Free Invoice Template for Excel to Simplify Your Billing

Efficient financial management is crucial for any business, and keeping track of payments and expenses is a key part of it. Using digital tools can significantly simplify this task, providing an organized and professional approach to handling transactions. One of the most effective ways to ensure consistency and accuracy is by utilizing customizable document formats that allow you to manage client billing with ease.

Whether you’re running a small startup or a freelance operation, finding an adaptable solution that works for your needs is essential. The right document layout can help you present all necessary information clearly and concisely, ensuring you maintain a professional image while keeping track of crucial financial details. With the ability to make quick adjustments, these layouts save you time and effort, allowing you to focus on more important aspects of your business.

Optimizing your approach to handling payments with the right structure can significantly improve your workflow. Leveraging digital platforms offers flexibility, enabling you to modify key sections like amounts, dates, and client details. This simple yet powerful tool can help you stay organized, avoid errors, and ensure timely payments from your customers.

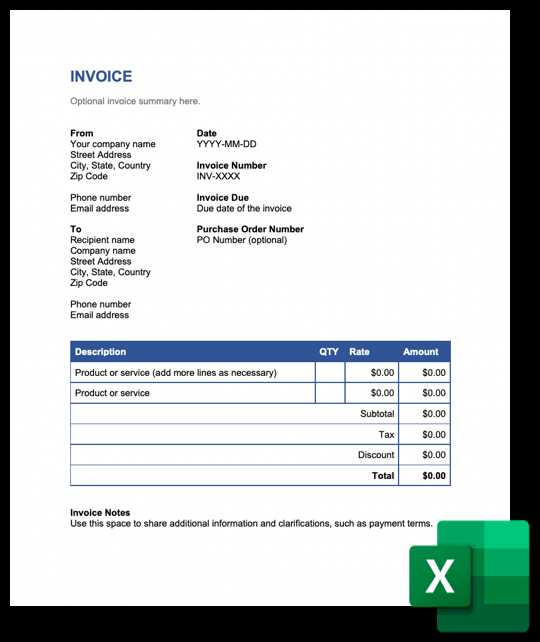

Free Invoice Template for Excel

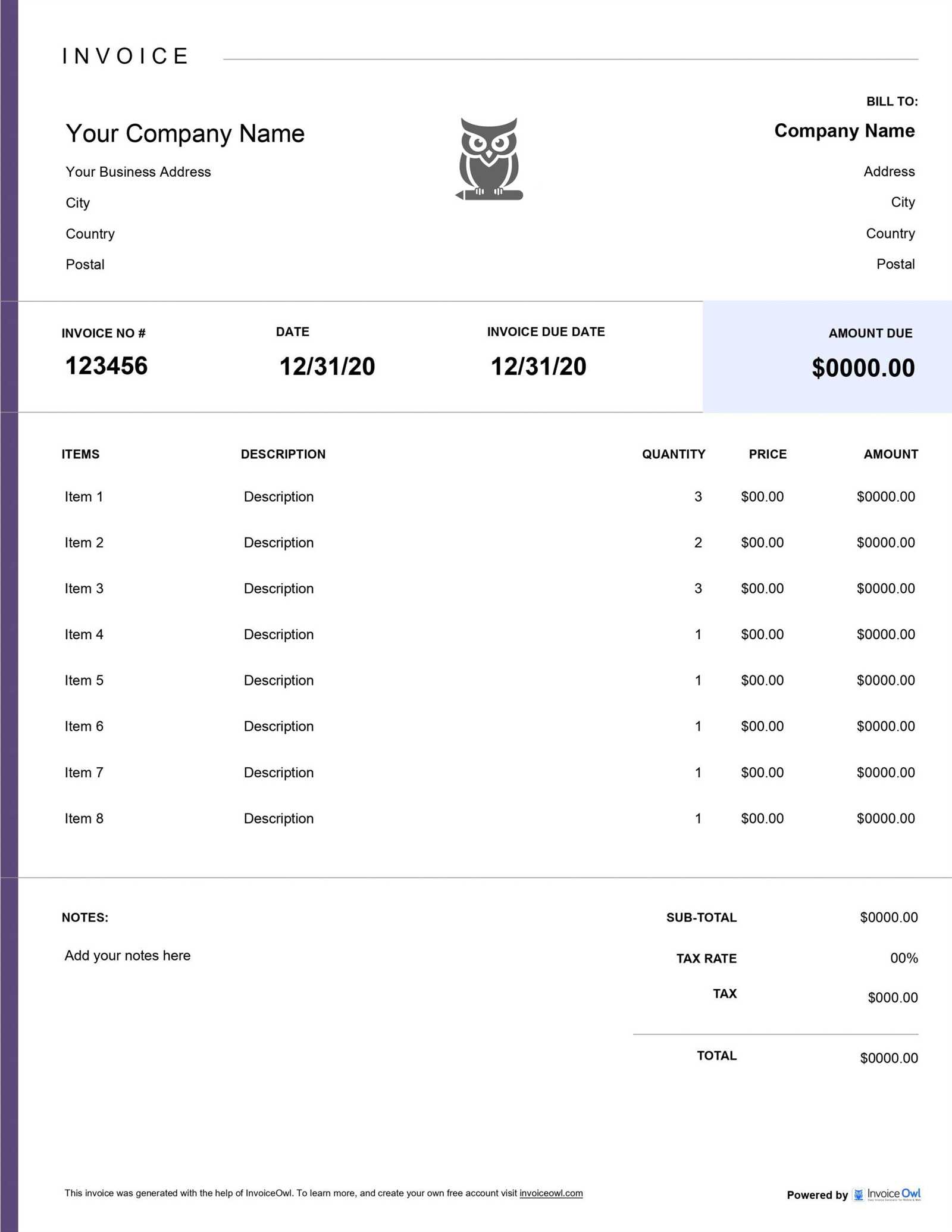

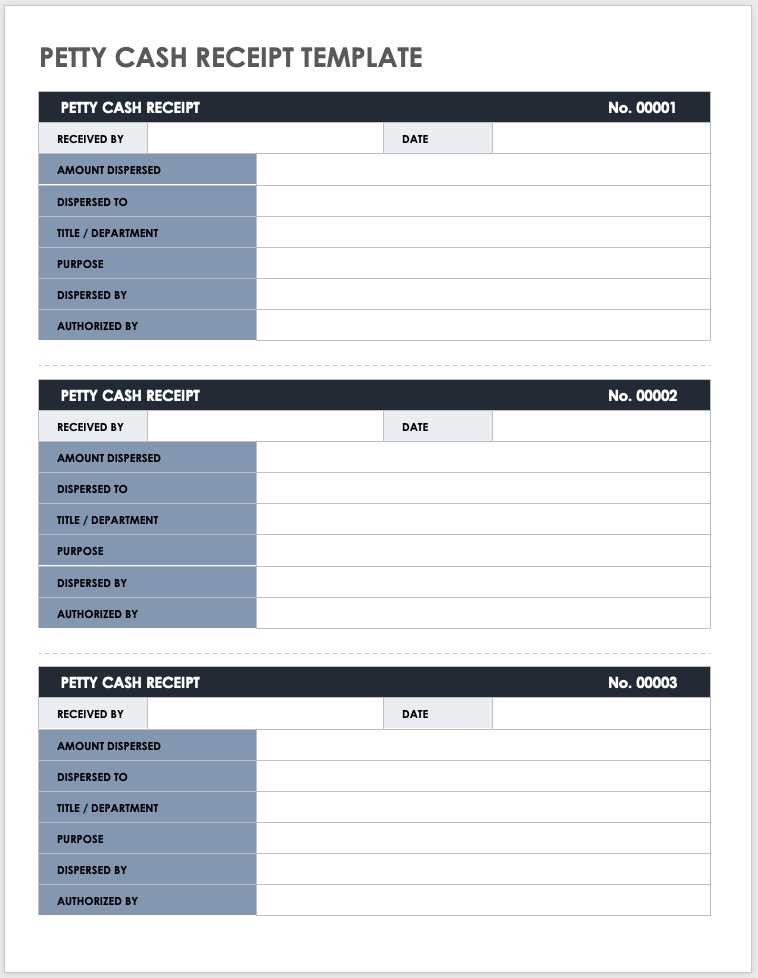

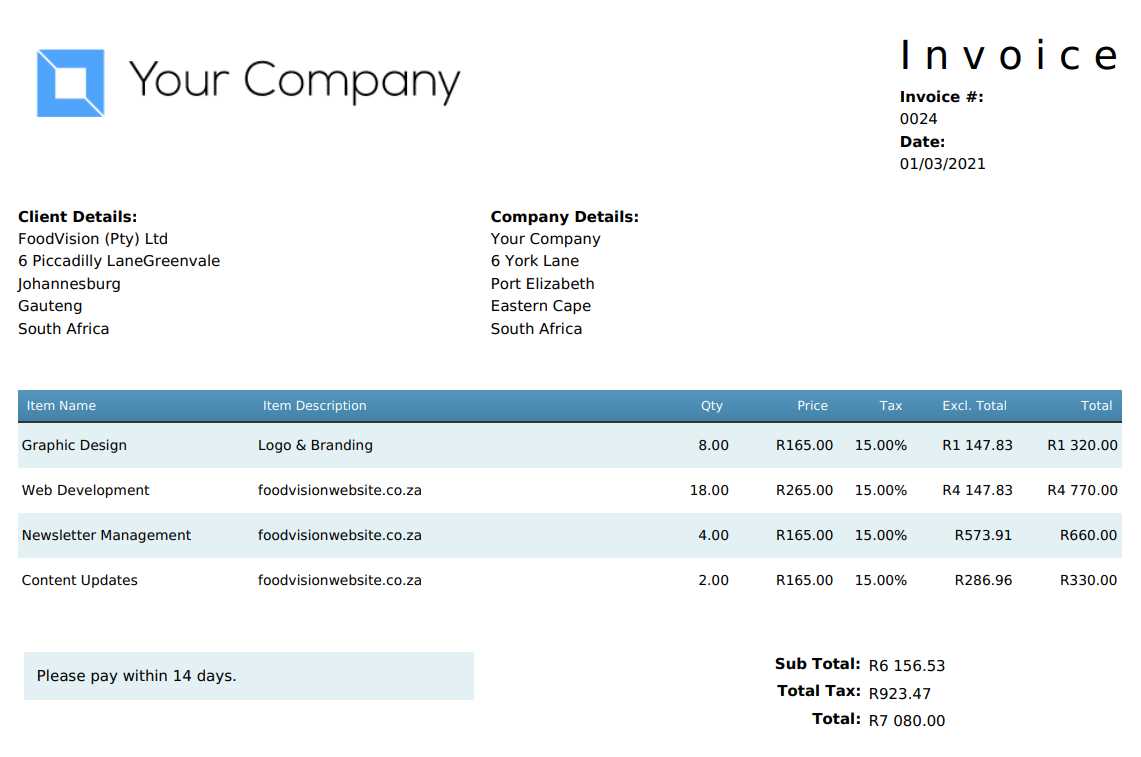

Managing financial transactions effectively is essential for any business, and having a well-structured document to track payments is a valuable asset. By using an organized layout that can be easily adjusted, you can streamline your billing process, maintain consistency, and ensure that all the necessary details are captured. This tool allows you to manage client accounts efficiently, providing a professional method of handling each transaction.

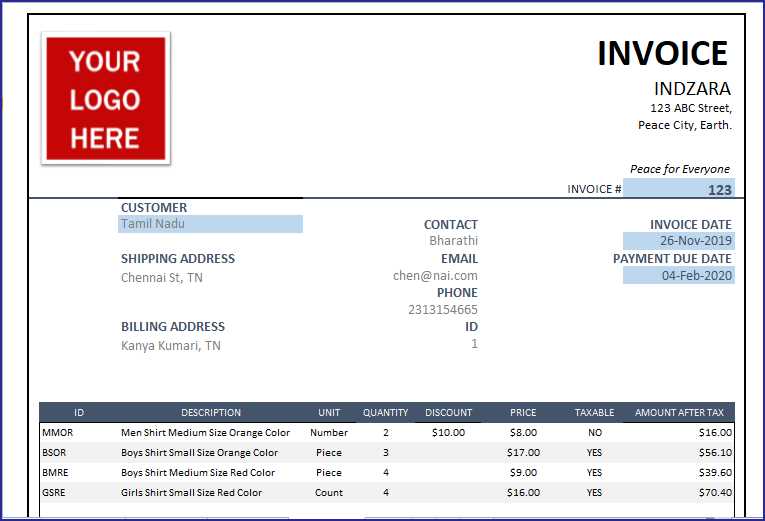

With a customizable format, you can input the details of each transaction quickly. Fields such as amounts, dates, and recipient information can be edited as needed, making it an ideal solution for both recurring and one-time payments. Additionally, the ability to automate calculations within the document minimizes errors and saves time, giving you more control over the financial aspects of your business.

Having access to such a solution also makes it easier to track overdue payments, providing a clear overview of your financial status. The design is simple yet functional, offering a clean and professional presentation that helps you maintain a positive relationship with your clients. This adaptable system is perfect for small businesses, freelancers, or anyone who needs an efficient way to handle their financial documentation.

Benefits of Using Excel for Invoices

Using a digital system to manage financial records offers significant advantages, especially when it comes to organizing billing details. A versatile tool allows you to track payments, manage client information, and keep everything in one place, making it easier to stay on top of business finances. The flexibility to customize and adjust various sections of your documents ensures accuracy and efficiency.

Efficiency and Customization

One of the main advantages of using this tool is its ability to be tailored to fit specific business needs. You can adjust the layout, add or remove fields, and even automate calculations, reducing the time spent on manual tasks. With just a few clicks, you can update the document for each transaction, ensuring that every detail is correct. This level of customization makes it ideal for businesses of all sizes, as it can grow and adapt with your needs.

Easy Tracking and Management

Tracking payments and managing accounts becomes much simpler with a digital solution. The built-in features allow you to monitor overdue balances, keep a record of transactions, and quickly access past data. This means less time spent searching for information and more time focusing on the growth of your business. By organizing everything in one place, you ensure that all financial data is available when you need it, leading to better financial management.

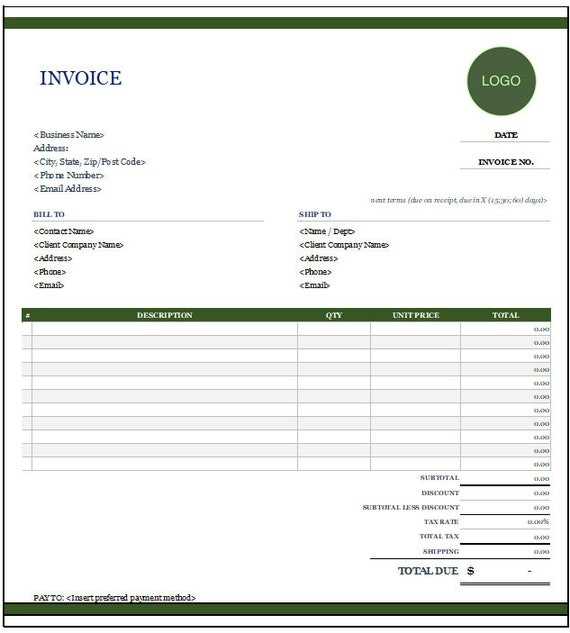

How to Customize Your Invoice Template

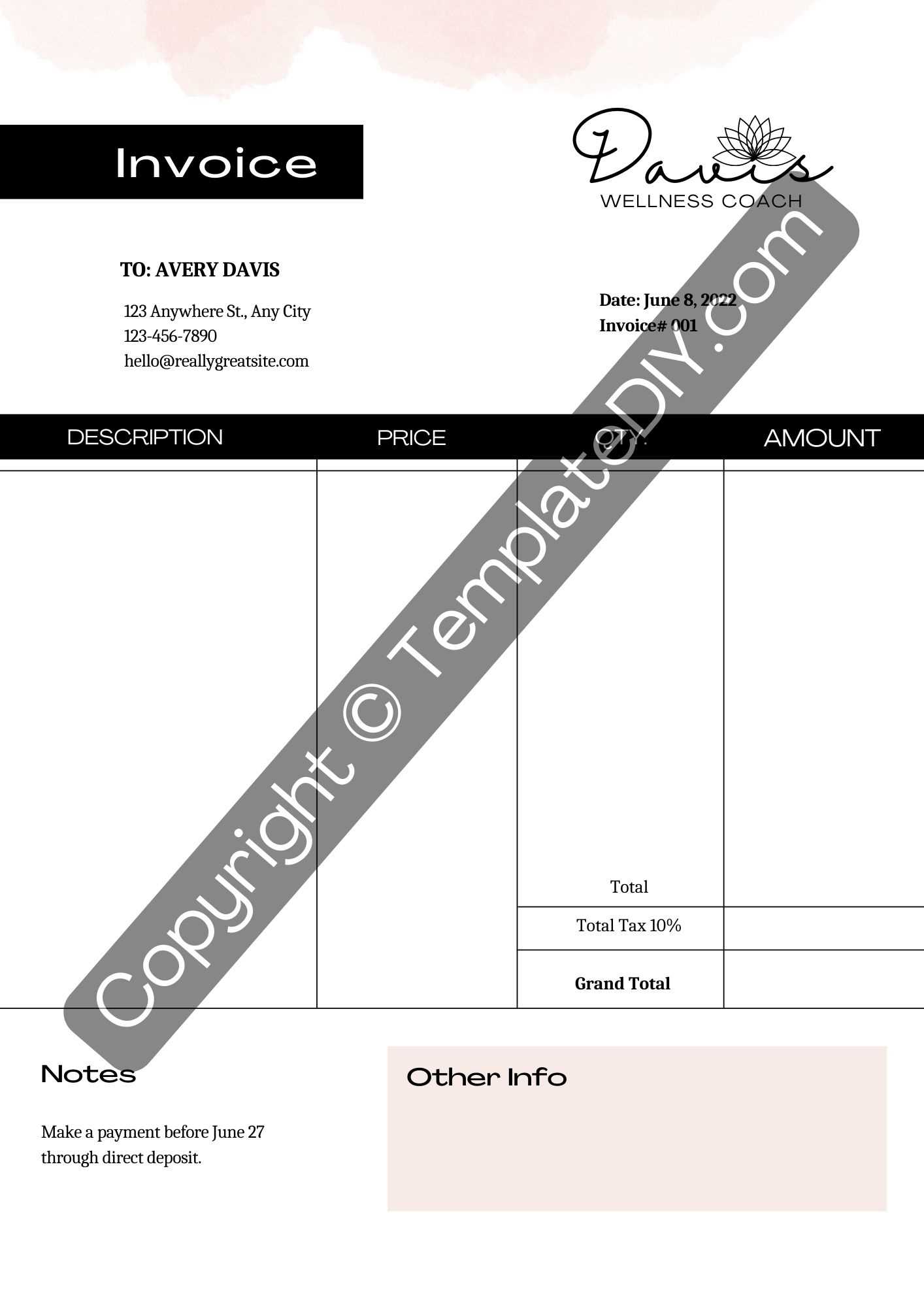

Adjusting your document layout to meet specific business needs is an essential step in creating an efficient billing system. Customization allows you to personalize the format, ensuring that it reflects your brand, includes all necessary details, and functions optimally. By tailoring the fields, structure, and style, you can enhance both the clarity and professionalism of your financial records.

Modifying Layout and Fields

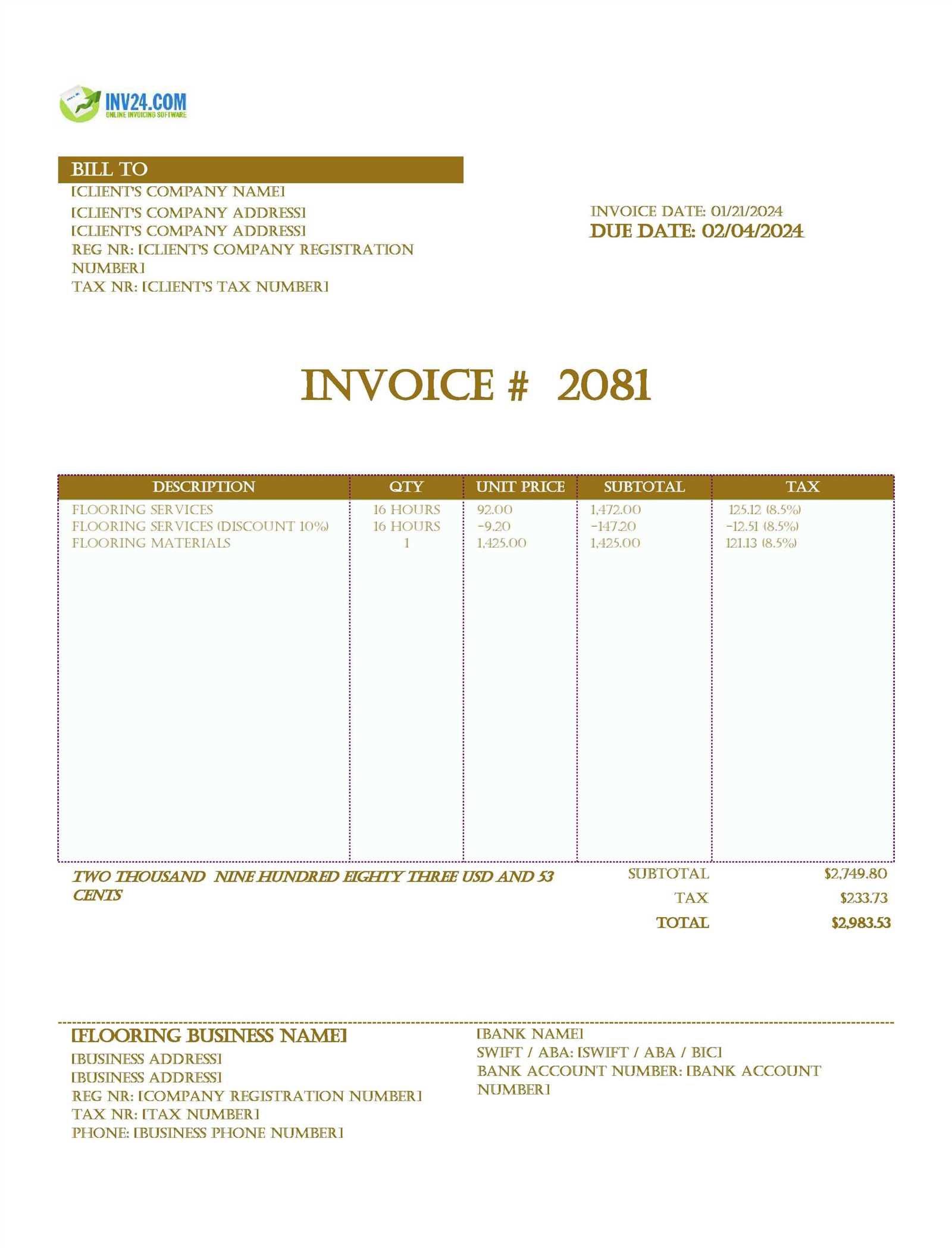

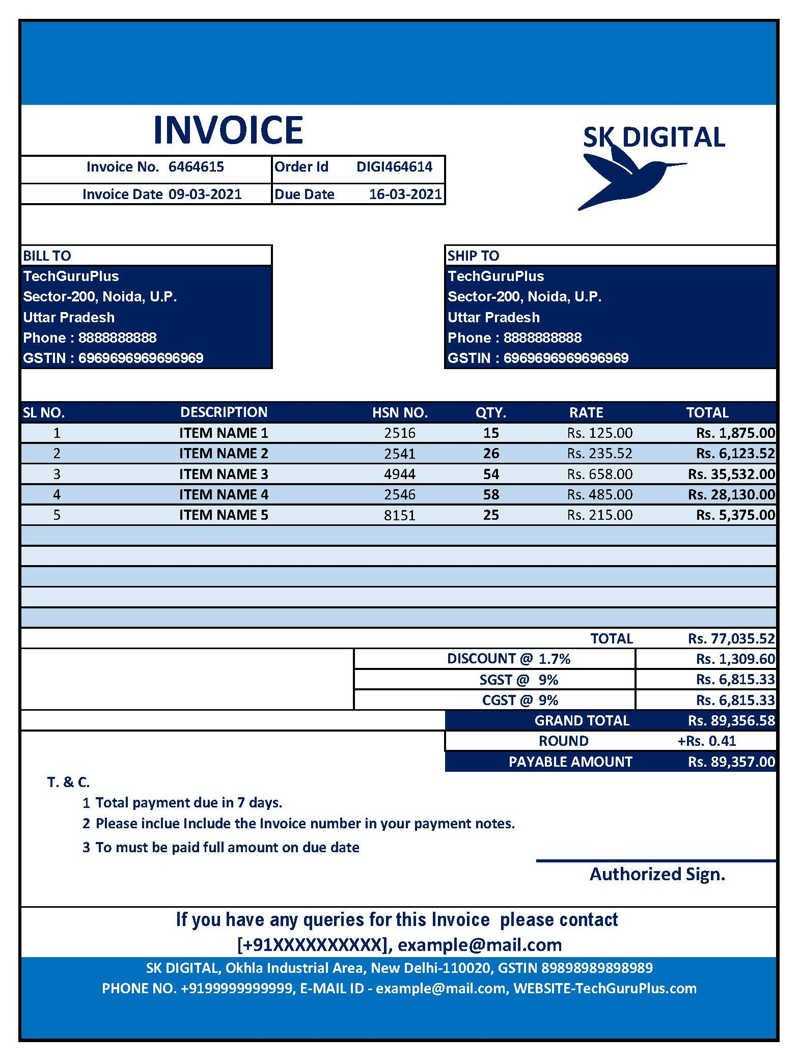

The first step in customization is adjusting the overall layout. This includes resizing columns, rearranging sections, and ensuring that the essential details such as amounts, client information, and payment terms are clearly visible. You can also add or remove fields based on your specific needs. For example, if you work with multiple items or services, you can add more line items, or if taxes are required, include a field for the applicable tax rate. Making these adjustments ensures the document captures everything relevant to your transactions.

Personalizing Design Elements

After fine-tuning the structure, the next step is to focus on the visual design. This includes adding your business logo, adjusting fonts, and choosing colors that align with your brand identity. A clean, professional appearance not only improves the look of the document but also enhances its readability. Customizing the design elements ensures that your business appears polished and credible to your clients, reinforcing a positive relationship.

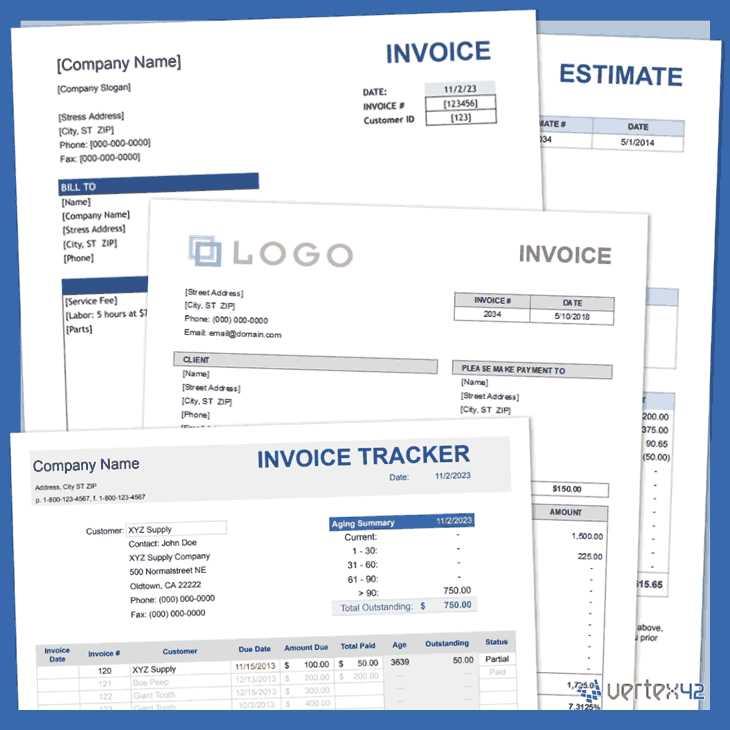

Where to Find Free Templates Online

There are numerous online resources that offer pre-designed layouts for managing business transactions, saving you time and effort in creating one from scratch. These resources provide a variety of designs that can be easily downloaded and adapted to your needs. Many platforms offer these layouts at no cost, ensuring you have access to professional solutions without the need for expensive software.

Popular Platforms for Download

Several websites specialize in offering downloadable formats tailored to different business needs. These platforms often provide a wide range of designs, from basic to more sophisticated formats, all of which can be modified to suit specific requirements. Below are a few well-known sources:

| Website | Features | Customization Options |

|---|---|---|

| Template.net | Variety of designs and easy download | Fully customizable fields and sections |

| Microsoft Office Templates | Pre-built layouts available in Word and Sheets | Editable text and layout adjustments |

| Vertex42 | Professional, business-ready designs | Simple to modify with built-in formulas |

Other Useful Resources

In addition to dedicated template sites, several other platforms, including open-source communities and business forums, offer shared solutions that can be customized and used at no charge. These can be great places to find unique, user-generated layouts that might offer fresh approaches to managing business records. Exploring these sites can provide access to additional styles and designs that may better fit your specif

Step-by-Step Guide to Editing Excel Invoices

Customizing your billing documents is an essential task to ensure that all information is accurate and tailored to your specific business needs. Whether you’re adjusting the layout, adding new details, or automating calculations, the process can be straightforward once you understand the key steps. This guide will walk you through the necessary steps to modify your financial records, making them more effective and professional.

Editing Basic Information

The first step in personalizing your document is to adjust the basic details. This includes adding your company name, contact details, and the client’s information. Here’s a breakdown of the steps:

| Step | Action |

|---|---|

| Step 1 | Click on the cell containing your business name and type in your company’s name. |

| Step 2 | Enter your business address and contact details in the appropriate fields. |

| Step 3 | Fill in the client’s name, address, and contact information in their respective sections. |

Adjusting Layout and Formatting

Next, you can modify the structure of the document to suit your preferences. This might include resizing columns, changing font styles, or adjusting the alignment of text. These changes help make the document more visually appealing and easier to read. Here’s how to proceed:

| Step | Action | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Step 1 | Select the columns you want to resize and drag them to the desired width. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Step 2 | Highlight the text you

How to Add Your Business LogoIncluding your business logo in your financial documents not only adds a professional touch but also reinforces your brand identity. By adding a logo, you ensure that your documents reflect your company’s image, which can leave a lasting impression on clients. The process of inserting your logo into your document is quick and easy, and it can be done directly within the software you’re using to manage your business records. To add your logo, follow these simple steps:

Once added, your logo will appear consistently on all documents you create, adding a polished and cohesive look to your business communications. Automating Calculations in Your InvoiceStreamlining the calculation process in your financial documents is essential for reducing errors and saving time. By automating basic mathematical functions like totals, taxes, and discounts, you can ensure accuracy and consistency across all your records. This allows you to focus on other aspects of your business while your documents handle the number crunching automatically. Key Calculations to AutomateThere are several calculations that are commonly needed in financial documents, which can be easily automated. Below are the key areas you should focus on:

Steps to Automate CalculationsAutomating these calculations within your document is simple once you know the basic formulas. Follow these steps to set up automatic calculations:

Best Practices for Invoice FormattingProperly structuring your financial documents is essential to ensure clarity and professionalism. By following best practices for layout and design, you make it easier for clients to read, understand, and process the information. A well-organized document reflects your attention to detail and can help avoid confusion or delays in payments. Key Elements to IncludeTo maintain consistency and improve the overall presentation, be sure to include the following elements in your document:

Formatting TipsFollowing specific formatting guidelines can enhance readability and help clients process the document smoothly:

|