Free Invoice Book Template for Easy Billing and Tracking

Managing financial transactions efficiently is crucial for any business, whether large or small. Using well-organized documents that record payments and charges can help streamline the process, ensuring clarity and reducing errors. Many professionals seek simple yet effective solutions to handle their billing and payment tracking needs.

One of the best ways to address this is by utilizing ready-made, editable formats that allow for quick customization. These practical resources can save time and effort by providing a structured layout, making it easy to input relevant details, calculate totals, and maintain accurate records. They can be tailored to suit various industries and business sizes, offering both flexibility and convenience.

With the right tool, the process becomes not only faster but more reliable, helping you stay on top of finances while focusing on other aspects of your operations. Whether you’re a freelancer or managing a growing business, implementing a well-organized system can simplify your workflow and improve professionalism.

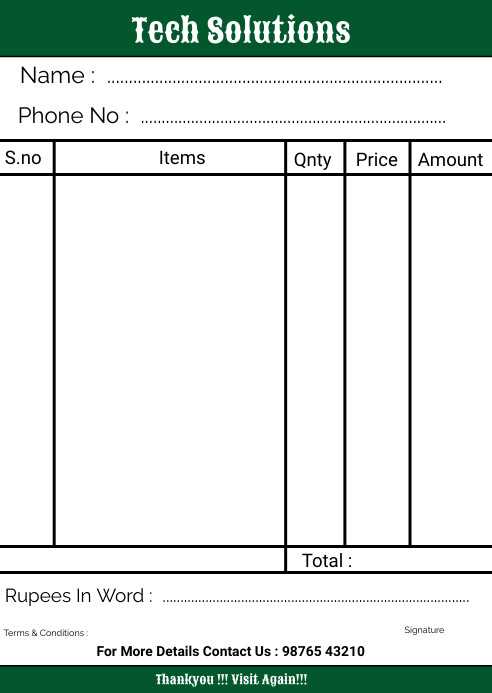

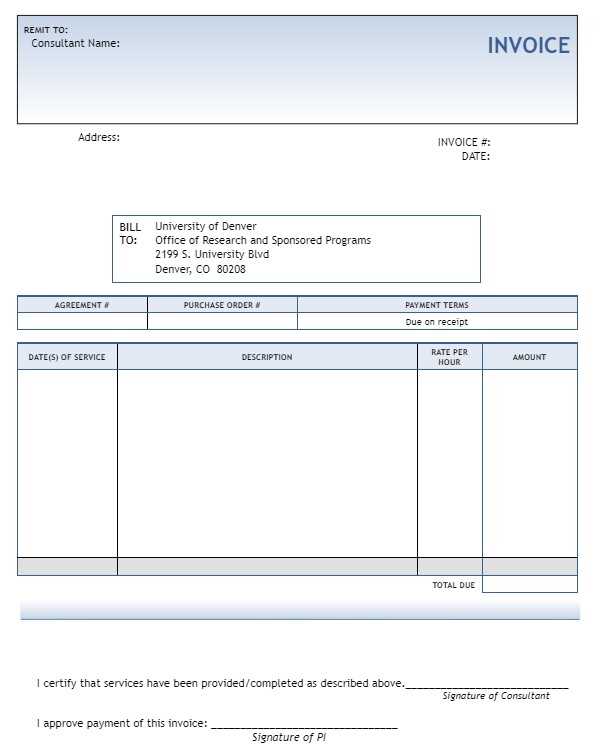

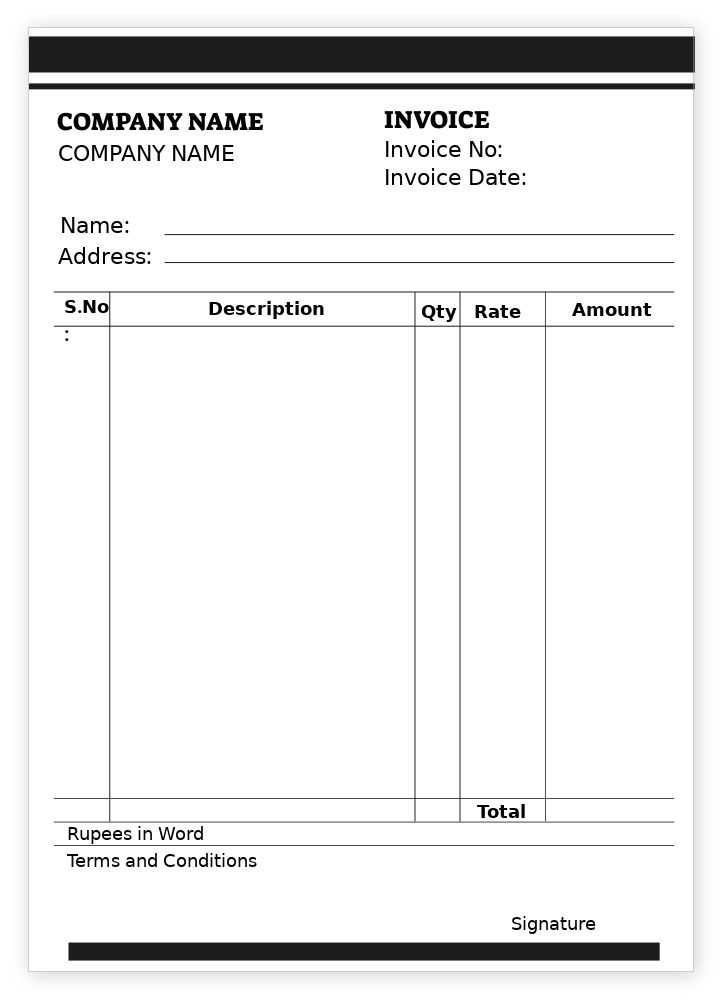

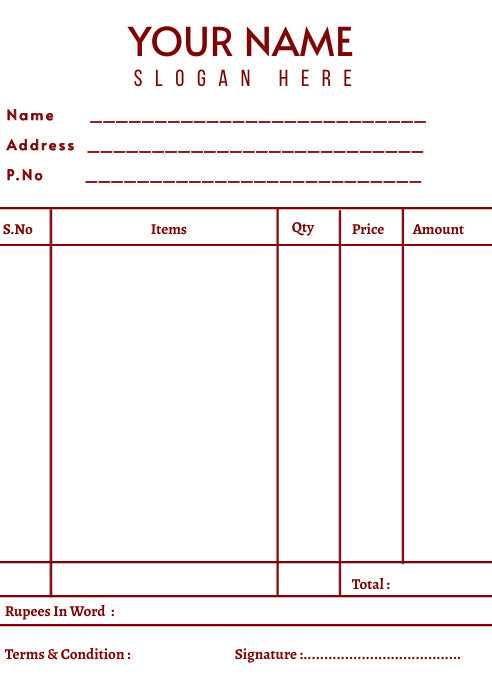

Free Invoice Book Template Overview

Managing financial records efficiently is key to maintaining a smooth workflow for any business. A well-structured document to track transactions helps keep things organized, ensuring timely payments and accurate financial reporting. Having access to customizable options can significantly improve the ease of handling such tasks, especially for entrepreneurs and small business owners.

These editable resources provide a reliable solution for recording charges, payments, and client details. Their primary function is to create a standardized format that can be quickly filled in, reducing the time spent on each individual record while keeping everything consistent. Here’s an overview of what these resources typically offer:

- Customizable Layouts: Choose a format that suits your business style and needs.

- Easy Tracking: Keep a clear record of all financial transactions.

- Flexibility: Modify details for each transaction with ease.

- Professional Appearance: Enhance your business’s credibility with polished, organized documents.

- Time-saving: Quickly input necessary details without starting from scratch each time.

These resources are ideal for those who want to focus on growing their business without getting bogged down in manual documentation. They are easy to use, accessible, and effective in creating well-organized financial records that can be easily referenced or shared when needed.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for tracking financial transactions offers numerous advantages for businesses of all sizes. These resources help streamline the administrative process, ensuring that crucial details are captured accurately and consistently. By adopting such solutions, businesses can maintain a high level of organization and efficiency in their daily operations.

One of the main benefits is time-saving. With a ready-made structure, you no longer need to create each document from scratch. Simply fill in the relevant information, and the rest is taken care of. This not only speeds up the billing process but also ensures that each document adheres to a professional format.

- Consistency: Maintain uniformity across all records, reducing the risk of errors.

- Easy Customization: Tailor the format to suit your specific needs and business style.

- Professionalism: Provide clients with polished, well-organized documents that enhance your credibility.

- Accuracy: Reduce human error with predefined sections for each key piece of information.

- Convenience: Access and edit the documents at any time, from anywhere, ensuring flexibility in your workflow.

These benefits make using such resources a smart choice for business owners looking to simplify their processes, improve accuracy, and present a more professional image to clients and partners.

How to Download Invoice Book Templates

Getting started with ready-made document formats is simple and efficient. Many online platforms offer a wide range of options, from basic layouts to more specialized designs, catering to different business needs. By following a few straightforward steps, you can easily download and start using these resources for your financial tracking.

Step 1: Find a Trusted Source

The first step is to identify a reliable website that offers high-quality, customizable document formats. Look for platforms that provide a variety of styles and formats to ensure you find one that suits your business requirements. Ensure that the website is reputable and offers secure downloads to avoid any issues with malware or unreliable files.

Step 2: Select the Right Format

Once you’ve found a trustworthy source, browse through the available options and choose the format that fits your needs. Many platforms offer different variations, such as simple designs or more detailed layouts with additional sections. Make sure the format is compatible with the software you plan to use, such as Excel, Google Sheets, or PDF editors.

Tip: Always check the customization options before downloading to ensure the document can be easily adjusted to fit your specific needs.

After selecting and downloading the appropriate file, you’ll be ready to start adding your own details. The ease of downloading and customizing these resources allows you to quickly implement an efficient system for tracking transactions and managing financial records.

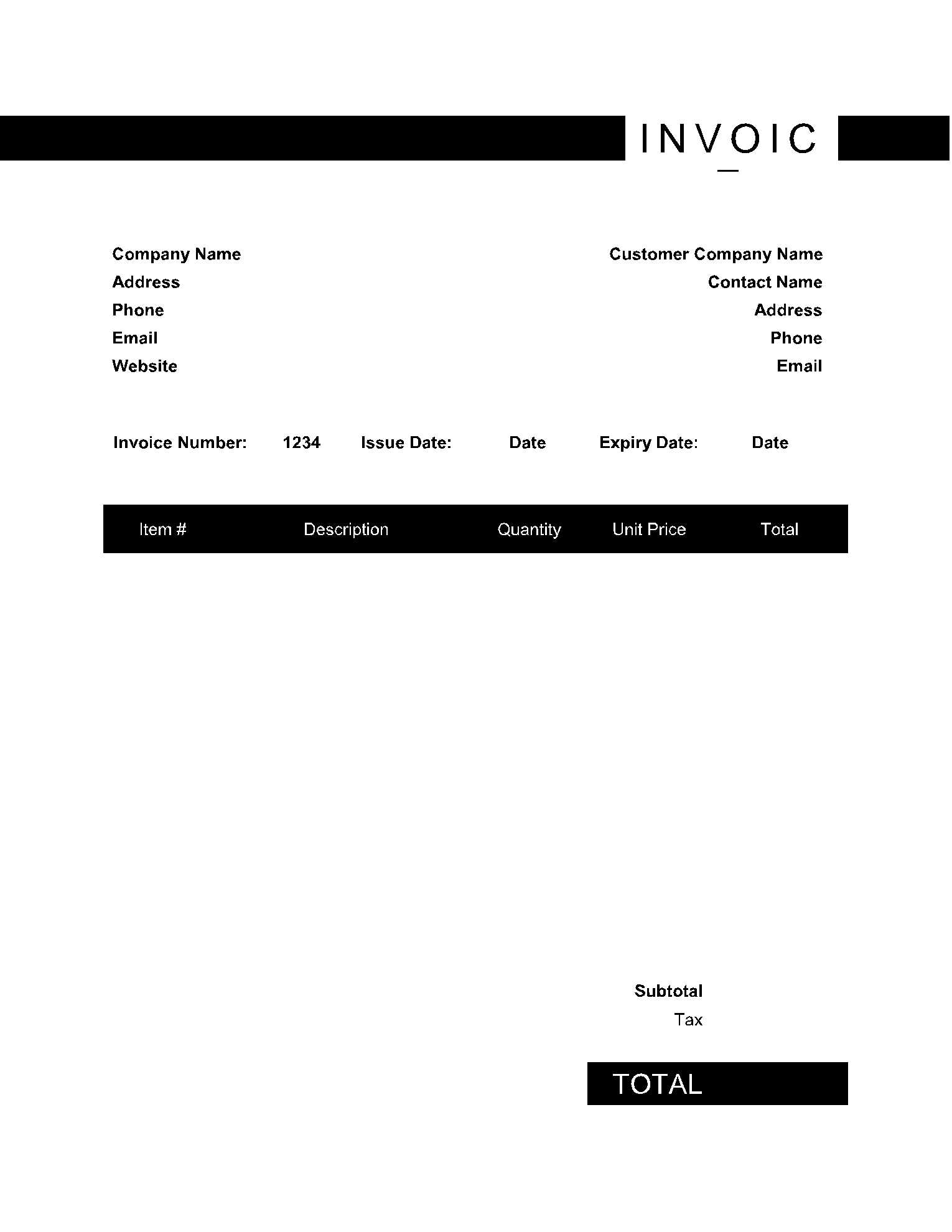

Customizing Your Invoice Book Template

Personalizing your document layout is essential to make it align with your business needs. Customization allows you to adjust the format, structure, and design, ensuring it reflects your brand identity and provides the necessary fields for tracking financial details effectively. With a few simple modifications, you can create a system that works specifically for your workflow.

Step 1: Adjust the Layout and Design

The first step in customization is modifying the layout to suit your preferences. You can adjust margins, fonts, and overall formatting to match your business style. Many users prefer to add their logo, company name, and contact details at the top to make the document more professional. You can also choose colors and fonts that align with your brand’s aesthetic.

Step 2: Add or Remove Fields

Next, review the predefined sections of the document and modify them based on your specific needs. You may need to add extra fields for detailed information or remove unnecessary sections that don’t apply to your business. This ensures that every transaction record includes only the relevant data, making the process smoother and more accurate.

Tip: Ensure that essential fields like the date, client information, amounts, and due dates are clearly visible and easily accessible for quick referencing.

Once customized, your document will not only meet your business’s requirements but also convey a more professional appearance to clients and partners. Customizing these resources enables better control over your financial records while enhancing efficiency in your daily operations.

Free vs Paid Invoice Templates

When choosing a document format to track financial transactions, businesses often face the decision between using no-cost options or investing in premium designs. Both choices come with their own set of advantages and limitations. Understanding the differences between free and paid resources can help you make an informed decision based on your specific needs and budget.

Advantages of Free Resources

Free options provide a low-barrier entry for small businesses or individuals who may not have the budget for premium resources. These resources often include basic layouts with essential fields for recording payments and charges. While they may be simple, they are a suitable choice for businesses just starting out or those with minimal invoicing needs.

Advantages of Paid Resources

On the other hand, paid options typically offer more advanced features and greater flexibility. These resources often come with customizable designs, additional sections, and tools that can integrate with other software. Businesses that need more sophisticated features, like recurring billing or detailed financial reporting, may find paid formats to be a worthwhile investment.

| Feature | Free Options | Paid Options |

|---|---|---|

| Design and Customization | Basic layouts with limited customization | Fully customizable with advanced design options |

| Advanced Features | Minimal features, often no integrations | Advanced features like automation, reporting, and integration |

| Support | Community support or none | Dedicated customer support and resources |

| Cost | No cost | Requires payment or subscription |

Ultimately, the choice depends on the complexity of your business and the volume of transactions you need to handle. If you’re a small business with straightforward needs, a free option might be sufficient. However, as your business grows or if you require more specialized features, investing in a paid solution may be the better choice for long-term efficiency and scalability.

Choosing the Right Invoice Format

Selecting the appropriate document structure for managing financial records is essential for ensuring smooth operations and accurate tracking. The format you choose should meet the specific needs of your business while providing flexibility and ease of use. With a variety of options available, it’s important to consider factors such as simplicity, functionality, and compatibility with your business processes.

Here are some key factors to consider when selecting the right layout:

- Business Type: Consider the nature of your work. Freelancers may need a simple layout, while larger businesses might require more detailed sections for multiple line items, taxes, or discounts.

- Customization: Choose a design that allows you to easily personalize it with your company logo, contact details, and other important information.

- Features: Look for formats that include essential sections like payment terms, itemized charges, and due dates. Some formats also include advanced options like tax calculations or digital signatures.

- Software Compatibility: Ensure that the format works with the software you are comfortable using, such as Excel, Google Sheets, or PDF editors.

- Ease of Use: The layout should be easy to navigate and fill in quickly, without unnecessary complexity.

Ultimately, the right structure will depend on your specific business needs, transaction volume, and how much detail you want to include in each record. A well-chosen format helps maintain professionalism, organization, and efficiency in managing payments and client interactions.

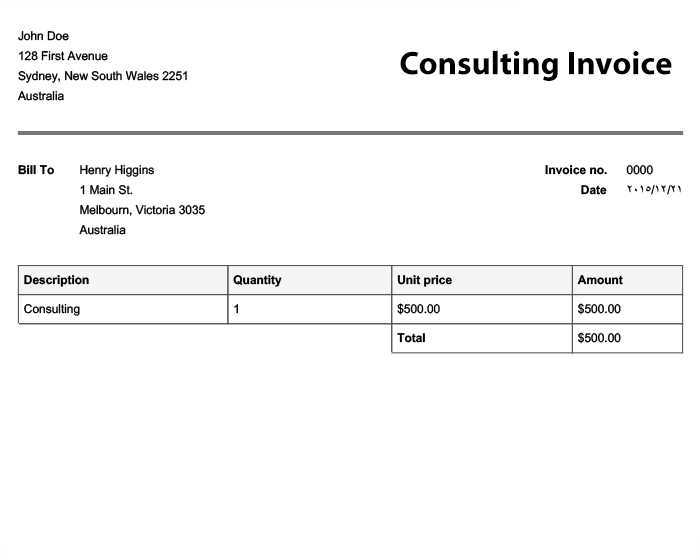

Common Invoice Template Features

When selecting a layout for tracking financial transactions, certain features are essential for ensuring the document is comprehensive, professional, and easy to use. These features help streamline the process of recording charges and payments, while also providing clarity and structure. Most document layouts include several key elements to make the transaction record complete and organized.

Key Elements in Financial Documents

- Business Information: This section typically includes your company’s name, address, phone number, and email. It helps establish your business’s identity and ensures clients can contact you easily.

- Client Information: The recipient’s details, including their name, address, and contact information, are crucial for identifying who the payment is due from.

- Unique Identifier: Each document should have a unique number or code for easy tracking and reference in case of future inquiries.

- Itemized List: A clear breakdown of the products or services provided, including descriptions, quantities, unit prices, and totals, is essential for transparency.

- Payment Terms: This includes the due date for payment, any applicable late fees, and payment methods accepted, ensuring both parties are on the same page regarding terms.

- Subtotal, Taxes, and Total: A clear summary of the subtotal, taxes applied, and final amount due helps avoid confusion and ensures accurate calculations.

Optional Additional Features

- Notes or Instructions: A section for special instructions or messages to the client, such as reminders for payment or additional details about the transaction.

- Discounts or Coupons: If applicable, this area outlines any discounts provided, helping to clarify the final price adjustment.

- Payment Methods and Bank Details: Providing payment methods, including bank account details or online payment links, simplifies the process for your clients.

These common features ensure that the document not only serves as a clear record of the transaction but also enhances professionalism, making the process easier for both businesses and clients alike.

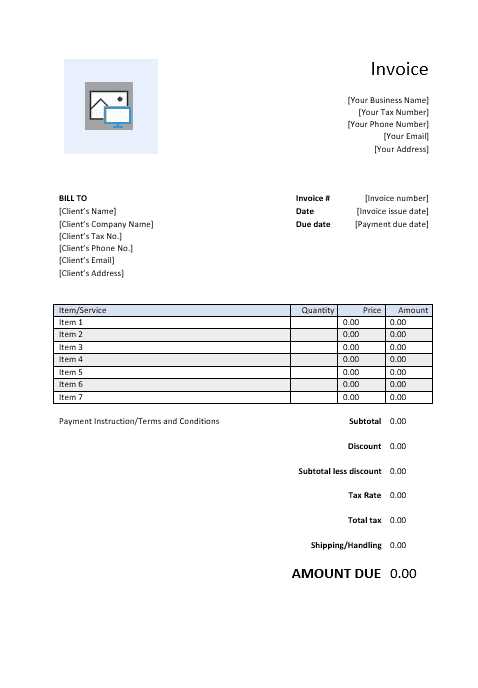

Steps to Create Professional Invoices

Creating well-structured and professional transaction records is key to maintaining a smooth business operation. A clear and concise document not only helps you get paid promptly but also enhances your credibility with clients. Below are the essential steps to ensure your transaction records are accurate, professional, and easy to process.

Step 1: Include Business and Client Information

The first section of any financial document should include both your business and your client’s contact details. This ensures that there is no confusion about who is issuing the record and who is the recipient.

- Business Details: Include your company name, address, phone number, and email address.

- Client Information: Add the name, address, and contact details of the client receiving the document.

Step 2: Add a Unique Document Number

Each record should be assigned a unique reference number to help both parties easily track payments and manage their records. This also aids in organizing and referencing past transactions if necessary.

Step 3: List the Products or Services Provided

Next, include a detailed description of the items or services provided. Be specific about quantities, prices, and any applicable discounts.

- Description: Clearly explain what was provided or completed.

- Quantity and Unit Price: Include the number of items or the time spent on services along with the price per unit.

- Total Cost: Provide a clear total for each item or service listed.

Step 4: Include Payment Terms

Set clear expectations by outlining the payment terms. This includes specifying the due date, accepted payment methods, and any late fees that may apply if the payment is delayed.

- Due Date: Clearly state when the payment is expected.

- Late Fees: If applicable, include information on penalties for late payments.

- Payment Methods: Mention the available ways for clients to pay (e.g., bank transfer, credit card, or online payment systems).

Step 5: Double-Check for Accuracy

Be

Best Practices for Invoice Organization

Effective management of financial records is essential for smooth business operations. Organizing these documents in a consistent, efficient manner helps ensure timely payments, reduces errors, and simplifies record-keeping for future reference. By adopting best practices for organizing your records, you can improve workflow and maintain accuracy in your accounting system.

Key Organization Strategies

- Use a Consistent Naming System: Give each document a unique and easily identifiable name, such as a combination of client name and date. This helps you find specific records quickly when needed.

- Maintain Separate Folders: Keep separate folders for each year or client, depending on the volume of transactions. This reduces the time spent searching for documents and helps in organizing financial reports.

- Track Payments and Due Dates: Set up a system to track payments and due dates to prevent missed or delayed payments. This could be done through a simple spreadsheet or accounting software.

- Keep Digital and Physical Copies: While digital files offer convenience, maintaining physical copies in a safe place may be necessary for legal or tax purposes.

Organizing Financial Records Efficiently

Once you’ve established a naming system and organizational structure, consider additional ways to improve your workflow:

| Method | Benefit |

|---|---|

| Use Accounting Software | Automates the tracking process, making it easier to manage transactions and generate reports. |

| Regularly Back Up Digital Files | Protects your data in case of system failures and ensures you have access to important documents at all times. |

| Reconcile Accounts Monthly | Helps spot discrepancies early and ensures your records match the bank statements or payment systems. |

By implementing these organizational strategies, you will be better prepared to manage your financial records efficiently, reduce the likelihood of errors, and improve overall business operations.

Managing Multiple Invoices Efficiently

Handling numerous financial documents can be challenging, especially when dealing with various clients and projects. An efficient management system is crucial for maintaining accuracy, ensuring timely payments, and providing a clear overview of outstanding balances. By adopting effective strategies, you can streamline the process and reduce the administrative burden associated with managing multiple accounts.

Establishing an Organized Workflow

To manage multiple financial records effectively, it’s important to create a structured workflow that allows for easy access and tracking. Here are some strategies to consider:

- Create a Centralized System: Utilize accounting software or a dedicated spreadsheet to centralize all records. This ensures that all information is in one place, making it easier to track payments and outstanding amounts.

- Set Up Client Folders: Organize documents by client, creating a folder for each one that contains all relevant records. This can help you quickly access information specific to each client when needed.

- Implement a Color-Coding System: Use colors to differentiate between paid, unpaid, and overdue accounts. This visual cue allows for quicker identification of statuses at a glance.

Regular Review and Follow-Up

In addition to organizing your records, regular reviews and proactive follow-ups are essential for maintaining efficiency:

- Schedule Routine Checks: Set aside time weekly or monthly to review accounts. This helps identify any discrepancies or outstanding payments that need attention.

- Automate Reminders: Use reminders for follow-ups with clients regarding payments. Automated notifications can significantly reduce the need for manual tracking.

- Maintain Open Communication: Foster strong relationships with clients through clear communication. This can facilitate prompt payments and help resolve any issues quickly.

By implementing these practices, you can effectively manage multiple financial documents, streamline your workflow, and ensure that your business operations run smoothly.

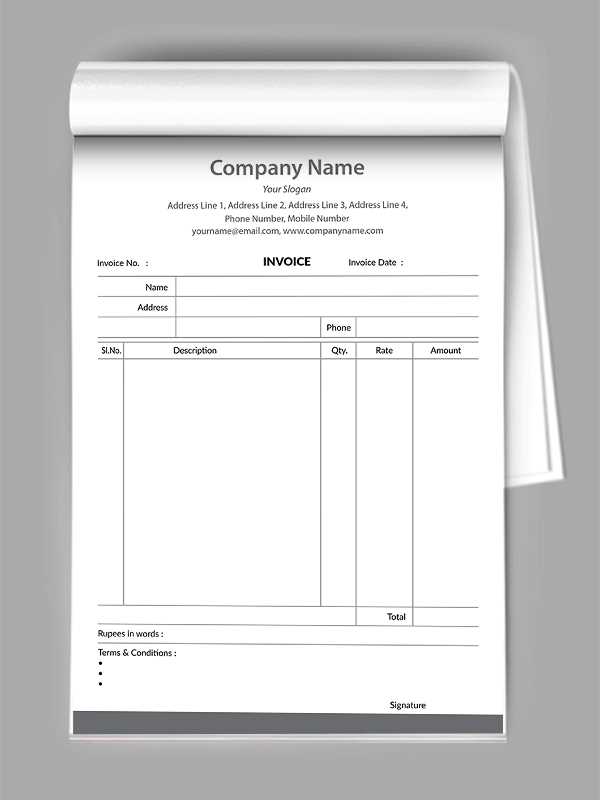

How to Print Your Invoice Template

Once you’ve customized your financial document for a specific client or transaction, it’s important to know the right steps for printing it. Proper printing ensures that all details are clearly visible and that the document maintains a professional appearance. Whether you are printing a single document or multiple copies, following a few key steps will make the process smooth and efficient.

Preparing Your Document for Printing

Before printing, make sure that your document is fully completed and formatted correctly. Here are a few things to check:

- Verify the Information: Double-check that all details, such as client name, address, and payment terms, are correct and up to date.

- Check Layout and Design: Ensure that the document fits well on the page and the layout is clean and professional. Consider using a consistent font size and style for clarity.

- Preview the Print: Use the print preview function on your software to ensure everything looks right before sending it to the printer.

Selecting the Right Printer and Settings

Choosing the correct printer and settings can significantly affect the quality of your printed documents:

- Choose a Reliable Printer: Use a high-quality printer to ensure that the text is sharp and the layout is intact. Laser printers are often the best option for clear, professional results.

- Adjust Printer Settings: Select the appropriate paper size (e.g., A4 or Letter) and orientation (portrait or landscape) based on your document’s layout. Also, choose a high-quality print setting to ensure the details are crisp.

- Consider Paper Quality: Opt for a thicker, more professional paper type if the document will be mailed or presented in a formal setting.

Following these steps will ensure that your documents are printed correctly and professionally, providing a polished look for any business interaction.

Integrating Templates with Accounting Software

Integrating your financial document system with accounting software can significantly enhance efficiency, reduce errors, and streamline your overall financial management process. By connecting these two systems, you can automate the transfer of key data, maintain accurate records, and ensure consistency across all your financial interactions.

Benefits of Integration

Linking your document templates with accounting software offers several advantages:

- Automated Data Entry: Automatically populate client details, payment amounts, and dates, saving time and reducing the risk of manual errors.

- Real-Time Updates: Changes made in your accounting software will reflect instantly in your financial documents, ensuring that you are always working with the latest information.

- Improved Accuracy: Automation reduces human input, minimizing the chances of errors that can occur with manual entry.

- Streamlined Reporting: Integration allows for easy extraction of data, making it simple to generate financial reports and monitor your business’s performance.

Steps to Integrate Your System

Follow these steps to successfully integrate your document templates with accounting software:

- Select Compatible Software: Ensure that the software you are using supports integration with your document system. Popular accounting platforms often offer built-in template integration.

- Connect the Systems: Follow the provided instructions to link the two systems. This might involve configuring API connections or using export/import features.

- Customize Data Fields: Align the data fields in both systems to ensure that the information flows smoothly between the accounting software and your document format.

- Test and Verify: Before fully integrating, run tests to ensure that the data syncs correctly and all information is displayed as intended on your documents.

By integrating your systems, you can save time, ensure consistency, and gain greater control over your financial processes.

Tracking Payments Using Invoice Books

Effectively managing and monitoring payments is essential for maintaining smooth business operations and financial health. By using organized records, you can easily track payments received, outstanding balances, and payment dates. This process helps ensure that you stay on top of your cash flow and can follow up with clients promptly when necessary.

One of the most reliable methods for tracking payments is by maintaining detailed records in an organized format. When using such documents, you can record important payment information such as amounts, due dates, and transaction details in a structured way, making it easier to follow up with clients and keep track of all financial exchanges.

Here are a few benefits of using such systems for payment tracking:

- Clear Payment History: Keep a comprehensive history of all payments, making it easy to reference past transactions.

- Easy Reconciliation: Simplify the process of reconciling accounts by matching payments against outstanding balances.

- Improved Client Communication: Quickly reference payment status when communicating with clients, improving transparency and reducing disputes.

- Efficient Record Keeping: Maintain well-organized records that can be easily accessed for audits, tax reporting, or financial analysis.

With a clear system in place, you can ensure that no payment is missed and that your records remain accurate and up-to-date.

How to Edit Templates in Excel

Customizing documents in Excel allows you to adapt pre-made formats to suit your specific needs. Whether you want to adjust the layout, add or remove fields, or personalize the design, Excel offers a wide array of tools to modify existing structures. By understanding the basics of editing within this program, you can create tailored financial documents that align with your business requirements.

Basic Steps to Edit in Excel

Follow these simple steps to start editing your document structure:

- Open the File: Launch Excel and open the existing file that you wish to edit.

- Modify Text and Data: Click on any cell to change text, numbers, or dates. You can also add new rows or columns as needed.

- Adjust Formatting: Use Excel’s formatting tools to change fonts, colors, borders, or cell size to match your preferences.

- Update Formulas: If your document includes calculations, you can adjust formulas to reflect the correct data or update references.

Advanced Customization Tips

For more complex edits, consider the following advanced techniques:

- Insert Custom Fields: Add your own data fields such as client name, project details, or payment terms by simply inserting new columns.

- Design Improvements: Enhance the visual appeal of your document by utilizing charts, logos, or conditional formatting to highlight key information.

- Automate Calculations: Use Excel’s built-in functions such as SUM or VLOOKUP to automatically calculate totals, taxes, or discounts.

With these tools and techniques, you can easily adapt and update any financial document to meet your needs, making it both efficient and professional.

Legal Aspects of Invoicing for Businesses

When managing financial transactions, businesses must adhere to certain legal requirements to ensure that their records are compliant with local regulations. These regulations govern the creation and distribution of payment requests, which are vital for both tax reporting and maintaining transparent relationships with clients. Proper documentation serves as proof of transaction, which is crucial for both parties in case of disputes or audits.

Key Legal Considerations

Understanding the legal implications of creating and sending payment requests helps protect both businesses and their clients. The following points highlight the most important legal aspects:

- Accurate Information: Ensure that the document contains all necessary information, such as the business name, contact details, payment terms, and legal registration numbers.

- Tax Compliance: The document must accurately reflect applicable taxes (e.g., sales tax or VAT) in accordance with the local tax laws. Failure to include the correct tax can result in legal penalties.

- Clear Payment Terms: Clearly outline payment deadlines and any penalties for late payments to avoid misunderstandings.

- Record Keeping: Businesses must retain records of all transactions, typically for several years, as required by law. This ensures that all dealings can be audited if necessary.

Example of Legal Elements in a Financial Document

The table below outlines the key legal elements that should be included in every financial document:

| Element | Description |

|---|---|

| Business Details | Include business name, address, and legal registration numbers. |

| Client Information | Client name, contact information, and payment terms. |

| Transaction Date | The date when the service or product was delivered or completed. |

| Tax Information | Any applicable taxes (e.g., VAT or sales tax) clearly stated. |

| Payment Instructions | Details on how payments should be made (e.g., ba

Invoice Template Security Tips

Ensuring the security of financial documentation is crucial for businesses to protect sensitive data and maintain trust with clients. With digital records becoming the norm, safeguarding these files against unauthorized access, fraud, and potential data breaches is paramount. Following best practices can significantly reduce the risk of vulnerabilities in the system and prevent misuse of financial documents. 1. Use Strong Passwords One of the most fundamental steps in securing financial documents is using strong, unique passwords. Ensure that files are protected with passwords that are difficult to guess. Avoid using common passwords and consider using password managers to generate and store complex passwords securely. 2. Encrypt Your Files Encryption is a critical tool for safeguarding documents when stored digitally or transmitted online. By encrypting your files, you ensure that even if they are intercepted, they cannot be read without the decryption key. Encryption adds an extra layer of protection, making it much harder for unauthorized parties to access your sensitive information. 3. Use Secure Cloud Storage When storing financial files in the cloud, choose a reputable service provider that offers secure storage solutions. Many cloud platforms provide encryption and multi-factor authentication (MFA), which can enhance the security of your records. Always ensure that you have control over who can access these documents and that any data transferred is encrypted. 4. Limit Access to Documents Restrict access to sensitive financial records only to authorized individuals. This reduces the likelihood of accidental or intentional data breaches. For teams, create permission-based access and ensure that users only have access to files necessary for their role. 5. Regularly Update Software Keeping your software, including any document management or accounting tools, up to date is essential for maintaining secu Frequently Asked Questions About Invoice BooksIn this section, we address common queries related to the creation, usage, and management of financial documentation. Understanding the essentials can help businesses streamline their billing processes and avoid common pitfalls. Below are some of the most frequently asked questions about managing records for transactions. 1. What are the benefits of using structured documents for transactions?Using organized documents ensures clear, professional communication with clients. It helps businesses maintain accurate records for accounting purposes and serves as a legal document in case of disputes. Well-structured forms also make it easier to track payments, taxes, and compliance with financial regulations. 2. Can I customize transaction forms for my business needs?

Yes, you can easily customize transaction records to meet your specific requirements. Most systems allow you to modify fields, add your logo, or change the layout according to your branding and workflow needs. Customization ensures that the forms reflect the uniqueness of your business while meeting legal and accounting standards. 3. How can I secure my financial records?To secure your financial documents, it’s important to use encryption, strong passwords, and limit access to authorized personnel only. Storing records in secure cloud services or encrypted files provides an added layer of protection. Additionally, regular backups and monitoring for suspicious activity are essential for safeguarding your data. 4. What should I include on my financial documentation?A well-rounded document should include essential details such as the transaction date, description of goods or services provided, the total amount due, and payment terms. You should also include your contact information, any applicable tax rates, and unique identifiers for easy tracking. Properly itemized records ensure clarity and transparency for both parties involved. 5. How can I track payments effectively?Tracking payments can be done by maintaining a clear system of record-keeping. Each document should have a unique reference number, and the status of payments (e.g., paid, pending, overdue) should be updated regularly. Integrating these documents with accounting software can a |