Free Invoice Document Template for Easy Customization

Managing finances efficiently is crucial for any business. One of the most important tasks is issuing payment requests that are clear, accurate, and easy for clients to process. Having a well-structured form can save you time and help maintain a professional image. Whether you’re running a small startup or a larger operation, using standardized documents can streamline your workflow and improve communication with customers.

Streamlined processes allow businesses to avoid errors and delays. When billing is organized, the chance of miscommunication or overlooked details is minimized. A consistent approach ensures all necessary information is included, such as services rendered, payment terms, and due dates. With the right format, you can focus more on growing your business rather than worrying about administrative tasks.

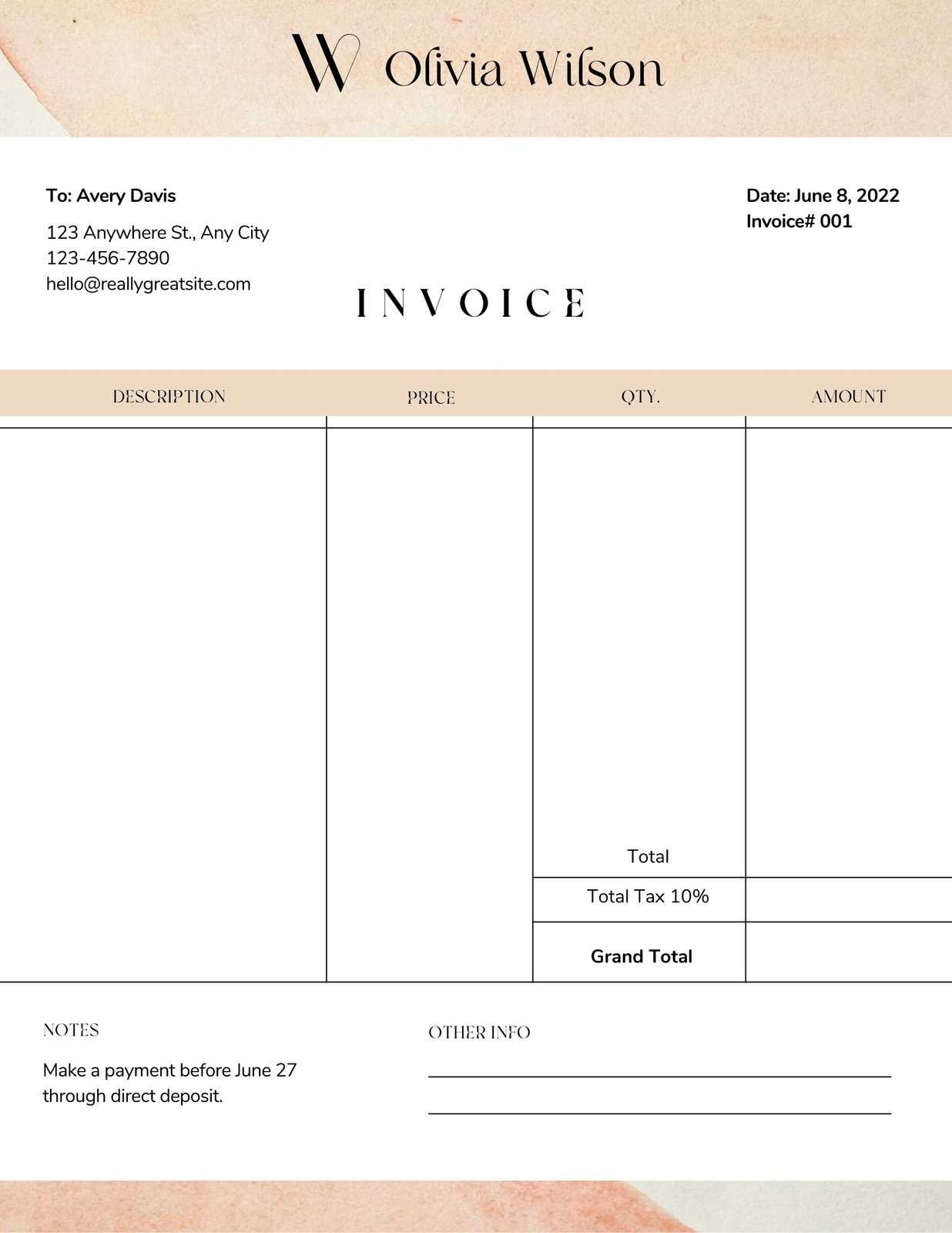

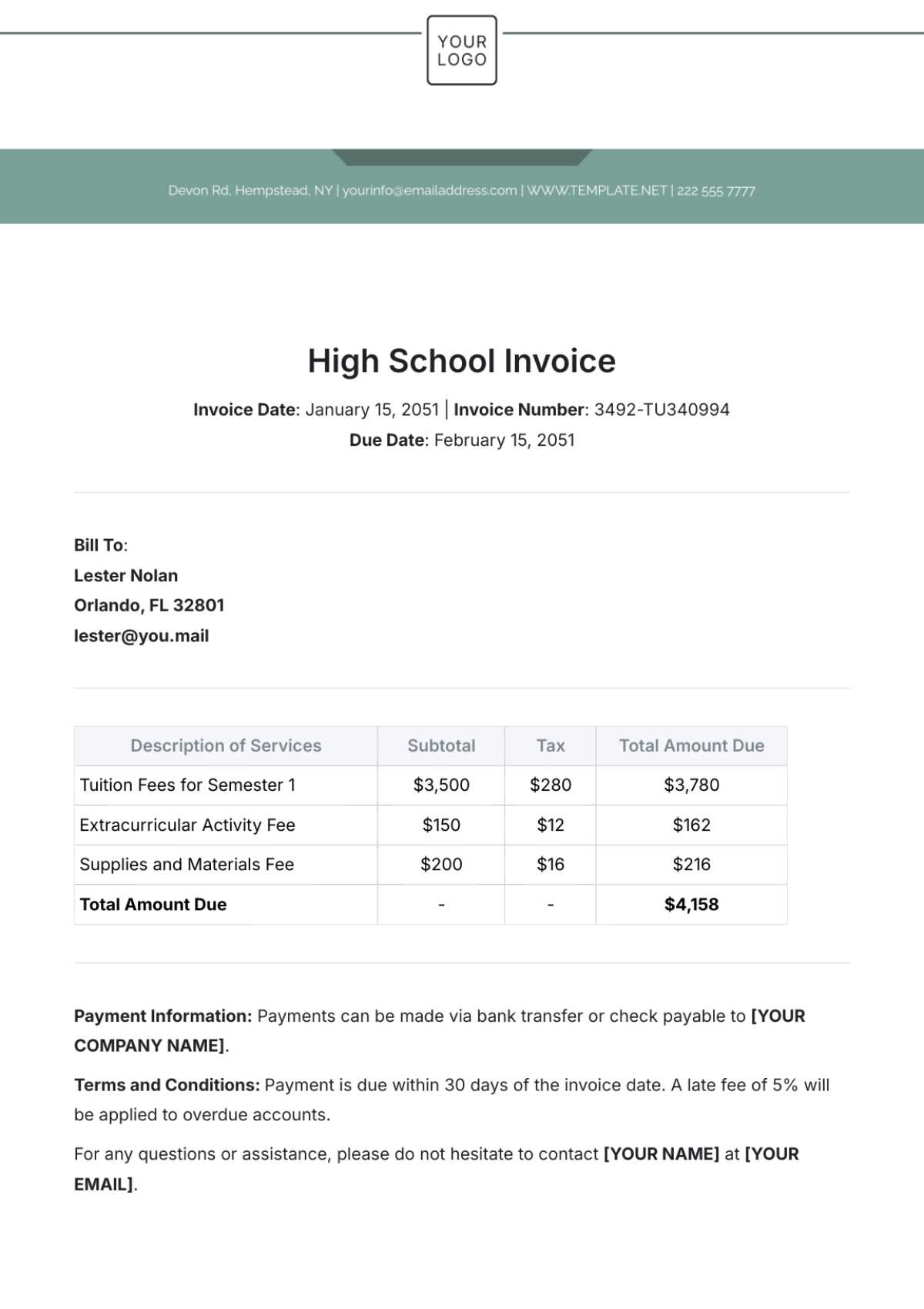

Customizing these forms to match your business style also enhances brand recognition. By adding your logo, colors, and business details, these forms become an extension of your company’s professional presence. Whether you are sending them digitally or in print, a cohesive look can leave a lasting impression on clients and partners alike.

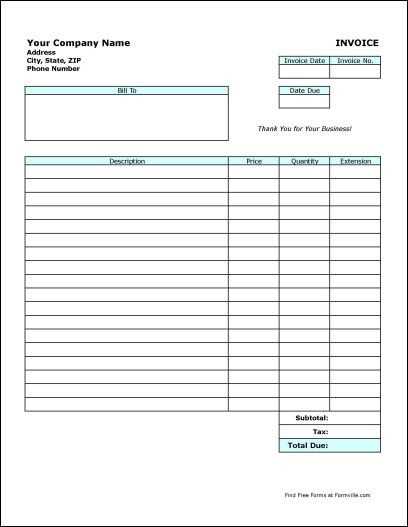

Free Invoice Document Template Overview

Having a well-designed billing form is essential for any business to maintain clear financial records. These forms provide a structured format to present charges, payment details, and other critical information in a consistent manner. By using pre-made layouts, companies can save time and ensure they meet all the necessary requirements without starting from scratch each time.

Pre-designed billing forms are especially useful for small businesses or freelancers who need to issue payment requests quickly. Instead of spending time creating custom documents, they can simply select a layout that suits their needs, add specific details, and send it to clients. This not only simplifies the process but also ensures that every request follows the same professional standard.

Customizable options are often included with these forms, allowing businesses to add their branding, adjust the layout, and personalize the content. This flexibility makes it easy to adapt the form to different industries, payment structures, and client needs while maintaining consistency. Whether you’re offering a one-time service or a subscription, a well-organized billing form is an essential tool for smooth business operations.

Benefits of Using Invoice Templates

Utilizing pre-designed forms for billing offers numerous advantages to businesses of all sizes. These forms not only help save time but also ensure consistency and accuracy in financial communication. By relying on a standard structure, companies can easily maintain professionalism, avoid errors, and streamline their administrative processes.

One of the primary benefits is the ability to speed up the invoicing process. Instead of creating a new document from scratch for each transaction, businesses can simply modify an existing layout to suit their needs. This saves valuable time and reduces the risk of overlooking important details.

Here are some additional benefits of using such forms:

| Benefit | Description |

|---|---|

| Consistency | Using a set format ensures all transactions follow the same structure, reducing confusion and maintaining a professional image. |

| Customization | Many pre-made forms allow for easy adjustments to match a company’s branding and specific needs, enhancing customer experience. |

| Legal Compliance | Standardized billing layouts often include key legal requirements, ensuring your forms meet regulations in your industry. |

| Efficiency | Quickly fill in essential details like services provided and payment terms, speeding up the entire billing process. |

How to Customize Your Invoice Template

Personalizing a billing form is a simple but effective way to make it more aligned with your brand and business requirements. Customization ensures that all necessary information is included in a clear, professional manner while reflecting the identity of your company. Adjusting pre-made layouts to your specific needs can be done in just a few easy steps, enhancing both the form’s functionality and visual appeal.

Basic Customization Steps

To begin, you should focus on the key elements that need to be adjusted in any layout. Here are some common modifications:

- Branding – Add your logo, company name, and contact details to make the form instantly recognizable.

- Design – Customize colors and fonts to match your brand’s visual style.

- Payment Terms – Adjust the payment conditions and due date according to your business model.

- Service Description – Make sure all the services provided are clearly listed with corresponding charges.

Advanced Customization Options

For a more advanced look, consider adding additional sections or features to better meet your needs. Some options to consider include:

- Itemized Lists – Break down the charges into specific items to make the billing process more transparent.

- Discounts – If applicable, include any discounts, promotions, or special offers.

- Payment Methods – Provide a list of accepted payment methods or bank account details.

- Legal Clauses – Add any necessary terms and conditions, such as late payment penalties or warranties.

By making these simple changes, you can create a billing form that not only serves its purpose but also reinforces your business’s professionalism and branding.

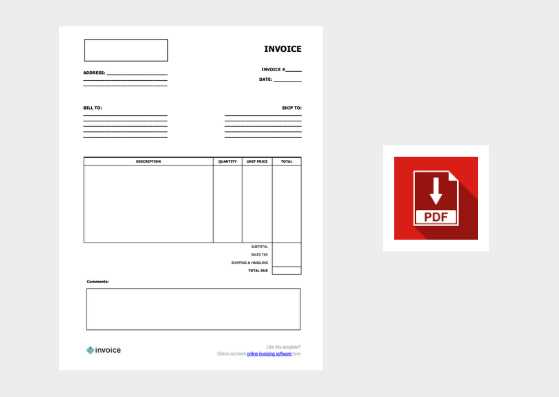

Where to Download Free Invoice Templates

Finding reliable sources for downloading pre-designed billing forms can help streamline your business operations. Many websites offer free layouts that can be easily adapted to suit your specific needs. These resources allow you to avoid starting from scratch, enabling you to focus more on your work while ensuring all necessary information is included in a professional manner.

Popular Websites for Downloading Billing Forms

Here are some reputable platforms where you can find various layouts ready for use:

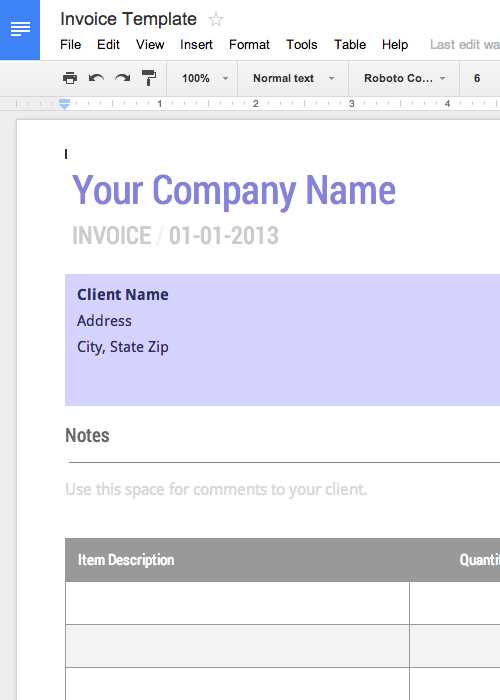

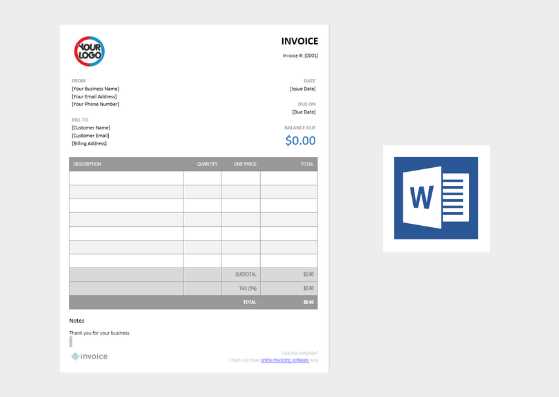

- Microsoft Office Templates – A wide range of customizable options for Word and Excel users, offering basic and advanced designs.

- Google Docs – Provides easy-to-edit forms that can be accessed from any device with an internet connection.

- Template.net – Offers multiple formats for different industries and provides a variety of styles to choose from.

- Canva – Known for its intuitive design tools, Canva lets you customize and download billing forms with ease.

Considerations When Choosing a Source

When selecting a platform, keep these factors in mind:

- File Compatibility – Ensure the format works with the software you use regularly (Excel, Word, PDF, etc.).

- Customization Options – Look for sources that offer enough flexibility to add your branding, change layouts, and adjust content.

- Ease of Use – Choose a platform with an intuitive interface that makes it easy to modify and download files quickly.

By exploring these options, you can find the perfect solution for creating professional billing forms in no time.

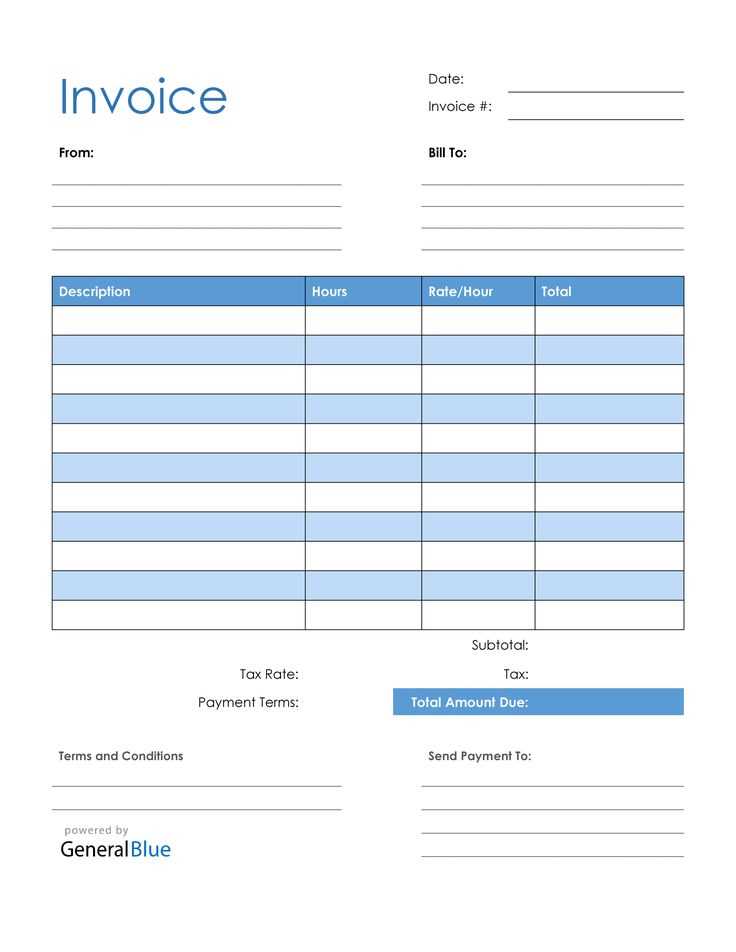

Common Invoice Template Formats Explained

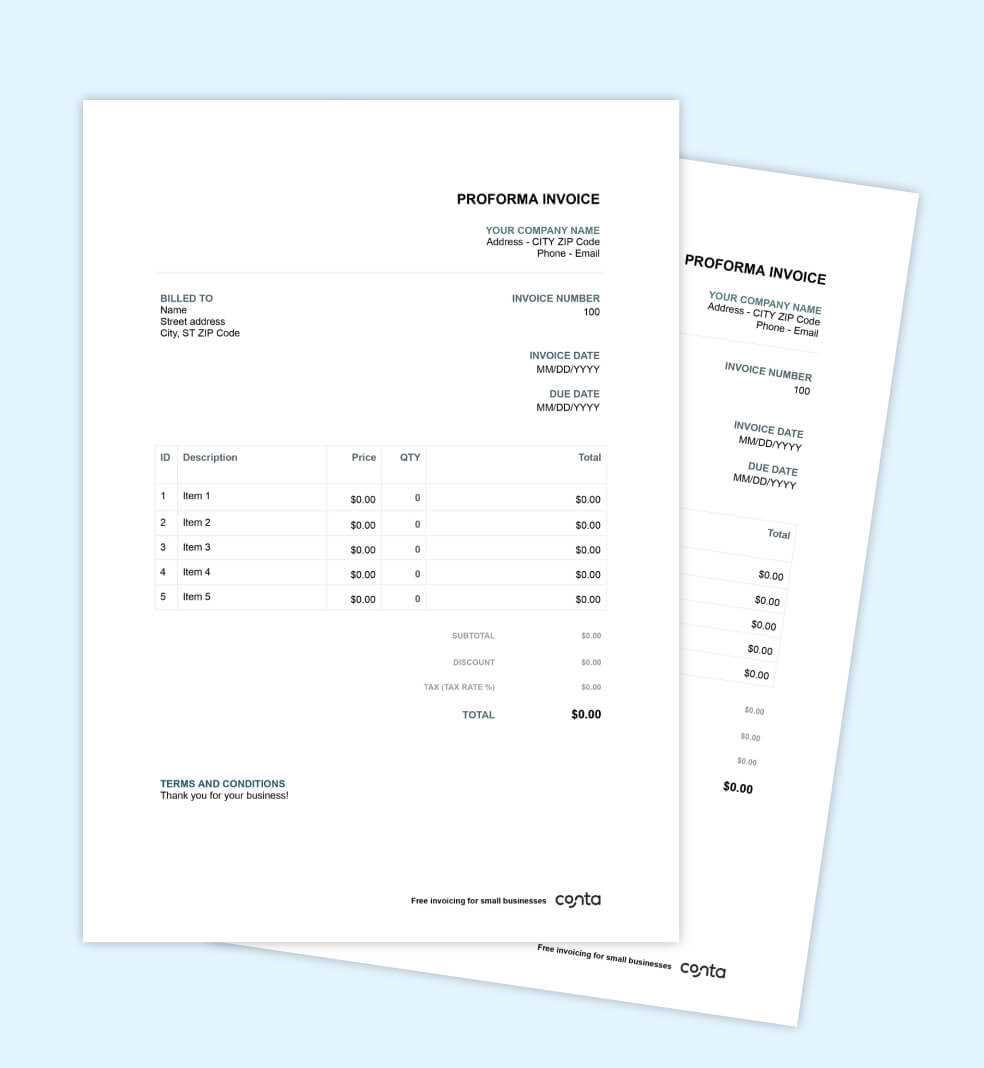

There are various formats available for creating professional billing records, each offering distinct features depending on the specific needs of businesses and freelancers. Understanding these different styles is crucial for ensuring clarity and accuracy in financial transactions. Here, we will explore the most commonly used formats and their key attributes, helping you choose the best option for your operations.

Each format serves a specific purpose and caters to different industries or preferences, ranging from simple designs to more detailed layouts. Let’s break down the most popular options.

| Format | Description | Best For |

|---|---|---|

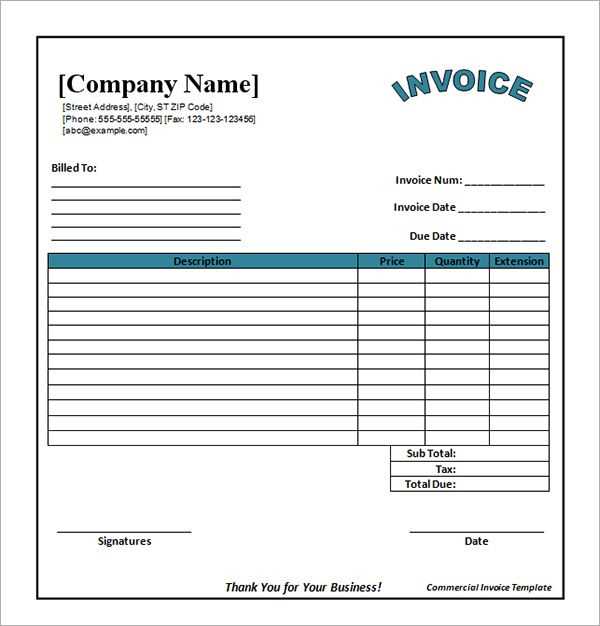

| Simple Layout | Features a clean and minimalistic design with basic fields like date, amount, and recipient details. Easy to create and understand. | Freelancers, Small businesses, and Startups |

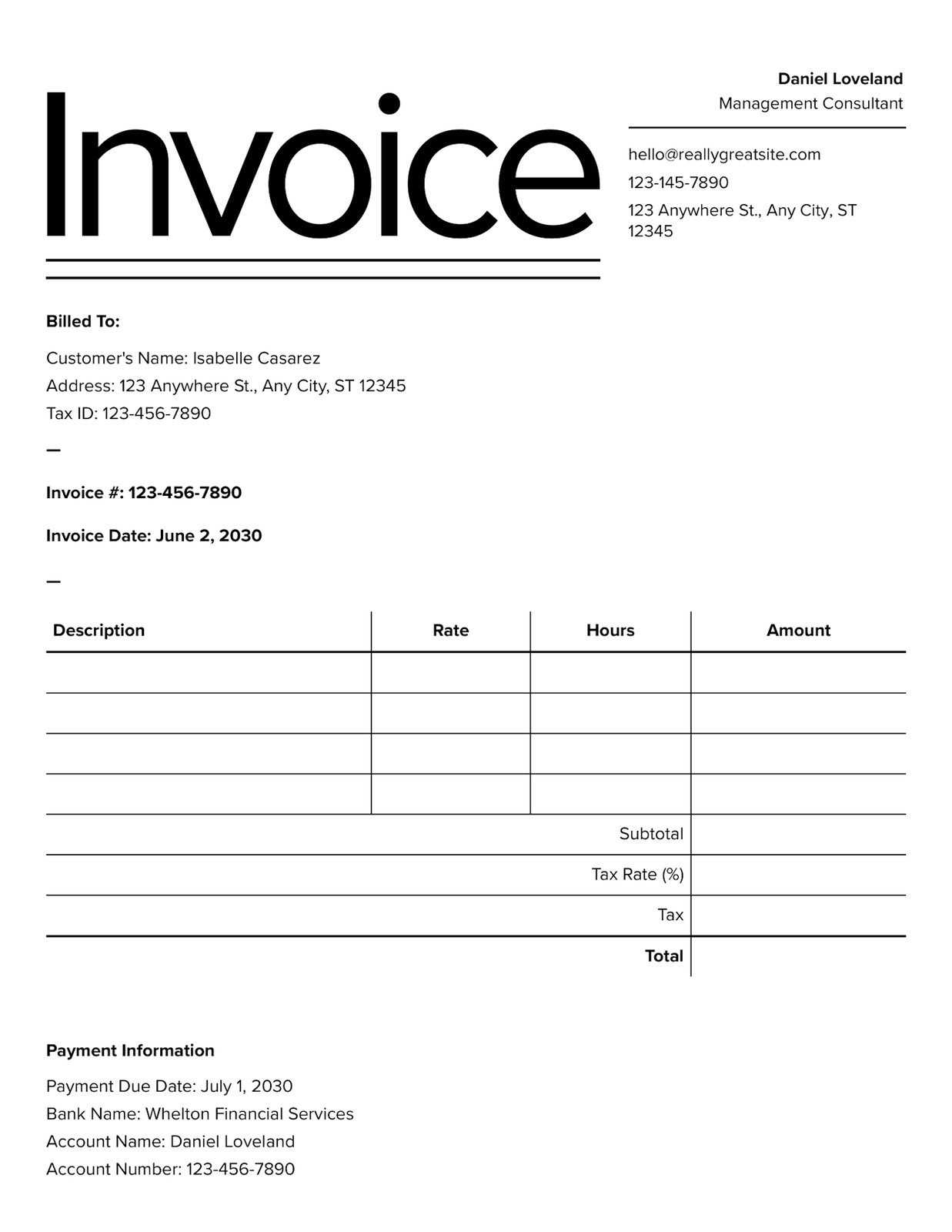

| Detailed Layout | Includes additional sections such as itemized lists, tax breakdowns, and payment terms. Often used for more complex transactions. | Consultants, Contractors, Large corporations |

| Customizable Format | Allows for personalized branding and flexible sections, offering more control over the design and structure. | Companies seeking a unique look, Online retailers |

| Professional Accounting Format | Contains advanced financial details such as balance due, overdue notices, and payment schedules. Typically used for accounting purposes. | Accountants, Law firms, Financial services |

Choosing the Right Template for Your Business

Selecting the appropriate format for billing can significantly impact how your company communicates with clients and manages financial transactions. The right choice helps maintain professionalism, ensures clarity, and saves time in day-to-day operations. Here are key factors to consider when making this important decision.

- Nature of Your Business: Different industries have unique requirements. A service-based business might need a simpler layout, while a company selling products may require itemized lists with tax calculations.

- Level of Customization: Consider whether you need a fully customizable design that reflects your brand or if a standard layout will suffice.

- Frequency of Use: If you regularly send out statements, a streamlined and easy-to-use design will save time. For less frequent transactions, a more detailed format might be appropriate.

- Client Expectations: Understand the preferences of your clients. Some may expect professional, detailed statements, while others may be fine with something simple and straightforward.

- Legal and Tax Requirements: Certain regions or industries require specific information to be included. Be sure to select a structure that supports these needs.

By considering these factors, you can choose the best layout that fits both your business operations and the expectations of your clients.

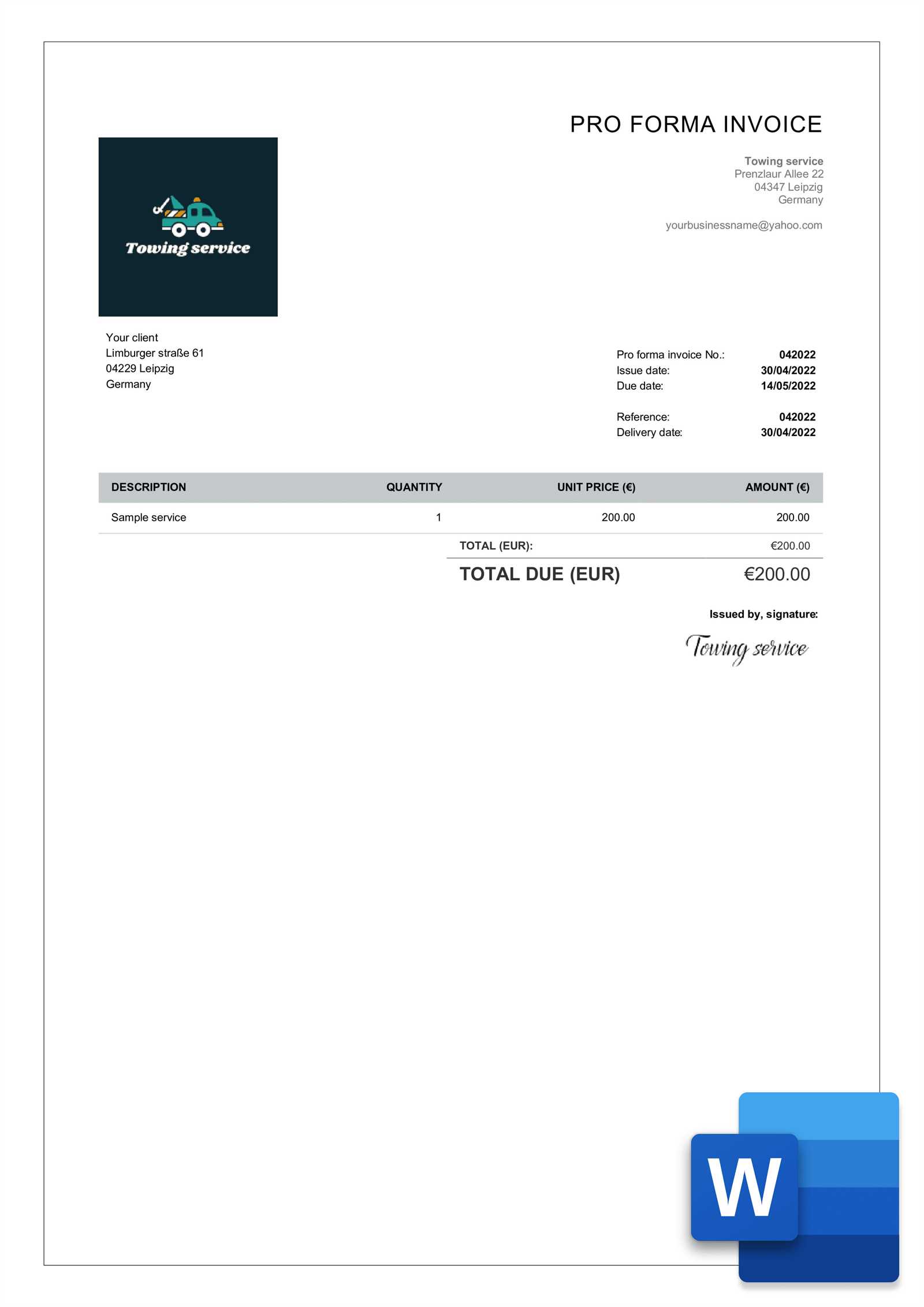

Key Elements of an Invoice Template

When creating a billing record, it is essential to include certain components that ensure accuracy and clarity. These key elements not only help streamline communication with clients but also provide all the necessary details for proper accounting and payment processing. Below are the main components that every well-structured billing format should contain.

Essential Information

The most fundamental aspects of any record are the identifying details. This section typically includes:

- Sender’s Information: Name, address, and contact details of the business or individual issuing the statement.

- Recipient’s Information: Name, address, and contact details of the client or customer being billed.

- Unique Identifier: A unique number or code for each record to help track payments and organize financial data.

Payment Details

To ensure a smooth transaction, it is crucial to include the following:

- Transaction Date: The date when the goods or services were provided, or when the payment is due.

- Itemized List: A breakdown of services or products provided, including their individual cost and quantities.

- Total Amount: The total amount due, including taxes, discounts, or additional charges, clearly stated at the bottom.

By ensuring these critical elements are present, you can help avoid confusion and streamline the payment process for both parties involved.

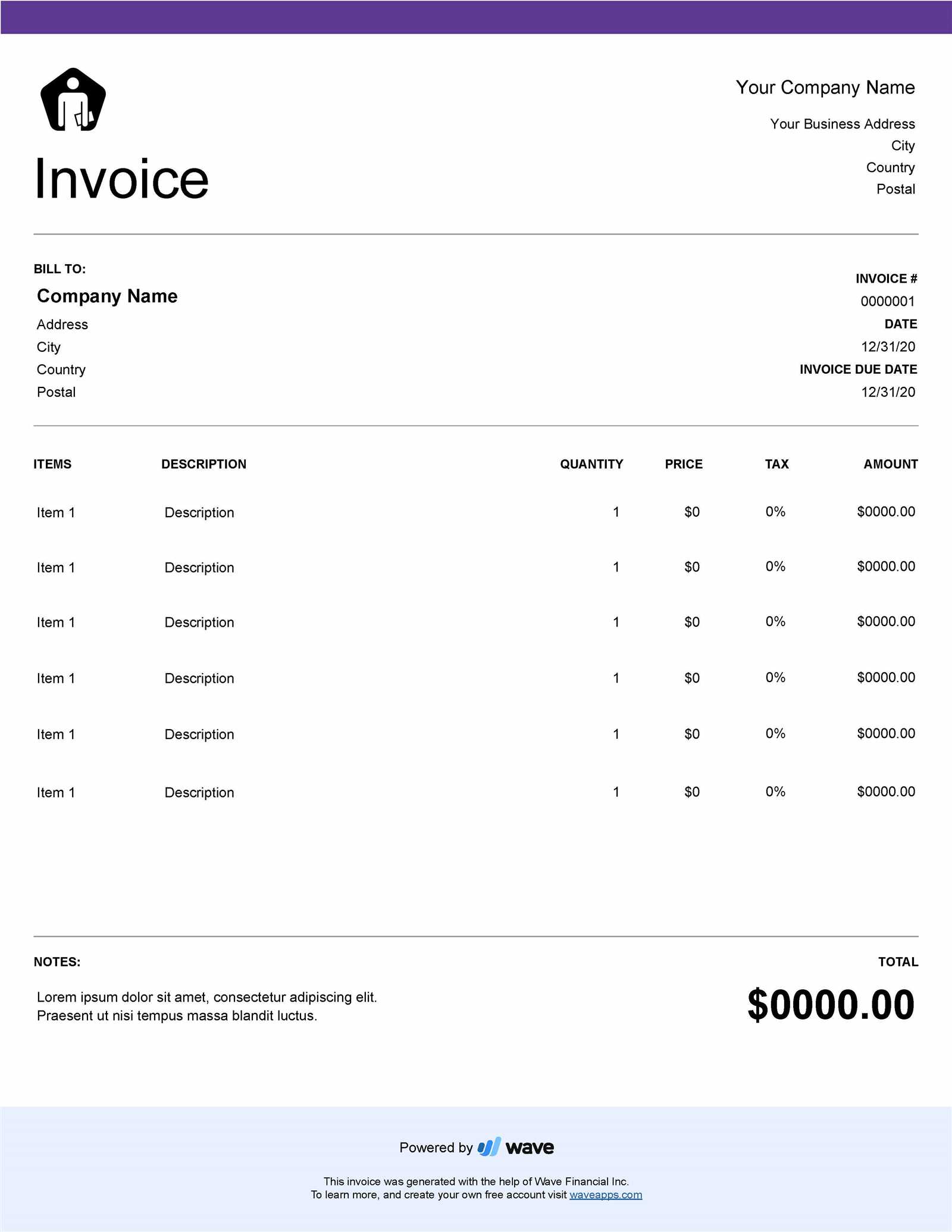

How to Add Your Branding to an Invoice

Personalizing your billing records with your company’s branding is an effective way to reinforce your identity and present a cohesive professional image. Customizing these documents not only helps build brand recognition but also creates a more polished and consistent experience for your clients. Below are a few key ways to incorporate your branding elements.

- Logo: Including your company logo at the top of the record makes it instantly recognizable. Ensure it’s placed in a prominent spot without overwhelming the content.

- Color Scheme: Use your brand’s colors for headings, borders, or background elements to maintain a visual connection with your company’s design language.

- Typography: Choose fonts that align with your brand’s style. Stick to one or two types to keep the layout clean and readable.

- Tagline or Slogan: If you have a brand tagline, adding it subtly can remind clients of your company’s values or unique offerings.

By thoughtfully integrating these elements, you can make your billing records not only functional but also an extension of your brand’s identity.

Why Invoice Templates Save You Time

Using pre-designed formats for your billing processes can greatly reduce the amount of time spent on administrative tasks. These ready-made structures allow you to focus on the core aspects of your business rather than spending time creating a layout from scratch. By streamlining the process, you ensure consistency, accuracy, and speed.

Efficiency in Repetitive Tasks

With a standardized structure in place, you eliminate the need to re-enter the same information repeatedly. The basic fields such as client details, payment terms, and services offered are already set, allowing you to quickly customize for each transaction.

Less Room for Errors

Consistency in format reduces the likelihood of mistakes. With a predefined layout, there’s less chance of forgetting important information or misplacing key data, ensuring that your records are both accurate and professional every time.

By adopting these formats, you save valuable time while maintaining a high level of organization and professionalism in your financial communications.

Free Invoice Templates vs Paid Options

When it comes to selecting a layout for your billing needs, you may encounter two primary choices: no-cost options and premium solutions. Both offer distinct advantages, but the right choice depends on your specific requirements. Below is a comparison to help you understand the key differences and determine which suits your business best.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization; often restricted to basic fields and layout. | Highly customizable with advanced features, allowing you to tailor the design to match your brand. |

| Design Quality | Basic or simple designs with minimal visual appeal. | Professional and polished designs, often created by experts for a more refined look. |

| Support | Limited or no customer support. Often community-driven help. | Access to customer service and technical support for troubleshooting and updates. |

| Additional Features | Basic fields and calculations, with little room for advanced features like tax calculations or integrations. | Advanced features such as automated calculations, integrations with accounting software, and more. |

| Updates | Updates are sporadic, and you may have to manually adjust templates to stay current with legal or industry changes. | Frequent updates, including adjustments for legal compliance and industry standards. |

Ultimately, choosing between no-cost and premium options comes down to your business needs. If you’re just starting out and require basic functionality, a no-cost option may suffice. However, for businesses seeking more professional features, customization, and ongoing support, paid solutions offer a significant advantage.

How to Handle Multiple Invoice Templates

Managing various billing formats can be challenging, especially when your business requires different layouts for distinct clients or services. Using multiple designs allows you to cater to specific needs but also introduces complexities in organization and consistency. Here’s how you can effectively manage and streamline the process.

1. Organize Templates by Category

First, categorize your billing formats based on the type of service or client. For instance, you might have one layout for product sales, another for consulting services, and a third for recurring subscriptions. Creating folders or digital tags for each category will help you quickly find the right format when needed.

2. Standardize Key Information

Despite using multiple layouts, it’s crucial to standardize key fields like client details, payment terms, and itemized descriptions. This consistency ensures that you don’t miss any important information, regardless of the format you’re working with. Set up templates with placeholders for each of these elements to save time.

3. Use Automation Tools

If you frequently need to generate multiple formats, consider using software that automates the process. Many tools allow you to create multiple templates and fill in relevant information with a few clicks. This eliminates the need to manually adjust the structure each time.

4. Maintain Flexibility for Customization

While it’s important to have a consistent structure, make sure your layouts allow for customization when necessary. Some clients might request specific details, and you should be able to modify the design to meet these needs without starting from scratch.

By implementing these strategies, you can maintain a high level of efficiency while managing different formats for your business, ensuring a smooth workflow and professional results every time.

Ensuring Legal Compliance with Your Invoices

Maintaining legal compliance in your billing practices is essential for both protecting your business and ensuring smooth financial transactions. Depending on your location, industry, and client base, there are specific regulations that govern the details you must include in your records. Below are key factors to consider when ensuring that your records align with legal requirements.

| Compliance Aspect | Required Information |

|---|---|

| Tax Identification | Tax ID numbers: Both your business and the client’s (if applicable) may need to be included, especially for cross-border transactions. |

| Legal Language | Payment Terms: Clearly state the payment terms, including due dates, late fees, and any other legal obligations related to payments. |

| Itemized Breakdown | Detailed Descriptions: List all products or services, including quantities, unit prices, and applicable taxes. This ensures transparency and compliance with tax regulations. |

| Tax Compliance | Tax Rates: Ensure that the correct tax rate is applied for your region and the nature of the transaction, and that it’s clearly stated on the billing record. |

| Digital or Physical Copy Requirements | Format: Depending on your jurisdiction, you may be required to provide either a physical or a digital version, or both, for legal purposes. |

By including these essential elements and staying up-to-date with local laws, you can help protect your business from legal issues and create trust with your clients. Regularly reviewing your billing practices is a proactive step toward compliance and professionalism.

How to Track Payments with Templates

Effectively managing payments is essential for any business, and using a standardized layout can help you stay on top of incoming funds. With the right structure, you can easily track which transactions have been completed, which are pending, and which may be overdue. Below are some tips on how to track payments using pre-designed formats.

- Include Payment Status: Add a field for payment status (e.g., “Paid”, “Pending”, “Overdue”) to quickly see the current state of each transaction.

- Set Clear Payment Terms: Define payment due dates, penalties for late payments, and accepted methods of payment. This will help you track whether clients are complying with the agreed terms.

- Use Unique Reference Numbers: Assign each record a unique identifier so you can easily reference and cross-check payments in your accounting system.

- Record Payment Dates: Ensure that each completed payment includes the date it was received, providing a clear timeline for when funds were transferred.

- Track Partial Payments: If clients make partial payments, ensure there’s a way to record the amount paid and the remaining balance, preventing confusion.

By incorporating these features into your formats, you can efficiently manage your accounts, reduce errors, and ensure timely payments. Consistent tracking will improve your cash flow and help you stay organized in the long run.

Printable vs Digital Invoice Templates

When choosing a layout for your billing needs, you may wonder whether to opt for a printable format or a digital version. Both options have their own advantages, depending on the nature of your business, your clients’ preferences, and your workflow. Here’s a comparison to help you decide which method works best for your operations.

Printable Formats

Advantages:

Printable formats are typically used when you need a hard copy for record-keeping, mailing, or physical signatures. They can be useful in industries that require physical documentation, such as construction, legal, or medical fields. Some key benefits include:

- Physical Record-Keeping: Easier to store and organize in filing cabinets for future reference.

- Paper Trails: Can be signed and physically delivered, which may be required for certain legal or contractual purposes.

- Client Preferences: Some clients may prefer to receive physical copies, especially in more traditional industries.

Digital Formats

Advantages:

Digital formats are increasingly popular due to their convenience, speed, and cost-efficiency. They are ideal for businesses that handle transactions online or use software for financial management. Key advantages include:

- Easy Sharing: Can be emailed instantly, reducing delivery time and costs.

- Automation: Digital formats can be automated for recurring transactions, saving time and effort on repetitive tasks.

- Environmental Benefits: Reduces paper waste and is more eco-friendly, aligning with sustainability efforts.

- Storage and Accessibility: Easy to store in the cloud and access from anywhere, making it more flexible for businesses on the go.

Ultimately, the choice between printable and digital formats depends on your business needs, client preferences, and the level of convenience you seek. Many businesses now use a combination of both, offering clients a choice between digital or physical versions depending on their needs.

Tips for Creating Professional Invoices

Creating a well-structured and clear billing statement is essential for maintaining a professional image and ensuring smooth financial transactions. A polished layout not only enhances your business credibility but also helps avoid misunderstandings with clients. Here are some practical tips to help you create professional and effective billing records.

1. Use Clear and Concise Language

Ensure that the language used in your record is straightforward and easy to understand. Avoid using jargon or overly complex terms that might confuse your clients. Include all necessary information without unnecessary details, focusing on clarity and precision.

2. Maintain Consistency in Layout

Consistency is key to professionalism. Use a uniform layout for all of your records to create a recognizable and cohesive look. This includes consistent font choices, spacing, and alignment. A clean, well-organized design allows your client to easily find essential details such as the total amount, payment terms, and due dates.

- Headers: Use bold, larger fonts for important sections like “Client Information” or “Payment Summary”.

- Itemization: If applicable, break down products or services clearly with line items that include quantities and rates.

- Payment Information: Ensure the payment methods, terms, and due dates are clearly visible to avoid confusion.

3. Incorporate Your Branding

Make sure your business branding, such as your logo and company colors, is incorporated into the design. This adds a professional touch and reinforces your brand identity. Keep the design minimalistic, avoiding any unnecessary embellishments that could distract from the key information.

By following these tips, you can create billing statements that are not only functional but also leave a positive, lasting impression on your clients.

Best Practices for Invoice Template Organization

Effective organization of your billing records is crucial for both efficiency and accuracy in your business operations. By keeping your layouts structured and easy to manage, you can quickly find the necessary details when needed, reduce errors, and ensure a smooth workflow. Here are some best practices to help you stay organized with your billing formats.

1. Categorize by Client or Service Type

To ensure that you can quickly locate the correct format for each transaction, categorize your layouts based on client types or services provided. For example, you might have separate formats for regular clients, one-time projects, or subscriptions. This makes it easier to tailor the details for specific needs and keep everything well-organized.

2. Implement a Standard Naming System

Consistency in file naming can significantly improve your ability to locate and track your records. Use a naming convention that includes the client name, date, and unique reference number. For example, “ClientName_YYYY-MM-DD_12345” allows for quick identification and sorting in your files or digital system.

3. Keep Version Control

When making updates or adjustments to your layouts, always save new versions separately and keep track of changes. Label each version with a clear descriptor, such as “V1” for the first version, “V2” for the second, and so on. This helps prevent confusion and ensures that you’re using the most up-to-date format at all times.

4. Use Cloud Storage for Easy Access

Store all your billing layouts in a cloud-based system for easy access and backup. Cloud storage allows you to organize formats into folders and subfolders by category, making it simple to retrieve the right format whenever needed. Additionally, cloud services provide security and the ability to access your files from multiple devices.

5. Keep a Template Bank

Maintain a master collection of all your formats in one central location. This “template bank” should include all the different variations and layouts you’ve created, organized by purpose or client. This helps you avoid the need to recreate a layout from scratch each time, saving you both time and effort.

By implementing these organizational strategies, you can ensure that your billing processes are streamlined, professional, and easy to manage, helping you stay on top of your financial tasks.

Common Mistakes to Avoid with Invoices

When creating billing records, small errors can lead to significant issues, from delayed payments to damaged client relationships. Avoiding common mistakes ensures that your financial documents are professional, accurate, and effective. Here are some of the most frequent pitfalls and how to prevent them.

1. Missing or Incorrect Contact Information

Always double-check that both your business and the client’s contact details are accurate. Incorrect or missing contact information can delay communication and cause confusion when it’s time for payment. Ensure that names, addresses, and phone numbers are all properly listed.

2. Failing to Include a Clear Payment Deadline

One of the most common mistakes is not specifying a clear due date for payment. Without a defined timeline, clients may not prioritize timely payment. Always include a specific payment due date and outline any late fees or penalties for overdue payments.

3. Overlooking Itemized Details

Failing to provide a clear breakdown of products or services can lead to misunderstandings. Itemized lists make it easier for clients to understand exactly what they are being charged for. Always include detailed descriptions, quantities, rates, and taxes when applicable.

4. Incorrect or Missing Tax Calculations

Not calculating taxes correctly or failing to include them can lead to legal issues. Double-check that the right tax rates are applied for your location and the type of goods or services provided. If applicable, specify the tax amount separately to avoid confusion.

5. Using an Unprofessional Layout

A cluttered or unprofessional layout can make your records appear unorganized and may create a negative impression with clients. Always use a clean, easy-to-read layout that presents all the necessary information in a structured way.

6. Forgetting to Include a Unique Reference Number

Not using a unique reference number for each billing statement can make it difficult to track payments and identify specific transactions. Always assign a unique identifier to each record, which will help with tracking and organization.

Avoiding these mistakes ensures that your financial records are clear, accurate, and professional, which can help you maintain positive relationships with clients and keep your business running smoothly.

How Invoice Templates Help Small Businesses

For small businesses, managing finances efficiently can be a challenging task. Having a consistent and professional way to record transactions can save time, improve cash flow, and minimize errors. Pre-designed layouts are an effective tool that can simplify this process, offering structure and consistency to everyday billing tasks.

1. Time and Cost Efficiency

By using pre-made formats, small business owners can avoid starting from scratch each time they need to send a payment request. With a ready-to-use layout, all necessary fields such as client details, payment terms, and service descriptions are already in place. This not only saves time but also reduces the risk of missing critical information, which could cause delays or misunderstandings.

2. Improved Professionalism

Using a standardized, well-organized format helps small businesses present themselves in a more professional light. Clients are more likely to take businesses seriously when they receive clear, well-structured payment requests. A consistent appearance also reinforces your brand, as you can customize layouts with your business logo, color scheme, and other personalized details.

Ultimately, using structured billing formats helps small businesses stay organized, ensuring that they maintain clear records, improve client communication, and enhance their overall efficiency. With fewer administrative burdens, small business owners can focus more on growth and customer satisfaction.