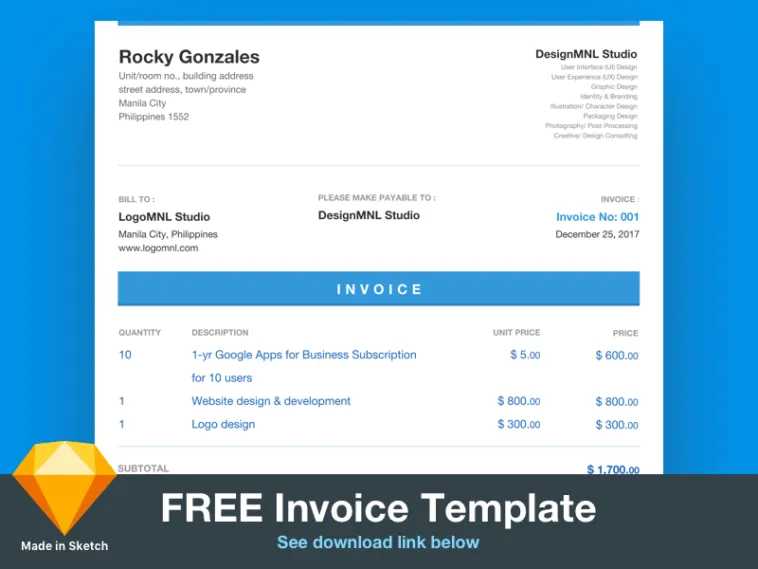

Free Invoice Template Aynax for Effortless Billing

Managing payments and creating professional documents for clients doesn’t have to be complicated. With the right tools, businesses can save time and effort while ensuring accuracy and clarity. By choosing efficient solutions, you can simplify financial transactions and enhance your company’s image. Whether you’re a freelancer or a small business owner, having access to customizable forms can make your day-to-day operations much smoother.

There are various resources available that help generate clear, organized documents for billing purposes. These tools allow you to personalize your forms with essential details such as payment terms, company information, and pricing. By using a ready-made solution, you eliminate the hassle of starting from scratch, ensuring that you’re always prepared to send professional documents with ease.

In this article, we’ll explore a popular and accessible option that offers a straightforward approach to creating essential business paperwork. With just a few clicks, you can begin issuing documents that reflect your professionalism while streamlining your payment process.

Free Invoice Template Aynax for Small Businesses

For small businesses, managing financial transactions efficiently is crucial to maintaining smooth operations. By using a well-organized solution for creating payment requests, you can save valuable time and ensure that your communications with clients are both professional and clear. These tools allow entrepreneurs to easily generate documents that reflect their brand’s identity, improve cash flow, and stay organized with minimal effort.

With a simple and accessible system, small business owners can quickly create customized forms tailored to their needs. From adding logos to adjusting payment terms, these resources provide the flexibility to ensure every detail is correct, making the billing process seamless and efficient. In this section, we’ll dive into the features that make this solution ideal for entrepreneurs looking to streamline their financial operations.

Key Features for Small Business Owners

The tool offers several key benefits to entrepreneurs looking to simplify their financial workflows:

| Feature | Description |

|---|---|

| Customizable Layout | Adjust the document to reflect your company’s branding and unique business style. |

| Time-Saving | Automated fields for essential details like payment amounts and client information help you save time. |

| Easy Payment Tracking | Track payments efficiently and follow up with clients directly through the document. |

| Professional Appearance | Ensure your documents maintain a polished and trustworthy look that impresses clients. |

Why It’s Ideal for Small Businesses

For small businesses, managing financial documentation can be a daunting task. However, using a reliable solution ensures that you can maintain a professional appearance and focus on growing your business rather than getting bogged down by administrative tasks. By choosing a user-friendly option, small business owners can create payment requests quickly and without confusion, all while maintaining accuracy and consistency in their financial communications.

How to Use Aynax Invoice Template

Creating professional documents for billing and payment requests doesn’t need to be a complicated task. With the right tool, you can quickly generate clear, accurate forms that are ready to be sent to clients. The process is simple and intuitive, offering flexibility for customization without overwhelming you with unnecessary steps. Whether you’re a freelancer or a small business owner, this system can make the task of creating financial documents faster and more efficient.

In this section, we’ll walk through how to use this tool to produce high-quality documents that meet your business needs. From entering client information to adjusting payment terms, you can tailor each form to suit your requirements.

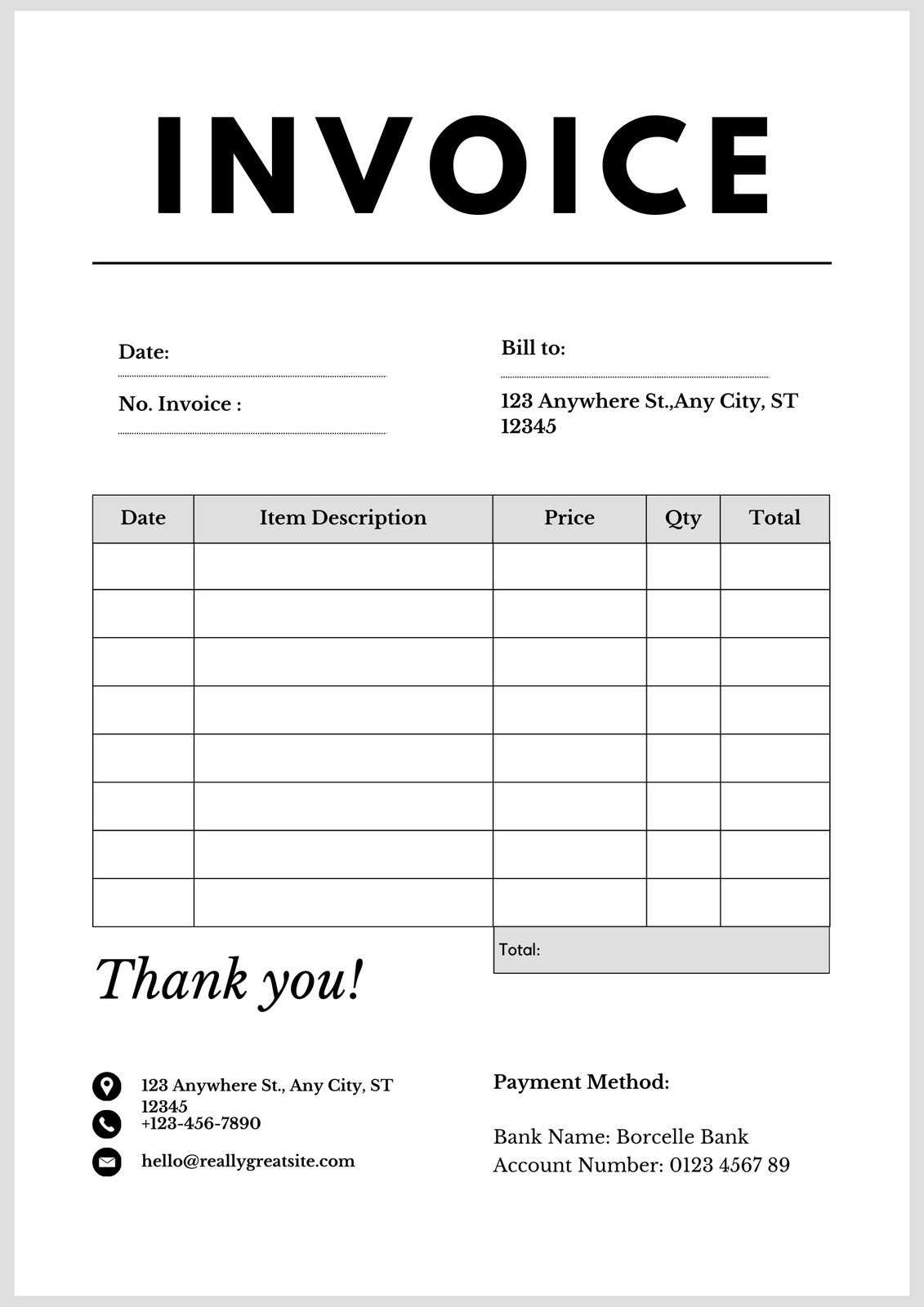

Step-by-Step Guide to Creating Professional Forms

Follow these easy steps to create a customized document:

- Choose a Layout: Select a layout that best fits your business type. Choose from several pre-designed options or start from scratch to match your branding.

- Enter Client Information: Input your client’s name, address, and contact details into the designated fields. Make sure to double-check the spelling for accuracy.

- Add Payment Details: Include the amounts owed, payment terms, and any other specifics related to the transaction, such as discounts or taxes.

- Customize Your Look: Add your company logo, change the font style, or adjust the color scheme to match your brand identity.

- Review & Send: Once everything is entered correctly, review the document for errors. When satisfied, save it in the desired format (PDF, Word) and send it to your client.

Additional Tips for Success

Consistency is key when creating financial documents. Maintaining a standardized look across all your forms can help build trust with your clients and give your business a professional appearance. Furthermore, make sure to keep track of each transaction by saving and organizing completed documents. This will help you stay on top of payments and manage your financial records with ease.

Benefits of a Free Invoice Template

Using a well-designed document generation tool offers numerous advantages for businesses, especially when it comes to simplifying financial tasks. With the right resource, you can quickly produce professional documents without having to manually format each one from scratch. This saves time, ensures consistency, and helps maintain a high level of professionalism in all client interactions.

For entrepreneurs and freelancers, having access to a ready-made solution that handles essential billing details can drastically reduce administrative workload. It allows you to focus on growing your business while staying organized and on top of your financial commitments.

Time Efficiency

One of the most significant benefits of using an automated solution is the time saved in document creation. Rather than manually formatting each document or tracking down important fields, a customizable tool helps you fill in the necessary details with ease. Pre-designed fields for payment terms, amounts, and client information make it easy to generate the paperwork quickly and accurately.

Cost-Effective Solution

For small businesses or solo entrepreneurs, cutting costs without compromising quality is always a priority. Using a no-cost option to generate billing paperwork eliminates the need for expensive software or hiring external help. With an easy-to-use interface, you can create professional-grade documents at no additional expense, keeping your overhead costs low while maintaining a polished business image.

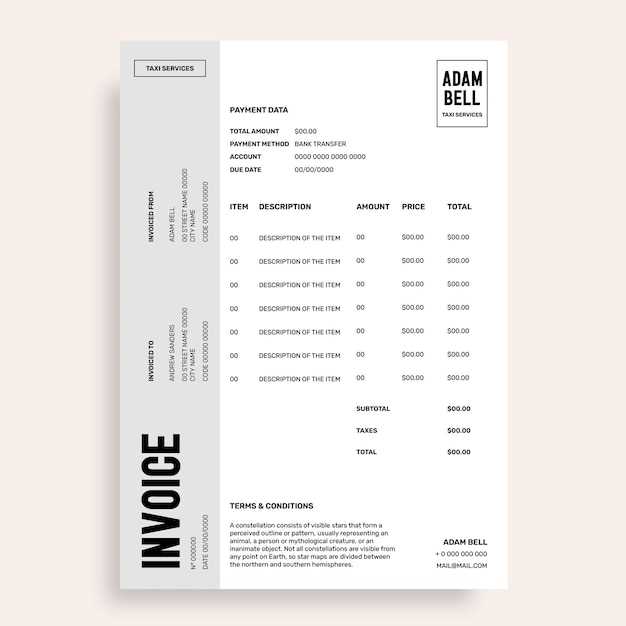

Customizing Your Aynax Invoice Template

Personalizing your financial documents is essential for reflecting your brand and ensuring your business stands out. With the right tool, you can easily adjust various aspects of the design and content to meet your specific needs. Whether it’s adding your company logo or modifying payment terms, customizing the look and feel of your paperwork helps maintain a professional image while aligning with your business style.

In this section, we’ll guide you through the simple steps to make the most of this customizable tool, allowing you to tailor each document to fit your brand’s identity and your clients’ needs.

Adjusting Design Elements

Customizing the design of your document is an important step in ensuring it reflects your business’s professional appearance. Here are some of the design elements you can personalize:

| Design Element | Customization Options |

|---|---|

| Logo | Add your business logo to the top of the document for brand recognition. |

| Colors | Choose colors that match your brand’s palette for headings and borders. |

| Font Style | Select a font style that suits your brand’s personality, whether formal or casual. |

| Layout | Adjust the layout to fit your needs, such as rearranging sections or resizing text boxes. |

Modifying Content Fields

It’s equally important to ensure that all the content in your document is tailored to your specific business needs. Here are the key fields you can modify:

- Business Information: Enter your company name, address, and contact details in the header section.

- Client Details: Include the client’s name, contact information, and payment address.

- Payment Terms: Customize payment due dates, late fees, and any other terms specific to the transaction.

- Service Description: Adjust the description of the services or products provided, including quantities and prices.

By customizing both the design and content, you can create documents that are not only professional but also aligned with your branding and business needs.

Why Choose Aynax for Invoices

When it comes to creating professional and accurate business documents, choosing the right tool can make a significant difference. Opting for a solution that is simple to use, customizable, and time-efficient ensures that you can focus on your business operations without worrying about the complexities of paperwork. This platform provides everything you need to streamline your billing process while maintaining a polished and professional appearance.

With its user-friendly interface and customizable features, this system allows you to generate essential financial documents quickly and easily. Whether you’re a freelancer or a small business owner, it provides all the tools you need to keep your transactions smooth and organized. In this section, we’ll discuss why this platform is a trusted choice for many businesses.

Ease of Use

One of the standout features of this solution is its simplicity. The platform is designed with user experience in mind, allowing users to generate documents without any technical expertise. You don’t need to spend hours learning complex software or creating forms from scratch. The process is straightforward, making it ideal for busy entrepreneurs who need to focus on their business rather than administrative tasks.

Customization and Flexibility

Another reason to choose this tool is the level of customization it offers. You can easily adjust the layout, colors, fonts, and content to align with your branding and specific business needs. This flexibility ensures that your documents are not only professional but also tailored to fit your business identity. The ability to personalize every aspect of the document helps you maintain consistency and professionalism in all client communications.

How Aynax Simplifies Billing Process

The process of creating and sending financial documents can often be time-consuming and prone to errors, especially when it comes to handling multiple clients and transactions. Simplifying this task helps businesses save valuable time and ensures that all necessary details are accurately captured. With an efficient solution, you can automate many aspects of the billing process, making it easier to generate documents and track payments.

This platform is designed to streamline the billing process, offering tools that simplify creating, managing, and sending payment requests. By automating key steps and allowing for customization, it reduces the likelihood of mistakes and ensures a professional presentation for every transaction.

Automating Repetitive Tasks

One of the key ways this solution simplifies billing is by automating the most repetitive tasks. Instead of manually entering the same client details or payment terms each time, you can save frequently used information and apply it with just a few clicks. This reduces errors and ensures consistency across all documents.

| Automated Task | Benefit |

|---|---|

| Client Information | Quickly insert saved details for recurring clients, saving time on each new document. |

| Payment Terms | Automatically apply standard payment terms such as due dates and late fees. |

| Service Descriptions | Reuse common service descriptions to avoid manual entry and ensure consistency. |

Tracking and Managing Payments

Another feature that simplifies the process is the ability to track payments directly from the document. You can easily mark invoices as paid, partially paid, or unpaid, and set up reminders for overdue payments. This helps you stay on top of outstanding amounts and reduces the effort needed to manually track every transaction.

Features of the Aynax Invoice Template

When it comes to creating professional documents for billing, having access to a solution that offers a variety of useful features is essential. These features not only make the process faster but also ensure that your paperwork is accurate, consistent, and tailored to your specific business needs. From customization options to time-saving functionalities, this tool is equipped with everything needed to create high-quality payment requests efficiently.

In this section, we’ll explore the key features that set this platform apart and help businesses streamline their financial documentation process.

Customizable Design Elements

One of the standout features is the ability to fully customize the design of your business documents. You can personalize the layout and appearance to reflect your brand identity. Some of the customizable elements include:

- Logo Placement: Add your business logo to the header for easy brand recognition.

- Color Scheme: Adjust colors to match your business’s visual style, whether it’s for a formal or casual tone.

- Font Styles: Choose from a variety of fonts to give your documents the right professional touch.

- Layout Adjustments: Rearrange sections and fields as needed to fit the type of service you provide.

Ease of Use and Time Efficiency

This tool is designed with simplicity in mind, making it easy for anyone to use, even without technical expertise. The streamlined process saves you time by automating key aspects of document creation:

- Pre-filled Fields: Save commonly used client and business information for quick entry.

- Auto Calculations: Automatically calculate totals, taxes, and discounts to reduce the risk of errors.

- Quick Export Options: Save completed documents in various formats like PDF or Word with a single click.

Payment Tracking and Notifications

Another feature that makes this platform stand out is the ability to track payments and send reminders for overdue balances. This functionality helps you stay organized and on top of your financial transactions:

- Payment Status: Mark documents as paid, partially paid, or unpaid, and track the history of each payment.

- Automatic Reminders: Set up reminders to notify clients when payment is overdue, making follow-ups easier.

- Multiple Payment Methods: Include different payment options to give clients flexibility and increase the likelihood of timely payments.

These features make the process of managing billing much more efficient, helping businesses maintain professionalism while sav

Creating Professional Invoices in Minutes

For businesses, time is valuable, and efficiency is key when it comes to managing financial tasks. With the right tool, creating high-quality, polished documents for payment requests can be done in just a few minutes. By simplifying the process, businesses can quickly generate professional forms that meet both legal and client expectations, ensuring smooth transactions and improved cash flow.

This section will walk you through how you can use an easy-to-use system to create precise, well-structured documents in no time. From entering essential details to customizing the layout, the process is designed to be quick and efficient, allowing you to focus on your business instead of spending time on paperwork.

Steps to Quickly Create Professional Documents

Creating a well-organized payment document is a straightforward task with this tool. Just follow these simple steps to generate your documents:

- Enter Client Details: Fill in your client’s name, address, and contact information. If you have frequent clients, save this data for future use.

- Add Service or Product Information: Input the description of the services or goods provided, along with their costs and quantities.

- Include Payment Terms: Specify the due date, payment methods, and any applicable discounts or taxes.

- Customize the Layout: Select from pre-designed layouts or adjust elements like colors, fonts, and positioning to match your brand.

- Review and Finalize: Double-check the information for accuracy. Once satisfied, save the document in your preferred format (PDF, Word, etc.) and send it to your client.

Features That Speed Up the Process

This tool is designed to help you create professional documents quickly, with features that streamline the entire process:

- Pre-saved Information: Save frequently used client and business details for easy access on future documents.

- Auto Calculations: The tool automatically calculates totals, taxes, and discounts to eliminate errors and save time.

- Quick Export Options: After completing the document, export it instantly in your desired format, ready for sharing.

- Ready-Made Layouts: Use pre-designed, customizable layouts that require no graphic design skills, helping you create a polished look in minutes.

With these simple steps and helpful features, you can create professional-grade documents in no time, improving efficiency and making your business operations run more smoothly.

How to Download the Aynax Template

Getting started with creating professional billing documents is quick and easy. With the right system in place, you can download and begin using customizable forms within minutes, making your administrative tasks more efficient. This section will guide you through the simple steps to download and set up your business document solution, allowing you to start generating essential paperwork immediately.

By following these easy instructions, you can download the necessary file and begin personalizing it for your specific needs. Whether you’re a freelancer or a small business owner, the process is designed to be hassle-free, so you can focus more on your business and less on paperwork.

Step-by-Step Guide to Download

To download your chosen business document form, follow these straightforward steps:

- Visit the Website: Go to the platform’s website where the document tools are offered.

- Select Your Desired Document: Choose the form that best fits your business needs from the available options.

- Customize Settings: If available, select any customization options such as layout, design, and other preferences before downloading.

- Download the File: Click on the download button to receive the document file in your preferred format (PDF, Word, etc.).

- Save and Store: Save the document file to your device and begin using it for your next business transaction.

Important Tips

- Double-check your internet connection: A stable connection will ensure that the download process goes smoothly.

- Save in an easily accessible folder: Store the downloaded document in a folder where you can quickly find it when needed.

- Keep the file backed up: Always back up important documents to avoid data loss and ensure easy retrieval when required.

Once you’ve downloaded the document, you’re ready to begin creating and customizing your own payment requests with ease. The quick and simple download process ensures you can get to work without unnecessary delays.

How to Add Your Business Details

Including your business information on documents is a crucial step to ensure clear communication and a professional appearance. By adding the correct contact details and company specifics, you ensure that clients know who they are dealing with and how to reach you if needed. This section will guide you through the process of entering your business details, making your documents personalized and complete.

Once you’ve chosen the format for your payment requests, it’s time to add the necessary business information that will appear on every document. This ensures consistency and saves time when you need to create additional forms.

Steps to Add Your Business Information

Follow these simple steps to input your business details into the document:

- Locate the Header Section: Most documents will have a section at the top where you can enter your company name and contact details.

- Enter Business Name: Type your company’s official name as it should appear on the document, ensuring it’s spelled correctly.

- Input Address: Include your business’s physical address. This could include street address, city, state, and ZIP code.

- Add Phone Number: Include a direct phone number where clients can reach you for inquiries or payment-related questions.

- Provide Email Address: Add an email address where clients can contact you regarding payments or any other issues.

- Include Website (optional): If your business has a website, add it for clients who may want more information about your services.

Tips for Accuracy and Consistency

- Verify Details: Double-check all business information for accuracy to avoid any mistakes that could confuse clients or delay payments.

- Consistency Across Documents: Ensure that the same details are used consistently across all your documents for a professional look.

- Update Regularly: If any business information changes (e.g., phone number or address), make sure to update it in your saved document templates as well.

By entering your business details, you make your payment documents complete, accurate, and professional. This step helps build trust with your clients and ensures that they can easily contact you for any follow-up or clarifications.

Incorporating Tax Information into Invoices

For businesses that operate in regions with sales tax requirements, including tax details in payment requests is essential for compliance and transparency. Accurately calculating and displaying tax information ensures that both the business and the client are clear on the total amount owed. It also helps avoid any misunderstandings or disputes related to taxes.

In this section, we’ll explain how to properly incorporate tax information into your documents, including how to calculate and display taxes in a way that is both clear and professional. Whether you are adding sales tax, VAT, or other applicable fees, it’s crucial to make this information easily accessible to your clients.

Steps to Add Tax Information

Here’s how you can incorporate tax details into your payment documents:

- Identify the Tax Rate: Research the applicable tax rate in your region or industry. This will vary based on the location and type of service or product sold.

- Calculate the Tax: Multiply the taxable amount (total cost of goods or services) by the tax rate to determine the total tax owed.

- Include the Tax Amount: Clearly list the tax amount as a separate line item in your document, indicating it is for taxes and showing the rate applied.

- Display the Total Amount: After calculating the tax, ensure the total amount due reflects both the cost of services or goods and the applicable tax. This will give your client a clear understanding of the total they need to pay.

- Provide Tax Identification Number (optional): If required by your country or region, include your business’s tax ID or VAT number on the document.

Example of Tax Information in a Document

Here is an example of how tax information should appear in your document:

| Description | Amount |

|---|---|

| Services Rendered | $500.00 |

| Sales Tax (10%) | $50.00 |

| Total Amount Due | $550.00 |

Including tax information not only ensures legal compliance but also helps maintain a transparent relationship with your clients. By clearly outlining tax charges, you reduce the chance of confusion and

Managing Payments with Aynax Templates

Efficiently managing payments is critical for maintaining cash flow and ensuring the smooth operation of a business. With the right tools, businesses can keep track of amounts due, received, and outstanding, all while reducing the time spent on administrative tasks. The platform’s system simplifies this process by providing a structured and organized way to manage financial transactions, helping businesses stay on top of their billing cycle.

This section will walk you through how to leverage the system to track and manage your payments effectively, ensuring that your records are accurate, up to date, and easy to access when needed.

Tracking Payment Status

One of the most important aspects of managing payments is keeping an accurate record of payment status for each transaction. This system makes it easy to monitor whether payments have been made, are pending, or are overdue. Here’s how you can track payments:

- Mark Payments as Received: Once a payment has been made, mark it as “paid” in your system. This updates your records and shows clients that their balance is cleared.

- Partial Payments: If your client pays only part of the amount, you can mark it as “partially paid” and indicate the remaining balance.

- Track Overdue Payments: Set up alerts to notify you of overdue payments, ensuring you follow up with clients on time.

Organizing Payment History

Keeping a well-organized payment history is essential for tracking financial health. The system allows you to access the history of all transactions, making it easy to review past payments and detect any discrepancies. Here’s how you can manage your payment history:

- Filter by Date: Search and filter your records by specific time periods to get a snapshot of payments made over weeks, months, or even years.

- Download Payment Reports: Generate and export reports of all transactions, which can be used for accounting purposes or shared with stakeholders.

- Search by Client: Quickly find all payment records related to a particular client, which helps when preparing for client meetings or audits.

By efficiently managing payment records, you can reduce confusion, improve cash flow, and ensure that your business stays financially organized. This system simplifies the payment management process, allowing you to focus on growing your business while keeping your financial transactions accurate and up to date.

Free vs Paid Invoice Templates Comparison

When it comes to generating business documents, you often have to decide between using no-cost options and investing in premium solutions. Both types come with their own sets of benefits and limitations. Understanding the differences between the two can help you make the right choice for your business needs, ensuring you get the functionality, customization, and professional appearance that you require without overspending.

This section compares the key features of both free and paid document generation tools, highlighting what you can expect from each and helping you determine which is best suited for your business.

Features of Free Solutions

Free solutions can be a great starting point, especially for small businesses or those just beginning to establish their financial processes. However, these options often come with some limitations that may impact your long-term needs:

- Basic Design Options: Free options usually offer limited design features, with few customization options for layout, branding, or color schemes.

- Limited Functionality: These tools may not support advanced features like automatic calculations, recurring billing, or integration with other accounting software.

- No Customer Support: Free services generally offer minimal customer support, which could be an issue if you encounter technical problems or need assistance.

- Generic Templates: While functional, the documents generated are often very basic and lack the professional touch that paid options may offer.

Benefits of Paid Solutions

Paid solutions typically provide a higher level of service, making them ideal for businesses that need more robust and professional tools. Here are some of the advantages:

- Customizable Features: Paid tools often allow for extensive customization, including adding logos, adjusting colors, and selecting from a variety of design layouts.

- Advanced Functionality: Paid platforms may include features like automated calculations, tax support, recurring billing options, and integration with accounting software, making business processes more efficient.

- Priority Customer Support: Premium services typically offer quicker, more personalized customer support, which can be crucial if your business relies on timely document generation.

- Professional Appearance: Paid options tend to produce higher-quality, more polished documents that enhance your company’s brand and professionalism.

While free options are suitable for businesses with limited budgets or simple needs, paid solutions offer greater flexibility, advanced tools, and professional-grade results. Deciding which is right for your business will depend on your specific requirements and the resources you’re willing to invest.

How to Print and Send Your Invoice

Once your payment request is ready, the next step is to distribute it to your client. Whether you choose to send it electronically or via traditional mail, knowing how to properly print and deliver your documents ensures a smooth transaction and maintains professionalism. This section will guide you through the process of preparing, printing, and sending your document in the most efficient way possible.

Depending on your business model and client preferences, you may opt for digital or physical delivery. Both methods have their own advantages, and selecting the right one will help streamline your workflow and improve communication with your clients.

How to Print Your Document

Printing your document is a simple process. Follow these steps to ensure your document looks polished and professional:

- Review the Document: Before printing, double-check all the details such as the amounts, client information, and payment terms to ensure everything is accurate.

- Select Printer Settings: Choose the appropriate paper size (usually A4 or letter size) and make sure your printer settings match the layout of the document.

- Print a Test Copy: It’s always a good idea to print a test copy to check if the document aligns correctly and appears as expected before printing the final version.

- Print Multiple Copies (if necessary): If you need to send a physical copy to multiple clients or keep extra copies for your records, ensure you print enough.

How to Send Your Document

Once your document is ready, it’s time to send it to your client. Below are a few methods for delivering your documents:

- Email: This is the fastest and most convenient way to send documents. Simply attach the document file to an email, add a brief message, and send it to the client. Make sure the file is in a universally accessible format, such as PDF.

- Postal Mail: If your client prefers a physical copy, print the document and mail it to their address. Make sure to use the appropriate envelope and include any other required paperwork.

- Online Platforms: Some businesses may use secure online platforms or accounting software to send payment requests directly to clients. These platforms often provide tracking features and automatic payment reminders.

By following these steps, you ensure that your payment request reaches the client efficiently and in a professional manner, helping maintain a smooth and positive business relationship.

Integrating Aynax with Accounting Software

Integrating document management systems with accounting software is a crucial step toward streamlining business operations. This integration enables automatic data synchronization, reducing the risk of manual errors and ensuring that financial records are always up to date. By linking your payment request creation platform with accounting tools, you can manage transactions, monitor payments, and generate reports seamlessly.

This section will explain how integrating these tools can save time, improve accuracy, and simplify your financial processes, making it easier to focus on growing your business.

Steps for Integration

Connecting your document creation system with your accounting software is relatively straightforward. Here’s a general overview of the steps involved:

- Choose Compatible Software: Ensure that your document generation tool and accounting software are compatible. Many platforms offer integration options with popular accounting systems like QuickBooks, Xero, or FreshBooks.

- Set Up API Connections: If available, use the API (Application Programming Interface) features to link both platforms. This allows data to flow seamlessly between the two, ensuring that all transaction details are synchronized.

- Import Client Data: Once integrated, import your client and transaction data from your accounting software to automatically populate client details in your payment requests.

- Sync Payment Status: As payments are processed, the information will update automatically in both systems, keeping your records up to date in real-time.

- Generate Reports: The integration allows you to easily generate financial reports, showing a complete overview of your transactions, pending payments, and completed sales.

Benefits of Integration

Integrating your document management system with accounting software offers several benefits:

- Time Savings: Automating data entry and syncing payment statuses between systems reduces the time spent on manual updates.

- Increased Accuracy: Integration minimizes human error by automatically transferring data between systems, ensuring your financial records are always correct.

- Improved Financial Tracking: By syncing your financial records with your documents, you can track income, expenses, and outstanding balances without needing to cross-check multiple platforms.

- Easy Tax Reporting: Integrated systems make it easier to generate accurate tax reports by pulling the necessary data from both your financial and transaction records.

By linking your document management and accounting platforms, you ensure smoother operations, better control over your finances, and more time to focus on what matters most: growing your business.

Common Mistakes to Avoid with Invoices

When managing payment requests, even small mistakes can have a significant impact on your cash flow and client relationships. Common errors, such as incorrect amounts, missing details, or poor formatting, can lead to delays in payment, confusion, or even disputes. To ensure smooth transactions and maintain a professional image, it’s essential to avoid these common pitfalls when creating and sending documents.

This section highlights the most frequent mistakes businesses make when preparing financial requests and provides tips on how to avoid them, helping you maintain accuracy and professionalism in your dealings.

Common Mistakes and How to Avoid Them

- Incorrect Payment Amounts: One of the most common mistakes is listing the wrong payment amount. Double-check all figures, especially when dealing with multiple items or complex pricing. Ensure that all calculations are correct before sending the request.

- Missing Client Information: Omitting important details like your client’s name, address, or contact information can cause confusion and delays. Always verify that all required fields are filled out completely and accurately.

- Failure to Include Payment Terms: Clearly specify the payment terms, such as the due date, late fees, and available payment methods. This helps avoid misunderstandings and encourages prompt payment.

- Not Including a Unique Identifier: Each document should have a unique number for reference. Without this, tracking payments and resolving any potential issues can become complicated.

- Unclear Descriptions of Products or Services: Be sure to provide a detailed description of what the payment covers. Ambiguous descriptions can lead to confusion, especially if clients dispute the charges later on.

- Not Following a Consistent Format: A disorganized or inconsistent format can make your documents difficult to read and less professional. Stick to a clean, easy-to-read layout with consistent fonts and sections.

- Ignoring Tax Information: Always ensure that tax rates are clearly indicated if applicable. Missing or incorrect tax details can lead to problems with both clients and tax authorities.

- Neglecting to Send Reminders: If a payment is overdue, failing to send a reminder can prolong the collection process. Set up reminders or follow-up notices for overdue payments to stay on top of outstanding balances.

How to Avoid These Mistakes

- Double-Check Everything: Review the details thoroughly before sending the document. Look for errors in client information, payment amounts, and terms.

- Use Professional Tools: Using structured systems or tools designed for creating documents helps avoid many of these mistakes by automatically checking for common issues.

- Follow a Checklist: Create a checklist of essential elements that must be in