Templates simplify workflow by automating routine tasks, enabling faster turnaround times for key business operations.

How to Protect Your Template Files

Maintaining the security and integrity of your business documents is crucial to prevent unauthorized access, alteration, or loss of important information. Properly securing your file formats ensures that they remain safe from data breaches and accidental damage. Whether you’re managing contracts, financial reports, or business communications, taking steps to protect your files is essential for safeguarding your work and your reputation.

Best Practices for File Protection

- Use Strong Passwords: Ensure that files containing sensitive information are password-protected. A strong, unique password can prevent unauthorized access.

- Backup Regularly: Store copies of your files in a secure location, such as a cloud storage service or an external drive, to protect against data loss.

- Restrict Access: Limit file access to authorized individuals only. Use permission settings to control who can view or edit the documents.

- Enable Encryption: Encrypt files to protect their contents. This ensures that even if files are intercepted, they cannot be easily read or altered.

Maintaining File Integrity

Beyond protecting files from unauthorized access, it’s equally important to ensure that the content remains intact and unaltered. Employing version control systems can help track changes and prevent errors from slipping through. Additionally, using reliable file formats that are less susceptible to corruption is another key aspect of maintaining file integrity.

- Use Trusted File Formats: Stick to well-established, secure formats that are widely used and supported to minimize the risk of corruption or compatibility issues.

- Regularly Update Software: Ensure that any software used for creating or editing documents is up to date, as updates often include security patches.

- Audit Changes: Keep a record of all edits or updates made to the files, so you can revert to previous versions if necessary.

Best Practices for Invoice Tracking

Efficient tracking of payments and outstanding balances is essential for maintaining healthy cash flow and ensuring timely collections. By implementing best practices, businesses can stay on top of their financial records, reduce the risk of missed payments, and improve their overall financial management. Consistently monitoring transactions is a key step in achieving financial stability and avoiding misunderstandings with clients.

Key Strategies for Effective Tracking

- Organize Your Records: Keep all your financial documents neatly organized, whether digitally or physically, so that you can quickly reference any information as needed. Categorize entries by client, date, and status for easier management.

- Automate Reminders: Use automated tools to send reminders to clients as their payment deadlines approach. This reduces the risk of missed payments and ensures timely collections.

- Set Clear Payment Terms: Always define clear payment terms with clients, including deadlines and accepted methods of payment, to minimize confusion and disputes.

- Monitor Due Dates: Keep a close eye on the due dates for payments, and use reminders or tracking systems to flag overdue balances and take prompt action.

Tools to Enhance Tracking Efficiency

- Spreadsheets: Simple spreadsheets can be a cost-effective method for tracking payments and balances. Using formulas to calculate totals and due dates can save time.

- Accounting Software: More advanced software solutions provide automated tracking, real-time updates, and integrated payment systems, which streamline the entire process and reduce manual work.

- Mobile Apps: For on-the-go management, consider using apps that offer invoice tracking capabilities, allowing you to monitor payments and balances from your phone or tablet.

By adopting these practices and tools, businesses can ensure accurate, timely tracking of payments, fostering better relationships with clients and supporting the financial health of their operations.

How to Share Your Invoice Efficiently

Sharing financial documents with clients in a timely and organized manner is crucial for maintaining a smooth business operation. Ensuring that your documents are delivered securely and promptly not only speeds up the payment process but also strengthens your professional reputation. Whether you’re dealing with one-time clients or regular partners, there are multiple ways to share these documents effectively, with attention to both speed and clarity.

Effective Methods for Document Delivery

- Email: One of the most common and efficient ways to send documents is via email. Ensure the file format is easily accessible for the recipient, such as PDF, and include a clear subject line with a polite message in the body.

- Cloud Storage: For clients who require frequent access to multiple documents, cloud storage services like Google Drive or Dropbox allow you to securely store and share files. You can provide links to documents that clients can download or view at any time.

- Client Portals: Some businesses use client portals where documents are securely uploaded and stored, making it easy for both parties to access important files whenever necessary. These portals may also include features for tracking payment status and communicating directly.

- Printed Copies: In specific cases where a client prefers hard copies, printing and mailing documents can still be an effective method. However, ensure that this process is both timely and cost-effective.

Best Practices for Secure Sharing

- Use Password Protection: For sensitive financial documents, always password-protect the file before sharing it online. This adds an extra layer of security to prevent unauthorized access.

- Verify Recipient Information: Double-check the recipient’s contact details to avoid sending documents to the wrong person. This simple step helps prevent mistakes and potential data breaches.

- Include Clear Instructions: When sending documents through digital platforms, ensure the recipient understands how to access, view, and download the files. Providing brief instructions will help avoid confusion.

By choosing the right method and following best practices, you can ensure that your financial documents reach clients efficiently, enhancing both your professional image and the overall client experience.