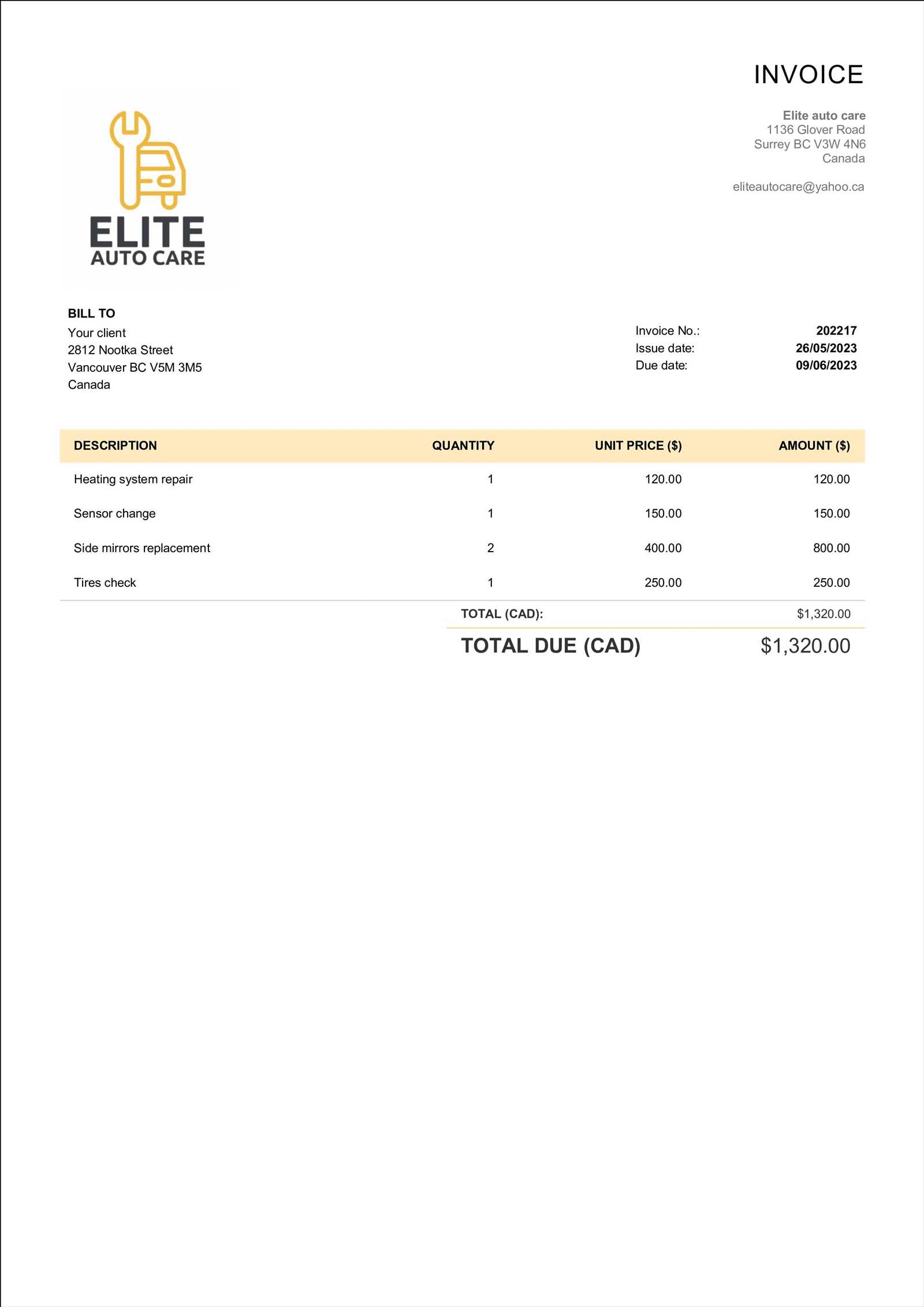

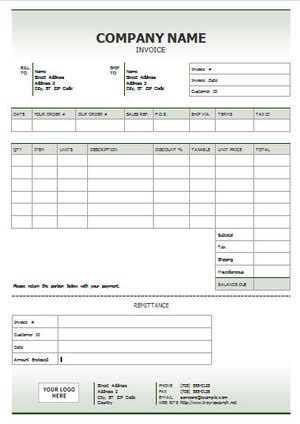

Free Invoice Template for Canada to Customize and Use

Managing financial transactions smoothly is crucial for any business, whether you’re a freelancer or a growing company. Proper documentation ensures that both you and your clients are on the same page, minimizing confusion and maintaining professionalism. Having a customizable solution for creating billing records can save time and help keep your operations efficient.

Efficiently crafting payment records doesn’t have to be complicated. With the right tools, you can easily produce well-organized and clear statements, tailored to your business needs. This approach not only simplifies the process but also helps in establishing a trustworthy relationship with clients by providing them with transparent and easy-to-understand summaries of services rendered or products sold.

Whether you’re starting a new business or looking to streamline your current billing process, having a well-structured document format is key. This guide will help you navigate through various options that can be adapted to fit your needs, making billing as simple and effective as possible.

Free Invoice Template Canada Overview

When managing business finances, having the right tools to create detailed billing documents is essential. These documents help ensure transparency and accuracy in all financial dealings, contributing to smooth transactions and professional communication with clients. For businesses in need of efficient solutions, there are various options available to streamline the creation of these documents, making it easier to focus on what matters most–growing your business.

Using an accessible and customizable format allows businesses to produce documents quickly without the need for specialized software. With these tools, customization options are available, so the document can reflect your brand’s style and meet legal requirements. Whether you’re handling large orders or small-scale projects, having a clear and structured record will support both financial management and client relationships.

The best part is that these formats come with a range of features, from editable fields to the ability to add detailed descriptions of services, payment terms, and applicable taxes. As a result, businesses can ensure that their financial documents are professional, accurate, and tailored to their specific needs.

Why Choose a Free Template

Opting for a customizable and accessible document format can significantly improve your workflow. With the right approach, you can create professional records that not only meet your business needs but also maintain a streamlined process. These solutions provide a simple and effective way to manage billing tasks without requiring advanced tools or a steep learning curve.

Cost-Effective and Accessible Solution

One of the primary reasons businesses choose an easily accessible document format is its affordability. With no additional costs for purchasing software or specialized services, these resources provide a practical alternative to more expensive solutions. They allow businesses to start working immediately without the need for a budget allocation for document creation tools.

Customizability and Convenience

These formats are highly customizable, which makes them versatile for various business needs. Whether you require a simple layout or more detailed fields, you can easily adjust the format to align with your brand identity and operational requirements.

| Benefits | Advantages |

|---|---|

| Cost-Free | No upfront cost, budget-friendly |

| Customizable | Adjust layout, colors, and content |

| Easy to Use | No technical skills required |

| Efficient | Create documents quickly and accurately |

How to Download an Invoice Template

Accessing a well-structured document format is an essential first step in streamlining your business processes. With the right resources, you can easily download a design that fits your needs. These formats are typically available from a variety of online sources, offering flexibility and quick access. The process of acquiring one is simple and can be completed in just a few steps.

Step 1: Identify the type of document that best suits your business requirements. Many platforms offer multiple designs that cater to different industries, allowing you to choose one that matches your needs in terms of style and functionality.

Step 2: Navigate to a reputable website offering the document format you need. Many online resources provide downloadable versions that can be accessed without any hidden fees.

Step 3: Select the format you wish to download, and click the appropriate button or link to start the process. These downloads are typically available in various formats, such as Word, Excel, or PDF, giving you flexibility in how you wish to use the document.

Step 4: Once the document is downloaded, open it on your device and begin customization. You can add your business information, adjust the layout, and include relevant details to create a professional document ready for use.

Benefits of Using Invoice Templates

Utilizing a pre-designed document format for managing financial transactions can bring a variety of advantages to your business. These formats offer more than just convenience–they help ensure consistency, professionalism, and efficiency in your daily operations. By implementing an easy-to-use system, businesses can focus on growing their customer base and improving services instead of spending time on manual document creation.

Time-Saving and Efficiency

Creating a professional-looking financial record from scratch can be time-consuming. Pre-made solutions simplify this process, allowing you to generate documents in just a few clicks. This can significantly reduce the time spent on repetitive tasks, enabling you to focus on other critical aspects of your business.

- Quick document generation

- Minimal setup required

- Ready-to-use layouts

Consistency and Accuracy

Maintaining consistency across all your financial records is crucial for both legal compliance and customer trust. Using a standardized design helps ensure that each document you send out looks professional and contains all the necessary information.

- Uniform appearance for all documents

- Pre-defined fields to avoid missing data

- Helps reduce human error

In addition to time-saving and consistency, these solutions can also be easily customized to fit your specific needs, making them a practical and effective choice for any business looking to streamline its operations. Whether you are handling a few transactions or managing a high volume of clients, these resources provide significant value at every stage of the process.

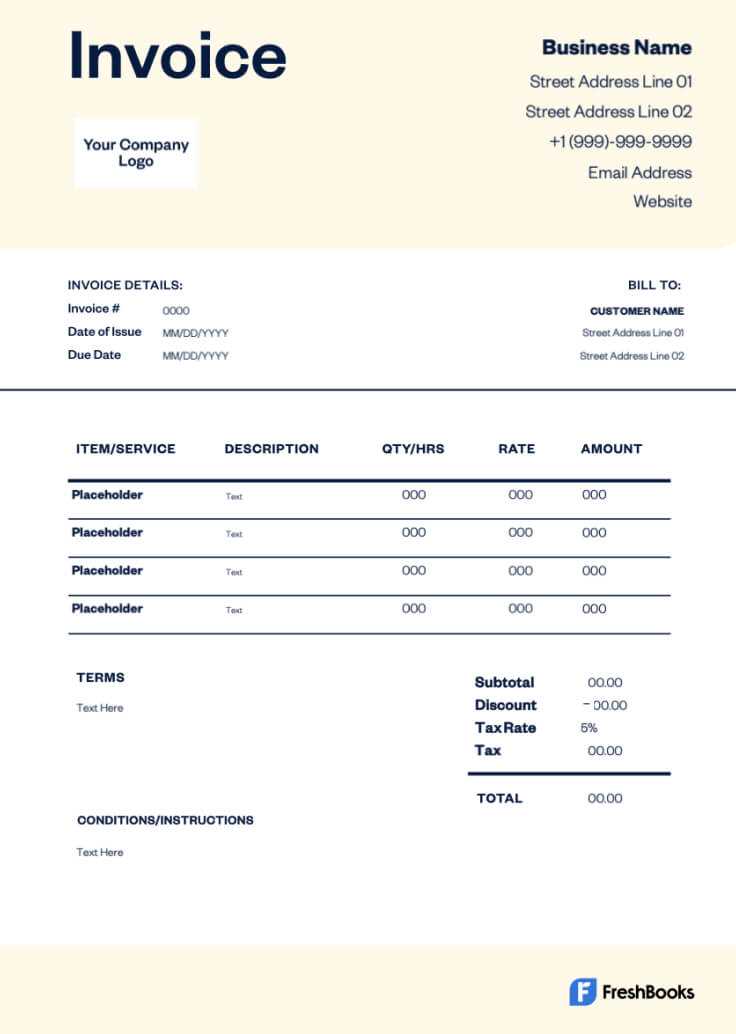

Customizing Your Invoice for Business

Tailoring financial documents to reflect your brand and meet specific business needs is essential for maintaining professionalism and clarity in all transactions. Customization allows you to ensure that every detail is accurate and aligned with your company’s requirements, creating a more personalized experience for your clients. Whether you’re looking to add your logo, adjust payment terms, or modify the layout, making these adjustments is a straightforward process that can enhance the quality of your communications.

Branding and Design Elements

Incorporating your company’s logo, colors, and branding elements into your billing records is an effective way to create a consistent brand image. These adjustments help set your business apart and reinforce your professional identity every time a document is sent.

- Add your company’s logo for instant recognition

- Choose colors that align with your branding

- Ensure your contact information is prominently displayed

Adjusting Fields and Information

Another important aspect of customization is adjusting the fields and information to suit your business’s unique needs. Whether it’s adding a description of services, setting specific payment terms, or including tax information, you have the flexibility to include the necessary details for your transactions.

- Include itemized descriptions of products or services

- Specify payment terms and deadlines

- Incorporate tax calculations or applicable discounts

By making these changes, you ensure that your financial documents not only look professional but also function effectively for your specific business operations. This level of personalization fosters better communication and helps build trust with clients, ensuring smooth and successful business relationships.

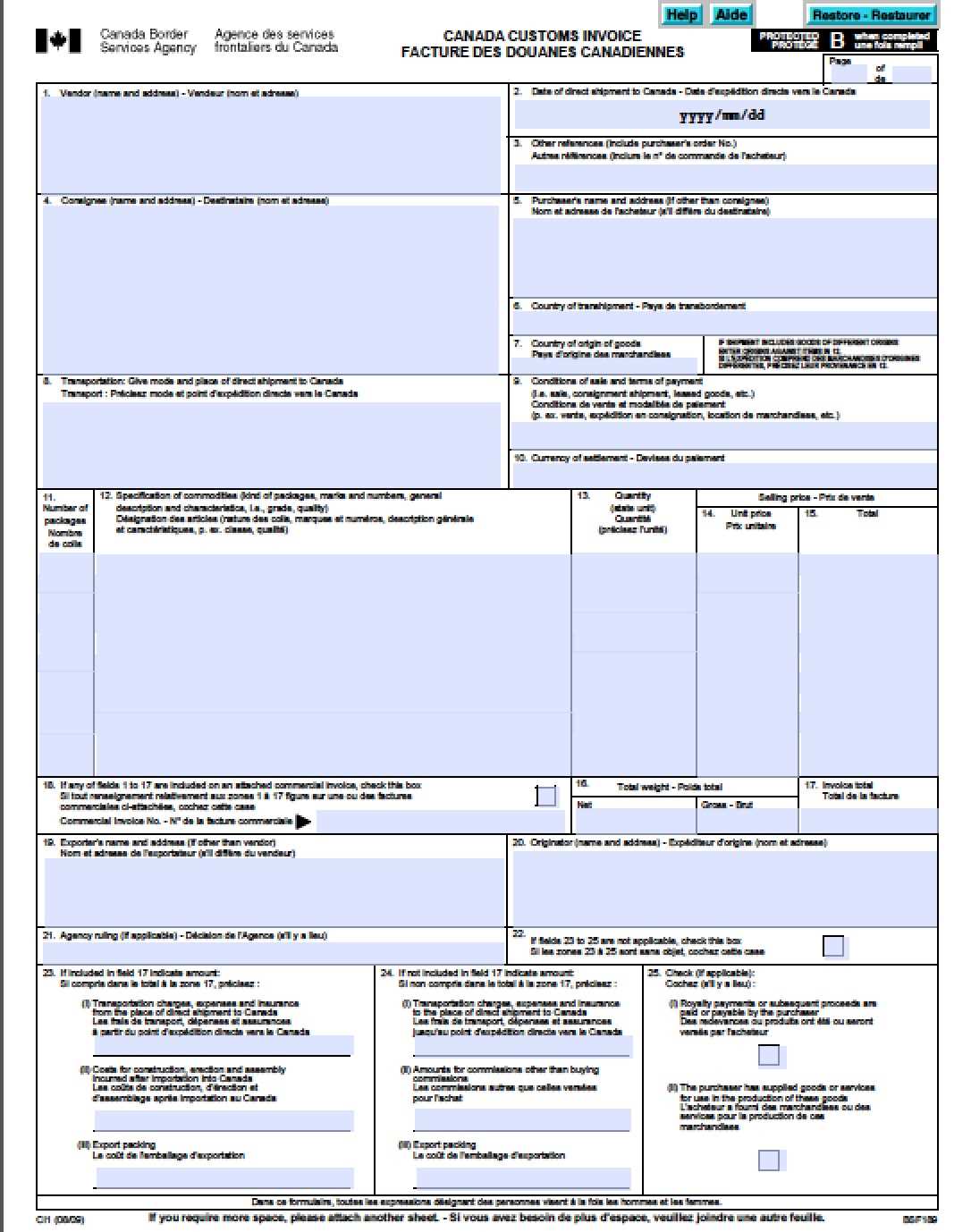

Legal Considerations for Canadian Invoices

When creating financial records for your business, it is essential to comply with local legal requirements. Ensuring that your documents meet the necessary standards will help you avoid issues with tax authorities and maintain professionalism. In Canada, there are specific regulations that must be followed to ensure your business transactions are properly documented and legally sound.

Mandatory Information to Include

To ensure your financial documents are compliant with Canadian regulations, certain details must be included. These elements not only guarantee the accuracy of your records but also help protect both parties involved in the transaction.

- Legal business name and address

- Unique document number for tracking

- Clear breakdown of goods or services provided

- Date of issue and payment due date

- Applicable taxes, including GST or HST

- Payment terms and conditions

Taxation and Compliance

Understanding the correct application of taxes is crucial for maintaining legal compliance. Different provinces in Canada may have varying tax rates, and businesses need to ensure they calculate and apply the appropriate tax, whether it’s the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

- Accurate tax rate based on location

- Tax-inclusive or tax-exclusive amounts clearly shown

- Proper handling of exempt goods or services

Adhering to these guidelines ensures that your records are legally compliant and can protect you in the event of an audit or dispute. By following the necessary rules, you can keep your financial dealings transparent and avoid costly mistakes.

Tracking Payments with Templates

Effectively managing and tracking payments is a vital part of running a business. By using a structured document format, you can easily monitor the status of each transaction, ensuring that payments are received promptly and accurately recorded. This not only helps streamline your accounting process but also improves cash flow management.

Tracking payments becomes much simpler when you incorporate fields that allow for easy updates and modifications. With a customizable layout, you can quickly mark payments as received or pending, track overdue amounts, and maintain a clear record of all financial transactions with your clients.

How to Track Payments Efficiently

To get the most out of your billing records, it is important to include key information that will help you stay on top of payment schedules. This allows for easy follow-up and ensures no payment goes unnoticed.

- Include a “Payment Status” field to easily mark when payments are made

- Track due dates and set reminders for upcoming payments

- Use an “Outstanding Balance” section to keep tabs on unpaid amounts

- Provide a clear summary of partial or full payments

Benefits of Payment Tracking

Tracking payments through your billing documents brings several advantages, particularly in the areas of financial management and client relationships. By having an organized system, you can quickly access historical payment records, which makes it easier to resolve disputes or confirm payment histories.

- Improved cash flow management

- Easy identification of overdue payments

- Increased accuracy in accounting

- Stronger customer relationships through timely follow-ups

By integrating payment tracking into your financial documents, you can create a more organized, efficient system for managing your transactions. This not only saves time but also ensures a smoother business operation.

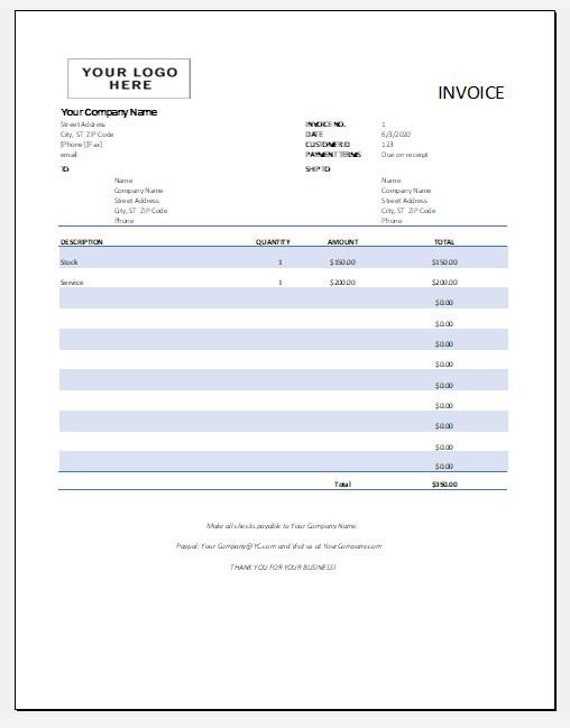

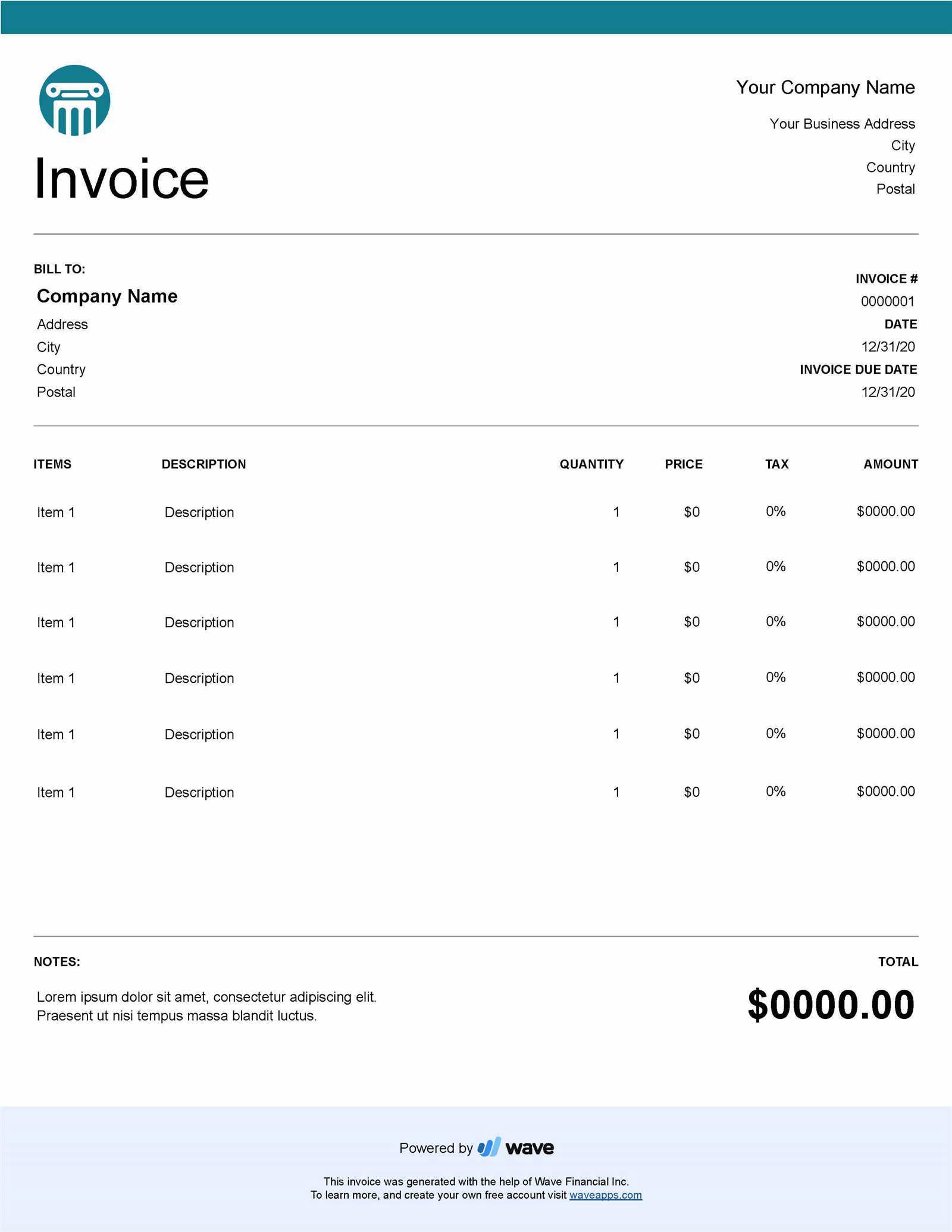

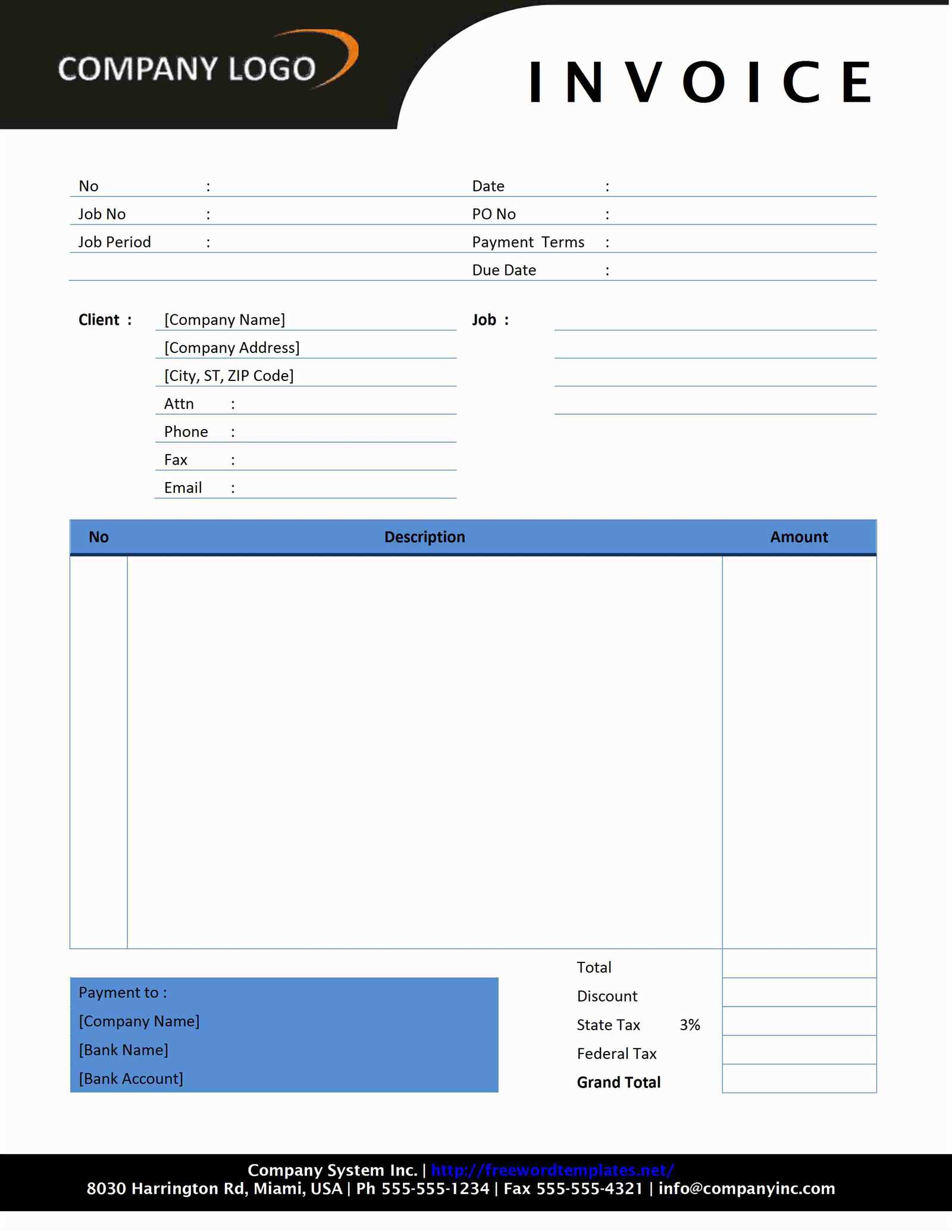

Design Features of Free Templates

The design of a document format plays a critical role in ensuring that your business communications are clear, professional, and easy to understand. By utilizing a well-organized layout, you can present important information in a way that is both visually appealing and functional. These formats often come with built-in features that help streamline the process of creating financial records, making them more effective and easier to use.

User-Friendly Layout

A good document design prioritizes simplicity and ease of use. These layouts often feature pre-arranged sections that allow you to quickly input the necessary details without clutter or confusion.

- Clear, structured sections for each required piece of information

- Simple formatting for easy navigation

- Easy-to-read fonts and clean design

Customizable Fields and Sections

Customization is another key feature of these layouts. You can easily modify sections to fit your specific business needs. Whether it’s adding extra fields, adjusting the font size, or changing the layout, these formats allow flexibility while keeping a professional appearance.

- Adjustable fields for company details, payment terms, and services

- Ability to include logos and brand elements

- Predefined sections that can be edited or removed as needed

These design elements make the documents more adaptable to your business, improving both functionality and presentation. By choosing the right layout, you can ensure that your financial documents are not only effective but also reflective of your brand’s professionalism and attention to detail.

How to Add Your Company Logo

Incorporating your business logo into financial documents is a simple yet effective way to enhance your brand’s visibility and professionalism. Displaying your logo helps clients immediately recognize your company and adds a personal touch to your communications. It also reinforces your identity and promotes brand consistency across all your business documents.

Choosing the Right Placement

The placement of your logo can impact the overall look of your document. It is important to position it in a way that is both visible and aesthetically balanced with the rest of the content. Typically, the logo is placed at the top of the page, but there are several options depending on your preferred style and layout.

- Top-left corner for easy visibility

- Centered at the top for a formal and balanced look

- Bottom or footer area for a less intrusive placement

How to Insert Your Logo

Adding your company’s logo is a straightforward process, especially with customizable document formats. Most editing tools allow you to insert an image file directly into the document, adjusting its size and position with ease. Here’s how you can do it:

- Open the document in your preferred editing software (such as Microsoft Word, Google Docs, or a PDF editor).

- Select the “Insert” or “Image” option in the menu.

- Upload your logo file (preferably in .PNG or .JPEG format for quality and transparency).

- Resize the image to fit the document layout without overwhelming other content.

- Position the logo in the desired area, ensuring it aligns with the rest of the text and fields.

By following these simple steps, you can quickly add your company’s logo to any business document, enhancing its appearance while maintaining consistency with your brand identity. This small addition can make a significant difference in how your company is perceived by clients and partners.

Editable Fields in Invoice Templates

Editable fields allow for easy customization and personalization of your financial documents, making it simple to adapt them to your business needs. By including flexible areas where you can input specific details, you ensure that each document accurately reflects the transaction at hand. These customizable sections help you save time, reduce errors, and maintain consistency across all your business communications.

Key Fields to Customize

Editable sections within your document provide a tailored experience, allowing you to input necessary information for every transaction. Here are some of the key areas typically available for customization:

| Field | Description |

|---|---|

| Company Name | Enter your business name or client’s name depending on the document. |

| Date | Specify the date the transaction was created or the payment is due. |

| Amount | Detail the total amount owed or paid, including itemized pricing if necessary. |

| Payment Terms | Define the terms of payment, such as net 30, due upon receipt, etc. |

| Tax Rate | Adjust tax rates based on your location or the product/service provided. |

Advantages of Editable Fields

Editable fields simplify document creation and management, offering several benefits to businesses:

- Ensures accurate and up-to-date information for each transaction.

- Allows for quick adjustments based on client needs or legal requirements.

- Reduces the need to create new documents from scratch for every transaction.

- Enhances the consistency and professional appearance of your business records.

By leveraging editable fields, you can create a more streamlined and efficient process for handling financial documents, improving accuracy and professionalism in your business operations.

Handling Multiple Currency Invoices

Managing documents that involve different currencies can be challenging, especially when dealing with international clients or vendors. It’s essential to properly track and convert amounts to ensure accuracy and avoid confusion. Using the right system for multi-currency transactions ensures that you maintain clarity in your records while adhering to global business practices.

Understanding the Importance of Currency Conversion

When working with multiple currencies, it is crucial to calculate the exchange rate correctly to ensure that both parties agree on the terms. This helps prevent discrepancies and ensures transparent financial communication. Accurate conversions also aid in compliance with tax regulations and accounting standards.

- Always use up-to-date exchange rates to ensure accurate conversion.

- Make sure both the payer and the recipient understand the converted amounts.

- Specify the original currency and conversion rate used for clarity.

Key Features for Multi-Currency Management

To simplify the process of handling multiple currencies, there are several important features that can be included in your document layout:

- A clear section displaying the original currency and the amount in both currencies.

- A dedicated field for exchange rate information to show how conversion is calculated.

- Including tax and fee breakdowns in both currencies for transparency.

- Ability to add notes for specific instructions regarding payment or conversion terms.

By incorporating these features into your documents, you ensure that multi-currency transactions are accurately represented, making it easier for both you and your clients to manage international deals without confusion or errors.

Integration with Accounting Software

Integrating your business documents with accounting software is a game changer when it comes to streamlining financial management. It allows you to automate data entry, track payments more efficiently, and maintain accurate records with minimal manual effort. This integration can help ensure consistency across your financial reports and provide a seamless experience for managing both your transactions and accounting books.

Benefits of Integration

By connecting your financial documents with your accounting system, you can unlock several advantages that contribute to improved efficiency and accuracy:

- Automatic Data Sync: Data is transferred directly from your documents into your accounting system, reducing errors and saving time.

- Real-Time Updates: Payments and adjustments are reflected immediately, offering a real-time view of your financial status.

- Increased Accuracy: Integration minimizes the risk of manual input mistakes and ensures that all amounts and taxes are calculated correctly.

- Seamless Reporting: Financial reports are automatically updated, giving you a clear picture of your revenue and expenses without having to manually compile data.

Popular Accounting Software Integrations

Many accounting platforms support integrations with commonly used document systems, making it easier for businesses to sync their records. Below is a comparison of some popular accounting tools:

| Software | Integration Features |

|---|---|

| QuickBooks | Automatic syncing of payment records, expense tracking, and tax calculation. |

| Xero | Integration with banking and payment services for seamless transaction management. |

| Wave Accounting | Free integration with bank accounts and credit cards, providing automatic updates of financial data. |

| FreshBooks | Easy integration with payments, invoicing, and expense tracking for better financial oversight. |

These integrations provide an efficient, paperless method of handling your business’s finances. By connecting your accounting software with your documents, you streamline the workflow, reduce the likelihood of human error, and improve financial transparency.

Creating Professional Invoices Quickly

Generating professional financial documents quickly is crucial for businesses to maintain a steady cash flow and ensure timely payments. With the right tools and processes in place, you can create accurate and polished documents in minutes, allowing you to focus on more strategic aspects of your business. Speed and accuracy go hand-in-hand when it comes to managing your finances, and using streamlined systems can simplify the entire process.

Key Tips for Fast and Professional Creation

To ensure that your documents look polished while minimizing the time spent, here are some key strategies to follow:

- Use Pre-Formatted Fields: Leverage fields that automatically adjust according to your inputs, ensuring consistency across all your documents.

- Maintain a Standard Layout: Stick to a design that includes essential details such as payment terms, your business contact info, and a clear breakdown of charges.

- Automate Calculations: Use tools that can automatically calculate taxes, discounts, and totals to eliminate manual errors and speed up the process.

- Save and Reuse Templates: Once you have a well-structured document, save it as a reusable framework for future use, allowing for quick adjustments rather than starting from scratch.

Essential Fields for Every Document

Every professional financial document should contain a set of key components to ensure clarity and professionalism. These fields ensure all necessary details are covered:

| Field | Description |

|---|---|

| Business Name & Address | Clearly display your business name, address, and contact information at the top of the document. |

| Client Information | Include the client’s name, address, and any necessary contact information. |

| Services or Products Provided | List the items or services with clear descriptions and individual costs. |

| Payment Terms | Outline your payment terms and deadlines, specifying due dates and any applicable late fees. |

| Total Amount Due | Summarize the total amount due, including taxes, discounts, and any additional fees. |

By using these strategies and essential fields, you can create professional financial documents quickly, ensuring both you and your clients have all the necessary details for a smo

How to Save and Print Invoices

Once your financial documents are complete, the next step is ensuring they are properly saved and ready for printing. This process allows you to maintain accurate records for future reference while also ensuring that clients receive their copies in a professional format. Saving and printing your documents correctly ensures their accessibility and reliability in both digital and physical forms.

Steps to Save Your Documents

There are several formats and storage methods that can help you manage your documents effectively. Below are the most commonly used options:

| Method | Description |

|---|---|

| PDF Format | Saving your document as a PDF is one of the most professional and secure methods. It preserves your formatting and is easily accessible across different devices. |

| Word Document | For those who may need to make additional edits later, saving as a Word document allows for easy adjustments while retaining most formatting features. |

| Cloud Storage | Using cloud-based storage services like Google Drive or Dropbox provides convenient access from any location, as well as automatic backups for added security. |

Printing Your Documents

Once saved, the next task is printing your documents. Here are some tips for producing high-quality physical copies:

- Choose the Right Printer: Ensure you have access to a reliable printer that produces clear and professional output.

- Use Quality Paper: For a polished look, print your documents on high-quality paper, preferably with a heavier weight to prevent it from feeling flimsy.

- Preview Before Printing: Always preview your document to check formatting, spacing, and alignment before printing the final copy.

- Consider Digital and Physical Copies: While physical copies are useful, maintaining digital versions is critical for easy access and long-term storage.

By following these simple steps, you can ensure your financial documents are not only stored correctly but also printed in a way that reflects your business’s professionalism.

Free vs Paid Invoice Templates

When deciding between using no-cost or premium solutions for your business documents, it’s important to consider both the features and limitations of each option. While the free versions often offer basic functionality, paid options can come with advanced features that may better suit specific business needs. Understanding the differences between these options can help you make a more informed decision, ensuring that the choice you make aligns with your business goals and operational requirements.

Advantages of No-Cost Solutions

There are several reasons why businesses may opt for free versions of document management tools. Here are the most notable advantages:

- Cost-Effective: The most obvious benefit is that no payment is required, making it an ideal choice for startups or small businesses with limited budgets.

- Simple to Use: Free solutions tend to be straightforward, with fewer options to configure, allowing users to get started quickly without a steep learning curve.

- Basic Features: Many free tools include the essential features needed for daily business tasks, such as creating and sharing documents, making them suitable for those with minimal needs.

Benefits of Paid Options

On the other hand, premium options often come with enhanced capabilities that can provide significant advantages to businesses as they scale. Here’s why some companies choose to invest in paid solutions:

- Customization: Paid versions typically allow for greater customization, such as adding logos, adjusting layout designs, or modifying specific fields to suit unique business needs.

- Advanced Features: These solutions may offer features like automatic tax calculations, integration with accounting software, or client management tools, which streamline business processes.

- Customer Support: With paid services, you often have access to premium customer support, ensuring that any issues or questions are addressed promptly.

- Security: Premium services usually come with better data protection features, ensuring that your documents are stored and transferred securely.

Ultimately, the choice between free and paid options depends on the size and needs of your business. For those with basic requirements, a free solution may be sufficient. However, if your business is growing or requires more sophisticated features, a paid service could offer long-term benefits that justify the investment.

Common Mistakes to Avoid in Invoices

When preparing business documents for billing, accuracy and clarity are essential. Small errors can lead to confusion, delayed payments, or even disputes with clients. By avoiding common mistakes, businesses can ensure a smooth and professional process that maintains good client relationships. Below are some of the most frequent mistakes and how to prevent them.

Missing Essential Information

One of the most frequent errors when preparing business documents is failing to include all the necessary details. Without the correct information, the client may not be able to process the payment, leading to unnecessary delays. The following elements should always be included:

- Client and business information: Ensure that both your business and client details are correct, including names, addresses, and contact information.

- Invoice number: Every document should have a unique identifier to avoid confusion, especially when tracking payments.

- Payment terms: Clearly state the payment due date and any late fees that may apply.

Incorrect Calculations

Another common mistake is making errors in the financial figures, such as incorrect totals, tax calculations, or discounts. These mistakes can lead to client dissatisfaction and potential financial discrepancies. Here’s how to avoid calculation issues:

- Double-check totals: Always verify that all line items, taxes, and discounts are calculated correctly before finalizing the document.

- Automate calculations: Many solutions offer automatic calculations for tax and discounts, reducing the likelihood of human error.

- Use clear formatting: Ensure that your document clearly separates individual items, taxes, and total amounts to make it easier for clients to understand.

By paying attention to these details, businesses can create clear, professional, and accurate documents that foster trust and streamline the billing process. Avoiding these common mistakes ensures smoother transactions and stronger business relationships.

Using Templates for Different Industries

In business, the need for clear and structured documents is universal, but each industry may require slightly different formats or specific information. Utilizing pre-designed forms can streamline the process, ensuring consistency and accuracy across various fields. Understanding the unique requirements of your industry is crucial to customizing these documents effectively, ensuring they meet all necessary standards and expectations.

Common Industries and Their Unique Needs

Different industries have distinct needs when it comes to documentation. Below are a few examples of how these forms can be adapted to suit various fields:

- Construction: These documents often include project details, labor rates, materials used, and timelines. It’s essential to have a breakdown of charges for transparency.

- Consulting: Consulting businesses may need to include detailed hourly rates or project phases, making it easy for clients to understand billable hours or milestones.

- Retail: For retail businesses, these forms might include product codes, quantities, and pricing tiers. A clear itemized list is necessary to avoid confusion.

- Freelancing: Freelancers often require more flexibility, allowing them to include service descriptions, hourly rates, and project-based payments.

- Legal Services: Legal documents may require extra space for retainer fees, hourly rates, and specific legal service charges that vary by case.

Customization for Industry-Specific Needs

When adapting pre-made forms for your industry, it’s essential to focus on the following:

- Detailed Descriptions: Ensure that each item or service is clearly described, so there are no ambiguities about the charges.

- Tax and Regulatory Compliance: Different industries may be subject to various tax rules or regulations. Ensure your document includes any applicable tax rates, legal disclaimers, or regulatory requirements.

- Professional Formatting: A clean and well-organized layout is key to ensuring that your clients understand the document quickly and without confusion.

By customizing these forms for your specific industry, you not only save time but also create a professional experience for your clients. Industry-specific documents can enhance credibility and ensure that all necessary information is communicated clearly and accurately.

Ensuring Compliance with Canadian Tax Rules

When conducting business in Canada, adhering to the country’s tax laws is essential to avoid legal complications. Properly documenting transactions and including necessary tax information ensures that your business remains compliant. This includes understanding how to apply the correct tax rates, report earnings, and provide clear details for both clients and tax authorities. Accuracy in financial documents is vital, as incorrect information could lead to penalties or disputes.

Key Tax Considerations for Canadian Businesses

There are several important tax rules that businesses need to be aware of when creating official documents. These include:

- Goods and Services Tax (GST) and Harmonized Sales Tax (HST): Depending on the province or territory, businesses may be required to charge GST or HST on their goods and services. It’s crucial to know whether your business is required to register for these taxes and which rate applies to your transactions.

- Provincial Sales Tax (PST): Some provinces have their own sales tax in addition to GST/HST. It is important to know the tax rules in the province where your business operates.

- Tax Exemptions: Certain goods and services are exempt from taxation in Canada. Knowing which items are tax-exempt will help avoid charging taxes unnecessarily.

- Income Reporting: Businesses must report their income accurately and submit it in accordance with Canada Revenue Agency (CRA) guidelines. Keeping detailed records of all financial transactions is essential for compliance.

Steps to Ensure Accurate Tax Documentation

To ensure your business complies with Canadian tax regulations, follow these steps:

- Understand Your Tax Obligations: Familiarize yourself with the tax rates that apply to your business and location.

- Use Clear Tax Breakdown: Include clear tax calculations and the applicable rates on any documents, making sure they reflect the correct amounts for each transaction.

- Regularly Update Records: Maintain up-to-date records of all transactions, payments, and tax charges to ensure smooth reporting at tax time.

- Seek Professional Advice: If unsure about any tax rules or calculations, consult with an accountant or tax professional familiar with Canadian tax laws.

By following these guidelines, you can minimize the risk of errors and ensure your business remains compliant with Canadian tax laws. Consistency and accuracy are key to managing your tax responsibilities effectively and avoiding any issues with regulatory authorities.