Free Invoice Template for Mac Users

Managing financial documents efficiently is crucial for businesses of all sizes. Whether you’re a freelancer or running a small company, having a reliable way to create and manage your billing records can save time and reduce errors. With the right resources, generating professional-looking forms for clients becomes an easy task, helping you stay organized and focused on growing your business.

Customizable solutions provide a simple way to input necessary details, automate repetitive tasks, and maintain a polished appearance. With these ready-made documents, you can ensure that every transaction is accurately recorded, all while giving your clients a professional impression. Utilizing such tools also allows you to adapt them to your needs, making it easier to track payments, issue corrections, and manage financial data on the go.

By leveraging the best options available, you can streamline your workflow and avoid the hassle of manually creating these documents from scratch. There’s no need for complicated software or expensive subscriptions when a straightforward solution is available to meet your needs.

Free Invoice Template for Mac

When managing business transactions, having a simple and effective tool to generate financial documents is essential. There are numerous resources available to help you easily create structured forms that capture all the necessary details without the complexity of custom designs. These resources allow users to quickly produce professional-looking documents, ensuring that both clients and companies have a clear record of agreements.

For individuals and small businesses using Apple devices, there are several options that cater to the specific needs of creating such documents. Here are some reasons why using these tools is a practical solution:

- Time-saving: Easily generate documents without starting from scratch.

- Customization: Adjust fields to match your specific business needs.

- Professional Design: Create polished and well-organized forms that reflect your business professionalism.

- Ease of Use: User-friendly interface requiring little to no experience with design software.

These tools are often compatible with other software, enabling seamless integration with accounting systems, file sharing, and cloud storage. Whether you are managing payments for services rendered or tracking expenses for a project, the flexibility of such resources ensures you stay organized and efficient.

For those looking to avoid costly subscriptions or complicated software, the availability of these solutions offers an accessible and efficient way to stay on top of business finances. With just a few clicks, you can access various styles and formats tailored to suit your specific needs, from simple designs to more complex layouts.

Why Use Invoice Templates on Mac

Efficiently handling billing and financial records is crucial for businesses of all types. Having a reliable and streamlined way to create payment requests or receipts can save time, reduce errors, and make your business appear more professional. Instead of manually crafting documents each time, utilizing a pre-designed format ensures consistency and accuracy in your financial dealings.

For those using Apple devices, there are significant advantages to employing these ready-to-use solutions. Here are some reasons why they are a preferred choice:

- Convenience: Quickly generate structured documents without the need for design expertise.

- Consistency: Ensure uniformity across all documents, which is essential for professional branding.

- Efficiency: Save time by automating the document creation process, leaving more time for other important tasks.

- Customization: Easily adapt fields to suit the unique needs of your business, from services rendered to payment terms.

Furthermore, these options are often compatible with a variety of business management tools. They integrate seamlessly with accounting software and cloud-based systems, helping you track payments, manage finances, and share documents effortlessly. With the ability to quickly generate accurate, professional-looking forms, you can maintain a well-organized workflow, no matter the scale of your operations.

Top Features of Mac Invoice Templates

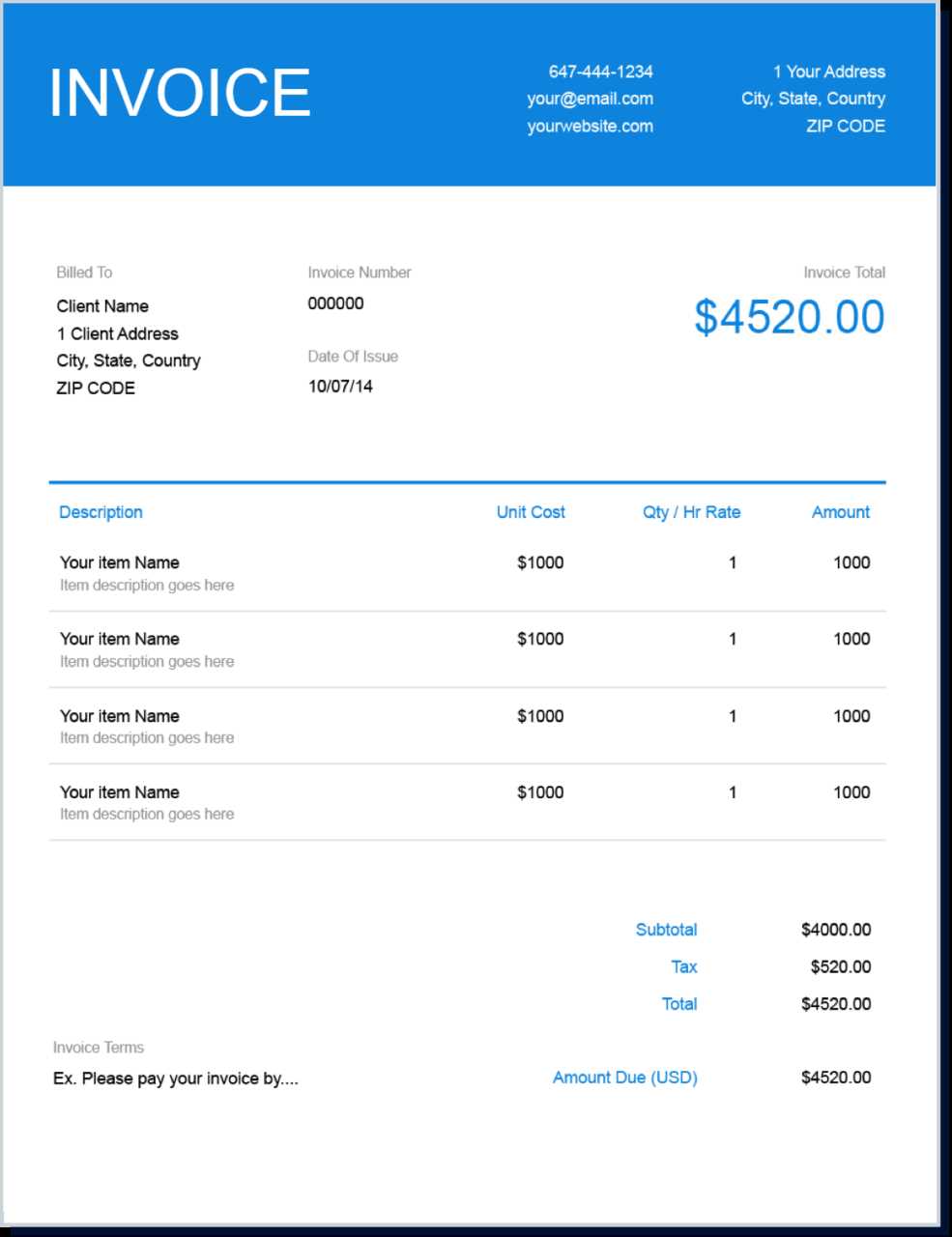

When it comes to creating professional financial documents, having access to well-designed, customizable options can make a huge difference. These tools provide a range of features that not only simplify the process but also ensure your documents are clear, consistent, and ready for business. Here are some of the most valuable attributes to look for when choosing such resources for your business:

- Customizable Fields: Adjust the structure of your document to suit your specific needs, including adding or removing fields for items, taxes, and payment terms.

- Pre-built Layouts: Choose from a variety of ready-made formats designed for professional use, ensuring your documents are polished and easy to read.

- Automatic Calculations: Built-in features that automatically calculate totals, taxes, and discounts save time and reduce the chance of errors.

- Ease of Editing: Simple drag-and-drop or text editing functionality makes it easy to update details such as client information, amounts, and dates.

- File Format Compatibility: Options to export and share your documents in formats like PDF, Word, or Excel make it easy to distribute and store your files.

These features help you streamline the document creation process, allowing you to focus on other aspects of your business while maintaining a high standard of professionalism. Whether you’re handling payments for clients, tracking projects, or maintaining financial records, these resources make it easy to stay organized and efficient.

How to Customize Your Invoice Template

Personalizing your financial documents is essential for reflecting your brand and meeting specific business needs. Customizing the layout, details, and structure of the document can make it more effective in conveying the necessary information clearly and professionally. Here’s a step-by-step guide to help you tailor these resources to your preferences:

Step 1: Modify Basic Information

Start by updating key details such as your company name, address, and contact information. This ensures your documents are branded and that clients can easily reach you for follow-up. Also, make sure to include any necessary legal information, such as tax identification numbers or business registration details, if applicable.

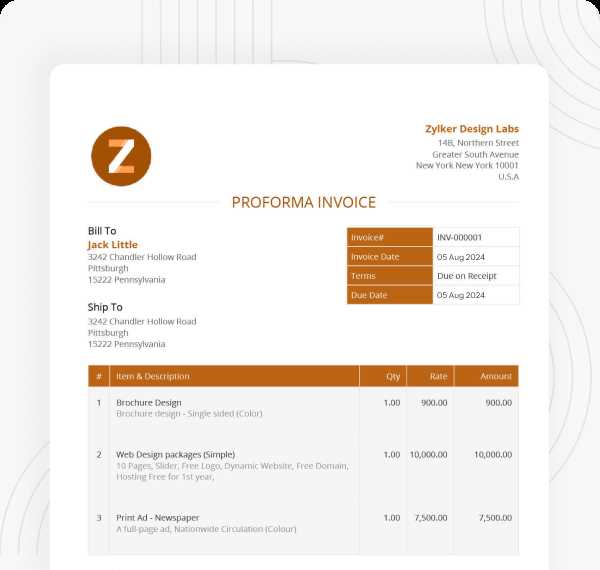

Step 2: Adjust Fields for Specific Needs

Customize sections like the list of products or services, payment terms, and additional notes to fit the nature of your business. You can add or remove columns based on the types of transactions you handle. For example, a service-based business may require different fields than a product-based one.

| Field | Description |

|---|---|

| Item Description | Details about the product or service offered. |

| Unit Price | Cost of one unit of the item or service. |

| Quantity | Number of items or hours for services rendered. |

| Total | Final cost after multiplying quantity by unit price. |

By adjusting these fields, you ensure that the final document is both clear and tailored to your specific business practices, making it easier for clients to understand the charges and terms.

With these simple customizations, you can create professional documents that are both efficient and reflective of your business identity, while also making the process more streamlined and personalized for your clients.

Choosing the Right Template for Your Business

Selecting the right format for your financial documents is crucial for ensuring clarity, professionalism, and efficiency. Every business has unique needs, and finding a structure that best suits your operations can make a significant difference. Whether you’re dealing with services, products, or subscriptions, the layout and features of the document can influence how smoothly your transactions run.

Here are some key factors to consider when choosing the best solution for your business:

- Business Type: Choose a format that aligns with your industry. Service-based businesses may need a more detailed breakdown of hours worked, while product-based businesses might focus on quantities and pricing.

- Customization Options: Ensure the document allows for easy updates and modifications. You may need to add custom fields such as discounts, shipping costs, or project milestones.

- Professional Design: The look of your document should reflect your brand’s identity. Opt for a clean, simple design that is easy for clients to read and understand.

- Ease of Use: Choose an option that is intuitive and doesn’t require specialized software or skills to modify.

- Exporting and Sharing: Make sure the document is compatible with multiple file formats (PDF, Word, Excel) and can be easily shared via email or printed.

By considering these elements, you can select a format that helps you maintain consistency and professionalism while making document creation faster and more efficient. Tailoring the structure to suit your specific business requirements will also save time and reduce the chance of errors in your financial paperwork.

Free vs Paid Invoice Templates for Mac

When it comes to selecting a solution for creating business documents, there are two main options: no-cost options and paid versions. Each has its own set of advantages and potential drawbacks, depending on the specific needs of your business. Understanding the differences between the two can help you decide which option best suits your workflow and budget.

Advantages of No-Cost Solutions

Using no-cost options for generating financial documents can be a practical choice, especially for small businesses or startups. These tools typically offer the basic functionality you need without requiring an upfront investment.

- Low or No Cost: Perfect for businesses on a tight budget or those just starting out.

- Basic Features: Offers the essential fields for creating basic documents, including item descriptions, quantities, and totals.

- Easy to Use: Typically straightforward with minimal learning curve, suitable for users with limited experience.

Benefits of Paid Solutions

On the other hand, paid versions often come with enhanced features and greater customization options that can be beneficial as your business grows. Here are some advantages of choosing a paid option:

- Advanced Customization: More flexibility to add custom fields, branding, and complex calculations to your documents.

- Professional Design: Access to more sophisticated, visually appealing templates that are designed to impress clients and partners.

- Integration with Other Tools: Many paid solutions integrate seamlessly with accounting software or payment systems, helping you keep everything organized in one place.

- Customer Support: Paid versions often include dedicated support, ensuring help is available when needed.

While both options can serve your needs, the choice between no-cost and paid resources largely depends on your business size, the level of customization required, and your budget. For a simple, one-person operation, no-cost solutions may be sufficient, while larger businesses or those requiring additional features may find the investment in a paid option worthwhile.

How to Download Invoice Templates for Mac

Downloading pre-designed solutions for creating business documents is a simple and effective way to streamline the document creation process. These ready-made formats can save you time by providing a starting point, which you can easily customize according to your needs. Whether you’re looking for basic designs or more sophisticated options, the process of obtaining them is straightforward and accessible.

Here’s a step-by-step guide on how to find and download these resources for your Apple device:

- Search for Trusted Sources: Start by looking for reliable websites or platforms that offer downloadable options. Popular resources include official software providers, business resource sites, and third-party vendors.

- Choose Your Format: Once you’ve found a reputable source, select the format that suits your needs. These documents can typically be downloaded in various file types such as PDF, Word, or Excel.

- Download and Save: Click the download link to save the file to your device. Ensure the file is compatible with your software and operating system to avoid any issues.

- Customization: After downloading, open the document in the appropriate application (such as Pages, Numbers, or Word) to make any necessary adjustments, such as adding your business information or modifying the layout.

Here is a table summarizing the types of files you may encounter when downloading these resources:

| File Type | Description | Software to Use |

|---|---|---|

| Portable format that preserves the document’s layout and design. | Preview, Adobe Acrobat | |

| Word | Editable format for customizing text, layout, and fields. | Microsoft Word, Pages |

| Excel | Spreadsheet format for detailed calculations and financial tracking. | Microsoft Excel, Numbers |

After downloading and customizing your document, you’ll have a professional-looking financial record ready to use whenever you need it, saving both time and effort.

Best Software for Editing Invoice Templates

Editing pre-designed business document formats requires the right software to ensure flexibility and ease of use. The ideal tool allows for simple customization, whether you need to adjust text, add logos, or modify the layout. Below, we’ll explore some of the best software options for tailoring these files to your specific business needs.

Popular Software for Basic Customization

If you’re looking for tools that provide straightforward editing capabilities, here are some excellent options:

- Microsoft Word: A well-known word processing tool that offers easy-to-use editing features for text and basic design. It’s perfect for users who need to make quick adjustments without complex formatting.

- Apple Pages: A powerful alternative for Mac users, offering intuitive drag-and-drop design capabilities. It allows for customizing text, adding images, and adjusting document structure with ease.

- Google Docs: A cloud-based option for basic editing. It’s accessible from any device with internet access and provides real-time collaboration, making it ideal for teams.

Advanced Tools for Professional Customization

For more advanced features and intricate layouts, these software programs offer higher levels of customization:

- Adobe InDesign: A professional design tool ideal for creating high-quality, complex documents. It offers advanced typography, layout control, and the ability to work with various file formats.

- Microsoft Excel: Though primarily a spreadsheet tool, Excel provides advanced formatting and calculation capabilities that are useful for businesses that need to include detailed financial data.

- Canva: A user-friendly graphic design tool that’s great for businesses looking to create visually appealing documents. Canva offers templates that are easy to modify with drag-and-drop functionality.

Choosing the right software depends on your specific needs–whether you’re looking for basic adjustments or advanced design capabilities. Each of these tools provides a different set of features to cater to various business requirements, making it easier for you to generate professional documents that reflect your brand and business style.

Creating Professional Invoices on Mac

Generating polished and professional financial documents is an essential task for any business. Using the right software on your Apple device, you can create visually appealing and accurate records that reflect the quality of your work. Whether you’re billing clients for services or products, the key is to use a format that is clear, organized, and easy to customize.

Steps to Create a Professional Document

To start creating your own documents, follow these essential steps:

- Choose a Suitable Layout: Begin by selecting a layout that aligns with your business needs. You can find both simple and more advanced formats, depending on the level of detail you require.

- Customize the Design: Tailor the design to reflect your brand identity. This includes adding your logo, adjusting fonts, and ensuring the document matches your business’s visual style.

- Include All Necessary Information: Ensure the document includes all key fields such as your business name, client information, payment terms, and itemized services or products provided. This is crucial for clarity and transparency.

- Review and Edit: Before finalizing the document, thoroughly review it for accuracy. Double-check all financial figures, business details, and client information.

Useful Tools for Professional Results

To achieve a high-quality result, consider using the following tools and features available on your Apple device:

- Numbers: Ideal for creating detailed financial breakdowns, Numbers is a powerful tool that allows for smooth calculations and data organization.

- Pages: A simple yet effective tool for customizing the overall design, adding text, logos, and adjusting the layout to fit your business needs.

- Preview: After creating the document, use Preview to check how the final version will look and ensure everything is in place before exporting or sending it to clients.

By following these steps and utilizing the right tools, you can create professional financial documents that convey trust and reliability, ultimately supporting your business’s success and maintaining a strong relationship with your clients.

Benefits of Using Templates for Billing

Utilizing pre-designed documents for managing payments offers numerous advantages that can significantly improve the efficiency and professionalism of your business operations. By incorporating ready-made formats, you can save valuable time while ensuring that all essential details are included, leading to smoother transactions and more satisfied clients.

Here are some key benefits of using these formats for your billing process:

- Time Efficiency: Pre-designed documents allow you to quickly fill in the required information without needing to start from scratch each time. This speeds up the billing process and frees up time for other important tasks.

- Consistency: Using standardized formats ensures that all your documents follow a uniform layout and structure. This consistency helps maintain a professional image and avoids confusion for your clients.

- Accuracy: Ready-made structures often include fields for essential details like due dates, itemized services, and payment instructions, reducing the risk of missing critical information and minimizing errors.

- Customization: Although these documents come with predefined designs, they can easily be customized to suit your specific business needs. You can add your branding elements, adjust text, and update the format as required.

- Cost Savings: Many options are available at no cost or come as part of software suites, saving you the expense of hiring a designer or purchasing expensive software just to create billing records.

- Professional Appearance: Well-designed documents give your business a polished, trustworthy appearance, which can help build client confidence and improve relationships.

Overall, incorporating these resources into your billing process can streamline operations, reduce errors, and enhance your business’s overall efficiency and reputation. Whether you are a freelancer, a small business owner, or a large enterprise, these benefits can help make financial management simpler and more effective.

How to Automate Invoice Creation on Mac

Automating the process of generating financial documents can significantly reduce manual effort and ensure accuracy in your business operations. By using the right tools and setting up automation, you can streamline the billing process and focus on other critical tasks. Below, we’ll discuss how to leverage automation features available on your Apple device to simplify document creation.

To start automating, consider the following steps:

1. Use Automation Software

Automation software can help streamline the entire process, from creating documents to sending them to clients. Popular tools can integrate with your accounting systems and generate forms based on predefined data inputs. Some options to consider include:

- Zapier: Zapier can connect various apps like spreadsheets, email, and payment platforms. You can set up triggers that automatically create and send your documents when certain actions occur.

- Automator (on Mac): Built into macOS, Automator allows you to create custom workflows that can automatically generate and format your documents. You can set it to fill in specific details and organize data for you.

- QuickBooks: An accounting software with integrated automation features. QuickBooks can generate documents based on data you’ve entered, such as product details, client information, and due dates.

2. Use Spreadsheets for Template-Based Automation

If you prefer working with spreadsheets, using Excel or Numbers on your Mac can be a great way to automate document creation. With formulas, templates, and scripting, you can automate the population of key fields such as client names, itemized lists, and totals. Here’s how to set it up:

| Step | Description |

|---|---|

| Step 1 | Design a template with placeholders for customer data, service details, and other key fields. |

| Step 2 | Use formulas to automatically calculate totals, taxes, and other financial information based on inputs. |

| Step 3 | Link your spreadsheet to your payment system to automatically fill in transaction data for each client. |

| Step 4 | Set the spreadsheet to generate a new document with each new entry, and email it directly to your client. |

By integrating automation into your document creation process, you can reduc

Invoice Templates for Freelancers and Small Business

For freelancers and small business owners, managing finances and ensuring timely payments can be a challenge. The use of ready-made document formats tailored for billing purposes can simplify this process. These predefined structures allow professionals to create detailed, clear documents that represent their services and transactions effectively, without spending too much time on formatting or design.

Below are key features and benefits of using pre-designed forms for billing purposes:

1. Streamlined Billing Process

Pre-structured billing documents can save you time by eliminating the need to design a new one each time you need to send a bill. These resources usually come with all essential fields, including client information, services rendered, pricing, taxes, and due dates. This helps to maintain consistency while making the process quicker and more efficient.

2. Professional and Clear Documentation

For small business owners and freelancers, maintaining a professional image is crucial. Ready-made documents ensure that all critical information is included in a clear and organized manner, helping build trust with clients. Properly formatted records can make a big difference in how your business is perceived and can help avoid misunderstandings.

By utilizing pre-designed resources, freelancers and small business owners can ensure that every billing document is professionally created, accurate, and consistent. This contributes to smoother transactions and fosters stronger client relationships.

Common Mistakes When Using Invoice Templates

While utilizing pre-designed billing documents can be a huge time-saver, it’s easy to make mistakes that could lead to confusion or delays in payments. Some common errors arise from overlooking details, improper customization, or simply misusing the available features. Recognizing these pitfalls can help you create accurate, professional documents every time.

Here are some frequent mistakes to watch out for:

1. Incorrectly Filling Out Client Information

One of the most common errors is failing to enter the correct client details, such as the company name, address, and contact information. If this information is incorrect or missing, it can lead to confusion and delays in payment. Always double-check that all client data is accurate and up-to-date.

2. Forgetting to Include Payment Terms

Omitting payment terms is another mistake that many make. It’s essential to clearly state when payments are due, any late fees, and accepted payment methods. Without this, clients may not know exactly when to pay, or they may misunderstand the terms of payment.

3. Overlooking Tax Calculations

Many billing forms allow for automatic calculations of taxes, but not all users are familiar with how to set these up. Make sure that your document accurately reflects the necessary taxes for your region and business type. Failing to include the correct tax rate can result in undercharging or overcharging your clients.

4. Using an Inconsistent Layout

While it may be tempting to change the layout or design of the document, this can often make the bill look unprofessional. Consistency in design helps maintain clarity and ensures that all crucial details are easily identifiable. Stick to standard formats that make it easy for clients to understand.

By being mindful of these common mistakes, you can create more accurate and professional documents, helping to streamline your billing process and avoid potential issues with clients.

Integrating Invoices with Accounting Software

Managing finances can be complex for any business, but integrating your billing documents with accounting systems can simplify the process significantly. By syncing your billing data with accounting software, you can streamline financial tracking, ensure accuracy, and reduce the risk of human error.

When you connect your billing processes with an accounting platform, the benefits are clear:

1. Real-Time Data Sync

One of the main advantages of integrating your billing documents with accounting software is the ability to sync data in real time. This ensures that every transaction, payment, or adjustment is immediately reflected in your financial records without needing to manually enter data twice.

2. Automated Financial Tracking

Accounting software can automatically track payments, outstanding balances, and other financial metrics when integrated with your billing process. This reduces the need for manual tracking and provides a more accurate view of your finances.

3. Error Reduction

Manual data entry often leads to mistakes such as double billing, missing information, or incorrect figures. By connecting your billing documents with software that handles financial tracking, you can minimize the chances of such errors.

Some common features of accounting software that can integrate with billing documents include:

- Automated Calculation: Automatically calculate totals, taxes, and discounts based on the information you enter.

- Payment Reminders: Set up automatic reminders for clients to pay overdue bills.

- Financial Reporting: Generate reports that provide a clear overview of your business’s financial health.

By integrating your billing processes with accounting software, you can save time, reduce errors, and gain better insights into your business’s financial status.

Printing and Sharing Your Mac Invoices

Once you’ve created your billing document, the next step is ensuring it reaches your client in a professional and timely manner. Printing or sharing the document electronically are two common methods, and both come with their own set of advantages. Knowing how to properly print and share your documents can enhance your communication and help maintain a smooth billing process.

Printing Your Billing Documents

If you need a physical copy for your records or for a client who prefers printed documents, printing is a simple but important process. To ensure your documents are printed correctly, follow these steps:

- Choose the Right Printer: Ensure your printer is capable of handling the document format you’re using, whether it’s A4 or letter-sized paper.

- Check Formatting: Before printing, review your document to ensure that all text and numbers are aligned properly and that nothing is cut off.

- Use High-Quality Paper: Use professional-grade paper to make the document look more polished and official.

Sharing Your Billing Documents Electronically

For faster communication, sharing your documents via email or cloud services is a convenient option. Most modern systems allow you to export your document in formats such as PDF, which ensures the file is accessible and easily viewable on any device. Here’s how you can share your documents effectively:

- Export as PDF: PDFs are universally compatible and preserve the formatting of your document, ensuring it looks the same on all devices.

- Send via Email: Attach the PDF to an email and include a brief message to your client explaining the document and the payment terms.

- Use Cloud Storage: Upload your document to cloud storage services like Google Drive or Dropbox and share a link for easy access and download.

Whether you choose to print or share electronically, the key is to ensure that your client receives a clear and professional document that reflects your business standards. By selecting the appropriate method, you can maintain efficient communication and avoid delays in payments.

How to Track Payments Using Invoices

Managing payments efficiently is an essential aspect of maintaining a healthy cash flow for any business. One of the most effective ways to keep track of payments is through well-documented records that clearly indicate the status of each transaction. Properly tracking payments ensures that you stay on top of outstanding balances and can follow up promptly with clients when necessary.

When using billing documents to track payments, it’s crucial to establish a system that clearly distinguishes between paid and unpaid amounts. Here are a few key strategies for effective payment tracking:

- Mark Payments as Received: Once a payment has been made, immediately update the document to indicate that the amount has been paid. This can be done by adding a “Paid” stamp or checking off a payment box.

- Include Payment Terms and Due Dates: Clearly state the due date and payment terms on your document. This helps both you and the client stay on track and avoid misunderstandings regarding the timing of payments.

- Use Payment Reference Numbers: Include a reference number for each transaction to make it easier to trace the payment in your records or accounting system.

Tracking payments effectively also involves staying organized and keeping an up-to-date record of all transactions. You can achieve this by:

- Creating a Payment Log: Maintain a separate log or spreadsheet to track the status of each payment. This should include the invoice number, amount due, amount received, and any notes related to payment history.

- Setting Payment Reminders: Use reminders or automated systems to follow up on overdue payments. These reminders can be set for specific intervals after the due date to keep clients accountable.

- Integrating with Accounting Software: Use software that integrates payment tracking features. This helps automate the process and reduces the chances of missing payments or losing track of past transactions.

By systematically tracking payments through well-structured records, you can ensure that your finances remain organized and your business operations stay smooth. This process not only minimizes errors but also improves cash flow management and helps build trust with your clients.

Security Tips for Invoice Files on Mac

When managing financial records on your computer, safeguarding sensitive information is of utmost importance. Ensuring that documents containing payment details or personal client data are kept secure helps prevent unauthorized access, data breaches, and potential fraud. By implementing a few simple security measures, you can protect your business and clients from unwanted exposure.

Here are some essential tips for enhancing the security of your files on your device:

- Use Strong Passwords: Always protect your documents with strong, unique passwords. This adds an extra layer of protection, especially when dealing with sensitive financial data. Consider using password managers to generate and store complex passwords securely.

- Enable Encryption: Enable built-in encryption on your system to protect documents from being accessed by unauthorized users. Full-disk encryption ensures that all files on your device are secured.

- Utilize Secure Cloud Storage: If you need to store or share documents online, use secure cloud storage services with strong encryption. Avoid using free or untrusted services that may compromise your data.

- Regular Backups: Regularly back up your files to an external hard drive or secure cloud service. In case of accidental deletion or ransomware attacks, having a backup ensures you can recover your data without losing important records.

In addition to these practices, ensure your device is always up to date with the latest software and security patches. Regular software updates help protect against vulnerabilities and malware that could target your documents. Furthermore, consider installing antivirus software to monitor potential threats.

Lastly, it’s essential to be cautious about where and how you share these files. Avoid sending documents over unsecured channels like email or unencrypted messaging platforms. Instead, opt for secure file-sharing methods to protect sensitive financial details from interception.

By following these security tips, you can safeguard your business’s sensitive records and maintain client trust, ensuring that your financial data stays protected at all times.

Finding the Best Free Invoice Templates Online

When searching for a document format that helps streamline your billing process, there are many options available online. It’s important to find reliable resources that offer high-quality, customizable documents suited to your needs. These resources can be particularly helpful for small businesses and freelancers looking to save time while maintaining professionalism in their communications.

Here are a few tips for finding the best resources:

- Check for Customization Options: Look for documents that offer easy customization, allowing you to adjust the layout, colors, fonts, and fields to match your brand’s style.

- Ensure Professional Quality: Even if the document is free, ensure that it has a polished and professional appearance. A well-organized layout makes your document easier to read and more credible to clients.

- Consider Your Business Type: Choose documents that are tailored to your industry. For example, a freelancer may need a different design than a contractor or a service-based business.

- Look for Reliable Sources: Use reputable websites or platforms with positive reviews to ensure the document is free of malware and other security risks.

Additionally, some platforms allow you to download documents directly in your preferred format, whether it’s a Word document, Excel file, or PDF. This flexibility ensures compatibility with your existing software, making it easier to start using the file right away.

By following these steps, you can find a professional, easy-to-use document that fits your needs without compromising quality or security.