Free Invoice Template for Cleaning Services to Simplify Your Billing

Managing financial transactions efficiently is essential for any business, especially when dealing with regular client interactions. Having a standardized document that clearly outlines the details of the work completed can save time, reduce errors, and ensure smoother communication with clients. A well-designed financial record not only helps in tracking payments but also builds professionalism and trust with your clients.

Instead of spending time creating these documents from scratch, using pre-made formats tailored to specific industries can help you focus on what matters most–delivering quality results. These customizable solutions can simplify the entire billing process, enabling you to quickly generate a document that includes all the necessary information, from task descriptions to payment terms.

By choosing a ready-to-use option, you’ll save both time and effort, ensuring that you can send out professional and accurate billing statements without delay. This practical tool can be easily adjusted to fit any project scope, whether it’s a one-time task or ongoing work with multiple clients.

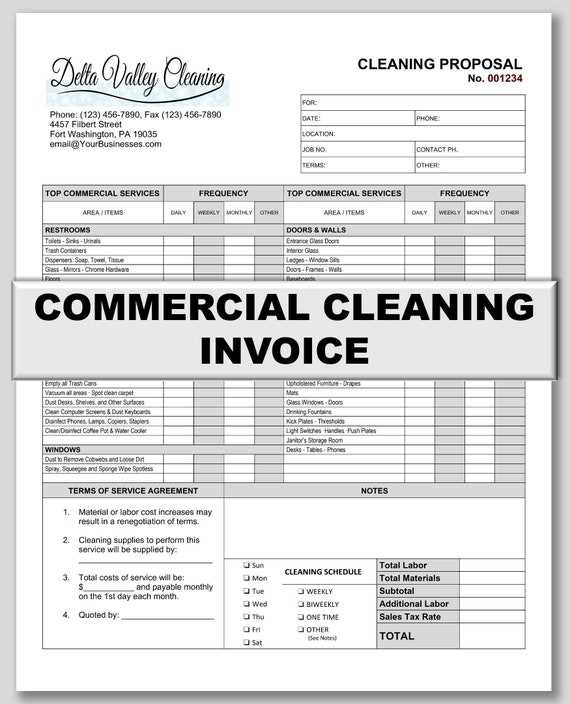

Free Invoice Template for Cleaning Services

Having an organized and professional way to request payments is crucial for businesses that provide regular tasks or maintenance. With the right document, you can ensure that all relevant details are included, making it easier for clients to understand and pay on time. A customizable option allows you to quickly generate accurate records for any job, streamlining the billing process and saving time in the long run.

Why Use a Pre-Designed Billing Document?

Using a pre-made record format can significantly reduce the effort required to create a new one every time. It ensures consistency, minimizes the risk of forgetting essential information, and allows you to maintain a professional appearance with every transaction. These solutions are easy to adapt for any task type, giving you flexibility in your billing practices.

- Quick and easy to set up

- Ensures accuracy with consistent formatting

- Helps maintain a professional image

- Reduces the chance of errors or missed details

- Customizable to suit different job types and client needs

Key Features to Look For

When selecting the right solution, consider the key elements that should be included in any billing document. These features will ensure that all necessary information is communicated clearly to the client:

- Client Information: Include the client’s name, address, and contact details.

- Work Description: Detail the tasks completed, providing enough clarity for the client.

- Payment Terms: Specify due dates, late fees, or discounts if applicable.

- Pricing Structure: Break down the cost for each task or service provided.

- Payment Methods: List accepted methods for ease of payment.

These elements will not only help ensure that clients have all the information they need, but they will also improve your ability to get paid on time and avoid unnecessary disputes. Customizable solutions allow you to tweak the content as needed for each specific job, making them versatile and efficient tools for any business.

Why Use an Invoice Template

When managing payments for work completed, having a standardized document can simplify the entire process. Whether it’s a one-time project or an ongoing arrangement, a consistent format helps ensure that all the necessary information is provided clearly and professionally. This not only saves you time but also improves your workflow and reduces the likelihood of errors or omissions.

Benefits of Using a Ready-Made Document

One of the main advantages of using a pre-designed solution is the ability to quickly generate accurate records without having to start from scratch each time. Instead of manually creating a new document for each client, a ready-made option provides a structure that can be easily customized with the relevant details.

- Time-saving: Quickly generate documents without creating one from the ground up.

- Consistency: Ensure all necessary details are included every time.

- Professionalism: Present a polished and organized look to your clients.

- Accuracy: Minimize the chance of errors or missed details.

Key Features of a Useful Solution

A well-structured document typically includes essential elements such as client details, a breakdown of completed tasks, payment terms, and methods. Having all these key components in place helps maintain transparency and promotes timely payments, ultimately benefiting both the service provider and the client.

- Clear task descriptions: Clients can easily understand what work was performed.

- Transparent pricing: Itemized costs help avoid confusion over charges.

- Flexible payment terms: Clearly defined due dates and accepted payment methods simplify the process.

By adopting a professional structure, you streamline your business operations and ensure smoother transactions, which helps build trust and long-term relationships with clients.

How to Customize Your Invoice

Customizing your billing document is essential for ensuring it meets the specific needs of your business and clients. By personalizing your records, you can reflect your brand’s style, provide all relevant details, and make the process smoother for both you and your customers. Adjusting elements such as contact information, pricing, and task descriptions allows you to create a clear, professional, and personalized record every time.

Adjusting Key Information

First, ensure that the essential details are correctly entered. This includes the client’s name, address, and contact details, as well as your own business information. Double-checking this section ensures that there are no errors when it comes to communication or payment processing.

- Client details: Always include the full name and address of the customer.

- Your business information: Include your company name, address, and contact details for easy follow-up.

Personalizing Task Descriptions and Pricing

When documenting the tasks completed, be as specific as possible. Include the type of work, the date it was performed, and any special instructions or requirements. Clear descriptions help avoid misunderstandings and ensure your client knows exactly what they are paying for. Additionally, make sure the pricing structure is transparent, whether you charge hourly, per project, or through a flat fee.

- Task details: Be detailed and clear to eliminate confusion.

- Cost breakdown: Provide a transparent list of all charges, whether hourly or flat rates.

Customizing these elements not only ensures accuracy but also adds a personal touch, helping to establish stronger client relationships and improving your professionalism. A tailored document that reflects the work done and the agreed-upon terms can also help minimize payment disputes and delays.

Benefits of Digital Invoicing

Transitioning to electronic documents for payment requests offers a variety of advantages over traditional paper-based methods. By using digital solutions, you can enhance efficiency, reduce errors, and simplify the overall process of managing payments. These tools also help businesses stay organized and offer a more professional experience for clients.

Increased Efficiency

With digital billing, creating and sending records becomes a quick and automated process. Rather than manually drafting documents, you can generate them instantly and email them directly to your clients. This significantly reduces the time spent on paperwork and speeds up the entire billing cycle.

- Faster generation: Create and send documents in a matter of minutes.

- Immediate delivery: Send directly to clients through email, reducing postal delays.

Improved Accuracy

Manual processes often lead to mistakes, whether it’s a typo in the client’s details or a miscalculation of costs. With automated digital solutions, these errors are minimized because the structure is pre-set, and calculations are done automatically. This ensures that all figures are correct and that clients receive accurate information.

- Pre-set calculations: Automatic math ensures no errors in pricing or totals.

- Consistency: Reusable formats ensure all necessary fields are filled out every time.

Better Record Keeping

Electronic systems allow for easy storage and retrieval of records. You can organize and store all payment requests in digital files, making it simpler to track outstanding balances, monitor payment history, and quickly find specific records when needed. This reduces the need for physical storage space and provides easy access to past documents.

- Easy organization: Store records electronically for quick access.

- Searchable data: Find past transactions and client details within seconds.

Enhanced Professionalism

Sending a well-organized, professional document creates a positive impression. Digital tools allow you to add your business logo, customize the layout, and ensure that every document is clean, clear, and consistent. This attention to detail can help build trust and improve client relationships.

- Custom branding: Include your logo and business details to personalize the documents.

- Consistent presentation: Ens

Essential Details for Cleaning Invoices

When preparing payment documents, it’s important to include all the relevant information that ensures clarity and transparency. A well-structured record not only facilitates smooth transactions but also protects both parties by providing a detailed account of the work performed and the agreed-upon terms. Including the right elements ensures that no important details are overlooked, helping avoid confusion or delays in payments.

Key Information to Include

Every record should include specific details to ensure accuracy and prevent disputes. These include both the service provider’s and the client’s contact information, a clear description of the tasks completed, the agreed costs, and the payment terms. Let’s take a closer look at the crucial elements to include:

- Provider Information: Include your business name, address, and contact details to make communication easy.

- Client Information: Clearly state the client’s name, address, and contact details to avoid confusion.

- Work Description: Be specific about the tasks completed, including dates and any special instructions.

- Cost Breakdown: List individual charges, such as hourly rates or flat fees for each task, to ensure transparency.

- Payment Terms: Outline the payment due date, any discounts offered, and late fees if applicable.

- Accepted Payment Methods: Provide details on how payments can be made (e.g., bank transfer, online payment, check).

Why These Details Matter

Including these elements helps ensure both you and your client have a mutual understanding of the work performed and the cost involved. Clear documentation also prevents misunderstandings about payment schedules and expectations, fostering trust and professional relationships.

By ensuring that every essential detail is included in your billing documents, you can create an efficient, streamlined process that benefits both you and your clients, ultimately making the transaction process smoother and more transparent.

Common Mistakes in Cleaning Invoices

When preparing payment documents, small errors can lead to misunderstandings, delayed payments, or dissatisfaction from clients. It’s important to pay attention to detail, as even minor mistakes can affect your business’s professionalism and cash flow. By understanding the most common mistakes in billing, you can avoid these pitfalls and ensure that your transactions run smoothly.

Frequent Errors to Watch Out For

There are several key mistakes that tend to crop up when creating financial documents. Whether it’s incorrect client details, missing charges, or unclear payment terms, these issues can cause confusion and delay payments. Below are some common errors:

- Incorrect Client Information: Missing or wrong contact details can delay communication or payment processing.

- Unclear Task Descriptions: Not being specific enough about the work completed can lead to questions and disputes over charges.

- Overlooking Additional Costs: Failing to include extra fees, such as transportation or special supplies, can create confusion and lead to disagreements.

- Missing Payment Terms: Not clearly stating when the payment is due or what late fees apply can lead to late or missed payments.

- Omitting Accepted Payment Methods: If the available ways to make payments are not listed, clients may be unsure of how to pay, leading to delays.

How to Avoid These Mistakes

By thoroughly reviewing your documents and ensuring all relevant details are included, you can avoid most common mistakes. Double-check all client information, list every charge clearly, and specify payment methods and deadlines. Taking these simple steps can make the process much smoother and more professional.

- Review details carefully: Double-check all contact information and task descriptions.

- Clarify payment terms: Be clear about deadlines, payment methods, and any potential late fees.

- Itemize charges: Always include a clear breakdown of costs to ensure transparency.

Avoiding these common mistakes will help foster trust with your clients and ensure that your billing process remains professional and efficient, leading to faster payments and fewer misunderstandings.

How to Avoid Late Payments

Late payments can disrupt your cash flow and cause unnecessary stress for your business. To minimize the risk of overdue balances, it’s important to set clear expectations and take proactive steps throughout the billing process. By establishing well-defined payment terms and maintaining strong communication, you can ensure that payments are made on time, every time.

Set Clear Payment Terms

One of the best ways to avoid late payments is to clearly outline your payment terms from the start. Define when payments are due, what methods are accepted, and any penalties for overdue balances. The more transparent you are about your expectations, the easier it will be for clients to comply.

- Specify Due Dates: Make sure the payment deadline is clear and prominently displayed.

- List Accepted Payment Methods: Provide a range of options, such as bank transfers, checks, or online payments, to make it easy for clients to pay.

- Include Late Fees: Mention any late fees or penalties that apply if the payment is not made on time.

Send Timely Reminders

Sometimes, clients may simply forget about upcoming payments. Sending a friendly reminder a few days before the due date can prevent delays. If the payment is missed, follow up promptly with a polite yet firm reminder to ensure that the balance is settled quickly.

- Pre-Due Date Reminders: Send a courtesy reminder a few days before the payment is due.

- Post-Due Date Follow-Up: If the payment is late, contact the client as soon as possible to resolve the issue.

Offer Early Payment Discounts

Encouraging clients to pay early can help you avoid late payments altogether. Offering small discounts for early settlement provides an incentive for clients to pay before the due date, benefiting both parties. This approach can improve cash flow while keeping clients satisfied.

- Discount for Early Payment: Offer a small discount for payments made before the due date.

- Clearly Communicate the Offer: Make sure the early payment incentive is included in the terms of the agreement.

By implementing these strategies, you can minimize the risk of late payments and maintain a healthy financial flow, ensuring that your business continues to run smoothly without unnecessary interruptions.

What to Include in Service Descriptions

When documenting the tasks performed, it’s essential to provide a clear and detailed description of the work completed. A well-written explanation not only helps prevent confusion but also ensures that clients understand exactly what they are paying for. Including the right details in your task descriptions ensures that both parties are aligned on expectations and terms.

Key Elements to Mention

To ensure transparency and avoid misunderstandings, here are the critical details that should always be included in your task descriptions:

- Task Overview: Provide a brief summary of what was done, such as “floor scrubbing” or “window cleaning.” This gives clients a quick understanding of the work performed.

- Dates and Duration: Clearly state when the work was done and how long it took. This helps to avoid confusion regarding timeframes.

- Specific Areas or Items: If applicable, specify the exact areas or items that were worked on. For example, “living room carpet” or “kitchen counters.” This ensures clients know exactly what was addressed.

- Materials Used: List any special products or tools that were necessary to complete the task, such as eco-friendly detergents or high-powered equipment.

- Special Requests: If the client made any special requests, such as focusing on certain areas, make sure to include them in the description. This shows attention to detail and ensures the client’s specific needs are met.

Why Detailed Descriptions Matter

By including these specifics, you not only demonstrate professionalism but also provide clarity on the scope of work completed. This transparency helps build trust with your clients and minimizes potential disputes about the services rendered. It also serves as a record in case any questions arise later.

- Prevents Misunderstanding: Clear descriptions reduce the chances of confusion over what was provided.

- Improves Client Trust: Detailed records show clients that you are thorough and take their needs seriously.

- Protects Your Business: Accurate descriptions serve as a reference in case of any future disagreements.

Ultimately, including comprehensive and precise descriptions in your records ensures that both you and your clients are on the same page, fostering positive relationships and repeat business.

How to Track Payments Efficiently

Managing payments and keeping track of outstanding balances is crucial for maintaining a healthy cash flow in any business. Proper tracking ensures you are paid on time and can identify any overdue payments promptly. By implementing an organized system, you can reduce the chances of missed payments, prevent financial confusion, and maintain strong client relationships.

Use Digital Tools

One of the easiest and most efficient ways to track payments is by using digital tools such as accounting software or spreadsheet applications. These platforms allow you to record, update, and monitor payments in real time, giving you a comprehensive view of your financial transactions.

- Automated Updates: Many software options automatically update your records as payments are received, reducing manual entry.

- Real-Time Access: Cloud-based systems allow you to check the status of payments from anywhere, anytime.

- Custom Alerts: Set reminders for upcoming payments or overdue balances to stay on top of your cash flow.

Maintain a Payment Log

If you prefer a more hands-on approach, a simple payment log can also work effectively. Maintain a spreadsheet or physical log that records each payment, including the amount, date received, and the client’s name. Regularly update this log to ensure accurate tracking of incoming funds.

- Consistent Updates: Update the log as soon as a payment is received to avoid missing any transactions.

- Detailed Entries: Record all the details, including the method of payment (e.g., bank transfer, check, cash), for future reference.

Set Clear Payment Terms

Clearly communicating your payment terms at the outset can help reduce confusion and late payments. Include due dates, accepted payment methods, and any penalties for overdue balances. When clients are aware of the terms from the beginning, it’s easier to track payments and follow up when necessary.

- Specify Payment Deadlines: Include clear due dates for each transaction.

- Offer Multiple Payment Methods: Make it easier for clients to pay by offering various options, such as online payment systems or bank transfers.

By implementing these tracking strategies, you can maintain better control over your finances, reduce the risk of late payments, and ensure a smoother financial operation for your business.

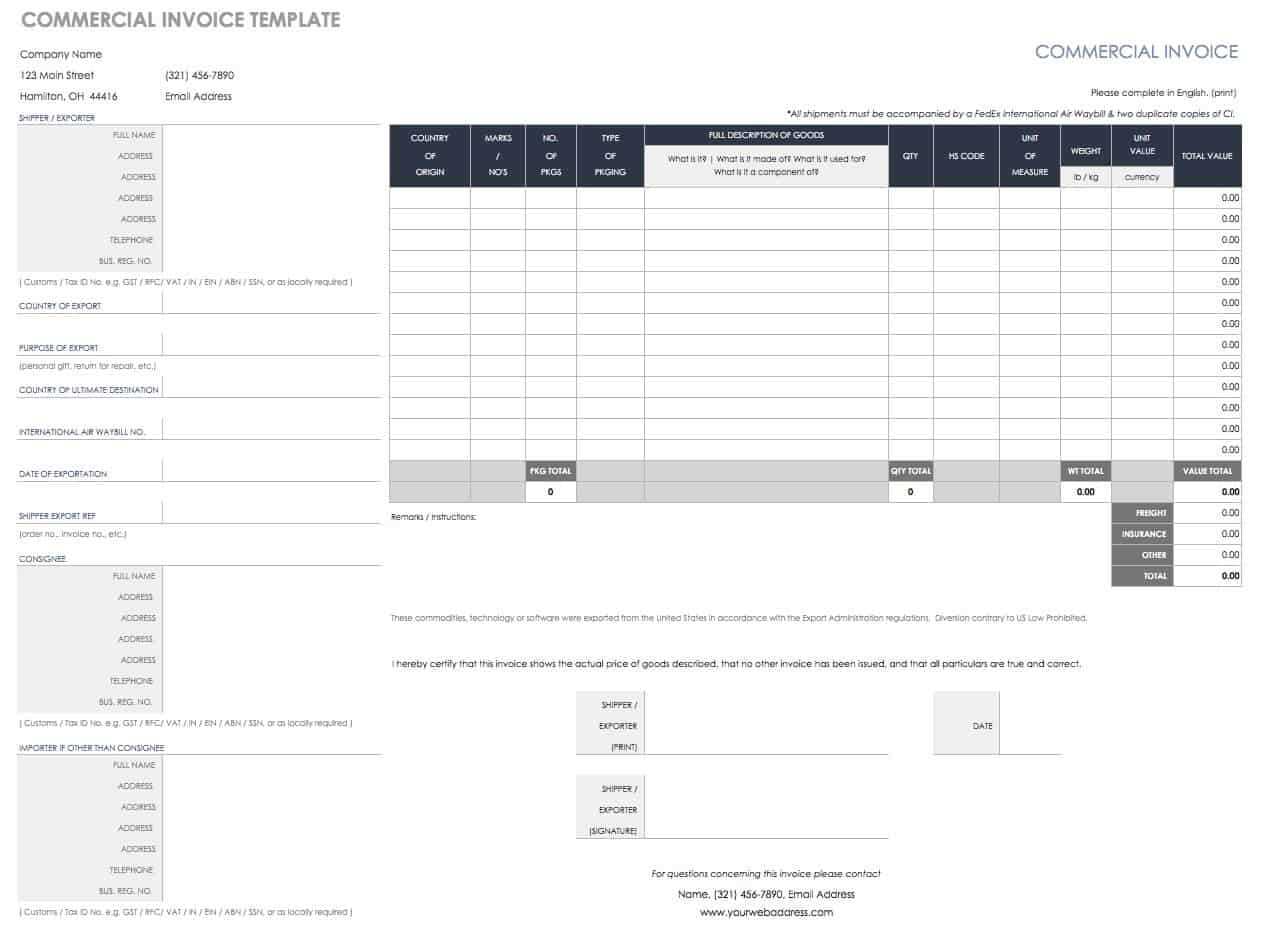

Choosing the Right Invoice Format

Selecting the appropriate format for your billing records is crucial for ensuring clarity and professionalism. The right layout not only makes your documents easier to understand but also helps streamline the payment process. Whether you choose a simple design or a more complex layout, it should reflect your brand, provide essential details, and be easy for clients to navigate.

Factors to Consider When Choosing a Format

When selecting a format for your billing documents, there are several factors to consider. These include the level of detail needed, the type of work provided, and your business’s overall branding. A clear, well-organized format will make it easier for clients to process the document and ensure that all necessary information is included.

- Client Preferences: Some clients may prefer a more detailed record, while others might appreciate a simpler, quicker overview. Know your client’s expectations.

- Task Complexity: For more detailed or specialized work, a format that includes itemized charges may be necessary to avoid confusion.

- Branding Consistency: Choose a layout that aligns with your business’s image and style. Consistency helps reinforce your brand.

Simple vs. Detailed Formats

Depending on the nature of the tasks performed, you may want to decide between a simple format or a more comprehensive one. Simple formats are ideal for quick, straightforward transactions, while more detailed formats are necessary for projects that involve various components or tasks.

Type of Work Recommended Format Key Elements Basic Tasks Simple Layout Date, Total Amount, Payment Due Date Complex Projects Itemized Layout Task Breakdown, Individual Costs, Materials Used Choosing the right format not only ensures that your clients understand the charges but also helps you maintain a professional image. The simpler the document, the easier it is for clients to pay on time, and the more detailed the document, the clearer your work’s value becomes.

Best Practices for Invoice Design

Designing a professional and clear payment document is key to ensuring smooth transactions and positive client relations. The layout should be clean, easy to read, and well-organized to avoid confusion and delays. By following a few best practices, you can create a document that not only looks professional but also helps clients quickly understand the details of the work completed and the payment terms.

Key Elements of an Effective Design

When designing your billing documents, there are certain elements that must be highlighted to make the information clear and accessible. Here are the core components to focus on:

- Consistent Branding: Your business name, logo, and contact information should be clearly visible, reinforcing your professional image.

- Readable Fonts: Use simple, easy-to-read fonts, avoiding overly decorative or hard-to-decipher text styles.

- Clear Task Descriptions: Provide concise and accurate descriptions of the tasks performed, including dates and details, to prevent misunderstandings.

- Organized Layout: Break the document into clearly defined sections such as client details, service descriptions, charges, and payment terms to make the information easy to find.

Making Payment Information Stand Out

One of the most important aspects of the design is ensuring that the payment instructions are easy to locate and understand. This includes providing clear due dates, payment methods, and penalties for late payments. Here’s how to make these sections stand out:

- Highlight Due Dates: Ensure the payment deadline is in a prominent location and easy to spot.

- Emphasize Payment Methods: List acceptable payment methods clearly so the client knows how they can pay.

- Include Payment Instructions: Provide step-by-step guidance on how to make the payment if needed, especially for online transfers or specific platforms.

By focusing on these design best practices, you can create professional, effective documents that help streamline the payment process, reduce confusion, and ultimately improve your business’s efficiency and client satisfaction.

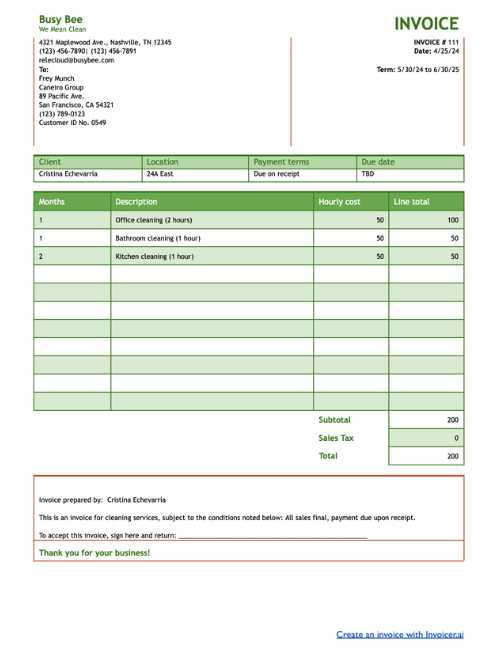

How to Create Professional Invoices

Creating a professional billing document requires careful attention to detail, organization, and clarity. A well-designed statement not only ensures you get paid promptly but also helps build trust with clients by showcasing your business’s professionalism. By following a few straightforward steps, you can create a document that is easy to understand, accurate, and aesthetically pleasing.

Essential Steps for Crafting a Professional Document

To create a polished and professional billing document, you need to include all necessary elements in a clear and structured way. Below are the key steps to follow when preparing your statement:

- Include Your Business Information: Start by listing your business name, address, phone number, email, and website. This provides the client with a quick way to contact you if necessary.

- Client Details: Include the full name, company name (if applicable), address, and contact information of the client. Make sure the details are accurate to avoid issues later.

- Unique Identification Number: Assign each document a unique number or code for easy reference and tracking. This helps you keep your records organized and facilitates any future follow-ups.

- Clear Description of the Work Done: Provide a detailed breakdown of the tasks or work completed. Be specific about the services rendered, including dates and any special requests made by the client.

- Itemized Charges: List each item or task separately, along with the corresponding cost. This transparency ensures that the client understands exactly what they are paying for.

- Payment Terms: Clearly state the due date for the payment, the accepted payment methods (bank transfer, credit card, etc.), and any penalties for late payments.

- Subtotal and Total: Include the subtotal of all charges before tax, followed by any applicable taxes, and then the final total amount due. Make sure this is clearly marked.

Design Tips for a Professional Look

Aside from the content, the design of your document also plays a key role in conveying professionalism. Here are some design tips to ensure your billing document looks polished and neat:

- Maintain a Clean Layout: Keep the document uncluttered and easy to read by using plenty of white space and simple fonts.

- Use Your Branding: Incorporate your business logo, colors, and fonts to ensure that the document reflects your brand identity.

- Organize Information Clearly: Use bold headings, bullet points, and tables to separate se

Using Online Tools for Invoicing

In today’s digital world, managing financial records has become more efficient thanks to online platforms designed to streamline the billing process. These tools offer various features that help automate the creation, tracking, and management of payment documents. By leveraging these tools, businesses can save time, reduce human error, and maintain a more organized approach to financial management.

Advantages of Online Billing Platforms

Using online tools to handle your financial records provides several benefits that can improve both the accuracy and efficiency of your operations. Below are some key advantages:

- Automation: Many online platforms offer automation features, such as automatic calculations and recurring billing, saving you the time and effort of manually entering information.

- Accessibility: Cloud-based tools allow you to access your financial data from anywhere, making it easier to manage payments even when you’re on the go.

- Customization: Most online tools allow you to fully customize your documents, adding your branding, adjusting the layout, and including specific details unique to your business.

- Integration: Many platforms can integrate with accounting software or payment gateways, simplifying the process of tracking transactions and reconciling accounts.

- Security: Online platforms typically offer enhanced security features, ensuring that your financial data is stored and transmitted safely.

Popular Online Tools for Billing

Several online platforms cater to businesses looking to create and manage their payment records. Here are a few well-known tools:

- FreshBooks: A popular accounting platform that offers user-friendly billing features, including time tracking, expense management, and customizable documents.

- QuickBooks: A comprehensive accounting solution with invoicing capabilities, tax calculations, and financial reporting tools, perfect for businesses of all sizes.

- Wave: A free tool that provides customizable billing, as well as the ability to track expenses and income, making it ideal for smaller businesses.

- Zoho Invoice: An online platform that enables businesses to create, send, and manage billing documents with automatic reminders and multi-currency support.

By using these online tools, businesses can simplify their billing processes, improve organization, and enhance overall efficiency, allowing more time to focus on growth and customer satisfaction.

How to Handle Disputes Over Invoices

Disputes over billing can sometimes arise, causing tension between a business and its clients. Whether it’s due to misunderstanding, discrepancies in charges, or dissatisfaction with the work completed, addressing these conflicts promptly and professionally is key to maintaining positive relationships. By approaching disputes with a clear, structured, and calm mindset, you can resolve the issue while ensuring that both parties are satisfied.

Steps to Resolve Billing Disputes

When facing a dispute, it’s important to follow a step-by-step process to address the issue. Here are the essential steps for managing disagreements over payment documents:

- Review the Details: Before responding to the client, thoroughly review the billing record in question. Ensure that all charges are accurate, and cross-check against any agreements or contracts made with the client.

- Communicate Clearly: Reach out to the client and clearly explain the charges, the work completed, and the payment terms. Sometimes, misunderstandings can arise from a lack of communication.

- Be Professional and Calm: Even if the client is upset, maintain professionalism and avoid becoming defensive. A calm and respectful approach will help facilitate a smoother resolution.

- Offer Solutions: If an error is found on your part, be willing to make corrections. If the client’s issue is based on dissatisfaction, try to negotiate a compromise, such as a discount or partial refund.

- Provide Documentation: If necessary, provide any supporting documentation to clarify the charges or justify the cost. This could include contracts, signed agreements, or work logs.

Preventing Future Disputes

While disputes are sometimes unavoidable, there are proactive steps you can take to minimize their likelihood in the future:

- Set Clear Expectations: From the beginning, ensure that the client understands the scope of work, pricing structure, and payment terms. Provide a detailed summary of these points in a written agreement.

- Document Everything: Keep thorough records of all communications, agreements, and work performed. This documentation can serve as evidence if a dispute arises.

- Follow Up Promptly: After the work is completed, follow up with the client to ensure they are satisfied. Address any concerns early before they escalate into a larger issue.

By staying organized, maintaining open lines of communication, and being proactive about setting clear expectations, you can effectively handle disputes and foster positive relationships with your clients.

Why Invoice Templates Save Time

Time is one of the most valuable resources for any business. Creating billing documents manually for every transaction can be a time-consuming process, especially when you have multiple clients or ongoing projects. Using pre-designed forms allows businesses to streamline this process, saving time and reducing errors. These ready-made structures make it easy to generate consistent, professional documents quickly and efficiently.

Benefits of Using Pre-Designed Billing Forms

Here are some of the key advantages of using pre-made billing forms:

- Consistency: By using a set format, you ensure that all your documents look the same, which reinforces your business’s professional image.

- Speed: A pre-designed document requires only the insertion of basic details, such as client information and services rendered, making the process much faster than starting from scratch every time.

- Accuracy: Reduces the chances of errors by eliminating the need to manually calculate totals, taxes, or other details that can easily be overlooked.

- Ease of Use: Many tools offer user-friendly interfaces that allow you to quickly fill out and modify documents with minimal effort or technical knowledge.

How to Maximize Efficiency with Billing Forms

To make the most out of these time-saving tools, consider the following tips:

- Personalize Templates: Even though they come pre-designed, customize them with your logo, contact information, and branding to maintain a professional look.

- Set Up Recurring Options: Some platforms allow you to set up recurring billing, meaning you can automatically generate and send payment requests for repeat clients without having to redo the work each time.

- Integrate with Other Tools: Many tools allow integration with accounting or payment systems, enabling you to track and manage payments seamlessly without additional manual input.

By utilizing these time-saving options, you can increase the efficiency of your billing process, giving you more time to focus on growing your business and serving your clients.

Free vs Paid Billing Documents

When selecting a billing document solution, businesses often face the choice between using no-cost options or investing in a paid solution. Both options offer benefits, but the differences in features, customization, and support can significantly impact the way you manage transactions. Understanding the strengths and limitations of both free and paid tools will help you make an informed decision based on your business needs.

Benefits of No-Cost Billing Documents

No-cost billing documents are a great option for small businesses, startups, or entrepreneurs who are just starting to build their operations. Here are the main advantages:

- Cost-Effective: Free tools allow businesses to avoid upfront costs, making them a good choice for those on a tight budget or just getting started.

- Easy Access: Many free solutions are simple to use and accessible without requiring a subscription or long-term commitment.

- Basic Functionality: For businesses that only need to send basic payment documents with minimal customization, free options can offer sufficient features.

Advantages of Paid Billing Solutions

While no-cost options may meet basic needs, paid billing solutions offer a range of additional features that can make managing financial transactions more efficient and professional:

- Advanced Customization: Paid options typically provide more flexibility in terms of design and functionality, allowing businesses to create documents that match their branding and meet specific needs.

- Integration with Other Tools: Many paid platforms allow seamless integration with accounting software, payment gateways, and customer management systems, making it easier to track transactions and automate processes.

- Better Customer Support: Paid solutions often come with dedicated support teams who can assist with troubleshooting, customization, and other concerns.

- Additional Features: Paid platforms may include extra features, such as automated reminders, recurring billing, or advanced reporting tools, which can improve the efficiency of your financial operations.

Ultimately, the decision between free and paid tools comes down to your specific business needs. While free solutions are a good starting point, paid options offer more comprehensive features and support, making them a better choice for businesses looking for long-term scalability and enhanced functionality.

Keeping Your Billing Records Organized

Maintaining well-organized payment records is crucial for any business, whether you’re handling a few transactions or managing multiple clients. Keeping everything in order ensures that you can quickly access details when needed, reduce the risk of errors, and avoid potential confusion with clients. Proper organization not only helps you stay on top of your finances but also saves time during tax season or when performing audits.

Effective Ways to Stay Organized

There are several strategies to ensure your financial documents are well organized and easy to manage. Below are a few practical approaches:

- Use Folders or Categories: Group related documents together, such as by client, project, or month. Digital folders and categorized labels make it easier to locate records quickly.

- Implement a Numbering System: Assign a unique identifier or number to each record to help keep everything sequential. This system allows you to track specific transactions without confusion.

- Leverage Cloud Storage: Cloud storage platforms like Google Drive or Dropbox allow you to store and access records from anywhere, ensuring they’re safe and easily retrievable when needed.

- Utilize Software Solutions: Accounting software or management tools can automate and organize your records, making it easier to categorize, search, and retrieve them at any time.

- Regularly Review and Update: Set aside time to regularly check your financial documents. This will help you catch any missing information, errors, or inconsistencies before they become bigger issues.

Why Organization Matters

Keeping accurate and well-organized records benefits your business in various ways:

- Quick Access: Well-organized records allow you to retrieve any document instantly, whether for client inquiries or internal reviews.

- Reduced Stress: Avoid the last-minute rush of searching for misplaced records. A consistent organizational system ensures that everything is where it needs to be.

- Compliance and Reporting: An organized filing system simplifies compliance with tax regulations and supports transparent financial reporting.

Incorporating these practices into your routine will not only keep your records in check but will also improve your business’s overall efficiency and professionalism.