Free Invoice Email Template for Professional Billing

Sending professional payment requests is an essential part of any business transaction. By utilizing structured formats, you can ensure clarity and maintain a high level of professionalism. Having a well-organized communication method not only helps to streamline the payment process but also fosters trust with your clients.

Crafting an effective message for financial matters is key to conveying the necessary details without confusion. With the right approach, you can simplify your workflow while maintaining clear expectations. A carefully designed message allows you to highlight crucial information, such as due dates and amounts, in a concise and easily understood format.

Leveraging simple yet effective solutions enables businesses to save valuable time and focus on growth. Whether you’re running a small startup or managing a large corporation, this approach can be adapted to fit your specific needs. Maximize efficiency by ensuring each transaction is handled with precision and professionalism.

Free Invoice Email Template Guide

In business, clear and professional communication regarding payments is essential for maintaining smooth operations. A structured document to request payment can make a significant difference in how clients perceive your professionalism. By using well-organized formats, you can ensure that all necessary information is presented in a concise and understandable way.

Creating an effective payment request involves more than just listing numbers and dates. It’s about presenting the details in a way that is both efficient and easy to follow. A thoughtful layout ensures that the recipient can quickly identify the key points–such as the amount due, due date, and payment methods–without feeling overwhelmed.

Consistency in presentation also plays a key role. Whether you’re handling a one-time transaction or setting up regular billing, maintaining a professional tone across all communications will help build trust with your clients. With the right approach, you can create a seamless process for both you and your customers.

Why You Need an Invoice Email Template

Having a predefined structure for payment requests can significantly improve your business communication. It not only saves time but also ensures consistency in your correspondence. By using a standard format, you can avoid errors and make sure that all essential details are included each time, which helps maintain professionalism and clarity.

Streamlining Your Communication Process

Efficiency is key when managing financial transactions. A ready-made structure eliminates the need to start from scratch with each request. This allows you to focus on the specific details of each transaction rather than spending time reformatting or remembering what needs to be included.

Building Professional Relationships

Consistency in your approach reinforces your brand image and helps clients know what to expect. A well-crafted message creates a sense of trust and reliability, showing that you take your business seriously and respect your client’s time. With each interaction, you strengthen the professional relationship and create a seamless payment experience.

How to Create a Professional Invoice Email

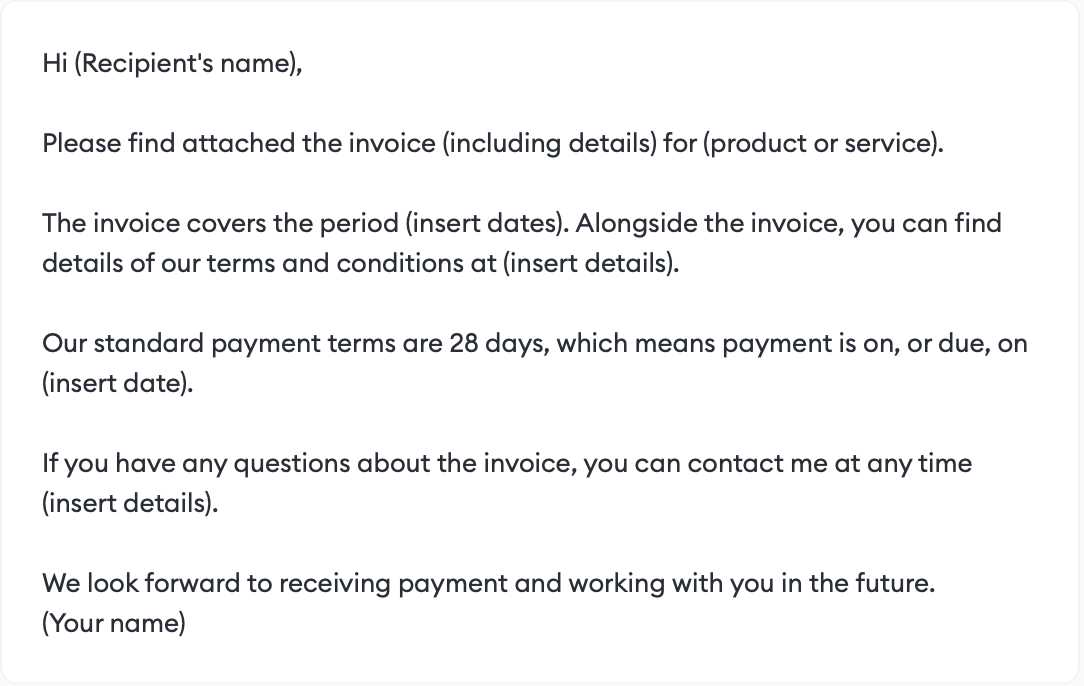

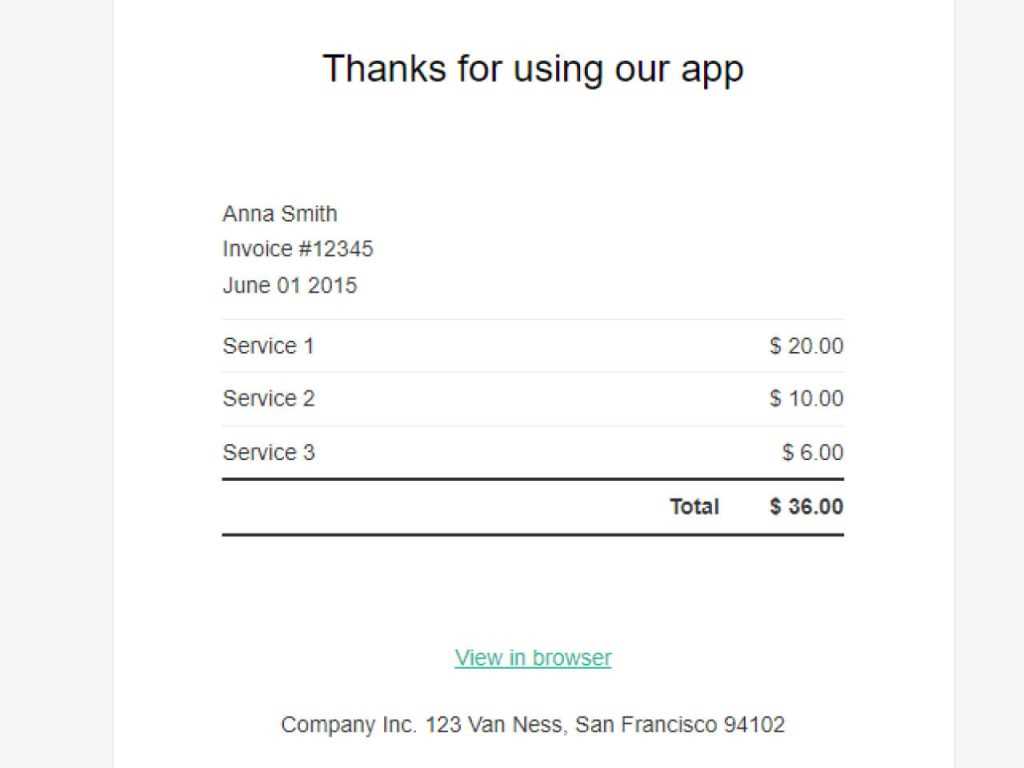

Creating a polished and effective payment request starts with the right structure. It is essential to include all the necessary details in a clear and professional manner. By presenting the information in an organized way, you ensure that your client can easily understand the payment terms and expectations.

Key Elements of a Payment Request

Clear communication is the foundation of any professional message. Make sure to include the amount due, the due date, and the payment methods. A simple, straightforward layout helps avoid confusion and ensures that your client knows exactly what is required. Keep the tone polite and formal to maintain professionalism throughout the message.

Formatting for Readability

Well-organized content not only looks professional but also ensures that key information stands out. Use bullet points or numbered lists to highlight important details, and avoid long paragraphs. A clean, structured approach makes it easier for the recipient to navigate through the information and act accordingly without feeling overwhelmed.

Top Features of a Good Invoice Email

A well-crafted payment request is crucial for maintaining professionalism and ensuring prompt payment. Certain features can help make your communication clear, organized, and easy to follow. The right structure and content will ensure that all the necessary details are included and that the recipient can respond without confusion.

Clarity and Precision

Clear and concise communication is a must. Avoid unnecessary details and focus on the key points: the amount owed, due date, and payment methods. Present this information in an easy-to-read format so the recipient can quickly grasp the details. This helps ensure timely processing and reduces the likelihood of misunderstandings.

Professional Tone and Formatting

Using a formal and respectful tone sets the right mood for a business transaction. The structure should also be neat and organized–proper spacing, consistent font usage, and logical flow of information make the message more approachable. The recipient should feel confident that this communication reflects the seriousness of the transaction.

Customizing Your Free Invoice Template

Personalizing your payment request format can make a significant difference in how your clients perceive your business. By adjusting the layout and content to suit your specific needs, you can create a more streamlined and professional approach. Customization ensures that each communication aligns with your brand and meets both your and your client’s expectations.

Here are some key elements you can modify to improve your document:

- Company Branding: Incorporate your logo, color scheme, and contact information to make the request feel like a natural extension of your brand.

- Payment Terms: Tailor the payment deadlines, methods, and any late fees or discounts based on the specific agreement with your client.

- Personalization: Adjust the tone and language to suit the nature of your relationship with the client–whether more formal or friendly.

- Additional Notes: Include extra sections for project details, terms, or discounts offered, ensuring everything is clearly laid out.

By customizing these aspects, you ensure that your request stands out and feels personal, professional, and aligned with your business goals.

Best Practices for Sending Invoice Emails

Sending a payment request requires more than just attaching a document; it involves thoughtful communication that ensures clarity and professionalism. Following best practices can help you maintain strong client relationships, avoid delays, and keep your financial transactions organized.

Here are some key strategies for effectively sending payment requests:

- Use Clear Subject Lines: A direct and concise subject line helps your client understand the purpose of the message at a glance. For example, “Payment Due for [Service/Product Name].”

- Ensure Proper Timing: Send your request well in advance of the due date. A polite reminder a few days before the due date can also be helpful in securing timely payments.

- Keep It Professional: Use a formal and respectful tone in your message. Avoid casual language and ensure that the request reflects the seriousness of the transaction.

- Be Specific with Details: Include all necessary information–amount due, payment methods, and due dates. Clearly outlining these details helps prevent confusion.

- Attach Relevant Documents: Include a copy of the detailed payment statement or agreement, ensuring the recipient has everything needed to process the payment.

- Offer Multiple Payment Methods: Provide a variety of payment options to make it easier for your clients to pay on time. This can help avoid unnecessary delays.

By following these best practices, you can streamline your payment requests, encourage prompt payments, and strengthen your professional image.

How to Include Payment Terms in Emails

Including clear payment terms in your communication is essential for setting expectations and ensuring a smooth transaction process. By outlining the agreed-upon conditions directly in your messages, you help avoid misunderstandings and reduce the likelihood of delayed payments. These terms should be simple, straightforward, and easily understood by the recipient.

Key Payment Information to Include

Payment deadlines: Specify the exact date by which payment is due. This helps your client understand the urgency and prioritize the payment accordingly.

Accepted payment methods: Clearly list all available payment options, such as bank transfers, credit cards, or online payment platforms, to offer flexibility to your client.

Clarify Any Additional Charges or Discounts

Include details about penalties for late payments or early payment discounts if applicable. This ensures that your client is aware of any financial incentives or consequences tied to the payment terms.

By providing this information up front, you make it easier for both parties to stay aligned on expectations and minimize any potential confusion.

Using Email Templates to Save Time

Efficiency is a key factor in any business, and using pre-designed formats for communication can save you valuable time. By creating a reusable structure for routine messages, you eliminate the need to start from scratch every time, allowing you to focus on other important tasks. This approach not only streamlines your workflow but also ensures consistency in your communications.

Here are some of the key benefits of using a standardized structure for payment requests:

- Faster Creation: Predefined structures save time by eliminating the need to manually craft each message. With a template, you only need to insert the necessary details.

- Consistency: A ready-made format ensures that every communication follows the same professional style, reducing the risk of missing important information.

- Less Room for Error: Using a consistent layout minimizes the chances of overlooking crucial details like due dates or amounts owed.

- Improved Efficiency: When time is of the essence, being able to quickly adjust a template and send it out can make a huge difference in managing multiple transactions.

By integrating reusable structures into your workflow, you’ll speed up your processes while maintaining a high level of professionalism and accuracy.

Choosing the Right Tone for Invoice Emails

When communicating with clients regarding financial matters, the tone of your message plays a crucial role in how the information is received. A message that is too casual may seem unprofessional, while one that is overly stern may cause unnecessary tension. Striking the right balance ensures that your request is clear, respectful, and encourages prompt action.

Understanding Different Scenarios

The tone of your message should vary depending on the relationship with the client and the stage of the payment process. Here are some guidelines for different situations:

| Situation | Recommended Tone | Reason |

|---|---|---|

| First Payment Request | Polite and Professional | Maintain a courteous approach to set a positive tone for the relationship. |

| Late Payment Reminder | Firm but Respectful | Clearly communicate the importance of timely payment while maintaining professionalism. |

| Long-Term Client | Friendly and Appreciative | Maintain a positive relationship by being warm and grateful for their business. |

Adapting Your Message

Choose your words carefully based on the client’s history and the urgency of the situation. A tone that is too harsh or demanding can cause unnecessary friction, while being overly lenient can lead to delayed payments. By adjusting your approach to each individual case, you build trust and maintain professional rapport.

Common Mistakes to Avoid in Invoice Emails

When requesting payment, it’s crucial to be clear and professional in your communication. Mistakes can cause confusion, delays, or even harm client relationships. By understanding common pitfalls, you can ensure that your request is handled smoothly and efficiently. Avoiding these errors can help maintain professionalism and prompt payment.

1. Missing or Incorrect Information

One of the most significant mistakes is failing to include essential details, such as payment amounts, due dates, or the services/products being billed. Missing or inaccurate information can lead to confusion and delayed payments. Always double-check the details before sending the request.

2. Lack of Clear Payment Instructions

If the payment process is unclear, clients may be unsure of how to proceed. Ensure you provide clear, concise instructions regarding the available payment methods and any necessary details (e.g., account numbers, online payment links). This will reduce the risk of follow-up questions and potential delays.

By avoiding these common mistakes, you can streamline your payment requests and build better professional relationships with clients.

How to Track Invoice Payments through Email

Tracking payments efficiently is crucial for maintaining accurate records and ensuring timely follow-ups. By incorporating clear tracking mechanisms in your communication, you can easily monitor the status of outstanding payments and take appropriate action when needed. This process not only streamlines financial management but also helps in maintaining strong client relationships.

To effectively track payments, consider the following steps:

- Request Payment Confirmation: Ask your client to confirm receipt of the payment request and, if applicable, notify you once the payment is made. This allows you to cross-check the transaction on your end.

- Use Unique Reference Numbers: Provide a unique identifier for each transaction. This makes it easier for both you and the client to track and reference specific payments in the future.

- Set Up Payment Reminders: If the payment hasn’t been received by the due date, send a polite reminder with all relevant details, such as the outstanding amount and payment instructions.

- Monitor Bank or Payment Accounts: Regularly check your accounts for incoming payments and match them with the reference numbers provided to clients. This will help identify any discrepancies quickly.

By using these strategies, you can easily stay on top of payments, ensuring timely receipts and minimizing potential delays.

Free Tools to Design Invoice Templates

Creating professional and well-structured documents for billing can be time-consuming, but with the right tools, you can streamline the process. There are several online platforms that offer easy-to-use design tools, allowing you to create customized documents without any graphic design experience. These platforms often provide a variety of pre-built layouts that you can personalize to suit your brand and specific needs.

Here are some free tools to help you create polished and professional payment requests:

- Canva: Canva offers a wide range of customizable document designs, including billing formats. It’s user-friendly and provides many design elements to enhance the look of your documents.

- Google Docs: While not specifically for designing billing documents, Google Docs provides a simple and effective way to create professional-looking formats with ease. You can also collaborate with others in real time.

- Invoice Generator: This tool allows you to quickly generate basic payment documents without needing an account or subscription. It offers customization options for adding your logo, adjusting fonts, and specifying payment details.

- Zoho Invoice: Zoho provides an easy-to-use interface for creating customized billing documents. It also allows for automatic calculation of totals, taxes, and discounts.

- PayPal Invoicing: PayPal offers a simple platform to create and send professional payment requests. It’s ideal for businesses already using PayPal to process payments.

Using these tools can save you time while ensuring that your payment requests look professional and meet your business’s needs.

How to Keep Your Communication Professional

Maintaining a professional tone and appearance in your written communication is essential for fostering positive relationships and ensuring clarity. Whether you are making a request, providing details, or following up, professionalism reflects well on your business and builds trust. A carefully crafted message helps convey your message effectively while minimizing any potential misunderstandings.

1. Be Clear and Concise

Avoid unnecessary jargon or long-winded explanations. Your recipient should be able to easily understand the purpose of your message at a glance. Use straightforward language, and focus on the key points to avoid confusion.

2. Maintain a Polite and Respectful Tone

Even if you’re requesting payment or addressing a sensitive matter, it’s important to maintain a courteous and respectful tone. Use phrases such as “please,” “thank you,” and “I appreciate your attention to this matter” to demonstrate professionalism and courtesy.

By ensuring clarity, using polite language, and paying attention to detail, you can make a positive impression and strengthen your business communications.

Adding Personalization to Your Payment Requests

Personalizing your payment communications can create a more engaging experience for your clients. When you tailor your messages to reflect the specific details of each transaction or relationship, you demonstrate attentiveness and professionalism. Personalization helps build stronger connections with your clients and shows that you value their business.

Ways to Personalize Your Payment Requests

- Use the Client’s Name: Start your message with a personal greeting, such as “Dear [Client Name],” to make your communication feel more individualized and considerate.

- Reference Specific Transactions: Mention the specific service or product provided, along with any unique details, like order numbers or dates, to make your message more relevant.

- Offer Custom Payment Options: If appropriate, provide flexible payment terms or methods that suit the client’s preferences, showing that you are willing to accommodate their needs.

- Include a Thank You Message: A brief expression of gratitude, such as “Thank you for your continued business,” can leave a positive impression and strengthen your professional relationship.

Benefits of Personalizing Your Messages

- Improved Client Relationships: Personalization shows that you care about your clients as individuals, not just as transactions.

- Increased Likelihood of Timely Payments: A thoughtful, personalized approach may prompt clients to act more quickly and prioritize their payment to you.

- Enhanced Professional Image: Taking the time to craft tailored communications conveys a high level of professionalism and attention to detail.

By adding these personalized touches, you not only improve client engagement but also enhance the overall professionalism of your business communications.

Sending Follow-Up Messages for Unpaid Balances

Following up on unpaid balances is a crucial part of maintaining healthy cash flow. A timely and respectful reminder can help ensure that payments are received promptly. While it’s important to be firm, maintaining professionalism and courtesy is key to preserving positive client relationships. A well-structured follow-up message increases the likelihood of payment while minimizing potential conflicts.

Best Practices for Sending Follow-Up Messages

| Action | Description |

|---|---|

| Send Early Reminders | Contact your client soon after the due date to remind them of the outstanding balance. This early reminder sets the tone for prompt payment. |

| Be Clear and Concise | Clearly outline the amount owed, the due date, and any applicable late fees. This removes any ambiguity about the payment terms. |

| Maintain a Professional Tone | Even if the payment is late, keep the tone polite and professional. Use phrases like “We kindly remind you” or “We would appreciate your prompt attention to this matter.” |

| Offer Payment Options | If applicable, provide clients with flexible payment options or offer a payment plan to accommodate their situation. |

| Set a Follow-Up Schedule | If the payment remains overdue, establish a follow-up schedule and inform the client about the next steps in the process. |

By sending well-crafted follow-up messages, you help maintain a professional and courteous relationship with your clients, while ensuring that your financial obligations are met on time.

How to Organize Billing Communication Records

Efficiently managing your billing communication is essential for keeping track of payments, resolving disputes, and maintaining accurate financial records. By organizing your records systematically, you ensure easy access to important information when needed. This process involves categorizing, labeling, and storing your communication in a way that promotes quick retrieval and clarity.

Steps to Organize Your Billing Records

| Step | Description |

|---|---|

| Centralize All Records | Store all related communication in one central location, such as a cloud storage service or a dedicated folder on your computer. This ensures no important documents are misplaced. |

| Use a Clear Naming Convention | Establish a consistent naming convention for your files (e.g., “ClientName_Amount_Date”). This makes it easier to search and identify specific records later. |

| Label Emails and Documents | Label your emails and associated documents with keywords such as “paid,” “pending,” or “dispute” to quickly categorize and prioritize tasks. |

| Track Payment Status | Maintain a simple spreadsheet or database to track payment statuses, deadlines, and any communication sent or received for each transaction. |

| Backup Your Records | Regularly back up your records to avoid losing crucial data in case of technical issues or system failures. |

By organizing your billing communication effectively, you can easily keep track of transactions, stay on top of outstanding payments, and reduce the risk of errors or misunderstandings.

Ensuring Communication Security for Sensitive Information

When sharing financial or personal details through digital means, safeguarding sensitive information is crucial. A breach of this data can lead to financial loss, identity theft, or legal complications. It’s important to take appropriate steps to ensure that the information you send remains confidential and secure from unauthorized access.

Encryption is one of the most effective methods for protecting sensitive data. By encrypting your messages or attachments, you convert the information into a code that only the intended recipient can decode with a specific key. This makes it much harder for hackers to intercept and misuse your data.

Two-Factor Authentication (2FA) can further enhance your security. By enabling 2FA on your communication platforms, you add an additional layer of protection that requires a second form of verification, such as a mobile code, alongside your password. This makes unauthorized access more difficult.

Regularly updating software and security protocols is also essential. Ensure your system’s firewall and antivirus programs are up to date, as well as any platforms you use to send sensitive data. New threats emerge continuously, and staying current with security patches helps protect your information.

Finally, it’s important to be cautious when sharing sensitive data over public or unsecured networks. Whenever possible, use a secure connection, such as a Virtual Private Network (VPN), to encrypt your data transmission. This adds an extra level of security when accessing or sending confidential materials from public Wi-Fi.

By implementing these security measures, you can significantly reduce the risk of exposing sensitive information and maintain a higher level of trust and professionalism in your communications.