Free Invoice Receipt Template for Word

Managing business transactions efficiently requires clear and concise records. One of the most essential documents in financial interactions is a well-structured form that acknowledges payment. This document serves as a proof of transaction, detailing important information such as amounts, dates, and payer details.

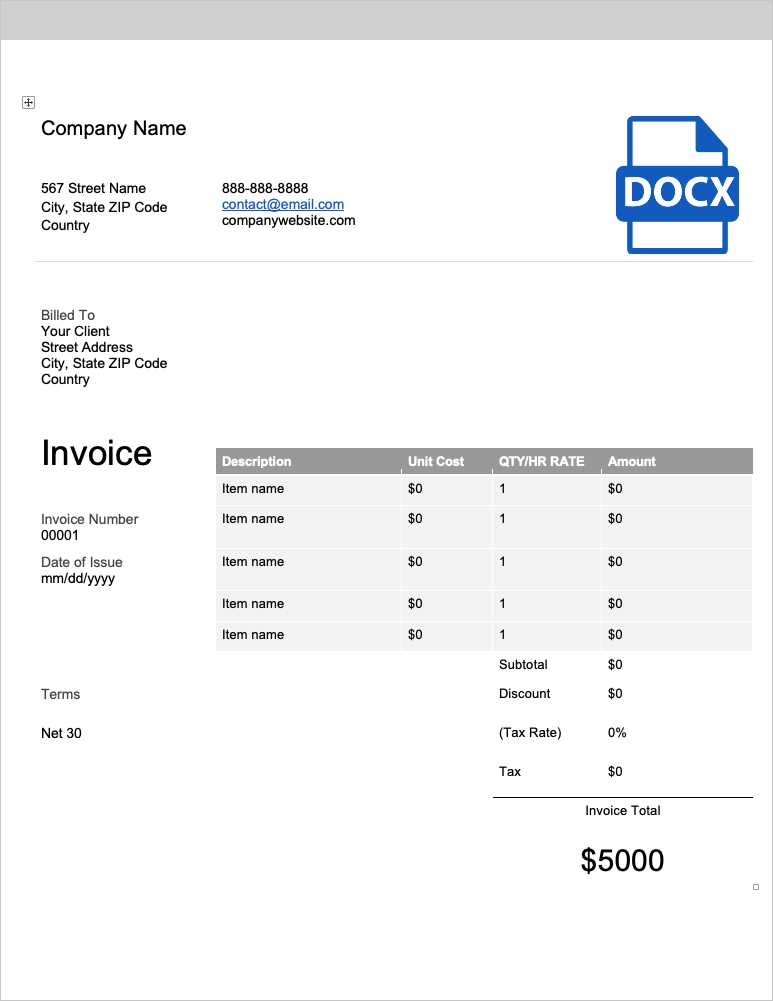

Instead of starting from scratch, many businesses opt for ready-made solutions that allow quick customization. By utilizing editable formats, entrepreneurs can easily adapt them to fit their specific needs, ensuring all necessary information is captured professionally. These adaptable options are an excellent resource for both small businesses and large organizations.

With a few adjustments, you can create a polished and functional document that represents your business accurately. Whether you’re sending it to a client or retaining it for internal records, such a document helps maintain organization and clarity in your financial dealings.

Free Invoice Receipt Template for Word

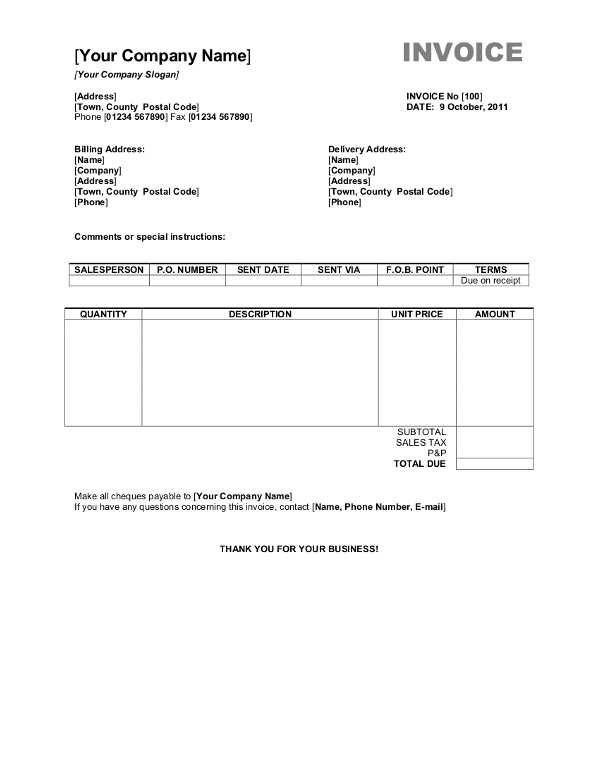

When managing payments, having a standardized document is essential for keeping track of transactions. Such documents ensure all necessary details are included, making it easy for both the sender and recipient to confirm the exchange of funds. Using a pre-designed structure is a great way to streamline the process and reduce errors in documentation.

Many businesses choose ready-made formats, which can be customized to reflect their specific requirements. These documents allow quick adaptation, whether you’re handling a one-time transaction or maintaining a long-term client relationship. Here’s how you can use these practical options to create consistent and professional documents for your business:

| Element | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sender’s Information | Includes your business name, address, and contact details. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recipient’s Details | Lists the client or customer name, along with their contact information. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction Date | Specifies when the payment was made or received. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount Paid | Shows the total amount involved in the transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Method | Describes how the transaction was

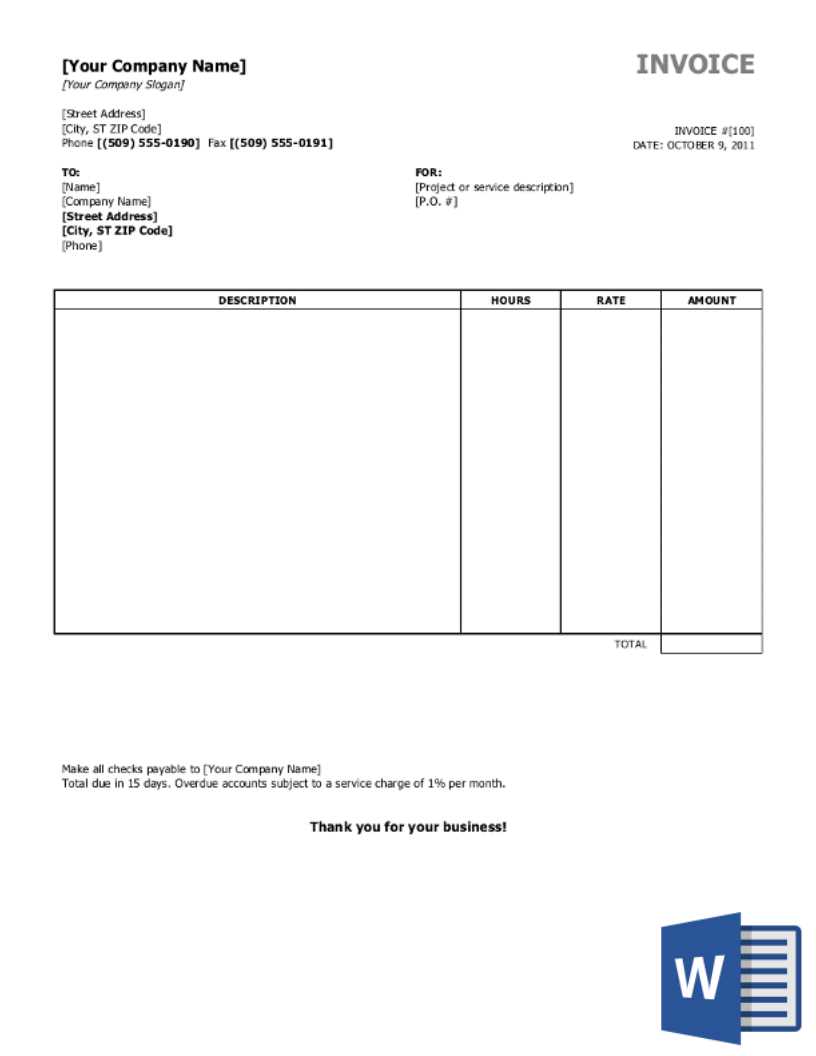

How to Create an Invoice ReceiptCreating a professional document to confirm the completion of a transaction is a key part of any business. This document serves as an official record, detailing all the important information regarding the exchange of goods or services. Crafting a clear and precise form ensures transparency and helps avoid any future disputes. To create an effective document, several key elements should be included. These components provide all the necessary details for both the payer and payee. Below is a simple guide on how to structure this document for maximum clarity:

Once you have these details, you can easily fill them into a document and ensure that it is organized, clear, and profes How to Create an Invoice ReceiptCreating a professional document to confirm the completion of a transaction is a key part of any business. This document serves as an official record, detailing all the important information regarding the exchange of goods or services. Crafting a clear and precise form ensures transparency and helps avoid any future disputes. To create an effective document, several key elements should be included. These components provide all the necessary details for both the payer and payee. Below is a simple guide on how to structure this document for maximum clarity:

Once you have these details, you can easily fill them into a document and ensure that it is organized, clear, and professional. Whether you choose a digital or printed format, maintaining consistency in structure is crucial to establishing credibility with clients. Key Features of an Invoice ReceiptWhen creating a document that confirms the exchange of goods or services, certain features are crucial for clarity and professionalism. These elements ensure that all necessary details are captured accurately, providing both the sender and recipient with a clear understanding of the transaction. Essential Information to IncludeA well-structured document should always contain the following details:

Formatting for ClarityBesides the essential data, how this information is presented is equally important. Ensure the document is easy to read by using clean formatting. Key aspects to focus on include:

Benefits of Using Free TemplatesUsing pre-designed formats for business documentation offers a wide range of advantages, especially when time and efficiency are of the essence. These ready-to-use structures allow individuals and businesses to avoid the hassle of creating documents from scratch while ensuring consistency in presentation and content. Whether you are a small business owner or a large organization, these formats provide a practical solution to streamline your administrative tasks. Time and Cost Efficiency

One of the most significant benefits of utilizing pre-made structures is the time saved. Instead of starting from zero, you can quickly adapt an existing document to suit your needs. This means less effort spent on formatting and more focus on the core task at hand–whether that be finalizing details with clients or keeping accurate records. Moreover, since many of these structures are offered at no cost, businesses can also avoid the financial burden of purchasing specialized software or hiring a designer. Consistency and ProfessionalismAnother key advantage is the level of professionalism that comes with using a polished, consistent format. These ready-to-use designs ensure that your documents look professional every time. By following a standard structure, businesses can maintain a uniform approach across all their transactions, which builds credibility and helps clients feel confident in their dealings with you. Whether for internal records or external communication, consistency in your documentation reflects positively on your business. Incorporating pre-designed formats into your workflow enhances overall efficiency and professionalism, making it easier to manage and present business transactions with ease and clarity. Customizing Your Invoice ReceiptCustomizing your business documentation allows you to personalize each document according to your specific needs, ensuring it aligns with your brand identity and communication style. With a few simple adjustments, you can create a document that reflects the unique aspects of your business while still maintaining professionalism. Tailoring your document is a great way to ensure that all important details are clearly presented, making the transaction process seamless for both parties. Personalizing Your Business InformationOne of the first steps in customization is adding your business details. These include your company name, logo, address, and contact information. Personalizing this section ensures that your clients can easily reach you with any questions or concerns. Here’s how you can adjust this section:

Adjusting Transaction InformationIn addition to your business information, the transaction section needs to be tailored to include specific details related to each payment. This section should clearly display the total amount, the payment method, and any other terms or notes relevant to the transaction. Customizing these elements can make the document more informative and easier for both parties t How to Add Your Business Logo

Incorporating your business logo into your documents is an important step for establishing brand identity and maintaining a professional appearance. By adding your logo, you not only reinforce your company’s image but also make your documents easily recognizable to clients and partners. This simple yet effective customization enhances the overall presentation of your paperwork and adds a personal touch. To include your logo, you need to follow a few straightforward steps. Here’s how to effectively add your logo to your business documents: 1. Choose the Right File Format Before inserting your logo, make sure it’s in a suitable format. Commonly used formats include .PNG, .JPG, or .SVG. PNG is especially popular due to its support for transparent backgrounds, which allows your logo to blend seamlessly into the document. 2. Position Your Logo Properly It’s essential to place the logo in a location that draws attention without overwhelming the content. The upper-left corner or the top center of the page are ideal spots for your logo. This placement ensures visibility while keeping the layout clean and balanced. 3. Resize the Logo Ensure the logo is sized appropriately for your document. It should be large enough to be clear but not so large that it takes up too much space. Keep in mind the overall design of the document to maintain a professional and polished look. 4. Maintain Consistency Across Documents Once you’ve inserted your logo, ensure that it remains consistent across all documents. This consistency helps build brand recognition and professionalism. Whether you’re sending out payment confirmations or other business-related documents, always use the same logo placement and size. Adding your logo is a simple yet powerful way to personalize your bu Essential Elements in an Invoice ReceiptTo create a comprehensive document that records the exchange of goods or services, it’s important to include key elements that provide all necessary details for both parties. These elements help ensure clarity, accuracy, and professionalism in your paperwork, preventing misunderstandings or disputes later on. Key Information to IncludeThere are several crucial sections that should be present in your business document to guarantee that all relevant data is captured. These include: Transaction DetailsIn addition to basic contact information, the document should include the specifics of the transaction itself. Key points to consider include: By including these essential elements, you can ensure that the document is both complete and easy to understand, providing both parties with a clea Adjusting Invoice Date and NumberWhen preparing business documents, correctly specifying the date and assigning a unique reference number is essential for proper record-keeping and tracking. These elements help both parties to easily identify and manage the transaction, ensuring transparency and minimizing confusion. By accurately adjusting the date and number, you create a document that is both professional and efficient in maintaining your transaction history. Setting the Correct Date The date of the transaction is one of the most critical pieces of information. It marks when the exchange occurred and serves as a reference point for payment terms and deadlines. Ensure that the date reflects the actual day of the transaction, and make adjustments as necessary if the document is being generated after the exchange took place. This avoids confusion and ensures that the document accurately reflects the terms of the agreement. Assigning a Unique Reference Number Each document should have a unique reference number, which serves as an identifier for tracking and organizing records. This number helps avoid confusion when referencing past transactions and provides a clear way to locate specific paperwork. When adjusting or generating a number, ensure it follows a consistent and logical sequence to maintain order. It is also helpful to include details such as the client’s name or the product involved to further distinguish the document. By carefully adjusting these two elements, you can ensure that your documents are well-organized, easy to track, and professionally presented, enhancing both internal management and client relations. Formatting Tips for Better ReadabilityWhen creating professional documents, the layout and design play a crucial role in ensuring that the information is easily understood. Proper formatting makes it simpler for recipients to find key details quickly, improving the overall user experience. By applying thoughtful design choices, you can enhance the clarity and flow of the document, making it not only visually appealing but also highly functional. Use Clear and Consistent FontsChoosing the right font is essential for readability. Avoid using too many different font styles, as this can create confusion. Instead, opt for clean, simple fonts like Arial or Times New Roman. Use larger font sizes for headings and smaller sizes for body text to establish a clear hierarchy. Consistency in font choice and size across the document helps create a cohesive, professional look. Organize Information with Headings and ListsBreaking the content into well-defined sections is key to making the document easy to navigate. Use headings to separate different parts of the document, such as client details, transaction information, and terms. Lists, whether bulleted or numbered, are also effective for organizing items or steps. This approach enables the reader to quickly identify and digest the important information without feeling overwhelmed by dense paragraphs. Whitespace and Alignment Whitespace around sections and between elements makes the document more visually appealing and less crowded. Proper alignment of text and numbers further enhances clarity. Align important information like totals and dates to the right, and ensure consistent spacing throughout the document to maintain a balanced, professional layout. By applying these simple yet effective formatting techniques, you can create documents that are easy to read and visually organized, improving communication and ensuring a professional presentation every time. Including Tax and Payment Information

Accurate and transparent financial details are crucial when preparing documents that record a transaction. Including the correct tax rates and payment information ensures clarity for both parties, helping to avoid misunderstandings. These details not only establish trust but also comply with legal and accounting requirements. Clear documentation of tax and payment terms is essential for effective record-keeping and future reference. Here are the key elements to include for taxes and payment information:

|