Free Invoice Template PDF for UK Businesses

Managing financial transactions efficiently is crucial for any business. Having the right tools to generate clear and professional records can save time and reduce errors. Whether you are a freelancer, small business owner, or large enterprise, using the right document format is key to maintaining smooth operations.

Choosing the right document structure for issuing payments and tracking orders can significantly impact your workflow. With customizable formats available, you can ensure that your records meet both your personal preferences and legal standards. These resources offer flexibility, allowing you to easily adjust details for each transaction.

Organizing financial details properly not only helps with better record-keeping but also enhances the professionalism of your business. With minimal effort, you can create accurate statements that reflect your company’s credibility, making communication with clients and partners much easier.

Free Invoice Template PDF UK Guide

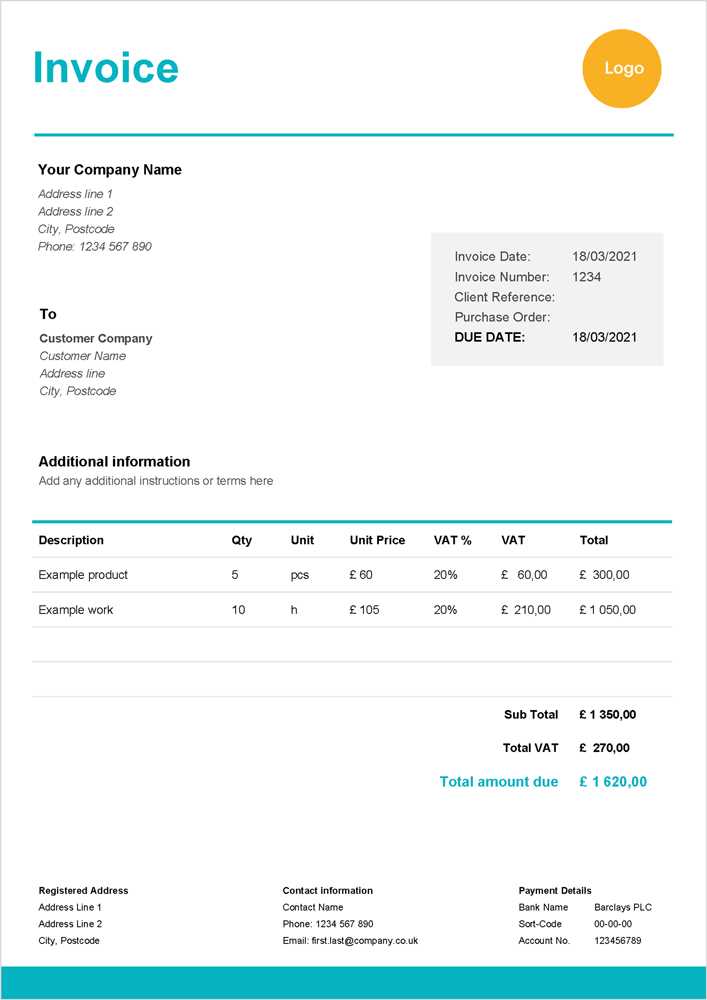

Creating professional documents for financial transactions is essential for businesses to maintain organization and clarity. Whether you’re a freelancer or a company, having access to editable resources that streamline the process of generating these documents can save significant time and effort. This guide will help you navigate through the best ways to use downloadable formats for your needs.

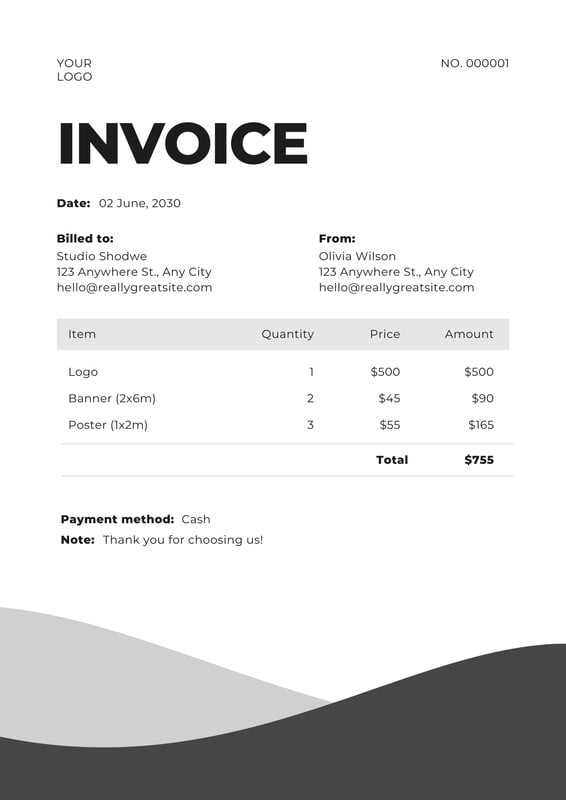

When selecting a suitable document structure for your business, consider the flexibility it provides. It should allow you to easily input necessary information, adjust for different clients, and ensure that all required details are included for compliance with local regulations. The key to efficiency is using a system that is both easy to modify and visually professional.

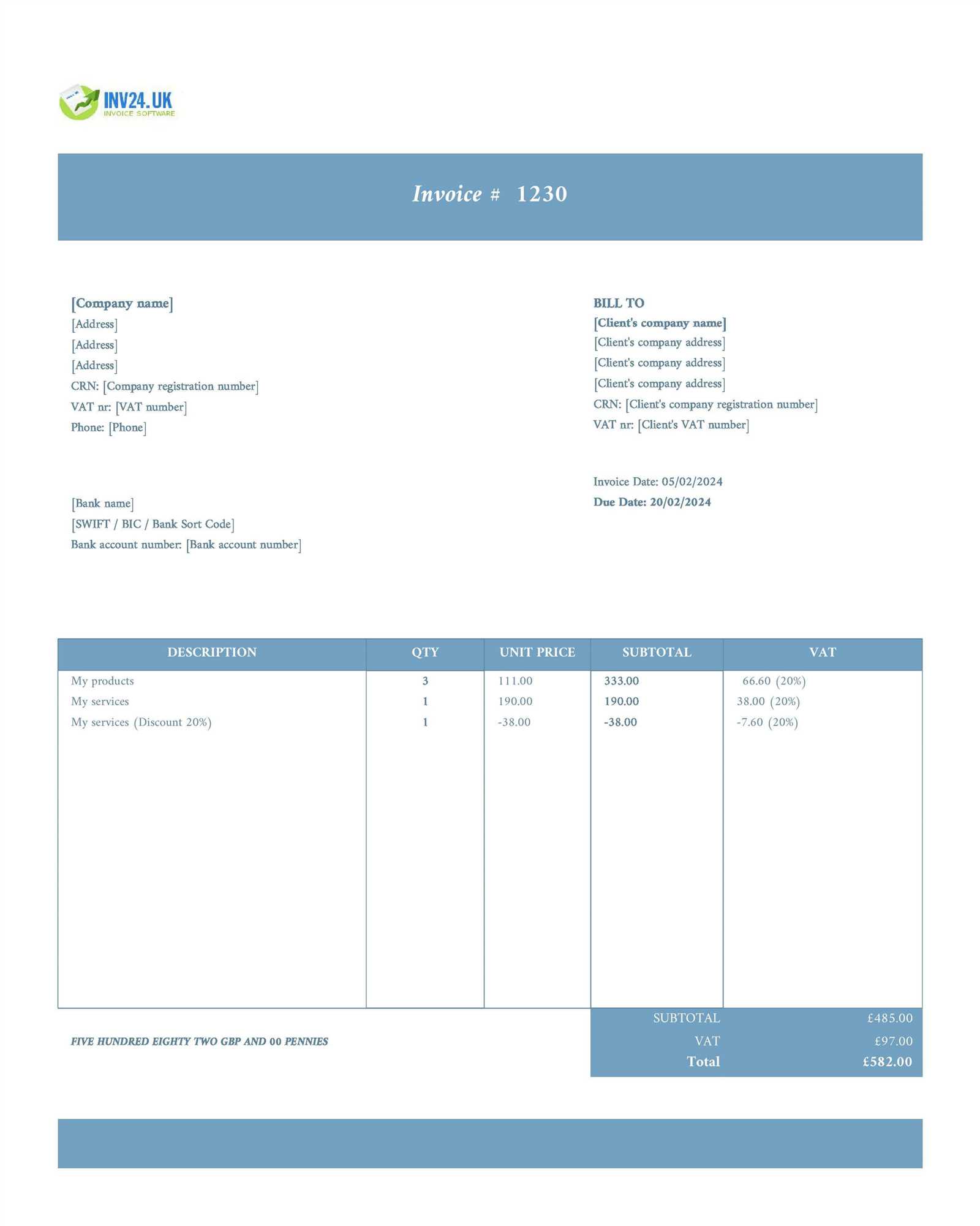

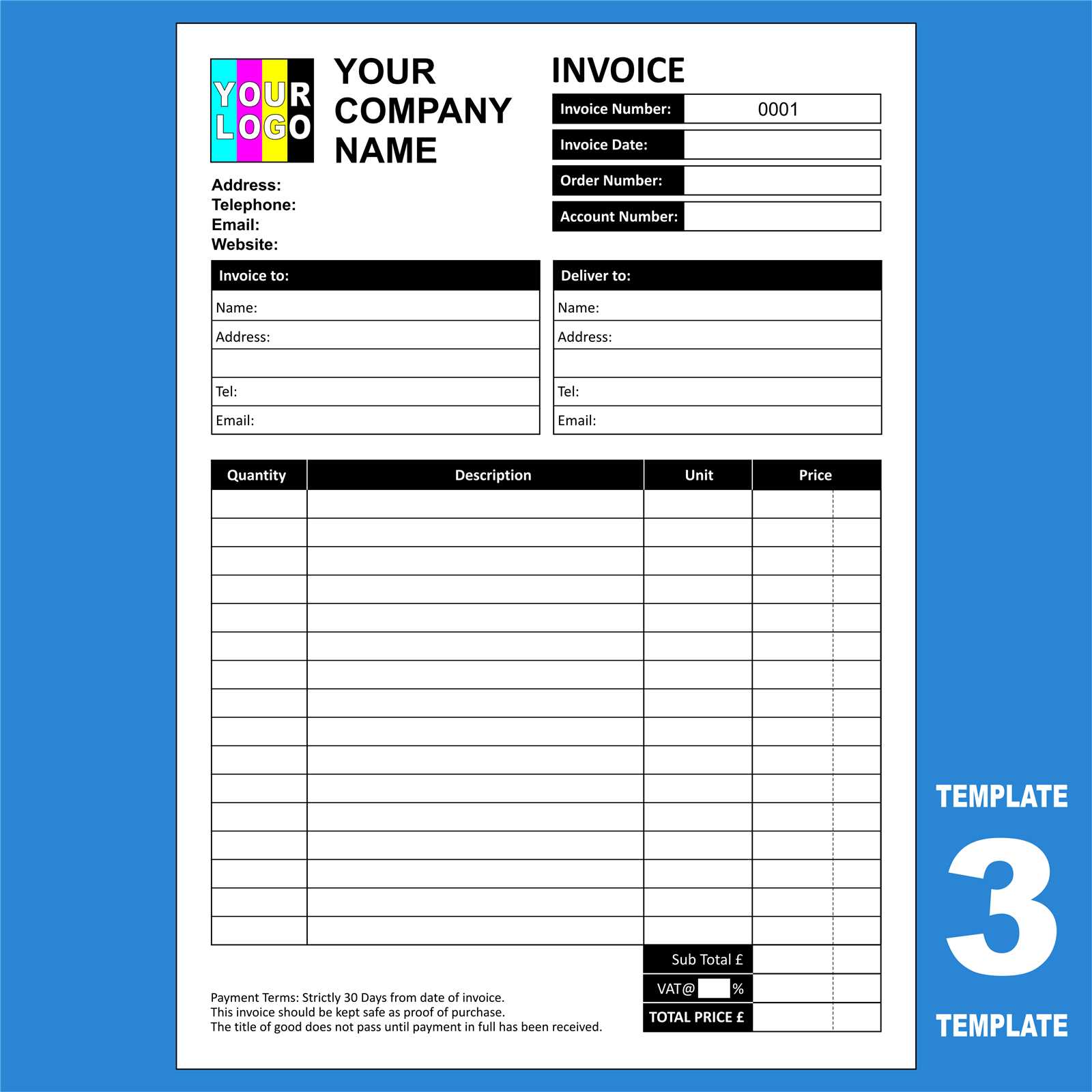

Here are the most important elements to look for when choosing an ideal document structure for your transactions:

| Element | Description |

|---|---|

| Header | Contains company name, address, and contact information |

| Transaction Details | Lists items or services provided, including quantities and pricing |

| Payment Terms | Includes due date, payment methods, and any applicable fees |

| Total Amount | Summarizes the overall amount due, including taxes and discounts |

| Footer | Notes any additional information such as terms of service or company policies |

By using such a structure, businesses can ensure that all important aspects of the transaction are properly recorded and communicated. This not only facilitates smoother operations but also ensures that payments are processed efficiently and professionally.

Why Use Free Invoice Templates

For any business, having a system in place for generating accurate financial records is essential. Using pre-designed formats for billing and payment tracking can simplify this process. These resources are widely available and allow you to focus on the core aspects of your business without worrying about formatting or legal compliance.

Here are some reasons why utilizing such resources is beneficial:

- Time-Saving: Pre-built structures eliminate the need to design new documents from scratch, allowing you to spend more time on business operations.

- Consistency: Using a standardized format ensures that every document follows the same structure, helping to maintain professionalism and clarity.

- Cost-Effective: There are no costs involved when using downloadable resources, making it an ideal solution for businesses with limited budgets.

- Customization: These formats can easily be adapted to suit the specific needs of your business, offering flexibility for different transaction types.

Additionally, utilizing these resources reduces the chances of making errors or missing important details. With all necessary fields pre-set, the likelihood of overlooking essential information is minimized, ensuring compliance with local laws and regulations.

In the long run, adopting a structured, efficient method of managing financial records can help streamline operations and support smooth business growth.

Benefits of PDF Format for Invoices

Using a digital format to create and share financial documents provides several advantages over traditional paper-based methods. Among the various digital formats, one stands out for its ability to preserve the integrity of the document, ensuring that it appears exactly as intended regardless of the device or software being used to view it.

Security and Professionalism

One of the key benefits of using a widely accepted digital format is the enhanced security it offers. Unlike editable file types, this format is not easily altered, ensuring that the details of each transaction remain intact. Additionally, the format allows for password protection and encryption, offering a level of confidentiality that physical copies cannot match.

Accessibility and Compatibility

Another significant advantage is the ease of access. This format can be opened on virtually any device without compatibility issues, whether on a smartphone, tablet, or desktop computer. This universal compatibility ensures that your documents can be shared and viewed without requiring the recipient to install specific software, making it an ideal choice for businesses dealing with clients and partners globally.

By using a digital format, you ensure that your records are both secure and easily accessible, streamlining communication and increasing efficiency in business operations.

How to Download an Invoice Template

Getting a professional document structure for financial transactions is easier than ever. Many websites offer simple and intuitive steps to download pre-designed formats, making it accessible for any business or individual. The process is straightforward and does not require any advanced skills or special software.

To begin, follow these simple steps:

- Step 1: Choose a trusted website that offers downloadable document formats suitable for your business needs.

- Step 2: Browse through the available options and select the one that best fits your requirements, considering factors like customization options and layout style.

- Step 3: Click the download button, and the file will be saved to your device in a universal format.

- Step 4: Open the file using any standard program, making edits as needed to include the necessary transaction details.

By following these steps, you can quickly obtain the perfect document structure and start using it for all your transactions, ensuring accuracy and consistency across all your business records.

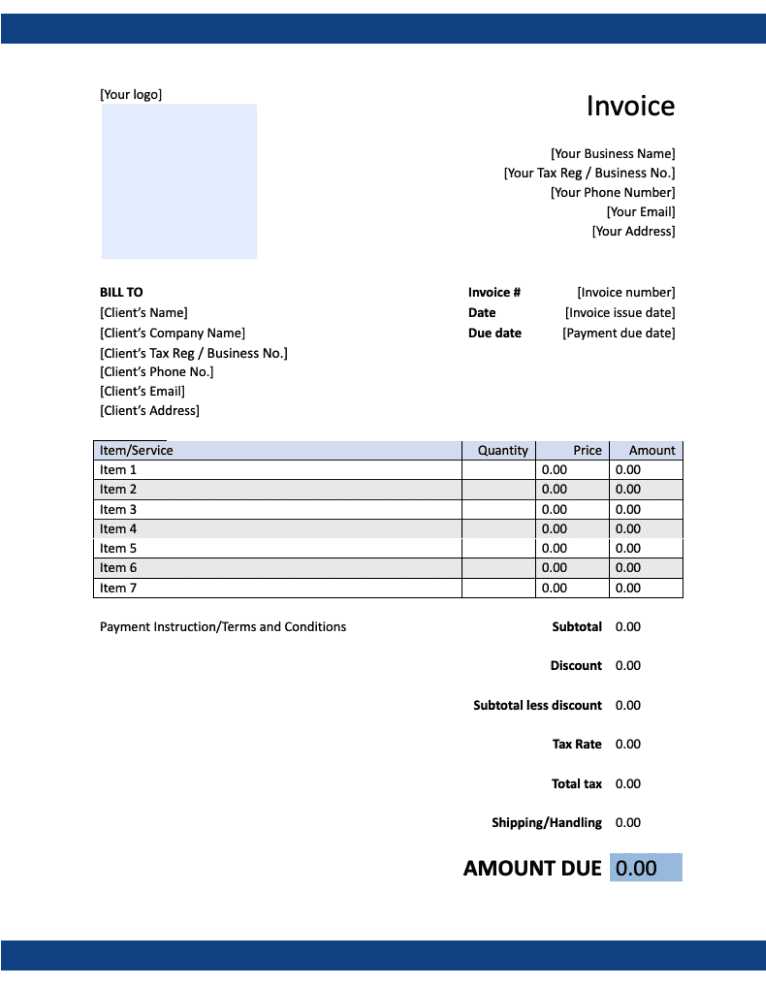

Customizing Your Invoice Template

Adjusting pre-designed documents to meet your business needs is a crucial step in creating professional records. Personalizing these resources allows you to reflect your branding, specific transaction requirements, and the unique structure of your operations. Customizing a document is straightforward and helps ensure that all essential details are included in a consistent and clear format.

Key Areas to Customize

When modifying a document structure, it’s important to focus on the following key elements:

- Business Information: Ensure your company name, logo, contact details, and any relevant legal information are prominently displayed.

- Transaction Details: Include the specific products or services provided, along with pricing, quantities, and any discounts offered.

- Payment Terms: Adjust payment methods, due dates, and any late fees or discounts for early payment according to your business policies.

- Visual Elements: Modify the color scheme and font style to match your brand’s aesthetic and ensure the document appears professional and cohesive.

Simple Tools for Customization

There are many tools available that make editing documents easy, even for beginners. Many software programs offer drag-and-drop features, allowing you to add or remove fields, change fonts, and adjust the layout. Additionally, online services often provide simple editing tools that allow for quick adjustments before saving or sending the document.

By making these changes, you can create a personalized and efficient resource that suits your business needs while maintaining a professional appearance for your clients and partners.

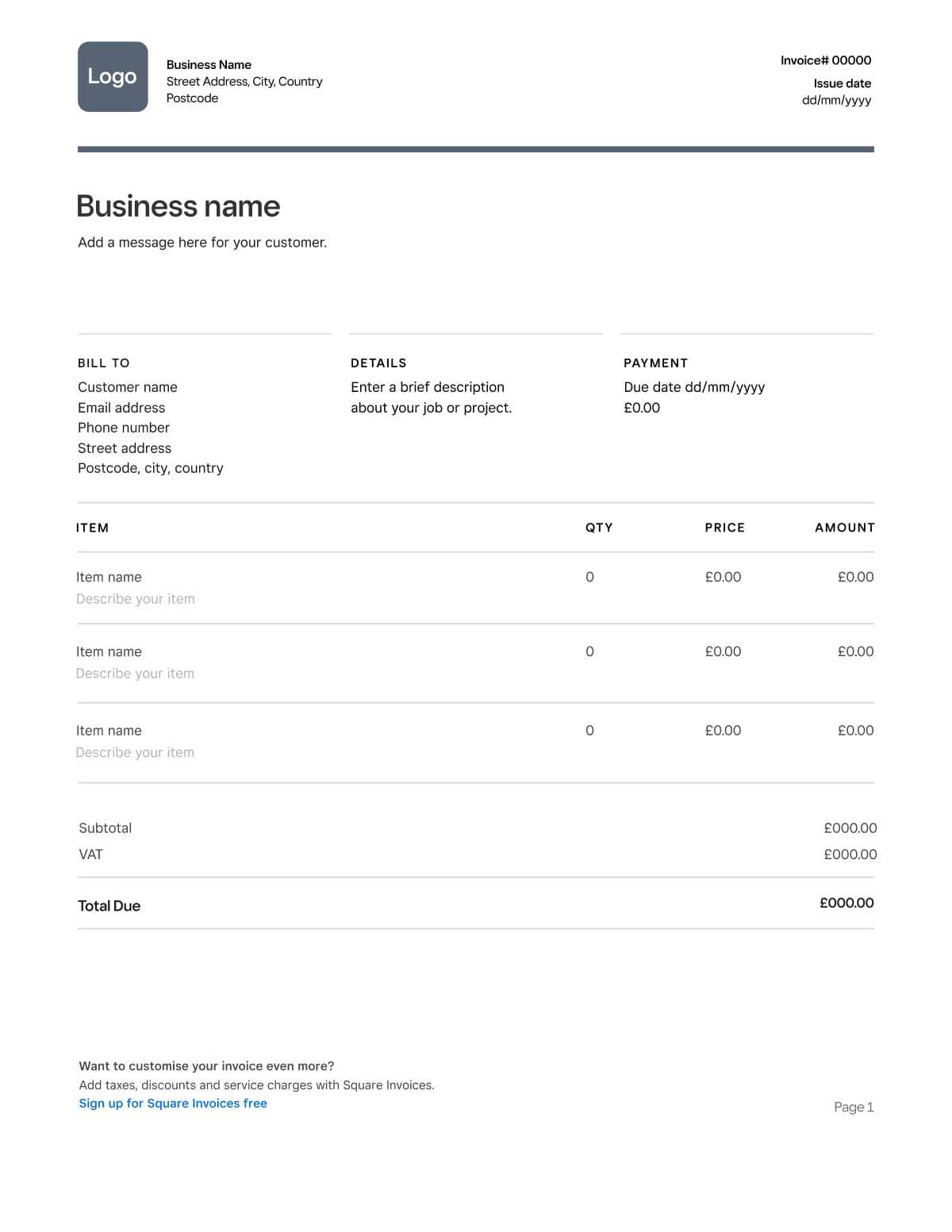

Essential Information to Include on an Invoice

To ensure clarity and avoid misunderstandings, it’s essential that every financial record contains all the necessary details. A well-structured document should provide both the sender and recipient with a clear understanding of the transaction. This includes identifying the parties involved, listing the services or products provided, and specifying payment terms.

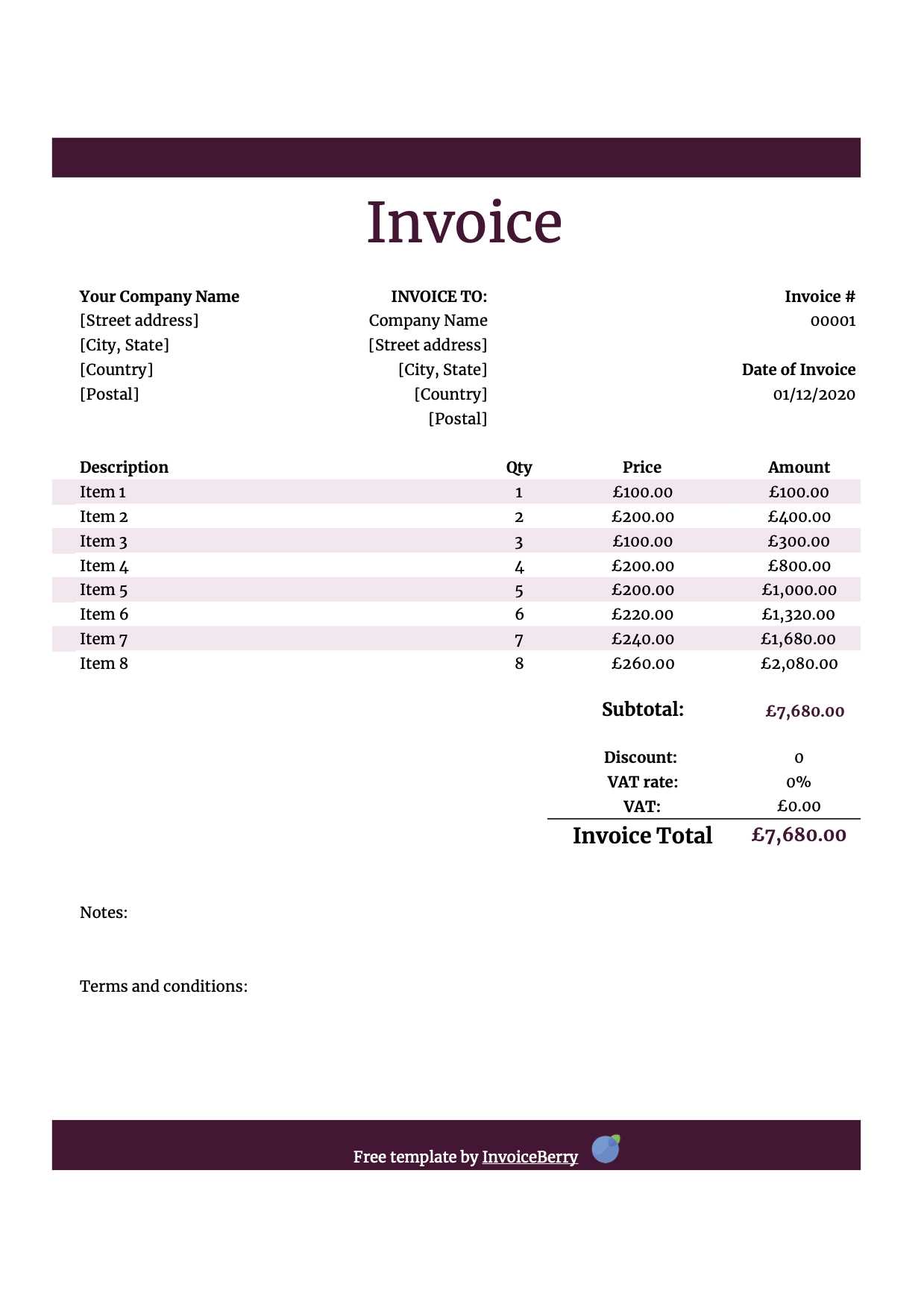

Here are the key elements that should always be included:

| Information | Description |

|---|---|

| Seller and Buyer Details | Names, addresses, and contact information for both parties involved. |

| Unique Identifier | A unique reference number or ID for the transaction, ensuring it can be easily tracked. |

| Transaction Date | The date when the goods or services were provided or completed. |

| List of Products/Services | Clear descriptions of the items or services provided, including quantities and unit prices. |

| Total Amount Due | The overall amount for the transaction, including taxes, discounts, and additional fees. |

| Payment Terms | Details about payment methods, due date, and any applicable late fees or early payment discounts. |

Including all these elements ensures that the transaction is fully documented and easily understandable by all parties. It helps to avoid confusion and provides legal protection in case of disputes.

Common Mistakes to Avoid in Invoices

When creating documents for financial transactions, accuracy is crucial. Small errors can lead to delays in payments, misunderstandings with clients, or even legal issues. Avoiding common mistakes ensures that your records are professional, clear, and effective in securing timely payments.

Here are some of the most frequent errors to watch out for:

- Incorrect or Missing Contact Details – Failing to include accurate names, addresses, and contact information for both parties can lead to confusion or miscommunication.

- Missing Unique Reference Number – Not assigning a unique reference number to each document can cause difficulties in tracking transactions and may lead to lost payments or duplicate entries.

- Incorrect Calculation of Amounts – Always double-check the math, including adding up product prices, taxes, and any additional charges. Errors in totaling amounts can delay payment processing and damage your credibility.

- Not Specifying Payment Terms Clearly – Failing to outline payment methods, due dates, and any late fees or discounts can create confusion and lead to delayed payments.

- Unclear Descriptions of Goods or Services – Ambiguous or vague descriptions of what was provided can lead to disputes with clients. Be sure to detail the items or services clearly, including quantities, unit prices, and any additional specifications.

By being mindful of these common pitfalls, you can ensure that your records are accurate, professional, and help you maintain positive relationships with your clients. Taking extra care with details helps you avoid unnecessary complications and enhances your reputation for reliability and precision.

How to Print Your Invoice Template

Once you have customized and finalized your financial document, the next step is to print it for physical records or to send it to clients. Printing the document correctly ensures that all information is clear and readable, and that it maintains a professional appearance when viewed by others.

Follow these simple steps to print your completed document:

- Step 1: Open the file in a compatible program or viewer that supports the format you’ve chosen.

- Step 2: Ensure that all details, including text, numbers, and layout, appear as intended. If any adjustments are needed, make them before printing.

- Step 3: Choose the ‘Print’ option from the file menu. Review the print settings, such as page orientation (portrait or landscape) and paper size.

- Step 4: Select the printer you wish to use and ensure it is connected and ready to print. Adjust any additional print settings if necessary (e.g., color, quality).

- Step 5: Click ‘Print’ to send the document to the printer. After printing, review the hard copy for accuracy and clarity before sending it to your client.

By following these steps, you can ensure that your printed document is professional, legible, and ready for distribution. Proper printing is essential for maintaining a high level of professionalism in your business operations.

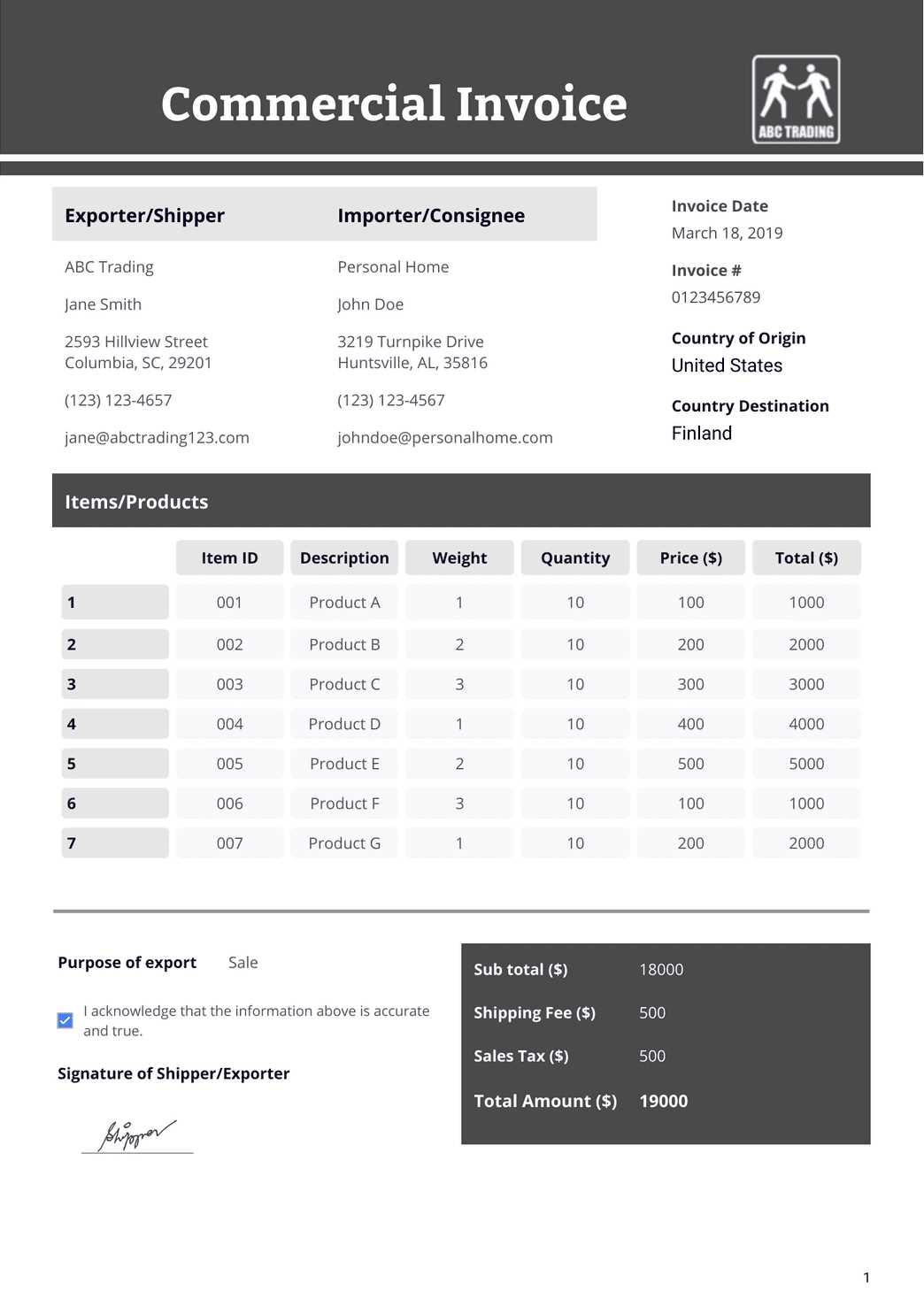

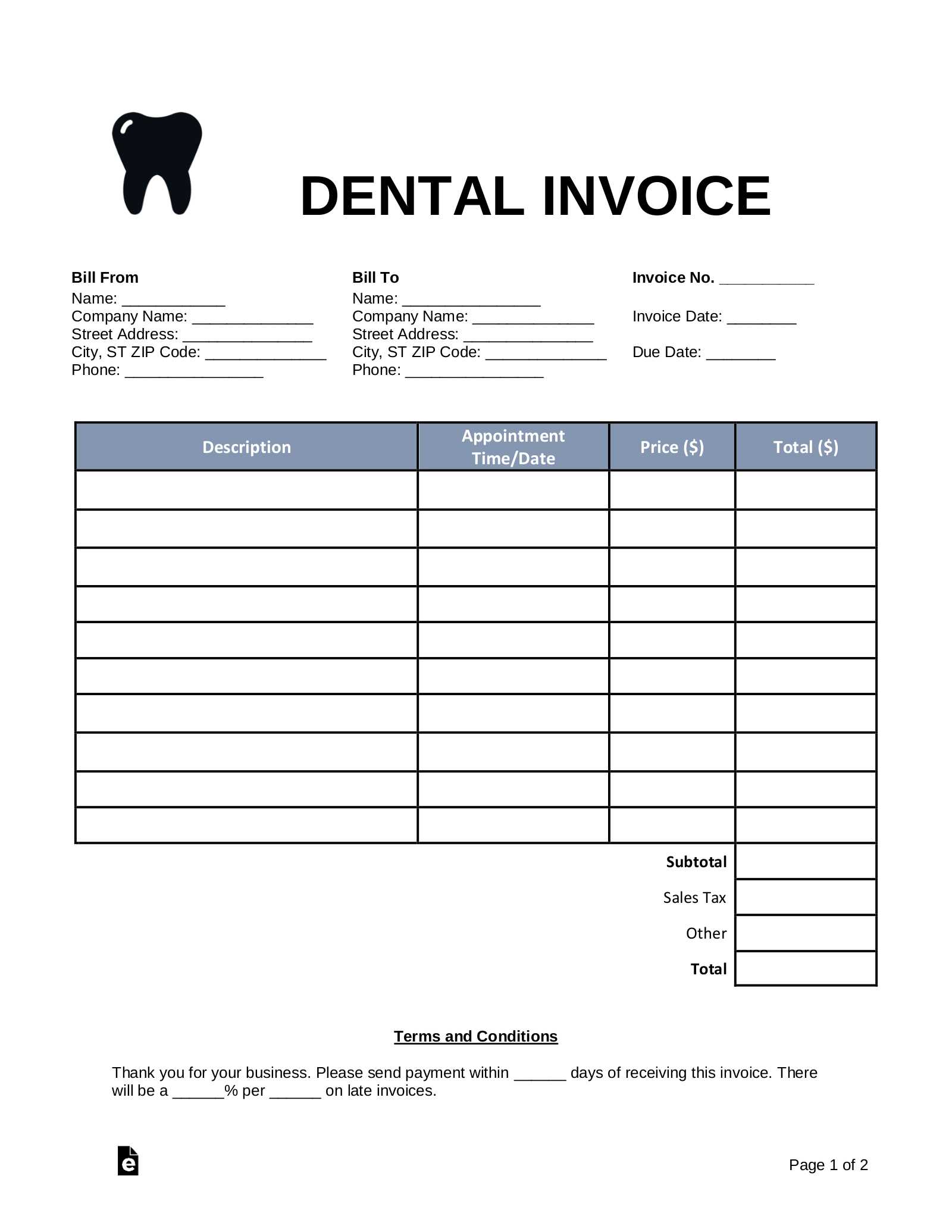

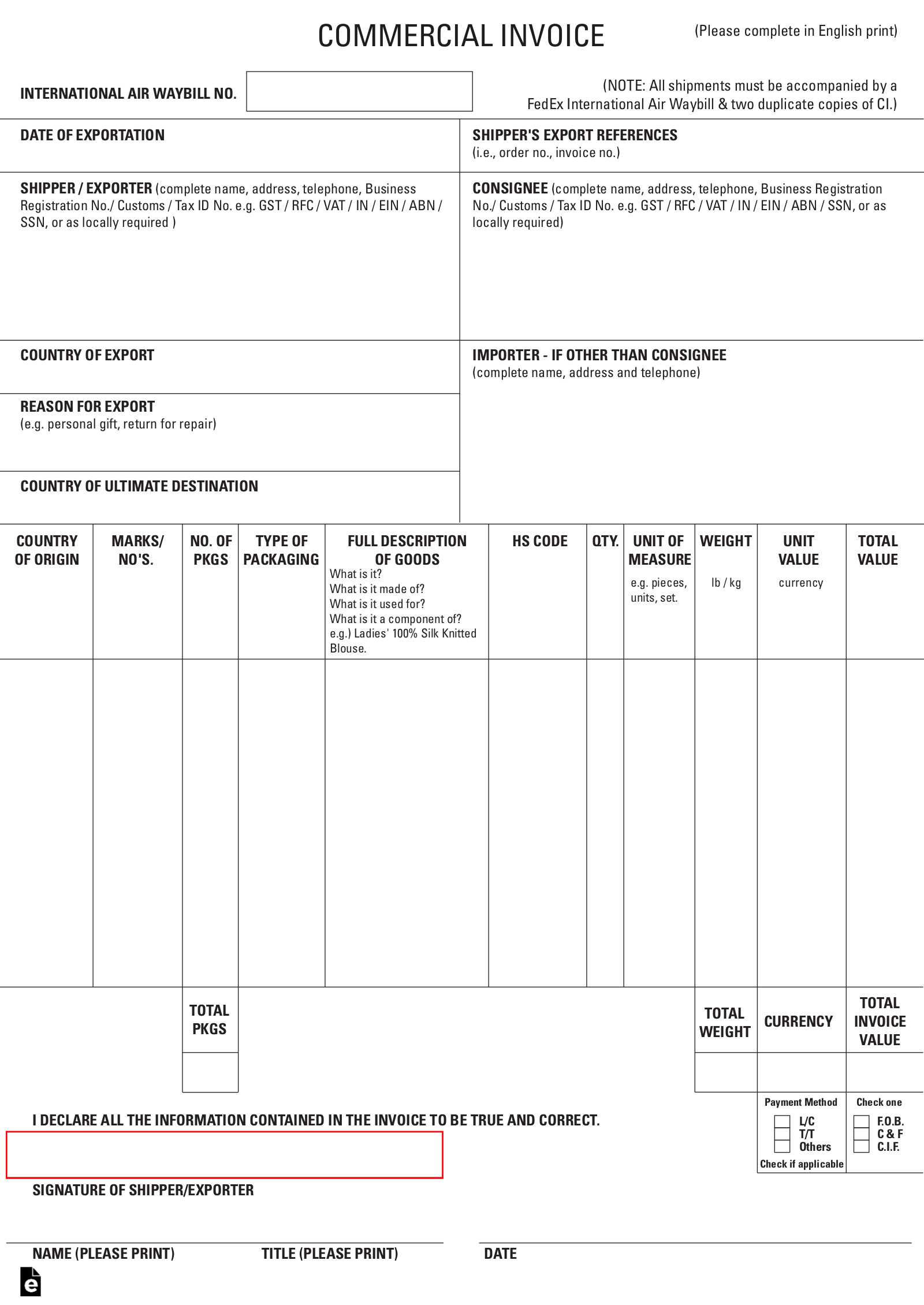

Invoice Templates for Different Industries

Every industry has unique requirements when it comes to documenting financial transactions. Customizing a document to meet the specific needs of your sector ensures that you include all necessary information while maintaining professionalism. Tailored formats help to improve efficiency, ensure accuracy, and provide a clear understanding between businesses and clients.

Here’s a breakdown of industry-specific elements you may need to include in your transaction records:

- Freelance & Consulting: For service-based businesses, include sections for hourly rates, project milestones, or retainer fees.

- Retail & E-commerce: Include product descriptions, quantities, unit prices, and shipping charges, ensuring everything is clearly itemized.

- Construction & Trades: Include detailed labor costs, material costs, project phases, and work completion timelines.

- Healthcare: List medical services, patient details, insurance information, and any co-pays or outstanding balances.

- Technology & Software Development: Include licensing fees, subscription periods, and any custom development charges or support services provided.

By using a structure that aligns with your industry’s requirements, you ensure that your documentation meets legal standards, client expectations, and helps streamline the payment process. Tailoring your documents can help prevent misunderstandings and improve overall communication.

Legal Requirements for UK Invoices

In the UK, proper documentation of financial transactions is not just good practice–it’s a legal obligation. Businesses must adhere to certain rules to ensure their records meet tax and regulatory requirements. These guidelines help avoid disputes, ensure accurate tax reporting, and maintain professional standards.

Here are the key legal elements that must be included in your financial documents:

- Unique Document Number: Every document should have a unique reference number for identification and tracking purposes.

- Issue Date: The date when the record is generated is crucial for tax reporting and payment tracking.

- Seller’s Details: Business name, address, and VAT number (if applicable) must be clearly stated to ensure transparency.

- Buyer’s Information: The recipient’s name and address should also be included, especially for business-to-business transactions.

- Clear Description of Goods or Services: A detailed list of products or services provided, including quantities and prices, ensures clarity.

- VAT Information: If applicable, the VAT amount charged should be clearly separated, with the total amount indicated for both before and after VAT.

- Payment Terms: Specify the payment due date and accepted payment methods, as well as any applicable late fees.

By ensuring that these legal requirements are met, businesses can avoid potential fines and confusion. Accurate and compliant financial records not only meet legal standards but also build trust with clients and partners.

Saving and Organizing Your Invoices

Properly storing and organizing your financial records is essential for maintaining smooth operations and ensuring compliance with tax regulations. A well-organized filing system allows for easy access when needed, reduces the risk of losing important documents, and simplifies auditing processes. It also ensures you can respond quickly to any client queries or disputes regarding past transactions.

Here are some effective ways to store and categorize your documents:

- Digital Storage: Save your records in a secure cloud storage or on a dedicated hard drive. This method offers easy access, reduces paper clutter, and provides backup in case of physical damage.

- Use Folders and Subfolders: Organize your files by client, date, or project. This helps to locate specific documents quickly when required.

- Backup Regularly: Ensure that you back up your digital files periodically to prevent loss in case of technical issues or hardware failure.

- Naming Conventions: Use a consistent and clear naming system for your documents, such as including the client name, date, and reference number, to make searching easier.

- Physical Copies: If you need to keep hard copies, store them in labeled folders or filing cabinets. Keep them organized by year or client for easy retrieval.

Organizing your financial documents not only saves time but also ensures you can handle any financial review or audit efficiently. Whether digitally or physically, a consistent and systematic approach to filing will help your business run smoothly.

How to Send Invoices via Email

Sending financial documents through email is a fast and efficient way to ensure your clients receive the necessary paperwork for payment. Email provides a convenient method of communication and allows for easy tracking of transactions. By following best practices, you can ensure that your messages are professional, clear, and secure.

Steps to Email Your Documents

- Step 1: Prepare the Document: Make sure all the details in your financial document are accurate and complete. Check that it includes the necessary information such as services provided, prices, payment terms, and contact information.

- Step 2: Save the Document: Save your finalized document in an easily accessible format, such as a Word or Excel file, or as a secure file like a .zip if necessary for large files.

- Step 3: Compose the Email: In the subject line, mention the document type and include the client’s reference number or the job/project name for clarity. In the body of the email, politely inform the recipient that the document is attached and that you look forward to receiving payment as per the agreed terms.

Best Practices for Sending Financial Documents

- Keep the Email Professional: Maintain a courteous and formal tone in your message. Avoid using overly casual language to ensure a professional impression.

- Use Clear Attachments: Attach the finalized document to the email, and make sure the file is named appropriately (e.g., “CompanyName_Invoice_12345”).

- Send a Test Email: Before sending to your client, send a test email to yourself to ensure the attachment is accessible and the email formatting is correct.

- Set a Reminder: After sending the document, set a reminder to follow up if the payment is not received by the due date.

By following these steps and guidelines, you can ensure that your financial communications are efficient, secure, and clear, helping to maintain a positive relationship with your clients.

Tracking Paid and Unpaid Invoices

Monitoring the status of payments is crucial for maintaining cash flow and financial stability in any business. Keeping track of which transactions have been settled and which remain outstanding ensures that you can follow up with clients in a timely manner. By systematically organizing this information, you can avoid confusion, reduce late payments, and improve your business’s financial management.

Steps for Effective Tracking

- Step 1: Use a Tracking System: Create a dedicated tracking sheet or software where you can mark the status of each transaction–whether paid, unpaid, or overdue. This will give you an overview of your financial status at a glance.

- Step 2: Record Payment Dates: For each completed transaction, note the date the payment was received. This ensures that you can easily reference when payments were made and can identify overdue amounts.

- Step 3: Monitor Due Dates: Keep track of the payment terms for each transaction. Be sure to mark when a payment is overdue, so you can act quickly to remind your clients.

Best Practices for Managing Unpaid Transactions

- Follow Up Promptly: As soon as a payment deadline passes, send a polite reminder to the client. Include clear details about the outstanding amount and any late fees that may apply.

- Keep Communication Professional: Always maintain a courteous and professional tone in your follow-up messages. Keep track of all communication in case you need to reference it later.

- Consider Offering Payment Options: If you frequently encounter late payments, consider offering flexible payment options, such as installment plans, to make it easier for clients to settle their balance.

By effectively tracking paid and unpaid transactions, you can maintain a steady cash flow, reduce the risk of late payments, and improve your financial record-keeping. Staying organized and proactive in your approach will help ensure the continued success of your business.

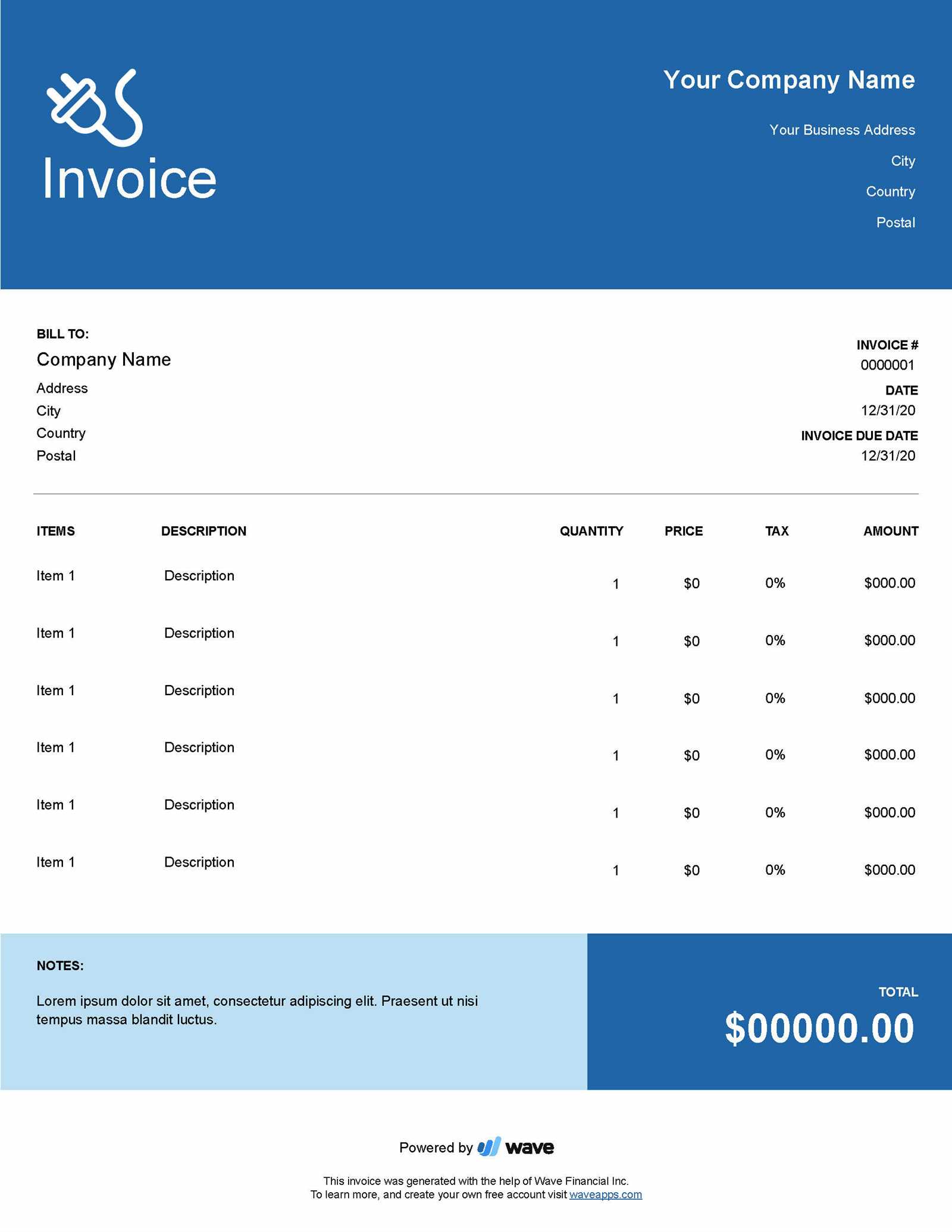

Free Online Tools for Invoice Creation

There are numerous online platforms that allow businesses to generate professional documents for billing purposes quickly and easily. These tools help streamline the process of creating detailed financial statements, ensuring they are properly formatted and include all necessary information. Whether you’re a freelancer or a small business owner, using these online resources can save time and effort while maintaining professionalism.

Benefits of Using Online Tools

- Easy to Use: Most online platforms are user-friendly, allowing you to create accurate documents without the need for advanced software skills.

- Customizable Designs: You can customize your documents to match your business’s branding, including adding logos, adjusting color schemes, and selecting the layout that best suits your needs.

- Quick and Efficient: Online tools typically offer pre-built fields and templates that make it faster to enter necessary information and generate your document.

- Cloud-Based: Many of these platforms allow you to store your documents online, ensuring you can access them from anywhere and reduce the risk of data loss.

Top Online Tools to Consider

- Tool 1: Simple Invoice Generator – An easy-to-use tool that allows for quick creation of professional documents with minimal effort.

- Tool 2: Zoho Invoice – Offers a robust free plan with features like time tracking and automated reminders for payment due dates.

- Tool 3: Wave – A comprehensive online tool designed for small businesses, offering features like expense tracking in addition to billing creation.

- Tool 4: PayPal Invoicing – A widely recognized platform with an intuitive interface and the ability to send documents directly through email or shareable links.

Using these online resources can significantly simplify the document creation process, save time, and improve the overall efficiency of your business’s billing procedures.

When to Update Your Invoice Template

Regular updates to your billing documents are essential for maintaining accuracy and compliance with changing regulations or business needs. Whether you’re adjusting to new legal requirements, changing your pricing structure, or rebranding your business, updating your financial documents ensures they remain relevant and professional. Knowing when and how to update these documents can improve your workflow and prevent potential issues down the road.

Key Reasons to Update Your Billing Documents

- Change in Business Information: If your business name, contact details, or bank information has changed, updating your documents is crucial for maintaining clear communication with clients.

- Legal or Tax Requirements: Regulations may change over time, so it’s important to adjust your billing documents to reflect new tax rates, legal obligations, or industry-specific standards.

- New Pricing Models: If you have revised your pricing or introduced new products or services, ensure your documents reflect these updates for clarity and transparency with clients.

- Improved Branding: As your business evolves, refreshing your document layout to align with your brand identity can create a more cohesive and professional image.

How Often Should You Review Your Documents?

- Annually: It’s a good practice to review your documents at least once a year to ensure compliance with any new tax or legal changes.

- After Major Business Changes: Update your documents immediately after any significant changes to your business structure, services, or branding.

- When You Introduce New Features: If you add new payment methods or services, update your document layout and details to reflect these options.

By staying proactive in updating your financial documents, you ensure that your billing process remains smooth, compliant, and aligned with your business’s current practices.

Why Choose Free Over Paid Templates

Many businesses are faced with the decision of whether to use a paid or a cost-free option when selecting documents for financial transactions. While paid solutions may seem appealing due to additional features or advanced customization, free options often meet all the essential needs for most small businesses or individuals. Choosing no-cost documents can provide significant benefits without compromising on professionalism or functionality.

Benefits of Using No-Cost Documents

- Cost Efficiency: The most obvious advantage of opting for no-cost documents is the financial savings. Small businesses, startups, and freelancers can significantly reduce operational costs by avoiding unnecessary expenses for templates that may not offer a considerable return on investment.

- Ease of Access: Free options are typically accessible to everyone with little to no barriers, offering a simple and quick solution. This is especially valuable for businesses that need to start operating immediately without waiting for complex setups or payments.

- Basic Features Sufficient for Most Needs: For many businesses, the basic features offered by free documents are more than enough to handle day-to-day billing and record-keeping needs. They often include customizable fields, simple layouts, and standard functionality suitable for common transactions.

- No Ongoing Subscription Fees: Unlike paid solutions that often require monthly or annual fees, free documents do not involve any recurring charges, ensuring that your business does not incur ongoing costs for something that can be managed efficiently without additional spending.

Considerations When Choosing Free Solutions

- Customization Limits: Free options may not offer the same level of customization as paid ones, but many still allow for basic modifications such as logo insertion, field changes, and layout adjustments.

- Security Features: While most free documents are safe to use, it’s important to choose reputable sources to ensure that your financial data is protected from potential security risks.

- Scalability: Free documents are great for small-scale operations, but as your business grows, you may need more advanced features or integrations, which could lead you to explore paid options in the future.

Overall, selecting no-cost documents is a practical and efficient choice for businesses looking to manage their billing and records without unnecessary expe