Download Free Invoice Template for Easy and Professional Billing

Efficient billing is essential for maintaining smooth business operations and ensuring timely payments. Having a ready-to-use document for requesting payment can save you time and reduce the risk of errors. Whether you’re a freelancer, a small business owner, or part of a larger company, using a professional layout helps convey your professionalism and keep transactions transparent.

By utilizing a well-structured form, you can customize each transaction to meet specific needs without starting from scratch every time. Such forms allow for quick adjustments, ensuring that every request is clear and concise. In this section, we explore how to easily access these helpful resources, adapt them to your needs, and optimize your billing workflow for maximum efficiency.

Free Invoice Templates for Small Businesses

For small business owners, managing finances and ensuring timely payments are critical for growth. One of the simplest yet most effective ways to streamline your billing process is by using well-structured documents designed for professional communication. These documents not only help you stay organized but also establish trust with clients by presenting clear and accurate financial requests.

Benefits of Using Ready-Made Forms

By opting for pre-designed forms, small businesses can save valuable time while maintaining consistency in their billing practices. These documents are typically easy to customize, allowing you to include essential details such as business information, services rendered, and payment terms. Using a standardized format can prevent errors and help ensure that nothing is overlooked in the transaction process.

How to Choose the Right Document for Your Business

When selecting a document, consider your specific industry needs. For example, service-based businesses might require a different structure compared to retail or e-commerce operations. Look for formats that allow you to clearly outline the products or services provided, pricing, and any taxes or additional fees. A well-organized document can improve cash flow and reduce misunderstandings with clients.

Tip: Always include a professional header with your business name and contact details, and make sure payment instructions are easy to find. This enhances the overall customer experience and encourages faster processing of payments.

Why You Need an Invoice Template

For any business, having a consistent and professional method of requesting payment is crucial. Not only does it reflect your company’s professionalism, but it also helps ensure that all necessary details are included for both you and your clients. Without a well-structured document, you may risk overlooking important elements or creating confusion about payment terms and amounts.

Clarity and Consistency in Transactions

Using a pre-designed structure allows you to include all necessary information in a clear and organized way. By adhering to a standard format, you reduce the chance of errors and ensure that clients can easily understand the charges and terms. This consistency builds trust and helps foster positive client relationships, as it demonstrates your attention to detail.

Time-Saving and Efficiency

Instead of creating a new request for every transaction, having a ready-to-use structure saves valuable time. Customizing an existing document is much faster than building one from scratch each time. This enables you to focus more on the core aspects of your business, while still maintaining a professional and organized billing system.

Tip: Streamline your business operations by automating as much of the billing process as possible. Using a structured document speeds up the payment cycle and reduces the chance of misunderstandings with clients.

How to Obtain a Payment Request Form

Acquiring a structured document for your billing process is simple and can save you a lot of time. Many online platforms provide these essential resources at no cost, allowing you to quickly get started with professional payment requests. Whether you need a basic design or something more detailed, finding the right one is an easy process that can significantly improve your workflow.

Steps to Find the Right Form

Start by browsing reliable websites that specialize in business resources. Many offer easy access to various designs that you can tailor to your business needs. Choose a format that aligns with your industry and the level of detail you require. Make sure the document includes all necessary fields such as item descriptions, prices, terms, and your contact information.

Customizing for Your Business

Once you’ve selected a suitable form, it’s important to personalize it. Replace default text with your business name, logo, and other relevant details. This ensures that the document reflects your branding and provides a professional appearance. Some platforms allow you to save the form in different file types, making it easy to use across various devices and software.

Pro Tip: Always review the document before sending it out to clients, ensuring all fields are filled correctly and clearly. A small error can delay payment and cause unnecessary confusion.

Customizing Your Payment Request Document

Personalizing your billing document ensures it aligns with your business identity and meets the specific needs of your clients. By adjusting the design and content, you can create a more professional and tailored experience that reflects your brand. Customization not only enhances your business image but also ensures that all the necessary details are clearly communicated.

Adjusting Layout and Design

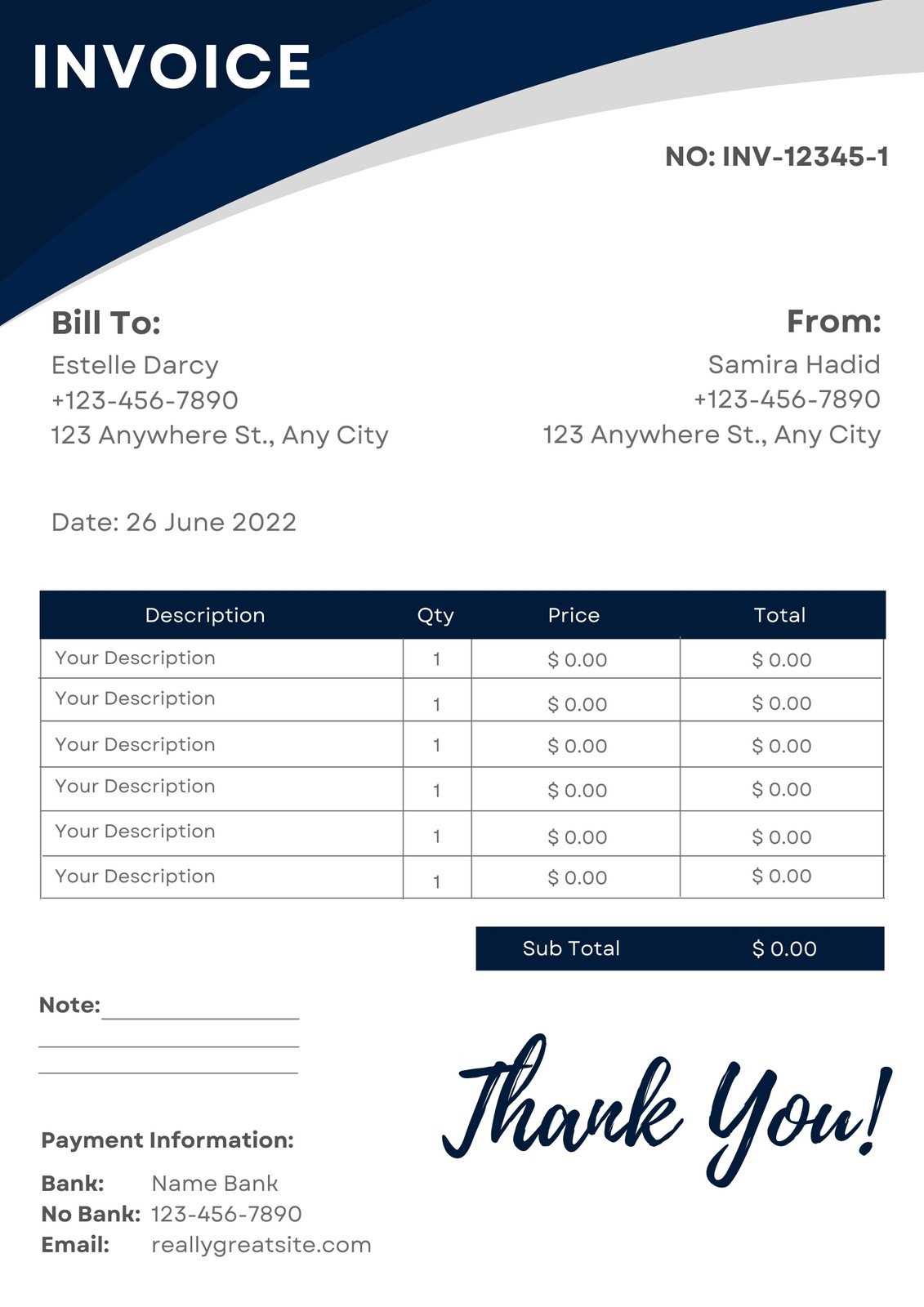

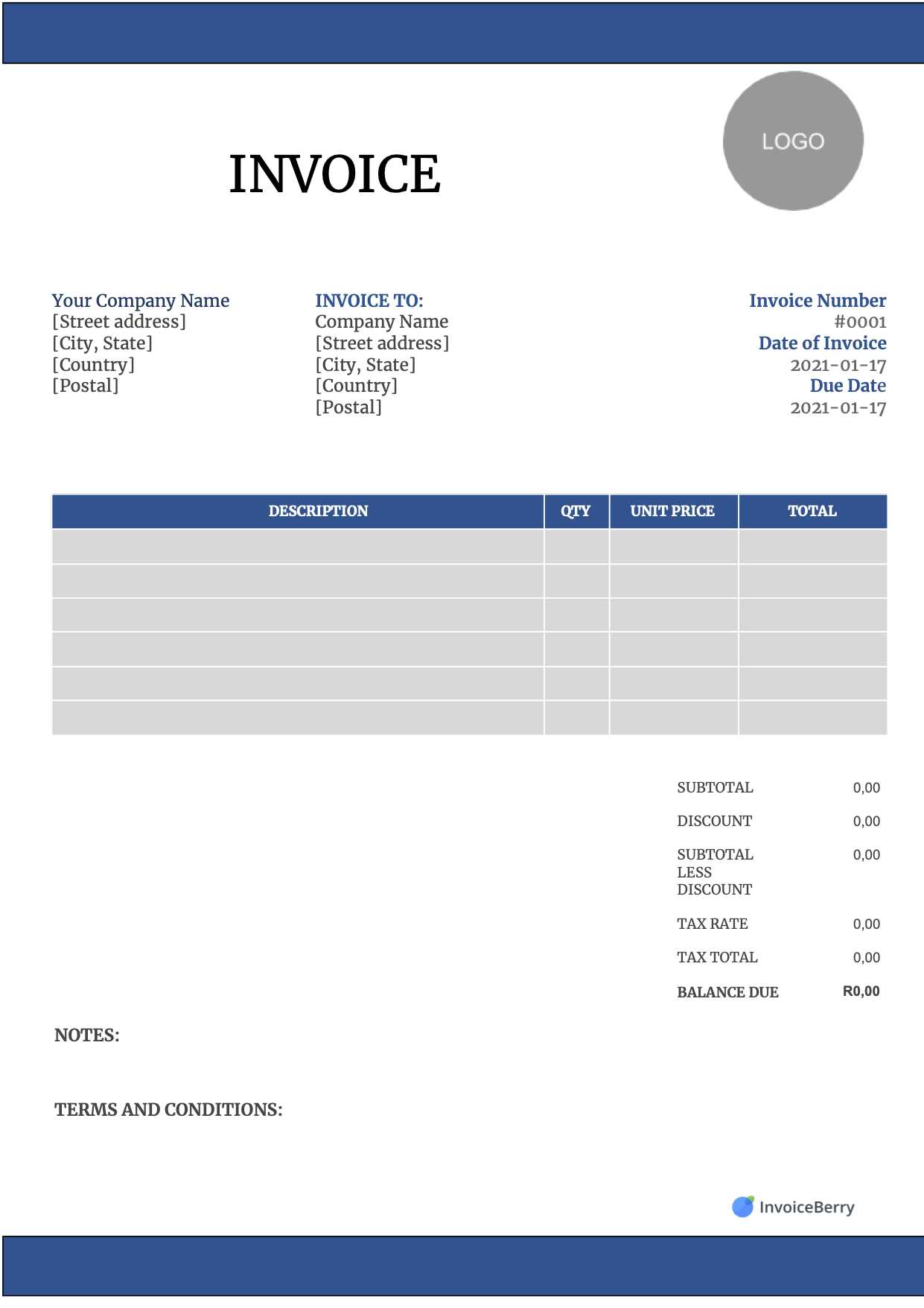

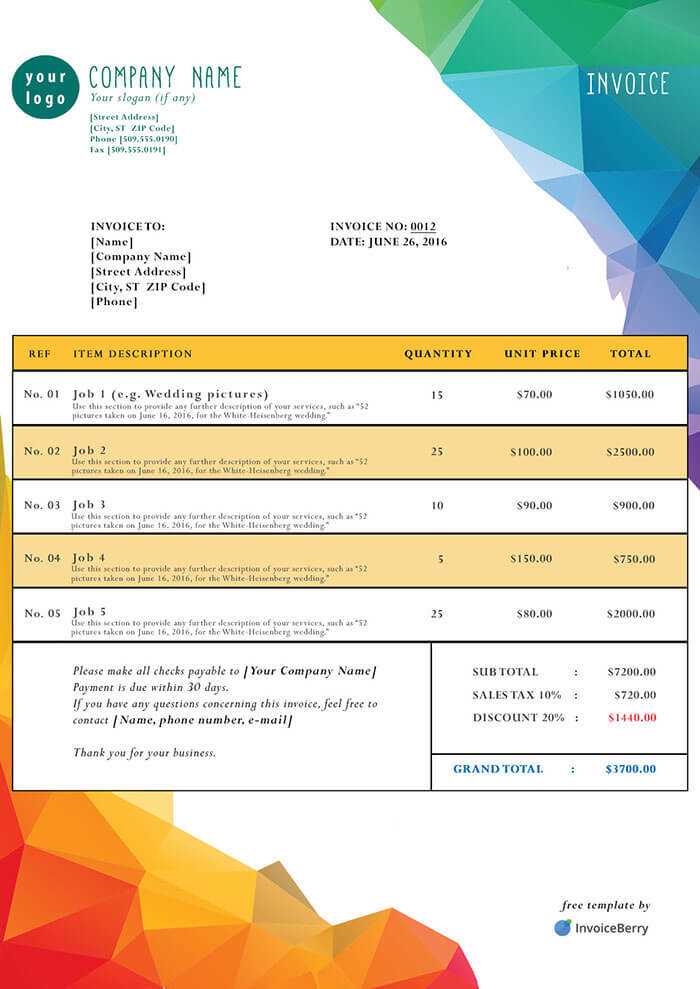

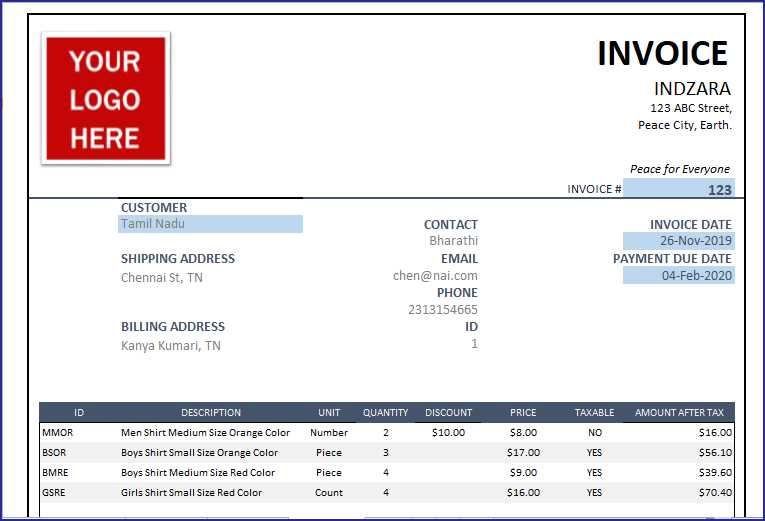

The first step in customization is choosing the right layout. Depending on your industry, you may want to adjust the format to include more or fewer details. Adding your business logo, changing fonts, or selecting colors that match your branding can make a significant impact. A clean, easy-to-read design is essential to ensure your clients can quickly understand the payment information.

Updating Essential Information

Next, update the form with your specific business details, including your company name, address, and contact information. Make sure you also input the correct payment terms, item descriptions, quantities, and pricing. It’s crucial that these fields are accurate and up-to-date to avoid any confusion or delays in receiving payment.

Tip: Consider adding additional notes, such as thank-you messages or reminders about due dates, to create a positive client experience. A personalized touch can help strengthen client relationships and encourage faster payment processing.

Choosing the Right Payment Request Format

Selecting the right format for your payment request is essential for ensuring clarity and professionalism in your financial communications. The structure of the document you use should not only align with your business needs but also provide a seamless experience for your clients. An appropriate layout helps to avoid confusion, accelerates the payment process, and leaves a positive impression on the recipients.

Consider Your Industry Needs

Different industries may require different types of documents. For example, service-based businesses might need a more detailed layout that explains the services provided, while product-based businesses may focus on itemized lists. Consider your specific business requirements when choosing a format, as this will influence the document’s structure and the information it includes.

Assessing Simplicity vs. Detail

When choosing the format, it’s important to balance simplicity with necessary details. A straightforward design with clear sections is usually best, but you may need to add more information such as taxes, discounts, or payment instructions. Ensure that the format you select allows for easy adjustments without becoming too cluttered or overwhelming for the client to read.

Pro Tip: Keep your format professional, but ensure it is easy to understand. Avoid overwhelming your clients with unnecessary data, and keep the focus on the essential transaction details.

Benefits of Using a Payment Request Document

Utilizing a pre-designed structure for requesting payments offers several advantages that can streamline your business operations. These ready-made forms not only save time but also ensure consistency and professionalism in all your financial communications. Whether you’re a freelancer, a small business owner, or part of a larger company, using such resources simplifies the process and reduces the risk of errors.

One of the main benefits is efficiency. Instead of creating a new document from scratch each time, you can simply fill in the relevant details and send it out. This saves you valuable time and allows you to focus on other important tasks. Moreover, these forms are often designed to be user-friendly, with fields that guide you through the necessary information, ensuring that nothing essential is overlooked.

Additionally, a standardized structure helps reinforce your business’s professionalism. Consistency in your financial requests builds trust with clients and gives your communications a polished, credible appearance. With all required details laid out clearly, you reduce the chance of misunderstandings or disputes over payment terms.

Pro Tip: Use a template that aligns with your branding, including your logo and company colors, to further enhance your professionalism and strengthen your company’s identity.

Essential Elements of a Professional Payment Request

A well-crafted payment request is not just about asking for money–it’s about providing all the necessary information in a clear and organized way. A professional document ensures both you and your client are on the same page, reducing the likelihood of confusion and ensuring timely payment. To achieve this, certain key components must be included to make the request both comprehensive and easy to understand.

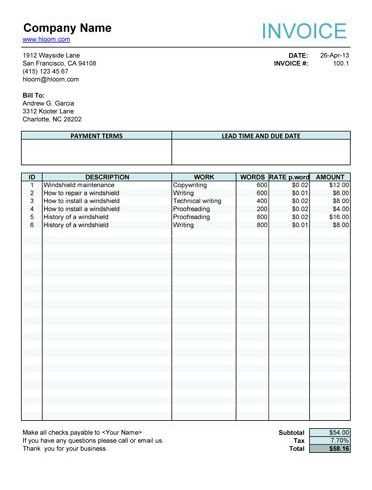

The first essential element is clear identification. Your document should feature your business name, logo, and contact details, as well as the client’s information. This establishes legitimacy and helps avoid any confusion about which company is requesting payment. Furthermore, the inclusion of an invoice number, date of issue, and due date is crucial for tracking purposes and ensuring the timely settlement of the payment.

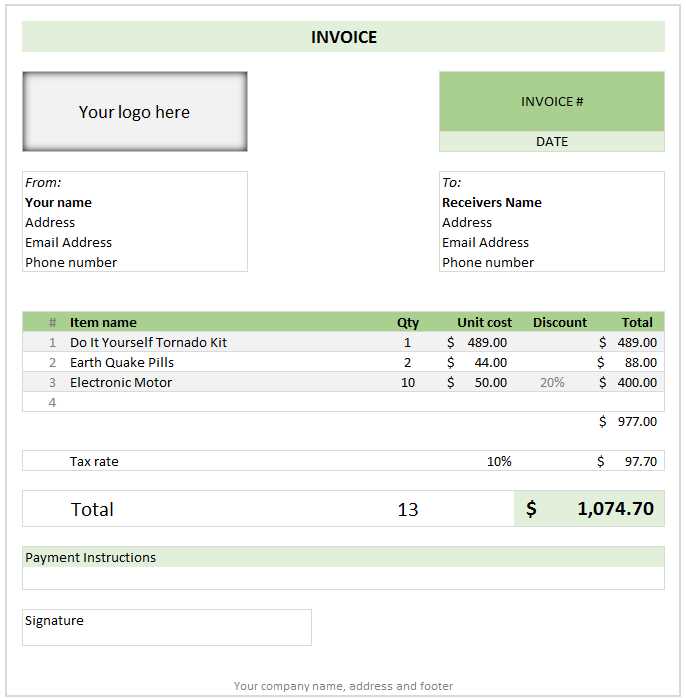

Another vital part is an itemized list of goods or services provided. Each entry should include a brief description, quantity, rate, and total amount. This breakdown not only helps your client understand exactly what they’re paying for but also ensures that there’s no ambiguity about pricing. Additionally, be sure to include any applicable taxes, discounts, or extra charges, as well as clear payment instructions, such as methods of payment and bank account details if necessary.

Pro Tip: Always double-check that all fields are correctly filled in, as even minor errors in pricing or dates can lead to delays or disputes.

How to Avoid Payment Request Mistakes

Creating a payment request might seem straightforward, but small errors can cause delays, misunderstandings, and even damage your professional reputation. Ensuring accuracy in all aspects of the document is crucial for smooth transactions. By being mindful of common mistakes and taking steps to prevent them, you can improve your cash flow and maintain positive client relationships.

One of the most common mistakes is incorrect or missing details, such as your company name, address, or the client’s contact information. Always double-check that these fields are complete and accurate. Additionally, ensure that each item or service is properly listed, with the correct quantities, rates, and totals. Simple errors in pricing or descriptions can lead to disputes or delays in payment.

Key Steps to Avoid Errors

To avoid mistakes, it’s helpful to have a checklist or use a standardized format that includes all necessary information. Never rush through the process–take the time to review your document before sending it. Another useful tip is to set up automated reminders for yourself to ensure you don’t forget important details like payment due dates or terms.

Check for Consistency

Ensure consistency across all documents by using the same format for every transaction. This includes consistent terminology, number formatting, and tax calculations. By maintaining uniformity, you can avoid confusion and make it easier for your clients to process payments quickly.

Tip: If possible, have a second person review the payment request before sending it out. A fresh pair of eyes can catch errors you might have missed.

Free Templates vs Paid Payment Solutions

When deciding between using a no-cost pre-designed structure or investing in a paid service, it’s important to weigh the pros and cons of each option. While both can effectively streamline the payment request process, they come with different features, capabilities, and levels of customization. Understanding the differences can help you make an informed decision that best fits your business needs.

Advantages of No-Cost Solutions

Free resources can be a great option for small businesses or freelancers who are just starting out and have a limited budget. These pre-designed forms often cover the basics, allowing you to create clear and professional-looking payment requests without any upfront costs. Here are some key benefits:

- Cost-effective: No upfront investment required, ideal for businesses on a tight budget.

- Quick and easy: Most free resources are simple to access and use, with minimal setup required.

- Basic functionality: Great for businesses that need a straightforward structure without complex features.

Advantages of Paid Solutions

On the other hand, paid solutions often provide additional features that can make your billing process even more efficient. These options tend to offer more advanced functionality, such as automated payment tracking, custom branding, and integration with accounting software. Here are some benefits of investing in a paid service:

- Advanced features: Integration with other business tools, automated reminders, and the ability to track payments.

- Customization: Greater flexibility in design and layout, allowing you to fully align the form with your branding.

- Support: Access to customer service or technical support if any issues arise with the solution.

Which is Right for Your Business?

Your choice depends on the complexity of your needs and the resources available. If you only need a basic, one-time solution, a no-cost option might be sufficient. However, for businesses looking to scale or needing more advanced features, investing in a paid service may be a better long-term solution.

Best Payment Request Documents for Freelancers

As a freelancer, creating clear and professional payment requests is crucial for maintaining smooth financial operations. Whether you’re providing services in design, writing, web development, or any other field, a well-organized document helps ensure that clients understand exactly what they are paying for and when. Choosing the right structure can save time, reduce errors, and enhance your professionalism.

Key Features for Freelance Payment Requests

When selecting a document format, there are a few key features to look for that can make your payment requests more effective and easier to manage:

- Clear Itemization: Ensure that each service provided is listed with a brief description, rate, and total. This transparency helps avoid confusion and sets clear expectations with clients.

- Professional Design: A clean and polished format creates a positive impression and reinforces your credibility. Including your logo and branding elements can give the document a personal touch.

- Payment Terms: Make sure to include payment deadlines, methods, and any applicable late fees to prevent delays and ensure timely payments.

- Simple Customization: A document that’s easy to personalize will save time. Look for formats that allow for quick changes in client information, project details, or pricing.

Top Document Formats for Freelancers

Here are some of the best options for freelancers looking for well-structured payment request documents:

- Minimalist Layouts: Simple and straightforward formats that focus on clarity and essential details. These are perfect for smaller projects where the client needs only basic information.

- Creative Designs: If your work is in a creative field, choose a more visually appealing document. These formats allow you to showcase your personal style while still maintaining professionalism.

- Detailed Breakdown: Ideal for larger projects or ongoing services, these formats provide a detailed breakdown of hours worked, rates, and individual tasks, making them useful for clients who need more transparency.

Pro Tip: Choose a layout that suits both your style and your client’s expectations. A well-organized and thoughtful payment request can help establish strong business relationships and prompt faster payments.

How to Save Time with Pre-Designed Payment Documents

Using a pre-designed structure for your billing process can significantly reduce the amount of time spent on administrative tasks. Instead of creating a new document from scratch for each transaction, you can rely on ready-made formats that only require you to fill in specific details. This streamlined approach ensures that you can focus more on the core aspects of your business while maintaining a professional standard for your financial communications.

Advantages of Using Pre-Made Forms

By leveraging these resources, you can experience a variety of time-saving benefits:

- Quick Setup: Most pre-designed documents only need minor adjustments, such as client information or specific charges, allowing you to generate a new request in just a few minutes.

- Consistency: Using the same layout for all your transactions saves time by eliminating the need to reconsider formatting or layout for each request. This ensures uniformity across your business.

- Reduced Risk of Errors: With a ready-made structure, you are less likely to forget important details such as payment terms or services provided, which can result in fewer corrections or disputes later on.

How to Maximize Efficiency

To get the most out of pre-designed documents, follow these best practices:

- Keep Information Updated: Ensure that your business details, payment instructions, and services offered are always up to date within the form, so you don’t have to modify it every time.

- Automate Where Possible: If your document provider supports it, consider integrating your form with accounting or invoicing software to automate payment tracking and reminders.

- Save Frequently Used Versions: Save different versions of your document based on client or service type, so you don’t need to re-enter similar details repeatedly.

Tip: Using pre-designed resources with automation can drastically speed up the billing process and allow you to dedicate more time to growing your business.

Invoicing Tips for New Businesses

For new businesses, creating a professional and efficient billing process is essential for maintaining cash flow and establishing trust with clients. A well-structured payment request not only ensures that you get paid on time but also helps you present your business as organized and reliable. By following a few key tips, you can streamline your billing process and avoid common mistakes that could delay payments or harm your reputation.

1. Set Clear Payment Terms

It’s crucial to clearly define payment terms from the outset. Make sure your clients know exactly when the payment is due, what methods are accepted, and if there are any late fees. Providing this information upfront reduces confusion and helps you avoid delays. Specify terms such as net 30 or due upon receipt, so that both parties are on the same page.

2. Stay Consistent with Your Billing Process

Consistency is key in building a professional image. Use the same format for all your billing documents, and ensure that they include the same fields and structure every time. This consistency helps clients easily recognize and process your requests, which can lead to faster payments. Additionally, having a standardized format reduces the chance of forgetting important details, such as project descriptions or payment instructions.

3. Keep Detailed Records

Proper documentation is vital for managing finances and preparing for tax season. Keep detailed records of every transaction, including the services rendered, payment terms, dates, and amounts. This not only helps you track payments but also provides a reference in case any disputes arise. Consider using accounting software or spreadsheets to stay organized.

4. Follow Up on Late Payments

Late payments are common, especially when you’re just starting out. Don’t be afraid to send polite reminders if the payment deadline has passed. A friendly follow-up email or call can often nudge your clients to settle the balance. You may also want to set up automatic reminders if you’re using a software system for tracking payments.

Pro Tip: Be firm but courteous in your communication. Your approach to late payments can influence client relationships, so always maintain professionalism while enforcing your payment policies.

How to Make Your Payment Request Stand Out

Creating a payment request that grabs attention and reflects your business’s professionalism can make a significant impact on client relationships. A well-designed document not only ensures clarity but also demonstrates that you take your business seriously. With a few simple changes, you can make your request more memorable and improve your chances of getting paid on time.

1. Use Your Branding

Incorporating your business’s branding elements–such as your logo, colors, and fonts–into your payment request adds a personal touch and reinforces your brand identity. Consistency across your documents makes your business look more polished and trustworthy. A client is more likely to recognize and remember a well-branded document, which can help build brand recognition over time.

2. Keep the Layout Clean and Organized

A cluttered payment request can confuse clients and delay the payment process. To ensure your request stands out in a positive way, opt for a simple, organized layout. Make use of headings, bullet points, and ample white space to clearly present key information. A well-structured document will be easier to read, and clients are more likely to process it quickly.

3. Be Detailed but Concise

While you want to provide all necessary details, it’s important to avoid overwhelming your client with excessive information. Be clear and concise in describing the services or products provided, the payment terms, and any relevant dates. Highlight important points, such as due dates or total amounts, to ensure that nothing gets overlooked.

4. Include a Personal Touch

Adding a personal touch, such as a thank you note or a short message expressing appreciation for the client’s business, can help foster positive relationships. This small gesture shows that you value your clients and encourages repeat business. A simple “Thank you for your business” or “Looking forward to working with you again” can go a long way in strengthening your professional rapport.

5. Provide Clear Payment Instructions

Ensure that your payment request includes clear instructions on how to make the payment. Whether it’s through bank transfer, PayPal, or credit card, make sure your client knows exactly what steps to follow. Including detailed information such as bank account numbers or payment links helps streamline the process and reduces confusion.

Example of a Well-Formatted Payment Request

| Service | Description | Amount | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Web Design | Custom website design, 5-page layout | $1,000 | ||||||||||

| SEO Optimization | On-page SEO for 10 pages | $300 | ||||||||||

| Editable Payment Request Forms for Easy Use

Editable documents provide a convenient and efficient way to generate accurate and professional payment requests without the hassle of starting from scratch each time. These customizable formats allow you to modify details such as client information, itemized services, and payment terms, ensuring that each document is tailored to your specific needs. Whether you’re handling a few transactions or managing multiple clients, editable formats streamline the process and save valuable time. Benefits of Using Editable Payment Request FormsEditable forms offer a range of advantages for businesses of all sizes. Some key benefits include:

How Editable Payment Request Forms Work

Editable documents are typically available in various formats, such as Microsoft Word, Google Docs, or PDF. You can easily access and modify these files using basic text-editing software. Once you’ve set up your format, all you need to do is fill in the specific details for each transaction. Here’s an example of what an editable payment request might look like:

Pro Tip: Once you’ve created a standard form that works for your business, save it as a master document so you can easily modify it for each client. This approach ensures that all your payment requests have a uniform, professional look. When to Use a Simple Payment RequestIn certain situations, keeping your billing documents straightforward and uncomplicated can be the most efficient approach. A simple structure is ideal for small transactions, one-off services, or when working with clients who require only basic information. This type of document ensures clarity without overcomplicating the process, making it easier for both parties to understand the payment terms and proceed quickly. 1. Small or One-Time TransactionsWhen dealing with smaller, one-time projects or occasional services, a simple payment request is often sufficient. For example, if you’ve provided a quick service like a consultation or a small design task, a basic format that includes a description, cost, and payment details may be all that’s necessary. This approach saves time for both you and your client, while still maintaining a professional tone. 2. When You Don’t Need Detailed ItemizationIf the work you’re invoicing for doesn’t require a breakdown of individual tasks or hours, a simple document can suffice. For example, when providing a flat-rate service, listing the total amount with a brief description of the work done is often enough. This type of document is particularly useful for freelancers or businesses offering fixed-price services. 3. Regular Clients with Established TrustFor repeat clients who are familiar with your pricing and processes, you may not need to go into great detail with each request. A simple structure is often all that’s required for ongoing services or established relationships. This not only speeds up the billing process but also makes it easier for clients to recognize and process the payment. 4. When Speed is a PriorityIf time is of the essence, keeping your payment request concise can help you get paid faster. A simple structure means less time spent on formatting and more time spent on completing your work. This is particularly helpful when you need to issue a payment request quickly, whether for a short-term project or an urgent service. Pro Tip: While simplicity is important, don’t forget to include the essential details, such as the payment amount, due date, and your contact information, to avoid confusion or delays. Legal Requirements for Payment RequestsWhen issuing a payment request, there are certain legal obligations that businesses must adhere to in order to ensure the document is compliant with local laws and regulations. These requirements may vary by country or region, but they typically include essential details that provide both parties with clarity and protection. Understanding these requirements is crucial to avoid potential legal issues or disputes down the line. 1. Clear Identification of the BusinessIt is essential to clearly identify the business issuing the request. This includes providing the legal name of the business, address, and contact information. In many jurisdictions, businesses are also required to include their tax identification number or VAT registration number, if applicable. This ensures that the document is traceable to the correct entity and complies with tax reporting requirements. 2. A Unique Reference NumberEach payment request should include a unique reference number for identification purposes. This number allows both the business and the client to easily track and reference the transaction. In many cases, it also serves as a way to keep accurate records for accounting or tax purposes. The reference number should be sequential and not reused for different requests. 3. Description of Goods or Services ProvidedTo avoid confusion, it is important to include a clear and detailed description of the goods or services provided. This may include the quantity, unit price, and any applicable discounts or fees. In some cases, businesses are required to provide additional details, such as the dates the services were performed or the products were delivered. This level of transparency helps prevent misunderstandings and supports the legal enforceability of the request. 4. Payment Terms and Due DateThe document should clearly state the payment terms, including the total amount due, the due date, and the preferred method of payment. Many jurisdictions require businesses to include specific language about payment deadlines and any late fees that may apply if the payment is not made on time. This ensures that both parties are aware of the financial expectations and helps to avoid future disputes. 5. Taxes and Other Applicable ChargesIf applicable, businesses must include the appropriate taxes (e.g., sales tax or VAT) that apply to the transaction. These charges should be itemized clearly, with the relevant tax rates specified. It is also important to outline any additional fees, such as shipping costs or service charges, to provide a complete and transparent account of the payment being requested. Pro Tip: Always stay up-to-date with the specific legal requirements in your jurisdiction, as laws regarding payment requests and tax regulations can change over time. Where to Find Quality Payment Request FormsFor those looking to streamline the billing process without creating a document from scratch, there are numerous resources available online that offer high-quality, customizable forms. These platforms allow users to access professionally designed documents that can be tailored to meet their business needs. Whether you’re a freelancer, a small business owner, or a large enterprise, finding the right form can save valuable time and effort while maintaining a polished and professional appearance. 1. Online Document LibrariesThere are many reputable online document libraries that offer a wide range of customizable billing forms. Websites such as Google Docs, Microsoft Office Templates, and other similar platforms offer easy-to-edit formats that can be accessed and filled in directly in your browser. These resources typically feature templates designed by professionals, ensuring a high standard of quality. You can find various styles, from basic forms to more complex ones, depending on your needs. 2. Specialized Websites for Business DocumentsSeveral websites focus specifically on providing business-related documents, including payment forms. These platforms often offer free access to a selection of templates, designed to be versatile and easy to adapt to various industries. Many of these sites also allow for downloading and saving documents in multiple formats, making it easy to customize and print when needed. Be sure to check reviews or ratings to ensure the quality of the forms before using them for official purposes. Pro Tip: Always make sure that the document you choose complies with local legal requirements to ensure accuracy and legitimacy in your transactions. |

||||||||||||