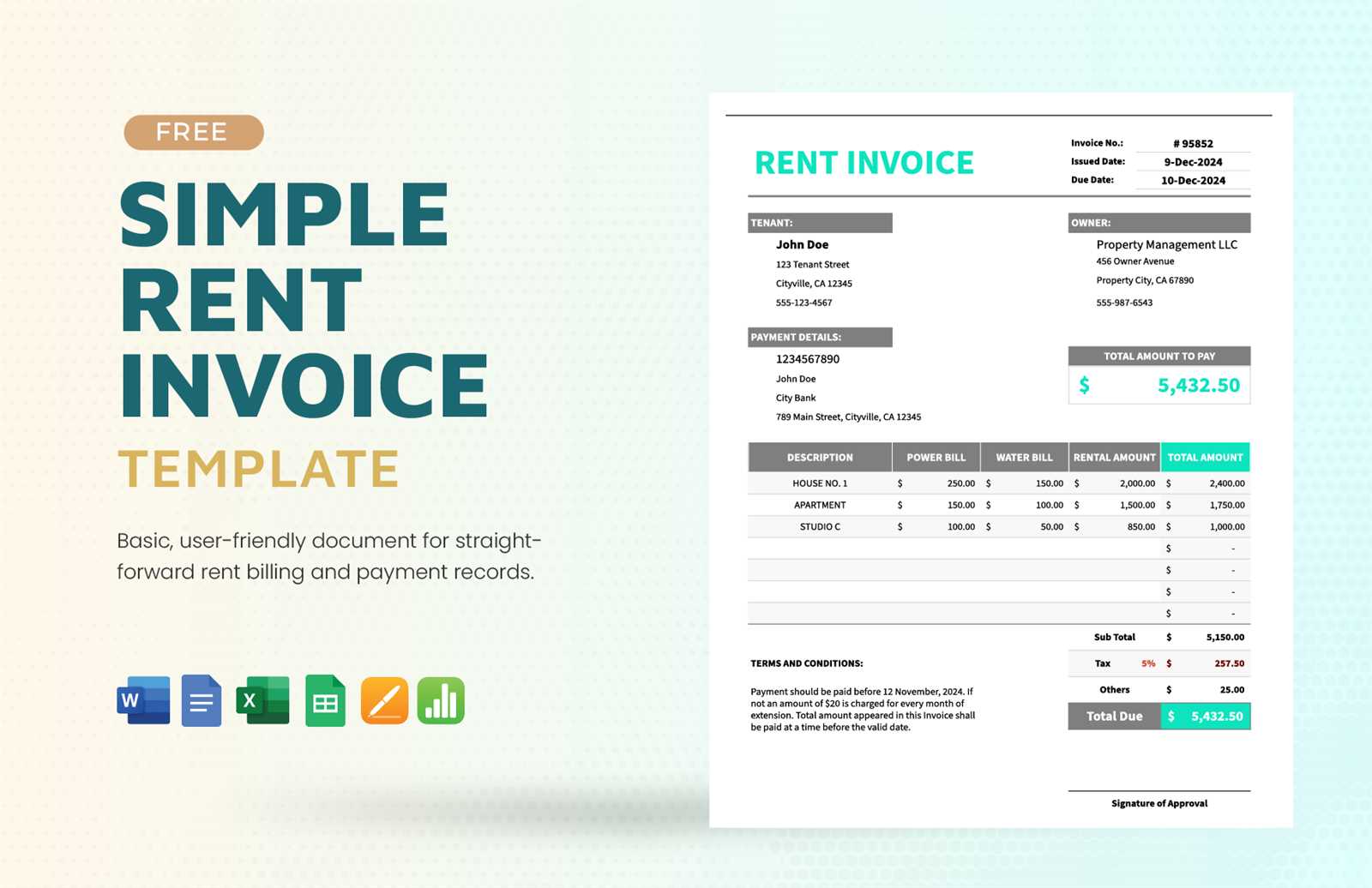

Free Invoice Template for Rental Property Management

Managing finances as a property owner involves consistent organization and a clear system to ensure all payments are accurately recorded and monitored. Clear documentation not only maintains transparency but also builds trust with those leasing from you. Having a structured format to document payments and charges can save time, reduce misunderstandings, and streamline communication.

In the world of property management, keeping accurate records is essential. A well-organized system can help landlords stay on top of due dates, manage multiple accounts, and prevent common issues related to missed payments or incorrect amounts. Using ready-made formats can simplify this process, making it easy to customize, update, and track over time.

With a carefully selected structure, landlords can enhance their financial oversight and create a smooth experience both for themselves and for tenants. This article provides resources and insights on using customizable layouts that suit different property management needs, helping you mana

Comprehensive Guide to Rental Property Invoices

Organizing financial transactions in the world of property management is crucial for clarity and accuracy. Ensuring a consistent approach to documenting payments provides a foundation that supports both the property owner and the tenant. With a structured format, you can streamline the entire process, from initial billing to ongoing tracking, making it easier to manage multiple accounts and stay on top of due dates.

For landlords, maintaining well-organized records aids in tracking revenue, handling disputes, and preparing for tax season with ease. By setting up a detailed document that includes essential transaction details, property managers can avoid misunderstandings and keep all information accessible and clear.

Whether you’re handling one residence or multiple, using a system that suits your specific needs helps you save time and improve accuracy. This guide will provide insights on effective ways to establish your records, what details to include, and how to tailor your approach to better serve your management goals and tenant relationships.

Benefits of Using an Invoice Template

Utilizing a structured document to track financial interactions between landlords and tenants offers numerous advantages. With a predefined layout, it becomes easier to ensure all essential details are consistently included, reducing the risk of errors and misunderstandings. This approach also allows for quicker updates and saves time, enhancing efficiency in managing recurring payments.

Another advantage lies in its ability to standardize records, making it simpler to review and compare past transactions. This organized system can be particularly helpful for landlords handling multiple units, as it consolidates information and aids in maintaining accurate financial oversight. Below are key benefits of using this approach:

| Benefit | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | Quickly manage recurring charges without manually recreating documents each time. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consistency | Ensure every record includes the necessary information for

How to Create a Rental InvoiceBuilding a clear document for tracking payments in property management ensures smooth transactions and accurate records. A well-designed format helps in organizing details such as amounts due, dates, and other essential information, reducing the risk of missed payments or errors. By following a few key steps, property owners can create a structured document that meets their needs and simplifies communication with tenants. Key Elements to IncludeTo ensure the document is effective, it should cover certain standard details. This will not only make it easy for tenants to understand but also support accurate record-keeping for the property manager. Below is a list of core elements to include:

By adopting these methods, you can streamline your approach to tracking payments, making the entire process smoother and more reliable. Best Practices for Invoice DesignCreating a well-structured document is essential to ensuring clear communication between the property owner and the tenant. A well-designed financial document not only conveys professionalism but also prevents confusion regarding payments and terms. Simple yet effective design choices can make a significant difference in how the recipient perceives and interacts with the document. Below are some best practices to keep in mind when designing financial documents for efficient communication and organization:

By following these simple design principles, you can create a professional and easy-to-read document that enhances communication and ensures payments are processed smoothly. Choosing the Right Template FormatSelecting the appropriate format for financial documents is crucial to ensure clarity and ease of use. The right format can simplify the process of creating, distributing, and managing the documents. It’s important to choose one that aligns with your needs and offers the flexibility to accommodate different types of transactions while maintaining a professional appearance. When deciding on the best format, consider factors such as ease of customization, compatibility with your existing systems, and the document’s overall readability. There are various formats available, each suited to different purposes, and understanding these can help you make an informed choice. Popular Format OptionsSome of the most commonly used formats include:

Making the Right ChoiceWhen choosing a format, think about how the document will be used and the level of detail required. PDF is usually the best option for a final, uneditable version, while Word or Excel might be more suitable for ongoing management and customization. Automating Your Rental Invoicing ProcessStreamlining the financial documentation process can save both time and effort. By automating this task, you can eliminate the risk of human error and reduce the manual workload. With the right tools, the entire process–from generating to sending reminders–can be handled with minimal intervention, allowing you to focus on other important aspects of managing your assets. Automation offers significant benefits, such as improving consistency and ensuring timely deliveries of financial documents. This can be achieved by integrating the right software or tools that handle repetitive tasks, leaving room for more strategic activities. Key Benefits of Automation:

By integrating automation into your documentation practices, you can ensure smooth operations and reduce the time spent on administrative tasks, ultimately enhancing your overall efficiency and effectiveness. Using Digital Templates for Billing

Leveraging digital solutions for generating financial documents can significantly improve the efficiency and accuracy of the process. Instead of manually drafting each document, digital formats allow you to create professional and consistent records with just a few clicks. These tools offer a wide range of customization options, ensuring that the documents you send meet your specific needs and standards. Digital formats also streamline the process by enabling quick edits, saving templates for future use, and reducing the need for printing or physical storage. With the rise of cloud-based platforms, these solutions also provide easy access from any device, allowing you to manage and send documents at any time. Advantages of Digital Formats:

By embracing digital solutions, you can automate and simplify your financial documentation process, improving both productivity and professionalism. Customizing an Invoice for Your NeedsTailoring financial documents to fit your specific requirements can significantly enhance clarity and professionalism. Customization allows you to add or remove sections, adjust the layout, and include personalized details that reflect your unique business practices. Whether you need to incorporate additional fees, change the currency, or highlight certain terms, the ability to modify the document ensures it aligns with your objectives. Customizing these documents not only helps in maintaining consistency but also ensures that all necessary information is accurately displayed, reducing the chances of miscommunication or disputes. It allows you to create a seamless experience for both you and your clients while keeping track of essential data effectively. Key Elements to PersonalizeSome important elements that can be modified include:

Using Software for CustomizationVarious software tools are available that allow you to easily create and save custom designs. These platforms often come with drag-and-drop features, making it simple to adjust elements and save them as reusable formats for future use. Managing Tenant Information on InvoicesEffectively organizing tenant details on financial documents is essential for smooth operations and clear communication. By ensuring all relevant tenant information is accurately captured and presented, you minimize the risk of errors and misunderstandings. This also provides a professional touch to your financial records, ensuring both parties are on the same page when it comes to payment terms, due dates, and amounts owed. Clear and organized tenant details help maintain a transparent relationship between landlords and tenants, reducing potential conflicts. Personalizing these records allows for easier tracking, ensuring that all communication remains efficient and professional. Key Tenant Information to IncludeEssential details about the tenant that should be included are:

Storing and Accessing Tenant InformationTo maintain an organized record system, it’s important to store this data securely and be able to access it when needed. Using digital storage solutions such as cloud-based systems or rental management software can help centralize and organize tenant details, making it easy to track payments and adjust records as necessary. Monthly vs. Yearly Billing StrategiesChoosing between monthly and yearly billing methods depends on a variety of factors, including cash flow preferences, tenant convenience, and administrative workload. Both approaches offer distinct advantages and challenges, and understanding these can help determine which strategy best aligns with your financial goals and operational efficiency. Monthly billing allows for more frequent transactions and can help maintain steady cash flow, but it often requires more administrative work. On the other hand, yearly billing reduces the frequency of transactions and simplifies record-keeping but may lead to larger one-time payments, which some tenants might find challenging to manage. Each method can be effective depending on your specific needs and the nature of your agreements. Protecting Financial Data on InvoicesEnsuring the security of sensitive financial information is crucial when handling billing documents. With increasing cyber threats and data breaches, it’s important to implement safeguards that protect both your business and your clients. This includes using secure methods for storing, transmitting, and sharing billing details to prevent unauthorized access or misuse of private information. One key measure is encrypting documents containing financial data, which adds a layer of protection when sharing electronically. Additionally, limiting access to these documents only to those who need it can reduce the risk of exposure. Below is an example of how different measures can be applied to secure sensitive data:

Frequently Asked Questions about Rental InvoicesManaging payments and billing records can often raise questions, especially when it comes to ensuring accuracy and compliance. Here are some common queries about handling financial documents related to rental agreements, along with helpful explanations to guide you in your process. 1. What Information Should Be Included in a Billing Statement?

2. How Often Should Billing Statements Be Issued?

3. How Can I Handle Late Payments?

|