Free Invoice Template for Mac to Easily Create Professional Invoices

Managing finances effectively is crucial for any business, and having the right tools can make the process seamless. Whether you’re a freelancer, small business owner, or large enterprise, creating professional and accurate records is essential. Fortunately, there are simple ways to design and customize your billing documents quickly, without the need for expensive software or complicated systems.

Using pre-designed formats allows you to save time and focus on what truly matters–serving your clients. These customizable files are user-friendly and can be tailored to fit the unique needs of your business. Whether you need to include tax information, offer discounts, or simply ensure clarity, the right document can make a lasting impression.

By taking advantage of readily available resources, you can simplify your accounting practices and present your business in a professional light. No need to start from scratch–efficient, well-organized records are just a few clicks away.

Free Invoice Template for Mac

Managing financial records can be a daunting task, especially when it comes to generating professional documents that are both accurate and easy to understand. Thankfully, there are efficient solutions available that allow you to create customized documents in just a few simple steps. These options offer flexibility, saving you time while ensuring that your paperwork looks polished and organized.

By using ready-made formats, users can quickly produce documents tailored to their specific needs. Customization options let you adjust details such as payment terms, business information, and client details with ease. Whether you’re tracking payments or providing clear breakdowns for clients, having access to such tools ensures a streamlined and professional approach to managing financial transactions.

These solutions are designed to integrate seamlessly with popular software, allowing easy access and use. You can download, edit, and save your documents in various formats, making it simple to share them with clients or store them for future reference. With the right approach, you can maintain a well-organized and efficient workflow without the need for expensive software or complicated processes.

Why Use an Invoice Template on Mac

Creating financial documents from scratch can be time-consuming and prone to error. Having access to pre-designed formats simplifies this process, allowing you to focus on the more important aspects of your business. With just a few edits, you can generate polished, professional records that clearly communicate all the necessary information to your clients.

Using such tools on a Mac offers several advantages. The user-friendly interface makes customization quick and efficient, while built-in features ensure your documents are well-structured. This approach reduces the chances of mistakes and saves time compared to manually creating documents. It also enhances consistency, ensuring that all your records adhere to the same professional standard.

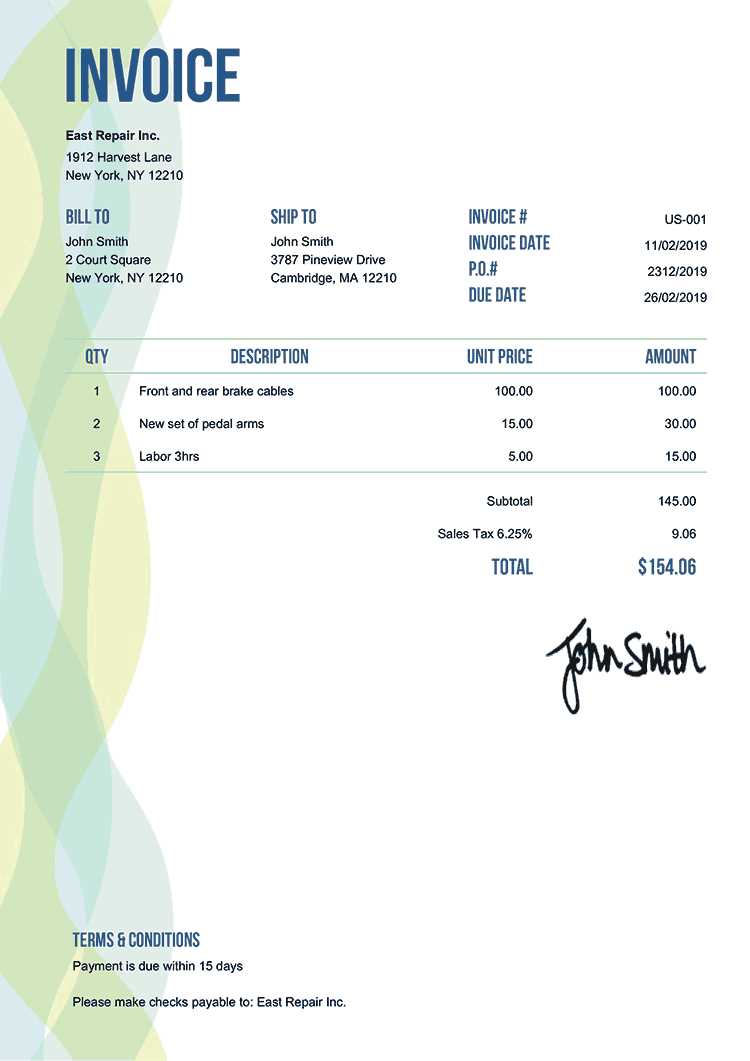

The flexibility of these solutions means you can easily modify the content to suit any situation. Whether you’re dealing with different types of clients or adjusting for varying payment schedules, these tools allow for seamless customization. Here’s a simple example of how a well-organized financial record might look:

| Item | Description | Amount |

|---|---|---|

| Service 1 | Web design | $500 |

| Service 2 | Consulting | $200 |

| Total | $700 |

This simple structure ensures clarity and makes it easy for both you and your clients to review and process the information. Using such resources on your Mac makes maintaining accuracy and professionalism effortless.

Top Features of Mac Invoice Templates

When selecting tools to create professional billing documents, it’s important to consider the features that will make the process easier and more efficient. On Mac, these options come equipped with a variety of helpful functions designed to save time and ensure accuracy. Here are some of the key features that stand out:

- Customizable Layouts – These tools allow you to adjust the layout to suit your business needs, including adding logos, changing fonts, and selecting color schemes.

- Pre-set Fields – Automatically populated fields make it easy to input essential information such as dates, totals, and contact details, reducing the chances of human error.

- Simple Editing Tools – The built-in editing options provide straightforward ways to modify text, adjust calculations, or add new sections without any technical expertise required.

- Professional Design – These solutions offer clean, polished designs that are ready to use, ensuring that your documents look professional right out of the box.

- Multiple Export Options – Easily save and export your files in various formats such as PDF, Excel, or Word, allowing you to share or store them according to your preferences.

- Compatibility with Other Software – Integration with accounting or financial management software can streamline the process by automatically syncing relevant information.

These features not only enhance the efficiency of creating detailed documents but also ensure that your records meet professional standards, helping to maintain clarity and organization in all your financial dealings.

How to Customize Your Invoice Template

Customizing your billing documents is essential to make them more aligned with your business needs and ensure they look professional. With the right tools, editing these records is simple and quick. You can adjust various elements such as business information, layout, or payment details to suit your preferences and create a document that reflects your brand identity.

Adjust Basic Information

Start by replacing default details with your own business information, including your company name, logo, address, and contact details. This is important for ensuring that your clients can easily get in touch with you. A personalized header helps maintain consistency and strengthens your brand presence.

Edit Payment Details

Next, tailor the payment terms according to your business model. You can adjust the payment due date, accepted payment methods, and any additional terms or discounts you offer. Make sure all numbers are accurate, especially totals and tax information, to avoid any confusion.

Advanced Customization also allows you to adjust fonts, colors, and sections to better fit your style or specific client requirements. By making these modifications, you can ensure that each document is clear, professional, and uniquely yours.

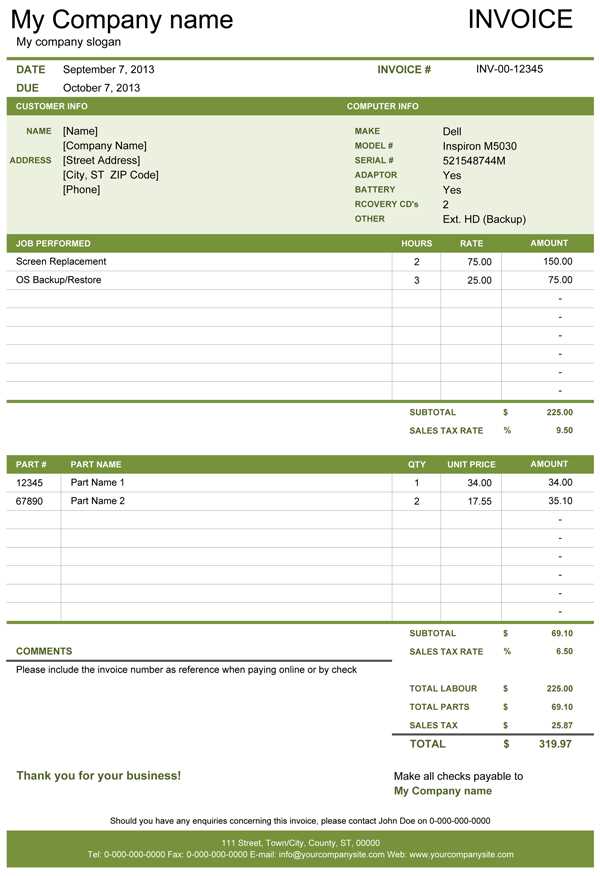

Best Free Invoice Templates for Mac Users

For those who need to manage their billing efficiently, choosing the right document design is crucial. Various options offer simplicity, customization, and professional appeal, making it easier for individuals and small businesses to send out accurate and polished records. Below are some of the top options available for users of Apple computers looking to streamline their invoicing process.

- Minimalist Style: Clean, no-frills designs perfect for straightforward transactions.

- Modern Layouts: Sleek formats with stylish typography and bold headings, ideal for freelancers and creative professionals.

- Classic Forms: Traditional yet elegant setups that suit a wide range of industries.

Whether you seek something simple or more sophisticated, these options cater to different needs, offering the ultimate flexibility for any business or personal use.

Easy Steps to Create Invoices on Mac

Generating detailed payment requests on an Apple computer is a simple task that can be done in just a few steps. By using built-in tools or third-party applications, you can craft professional-looking documents in no time. Here’s a straightforward guide to help you get started with the process.

| Step | Description |

|---|---|

| 1. Choose Your Tool | Pick an application like Pages, Numbers, or a dedicated software that suits your needs. |

| 2. Select a Design | Opt for a simple layout that aligns with your brand or personal style. |

| 3. Add Key Details | Include necessary information such as contact details, services rendered, and payment terms. |

| 4. Customize Fields | Adjust item descriptions, pricing, and dates to match the specifics of your transaction. |

| 5. Save and Share | Once finalized, save your file in PDF format or share it directly via email. |

With these steps, you can create accurate, professional documents that ensure smooth financial transactions, all from the convenience of your Apple device.

Choosing the Right Invoice Design for Your Business

Selecting the ideal document layout is an essential step in creating a professional and cohesive brand image. The design you choose should reflect your company’s values while being functional and easy for clients to understand. A well-crafted document can not only streamline your financial processes but also enhance your company’s credibility.

- Minimalistic Style: Ideal for businesses that value simplicity and efficiency, offering a clean layout with only the essential information.

- Modern and Bold: Suited for creative industries or startups looking to make a statement with sharp fonts and vibrant colors.

- Classic Format: A traditional design that provides a timeless, professional look, perfect for legal, consulting, or corporate sectors.

- Itemized Approach: Perfect for businesses offering multiple products or services, allowing clients to see a detailed breakdown of each charge.

By considering your industry, client preferences, and the nature of your transactions, you can pick a style that best suits your needs and helps present your brand in the most professional light.

Where to Find Free Mac Invoice Templates

There are various resources available to help you design polished and functional billing documents. Whether you’re looking for minimalistic formats or more detailed layouts, you can find multiple options online that cater to different needs and preferences. Here are some reliable places to search for ready-to-use designs that will help you create professional files in no time.

- Apple’s Built-in Apps: Tools like Pages and Numbers come with a variety of pre-made layouts that are easy to customize.

- Online Platforms: Websites such as Canva and Template.net offer numerous customizable formats, many of which are compatible with Apple devices.

- Open-Source Resources: Websites like GitHub and OpenOffice provide a range of freely accessible designs created by the community.

- Business Software: Some accounting software, like Wave or Zoho, offers integrated design tools that allow you to generate documents within their platforms.

By exploring these sources, you’ll find a variety of designs that can be easily adapted to suit your specific business needs, all without needing advanced design skills.

How to Save and Export Your Invoice

Once you’ve created your billing document, it’s important to save and share it in a format that ensures compatibility and maintains the integrity of the design. Exporting your file properly not only helps with organization but also guarantees that your document looks professional when sent to clients. Below are the steps to save and share your finalized file effectively.

Saving Your Document

To avoid losing your work, make sure to save your document in a secure location on your computer. Most applications will allow you to save in their default format, but you can also choose to save in other file types for compatibility with different devices and software.

- Choose “Save As” to specify a location on your computer.

- Consider organizing your documents into clearly labeled folders for easy access.

- If your software allows, save a backup copy to a cloud service for extra security.

Exporting to Popular Formats

After saving your file, you can export it in various formats to make it easily shareable with others. The most common formats include PDF, which ensures that your layout remains unchanged, and Excel or CSV, which might be useful for clients who prefer spreadsheets for tracking their expenses.

- In the “Export” or “Save As” menu, select “PDF” for universal compatibility.

- If sending by email, ensure the file size is manageable by using compressed formats if necessary.

- For editable formats, like Excel, export in .xlsx or .csv depending on your needs.

By following these steps, you can ensure that your document remains professional and accessible across different platforms and devices.

Customizing Your Invoice for Different Clients

Tailoring your billing documents to suit the specific needs of each client can enhance your professionalism and help build stronger business relationships. By adjusting certain details, such as the format, content, and payment terms, you can create a more personalized experience that reflects the unique nature of each transaction.

- Adjusting Payment Terms: Some clients may need extended payment periods, while others prefer faster turnaround. Clearly outlining these terms helps prevent misunderstandings.

- Client Branding: Incorporate the client’s logo or branding colors to create a cohesive look that aligns with their identity.

- Detailing Services: Depending on the project, you may need to include specific descriptions or breakdowns of services provided. Customizing this section ensures clarity and reduces the chances of disputes.

- Adding Special Notes: Some clients may require additional notes or instructions. Whether it’s a thank-you message, reminders, or tax information, personalizing these details can foster goodwill.

By adapting your documents in these ways, you can create an impression of thoughtfulness and attention to detail, making your clients feel valued and more likely to return for future work.

Tips for Professional Invoicing on Mac

Creating polished and accurate billing documents is an essential skill for maintaining professionalism and ensuring smooth business operations. With the right tools and attention to detail, you can produce documents that not only look great but also help avoid payment delays and misunderstandings. Here are some tips to make the process seamless and efficient when working on your Apple device.

1. Maintain a Consistent Layout

Consistency is key when designing your billing documents. A uniform layout creates a sense of professionalism and reliability. Always use the same fonts, colors, and logo placement to ensure that each document looks cohesive and aligned with your brand’s identity.

- Stick to 1-2 fonts to keep the design clean and legible.

- Ensure your logo is positioned consistently across all documents.

- Use clear headings and bold text to highlight important details like total amounts and due dates.

2. Automate Repetitive Information

If you frequently bill the same clients or offer the same services, consider using automation tools to reduce repetitive data entry. Many apps on Apple devices allow you to save client information, pricing, and service details, making it faster to generate documents.

- Set up client profiles with contact details and past payment records.

- Save common service descriptions or rates to speed up the process.

- Use calendar integration to set automatic reminders for payment due dates.

By following these practices, you can ensure your documents look professional and save valuable time when managing payments on your Apple device.

How to Add Tax and Discounts to Invoices

When creating a billing document, it’s important to accurately apply taxes and discounts to ensure clarity and compliance with local regulations. Whether you need to include sales tax, VAT, or offer special pricing adjustments, knowing how to integrate these elements is crucial for transparent transactions and client satisfaction. Below are some steps to help you add these details properly to your documents.

1. Adding Tax to Your Document

Taxes can vary depending on your location and the nature of your business. It’s essential to correctly calculate and present the tax amount on your document, ensuring clients understand the additional charges. Follow these steps:

- Determine the applicable tax rate based on your region or industry.

- Clearly label the tax section, specifying the rate and the total amount applied to the transaction.

- Ensure that the subtotal is displayed before the tax is added, followed by the final amount, including the tax.

- If applicable, separate different types of taxes (e.g., state tax, federal tax, VAT) for transparency.

2. Applying Discounts

Offering discounts is a great way to incentivize early payments or reward loyal customers. When applying a discount, be sure to show the percentage or fixed amount clearly so that clients can easily see the value they’re receiving. Here’s how to do it:

- Specify whether the discount is a percentage (e.g., 10%) or a fixed amount (e.g., $20 off).

- Indicate if the discount applies to the total amount or to specific items or services.

- List the discount separately from the subtotal, so it’s clear that the amount is being deducted.

- Ensure the final amount after the discount is displayed clearly at the bottom of the document.

By properly including taxes and discounts, you not only ensure the accuracy of your billing documents but also enhance the transparency and professionalism of your transactions.

Managing Multiple Invoices on Mac

When dealing with numerous billing documents, staying organized and efficient is key. Whether you are managing a small business or handling multiple clients, keeping track of each file, due date, and payment status can become overwhelming. Fortunately, with the right strategies and tools, you can streamline this process and ensure that every document is easy to access and follow up on.

| Step | Action |

|---|---|

| 1. Use Folders and Subfolders | Organize your files into clear categories like “Paid”, “Pending”, and “Overdue” to easily track payment statuses. |

| 2. Label Files Clearly | Include essential details in your file names, such as client names, dates, and invoice numbers (e.g., “ClientName_Invoice_2024-10-01”). |

| 3. Use Cloud Storage | Store documents on cloud services like iCloud or Google Drive for easy access and sharing from any device. |

| 4. Automate Reminders | Set up automatic reminders for due dates or follow-up actions using calendar apps to avoid missed payments. |

| 5. Keep Backup Copies | Regularly back up your documents to prevent data loss, ensuring you always have a copy available if needed. |

By following these practices, you can efficiently manage and stay on top of multiple billing documents, reducing administrative stress and improving cash flow tracking.

Integrating Invoice Templates with Accounting Software

Efficient financial management requires seamless integration between various tools and software. For businesses, connecting document creation tools with accounting platforms can save valuable time, reduce errors, and enhance workflow efficiency. By syncing billing documents directly with financial systems, companies can automate data entry, ensure accuracy, and streamline reporting processes. This integration leads to a more organized approach to tracking income and expenses, improving overall business operations.

Key Benefits of Integration

- Automated Data Transfer: When billing documents are linked with accounting software, customer and transaction details can be transferred automatically, reducing manual entry.

- Improved Accuracy: Integration minimizes the risk of human error by ensuring that all financial data matches between the documents and accounting records.

- Time-Saving: With a direct connection between billing systems and accounting software, business owners can cut down on the time spent on administrative tasks.

- Better Financial Reporting: Automated syncing ensures that all transactions are recorded in real-time, providing more accurate and up-to-date financial reports.

How to Set Up the Integration

- Choose an accounting platform that supports integrations with your document creation tool.

- Follow the software’s instructions to connect the two systems. This often involves linking API keys or using built-in connectors.

- Set preferences for automatic syncing, such as when to transfer data and what information to include.

- Test the integration to ensure that all data is transferring correctly and that no information is missed or duplicated.

Benefits of Using a Digital Invoice on Mac

Switching from paper-based to electronic documentation can significantly enhance business efficiency. By adopting a digital approach on Apple devices, companies can improve organization, reduce manual errors, and streamline their billing workflows. The ability to create, store, and send documents instantly offers flexibility and better control over financial records. This shift not only simplifies day-to-day operations but also helps businesses stay ahead in a fast-paced digital world.

Key Advantages of Using Digital Documents

- Instant Accessibility: Easily access records from any location, at any time, making it more convenient to manage accounts on the go.

- Cost Efficiency: No need for physical materials such as paper or printing supplies, which cuts down on office expenses.

- Environmentally Friendly: Reducing paper usage contributes to sustainability efforts by minimizing waste and conserving resources.

- Enhanced Organization: Digital documents can be easily categorized, searched, and archived, simplifying record-keeping tasks.

Security and Customization

- Improved Security: Files stored on your device or cloud platforms are encrypted, reducing the risk of loss or unauthorized access.

- Customizable Designs: Personalize the layout and details of your documents to reflect your business brand or meet specific customer needs.

- Automatic Backups: With cloud syncing options, your files are automatically backed up, providing an additional layer of security against data loss.

Common Mistakes to Avoid When Using Invoices

When managing financial documentation, small errors can lead to larger issues, such as delayed payments or confusion with clients. It’s crucial to ensure all details are accurate and consistent, as even minor mistakes can affect cash flow and customer relationships. Understanding the most common pitfalls and taking steps to avoid them can significantly improve your business efficiency and professionalism.

Frequent Errors in Financial Documents

- Missing or Incorrect Contact Information: Always double-check the recipient’s name, address, and contact details. Missing or incorrect information can delay processing and cause confusion.

- Failing to Specify Payment Terms: Clearly outline when payments are due and any penalties for late payments. Ambiguity in payment terms can result in delayed payments or disputes.

- Overlooking Tax Information: Ensure that tax rates and applicable tax numbers are accurately listed. Failing to include tax information can lead to compliance issues or payment discrepancies.

- Not Including Unique Identifiers: Every document should have a unique reference number for tracking purposes. This helps both parties keep a clear record of the transaction and simplifies future reference.

Formatting and Design Mistakes

- Cluttered Layout: A document that is difficult to read can cause confusion. Keep the design simple, clean, and organized to ensure that key details are easy to find.

- Incorrect Dates: Double-check the date of issue and the due date. Using the wrong date can result in clients misunderstanding the payment timeline and lead to delays.

- Lack of Professional Branding: Using inconsistent fonts or poorly designed layouts can create an unprofessional appearance. Ensure your branding is consistent and polished to reflect your business’s professionalism.

Legal and Compliance Oversights

- Failure to Meet Local Regulations: Depending on your location, there may be specific legal requirements for the information that must be included in financial documents. Familiarize yourself with these rules to avoid legal issues.

- Ignoring Client Preferences: Some clients may prefer electronic copies over printed ones or may have specific requirements. Always check client preferences to ensure smooth transactions.