Free Invoice Template PDF and Word Formats for Easy Customization

Managing financial transactions efficiently is crucial for any business. One of the simplest ways to handle payments is by using professional documents that outline the terms and amounts clearly. These tools are essential for ensuring smooth interactions with clients and maintaining a structured approach to business operations.

Editable documents offer the flexibility to customize each record according to your needs, making it easy to adjust details such as prices, services, and deadlines. Whether you need to generate a document for a one-time transaction or regular billing, these customizable formats provide a seamless solution for both small and large businesses.

Choosing the right format for your documents can significantly impact the clarity and professionalism of your communications. With a variety of options available for editing and sharing, you can ensure your records are both easily accessible and properly formatted for any situation.

Free Invoice Template PDF and Word

For businesses looking to streamline their billing process, utilizing ready-made documents can significantly reduce the time spent creating financial records. These customizable resources allow for quick entry of specific details such as payment amounts, terms, and contact information. They ensure consistency and professionalism in each transaction, enhancing the overall client experience.

By selecting from various available formats, companies can choose the most suitable option for their needs. Both printable and editable document types ensure that every transaction is documented clearly and accurately. Whether you need to send an email or print hard copies, these flexible options are designed to meet different business requirements.

Advantages of Editable Documents

Customizability is one of the key benefits of using these pre-designed files. You can easily adjust fields like amounts, dates, and service descriptions, ensuring the document matches the specifics of each transaction. With the ability to modify every section, businesses can tailor records to their exact requirements.

Choosing the Best Format for Your Needs

While both formats serve the same general purpose, each comes with its own set of benefits. Digital files are easy to distribute and store, while printable versions are perfect for businesses that need to provide physical copies to clients. Choosing the appropriate format depends on how you intend to share and store your documentation.

Why Use a Free Invoice Template

In any business, having standardized documents for financial transactions can save time and reduce errors. Ready-made formats allow for quick adaptation to specific needs, offering consistency across all transactions. By using a pre-structured file, you can focus more on your business while ensuring that your financial records remain clear and professional.

These pre-designed resources offer a reliable solution, especially for those who do not have the time or resources to create custom forms from scratch. They are easy to use and can be adjusted to include the details that matter most to your clients and business processes.

Time-Saving Convenience

Creating documents from scratch for every transaction can be tedious and inefficient. Pre-made resources offer a quick starting point that can be tailored in just a few minutes. With fields for all essential details already included, businesses can cut down on the time spent formatting and focus on the content.

Professional Appearance

Using well-organized and clearly formatted documents reflects professionalism and helps build trust with clients. These files are designed to ensure that important information is presented clearly, reducing the chance of confusion or disputes. When clients receive clean, consistent records, it enhances the overall experience and fosters positive business relationships.

Benefits of PDF and Word Formats

When it comes to creating professional documents, the format you choose can play a crucial role in how easily they are shared, edited, and stored. Both digital file formats offer specific advantages that make them popular choices for business transactions. Understanding the benefits of each can help businesses select the right format for their needs.

Each format has its unique strengths, and by using them appropriately, businesses can streamline their document management processes. Whether it’s for quick edits or easy sharing, these widely-used file types ensure that records are accessible and professionally formatted.

Advantages of Digital Formats

- Universally Accessible: These file types can be opened on almost any device, ensuring that clients or team members can view documents without compatibility issues.

- Easy to Edit: The ability to make quick changes ensures that details such as pricing, services, or dates can be updated without hassle.

- Flexible Sharing: Both formats can be shared via email, cloud services, or even printed, offering multiple methods of distribution depending on the business need.

Why Choose These Formats for Business Transactions

- Professional Presentation: The clarity and structure of these documents make them ideal for presenting accurate information to clients and partners.

- Security and Integrity: Once finalized, these files can be secured with passwords or encrypted, protecting sensitive business information from unauthorized access.

- Ease of Storage: Both formats can be easily stored on cloud services, making them simple to organize and retrieve when needed.

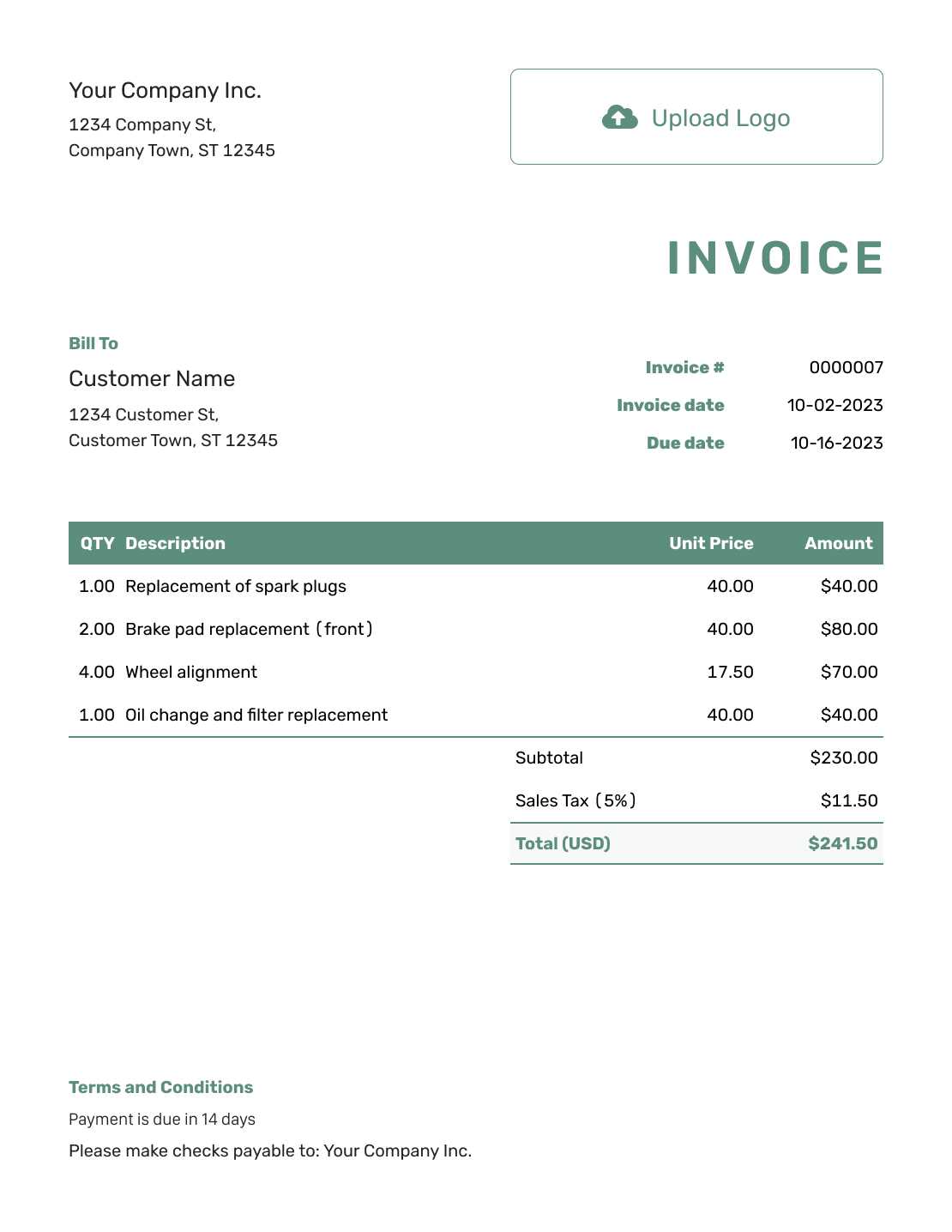

How to Customize Your Invoice

Personalizing your financial records ensures that each document accurately reflects the unique details of the transaction. Customizing a ready-made form allows businesses to add specific information such as payment terms, company branding, and customer details. This not only creates a more professional appearance but also ensures that all necessary information is clearly communicated.

By modifying various fields within the document, you can adapt it to suit different types of transactions. Whether you need to include tax rates, discount options, or special payment instructions, customizing the structure makes it easier to meet your business needs while maintaining a consistent format across all transactions.

Key Elements to Customize:

- Company Information: Include your business name, address, and contact details at the top to make the document instantly recognizable.

- Client Information: Add the customer’s name, address, and contact details for a personalized touch.

- Payment Terms: Specify due dates, late fees, and accepted payment methods to avoid confusion.

- Line Items: List services or products provided, along with their quantities and prices for complete transparency.

Tip: When adjusting your document, ensure that all critical information is easy to find and read. The more streamlined the layout, the better the recipient will understand the details of the transaction.

Choosing the Right Template for Your Business

Selecting the right document format for your transactions is a key step in maintaining professionalism and consistency. The appropriate choice depends on your business type, the frequency of transactions, and how you plan to interact with your clients. Tailoring the document to your specific needs ensures clarity and helps streamline your accounting processes.

By considering the nature of your services or products, you can choose a format that aligns with your business goals and client expectations. A well-chosen structure not only makes it easier to generate records but also strengthens your brand’s image and improves communication with your customers.

Factors to Consider When Choosing

- Business Type: Different industries may require specific formats. For example, a service-based business might need a simple record, while a product-based business may require more detailed entries for each item sold.

- Frequency of Use: If you’re generating documents regularly, choose a format that is quick to edit and update without losing consistency in the layout.

- Client Preferences: Consider how your clients prefer to receive documents. Some may prefer digital files, while others may require printed copies.

- Professional Appearance: Ensure that the format you choose reflects your brand image and helps you maintain a clean, professional presentation in all transactions.

Popular Format Choices

- Simple Layouts: Ideal for small businesses or freelancers who need straightforward records with minimal detail.

- Detailed Entries: Best for larger businesses or those with complex pricing structures, offering space for more itemized information.

- Branded Formats: Customizable documents that allow you to add your logo, business colors, and other branding elements for a more personalized touch.

Step-by-Step Guide to Creating Invoices

Creating professional records for each transaction is essential for maintaining clarity and ensuring that all financial details are documented accurately. By following a structured approach, you can create well-organized documents that reflect your business standards and provide the necessary information to your clients. This guide will walk you through each step of the process, from start to finish.

Step 1: Gather Required Information

- Client Details: Collect the name, address, and contact information of the customer.

- Business Information: Include your business name, address, and relevant contact details.

- Transaction Information: List the products or services provided, including quantities and pricing.

- Payment Terms: Specify due dates, late fees, or discounts for early payment.

Step 2: Organize the Layout

- Header: Place your business and client information at the top of the document for easy identification.

- Itemized List: Ensure that each product or service is clearly described, with corresponding amounts, quantities, and prices.

- Total Calculation: Double-check the total amount to avoid errors in the final sum, including tax if applicable.

- Footer: Include any additional details such as payment methods, bank account information, or return policies.

Step 3: Review and Finalize

- Proofread: Ensure there are no errors in the details, especially numbers and dates.

- Format Consistently: Use a uniform font, size, and layout for a clean, professional appearance.

- Save and Share: Once everything is in place, save the document and share it with your client via email, postal mail, or another preferred method.

Where to Find Reliable Invoice Templates

When looking for professional documents to manage financial transactions, it is important to source them from trusted and reputable places. Accessing well-designed, customizable resources ensures that all essential details are included and formatted correctly. Various platforms offer these documents, making it easy to find the right option for your business needs.

Reliable sources provide a range of formats, from simple designs to more detailed layouts, so businesses can select the best match based on their requirements. Whether you prefer downloadable files or online services, there are numerous places where you can find high-quality options to use for your transactions.

Popular Sources for Downloadable Documents

- Online Platforms: Websites dedicated to business resources often provide a wide selection of ready-to-use documents. These platforms typically allow you to download files directly in different formats, ensuring flexibility for your specific needs.

- Accounting Software: Many accounting tools offer integrated options for creating and managing financial records. These are often customizable and tailored for businesses of various sizes.

- Microsoft Office and Google Docs: Both platforms offer templates for creating records. They are easy to customize and share, providing a seamless experience for businesses.

Things to Consider When Choosing a Source

- Reputation: Ensure the platform or software you are using is known for providing high-quality, reliable resources.

- Customization Options: Look for options that allow you to add your business branding, adjust layouts, and make edits quickly.

- Compatibility: Make sure the documents are compatible with the software or platform you’re using, whether it’s for digital storage or printing purposes.

Printing and Sending Your Invoices

Once your transaction record is ready, the next step is sharing it with your client in a professional manner. Whether you prefer to send it digitally or print a hard copy, it’s important to ensure the document is clearly legible and accurately reflects all the details. Different delivery methods can be chosen based on your business practices and client preferences.

Sending your documents electronically is convenient and allows for quick transactions, while printing provides a more formal approach, especially for clients who require physical copies. Regardless of the method, always double-check the content for accuracy before sending it to avoid any confusion later on.

Options for Sending Your Documents

| Method | Description | Advantages |

|---|---|---|

| Sending via email is the fastest method and allows for easy attachments. | Quick delivery, environmentally friendly, cost-effective. | |

| Postal Mail | Printing the record and mailing it is ideal for clients who prefer physical copies. | More formal, suitable for clients who require paper records. |

| Cloud Storage | Uploading to cloud services and sharing via a link can work for businesses with frequent transactions. | Easy access, secure, and easily retrievable by both parties. |

Whichever method you choose, remember to ensure the file format is compatible with the recipient’s system. Double-checking delivery details and ensuring your client receives it on time are crucial for maintaining a smooth transaction process.

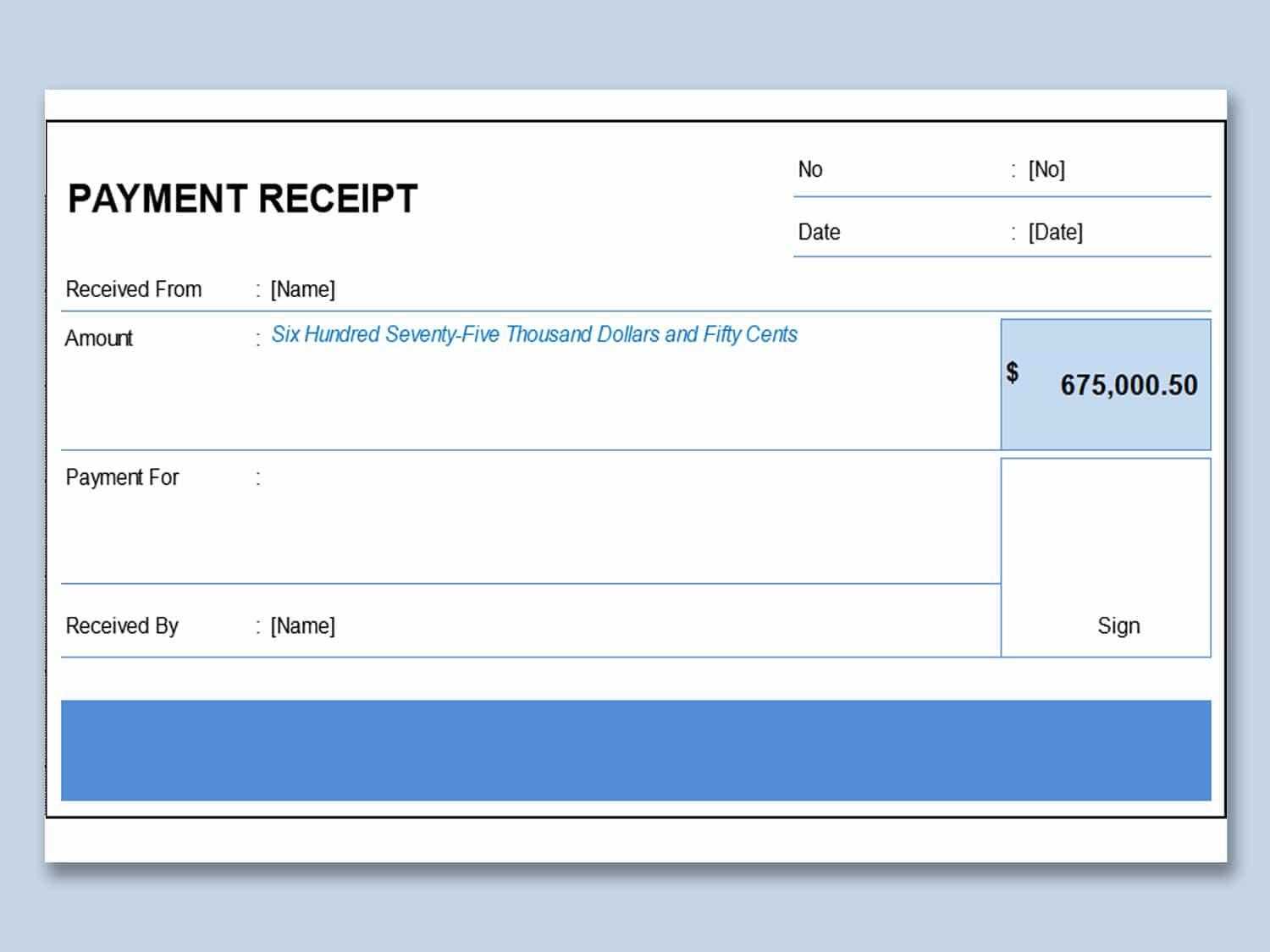

Common Features in Invoice Templates

When creating documents for financial transactions, certain elements are essential for providing clear and complete information to both parties involved. These features help ensure that all necessary details are included, making the document easy to understand and process. Whether you are designing a simple form or a more complex document, the following components are typically present to facilitate smooth transactions.

Commonly, these records will include sections for basic business details, transaction information, payment terms, and other important items. They are designed to provide transparency and ease of reference for both the sender and the recipient, allowing both parties to track and manage their finances effectively.

- Business Details: Includes your business name, address, contact information, and any relevant registration numbers.

- Client Information: The recipient’s name, address, and contact details should be clearly stated.

- Unique Identifier: A reference number for the transaction, which helps in organizing and tracking documents.

- Transaction Summary: A clear list of products or services provided, including descriptions, quantities, and individual prices.

- Total Amount: The sum of all charges, including applicable taxes or discounts.

- Payment Terms: Details on how and when payment is expected, including accepted payment methods and due dates.

- Additional Notes: Space for any terms, conditions, or additional information relevant to the transaction, such as return policies or warranties.

Free vs Paid Invoice Templates

When choosing resources to create professional financial documents, businesses often face the decision of whether to opt for no-cost options or invest in premium services. Each option offers unique benefits and drawbacks, which can impact the quality and functionality of the final product. Understanding the key differences between free and paid choices is essential for selecting the right option based on your business needs and budget.

While free resources may provide a basic, no-cost solution, they often come with limitations such as fewer customization options or a lack of support. On the other hand, paid services generally offer more advanced features, design options, and customer support. Below is a comparison of both options to help you determine which one is right for your business.

Comparison of Free and Paid Resources

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited options for adjusting layout and design. | Full flexibility with design, colors, and layout adjustments. |

| Design Quality | Basic or minimalistic designs, often less polished. | Professional, well-designed layouts with modern aesthetics. |

| Support | Minimal or no customer support. | Access to customer service, troubleshooting, and technical help. |

| Additional Features | May lack advanced features like tax calculation or integrated payment options. | Often includes advanced features, such as automatic tax calculations and payment gateways. |

| Updates | Rarely updated or maintained. | Regular updates, ensuring compatibility with the latest business practices. |

Ultimately, the choice between free and paid options depends on the complexity of your needs. If you’re running a small operation with basic requirements, free resources might be sufficient. However, larger businesses or those looking for more comprehensive features may find that investing in paid options provides greater long-term value and professionalism.

Best Practices for Professional Invoices

Creating well-structured and clear financial documents is essential for maintaining professionalism in business transactions. Ensuring that all necessary information is included in an organized manner helps to avoid confusion and promotes trust with clients. By adhering to best practices, businesses can streamline their billing process, minimize errors, and improve their cash flow management.

In this section, we will discuss the key principles that should guide the creation of any formal request for payment. These principles are designed to make your financial records easy to read, accurate, and complete, while also ensuring that they align with professional standards.

Key Elements of a Professional Document

- Clear Business Information: Always include your business name, address, contact details, and any registration numbers that are relevant.

- Client Details: Ensure the recipient’s information is accurate, including their business name, address, and contact information.

- Unique Identification Number: Use a unique reference number for each document to make tracking easier for both parties.

- Detailed Transaction Breakdown: List each item or service provided along with the quantities, unit prices, and total cost for each line item.

- Due Date and Payment Terms: Make the due date clear and include any specific payment terms, such as discounts for early payments or late fees for overdue balances.

Additional Tips for Clarity and Accuracy

- Formatting: Keep the document clean and easy to read, with adequate white space between sections and clearly defined headings.

- Tax Information: Clearly separate taxes from the total amount due, showing tax rates and calculations if applicable.

- Professional Language: Use polite, professional language and double-check the document for spelling and grammatical errors.

- Payment Instructions: Specify how payments should be made, including accepted methods such as bank transfer, credit card, or online payment portals.

By following these best practices, you can ensure that your financial documents are not only functional but also convey professionalism to your clients. A well-crafted request for payment is a reflection of your business’s commitment to accuracy, clarity, and customer satisfaction.

How to Include Taxes on Invoices

Including taxes correctly in financial documents is crucial for both compliance with regulations and maintaining transparency with clients. Accurately calculating and displaying taxes ensures that the total amount due is clear and prevents misunderstandings or disputes. Whether you’re dealing with sales tax, VAT, or other tax types, it’s essential to list them in a clear and organized manner.

In this section, we’ll discuss the key steps for including taxes on your financial requests, as well as best practices for ensuring that all necessary details are correctly presented. This process helps businesses stay in line with legal requirements while providing clients with an easy-to-understand breakdown of the charges.

Step-by-Step Guide to Tax Calculation

- Determine Applicable Tax Rates: Research and apply the correct tax rate based on the goods or services provided and your business’s location, as tax rates vary by jurisdiction.

- List Each Item’s Taxable Amount: If applicable, show the taxable amount for each item or service separately. For example, if only certain items are taxable, make sure to specify them.

- Calculate the Tax: Multiply the taxable amount by the appropriate tax rate to determine how much tax should be added to the total amount for each line item.

- Include a Tax Summary: In addition to listing the tax for each line item, it’s helpful to include a summary section that shows the total tax amount for the entire order.

Best Practices for Tax Inclusion

- Be Transparent: Make sure the tax rate and calculation are clearly visible so that clients can easily understand how the total was calculated.

- Separate Tax from Total Amount: It’s good practice to separate the tax amount from the subtotal and final total, so clients can easily see how much tax is being charged.

- Include Legal Information: If required by law, include any relevant tax identification numbers or references to tax laws in your financial documents.

- Keep Records for Tax Filing: Ensure that you maintain accurate records of the taxes charged for proper accounting and tax reporting purposes.

By following these steps and best practices, you can ensure that taxes are accurately reflected in your financial documents. This not only helps your business stay compliant with tax regulations but also fosters trust with clients by providing clear and transparent billing information.

Adding Payment Terms to Your Invoice

Clearly outlining payment expectations in your billing documents is essential for ensuring smooth transactions between you and your clients. Payment terms help set expectations regarding when and how payments should be made, which can reduce delays and avoid confusion. By providing clear guidelines, you can ensure timely payments and prevent potential disputes.

In this section, we will discuss the importance of including payment terms in your financial documents and provide tips on how to present them effectively. A well-defined set of terms will not only protect your business but also improve customer relationships by establishing a transparent payment process.

Essential Components of Payment Terms

- Due Date: Specify the exact date by which payment should be made. A clear due date helps to avoid ambiguity and encourages prompt payment.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, checks, credit cards, or online payment platforms.

- Late Fees: If applicable, state any penalties for late payments, such as a percentage of the total due or a fixed fee for each overdue day.

- Discounts for Early Payment: Consider offering a discount for clients who pay early. This can serve as an incentive for faster payments.

- Currency: Indicate the currency in which payments should be made to avoid any confusion, especially if you deal with international clients.

Best Practices for Presenting Payment Terms

- Positioning: Make sure your payment terms are prominently displayed on the document, preferably near the total amount due, so that they are easy to find and understand.

- Clarity: Use clear and concise language to avoid confusion. Terms like “Net 30” (payment due in 30 days) or “Due on receipt” should be easy to comprehend for clients.

- Consistency: Ensure that your payment terms remain consistent across all financial documents to avoid any misunderstandings with different clients.

- Communication: Before sending the document, consider discussing payment terms with your client to ensure that both parties are on the same page.

By clearly outlining payment terms in your billing documents, you create a sense of professionalism and set clear expectations for both you and your client. This simple step can help streamline the payment process and contribute to the financial health of your business.

Formatting Tips for Clear Invoices

Effective formatting is key to creating well-organized and easy-to-understand financial documents. A clean and structured layout helps ensure that all essential information is visible and accessible to your clients, reducing the chance of confusion or errors. Whether you are preparing a one-time bill or a recurring statement, following some basic design principles can greatly improve clarity.

In this section, we will explore some valuable formatting tips that can make your financial documents more professional and easier to read. With the right structure and attention to detail, you can create documents that not only convey information but also reflect the quality of your business.

1. Use a Consistent Layout

Maintaining a consistent format throughout your documents is crucial for creating a professional appearance. This includes using uniform font styles, sizes, and alignment. Here are some specific tips:

- Header Alignment: Place key information like the recipient’s name, address, and your business details in separate, clearly defined sections.

- Line Spacing: Use sufficient spacing between sections and lines to prevent the document from feeling crowded.

- Font Choices: Stick to simple, readable fonts like Arial or Times New Roman for a clean look.

2. Highlight Important Details

Make sure that critical information stands out to the reader. This includes total amounts, due dates, and payment terms. Use formatting tools like bold text, larger font sizes, or borders to draw attention to these elements.

- Total Amount Due: Ensure that the total is clearly marked, possibly with a larger font size or bold text.

- Due Date: Highlight the payment due date to avoid confusion and to encourage timely payment.

- Payment Methods: Make the payment options stand out by using bullet points or a table.

Why PDF Format is Ideal for Invoices

When preparing formal documents for billing or payment requests, choosing the right file format is crucial for both functionality and professionalism. A versatile, widely accepted format ensures that the document looks consistent across different devices and platforms. The benefits of using a particular file format go beyond aesthetics and play an important role in the security, accessibility, and ease of sharing such documents.

One of the most reliable formats for creating and sharing business documents is one that maintains the exact layout and appearance of the content. This ensures that all recipients, regardless of their operating system or software, will view the document in the intended format. Below are the reasons why this particular file type is considered an excellent choice for your billing needs:

1. Universal Compatibility

This format is compatible with nearly every operating system, ensuring that anyone can open it without the need for specialized software. Whether on a computer, tablet, or smartphone, the document retains its formatting, making it easily accessible to clients worldwide. The following table highlights the major operating systems that support this format:

Operating System Compatibility Windows Yes Mac OS Yes Linux Yes Android Yes iOS Yes 2. Preserved Formatting

One of the main advantages of this format is that it keeps the layout intact. Whether you’re using a complex design with tables, logos, or headers, this file format ensures that the final version looks exactly as intended on any device. There is no risk of text shifting or formatting errors, which can sometimes happen with other formats, ensuring a polished and professional appearance every time.

3. Security Features

When sharing sensitive financial details, it’s crucial to ensure the document is protected. This particular format allows users to easily add password protection, restrict editing capabilities, and prevent unauthorized access. This security feature gives users peace of mind when sending documents electronically.

4. Smaller File Size

Despite containing rich content such as images, tables, and detailed text, this format compresses files effectively without losing quality. Smaller file sizes are advantageous for email attachments and web storage, allowing for faster uploads and downloads.

Overall, using this format for business-related documents ensures clarity, security, and ease of access, making it the ideal choice for professional transactions. Its universal compatibility and robust features allow businesses to present documents confidently and efficiently to clients and partners alike.

How to Convert Word Files to PDF

Converting files to a widely used format is a common task when preparing documents for sharing or printing. This format ensures that the content appears the same across different platforms and devices, making it ideal for business and professional purposes. Converting documents from one format to another is a straightforward process and can be done using various methods, including built-in software options and online tools.

Below, we outline several methods for converting documents into the preferred format that ensures consistency and readability. Whether you’re using a desktop application or an online service, these options will help you achieve the desired outcome with ease.

1. Using Microsoft Office

One of the simplest ways to convert a document is through Microsoft Office, as it has built-in support for exporting files to the desired format. The process is straightforward:

- Open the document in Microsoft Office.

- Click on “File” in the top menu.

- Select “Save As” or “Export” depending on your version.

- Choose the “Save as type” dropdown and select the appropriate file format.

- Click “Save” to complete the conversion.

2. Using Google Docs

If you prefer working online, Google Docs offers an easy way to convert documents to the target format. Here’s how to do it:

- Upload the document to Google Drive and open it with Google Docs.

- Click on “File” in the top menu.

- Select “Download” from the options.

- Choose the format from the list of available file types.

3. Using Online Conversion Tools

If you don’t have access to a desktop application, there are several online tools that allow you to convert files quickly and for free. These platforms often support a wide variety of file formats, making the conversion process easy:

Tool Features Smallpdf Easy drag-and-drop interface, no software required, free for basic use ILovePDF Supports merging and editing, free with basic functions Online2PDF Supports multiple file conversions and compression options 4. Using Desktop Conversion Software

There are also third-party software solutions available for desktop users that can convert files with a higher level of customization. These tools often come with extra features such as batch conversion and additional security settings for sensitive files. Some popular desktop software includes:

- Adobe Acrobat Pro

- WPS Office

- Foxit Reader

Converting documents into a more universally accessible format ensures that they can be easily viewed, printed, or shared without any loss of formatting. Whether you choose a built-in method o