Free Invoice Template PDF for Simple and Professional Billing

Managing financial transactions efficiently is crucial for any business, whether small or large. One of the key elements in this process is the creation of clear, professional records that outline the services provided or products sold. Having an organized way to communicate payment details helps ensure smooth operations and fosters trust with clients. However, crafting these documents from scratch can be time-consuming and prone to error.

By using pre-designed files, businesses can easily streamline their billing process. These customizable options provide a hassle-free solution to creating professional records, saving time while maintaining accuracy. Such tools are especially useful for freelancers, small business owners, and anyone looking to maintain a consistent approach to managing payments. With just a few simple adjustments, these documents can be tailored to fit specific needs, providing a clear summary of transactions.

Whether you’re just starting out or looking to refine your current system, having access to reliable resources can significantly improve the efficiency of your financial operations. This guide will walk you through the advantages of using ready-made resources for your billing needs and how to implement them seamlessly into your business practices.

Free Invoice Template PDF for Easy Use

Creating well-structured documents for business transactions is essential for maintaining professionalism and clarity. Having a ready-made solution can simplify the process, ensuring that all necessary information is included without unnecessary effort. By using a pre-designed resource, you can save valuable time and focus more on your core activities, knowing that your financial documents are accurate and polished.

These ready-to-use files are designed with simplicity in mind, allowing anyone to generate essential paperwork quickly. With just a few customizations, you can insert client details, services rendered, and payment terms. The intuitive structure ensures that no critical element is overlooked, making it an ideal choice for businesses of any size.

Moreover, the ability to easily access and edit these documents makes them incredibly versatile. Whether you’re working from home, on the go, or in the office, you can create and send professional-looking records within minutes. This approach minimizes administrative burden and helps maintain a streamlined workflow, contributing to overall efficiency.

Benefits of Using PDF Invoice Templates

Utilizing pre-designed documents for financial transactions offers several advantages that streamline the billing process. These solutions are efficient, saving time while ensuring accuracy and consistency in your business communications. By relying on a standardized structure, you eliminate the guesswork involved in creating documents from scratch, leading to more reliable and professional results.

Consistency and Professionalism

One of the most notable benefits is the consistent look and feel of your paperwork. When using pre-made resources, every document follows a uniform layout, which not only reinforces your brand identity but also ensures all necessary information is presented clearly. This level of professionalism can improve your client relationships and convey a sense of reliability and attention to detail.

Ease of Customization and Use

Another key benefit is the ease of modification. These files are designed to be user-friendly, allowing you to quickly update details such as payment terms, services rendered, and customer information. With minimal effort, you can tailor each document to meet specific transaction requirements, making the entire process faster and more efficient.

How to Download a Free Invoice PDF

Downloading a ready-made document for billing purposes is a quick and simple process that can save you time and effort. There are many resources available online that allow you to access these professional files with just a few clicks. Once downloaded, you can easily customize the content to suit your specific needs and immediately start using it for your transactions.

To begin, locate a trusted website that offers downloadable files suitable for business record-keeping. After selecting the document you want, simply follow the on-screen instructions to complete the download. Most platforms offer files in a universal format that can be accessed from various devices, ensuring flexibility in how and where you work.

Once the document is downloaded, open it using your preferred software to make any necessary adjustments, such as entering client information or payment terms. Ensure that you save your customized version in a secure location for future use, so you can access it whenever needed without starting from scratch.

Top Features of Free Invoice Templates

When selecting a pre-designed document for billing, it’s important to understand the features that make these resources effective and easy to use. A well-constructed file can help streamline your financial processes while maintaining a professional appearance. Below are some of the top features that make these files highly beneficial for businesses and individuals alike:

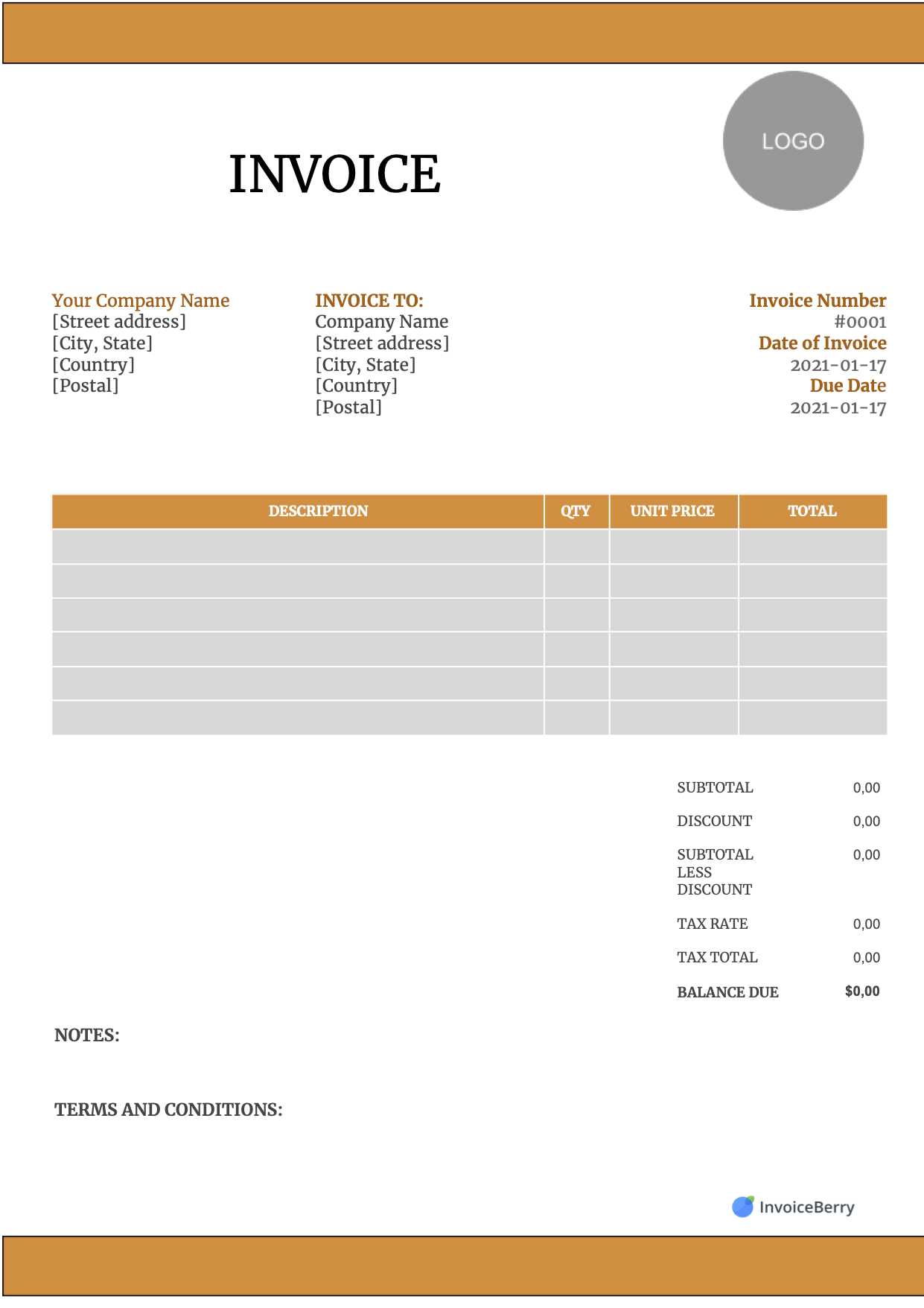

- Customizable Fields: These files typically come with editable sections for client information, service descriptions, and payment terms, allowing you to tailor each document to your specific needs.

- Professional Design: The layout is designed to give a polished and formal appearance, which helps instill confidence and reliability in your business communications.

- Clear Structure: A logical flow of information ensures that no key details are overlooked, making the document easy to read and understand for both parties involved.

- Cross-Device Compatibility: Most of these documents are accessible and editable across multiple devices, making them convenient to work with at home, in the office, or on the go.

- Easy-to-Fill Sections: Pre-set fields make it simple to input specific details, reducing the time spent on manual entry and minimizing the chance of errors.

- Consistency: Using the same design for all records ensures that your financial documents have a consistent, branded look, reinforcing professionalism in every transaction.

These features combine to make pre-made billing documents an invaluable tool for any business looking to maintain efficiency and professionalism in their financial dealings.

Customizing Your PDF Invoice Template

Personalizing a pre-designed document for billing purposes is a simple yet effective way to ensure it fits your specific business needs. By making a few adjustments to the layout and content, you can transform a generic record into a customized tool that reflects your brand identity and captures all the essential transaction details. This customization process is quick and easy, allowing you to create tailored records without starting from scratch.

Start by entering essential details, such as your company name, address, and contact information. Custom fields enable you to add the client’s name, the services rendered, and the agreed-upon payment terms. The flexibility of these resources allows you to make modifications that suit both one-time transactions and recurring billing, ensuring you have the right setup for each unique situation.

In addition to basic information, you can adjust design elements like fonts, colors, and logos to match your branding. This level of personalization not only improves the professional appearance of your documents but also reinforces your company’s identity with every transaction. Keep in mind that maintaining a clear and easy-to-read layout is essential, so avoid overcomplicating the design with too many elements.

Once customized, your document is ready to be saved and sent, offering you a fast and efficient way to manage payments while keeping everything consistent and professional.

Why PDF is the Best Format for Invoices

When it comes to business documents, especially those involving transactions, choosing the right file type is essential. Certain formats offer better compatibility, security, and ease of use than others, and one stands out as particularly effective for maintaining consistency and professionalism. The versatility and reliability of this format make it an ideal choice for businesses looking to streamline their billing process.

Universal Compatibility

One of the major advantages of using this file type is its universal compatibility across all devices and operating systems. Whether you’re working on a PC, Mac, or mobile device, these documents will maintain their integrity, ensuring that the layout and formatting are preserved when shared with clients or business partners. This makes it easy to send professional records without worrying about issues related to different software or device limitations.

Security and Integrity

Another reason this format is highly favored is its ability to preserve the integrity of the document. Unlike other file types that can be easily altered or corrupted, these files can be locked for editing, ensuring that the content remains unchanged. Additionally, they allow you to add password protection or digital signatures, offering an extra layer of security and trust for sensitive financial details.

Thanks to these key features, it’s clear why this format is widely recognized as the best choice for creating professional, secure, and easily shareable business documents.

Common Mistakes to Avoid in Invoices

When creating professional records for payment requests, attention to detail is critical. Even small errors can lead to confusion, delayed payments, or damaged client relationships. Understanding and avoiding common pitfalls in document preparation can save time, improve clarity, and help maintain a trustworthy image with your clients. Below are some of the most frequent mistakes to watch out for when preparing financial documents.

Missing or Incorrect Details

One of the most common mistakes is leaving out important details, such as client information, payment terms, or itemized services. A missing address or incorrect payment instructions can delay processing and cause unnecessary back-and-forth communication. Double-check the following before sending any document:

| Essential Detail | What to Double-Check |

|---|---|

| Client Information | Make sure the client’s name, address, and contact details are correct. |

| Payment Terms | Clearly state when payment is due, any applicable late fees, and accepted payment methods. |

| Itemization | Ensure that all products or services provided are listed with clear descriptions and costs. |

Unclear Payment Instructions

Another frequent mistake is failing to provide clear and detailed instructions on how the payment should be made. Whether it’s via bank transfer, credit card, or another method, make sure your clients know exactly what to do. Providing multiple payment options can also help avoid delays and ensure smooth transactions.

By taking the time to review these critical aspects, you can significantly reduce the risk of errors and ensure a smooth, professional process for both you and your clients.

How to Save Time with PDF Invoices

Managing financial records doesn’t have to be time-consuming. By using efficient, ready-made solutions for your billing process, you can drastically reduce the time spent on creating and sending documents. The key is to choose tools that allow for quick customization, easy updating, and seamless distribution. With just a few steps, you can automate much of the process, leaving you with more time to focus on other important tasks.

One of the best ways to save time is by using pre-designed files that can be easily edited. Instead of starting from scratch for every transaction, simply input the necessary details–such as the client’s name, the services rendered, and the total amount due–and you’re ready to go. These resources eliminate the need for repetitive formatting and structuring, reducing the chances of errors and allowing you to send documents faster.

Additionally, with digital versions of these records, there’s no need for printing, mailing, or manually handling paperwork. You can send them instantly via email or a secure online platform, which means faster turnaround times and quicker payments. This efficiency helps to ensure that you stay on top of your financial tracking without spending excessive time on administrative work.

Creating a Professional Invoice with a Template

Creating a well-designed payment request document is crucial for maintaining a professional image and ensuring clear communication with clients. A pre-designed structure simplifies this process by providing you with a ready-made layout that only requires minimal customization. By adjusting key sections like contact details, itemized services, and payment terms, you can generate a polished document that reflects your business standards and promotes efficient financial transactions.

Key Elements to Include

To ensure your document looks professional and contains all the necessary information, make sure to include the following elements:

- Business Information: Include your company name, address, phone number, and email address at the top of the page.

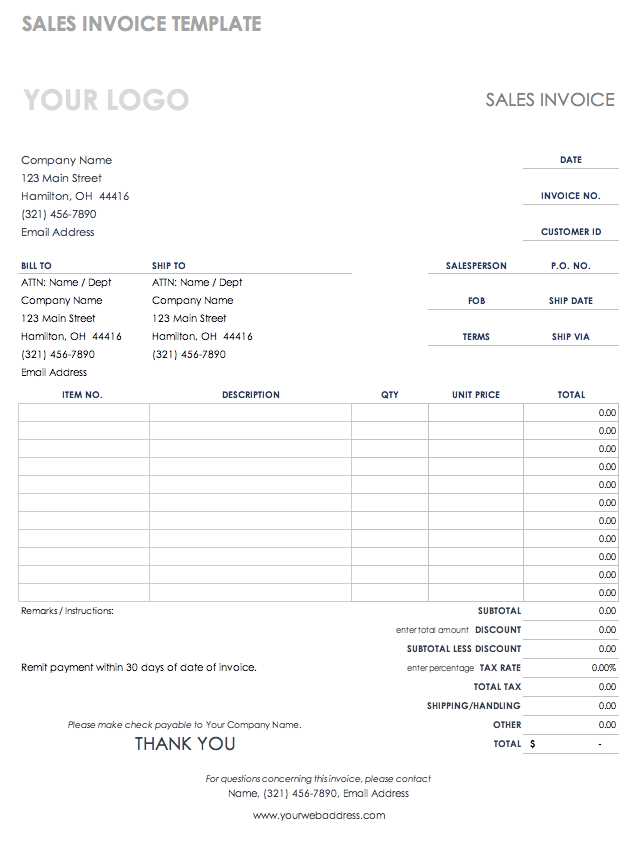

- Client Details: Add the recipient’s name, company (if applicable), address, and contact information.

- Service Description: Clearly list the services or products provided, including quantities and unit prices where applicable.

- Payment Terms: State the payment due date, any late fees, and accepted payment methods.

- Unique Reference Number: Add a reference number for each document to keep track of transactions easily.

Design Tips for Professionalism

While the content is crucial, design also plays an important role in creating a professional-looking document. Consider the following tips:

- Consistency: Use a consistent font style and size throughout the document for a clean and organized look.

- Branding: Add your company’s logo or brand colors to enhance your company’s visual identity.

- Whitespace: Ensure there’s enough spacing between sections so that the document remains easy to read and looks uncluttered.

By following these simple steps and utilizing a pre-designed structure, you can create a professional and effective document that instills confidence in your clients and helps facilitate timely payments.

Where to Find Free Invoice Templates

Finding a reliable resource for professional billing documents is easier than ever. Numerous websites and platforms offer downloadable files that can be customized to meet your business needs. Whether you’re looking for a simple design or a more advanced structure, there are many places where you can access these tools without cost. With just a few clicks, you can find a wide range of options suitable for freelancers, small business owners, or anyone needing a streamlined billing solution.

Here are some popular sources to explore when looking for a well-designed document to manage your transactions:

- Business Software Websites: Many business management platforms, such as QuickBooks or Zoho, offer downloadable files as part of their free tools or resources section.

- Online Document Libraries: Websites like Microsoft Office, Google Docs, and Canva provide a wide range of professional document formats that you can personalize for your own needs.

- Freelancer Resources: Freelance websites like Fiverr or Upwork often have free or low-cost resources that can help you generate professional paperwork quickly.

- Specialized Business Blogs: Many business-oriented blogs and websites offer free downloads as part of their content, often with tips and advice on how to use them effectively.

By exploring these platforms, you can easily find the right tools to streamline your billing process and maintain a professional approach in every transaction.

Choosing the Right Invoice Template for Your Business

Selecting the right billing document structure is crucial for maintaining professionalism and ensuring that all transaction details are accurately captured. Different businesses have unique needs, and it’s important to choose a layout that not only aligns with your branding but also meets the specific requirements of your industry. Whether you’re a freelancer, small business owner, or large enterprise, the right tool can help streamline your process, avoid errors, and enhance your client relationships.

Here are some key factors to consider when choosing the right document layout for your business:

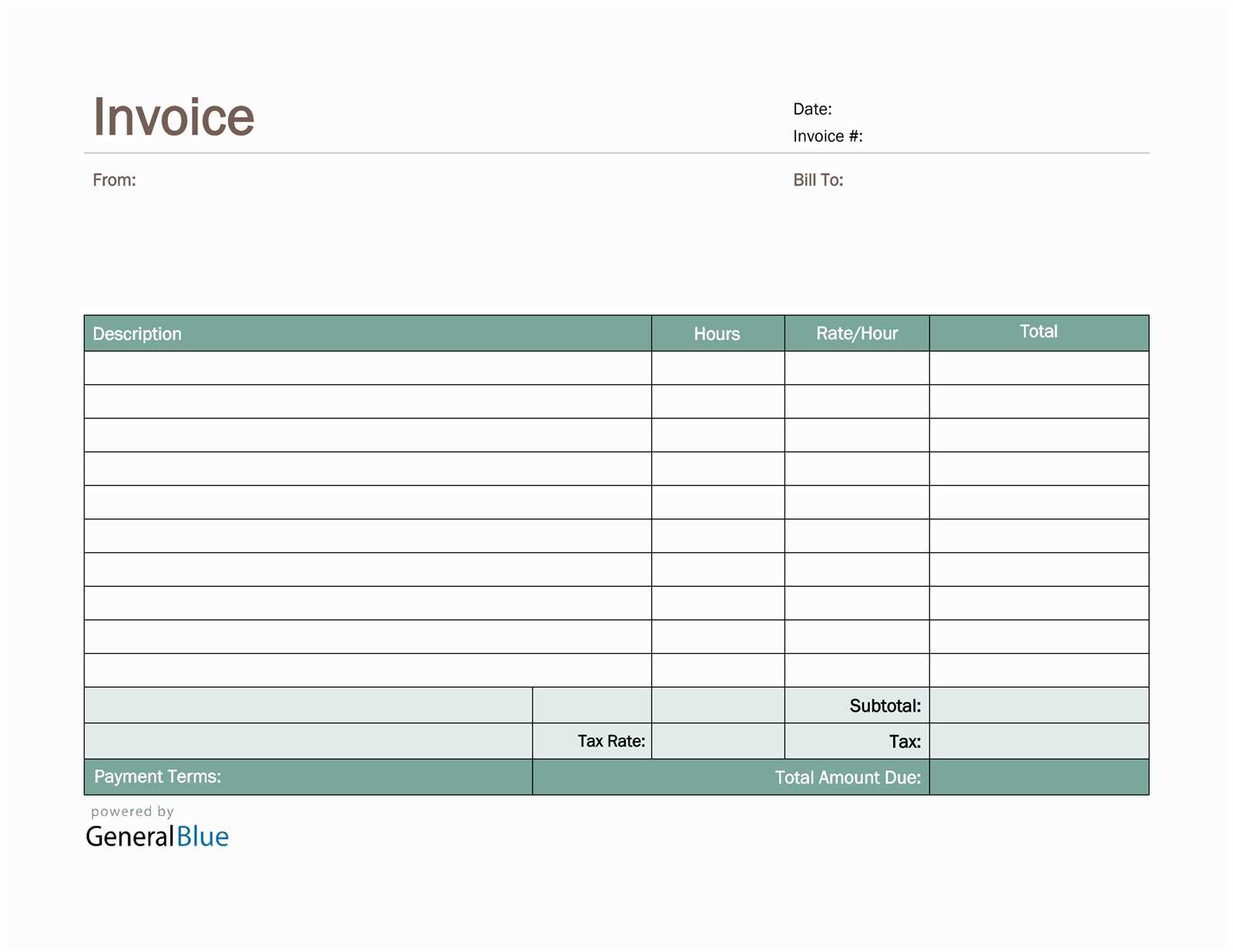

- Business Type: Consider the nature of your services or products. For example, a service-based business may require a more detailed description of services, while product-based businesses may need a section for quantities and unit prices.

- Customization Options: Look for a design that allows you to easily modify fields to suit your specific needs. This includes adding your company logo, adjusting the layout, and entering client-specific information.

- Ease of Use: Choose a layout that is simple to fill out and doesn’t require advanced skills. The easier it is to enter information, the less time you’ll spend on administrative tasks.

- Professional Design: Ensure that the layout reflects your company’s image and maintains a formal, consistent look. A well-designed document not only looks polished but also helps build trust with your clients.

- Payment Terms and Details: The right layout should make it easy to include critical payment information, such as due dates, accepted payment methods, and any late fees, in a clear and concise manner.

By carefully considering these factors, you can select the right document design that helps streamline your billing process and presents a professional image to your clients.

How to Add Payment Details to Your Invoice

Including clear and accurate payment information in your billing documents is essential for ensuring that clients understand how and when to settle their accounts. By providing all the necessary payment details, you minimize confusion and streamline the transaction process. This section explains how to effectively add payment terms, methods, and instructions to your documents to ensure a smooth and timely payment experience.

Start by including the following essential payment details:

- Due Date: Clearly specify the date by which payment should be made. This ensures that your client knows when to send the payment and avoids any misunderstandings about deadlines.

- Payment Methods: List the available payment options, such as bank transfers, credit cards, online payment platforms (like PayPal), or checks. Be sure to include all the necessary information for each method, such as account numbers or payment links.

- Late Fees: If applicable, mention any penalties for overdue payments. Clearly state the fee structure (e.g., a fixed amount or percentage of the total) and the timeframe in which these fees will apply.

- Payment Instructions: Provide step-by-step instructions on how clients can complete the payment. Include any necessary references or transaction codes for easy identification of the payment on your end.

Additionally, ensure that all payment details are easy to find on the document. Use clear headers and space the information in a way that makes it stand out. This will help your client quickly identify the payment terms and avoid any delays caused by confusion.

By including comprehensive and straightforward payment details, you make the process easier for both you and your clients, leading to faster and more reliable transactions.

Using PDF Invoices for Small Businesses

For small business owners, managing finances efficiently is crucial to maintaining smooth operations and healthy cash flow. One of the easiest ways to achieve this is by using digital billing documents, which allow you to keep track of payments, reduce errors, and maintain professionalism with clients. This method is especially beneficial for small businesses looking to save time, reduce overhead costs, and streamline their administrative tasks.

Here are several reasons why digital billing records are an excellent choice for small businesses:

- Cost-Effective: Unlike printed documents, there are no additional costs for paper, ink, or postage. By utilizing digital files, you can save money while keeping your operations professional.

- Time-Saving: Once a record layout is set up, creating new documents becomes a simple process. You can quickly input transaction details and send them to clients without the need for manual work or reformatting each time.

- Organization: With digital files, it’s easy to store and organize records. They can be quickly retrieved when needed for accounting or future reference, reducing clutter and improving overall business organization.

- Professionalism: A clean, well-organized document reflects a serious and professional approach to business, which helps build trust with your clients. It also ensures that all essential details are included clearly and accurately.

- Payment Tracking: By using digital records, you can easily track payments and monitor overdue amounts, which can help improve cash flow and ensure timely payments from clients.

Incorporating digital documents into your business’s workflow is an efficient and effective way to handle financial transactions. It not only simplifies the billing process but also supports your long-term growth by allowing you to focus on your core operations rather than administrative tasks.

What Information Should be Included in an Invoice

Creating a professional payment request document involves more than just listing services or products. It’s essential to include all the necessary details to ensure clarity, avoid confusion, and maintain transparency in your transactions. A well-structured document should provide both you and your client with all the information needed to complete the payment smoothly and accurately.

Here are the key elements that should be included in any payment request document:

- Your Business Information: Clearly state your business name, address, phone number, and email. This allows your clients to easily identify you and get in touch if needed.

- Client Information: Include the name, address, and contact details of the person or company you’re billing. This helps ensure that the document reaches the right individual and can be easily processed by the client’s accounting team.

- Unique Identification Number: Assign a unique reference number for each transaction. This helps both parties track payments and simplifies future reference or potential follow-up.

- Detailed List of Products or Services: Include a clear description of each product or service provided, along with quantities, unit prices, and the total cost for each item. This ensures transparency and avoids misunderstandings regarding what was billed.

- Total Amount Due: Clearly state the total amount owed, including any taxes or additional fees. This number should be easily distinguishable to prevent any confusion.

- Payment Terms: Specify the payment due date, any applicable late fees, and the methods of payment you accept (bank transfer, credit card, online payment platform, etc.).

- Payment Instructions: Provide step-by-step instructions on how to make the

Free Invoice Templates for Different Industries

Different industries have specific needs when it comes to billing documents. Whether you’re in construction, creative services, or retail, having a billing structure that aligns with your business type helps ensure clarity and professionalism. Specialized billing forms tailored for each sector can streamline the process, ensure accuracy, and reflect the unique nature of the services or products you provide. Here are some examples of how different industries can benefit from customized billing layouts.

Creative and Freelance Services

For freelancers and those in creative fields, such as graphic design, writing, or web development, a billing document should focus on detailed descriptions of services rendered. It’s important to include:

- Project Breakdown: Include a clear breakdown of tasks completed and time spent on each task, or specify a flat rate per project.

- Usage Rights: Mention whether the work is licensed or the client will own full rights after payment.

- Hourly or Fixed Rates: Clearly display your hourly rate, or specify a fixed cost for the entire project.

Retail and Product-Based Businesses

Retail businesses need a document layout that clearly outlines the products sold, including quantity, unit price, and total cost. For product-based transactions, include the following:

- Itemized List: Each product should be listed with quantity, unit price, and any discounts applied.

- Shipping and Handling: Clearly outline the shipping cost and any taxes or additional fees.

- Order Number: A reference number helps track the transaction for both the seller and the buyer.

By customizing billing documents to suit the needs of your industry, you ensure that all necessary information is clearly presented, improving communication with clients and enhancing your professional reputation.

How to Send Your PDF Invoice Effectively

Sending your billing documents efficiently is just as important as creating them. Properly delivering your request ensures that clients receive the correct information, making it easier for them to process the payment. Whether you’re emailing, printing, or using an online system, there are several best practices to follow when distributing your documents to ensure smooth and prompt transactions.

Here are some effective ways to send your billing documents:

- Use Professional Email: Send the document through a professional email account with a clear and concise subject line. For example, “Payment Request for [Service/Product Name] – Due [Date].”

- Attach the Document: Always attach the completed document as a file. Ensure the file name is professional and descriptive, such as “Billing_[Client Name]_[Date].” Avoid using generic names like “Document1.pdf” to help both you and your client stay organized.

- Include Payment Instructions: In the body of the email, include clear payment instructions, including due dates and acceptable payment methods. Also, remind clients of any specific terms, such as late fees or discounts for early payment.

- Verify Contact Information: Before sending, double-check the recipient’s contact details to avoid any delivery issues. Ensure the email address is accurate, and if necessary, confirm the best contact method with your client in advance.

- Use Secure Methods for Sensitive Information: If your document contains sensitive payment information, consider using secure email encryption or a trusted file-sharing platform to protect your client’s data.

- Follow Up: If you don’t receive confirmation or payment within the expected timeframe, send a polite reminder. This could be done via email or phone call, ensuring that you maintain a professional and friendly tone.

By following these best practices, you’ll ensure that your client receives all the information they need to process the payment quickly and accurately, helping to maintain positive business relationships.