Free Invoice Template in Word Easy to Edit and Download

Creating accurate and well-organized financial documents is essential for any business. Having a structured format allows companies to maintain professionalism and ensure clarity when requesting payments. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, it’s important to have a reliable system for generating these important records quickly and efficiently.

Many professionals prefer to use editable files for these tasks, as they can be easily customized to fit specific needs. The right tool can save you time and help streamline your workflow. By choosing a flexible, widely-used document format, you gain the ability to modify content as needed, ensuring that all details are up-to-date and accurate.

In this guide, we’ll explore how to create and customize such documents for your business needs. With the right approach, you can enhance both the appearance and functionality of your financial records, ultimately making them more effective and easier to manage.

Free Invoice Template in Word

For many businesses, having a pre-designed document for requesting payments can save time and ensure consistency. With customizable file formats, you can easily modify each section to reflect your specific requirements, such as adjusting dates, amounts, or client information. This flexibility makes it easier to generate these essential records, keeping everything professional and streamlined.

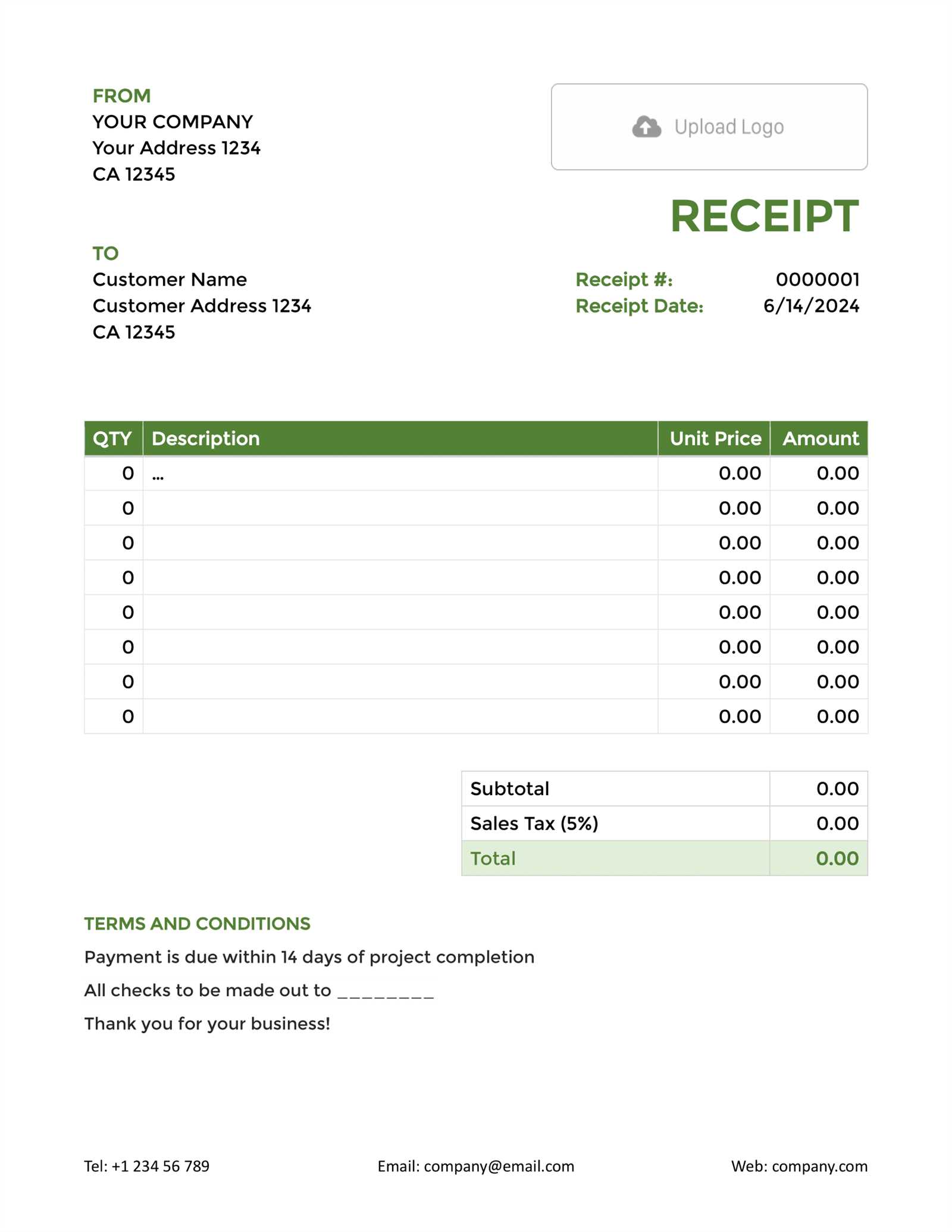

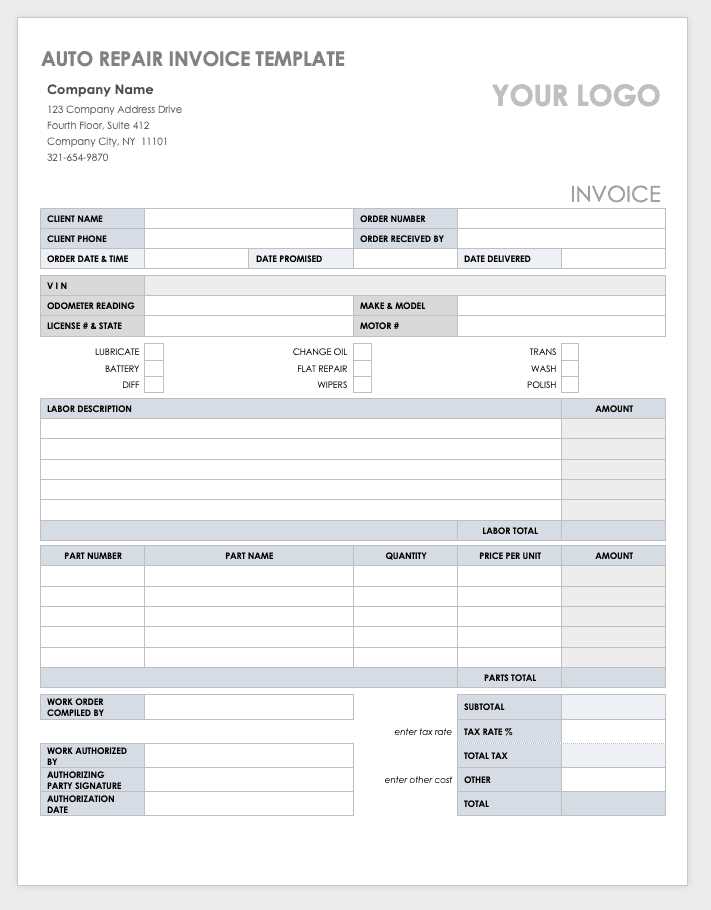

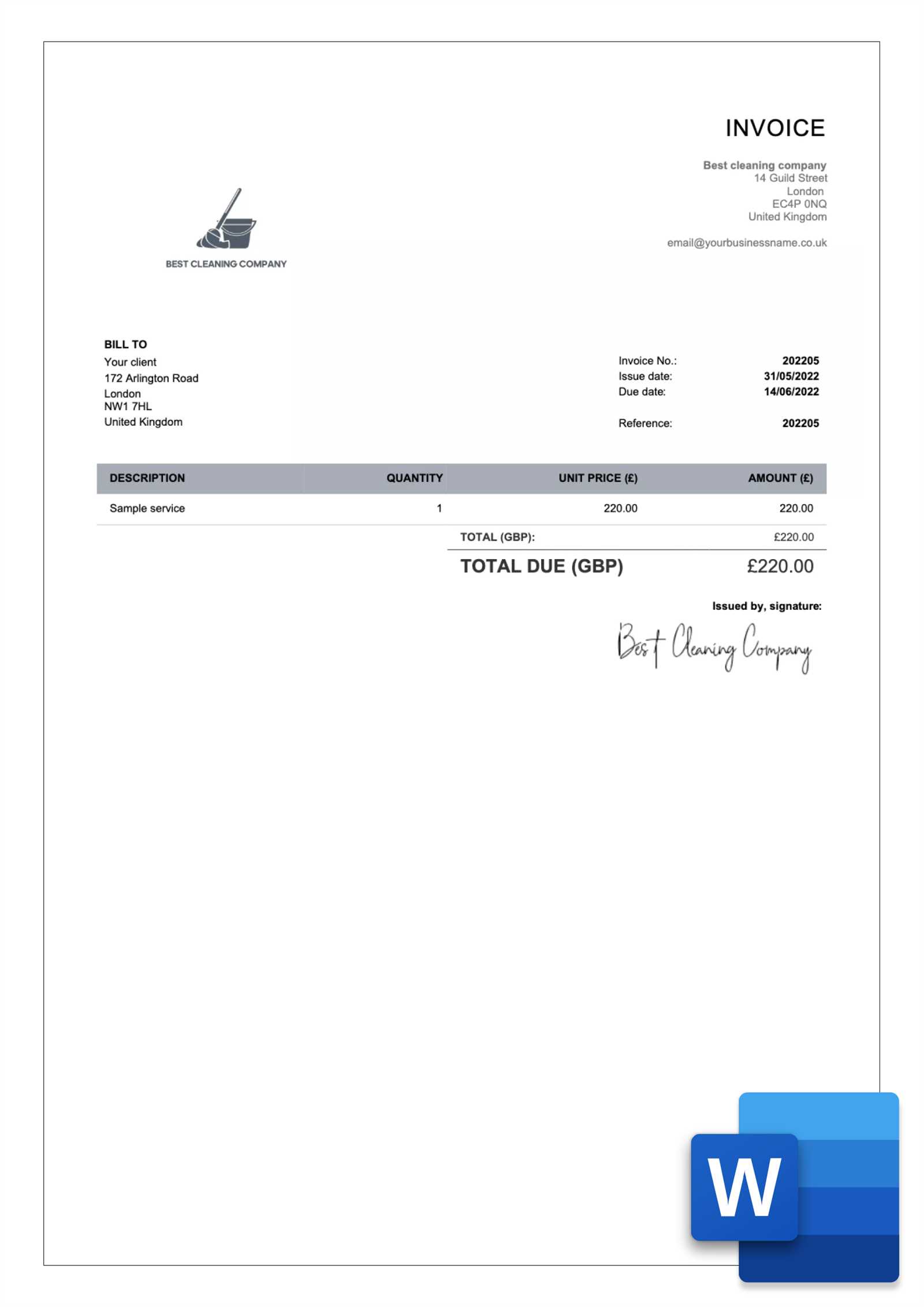

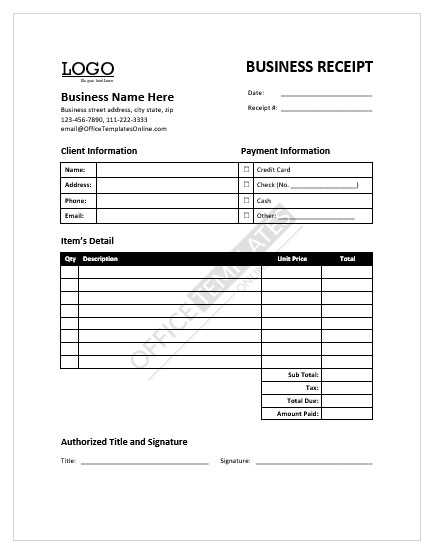

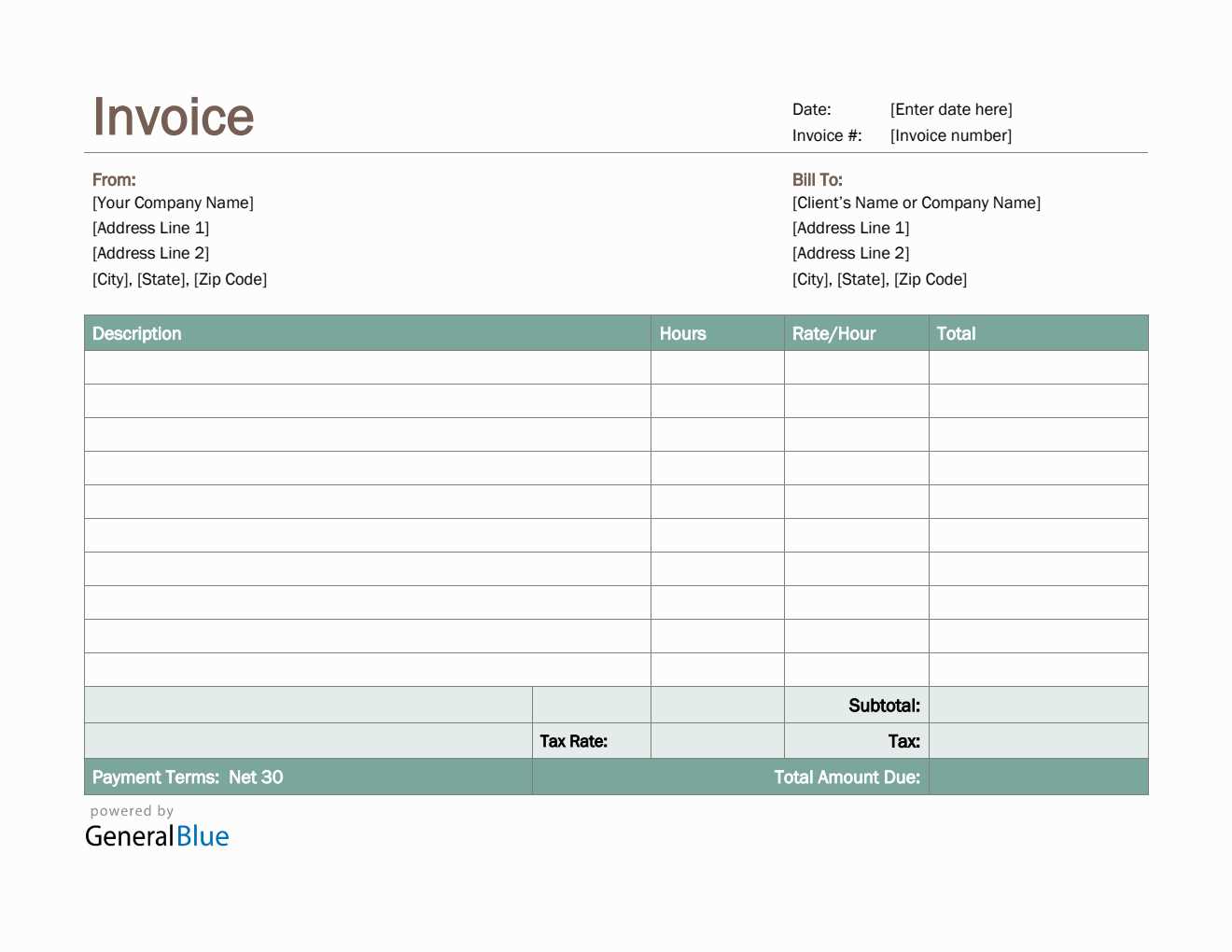

Below is an example layout that can be used for generating payment requests. This structure includes all necessary sections to ensure that the client has all the required details for processing payment promptly.

| Section | Description | ||

|---|---|---|---|

| Header | Include your business name, contact information, and logo if applicable. | ||

| Date | List the date the document is created and, if necessary, the payment due date. | ||

| Client Information | Provide the client’s name, address, and contact details. | ||

| Services or Products | Detail the items or services provided, including quantity, unit price, and total cost. | ||

| Amount Due | Clearly state the total amount the client owes, including taxes or additional fees. | ||

| Payment Terms | Specify the terms, such as due date, accepted payment methods, and late fees. | ||

| Footer | Include any necessary legal disclaimers or business policies. | ||

| Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| Product/Service 1 | 2 | $50 | $100 |

| Product/Service 2 | 1 | $150 | $150 |

| Total Before Tax | $250 | ||

| Tax (10%) | $25 | ||

| Total Amount | $275 | ||

Start by multiplying the quantity of each item by its unit price to determine the amount for each line item. After calculating the total cost of all products or services, apply any applicable tax rate. Finally, sum everything up to find the final amount due.

Including Taxes in Your Invoice

When creating billing documents, it’s crucial to include the appropriate taxes to ensure accuracy and compliance with local regulations. Depending on the nature of the products or services provided, taxes may vary. Including these charges in your document not only ensures transparency but also helps avoid confusion or disputes with clients regarding the final amount due.

Calculating the Correct Tax

To correctly calculate taxes, start by determining the applicable tax rate based on your location and the type of transaction. For example, sales tax might be different for physical goods compared to digital services. Once you have the tax rate, multiply the total amount of the goods or services by this percentage to calculate the tax amount. For instance, if the total amount is $500 and the tax rate is 10%, the tax amount would be $50.

Displaying Taxes Clearly

It’s essential to display the tax calculation clearly in your billing document. List the tax separately from the total amount due so that the client can easily identify the tax applied. For instance, you could write: Sales Tax (10%): $50. This way, the final total is transparent, and the customer can easily see the breakdown of the costs involved.

Setting Payment Terms Clearly

Clearly outlining payment expectations in your document helps avoid misunderstandings and ensures smooth transactions between you and your clients. Defining when and how payments should be made establishes transparency and helps manage cash flow effectively. Well-communicated payment terms also contribute to a professional relationship with your customers.

Key Elements to Include

When specifying payment terms, make sure to include the following important details:

- Due Date: Indicate the exact date by which the payment is expected.

- Accepted Payment Methods: List the options available for payment, such as bank transfer, credit card, or online payment platforms.

- Late Payment Fees: Clearly state any penalties or interest that will be applied if the payment is not made on time.

- Discounts for Early Payment: If applicable, offer a discount for payments made before the due date.

Examples of Payment Terms

Here are a few examples of payment terms you can include in your document:

- Payment due within 30 days from the date of issue.

- A 5% discount will apply if the amount is paid within 7 days of receipt.

- A 2% late fee will be charged for payments made 15 days after the due date.

By outlining these details, you set clear expectations for your clients and make the payment process easier to follow for both parties.

How to Save and Store Invoices

Properly saving and organizing your billing records is essential for maintaining accurate financial documentation and complying with tax regulations. Whether you choose to store them digitally or physically, having a clear system in place ensures that you can easily access past records when needed. Effective storage methods also help protect against data loss and simplify future audits or reference requests.

Digital Storage Options

Storing your documents digitally offers several advantages, including easy access, better security, and space savings. Here are some tips for managing your digital records:

- Use Cloud Storage: Platforms like Google Drive, Dropbox, or OneDrive provide secure, cloud-based storage that you can access from anywhere.

- Organize by Date or Client: Create folders for each year or client to make it easier to locate specific records when needed.

- Back Up Regularly: Ensure you back up your data to prevent loss due to hardware failure or accidental deletion.

- Use Naming Conventions: Name your files clearly, including relevant details like the client name and the date, e.g., “ClientName_2024_04_01.pdf”.

Physical Storage Options

If you prefer to store paper records, consider the following strategies for safe and organized filing:

- File by Category: Create a filing system that organizes documents by client, date, or type of service.

- Use File Folders: Label folders clearly and store them in a secure, easily accessible location such as a filing cabinet.

- Protect Against Damage: Use protective covers or binders to prevent wear and tear on physical documents.

Whether digital or physical, maintaining an organized storage system for your billing records is crucial for easy retrieval and long-term record-keeping.

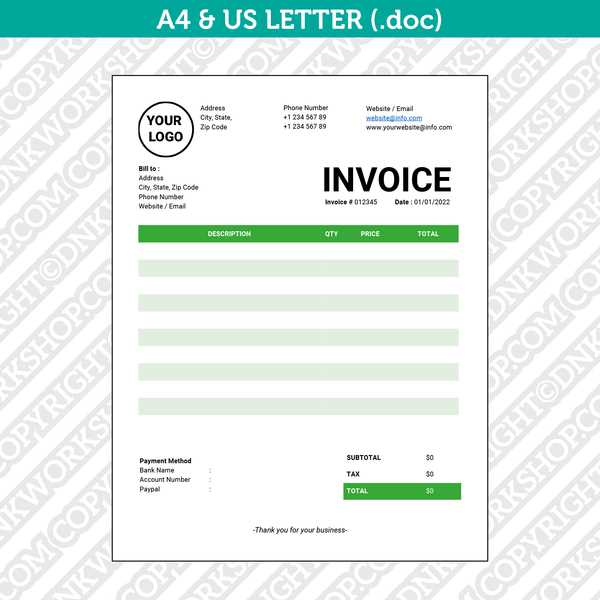

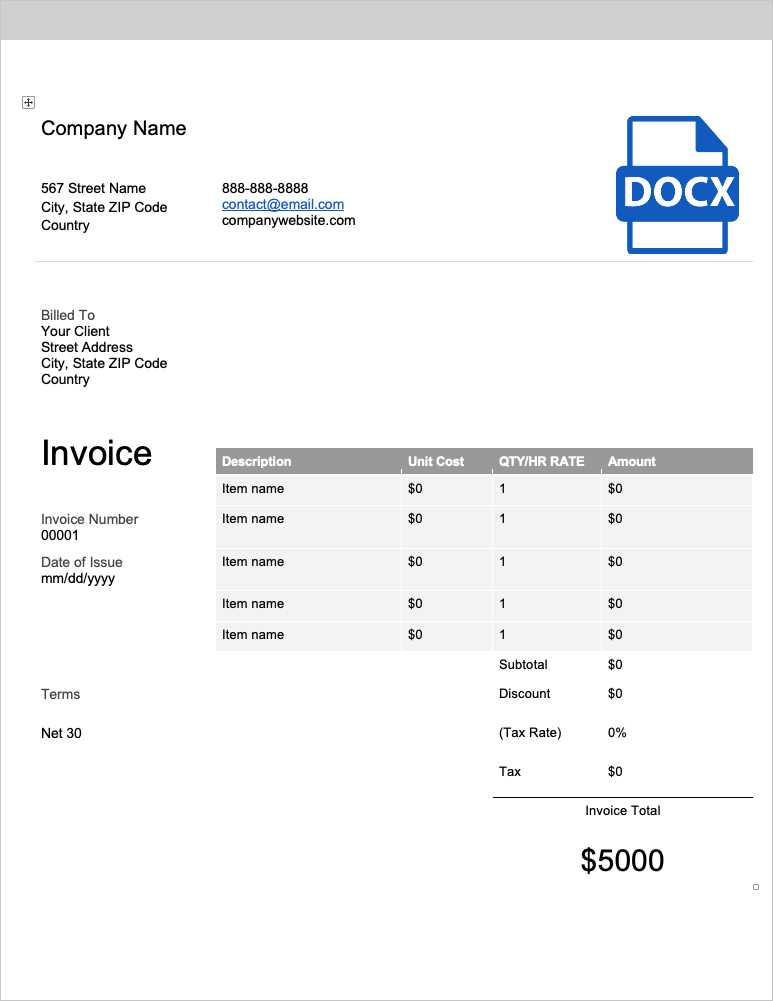

Making Your Invoice Professional

When creating a document for billing purposes, ensuring that it looks polished and well-organized is crucial. A professional appearance not only enhances credibility but also facilitates smooth transactions. The way the document is structured, the clarity of the information, and the attention to detail all contribute to presenting a trustworthy image to clients and partners.

Clarity is Key: A clean layout that clearly differentiates key sections–such as payment terms, contact details, and the breakdown of services–helps avoid confusion. Ensure that the amounts, dates, and descriptions are easy to read and understand at a glance. This can be achieved by using a simple, yet effective, font and a logical flow of information.

Consistent Branding: Incorporating your company logo, consistent colors, and fonts can make the document feel cohesive with your overall brand identity. This subtle branding adds a sense of professionalism and recognition, reinforcing the quality of your work.

Attention to Detail: Double-check all information for accuracy–misspelled names, incorrect amounts, or vague descriptions can create confusion and diminish your credibility. Including necessary legal or tax-related information where required can also demonstrate thoroughness and reliability.

By focusing on these key elements, you can create a polished and professional billing document that reflects well on your business and instills confidence in your clients.

How to Track Payments Efficiently

Managing payments in an organized and systematic manner is essential for maintaining smooth business operations. By keeping a clear record of when funds are received and ensuring that every transaction is logged accurately, you can avoid misunderstandings and cash flow issues. The right approach can help you stay on top of your finances and provide clients with an easy way to track their outstanding balances.

Use a Digital System: The most efficient way to track payments is by using digital tools that automate and centralize records. Software programs or online platforms allow you to record transactions in real-time and generate reports, saving time and reducing the risk of human error.

Stay Consistent with Your Process: Whether you’re tracking payments manually or digitally, consistency is key. Set up a clear process that includes recording each payment immediately upon receipt, noting payment methods, and verifying that amounts match the terms. Regularly updating your records ensures that nothing is overlooked.

Monitor Payment Status: Keeping track of payment deadlines and any outstanding amounts is crucial for effective cash flow management. Organizing your records by due dates and marking off completed payments allows you to easily identify overdue balances and follow up promptly with clients.

By implementing these strategies, you can maintain control over your finances and minimize the risk of missed or delayed payments, ensuring your business runs smoothly and efficiently.

When to Send Your Invoice

Timing plays a critical role in managing your financial transactions. Sending your billing document at the right moment can influence payment speed and improve client relationships. Knowing when to issue your request for payment ensures timely cash flow and avoids delays, which can negatively impact your business operations.

Consider the Terms of Agreement

Before sending your payment request, review the terms agreed upon with the client. Depending on whether you have a contract or informal arrangement, payment expectations may vary. Most agreements specify a time frame, such as net 30 or net 60, which indicates when the payment is due after the service or product is delivered.

Common Billing Milestones

Understanding key milestones in the project or transaction process can help determine the best time to send a request for payment. The timing of your submission should reflect these milestones to ensure clarity and avoid confusion.

| Milestone | Suggested Time to Send |

|---|---|

| Upon Completion of Service | Immediately after the service or project is completed. |

| Partial Payments for Ongoing Projects | At agreed intervals, such as weekly or monthly. |

| Prepayment or Deposits | Before work begins, based on agreement. |

By aligning your billing cycle with project milestones and agreements, you can maintain smooth cash flow and foster trust with your clients.

Integrating Templates with Other Tools

Efficient business operations often require seamless coordination between various tools and processes. By combining your document structure with other software, you can automate workflows, save time, and ensure accuracy. Integration between different platforms allows you to streamline the creation, sending, and tracking of financial documents, making the entire process more effective and less prone to errors.

Benefits of Integration

Integrating your billing and record-keeping documents with other tools offers numerous advantages:

- Time Savings: Automation reduces manual entry, making the process faster and more efficient.

- Consistency: By connecting different systems, your documents remain consistent and aligned with your business standards.

- Improved Accuracy: Synchronization between platforms helps reduce human errors by automatically updating fields and details.

- Better Tracking: Integration with accounting or CRM tools helps you track payment status, due dates, and client interactions in one place.

Tools to Consider for Integration

To optimize your document handling, consider integrating with the following tools:

- Accounting Software: Programs like QuickBooks or Xero automatically sync payment data, simplifying financial tracking.

- Customer Relationship Management (CRM) Systems: CRMs like HubSpot or Salesforce can store client details, streamlining communication and record-keeping.

- Payment Platforms: Platforms such as PayPal, Stripe, or Square can be integrated to directly collect payments and update your financial records in real-time.

- Project Management Tools: Tools like Trello or Asana help track project milestones and payment terms, ensuring you bill clients at the right time.

By integrating your business documents with other essential tools, you can boost efficiency, enhance accuracy, and create a smoother workflow for managing finances and client relationships.