Free Invoice Template for Open Office

Managing payments and transactions efficiently is essential for maintaining smooth operations in any business. Whether you’re a freelancer or run a small company, having a structured way to document and track charges is crucial. A well-organized billing document ensures that all required information is accurately recorded, making it easier to manage finances and avoid errors.

Many solutions are available for creating these important documents, but choosing the right one can save you time and effort. By utilizing a simple and flexible tool, you can create polished, professional documents without the need for expensive software. The ability to customize these documents to fit your specific needs adds another layer of convenience, making it easier to maintain consistency and accuracy across your records.

With the right approach, preparing statements becomes a quick and straightforward task. Tools designed for this purpose often provide customizable fields for all the necessary details, helping you focus on providing excellent service rather than worrying about formatting or calculation errors. Embrace a more efficient way to handle your billing process, and see how it simplifies your workflow.

Free Invoice Template for Open Office

For small businesses or individuals looking to streamline their billing process, using a structured document can save time and ensure accuracy. A customizable billing document is an effective tool to keep all financial records in order. With the right layout, users can easily fill in the necessary details, making the task of preparing these records more efficient and professional.

These documents are designed to allow users to quickly input information without worrying about complicated formatting. With flexible fields, businesses can easily add and remove sections to fit their specific needs. Whether you’re sending a request for payment or tracking services provided, having a well-organized file is key to maintaining professionalism.

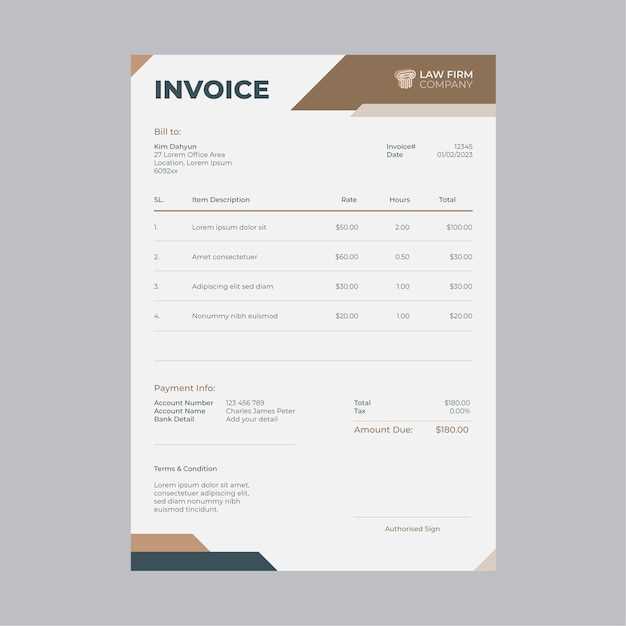

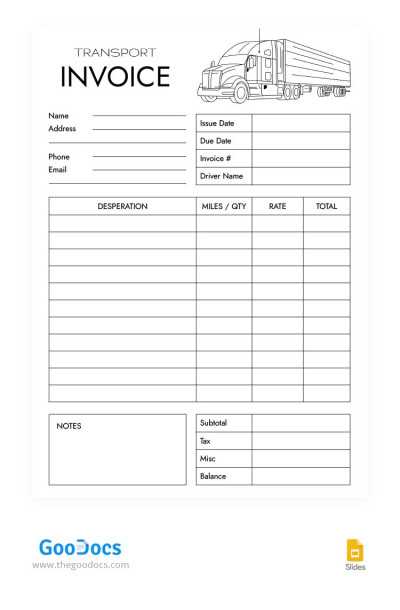

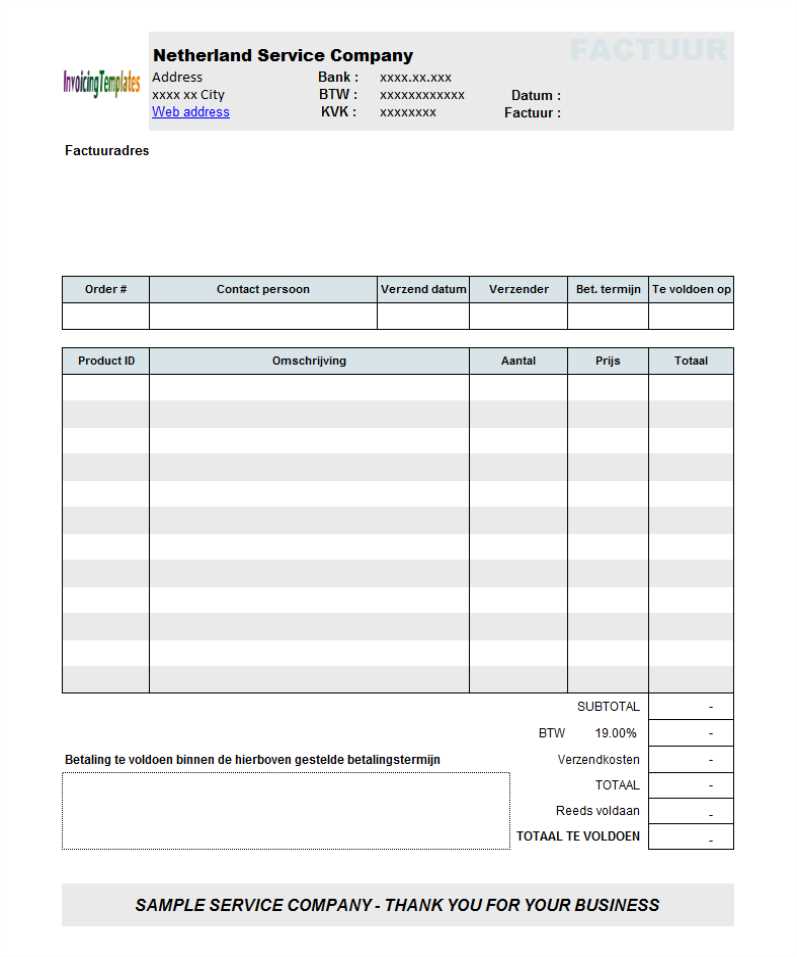

Here’s an example of a basic structure for creating such a document:

| Section | Description |

|---|---|

| Client Information | Includes details like name, address, and contact information of the client |

| Services Rendered | Lists the products or services provided, including dates and amounts |

| Payment Terms | Describes the terms for payment, including due date and payment methods |

| Total Due | Displays the total amount owed, including taxes and any discounts |

| Notes | Any additional comments or terms related to the billing |

By using such documents, you can ensure all necessary details are clearly presented and easy to understand. The ability to tailor these structures makes it simple to match your unique business needs while maintaining clarity and professionalism in every transaction.

Why Use an Invoice Template

Creating clear and professional billing documents is essential for businesses to manage payments and maintain organization. By using a pre-designed structure, you can ensure consistency and reduce the time spent on formatting. Whether you’re a freelancer or running a small company, utilizing a structured document simplifies the process and ensures that all necessary information is included every time.

Streamline Your Workflow

One of the main reasons to rely on a structured document is the time savings. With ready-made fields and sections, you don’t have to worry about formatting each time you need to generate a document. The setup is already done, so all that’s left is filling in the details. This allows you to focus more on your business operations rather than spending time on administrative tasks.

Enhance Professionalism

Having a standardized format ensures that your documents look polished and professional. Consistency in your billing process reflects well on your business and helps build trust with clients. By using a well-organized document, you provide your clients with all the necessary information in an easily understandable format, improving your communication and the likelihood of prompt payments.

Accuracy is another critical advantage. Pre-designed structures often include sections for all the necessary details, such as the recipient’s information, the services provided, and the payment terms. This minimizes the risk of errors or omissions, which could lead to misunderstandings or delays.

How to Download Free Templates

Accessing pre-made billing documents is easy and convenient. Many websites offer downloadable files that are ready for use, allowing you to quickly integrate them into your business workflow. Whether you’re looking for a simple design or something more detailed, these resources provide a variety of options to fit different needs.

Step-by-Step Process for Downloading

The process of obtaining these documents is straightforward. Most websites offer a selection of customizable files in various formats, which can be downloaded with just a few clicks. Below is a guide to help you get started:

| Step | Action |

|---|---|

| 1 | Visit a trusted website that offers document downloads |

| 2 | Browse through the available options and select the one that suits your needs |

| 3 | Click on the download button to save the file to your computer |

| 4 | Open the file in your preferred program to begin customization |

Where to Find Quality Resources

Several trusted platforms provide free, downloadable resources for all types of businesses. Look for sites that offer a variety of options, along with clear instructions for customization. Many also offer additional support, such as tips for editing the documents and troubleshooting any potential issues that may arise during use.

By following these steps, you can quickly get the necessary files and customize them to suit your specific needs, making the process of creating professional documents faster and easier.

Customizing Templates for Your Business

Personalizing billing documents to suit your business needs is an essential step in creating professional and consistent records. Customization allows you to tailor each document to reflect your brand, services, and specific business requirements. By adjusting sections, layout, and formatting, you ensure that each document not only meets legal standards but also aligns with your company’s image.

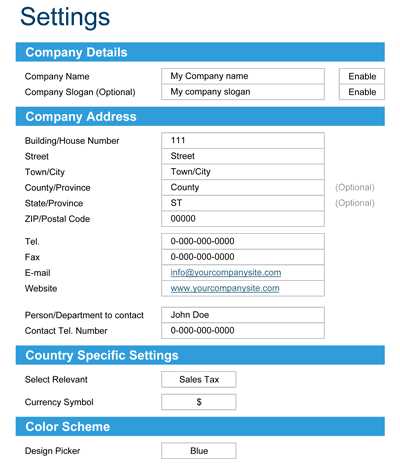

One of the main advantages of using a customizable document is the ability to modify various elements. For instance, you can add your business logo, contact details, and payment terms in a way that reflects your brand’s identity. This helps create a unified and professional appearance across all your correspondence with clients. Additionally, you can choose the style and structure that best fits the services you provide, making it easier for clients to understand the information presented.

Adjusting Sections such as the list of services or products, tax calculations, and payment due dates ensures that each document reflects the specifics of the transaction. It’s important to ensure that the fields you modify are both accurate and consistent across all documents for clarity and ease of use.

Branding is another key aspect of customization. Including your company’s colors, fonts, and logo can significantly enhance the appearance of the document and ensure it aligns with your business’s visual identity. This level of personalization not only looks professional but also reinforces your brand every time you send a document to a client.

Advantages of Open Office Invoice Templates

Utilizing a well-designed document structure for creating billing statements offers a range of benefits, especially when using open-source software. These resources allow for customization, ease of use, and flexibility, providing businesses with an efficient way to manage their financial documentation without the need for costly software. The main advantage lies in the ability to create professional-looking records quickly and at no additional cost.

One key benefit of using these tools is the flexibility they provide. Since the structure is editable, businesses can tailor each document to their specific needs. Whether you’re adjusting the layout, adding additional fields, or changing the style to better match your brand, this adaptability allows you to stay consistent and organized across all documents.

Additionally, accessibility is a major advantage. These solutions are often available for download and use without requiring expensive subscriptions. They also support a variety of file formats, making it easy to share documents across different platforms and devices. This ensures that your billing process remains efficient regardless of the tools or systems your clients use.

Finally, the integration with widely-used programs further simplifies the workflow. These resources can be opened and edited with ease, allowing for smooth integration into any business’s operations. With user-friendly features and compatibility, these solutions ensure you can focus on what matters most: running your business efficiently and professionally.

Creating Professional Invoices Quickly

Efficiently generating polished billing documents can save time and ensure your business remains organized. With the right tools, you can create professional records without the need for complex software. Streamlining the process allows you to focus more on your core operations while maintaining a high level of professionalism in your financial transactions.

Here are some steps to help you create well-structured records in less time:

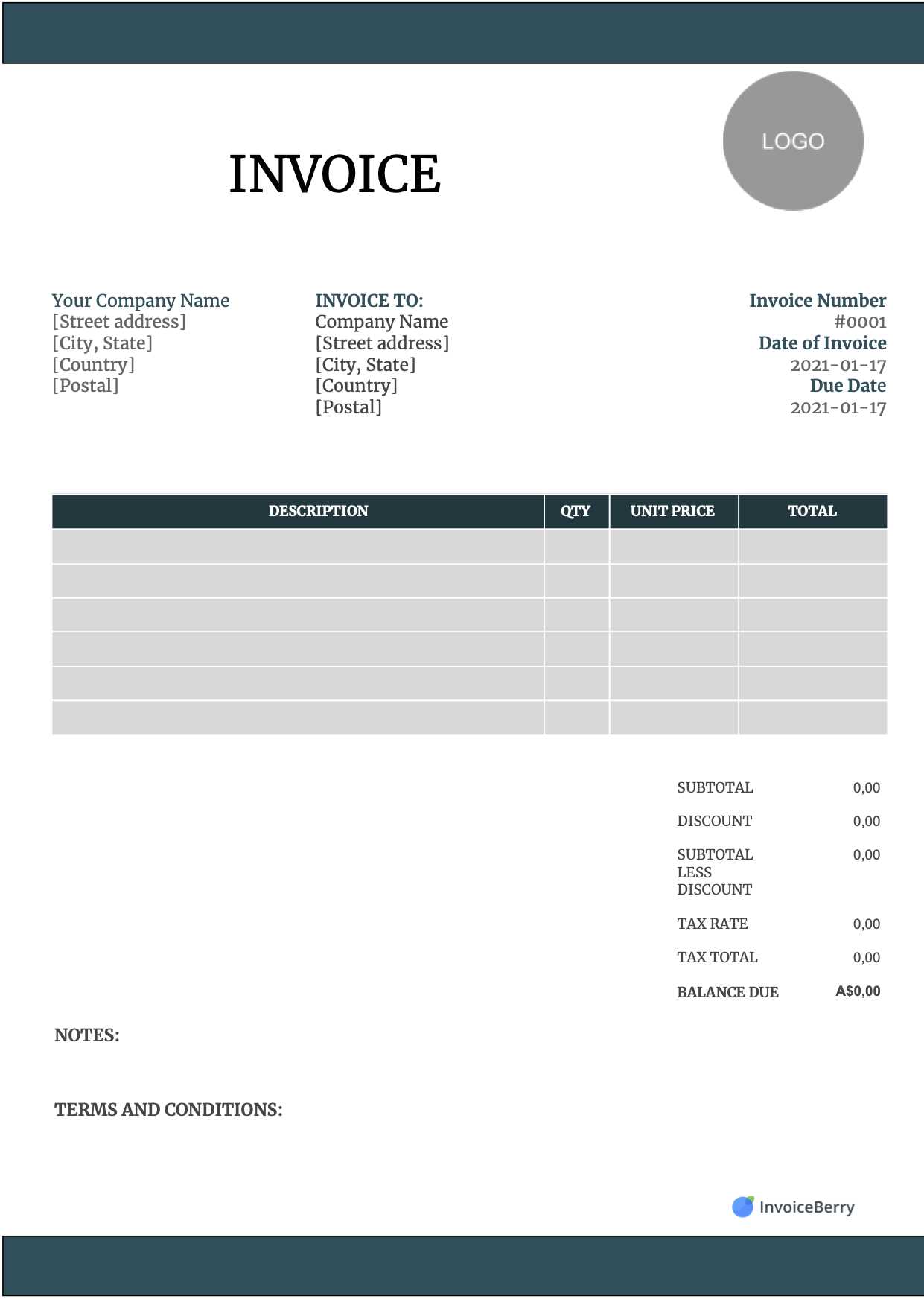

- Select the Right Structure – Choose a document layout that suits your business style and the information you need to include.

- Fill in Key Details – Quickly input the necessary information such as client name, services provided, payment terms, and totals.

- Customize for Branding – Add your company logo, color scheme, and fonts to give the document a consistent look that matches your business identity.

- Double-Check for Accuracy – Ensure all details are correct to avoid mistakes that could cause delays or misunderstandings.

- Save and Send – Once completed, save the document in your preferred format and send it directly to the client, saving time and effort.

By following these steps, you can produce high-quality records quickly and ensure that every transaction reflects professionalism and accuracy. These tools make it easy to stay organized while saving valuable time for other important tasks.

Free Templates vs Paid Invoice Solutions

When it comes to creating billing documents, businesses often face the decision of whether to use no-cost resources or invest in a premium solution. Both options offer distinct advantages, depending on the specific needs of the business. Understanding the key differences can help you choose the best option for efficiency, cost-effectiveness, and the level of customization required.

Free solutions typically provide a simple, ready-to-use structure that can be downloaded and customized to suit basic business needs. These options are ideal for small businesses or freelancers who require a straightforward, no-frills approach. While these documents are functional and easy to use, they may offer limited customization, and sometimes, lack advanced features that could improve workflow efficiency.

On the other hand, paid solutions often come with more advanced features, such as automated calculations, customizable fields, and integration with accounting software. These solutions are tailored to businesses that need to manage a higher volume of transactions or require specialized functionality, such as recurring payments or detailed reporting. However, the cost of these services may not be justified for businesses with simpler needs.

Ultimately, the choice between free and paid options depends on factors like the scale of your business, the complexity of your billing process, and your budget. Both approaches have their strengths, but understanding your specific requirements will ensure you select the solution that aligns with your needs and resources.

Best Practices for Invoice Formatting

Properly structuring and formatting your billing documents is crucial for clarity, professionalism, and efficiency. A well-organized document ensures that clients can quickly understand the details of the transaction, which helps streamline the payment process. Adhering to a few key formatting principles can make your documents stand out and reduce the likelihood of errors or misunderstandings.

Here are some best practices to follow when formatting your billing documents:

- Use Clear and Consistent Layouts – Ensure your document has a logical flow with clearly defined sections, such as contact details, item descriptions, and payment terms. Consistency across your documents helps improve readability.

- Include Essential Information – Make sure to include all necessary details, such as business name, contact info, client name, description of services, date, and payment terms. Missing information can cause delays and confusion.

- Choose Readable Fonts – Opt for easy-to-read fonts, such as Arial or Times New Roman, with an appropriate size. Avoid overly decorative fonts that might make the document harder to read.

- Highlight Important Sections – Use bold text or shading to emphasize key details, such as the total amount due or the payment due date. This helps clients easily spot the most crucial information.

- Ensure Proper Spacing – Avoid cramming too much information into a small space. Proper spacing between sections improves readability and prevents the document from looking cluttered.

- Maintain Alignment – Align text properly, particularly for the list of services or items and their respective prices. A clean, aligned document ensures a professional look and makes the information easier to follow.

By following these practices, you can create billing documents that not only look professional but also facilitate a smooth payment process, fostering trust and improving your business relationships.

Ensuring Accurate Billing Information

Accurate and clear billing is essential to maintaining smooth business operations and positive client relationships. Miscommunication or errors in billing details can lead to confusion, delayed payments, and dissatisfaction. Ensuring that all relevant information is correctly included and formatted will help avoid these issues and contribute to a professional and efficient payment process.

Here are some key steps to ensure accuracy when preparing your billing documents:

- Double-check Client Information – Always verify the client’s name, address, and contact details before sending any documents. Incorrect information can cause delays and even result in payments being sent to the wrong address.

- Review Service Descriptions – Ensure that each service or product is accurately described with the correct pricing. Be specific about quantities, rates, and any other details to avoid misunderstandings.

- Verify Dates – Check that all dates (e.g., issue date, due date, service dates) are correct. An incorrect date could confuse clients or cause confusion about payment deadlines.

- Confirm Payment Terms – Clearly state the payment methods, due date, and any late fees or discounts. This will reduce the likelihood of disputes later on.

- Check Totals and Calculations – Always double-check the totals, taxes, and any other calculations before sending the document. Automated tools can assist in ensuring the accuracy of complex calculations.

Tools for Ensuring Accuracy

Using reliable software or well-structured resources can assist in verifying and automating certain elements of your documents. Built-in formulas for totals and tax calculations, along with customizable fields, can significantly reduce human error and improve efficiency.

Review Before Sending

Always take a moment to review the completed document before sending it out. Even small errors can have a negative impact on your professional image. A final check will help ensure that all details are correct and the documen

Integrating Invoice Templates with Your Workflow

Incorporating structured billing documents into your day-to-day business operations can improve efficiency, minimize errors, and streamline the entire payment process. By integrating these documents seamlessly with your workflow, you can reduce manual tasks, ensure consistency, and maintain a professional approach to financial management.

To integrate these documents effectively, it’s essential to incorporate them into your existing processes. Here are a few steps to ensure smooth integration:

- Automate Document Generation – Set up automated tools to generate and fill in essential details like client names, amounts, and dates. This minimizes the time spent on manual entry and reduces the chances of errors.

- Link with Accounting Software – Integrate the documents with your accounting system to automatically track payments, outstanding balances, and other financial records. This provides real-time insights and makes accounting tasks easier to manage.

- Standardize Document Formatting – Ensure that all billing documents follow the same structure and style, making them easy to process and understand, both for your team and clients.

- Track Document History – Maintain a record of all documents sent and received, including payment status and any communication regarding them. This helps you stay organized and keeps everything accessible for future reference.

- Set Up Reminders for Follow-up – Automate follow-up reminders for outstanding payments, ensuring clients are notified of overdue amounts without the need for manual intervention.

By integrating these documents into your workflow, you create a more efficient, consistent, and professional process that not only saves time but also fosters better relationships with clients. When these resources are aligned with your business operations, your entire financial management system becomes smoother and more streamlined.

How to Add Tax Calculations to Invoices

Adding tax calculations to billing documents is a crucial step for businesses that need to comply with local tax regulations. By correctly calculating and displaying tax amounts, you ensure transparency for your clients and avoid potential issues with tax authorities. Accurate tax inclusion helps your business stay compliant while maintaining a clear and professional billing process.

Here are the key steps to add tax calculations to your billing documents:

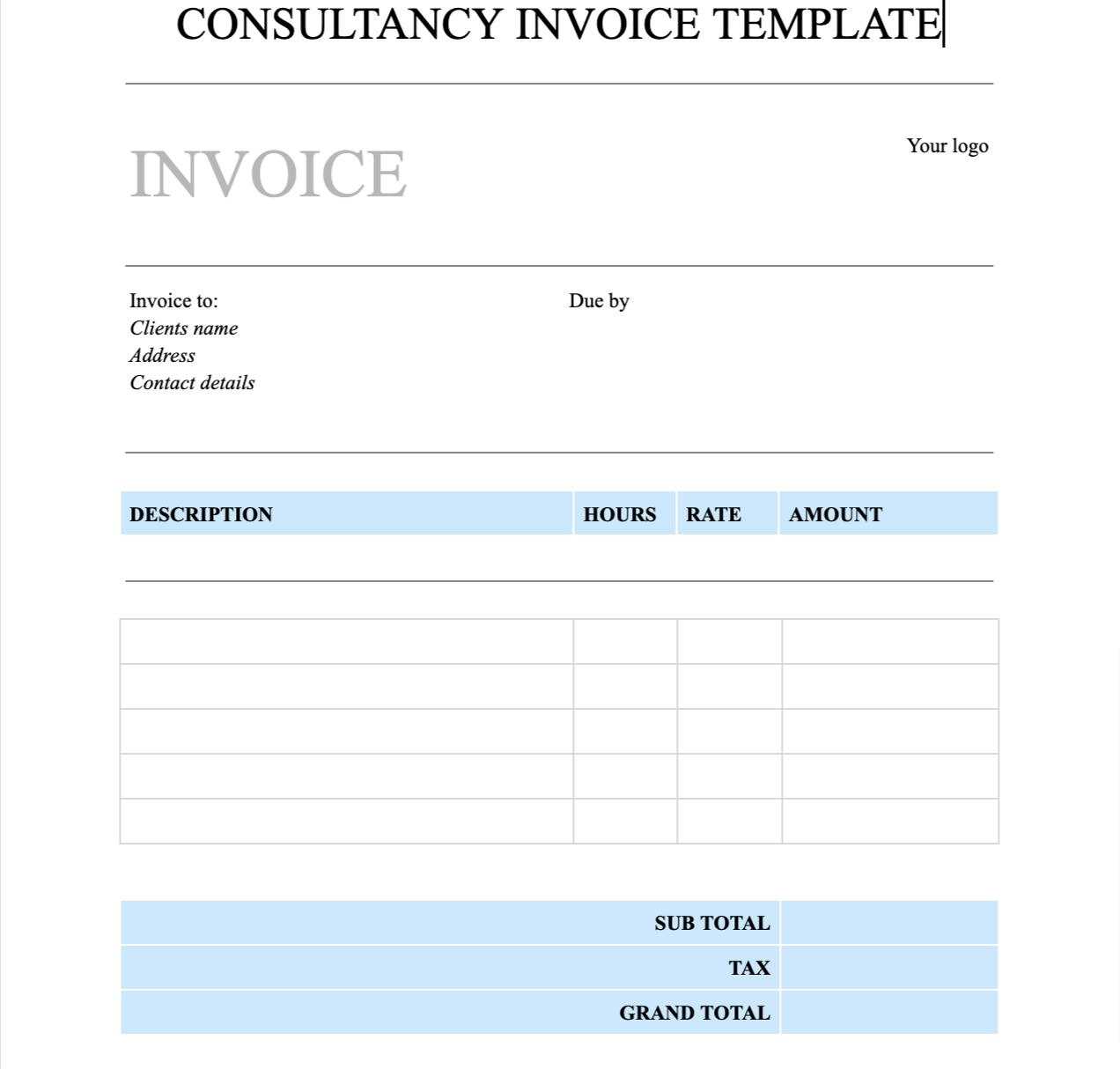

- Determine the Applicable Tax Rate – The first step is to identify the correct tax rate for the goods or services you are offering. This rate can vary depending on your location and the type of products or services provided.

- Calculate the Tax Amount – Multiply the taxable amount by the tax rate to calculate the tax due. For example, if the total cost of services is $100 and the tax rate is 10%, the tax amount will be $10.

- Include Tax Breakdown – Clearly display the tax amount as a separate line item on the document. This helps clients understand how much of the total is attributable to tax and ensures transparency in the billing process.

- Consider Multiple Tax Rates – If your business is subject to multiple tax rates (e.g., federal and state taxes), list each rate and its corresponding amount separately. This provides a clear breakdown for clients and keeps your records organized.

- Automate Calculations When Possible – Many digital tools offer automatic tax calculations based on your region. Using these tools can save time and reduce the chances of manual errors, ensuring accuracy in every document.

Incorporating tax calculations into your documents not only ensures compliance but also fosters trust with your clients. By following these steps, you can provide clear, transparent, and accurate documents every time.

Common Mistakes to Avoid When Using Templates

While using pre-designed documents can save time and improve efficiency, it’s important to be aware of common mistakes that can undermine the quality and accuracy of your paperwork. Even small errors can lead to confusion, delayed payments, or missed opportunities. By understanding these pitfalls, you can ensure a smoother, more professional experience for both your business and clients.

Overlooking Customization

One of the most frequent mistakes is using the document as-is without adjusting it to fit your business’s specific needs. While these resources are designed to be adaptable, they often come with default settings that may not suit your services or branding. Always tailor each document to include your business details, payment terms, and relevant service information.

Failing to Update Information Regularly

Another common issue is forgetting to update key details, such as contact information, pricing structures, or tax rates. Failing to keep this information current can lead to miscommunications with clients and possible legal complications. It’s crucial to regularly review and revise the document to reflect the most accurate and up-to-date information.

By being mindful of these mistakes, you can optimize the use of pre-designed documents, ensuring they effectively serve your business needs and create a professional impression with every interaction.

Invoice Template Features You Need

When choosing a pre-designed document for your business, it’s essential to ensure that it includes all the necessary features that will streamline your workflow and improve the clarity of your transactions. The right set of tools and sections can help ensure that the billing process is smooth, professional, and error-free. Below are some key elements to look for when selecting or creating these resources.

Essential Features

Here are some important features to include in your business documents:

- Professional Layout – A clean and structured design is crucial for making your documents easy to read and visually appealing. A cluttered document can confuse clients and affect the perception of your business.

- Customizable Fields – Ensure that the document allows you to easily change client names, services, pricing, and payment terms. This flexibility is key to adapting the document to different needs.

- Tax Calculation – Include a built-in tax calculation feature that allows for easy adjustments based on your location and the services or products you offer.

- Clear Payment Instructions – Provide a section that details how clients can make payments, including any payment methods accepted and relevant deadlines.

- Itemized List – A detailed breakdown of services or goods provided helps clients understand exactly what they are paying for, reducing potential disputes.

Advanced Features

For added convenience and professionalism, consider these advanced features:

- Automatic Calculations – Some advanced systems can automatically calculate totals, taxes, and discounts, reducing the risk of errors and saving time.

- Client Account Tracking – An ability to track clients’ payment history and account balance ensures better management of ongoing transactions and relationships.

- Multiple Currency Support – For international clients, it’s useful to have templates that can accommodate various currencies and convert rates easily.

Including these features in your business documentation ensures that your processes are efficient, professional, and error-free, ultimately improving your relationships with clients and streamlining your billing workflow.

Saving and Sharing Your Completed Invoice

Once you have completed your document, it’s essential to save it in the appropriate format and share it with your client in a secure and professional manner. Proper management of these files ensures that your records are well-organized and accessible, while also helping maintain a positive and efficient relationship with your clients.

First, it’s important to save the document in a format that is both universally accessible and secure. Popular formats such as PDF ensure that your document appears the same on all devices, regardless of the software being used. Most software programs allow you to easily save the file as a PDF, which can prevent accidental edits and preserve the formatting.

When sharing the document, consider your client’s preferences. Emailing the file as an attachment is a common method, but you can also use cloud storage services to provide a link if the file is too large. Ensure that the file name is professional and includes relevant details, such as the client’s name or the date of the transaction.

For clients who prefer physical copies, you can print the document and send it via traditional mail. However, the digital route is typically faster and more efficient, particularly for international transactions.

By properly saving and sharing your completed documents, you ensure that your billing process runs smoothly and that your clients have quick and easy access to important information when needed.

How to Protect Your Invoice Data

Protecting sensitive billing information is crucial for maintaining the trust of your clients and ensuring that your business remains secure from unauthorized access or data breaches. Proper protection measures help safeguard financial details, payment terms, and other personal data that could be vulnerable if not handled carefully.

Best Practices for Data Security

There are several key steps you can take to protect your data:

- Use Strong Passwords – Ensure that any digital files are protected with strong, unique passwords. Avoid using easily guessable passwords and update them regularly.

- Enable Encryption – Whenever possible, use encryption to protect sensitive documents. This adds an additional layer of security, making it harder for unauthorized individuals to access or alter the files.

- Limit Access – Only grant access to your documents to those who absolutely need it. This can include setting up user permissions or password-protecting files before sharing them.

- Back-Up Your Files – Regularly back up your documents to a secure cloud service or external storage. This ensures that you can recover data in the event of an accidental loss or breach.

Protecting Data During Sharing

When sharing sensitive information, consider these additional precautions:

- Use Secure Channels – Avoid sharing sensitive documents through unsecured methods such as regular email. Instead, use encrypted email services or cloud platforms that offer enhanced security features.

- Watermark Documents – For added security, consider watermarking your documents. This can discourage unauthorized distribution of your materials by clearly identifying the source.

- Limit Sharing Access – Set expiration dates or restrict viewing permissions when sharing files through cloud services. This reduces the risk of unauthorized access over time.

By following these best practices and taking extra precautions, you can ensure that your business and client data remain secure, safeguarding both your reputation and sensitive information from potential threats.

How to Update Templates for Future Use

Keeping your business documents up-to-date is essential for maintaining consistency and efficiency. Regularly updating your documents ensures they reflect current information, formats, and industry standards, making them ready for future transactions. By revisiting and adjusting your existing forms, you can save time and avoid errors in the long run.

Steps to Keep Your Documents Current

To effectively update your business documents for future use, follow these steps:

- Review Information Regularly – Set a schedule to review your existing documents for any outdated details. This can include changes in pricing, contact information, or business terms.

- Update Branding – As your company evolves, so should your branding. Ensure that the document reflects any logo, font, color, or style updates that align with your current marketing materials.

- Adjust for Legal or Regulatory Changes – Stay informed about any changes in your industry’s regulations or tax laws that may require adjustments to your forms. Make sure all compliance information is accurate and up-to-date.

- Optimize for User Experience – Evaluate whether the layout of your documents is user-friendly. Are the sections easy to navigate? Are all necessary fields included? Simplifying the process can improve ef