Free Invoice Template for Accounting Services

Managing financial transactions efficiently is a crucial aspect of running any business. Whether you are a freelancer, a small business owner, or an established firm, having a streamlined method for creating and sending payment requests is essential. A well-organized approach can save valuable time and reduce errors, helping you maintain professional relationships with clients.

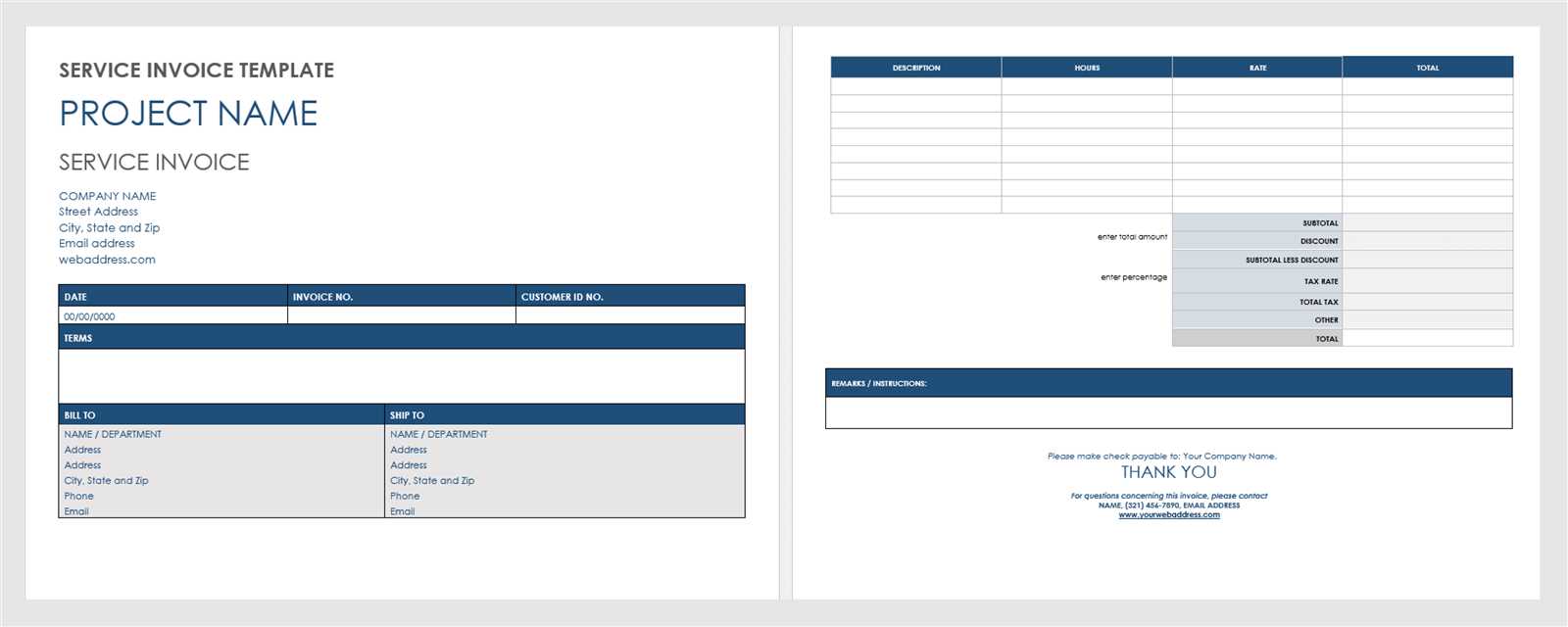

Customizable document designs offer a simple yet effective way to enhance your billing process. By using a pre-made structure that fits your needs, you can ensure clarity and consistency in every payment request you send. This eliminates the need to start from scratch every time, while still allowing room for personal adjustments based on the nature of each transaction.

With the right tools, you can ensure accuracy and maintain a professional image. Having a ready-to-use solution lets you focus on the core aspects of your business, without the hassle of worrying about formatting and details. These efficient systems make the entire process smoother, helping you stay organized and focused on growing your business.

Ready-to-Use Billing Documents for Professionals

Creating professional and accurate financial statements doesn’t have to be time-consuming or complicated. With a ready-to-use document design, anyone can quickly generate a formal request for payment, ensuring all essential details are included. These pre-structured formats make it easier to stay organized, improve efficiency, and maintain consistency in every transaction.

When choosing the right design, it’s important to consider several factors that can make a significant impact on the clarity and effectiveness of your communication:

- Customization: A design that allows you to easily modify sections ensures that each request fits your unique needs, whether for small or large transactions.

- Ease of Use: User-friendly formats that don’t require technical knowledge save time and prevent errors when preparing documents.

- Professional Appearance: Clean, simple layouts enhance credibility and present your business in a polished way.

- Clear Structure: Well-organized designs help both you and your clients quickly understand the terms, amounts, and deadlines involved.

Utilizing these pre-made solutions helps businesses of all sizes streamline their payment processes. Whether you are managing a small practice or overseeing a growing firm, having access to an efficient, customizable document format can simplify daily operations and reduce administrative burdens. This approach allows you to focus on providing quality work while ensuring financial matters are handled professionally.

Why Use a Ready-Made Billing Document

Choosing a pre-designed structure for creating financial documents can greatly simplify the process of managing transactions. It eliminates the need to build from scratch, allowing you to focus on what matters most: delivering high-quality work and maintaining smooth operations. With the right design, you can save valuable time while ensuring that each payment request is both clear and professional.

There are several key reasons why many professionals choose to use a pre-made solution:

- Time Efficiency: With a ready-made structure, there’s no need to spend time formatting or organizing every detail. You can focus directly on the content, knowing that the layout is already set up.

- Consistency: Using the same design for all financial communications ensures a consistent and professional appearance, helping build trust with your clients.

- Accuracy: A well-structured document ensures that no essential information is missed, reducing the chance of errors or confusion when requesting payment.

- Cost Savings: Many pre-made solutions are available at no cost, helping businesses save on costly software or professional design fees.

- Customization: Many pre-designed documents allow for easy adjustments, so you can tailor each request to suit specific needs or preferences.

By incorporating a ready-to-use structure, you streamline your workflow and increase the professionalism of your transactions. It’s an effective way to manage your billing process without overcomplicating it or investing unnecessary time and resources.

How Pre-Designed Documents Simplify Billing Process

Managing financial transactions efficiently requires a structured approach. A pre-made design can significantly reduce the time and effort needed to create formal payment requests. These formats come with essential fields already organized, allowing you to focus on the specifics of each transaction while ensuring consistency across all documents.

Key Benefits of Using Pre-Made Documents

By using a pre-structured format, you can streamline the entire billing cycle. Here are some ways these designs simplify the process:

| Benefit | Explanation |

|---|---|

| Speed | Pre-made formats save time by eliminating the need to organize details from scratch, allowing you to focus on the necessary information. |

| Consistency | Using the same design for all transactions ensures uniformity and professionalism in your documentation. |

| Accuracy | Structured formats help reduce errors by including all the required fields in a clear and organized manner. |

| Customization | Most pre-made formats allow easy adjustments, ensuring each document can be tailored to the specifics of the transaction. |

Reducing Administrative Tasks

Utilizing a ready-to-use format frees up your time for other important tasks. With everything in place, you can quickly generate formal requests and maintain a high level of accuracy. This not only improves your workflow but also helps you stay organized and efficient with your financial operations.

Features to Look for in Document Designs

When choosing a pre-made solution for generating formal payment requests, it’s important to consider specific features that can improve efficiency and accuracy. The right structure should not only streamline your process but also provide flexibility and professionalism. Here are some essential aspects to look for in a well-designed format.

Essential Elements of a Good Design

Customization Options: A key benefit of using a pre-made solution is the ability to adjust it according to your needs. Look for formats that allow easy editing of sections such as client information, transaction details, and due dates.

Clarity and Simplicity: The layout should be easy to follow, with clearly marked sections for all necessary details. A clean design reduces the chance of missing important information and ensures that both you and your client understand the terms easily.

Additional Features to Consider

- Payment Terms Section: Including a dedicated area for payment terms, such as late fees or early payment discounts, helps clarify expectations from the start.

- Branding Opportunities: Look for formats that allow you to add your company logo, colors, and other branding elements to maintain a professional appearance.

- Automated Calculations: Some formats include fields that automatically calculate totals, taxes, or discounts, reducing the risk of errors and saving you time.

- Compatibility: Ensure the design can be easily opened and edited in common software programs, such as word processors or spreadsheet tools, for added convenience.

By choosing a document structure with these features, you can save time, ensure accuracy, and present a professional image to your clients. The right design can make all the difference in streamlining your billing process and reducing administrative tasks.

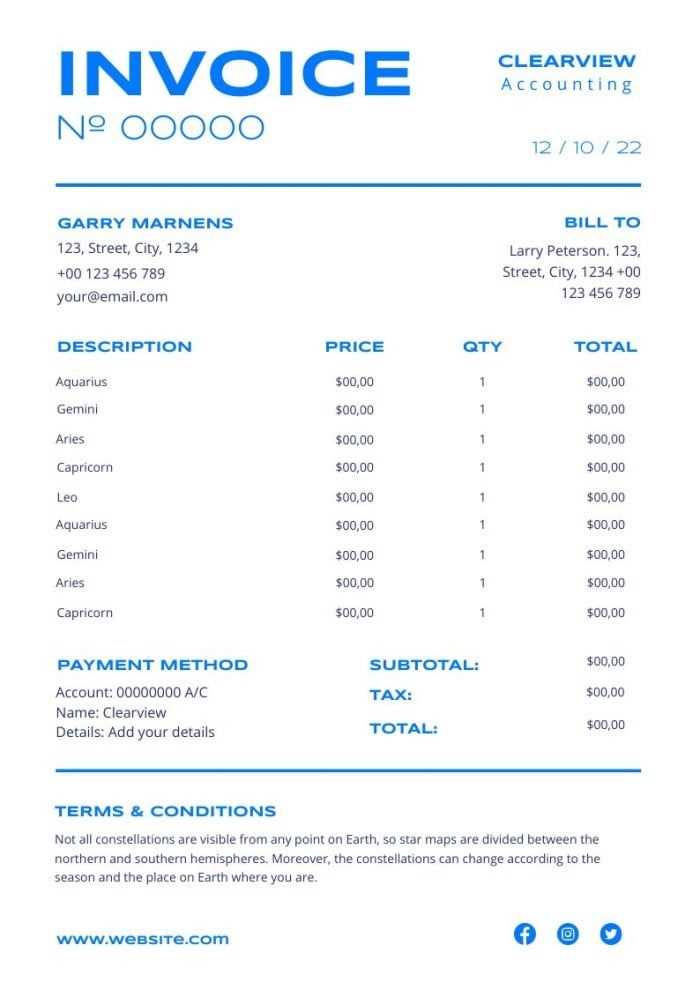

Advantages of Customizable Document Designs

One of the key benefits of using a customizable structure for creating formal payment requests is the flexibility it provides. Being able to adjust various sections to suit your needs can significantly enhance the efficiency of the billing process. Customizable designs not only allow you to tailor each document for different transactions but also help maintain consistency across all client communications.

Below are some notable advantages of using a customizable format for generating payment requests:

| Advantage | Benefit |

|---|---|

| Flexibility | Customizable designs allow you to adjust the layout and content according to the specifics of each transaction, whether for a one-time payment or a recurring contract. |

| Brand Identity | You can incorporate your business’s branding elements, such as logos, colors, and fonts, to create a professional and recognizable look that aligns with your brand. |

| Adaptability | These designs can be easily updated as your business grows or your client requirements change, making them useful over the long term. |

| Time Efficiency | Pre-designed structures that are easily editable can save you time by eliminating the need to start from scratch with every document, allowing you to focus on other essential tasks. |

| Accuracy | Customizable documents help ensure that all necessary fields are included and properly formatted, reducing the chance of errors and omissions. |

Incorporating these customizable elements into your workflow not only simplifies the billing process but also ensures that each transaction is handled with the attention to detail it deserves. Whether it’s adjusting the payment terms, adding a discount, or updating client information, the ability to easily modify your documents provides valuable convenience and professionalism in every transaction.

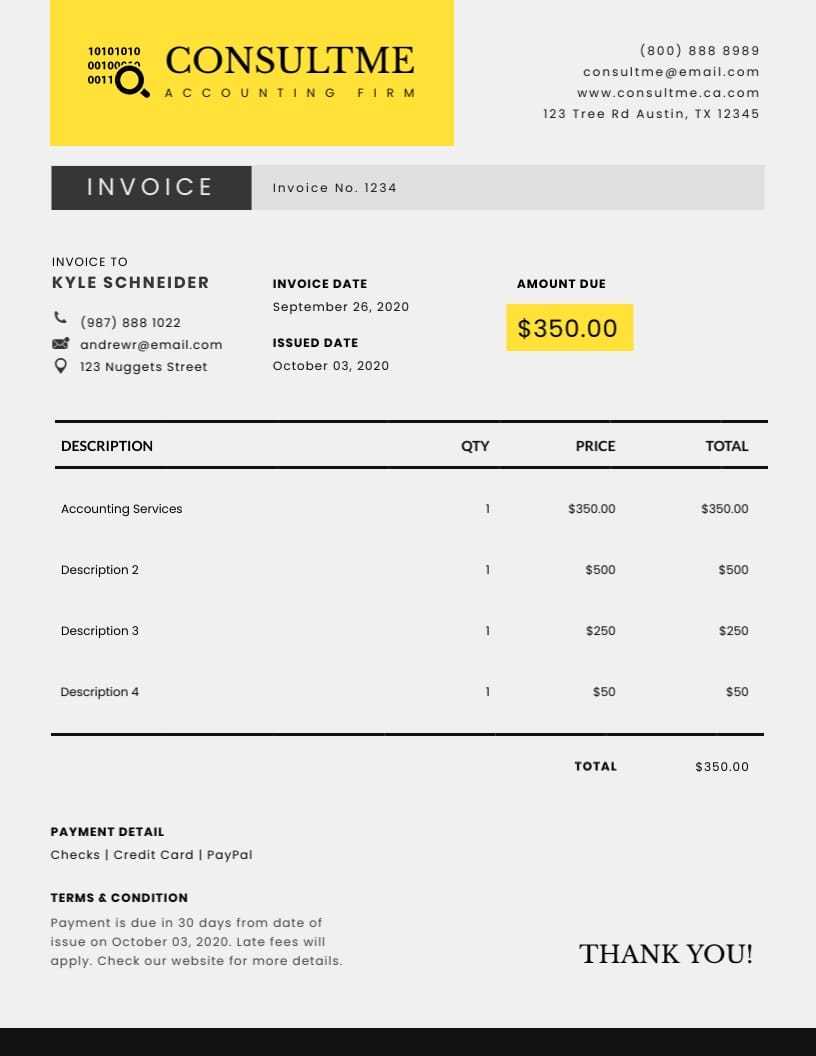

Choosing the Right Document Design for Your Business

Selecting the right structure for creating formal payment requests is essential to ensuring both efficiency and professionalism. The design you choose should align with your business type, the services you offer, and the expectations of your clients. A well-chosen format not only simplifies the billing process but also enhances the overall client experience.

Factors to Consider When Choosing a Design

When evaluating different document designs, several factors should guide your decision to ensure the best fit for your needs:

| Factor | Explanation |

|---|---|

| Business Type | Consider the nature of your business. A design for a consulting firm may differ from one suited for a retail business. Choose a format that suits the scale and industry you operate in. |

| Client Expectations | Different clients may expect different levels of detail. Some may prefer a simple format, while others may want comprehensive documentation. Choose a design that aligns with their needs. |

| Customization Options | Ensure the format allows you to easily adjust key elements, such as payment terms, item descriptions, and tax calculations, to match your specific requirements. |

| Professional Appearance | Your document should reflect your business’s level of professionalism. Select a design that is clear, easy to read, and polished, giving your clients confidence in your operations. |

| Ease of Use | Choose a design that is intuitive and simple to use, enabling you to quickly generate requests without unnecessary complexity. |

Making the Right Choice for Long-Term Use

Remember, the design you select will be part of your ongoing business operations. It should not only meet your immediate needs but also accommodate growth and future changes. With the right structure, you can streamline your billing process, improve consistency, and maintain a professional appearance across all client communications.

How to Edit and Personalize Billing Documents

Customizing your financial documents is an essential part of presenting a professional image and meeting client expectations. By adjusting key details such as client information, transaction terms, and payment instructions, you ensure that each document is both accurate and tailored to your business. Personalizing these documents not only enhances communication but also helps build stronger relationships with your clients.

Steps to Personalize Your Financial Documents

Editing and personalizing your billing documents is a straightforward process. Follow these steps to ensure your documents are both professional and unique:

- Modify Client Details: Update the client’s name, address, and contact information to ensure the document is specific to the recipient.

- Adjust Payment Terms: Customize the payment terms, such as due date, discounts, or late fees, according to your agreement with the client.

- Add Your Branding: Include your business’s logo, colors, and font style to maintain consistency with your brand identity.

- Include Specific Items or Services: Tailor the document by adding or modifying the list of products or services provided, including detailed descriptions and pricing.

- Customize the Layout: Rearrange sections if needed to emphasize certain details, such as payment instructions or terms of service.

Additional Tips for Personalization

- Use Clear and Simple Language: Make sure the document is easy to understand by avoiding complex jargon or terms that might confuse your client.

- Double-Check All Information: Before sending the document, verify that all client details and payment information are accurate to avoid misunderstandings or delays.

- Maintain Professional Formatting: Ensure the document is well-organized and visually appealing to create a positive impression on your clients.

By following these steps and tips, you can easily tailor each document to meet the specific needs of your clients while maintaining a high level of professionalism in your financial communications.

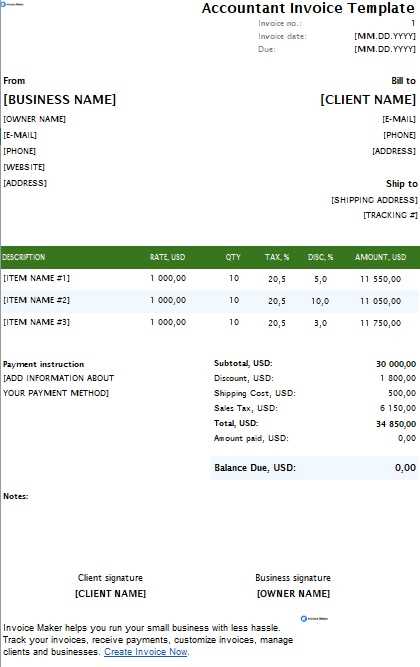

Best Practices for Accurate Billing

Ensuring accuracy in your billing process is crucial for maintaining smooth business operations and fostering positive client relationships. A well-structured and precise financial document not only reduces the risk of errors but also enhances your professional reputation. Following certain best practices can help you avoid common mistakes and ensure that every transaction is properly recorded and communicated.

Key Practices for Error-Free Billing

To maintain accuracy and clarity, consider the following best practices when preparing your payment requests:

- Include All Relevant Details: Always ensure that essential information such as client names, addresses, dates, and payment terms are clearly stated and accurate.

- Break Down Charges: Provide a clear itemization of products, services, or hours worked. This transparency helps avoid confusion and ensures your client understands the full breakdown of the costs.

- Verify Payment Terms: Double-check that the terms, such as due dates and any applicable taxes, fees, or discounts, are correct and match the agreed-upon conditions.

- Use Clear Formatting: A clean, well-organized layout makes the document easy to follow and minimizes the chance of missing or misinterpreting important information.

- Proofread Before Sending: Always review your documents before finalizing them. This extra step helps catch any mistakes, whether in numbers, names, or formatting.

Additional Tips for Ensuring Precision

- Automate Calculations: Use tools that automatically calculate totals, taxes, and discounts. This can greatly reduce the likelihood of errors and save time.

- Maintain Consistency: Use a consistent format for all your documents to ensure clarity and professionalism in every transaction.

- Track Sent Documents: Keep records of all documents sent to clients, including confirmation of receipt, to ensure everything is properly documented for future reference.

By following these best practices, you can ensure that every payment request is accurate, professional, and easy for your clients to process. This approach not only improves your operational efficiency but also builds trust and credibility with your customers.

Integrating Document Designs with Financial Software

Integrating structured payment request documents with your financial management tools can streamline your billing process, saving time and reducing errors. By connecting your documents with software that manages your business’s finances, you can automate the generation of reports, track payments, and keep records organized effortlessly. This integration enhances accuracy and provides a seamless experience for both business owners and clients.

Benefits of Integration

There are several advantages to linking your financial documents with specialized software:

- Efficiency: Automating document generation speeds up the billing process and reduces manual input, allowing you to focus on other important tasks.

- Accuracy: Integration ensures that information is automatically pulled from your records, minimizing the chance of errors and discrepancies in details such as amounts or dates.

- Real-Time Tracking: By syncing your documents with financial software, you can easily track the status of payments and stay updated on overdue amounts.

- Consistency: Using the same design across all platforms ensures uniformity, making it easier to maintain a professional image and meet client expectations.

- Comprehensive Reports: The integration allows you to generate detailed financial reports directly from your records, providing valuable insights into your business’s performance.

How to Integrate Your Document Design with Software

To successfully integrate your documents with accounting or finance software, follow these steps:

- Choose Compatible Software: Ensure the software you select supports the type of financial documents you use and allows for customization.

- Import or Sync Templates: Many programs allow you to upload your custom designs or sync them directly from a cloud-based system.

- Set Up Automated Fields: Configure the software to automatically fill in fields like client names, amounts, dates, and other relevant information.

- Test the System: Before fully relying on the integration, test it to ensure all data flows smoothly and the documents generate as expected.

By effectively integrating your document designs with your financial management software, you create a more efficient, accurate, and professional process that benefits both your business and your clients.

Ensuring Professionalism with Billing Documents

Maintaining a high level of professionalism in financial communications is crucial for building trust and credibility with your clients. A well-designed and accurate financial document reflects your business’s commitment to detail and enhances the overall client experience. By adhering to certain standards, you can ensure that every payment request you send out is not only clear but also conveys a sense of professionalism that supports long-term business relationships.

Professional billing documents should include essential elements such as correct client information, clearly stated amounts, and accurate due dates. Moreover, using consistent design elements like logos, fonts, and color schemes will help reinforce your brand image while making the document easy to read and understand. This level of attention to detail demonstrates that you value both your clients and your business operations.

By ensuring consistency in formatting, offering clear explanations of charges, and including all relevant details, you present a polished and professional appearance. These practices contribute to smoother transactions, fewer disputes, and a higher likelihood of timely payments.

Free Billing Designs vs Paid Options

When choosing the right financial documents for your business, one of the key decisions is whether to use a no-cost solution or invest in a premium option. Both approaches offer unique advantages and limitations depending on your needs. Free designs often provide basic functionality and simplicity, while paid alternatives can offer enhanced features, customization, and support. Understanding the differences between these options can help you make the best decision for your specific business requirements.

Free designs typically cater to small businesses or startups that need a straightforward and no-cost way to manage their financial documents. While they may be sufficient for basic transactions, they often come with limitations, such as fewer customization options, basic layouts, and limited features. On the other hand, paid options generally offer greater flexibility, such as advanced design features, integration with accounting tools, and ongoing customer support. This added value can be particularly beneficial for growing businesses that need more robust solutions to streamline operations and maintain a professional appearance.

How to Track Payments Using Templates

Managing payment records efficiently is crucial for maintaining financial clarity in any business. Utilizing well-organized documents can help you track payments effectively, ensuring you stay on top of outstanding balances and prevent any misunderstandings with clients. By incorporating payment tracking elements directly into your financial documents, you can streamline the process and save time on manual updates.

Here are some key features to include in your documents to effectively monitor payments:

- Payment Status Section: Clearly indicate whether a payment has been completed, is pending, or is overdue. This helps both you and the client stay informed about the transaction status.

- Payment Due Date: Always include a specific due date for payment. This encourages timely payments and provides a clear reference point for both parties.

- Transaction History: Include a running record of past payments, including amounts received and remaining balances. This can be helpful for both you and the client to track payment history.

- Payment Methods: List acceptable payment methods (e.g., credit cards, bank transfers), and indicate which method was used for each payment. This simplifies record-keeping and makes it easier to track payment sources.

- Automatic Reminders: Some software allows you to set up automatic reminders for overdue payments, which can be integrated directly into your payment documents. This feature reduces the need for manual follow-up.

By incorporating these elements into your financial documents, you can stay organized and ensure that all payments are properly tracked, reducing the risk of missed payments and financial errors.

Legal Considerations for Document Creation

Creating financial documents that are legally compliant is essential for protecting your business and ensuring smooth transactions. Various laws and regulations govern the creation and use of these documents, and understanding these requirements can help you avoid potential legal issues. By adhering to the relevant standards, you can maintain professional integrity and ensure that your business operations remain transparent and secure.

Here are some important legal aspects to consider when drafting financial documents:

- Client Information: Always include accurate and complete details of both parties involved in the transaction. This includes legal names, addresses, and business registration numbers (if applicable). Ensuring correct information helps prevent disputes over identity or payment responsibilities.

- Terms of Payment: Clearly outline payment terms, including due dates, interest rates for late payments, and any penalties for non-compliance. Transparent terms can prevent misunderstandings and provide a legal basis for enforcing payment collection.

- Tax Compliance: Depending on your location, you may be required to include specific tax information, such as sales tax or VAT numbers. Failing to do so can result in penalties or legal complications. Make sure you are familiar with your local tax laws.

- Document Retention: Legally, you may be required to keep financial records for a certain number of years. It’s essential to retain these documents in case of an audit or dispute. Consider using secure digital storage to ensure easy access and compliance.

- Invoice Numbering: Many jurisdictions require unique and sequential numbering for financial documents. This practice helps with tracking and ensures that records are well-organized, especially in case of tax audits.

By following these guidelines, you can create legally sound financial documents that not only protect your business interests but also ensure smooth and professional interactions with clients.

Improving Cash Flow with Invoices

Maintaining a healthy cash flow is essential for the success of any business, as it directly impacts your ability to cover operational expenses and invest in future growth. Efficiently managing financial documents can significantly enhance the cash flow process by ensuring timely payments and minimizing delays. By using properly structured financial statements, businesses can streamline their payment collection, improve predictability, and reduce administrative costs.

Key Strategies to Boost Cash Flow

To maximize cash flow through financial documentation, consider implementing the following strategies:

- Clear Payment Terms: Always specify clear terms for payment in your documents, including due dates, discounts for early payments, and penalties for late payments. This helps set expectations and encourages clients to settle their debts on time.

- Timely Issuance: Send financial statements immediately after delivering goods or services. The quicker you issue these documents, the faster you can begin the collection process, reducing delays in receiving payments.

- Multiple Payment Options: Providing clients with various payment methods can reduce friction in the transaction process. The easier you make it for customers to pay, the quicker you will receive funds.

- Frequent Follow-Ups: Regular follow-ups can be crucial in preventing overdue payments. Set up reminders or automated notifications for clients whose payments are close to being due, or who have missed their payment deadlines.

Leveraging Technology to Enhance Cash Flow

Integrating financial documents with invoicing software or cloud-based platforms can automate many of the above tasks. Such tools can track payments in real time, send reminders automatically, and even generate detailed reports to assess financial health, ensuring your cash flow remains consistent and predictable.

By incorporating these strategies into your financial management practices, you can enhance cash flow, reduce administrative burdens, and position your business for greater financial stability and growth.

Creating Templates for Different Services

Designing documents tailored to various types of work is crucial for streamlining business operations. Customizing these documents ensures that each transaction reflects the unique needs of the work being performed, whether it’s consulting, creative work, or product delivery. By structuring your documents appropriately, you can provide clarity for both the client and the business, ensuring smooth and efficient transactions.

Understanding the Importance of Customization

Different types of projects require different approaches to documentation. When creating structured documents for various fields, it’s important to consider the specific requirements of each type of work:

- Consulting Projects: When working with clients on consulting projects, it’s essential to outline the specific terms of the consultation, including hourly rates or project-based fees. These documents should also clarify the scope of work, deliverables, and timelines.

- Creative Work: For those in creative industries such as design, writing, or photography, contracts often include intellectual property terms, usage rights, and deadlines. A custom document should highlight the creative nature of the project and the unique expectations surrounding the work.

- Product Delivery: When delivering goods, the document should clearly list the items, quantities, prices, and delivery details. It’s important to specify the terms for returns, exchanges, and any warranties or guarantees.

Benefits of Tailoring Documents

Having customized documents helps avoid misunderstandings and ensures professionalism in every transaction. By addressing the specifics of each type of service or product offered, you present a clear and professional image to clients while maintaining organization in your business operations.

Creating documents that are flexible and adaptable for different types of work not only enhances operational efficiency but also strengthens client relationships, ensuring both clarity and trust throughout the project.

How to Avoid Common Invoice Errors

Ensuring accuracy in business documentation is crucial for maintaining professionalism and avoiding unnecessary disputes. Errors in these documents can lead to delayed payments, confusion, and even loss of trust between you and your clients. To prevent these issues, it’s important to be mindful of common mistakes and adopt a methodical approach to creating and managing documents.

Common Mistakes to Avoid

Even small errors can cause big problems. Below are some of the most common mistakes to watch out for:

- Incorrect Client Details: Double-check client names, addresses, and contact information. A minor typo can cause delays or confusion when processing payments.

- Missing or Wrong Dates: Always ensure that the date of issuance and the payment due date are correct. Failing to specify these dates can lead to misunderstandings about when payment is expected.

- Inaccurate Pricing: Verify the pricing details to avoid errors. Incorrect unit prices, quantities, or totals can lead to overcharging or undercharging clients, which can cause trust issues.

- Lack of Clear Payment Terms: Clearly define payment methods, due dates, and any applicable late fees. Vague or unclear payment terms can lead to delayed payments or disputes.

Tips to Ensure Accuracy

To reduce the chances of mistakes and maintain clear, error-free documents, consider the following tips:

- Use Automation: Utilize software or tools that automatically populate fields like client details and pricing, which reduces the likelihood of human error.

- Proofread Thoroughly: Always take a moment to carefully review each document before sending it out. Look for small mistakes that might have been overlooked initially.

- Standardize Your Approach: Consistently use a set structure for your documentation. Standardized formats reduce the chance of forgetting critical information.

- Use Templates: Employ well-designed documents that include all necessary fields and provide a professional layout. Templates can help eliminate the risk of missing important details.

By avoiding common errors and following best practices, you can improve the accuracy of your business documentation and maintain a professional reputation with your clients. These small efforts contribute to smoother transactions and better relationships over time.

Where to Find High-Quality Templates

When it comes to creating well-organized business documentation, finding reliable and well-designed documents is essential. Quality options can help ensure accuracy, consistency, and professionalism, which can reflect positively on your business. Knowing where to search for such resources is key to maintaining smooth operations and reducing the time spent on manual creation.

There are various platforms and tools where you can discover high-quality solutions for your business needs. Below are some recommended sources for obtaining polished, efficient documents:

| Source | Description |

|---|---|

| Online Marketplaces | Platforms like Etsy or Creative Market offer premium document options that are professionally designed and ready for use. You can find documents tailored to various industries and business needs. |

| Business Software Solutions | Software such as QuickBooks, Zoho, and FreshBooks often provide built-in documents that are customizable. These options integrate with other features, making them highly efficient for regular use. |

| Design Websites | Websites like Canva or Adobe Spark allow users to customize pre-designed layouts, which can be a great option for those seeking creative flexibility and visual appeal in their documents. |

| Templates from Professionals | Many professional designers or business consultants offer tailored document sets for specific industries. These documents are crafted to meet industry standards and often come with added customization options. |

| Public Domain Resources | Various public domain websites and open-source resources provide free access to basic, no-cost solutions that you can modify for your needs. While they might not be as polished, they can be a good starting point for smaller businesses. |

By exploring these different sources, you can easily find templates that are well-suited to your business operations. Whether you opt for a free solution or a more premium option, the key is selecting one that aligns with your professional image and ensures the accuracy of your documentation.