Download Free Invoice Template for Easy and Efficient Billing

Managing financial transactions can be a complex task, but with the right tools, it becomes a lot simpler and more organized. One of the key elements to smooth financial operations is having a structured document that helps you record payments and track outstanding amounts. Using a reliable and easily customizable document can save you time and effort, ensuring your business operations run without a hitch.

Streamlining the payment process through professional-grade forms can help avoid errors and maintain a consistent record of transactions. These documents not only enhance your credibility but also provide clarity for both parties involved. By offering a polished and easy-to-understand way to handle financial exchanges, you can focus more on your work and less on administrative tasks.

Whether you’re a freelancer, a small business owner, or a contractor, adopting an organized approach to handling payments can elevate your professionalism and efficiency. With a wide variety of tools available, it’s possible to find a suitable option that meets your specific needs and helps you manage finances with ease.

Free Invoice Template Benefits for Small Businesses

For small businesses, having an organized system to handle financial transactions is crucial for maintaining smooth operations. Using a well-designed document to track payments, receipts, and outstanding balances not only saves time but also ensures that everything is clearly recorded. A simple yet effective tool can streamline your billing process, helping you stay on top of your finances and avoid costly mistakes.

One of the main advantages of using a pre-designed form is the ability to create professional-looking records with minimal effort. For small business owners who may not have extensive administrative resources, this can be a huge benefit. With just a few adjustments, you can customize your records to include all the necessary details, such as payment terms, due dates, and itemized services or products.

Additionally, having access to a standardized format allows for consistency in your transactions. This helps to build trust with clients and makes the process of managing payments more transparent. When you present a well-organized document, it shows professionalism and reliability, which can improve client relationships and enhance your reputation in the industry.

Why Choose a Free Invoice Template

For small business owners and freelancers, keeping track of payments and transactions is essential for smooth financial management. Using a well-organized document not only simplifies this process but also ensures accuracy and professionalism. Opting for a pre-designed solution offers a range of benefits that can save time, reduce errors, and enhance overall efficiency.

Here are some key reasons why selecting a no-cost option can be a smart choice:

- Cost-Effective: Avoiding the need to invest in expensive software or paid solutions can help reduce overhead costs. A free, ready-to-use document allows you to manage finances without additional expenses.

- Customization: Even without paying for premium services, many pre-designed options offer flexibility, allowing you to tailor the document to meet your specific needs, such as adding company logos or adjusting payment terms.

- Quick Setup: Instead of spending time learning complex software, you can start using the document immediately. This is particularly beneficial for new businesses or freelancers who need to focus on client work.

- Professional Appearance: A polished and consistent design can make a strong impression on clients. Even without specialized design skills, you can present professional records that enhance your business’s image.

- Easy Accessibility: Most no-cost options are available online, meaning you can access and use them from anywhere, even on mobile devices, making them ideal for entrepreneurs on the go.

By choosing a simple and functional solution, small businesses can streamline their billing process while maintaining professionalism without the need for significant financial investment.

How to Use Invoice Templates Effectively

Using a pre-designed document to manage financial transactions can save time and help avoid errors. However, to truly benefit from such a tool, it’s important to use it in a structured and organized manner. Following a few simple steps can ensure that you’re maximizing its potential for smooth and professional billing.

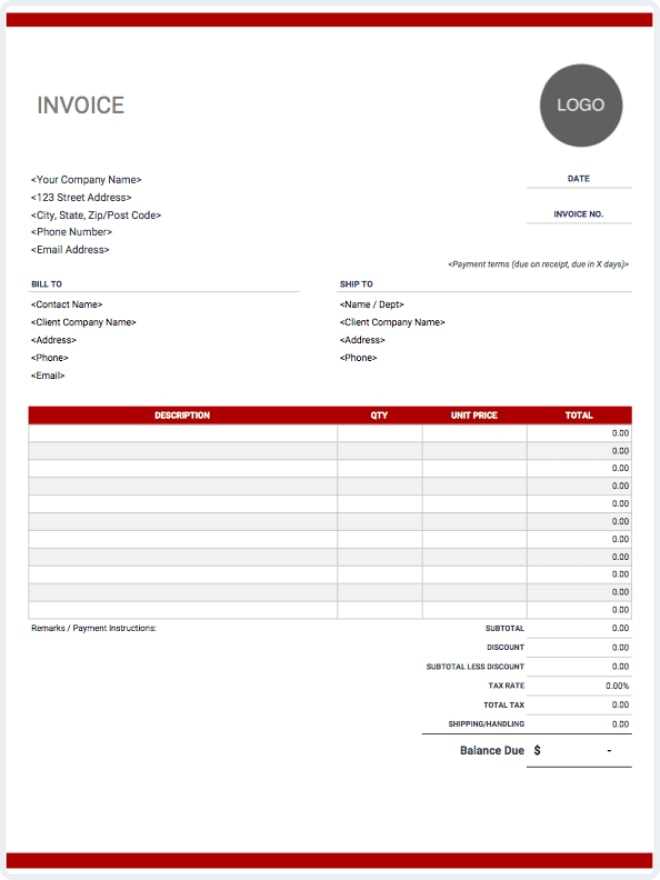

First, make sure that all relevant information is clearly and consistently included. This includes details such as your business name, client’s contact information, services rendered, payment terms, and due dates. The following example illustrates the key sections you should include:

| Section | Description |

|---|---|

| Business Information | Your company name, address, and contact details. |

| Client Information | The client’s name, address, and contact details. |

| Description of Services | A detailed list of the services or products provided, including quantity and price. |

| Total Amount | The total cost for the services or products provided. |

| Payment Terms | Due date and accepted payment methods. |

| Notes | Additional instructions or details, such as late fees or discounts. |

Second, always double-check the accuracy of the information before sending. Even though the document is pre-designed, any errors in the details can lead to confusion and delays. It’s also important to update the form regularly to ensure it aligns with your current business terms and practices.

Finally, customize your document to reflect your brand identity. By adding a logo or adjusting the layout to match your business’s aesthetic, you can make your billing process feel more personalized and professional. With these simple practices, you can make the most of a ready-to-use solution while maintaining efficiency and professionalism in

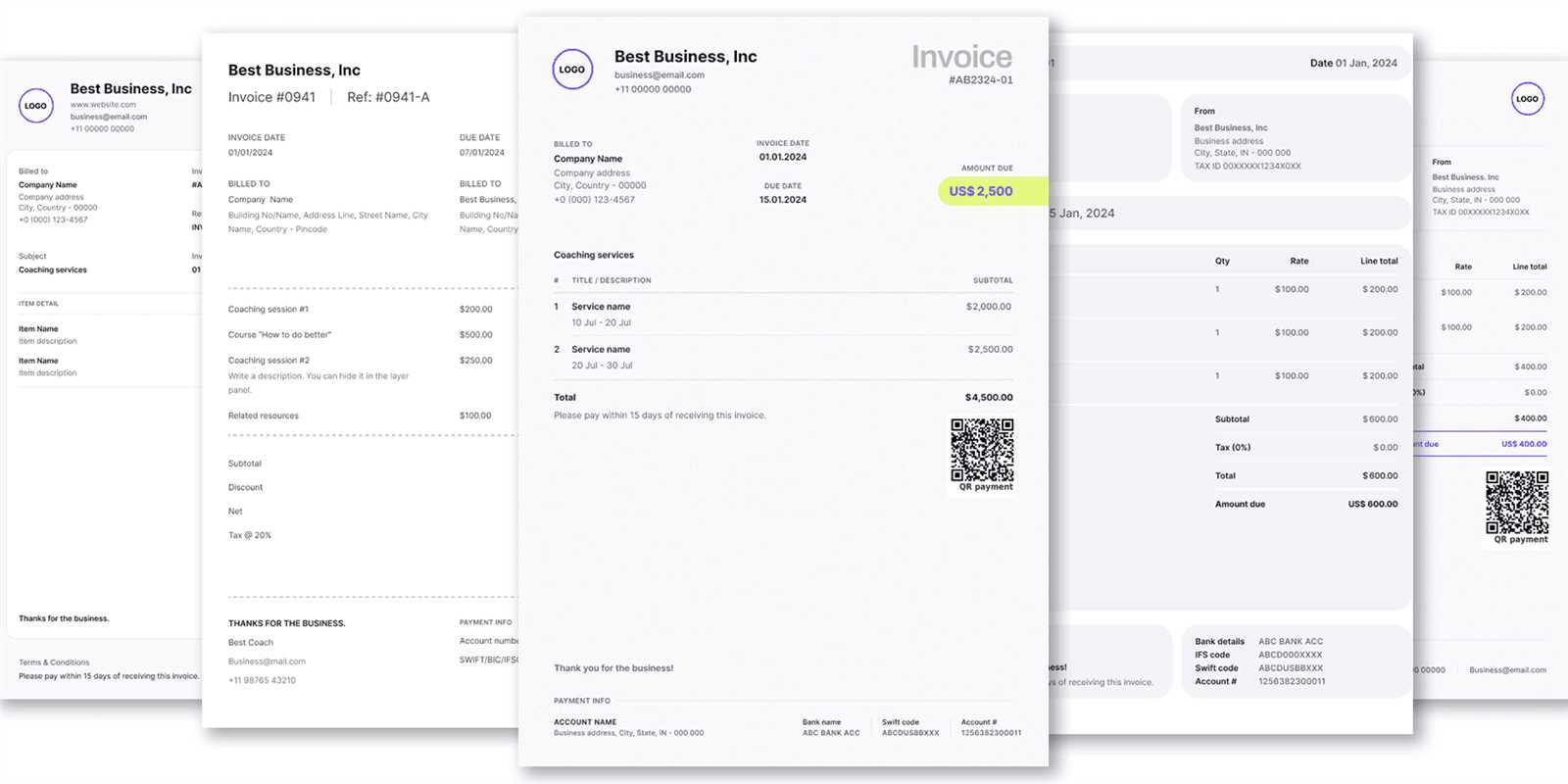

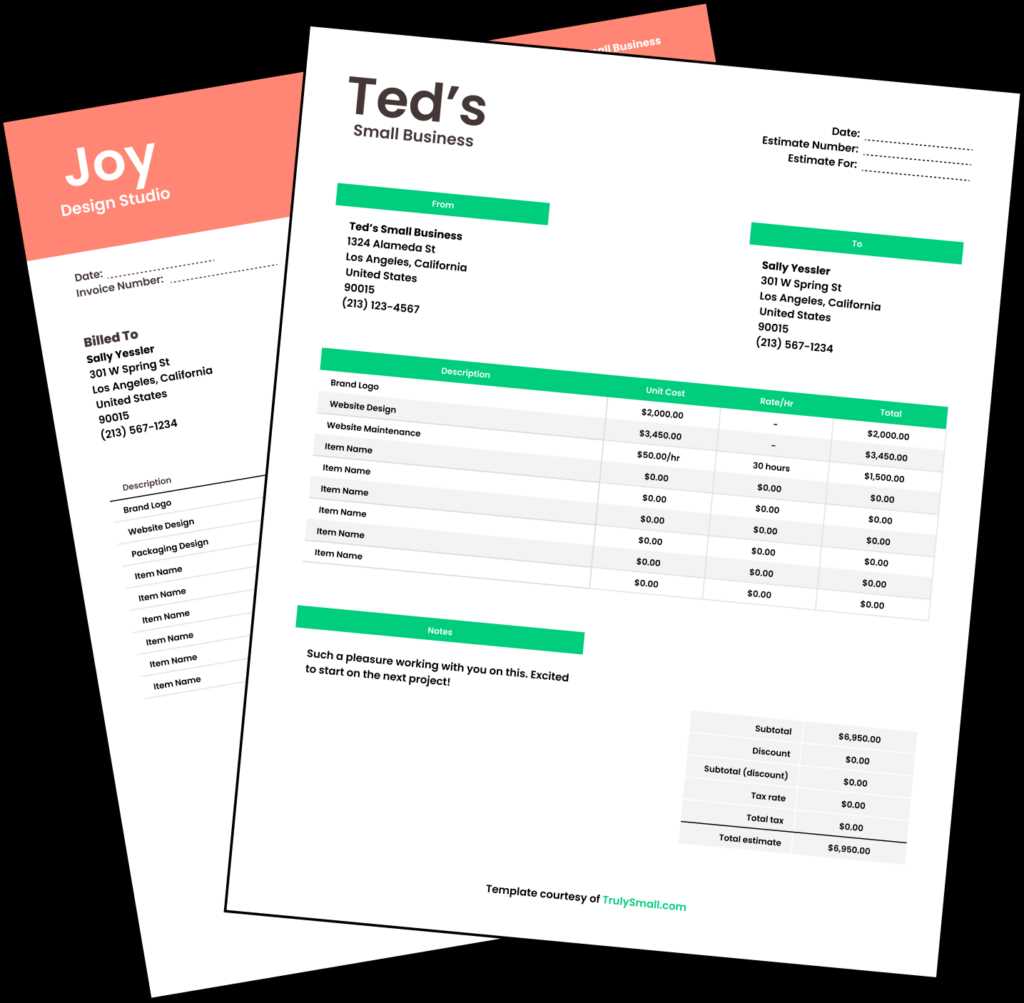

Best Free Invoice Templates Available Online

When it comes to managing financial records, having access to well-structured and easy-to-use tools is essential. There are numerous platforms offering ready-made documents designed to simplify the billing process. These solutions cater to various needs, providing different styles and functionalities for both freelancers and small businesses alike. Whether you need a simple document for a one-time job or a more detailed one for ongoing projects, the right resource can help streamline your workflow and maintain professionalism.

Top Platforms for Downloading Professional Billing Documents

Several online resources provide high-quality documents that can be customized to fit your needs. Here are some of the best options available:

| Platform | Description | Key Features |

|---|---|---|

| Canva | Canva offers a variety of visually appealing and customizable billing documents suitable for creative professionals. | Easy drag-and-drop editing, customizable templates, free account access. |

| Invoice Simple | A straightforward platform providing no-frills, functional templates for quick billing. | Fast setup, multiple formats available, user-friendly interface. |

| Zoho Invoice | Zoho’s platform offers a comprehensive set of billing tools, including customizable documents that integrate with accounting software. | Recurring billing, online payment integrations, professional templates. |

| Microsoft Office | Microsoft provides a range of customizable documents for those who prefer working within Excel or Word. | Variety of pre-made designs, integration with other Office tools, familiar interface. |

Choosing the Best Resource for Your Needs

The ideal platform depends on the specific needs of your business. For example, creative professionals may appreciate the aesthetic flexibility of Canva, while those looking for an all-in-one billing solution might benefit from Zoho’s advanced features. Regardless of your choice, these platforms offer robust options to help you manage transactions efficiently and with minimal effort. Selecting the best one ultimately comes down to the features that matter most to your workflow and business type.

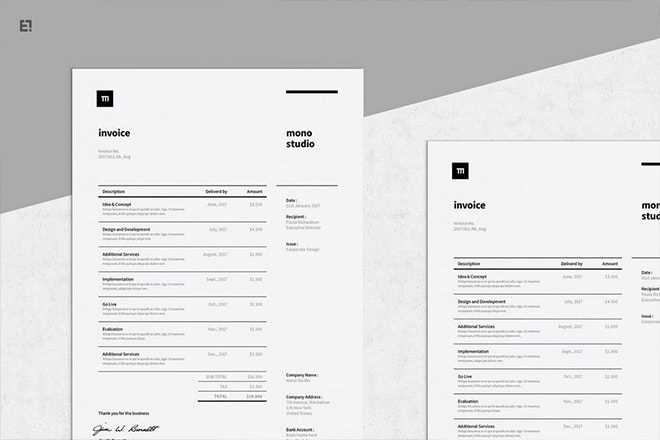

Customizing Your Invoice Template for Professionalism

To make a lasting impression with your financial documents, it’s essential to ensure they reflect your brand’s professionalism. Customizing your billing records not only enhances their visual appeal but also improves clarity and efficiency. With a few simple adjustments, you can tailor your document to meet both functional and aesthetic needs, helping your business stand out and build trust with clients.

Start by adding your business logo and branding colors. This gives your records a personalized and professional touch that aligns with your overall business image. A well-placed logo can reinforce your brand identity, making your documents instantly recognizable to clients.

Next, focus on clear and readable typography. Choose fonts that are easy to read, with appropriate sizes for headers, subheadings, and content. Avoid overly decorative fonts, as they can make your documents appear unprofessional or hard to understand. A clean and simple design will help clients quickly find the information they need.

Another important aspect is organizing the information logically. Use well-defined sections with clear headings and appropriate spacing to separate different types of content, such as services provided, payment terms, and contact information. This ensures that clients can navigate the document effortlessly and find relevant details without confusion.

Finally, consider adding additional elements such as payment instructions or terms that reflect your specific business practices. Whether it’s a discount for early payments or penalties for late fees, clear communication of these details can prevent misunderstandings and encourage timely payments.

Common Mistakes to Avoid in Invoices

When creating financial documents to request payment, accuracy and clarity are essential. Simple mistakes can lead to delays in payments, misunderstandings with clients, and even damage to your professional reputation. By being aware of common errors, you can ensure that your records are precise, complete, and easy to understand.

Key Mistakes to Watch Out For

Here are some of the most common mistakes made when preparing billing documents:

| Mistake | Explanation | How to Avoid It |

|---|---|---|

| Missing Contact Information | Omitting your contact details or the client’s information can cause confusion and delays when trying to resolve issues. | Always include both your business and the client’s full contact details, including email addresses and phone numbers. |

| Incorrect Payment Terms | Setting unclear or incorrect payment terms can lead to disputes or missed payments. | Clearly state payment due dates, accepted payment methods, and any late fees or discounts. |

| Omitting Item Descriptions | Failing to provide clear descriptions of the products or services can lead to confusion or disagreements over the charges. | Be specific and detailed about each item or service, including quantity, rate, and any additional costs. |

| Arithmetic Errors | Even minor calculation mistakes can create discrepancies and cause delays in payment processing. | Double-check all calculations, including taxes and totals, before sending the document. |

| Unprofessional Design | A poorly formatted or difficult-to-read document can make your business appear unprofessional. | Use a clean, organized format with easy-to-read fonts and clearly defined sections. |

Final Thoughts

By taking care to avoid these common mistakes, you can ensure that your documents are not only accurate but also present a professional image. A well-prepared billing record helps you maintain trust with your clients and promotes timely payments, making it easier to manage your cash flow.

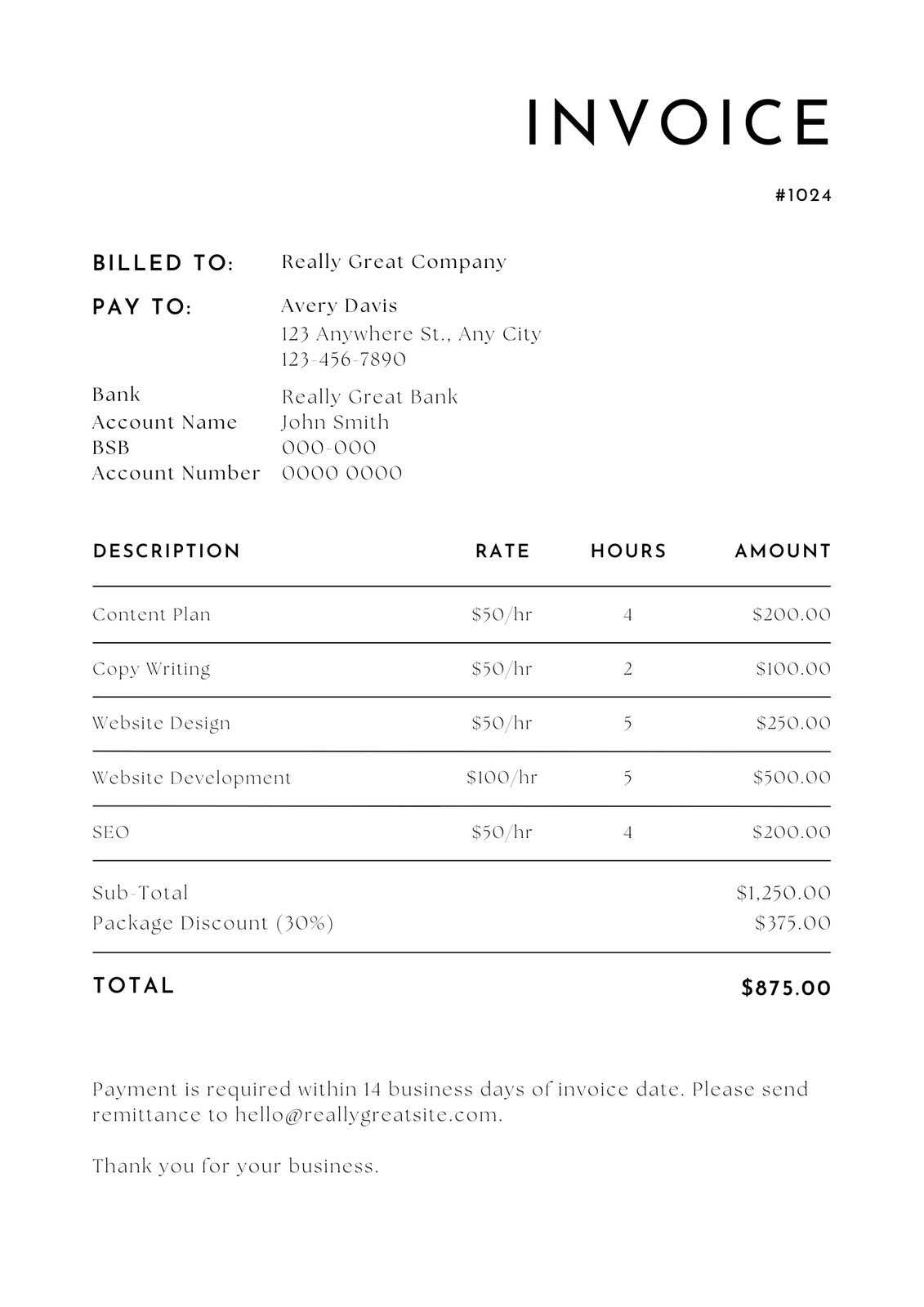

How to Create a Professional Invoice from Scratch

Creating a professional billing document from scratch allows you to tailor it precisely to your needs. While many pre-designed options are available, building your own gives you full control over the layout, details, and branding. By following a few simple steps, you can craft a clean, organized, and effective document that enhances your business’s image and ensures clear communication with clients.

Here are the steps to create a well-structured and professional record:

- Include Your Business Information: Start by adding your company name, address, phone number, and email at the top. This ensures clients can easily reach you with any questions.

- Add Client Details: Beneath your contact information, include the client’s name, address, and contact info to personalize the document and maintain clarity.

- Assign a Unique Reference Number: This helps both you and your client easily track and refer to the document. Numbering is especially important for keeping records organized.

- List Products or Services: Clearly describe the products or services provided. Be specific about each item, including quantity, unit price, and any applicable discounts or taxes.

- Calculate Total Amount: Ensure the total amount is clearly visible, including the subtotal, taxes, and final total. This helps prevent confusion and mistakes.

- Set Payment Terms: Clearly outline when the payment is due, acceptable payment methods, and any late fees for overdue payments. Include details on how the client can pay (e.g., bank transfer, credit card, etc.).

- Personalize with Branding: Add your business logo and choose a professional font and layout. Consistency in design helps maintain a professional look and reinforces your brand identity.

By following these steps and focusing on clarity and accuracy, you can create a billing record that not only looks professional but also ensures that both you and your clients are on the same page regarding the payment process.

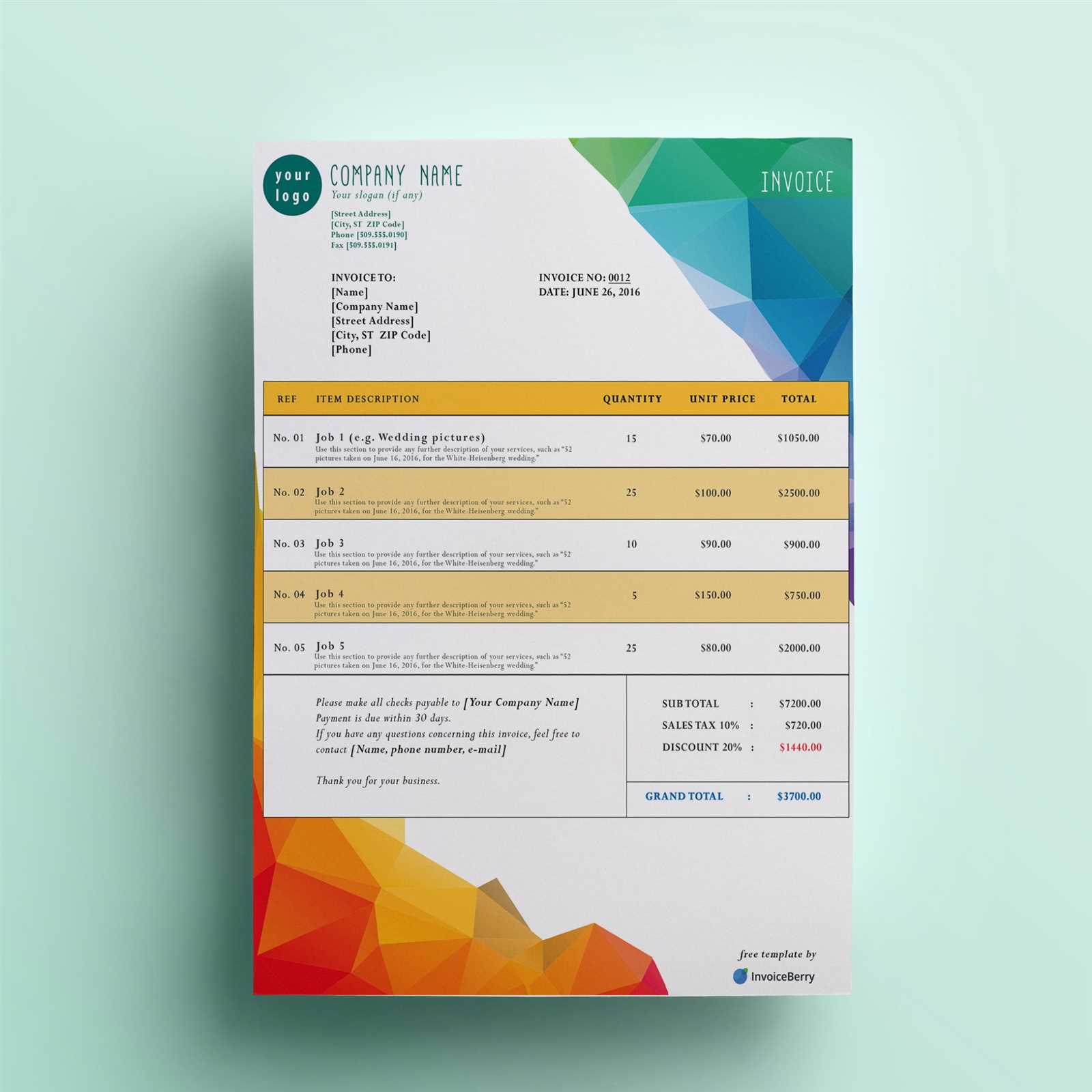

Free vs Paid Invoice Templates: What’s Best

When selecting a document for managing payments, businesses often face the choice between using a no-cost option or investing in a paid solution. Both types offer unique advantages, but understanding the differences can help you determine which option best fits your needs. While free resources are often sufficient for basic use, paid solutions can offer more advanced features and customization options for businesses seeking more control over their financial documents.

Benefits of Using No-Cost Solutions

No-cost options can be an excellent choice for small businesses, freelancers, or those just starting out. They offer a straightforward way to create organized records without the need for additional expenses. Here are some reasons why a free option might be the right fit:

- Cost-Effective: As the name suggests, no-cost options eliminate the need for any financial investment, which is ideal for businesses on a tight budget.

- Ease of Use: These documents are typically simple to use and quick to set up, which makes them perfect for people who need a fast, hassle-free solution.

- Basic Customization: While customization options may be limited, free resources still allow you to add key details like your business name, contact info, and services provided.

Advantages of Paid Solutions

On the other hand, opting for a paid solution provides access to more advanced features and higher levels of customization. Here are some reasons why businesses might choose a paid option:

- More Design and Layout Options: Paid solutions often come with a wide variety of professionally designed layouts, allowing businesses to choose or create a style that aligns with their brand.

- Advanced Customization: These tools allow for greater flexibility in adjusting the document to fit unique business needs, such as integrating tax calculations, multi-currency support, or including detailed project breakdowns.

- Additional Features: Some paid options offer features like recurring billing, automatic reminders, and integration with accounting or payment systems, making it easier to manage your finances.

Ultimately, the decision between free and paid resources depends on the complexity of your business and your specific needs. A no-cost option may suffice for freelancers or small businesses with simple billing requirements, while a paid solution may be better suited for businesses with ongoing projects or those looking to automate their payment processes.

How to Include Taxes in Your Invoice

Accurately including taxes in your billing records is essential for both legal compliance and clear communication with clients. Whether you’re required to charge sales tax, VAT, or other applicable taxes, it’s important to ensure that these amounts are presented clearly and correctly. By following the right steps, you can easily calculate and display taxes on your billing documents while keeping everything transparent and professional.

Steps to Include Taxes in Your Billing Record

Here are some steps to ensure taxes are included properly in your financial records:

- Determine the Applicable Tax Rate: Identify the tax rate that applies to your goods or services based on your location or the client’s location. Tax rates vary depending on the type of service, the country, and even the state or region.

- Calculate the Tax Amount: Multiply the taxable amount (the subtotal of the services or products) by the applicable tax rate to determine the tax due.

- Clearly Display the Tax on the Document: Make sure to list the tax separately, so clients can clearly see the amount being charged. This helps maintain transparency and avoids confusion.

- Include Any Relevant Tax Information: If required, add your business’s tax registration number, or provide a breakdown of how the tax is applied (e.g., state tax, federal tax, VAT).

Sample Table for Tax Calculation

Here’s an example of how taxes can be calculated and displayed on a billing record:

| Description | Amount |

|---|---|

| Subtotal | $100.00 |

| Sales Tax (8%) | $8.00 |

| Total Amount Due | $108.00 |

By following these steps and ensuring that tax details are clearly presented, you can make your billing process easier to understand and avoid potential disputes with clients regarding tax charges.

Top Features of an Ideal Invoice Template

When creating a billing record, it’s important to ensure that it not only serves its functional purpose but also reflects your professionalism and business practices. The right features can help make the document clearer, more organized, and easier to understand for both you and your clients. An ideal billing document should balance simplicity, clarity, and customization to suit your specific needs while maintaining a polished, professional appearance.

Essential Elements for a Well-Structured Document

Here are some key features to look for when creating or choosing a billing document:

- Clear Business and Client Information: Ensure that both your business and the client’s details are prominently displayed. This includes names, addresses, phone numbers, and email addresses to facilitate communication and avoid confusion.

- Unique Reference Number: A unique reference number for each document is essential for organization and easy tracking. This helps both you and your client quickly identify specific transactions.

- Itemized List of Services or Products: Clearly break down the products or services provided, including descriptions, quantities, unit prices, and any applicable discounts. This ensures that both parties agree on what’s being billed.

- Transparent Payment Terms: Clearly state when payment is due, how it can be made, and any late fees or discounts for early payment. These details are crucial for managing cash flow and avoiding misunderstandings.

- Easy-to-Find Total Amount: The total amount due should be easy to locate and clearly visible, making it easy for clients to understand what they owe at a glance.

Additional Features for Enhanced Customization

For businesses with more specific needs or a desire for customization, the following features can add significant value:

- Customizable Design: The ability to add your brand’s logo, color scheme, and fonts can help maintain consistency and create a stronger brand identity.

- Tax and Discount Calculations: Automatic calculations for taxes or discounts can save time and ensure accuracy when preparing the document.

- Space for Notes or Special Instructions: Including a section for additional information, such as payment instructions or special terms, can help clarify any details not covered in the main body of the document.

By ensuring your billing document includes these key features, you can create a tool that not only looks professional but also helps facilitate smooth transactions and positive relationships with your clients.

How Free Invoice Templates Improve Efficiency

Using pre-designed documents for managing payments can significantly streamline business operations. By providing a ready-made structure for billing, these solutions save time and reduce the risk of errors. They allow business owners to focus more on their core activities while ensuring that financial records are created quickly and accurately. The simplicity and ease of use offered by such documents can greatly enhance overall productivity.

Time-Saving Benefits

One of the most significant advantages of using pre-designed billing solutions is the time saved in preparing each document. Here’s how they improve efficiency:

- Pre-Formatted Structure: These documents come with pre-defined fields for all the necessary details, such as business and client information, service descriptions, and amounts due. This eliminates the need to manually design the layout from scratch.

- Quick Customization: You can easily fill in the relevant information, and many options allow you to personalize them with your logo or branding colors, saving valuable time on design work.

- Instant Calculation: Many pre-made records automatically calculate totals, taxes, and discounts, ensuring accuracy and reducing the time spent on manual calculations.

Reducing Errors and Increasing Accuracy

Accuracy is crucial when it comes to financial documents, and using pre-made solutions can help minimize human error. Here’s how they contribute to more accurate records:

- Standardized Layout: A consistent format reduces the chances of leaving out important information or presenting data in a confusing manner.

- Automatic Totals and Taxes: With built-in formulas, these documents automatically calculate taxes, discounts, and the final total, reducing the risk of arithmetic mistakes.

- Clear Sections and Labels: The pre-designed structure ensures that each section is clearly labeled, making it easy to check for missing information or discrepancies.

By using pre-designed billing records, businesses can save time, reduce errors, and create professional, accurate documents with ease, ultimately improving efficiency and workflow.

Choosing the Right Format for Your Invoice

When creating a billing document, selecting the appropriate format is crucial for clarity, professionalism, and ease of use. The right format ensures that your client can quickly understand the details, making it easier to process payments on time. Additionally, it allows you to present your services or products in a clear and organized way. The format you choose will depend on several factors, including your business needs, client preferences, and the complexity of the transaction.

Factors to Consider When Choosing a Format

Here are some important aspects to consider when selecting a format for your billing records:

- Business Type: The type of business you operate may influence the format. For example, service-based businesses might need a more detailed breakdown of hours worked, while product-based businesses may focus more on item descriptions and quantities.

- Client Preferences: Consider how your clients prefer to receive and view billing documents. Some clients may prefer a more straightforward format with minimal details, while others may require a comprehensive breakdown of all services or products.

- Ease of Use: Choose a format that is easy to fill out and easy for your clients to understand. A cluttered or overly complicated document can lead to confusion and delays in payment.

- Legal or Tax Requirements: Certain jurisdictions or industries may have specific requirements for how billing documents should be formatted, such as including tax rates, registration numbers, or other mandatory details.

Popular Formats for Billing Records

Here are a few common formats that businesses use for creating effective billing documents:

- Simple List Format: A basic format that lists services or products, quantities, and prices. This is ideal for businesses with straightforward transactions or small invoices.

- Detailed Breakdown: More complex formats that include detailed descriptions, hourly rates, and itemized charges. This format is useful for projects that require clear accountability and transparency.

- Pre-Formatted Accounting Format: A format that includes sections for taxes, payment terms, discounts, and totals. This is especially useful for businesses that need to track payments and report finances in a consistent manner.

Ultimately, the best format for your billing document will depend on your specific business needs, the expectations of your clients, and any legal requirements. A clean, organized, and easy-to-understand format will help ensure that your clients have a positive experience and that payments are processed smoothly.

How to Automate Invoicing with Templates

Automating the process of generating billing records can save your business significant time and reduce the chances of human error. By utilizing pre-designed structures that integrate with your accounting system or payment platform, you can streamline the process and ensure consistent and accurate documentation. Automation helps you focus on your core business operations while reducing the administrative burden of manual billing.

Here’s how you can automate your billing process using pre-made structures:

Steps to Automate Your Billing Process

- Choose an Automation Tool: Start by selecting a tool or software that supports the automation of financial documents. Many modern accounting platforms allow you to use pre-made structures to create and send billing records automatically.

- Integrate with Your Payment System: Link your chosen tool with your payment gateway to automatically generate and send records once payments are made. This reduces the need for manual intervention and ensures your records are always up to date.

- Set Recurring Schedules: If you offer subscription-based services or regular payments, configure your tool to send documents on a recurring basis, eliminating the need to manually create and send each record.

- Customize for Specific Clients: Personalize your automation setup to handle different client requirements. Some clients may require detailed descriptions, while others only need a summary. Automation tools typically allow for flexible customization based on these needs.

Example of Automated Billing Workflow

Here’s a simple workflow that illustrates how automation can streamline the billing process:

| Step | Action |

|---|---|

| 1. Client Agreement | Client signs up for a service or product with recurring billing terms. |

| 2. Integration Setup | Link payment platform with automation tool for seamless billing. |

| 3. Automated Record Creation | System generates a new billing record on the agreed-upon date. |

| 4. Client Notification | System sends the record to the client via email or preferred method. |

| 5. Payment Tracking | Once payment is made, the system updates the record automatically. |

By automating the billing process, businesses can reduce administrative work, minimize errors, and ensure clients receive accurate and timely documentation. This not only enhances efficiency but also creates a more professional experience for your clients.

Invoicing Tips for Freelancers and Contractors

For freelancers and contractors, creating accurate and professional billing records is crucial for maintaining positive client relationships and ensuring timely payments. A well-structured billing document not only ensures you get paid but also reflects your professionalism. By following best practices, you can streamline the billing process, reduce errors, and avoid delays. Below are some essential tips for creating and managing your billing documents effectively.

Best Practices for Creating Billing Documents

Here are several tips to help you create clear and accurate financial records:

- Be Clear About Payment Terms: Clearly outline the payment due date, accepted payment methods, and any late fees that apply. Make sure these terms are visible and easy to understand.

- Break Down Your Services: List each service or product you provided with a detailed description. This ensures that clients know exactly what they are being charged for and helps avoid misunderstandings.

- Include a Unique Reference Number: Every billing record should have a unique reference number. This makes tracking payments easier for both you and your clients and helps organize your financial records.

- Track Your Time and Expenses: For projects billed by the hour or with additional expenses, keep accurate records of time worked and expenses incurred. This will help you accurately calculate the total amount due.

Managing Your Billing Process Efficiently

Here are some strategies to make the invoicing process more efficient and professional:

- Automate the Process: Use software tools to automate the creation and sending of your billing records. Automation can save you time, reduce errors, and help you stay organized.

- Use Professional Designs: A clean, professional design gives a strong impression and reinforces your brand identity. Customize your documents to reflect your business style and make sure they look polished.

- Follow Up Promptly: If a client hasn’t paid by the due date, send a polite reminder. Clear communication about payment expectations can help avoid misunderstandings and delays.

- Stay Consistent: Be consistent in the way you format and send your billing records. Using the same layout and method each time helps reinforce professionalism and makes it easier for your clients to process payments.

By following these tips, freelancers and contractors can improve their billing efficiency, reduce errors, and ensure that payments are received in a timely manner. A well-managed billing process not only saves you time but also enhances your reputation as a reliable professional.

How to Track Payments Using Invoices

Tracking payments is essential for maintaining accurate financial records and ensuring that your business cash flow remains healthy. By using structured billing documents, you can easily monitor outstanding balances, track paid and overdue amounts, and stay on top of your income. Proper payment tracking not only helps you maintain a clear overview of your finances but also allows you to take timely actions if any payments are delayed.

Steps to Track Payments Effectively

To track payments accurately, consider the following strategies:

- Assign Unique Reference Numbers: Each document should include a unique reference or invoice number. This helps you match payments to specific transactions, making it easier to identify which amounts have been paid or remain outstanding.

- Record Payment Dates: When a payment is received, immediately note the date and amount in your records. This allows you to track when a payment was made and monitor if any payments are overdue.

- Include Payment Terms: Ensure that you clearly state payment due dates and terms on your documents. This sets clear expectations for your clients and helps you track whether payments are made on time or are past due.

- Update Payment Status Regularly: Keep your records up to date by marking payments as “paid” or “outstanding.” Regularly reviewing and updating your payment status helps you identify overdue payments and take appropriate action.

Using Accounting Tools for Payment Tracking

If you want to automate and simplify payment tracking, consider using accounting software or payment platforms that integrate with your billing system. Here’s how they can help:

- Automated Payment Reminders: Many accounting tools allow you to set up automated reminders to notify clients of upcoming or overdue payments. This reduces the need for manual follow-ups and encourages timely payments.

- Payment Status Updates: Integration with payment gateways allows for real-time updates on payment status. You can automatically mark documents as paid when a transaction is processed, ensuring your records are always accurate.

How to Keep Your Invoices Organized Maintaining an organized system for your financial documents is essential for ensuring that you can quickly access records, track payments, and manage your finances efficiently. Whether you’re handling a few transactions or managing a large volume of payments, having a well-structured approach to organizing your documents helps prevent errors and makes it easier to stay on top of your business operations. Here are some practical strategies to keep your records organized and accessible.

Effective Methods for Organizing Financial Documents

Here are some proven techniques to help you stay organized:

- Use a Clear Naming System: Give each document a unique, descriptive name, such as “ClientName_InvoiceNumber_Date.” This makes it easier to find and reference specific records when needed.

- Separate by Categories: Organize your documents into different categories, such as “Paid,” “Pending,” and “Overdue.” This helps you quickly see which transactions are completed and which ones need follow-up.

- Maintain a Digital Record: Use digital storage solutions like cloud services or accounting software to keep your records safe and easily accessible. Digital records are also more secure and easier to back up compared to physical copies.

- Keep a Consistent Filing System: Whether using physical folders or digital files, ensure that your filing system is consistent. Label folders clearly and use subfolders for better organization by client, project, or date range.

Using Software for Better Organization

Leveraging software tools can significantly improve how you organize your records:

- Cloud-Based Storage: Cloud services like Google Drive or Dropbox offer a convenient and secure way to store and organize your documents. With cloud storage, you can access your records from anywhere and share them with clients or accountants easily.

- Accounting Software: Using dedicated accounting platforms allows you to create, send, and store documents automatically. Most tools also let you track payment status and keep records organized in one place.

- Automatic Sorting: Some tools offer features that automatically categorize and label your documents based on set criteria, such as client name or date, saving you time on manual organization.

Best Practices for Ongoing Organization

Maintaining an organized system requires consistency and attention to detail:

- Update Your Records Regularly: Set aside time each week or month to review your documents, ensuring all records are filed correctly and payment statuses are updated.

- Back Up Your Documents: Always back up your digital records to avoid losing important files. Consider using both cloud storage and an external hard drive for added security.

- Keep Track of Key Dates: Use calendars or reminders to keep track of payment due dates, follow-ups, and other important milestones related to your billing cycle.

By implementing these methods, you can keep your financial records in order and avoid the chaos of misplaced documents or missed payments. Whether you prefer a manual approach or automated solutions, the key to effective organization is consistency and attention to detail.

Why Digital Invoices are Better Than Paper

In the modern business world, digital records offer significant advantages over traditional paper-based methods. Not only are they more efficient, but they also save time, reduce costs, and improve overall organization. As businesses transition to digital systems, it’s clear that electronic documents are the way forward, offering a more streamlined and reliable approach to managing transactions.

Advantages of Digital Records Over Paper

Here are the key benefits of using digital records instead of paper-based documents:

- Cost-Effective: Digital systems eliminate the need for paper, printing, and postage, significantly reducing operational costs. With no physical materials to manage, businesses can save money and allocate resources more effectively.

- Instant Delivery: Digital documents can be sent instantly via email or other electronic platforms, allowing for quicker communication and faster processing times. Clients receive their records without delays, which is especially important in a fast-paced business environment.

- Better Organization: Digital records can be easily sorted, categorized, and stored in cloud-based systems or digital folders. This makes it simple to access specific documents when needed, reducing the time spent searching through physical piles of paperwork.

- Increased Accuracy: With digital tools, there’s less chance of manual errors. Features like auto-calculations and customizable templates help ensure that all fields are filled in correctly and reduce the likelihood of mistakes in calculations or data entry.

- Environmental Benefits: By reducing paper usage, businesses contribute to environmental sustainability. Going digital helps reduce deforestation, paper waste, and energy consumption associated with printing and storing physical documents.

Why Businesses Should Make the Switch

Adopting digital systems brings several long-term benefits for businesses, including:

- Improved Security: Digital records are easier to secure and protect with password encryption, two-factor authentication, and regular backups. In contrast, paper documents are vulnerable to theft, loss, or damage.

- Faster Processing and Payment: Digital systems allow for faster transaction processing. Automatic reminders and online payment integration help ensure that clients can make payments promptly, reducing delays in cash flow.

- Easy Access Anywhere: Cloud-based solutions make it easy for businesses to access documents from anywhere, whether in the office, at home, or while traveling. This flexibility enhances productivity and m