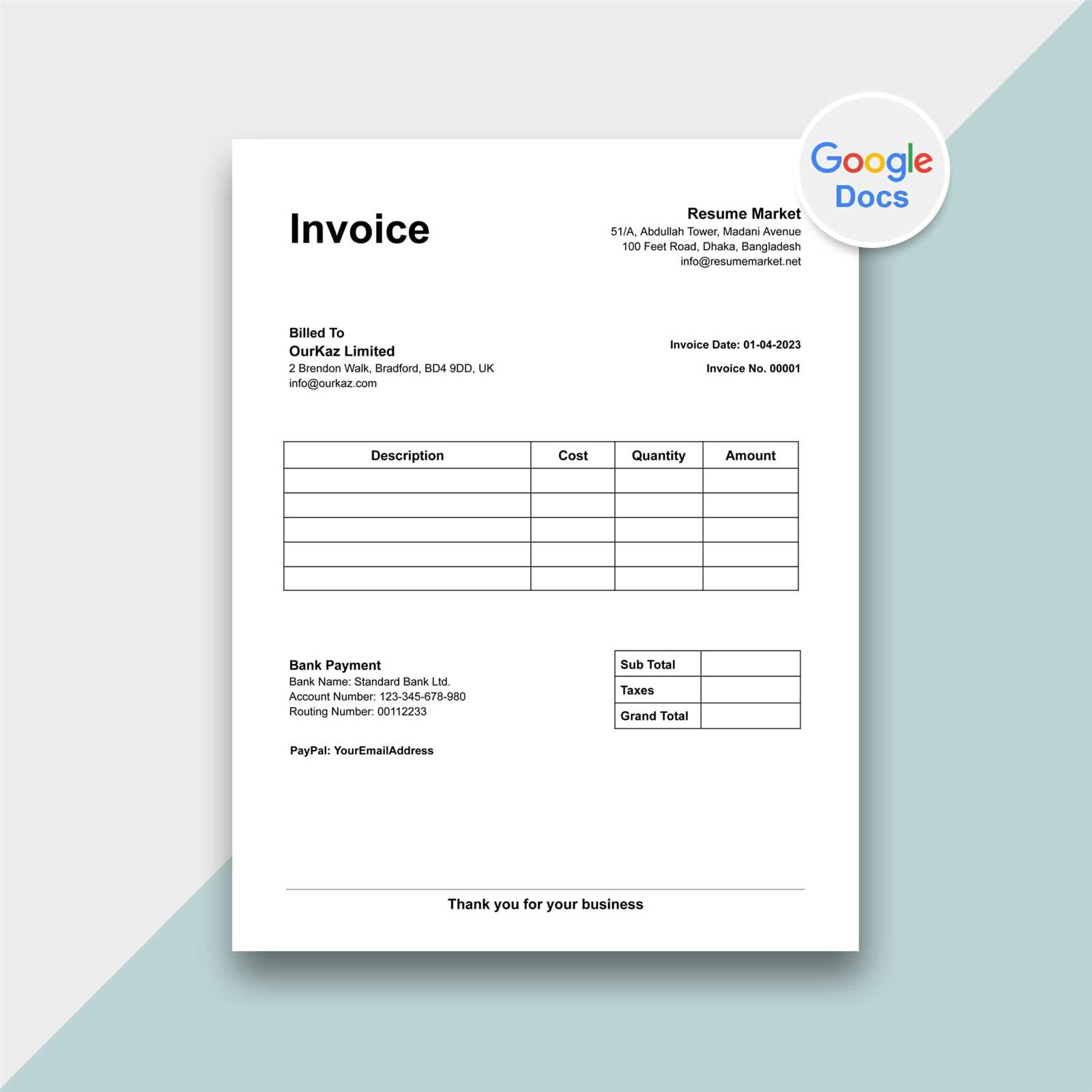

Download Free Invoice Templates for Easy and Professional Billing

Managing payments and creating professional documentation can be time-consuming for businesses of all sizes. However, with the right tools, you can simplify this task and ensure that every transaction is recorded correctly. Using pre-designed documents allows you to focus on what matters most, while still maintaining a polished and organized approach to billing.

Having access to ready-made forms can help you save valuable time. Instead of creating a new document from scratch for each transaction, you can quickly customize a template that fits your needs. This not only improves efficiency but also ensures consistency in your financial communications, giving your business a professional edge.

Whether you’re a freelancer, small business owner, or managing a larger enterprise, finding the right format is essential for smooth financial operations. By utilizing these ready-to-use forms, you can improve accuracy, reduce errors, and ensure that clients receive clear, comprehensive records of the services or products you’ve provided.

Free Invoice Template Downloads for Quick Billing

For businesses looking to streamline their payment processes, utilizing pre-designed documents can significantly speed up the billing cycle. With these ready-to-use formats, you can quickly generate professional and error-free records that meet your business needs. The ability to quickly produce consistent and accurate billing statements not only enhances workflow but also improves customer satisfaction by ensuring timely payments.

Advantages of Using Pre-Designed Forms

- Time-saving: No need to design a new form for every transaction; simply select and fill out the necessary details.

- Consistency: Ensure uniformity in your financial communications, enhancing professionalism and reducing errors.

- Customization: Easily personalize each form to fit your specific requirements, whether for different services or products.

- Cost-effective: Access ready-made solutions without the need for additional software or design expertise.

How to Quickly Access Ready-to-Use Forms

- Visit trusted websites offering a variety of formats.

- Select the document type that suits your business needs.

- Customize the fields with your company’s details and client information.

- Download and save for easy access or printing.

By leveraging these convenient options, businesses can reduce administrative overhead and focus more on core activities, ensuring that each transaction is handled swiftly and professionally. Whether you’re a freelancer, small business owner, or large enterprise, using these tools can significantly improve your financial workflows.

Why Use Free Invoice Templates

Utilizing pre-made forms to manage billing can save you considerable time and effort. With these ready-to-use formats, businesses can quickly generate accurate documents, ensuring that each transaction is recorded properly and professionally. This reduces the chances of errors and provides a consistent, reliable way to handle payments.

Key Benefits of Using Pre-Made Billing Forms

| Benefit | Description |

|---|---|

| Efficiency | Reduce time spent creating documents from scratch by filling in the necessary details on pre-designed forms. |

| Professional Appearance | Present your business in a polished and consistent manner, enhancing credibility and customer trust. |

| Customization | Adapt the layout and content to suit specific needs, such as different services, client details, or payment terms. |

| Cost Savings | Access high-quality documents without the need for expensive software or design services. |

How Pre-Made Forms Simplify Financial Processes

By adopting these ready-to-use solutions, you streamline the entire billing process, from creation to delivery. This not only saves time but also improves accuracy, ensuring that every detail is captured correctly and every transaction is processed smoothly. Whether you’re managing a small business or dealing with a high volume of transactions, using these formats can help you stay organized and professional at all times.

Top Websites for Free Invoice Templates

Finding the right place to access pre-designed documents can save both time and effort, especially for businesses looking to streamline their billing process. There are numerous reliable websites that offer high-quality, ready-to-use forms, enabling you to create professional financial statements quickly and easily. These platforms provide a variety of options that cater to different needs, from simple formats to more detailed layouts suited for larger transactions.

Best Resources for Professional Billing Documents

- Invoice Generator: This website offers an easy-to-use platform to create professional forms on the fly, with customizable fields for each client’s details.

- Zoho: Known for its suite of business tools, Zoho provides an array of clean, simple forms perfect for freelancers and small businesses.

- Canva: While primarily known for graphic design, Canva offers a variety of visually appealing billing documents that you can easily customize and print.

- Invoiced: This site is ideal for those seeking to streamline billing with recurring payments, providing a range of practical options.

- FreshBooks: A popular accounting tool, FreshBooks offers customizable options and integrates with their accounting software for seamless management of your finances.

How to Choose the Right Platform for Your Needs

When selecting a website for your billing documents, it’s important to consider the features that matter most to your business. For example, if you require automatic calculations or detailed itemized lists, platforms with more robust functionalities might be more suitable. On the other hand, if simplicity and speed are your priorities, more basic tools can help you get the job done quickly.

How to Choose the Right Template

When selecting a pre-designed document for managing your billing process, it’s important to consider several factors to ensure it suits your specific needs. The right format will not only save time but also make your financial records more professional and organized. With a variety of available options, choosing the best one can greatly impact the efficiency of your workflow.

Factors to Consider When Choosing a Format

- Business Type: Depending on whether you’re a freelancer, a small business, or a large corporation, your document needs may differ. Small businesses may prefer simpler layouts, while large enterprises might need more detailed forms for tracking multiple products or services.

- Customization Options: Choose a layout that allows easy customization. Whether it’s adjusting payment terms, adding your company logo, or modifying fields to fit specific client needs, flexibility is key.

- Detail Level: Think about how much information you need to include. If your transactions are straightforward, a simple document may suffice, while more complex billing might require itemized lists or breakdowns of costs.

- Style and Design: A well-designed document can make a big impression on clients. Choose a format that aligns with your brand and gives off a professional vibe while remaining functional and easy to read.

- Legal or Tax Requirements: Some businesses need to include specific legal or tax-related information. Be sure the form you choose accommodates these details, ensuring compliance with local regulations.

How to Test the Document Format

- Download a sample form and fill in the details for a few past transactions.

- Ensure the layout is clean and that all necessary fields are included.

- Check for ease of editing and customizing the document to suit your business.

- Review the final version for accuracy and professionalism before using it for client-facing transactions.

By carefully evaluating your options based on these factors, you’ll be able to select a format that enhances your billing efficiency while maintaining a professional image for your business.

Customizing Your Invoice Template Easily

Adapting a pre-designed form to suit your specific business needs can significantly improve your efficiency and professionalism. Customization allows you to make quick adjustments to the layout, content, and branding, ensuring that every document aligns with your company’s identity. The ability to tailor documents to fit different client needs or transaction types further streamlines your billing process.

Simple Customization Steps

- Adjust Layout: Start by altering the structure of the document. You can add or remove sections based on the details you need to include, such as payment terms, itemized lists, or special notes.

- Insert Branding: Personalize the form with your company logo, brand colors, and font styles. This not only adds a professional touch but also reinforces your brand identity in every transaction.

- Modify Fields: Update fields like client information, pricing, and dates. You can easily replace generic placeholders with specific details, making the document relevant to each transaction.

- Update Payment Terms: Ensure that your payment conditions, such as due dates, methods, and late fees, reflect the agreement made with the client.

Tools to Make Customization Easy

- Word Processors: Software like Microsoft Word or Google Docs provides user-friendly options to quickly modify text, adjust formatting, and insert logos or images.

- Online Generators: There are many online platforms that allow you to input your business details, then automatically generate customized documents with just a few clicks.

- Design Tools: For more advanced customization, tools like Canva or Adobe Spark allow for greater control over design elements, including fonts, colors, and layout options.

Customizing your documents ensures that they are perfectly suited to your business and client relationships. By making these adjustments, you not only enhance the presentation but also improve the clarity and accuracy of your billing statements.

Benefits of Using Professional Invoice Templates

Utilizing well-designed billing documents brings numerous advantages that can enhance your business operations. By choosing a professional format, you ensure that your records are both clear and organized, which can help avoid misunderstandings with clients and speed up the payment process. A polished document not only improves internal efficiency but also boosts your business’s reputation in the eyes of your customers.

Key Advantages of Professional Billing Forms

- Consistency: Using standardized formats ensures that every document you send looks professional and follows the same structure, giving your communications a cohesive, branded feel.

- Clarity: A well-organized document clearly communicates the details of each transaction, minimizing the risk of errors or confusion about what was billed and how payment should be made.

- Time-saving: With predefined sections and formatting, you can quickly fill in the necessary information without worrying about layout or design, freeing up time for other tasks.

- Legality and Compliance: Professional documents are more likely to meet legal requirements and industry standards, helping you avoid potential compliance issues down the line.

- Client Confidence: Sending well-crafted forms to clients helps build trust and portrays your business as reliable and organized, making it easier to maintain positive relationships.

How Professional Forms Streamline Your Billing Process

By adopting a professional approach to your billing, you ensure that each transaction is documented clearly and accurately. This reduces the need for follow-up questions or corrections, allowing for smoother and quicker payments. Additionally, the uniformity and professionalism of your documents reflect positively on your business, creating a lasting impression with clients.

Creating Invoices with Pre-Designed Forms

Creating professional billing documents doesn’t have to be a complex or time-consuming task. With the help of pre-made formats, you can generate accurate, polished records in just a few steps. These ready-to-use solutions simplify the process, allowing you to focus on your business operations rather than the administrative details of each transaction.

Steps to Create a Billing Document

- Select a Suitable Format: Choose the layout that best fits your needs, whether it’s a simple format for one-time purchases or a more detailed one for ongoing services.

- Fill in Business Details: Insert your company name, address, contact information, and logo to make the document personalized and professional.

- Enter Client Information: Add the client’s name, address, and any other relevant contact details to ensure the record is accurate.

- List Products or Services: Clearly itemize the goods or services provided, along with their quantities, prices, and any applicable taxes or discounts.

- Define Payment Terms: Specify due dates, acceptable payment methods, and any late fees to ensure clarity around expectations.

- Review and Finalize: Double-check all the details for accuracy, and make sure the layout is clean and easy to read before saving or sending the document.

Benefits of Using Ready-Made Formats for Billing

- Consistency: With a predefined layout, every document will follow the same professional structure, helping maintain brand consistency across your communications.

- Efficiency: The time spent on each document is reduced to just filling in the necessary fields, speeding up your billing cycle and improving cash flow.

- Accuracy: These formats often come with built-in calculations and logical flow, minimizing the chances of errors or omissions in important details.

By using pre-designed documents, you can efficiently handle your billing tasks while maintaining a professional appearance. This not only simplifies the administrative side of your business but also improves client relationships and supports timely payments.

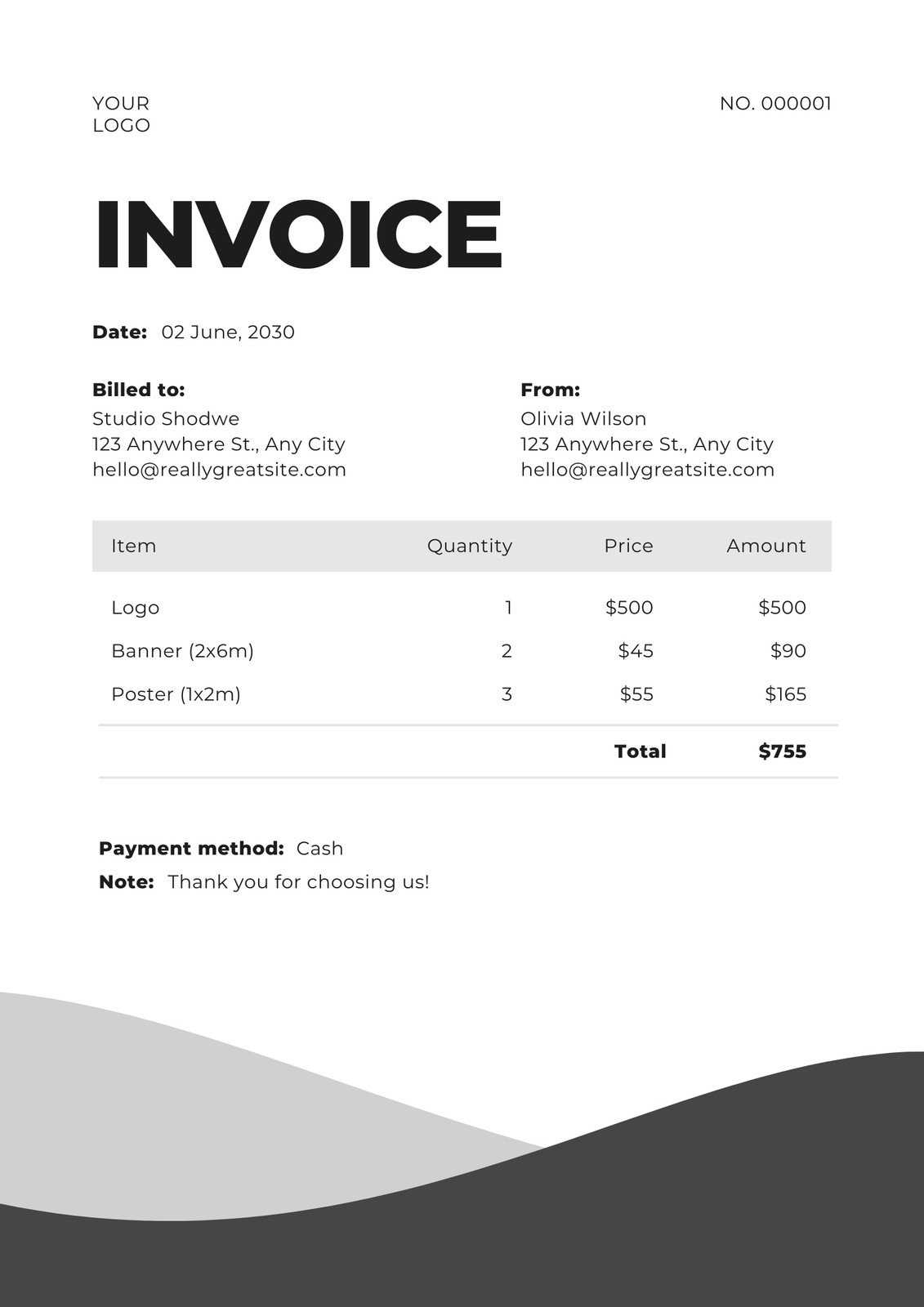

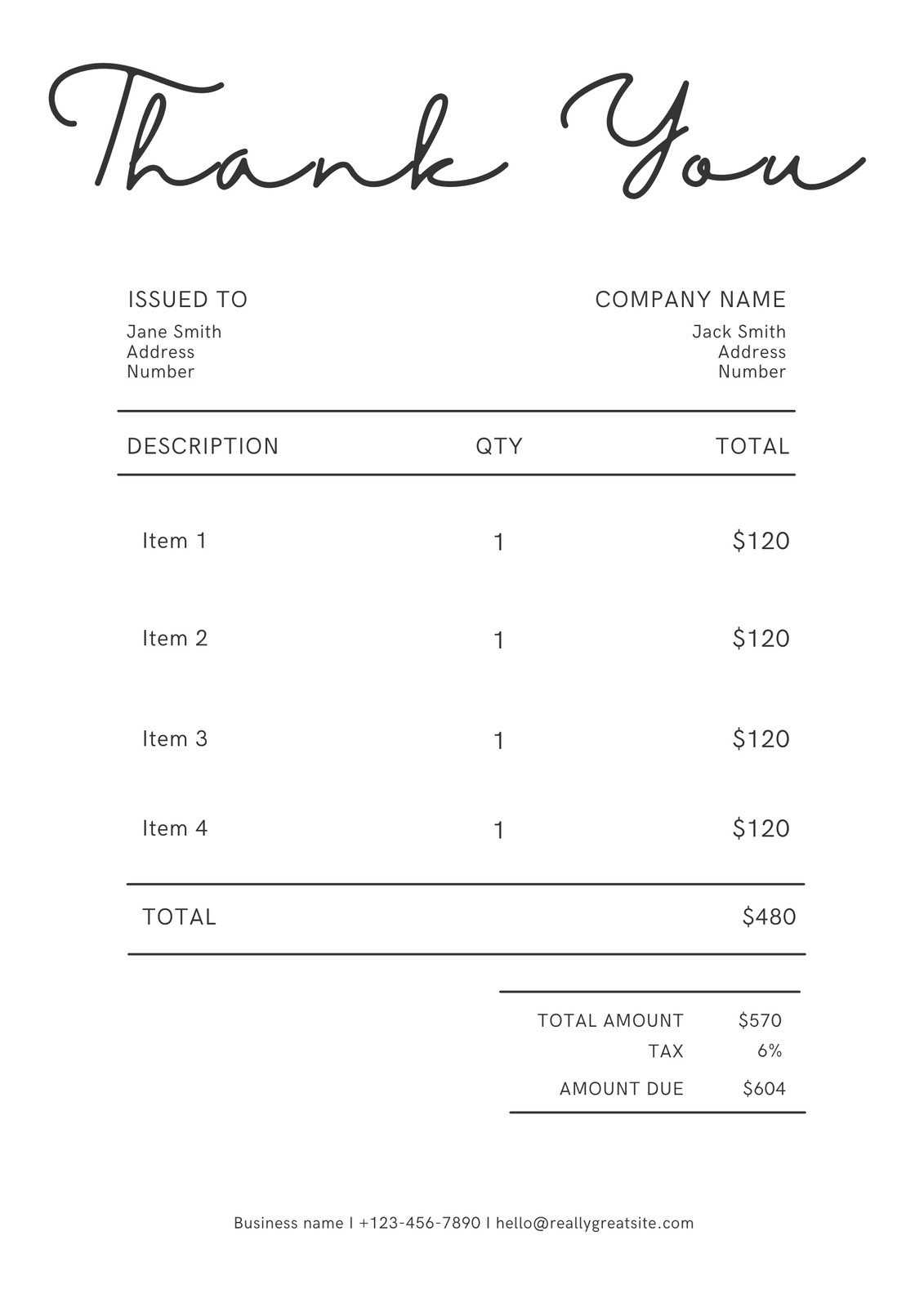

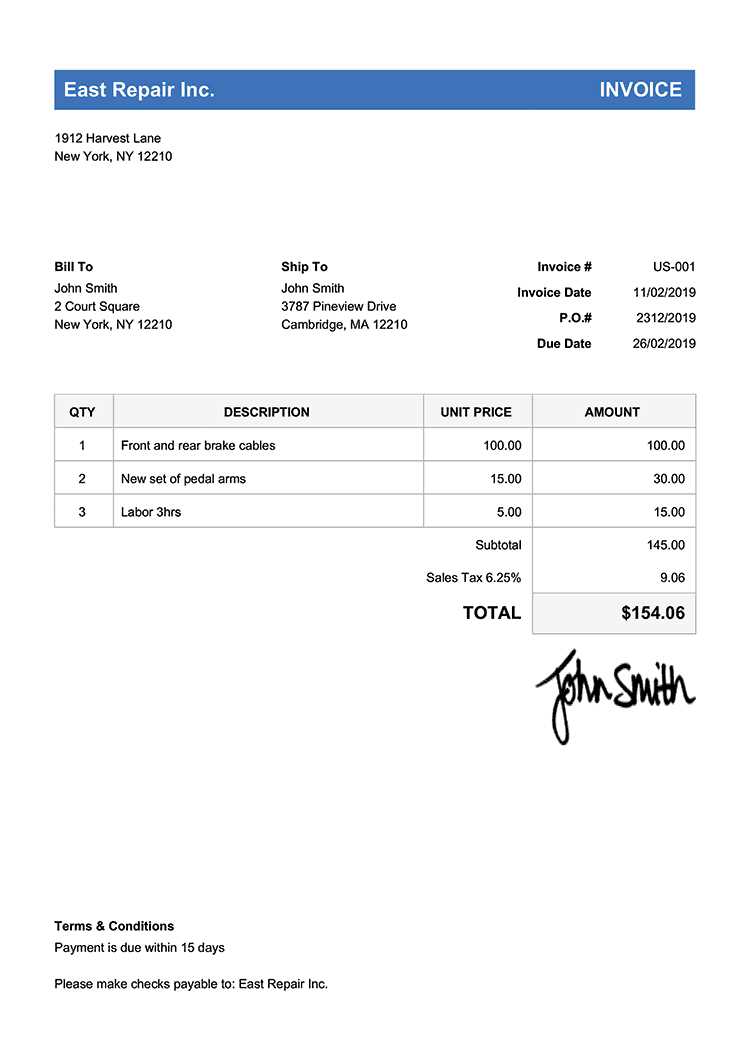

Different Invoice Formats You Can Download

There are various styles and layouts of billing documents available, each suited for different types of transactions and business needs. Whether you are managing a small freelance operation or running a large enterprise, selecting the right format is key to ensuring clarity and efficiency in your financial records. These formats come with different structures, allowing you to choose one that fits your specific requirements, such as itemized lists, recurring payments, or international transactions.

Common Formats for Different Business Needs

- Basic Format: Ideal for small businesses or freelancers, this layout typically includes essential fields such as client information, service/product details, price, and payment terms. It is simple and straightforward, making it quick to complete.

- Itemized Format: Best for businesses that sell multiple products or services, this format provides a detailed breakdown of each item, allowing you to list quantities, unit prices, and total costs. It ensures transparency for both parties.

- Recurring Payment Format: Designed for businesses offering subscription-based services or ongoing contracts, this layout includes sections to define billing cycles, payment methods, and recurring amounts, making it easier to manage regular transactions.

- Proforma Format: A preliminary version of a billing document, often used before the final transaction is completed. This format outlines expected costs and terms but doesn’t request payment until a later stage.

- Credit Note Format: Used when adjustments need to be made to a previous transaction, such as returns or refunds. This format helps to clearly outline the amount to be credited to the client and the reason for the adjustment.

Choosing the Right Format for Your Business

When selecting a format, it’s important to match it with the type of services or products you offer. Simpler businesses may find a basic document more than sufficient, while companies with more complex offerings may need a more detailed breakdown of costs. By understanding the specific requirements of your transactions, you can choose the format that will most efficiently serve your needs while maintaining professionalism and clarity.

Saving Time with Pre-Made Invoice Templates

Using pre-designed documents for billing can drastically reduce the time spent on creating each record from scratch. With ready-to-use formats, businesses can quickly input necessary details without worrying about formatting or structure. These documents allow you to focus on what truly matters–delivering your services or products–while ensuring that your financial paperwork remains professional and consistent.

How Pre-Made Billing Forms Save Time

- Eliminates Manual Design: No need to spend time setting up the layout or formatting each document. Pre-designed options come with everything in place, allowing you to simply fill in the details.

- Predefined Fields: These forms often feature placeholders for necessary information, such as client details, payment terms, and itemized lists, making it quick to customize for each transaction.

- Consistent Structure: With a consistent format, you don’t have to rethink the structure every time you create a new document. This uniformity speeds up the process and ensures accuracy in every transaction.

- Built-in Calculations: Many pre-made forms come with automatic total and tax calculations, reducing the risk of errors and saving time on manual math.

How to Maximize Time Savings

- Use the Same Format for All Transactions: Stick to one layout across all your transactions to save time and maintain consistency.

- Store Client Information: Keep a list of repeat client details saved so that you can easily populate fields for future transactions without having to re-enter everything.

- Automate Where Possible: Use digital tools that allow you to generate and send documents in just a few clicks to further streamline the process.

By incorporating pre-made formats into your workflow, you significantly cut down the time spent on billing, ensuring that you can focus on growing your business while maintaining a high standard of professionalism in your financial dealings.

How to Download an Invoice Template

Getting access to a pre-designed billing document is a simple and efficient process. Whether you’re looking for a basic layout or a more complex structure, finding and downloading a format that suits your needs can be done in just a few steps. Once you’ve located the right option, you can save it to your device and begin customizing it for your business.

Steps to Download a Billing Document

- Search for the Right Format: Use a search engine or visit a website dedicated to providing business resources. Look for a format that matches your requirements in terms of design and functionality.

- Select the Format: Browse through the available options and choose one that fits your business style. Some websites offer a variety of designs, so take your time to select the one that works best for your needs.

- Click the Download Link: Once you’ve chosen your preferred layout, simply click on the download button. This will typically trigger a prompt that allows you to save the document to your computer or cloud storage.

- Save the File: After clicking the download link, select a location on your device to store the file. You can name it for easy access later.

- Open the Document: Once saved, open the file in a program that supports the format, such as Microsoft Word, Google Docs, or any other compatible software. From there, you can start customizing the document to fit your business details.

Tips for Downloading Efficiently

- Check File Compatibility: Ensure that the format you are downloading is compatible with your preferred software (e.g., Word, Excel, or PDF).

- Use Trusted Websites: Download from reputable sources to avoid the risk of malware or faulty files.

- Save Frequently Used Formats: If you find a layout that works well for your business, consider saving it for future use to avoid repeated downloads.

By following these steps, you can easily access a professional billing document that will save you time and ensure accuracy in your financial communications.

Common Mistakes to Avoid in Invoices

While creating billing documents, small mistakes can lead to confusion, delayed payments, or even loss of trust from your clients. It’s important to pay attention to the details to ensure your records are clear, accurate, and professional. By being aware of common pitfalls, you can avoid errors that could disrupt your business transactions.

Common Errors to Watch Out For

| Mistake | Impact | How to Avoid |

|---|---|---|

| Incorrect Client Information | Delays in payment and confusion about who the document is for. | Double-check all client details, including names, addresses, and contact information before finalizing the document. |

| Missing or Incorrect Dates | Unclear payment timelines leading to missed payments or disputes. | Ensure that both the issue date and due date are accurately filled in and correctly formatted. |

| Unclear Payment Terms | Clients may be confused about when or how to pay. | Clearly state the payment terms, including due dates, accepted payment methods, and any late fees if applicable. |

| Calculations Mistakes | Incorrect totals can cause financial discrepancies and lead to disputes. | Use automatic calculations or double-check all sums and tax rates to avoid errors. |

| Missing Item Descriptions | Clients may not understand what they are being charged for, leading to confusion or disputes. | Provide clear descriptions for each product or service, including quantities, unit prices, and any discounts. |

Additional Tips for Error-Free Documents

- Use Professional Formats: A consistent, clean layout reduces the chance of errors and helps clients easily read the document.

- Proofread Before Sending: Always double-check for any typos or missed details before submitting your document to the client.

- Track Payment History:

Free vs Paid Invoice Templates: What’s Best

When it comes to selecting a document layout for billing, businesses often face the choice between free and paid options. While both types of formats serve the same basic purpose, each has its own set of advantages and limitations. Understanding the differences between these two can help you make an informed decision based on your needs, budget, and the level of customization you require.

Advantages of Free Formats

- Cost-Effective: Naturally, the biggest advantage is that these layouts come at no cost, making them perfect for startups or small businesses with tight budgets.

- Simple and Easy to Use: Free formats are often straightforward, providing basic functionality without unnecessary features or complexity.

- Readily Available: These layouts are widely available and easy to access, allowing you to quickly get started with your billing process.

Limitations of Free Formats

- Limited Customization: Most free layouts have limited options for personalization, which may not align with your branding or specific business requirements.

- Basic Design: Free versions may lack advanced design features, making them appear less professional in some cases.

- Fewer Features: Some free documents might not include useful functions, such as automatic calculations or detailed payment terms, which can slow down your workflow.

Benefits of Paid Formats

- Highly Customizable: Paid options often allow for greater flexibility in design and functionality, helping you tailor the document to meet your specific needs.

- Professional Appearance: These layouts tend to have more polished designs that can align better with your business’s branding, contributing to a more professional image.

- Additional Features: Paid formats often come with advanced features like automatic tax calculations, recurring billing options, and integrated payment gateways, making the billing process faster and more accurate.

Considerations When Choosing the Best Option

- Your Business Size: Small businesses or freelancers with limited resources may benefit from the simplicity and no-cost nature of free options, while larger businesses might find value in the added features and professional design of paid formats.

- Customization Needs: If your business requires specific branding or advanced features, a paid layout may be the better choice, offering more flexibility and functionality.

- Frequency of Use: For businesses that generate ma

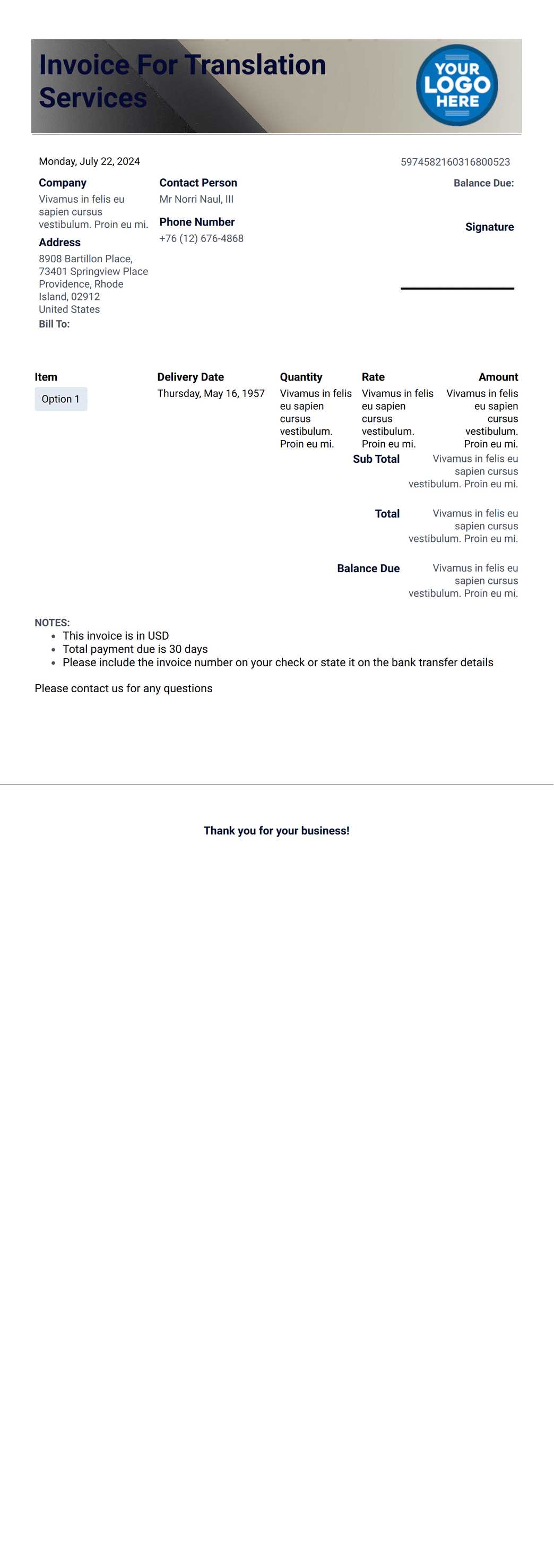

What Information to Include in an Invoice

When creating a billing document, it’s essential to include specific details to ensure clarity and prevent misunderstandings. A well-structured document helps both the business and the client track transactions accurately, ensuring smooth communication and timely payments. Including the right information also reflects professionalism and promotes trust between parties.

Key Elements to Include

- Business Information: Always include your company’s name, address, phone number, and email address. This ensures that the recipient can easily reach you if they have questions or concerns.

- Client Information: The client’s name, address, and contact details should also be listed. This helps confirm who the bill is directed to and ensures there are no mix-ups.

- Unique Document Number: Assigning a unique reference number to each document makes it easier to track and organize transactions, especially for accounting and future reference.

- Issue and Due Dates: Clearly state when the document was created and when payment is due. This helps the client know when they need to make payment and ensures both parties are on the same page.

- Description of Products/Services: Provide a detailed breakdown of the items or services provided, including quantities, unit prices, and any applicable taxes or discounts. This ensures transparency in the transaction.

- Subtotal, Taxes, and Total Amount Due: Clearly list the subtotal, any applicable taxes, and the total amount owed, making it easy for the client to understand the full payment required.

- Payment Terms: Specify your preferred payment methods (e.g., bank transfer, credit card, PayPal) and include any relevant payment terms, such as late fees or early payment discounts.

- Notes or Additional Information: Include any relevant notes, such as a thank you message, a reminder of terms, or instructions for special payments. This personal touch can strengthen client relationships.

Additional Considerations

- Clear Layout: Make sure all the information is well-organized and easy to read. Use headings and bullet points to break up the content and make important details stand out.

- Consistency: Use the same format for every document to ensure consistency across all your transactions. This will make it easier for both you and your clients to keep track of billing details.

- Legal Requirements: Depending on your location and industry, there may be specific information or legal terms you must include in your billing documents. Be sure to check local regulations for compliance.

Including these essential details ensures that your billing documents are accurate, clear, and professional. By maintaining a standard format with all the necessary information, you streamline the payment process a

Using Templates for Small Business Invoicing

For small businesses, managing billing can be a time-consuming and complex task. By using pre-designed documents, you can streamline the process and reduce errors, all while maintaining a professional appearance. These ready-to-use layouts save you time, ensuring that you can focus more on running your business and less on administrative tasks.

Benefits of Using Pre-Designed Billing Forms

- Time Efficiency: Pre-designed layouts eliminate the need to create a new document from scratch for every transaction. With just a few modifications, you can quickly generate an accurate and professional billing statement.

- Consistency: Using the same format for all your documents ensures a uniform appearance, which makes it easier to track payments and maintain organization.

- Customization Options: Many pre-built forms allow you to customize certain sections, like your business details, client information, and services offered, ensuring that each document is unique and relevant to the specific transaction.

- Professional Image: Well-designed formats help convey professionalism, which can improve client trust and prompt faster payments.

How to Use Pre-Made Documents Effectively

- Choose the Right Format: Select a layout that best suits your business type. For example, service-based businesses may need different layouts than product sellers. Make sure the design fits your billing needs.

- Fill in the Key Details: Personalize the form by entering accurate client information, item descriptions, quantities, prices, payment terms, and due dates.

- Double-Check for Accuracy: Review each document before sending it to ensure that all details are correct, including the total amount due and the payment instructions.

- Save for Future Use: Once you have a layout you like, save it for future transactions, making it easier to generate new billing statements quickly.

When to Consider Upgrading Your Document La

How Invoice Templates Improve Accuracy

Accuracy in billing is essential to maintaining good relationships with clients and ensuring that payments are processed on time. Using pre-designed documents can significantly reduce human error by providing a structured and standardized format for every transaction. These documents help you organize all the necessary information clearly, minimizing the chances of missing important details or making calculation mistakes.

Streamlining the Process

- Pre-filled Fields: Many pre-made formats come with predefined sections for key information, such as company details, payment terms, and item descriptions. This eliminates the need to manually input repetitive data, reducing the risk of errors.

- Consistent Layout: A standardized structure ensures that all necessary elements are included in every document, so nothing is left out. This consistency helps avoid mistakes such as forgetting to list items or incorrectly calculating totals.

- Automatic Calculations: Some advanced formats allow for automatic calculations, such as adding up line items, applying taxes, and totaling the amount due. This feature ensures that calculations are accurate and saves time compared to doing them manually.

Reducing Human Error

- Prevents Typing Mistakes: By using a fixed structure, you are less likely to make typographical errors that could lead to confusion or disputes with clients.

- Reduces Oversights: Standardized forms ensure that all critical fields are filled in before the document is finalized, reducing the chances of forgetting essential details like payment terms or client contact information.

- Helps Maintain Focus: Since the format is already set up, you can focus on entering the relevant details for each transaction, rather than spending time on formatting or structuring the document itself.

By using a pre-designed layout, businesses can ensure that their billing documents are accurate, consistent, and free from common errors. This not only speeds up the process but also builds trust with clients, ensuring that payments are processed smoothly and on time.

Get Paid Faster with Professional Invoices

When it comes to receiving payments promptly, the appearance and clarity of your billing documents play a crucial role. Professional, well-structured documents not only look more credible but also make it easier for clients to understand the payment terms and process. Clear and concise billing can help avoid confusion, reducing delays and ensuring timely payments.

Key Benefits of Professional Billing Documents

- Clear Payment Terms: A well-organized statement with defined payment terms (e.g., due date, late fees, early discounts) helps avoid misunderstandings. Clients are more likely to pay on time when they know exactly when and how much is due.

- Easy-to-Understand Breakdown: Clearly outlining products or services provided, along with prices and totals, ensures that clients can easily verify the charges. This minimizes disputes and speeds up approval for payment.

- Professional Image: Sending a polished and professional document gives your business credibility. It signals to clients that you take your work seriously, encouraging prompt payment to avoid delays or issues.

- Streamlined Communication: Well-structured documents reduce the need for back-and-forth communication about unclear charges or payment instructions. The clearer the document, the quicker the payment process becomes.

How Professional Billing Documents Help with Faster Payments

- Automated Calculations: Pre-designed layouts often include features like automatic tax and total calculations. This reduces the chance of errors that could lead to delayed payments or the need for follow-up corrections.

- Payment Methods Clearly Listed: Including multiple payment options (bank transfer, credit card, PayPal) and instructions helps clients pay quickly without unnecessary delays. The more convenient you make it, the more likely clients are to pay promptly.

- Client Trust: A professional-looking document enhances trust. Clients are more comfortable paying a company that appears organized and reliable. A consistent, polished approach increases the likelihood of timely payments.

Incorporating these elements into your billing process not only streamlines the payment cycle but also improves cash flow and ensures a smoother relationship with clients. Professional documents are key to getting paid faster and maintaining a professional reputation.