Download Free International Commercial Invoice Template for Global Business

Managing paperwork for cross-border business can be a challenging task. Ensuring all necessary information is captured correctly and complies with different regulations is crucial for smooth operations. Many companies face difficulties when they don’t have a clear structure in place, leading to delays or even misunderstandings with clients or authorities.

One of the most effective ways to simplify this process is by using well-organized documents that include all required details. By having a reliable format on hand, you can save valuable time, minimize errors, and ensure consistency in every transaction. Whether you’re shipping goods or providing services across borders, a properly designed form is an essential tool for any business engaged in global trade.

Take advantage of ready-to-use solutions that can be tailored to suit your specific needs. With the right structure, you can ensure that all essential fields are included, helping you avoid costly mistakes and improving communication with partners worldwide. These documents can serve as a foundation for faster and more efficient dealings with customs, suppliers, and clients alike.

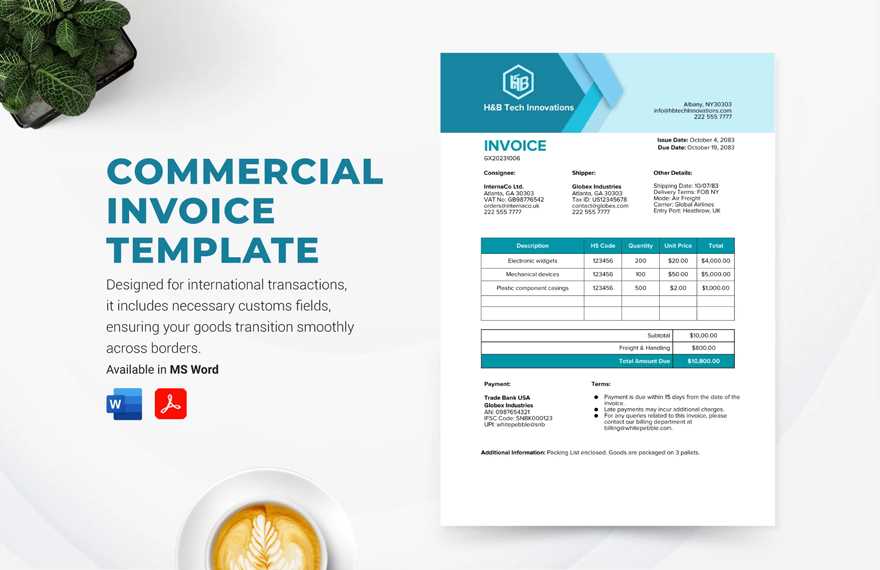

Free International Commercial Invoice Template

When conducting business across borders, having a structured document that ensures all key details are recorded is essential. A standardized format helps prevent errors, reduces confusion, and makes communication with clients and regulatory bodies much smoother. Having such a document readily available allows for quick adaptation to various trade scenarios, ensuring that both parties are on the same page regarding payment terms, delivery specifics, and product descriptions.

Accessing ready-made forms designed specifically for global transactions can be a huge advantage. These documents include all necessary fields, from buyer and seller information to shipping costs, taxes, and any other details relevant to the trade. By using pre-designed forms, you can avoid the hassle of creating a new document from scratch each time you engage in a new deal, while ensuring compliance with necessary regulations and standards.

Such solutions offer flexibility to customize the document to your specific requirements. You can easily modify sections to suit the needs of different industries or markets, making the document adaptable and effective across a wide range of business activities. This flexibility is key in maintaining consistency and professionalism in your cross-border transactions.

What is an International Commercial Invoice

In global trade, businesses often need a formal document to confirm the sale of goods or services between buyers and sellers from different countries. This document serves as an official record of the transaction, detailing essential information such as product descriptions, quantities, and pricing. It also helps ensure compliance with import/export regulations and facilitates the smooth movement of goods across borders.

Purpose of This Document

The main purpose of this type of record is to provide a clear summary of the transaction to customs authorities, the buyer, and the seller. It helps customs determine the correct duties and taxes, while also acting as proof of the transaction for both parties involved. It is also a vital tool for businesses to track payments and shipments.

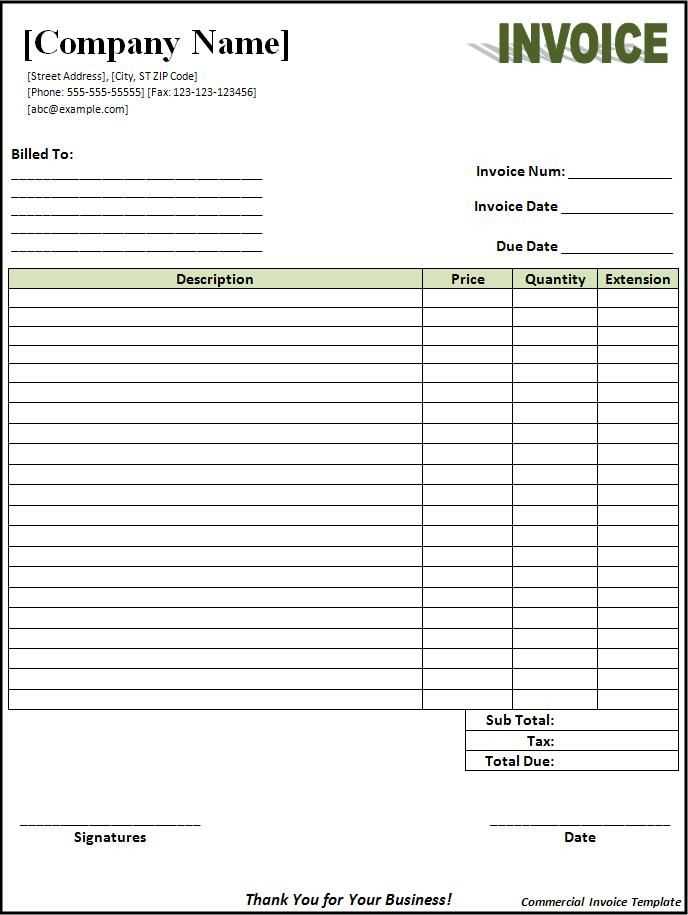

Key Components

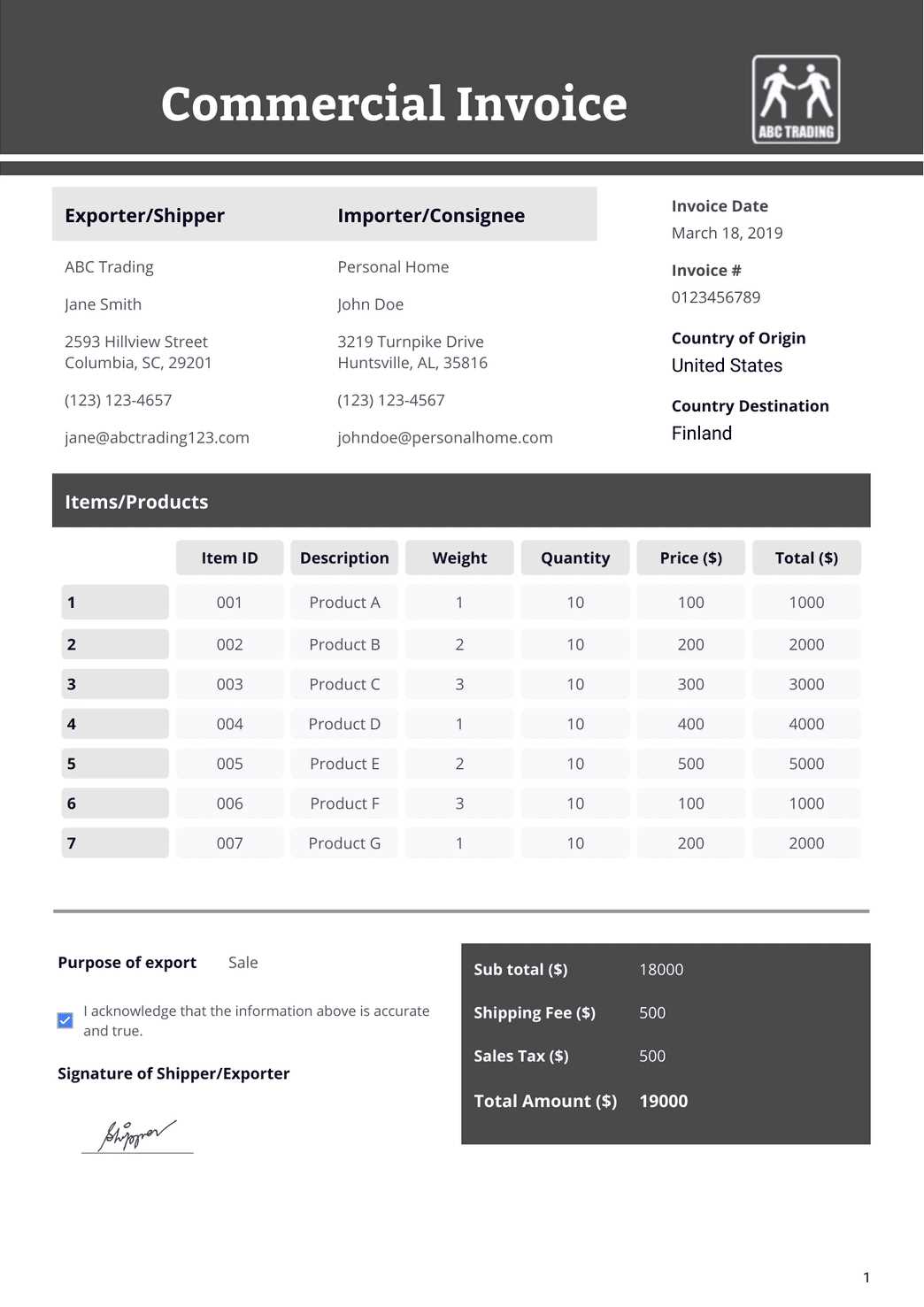

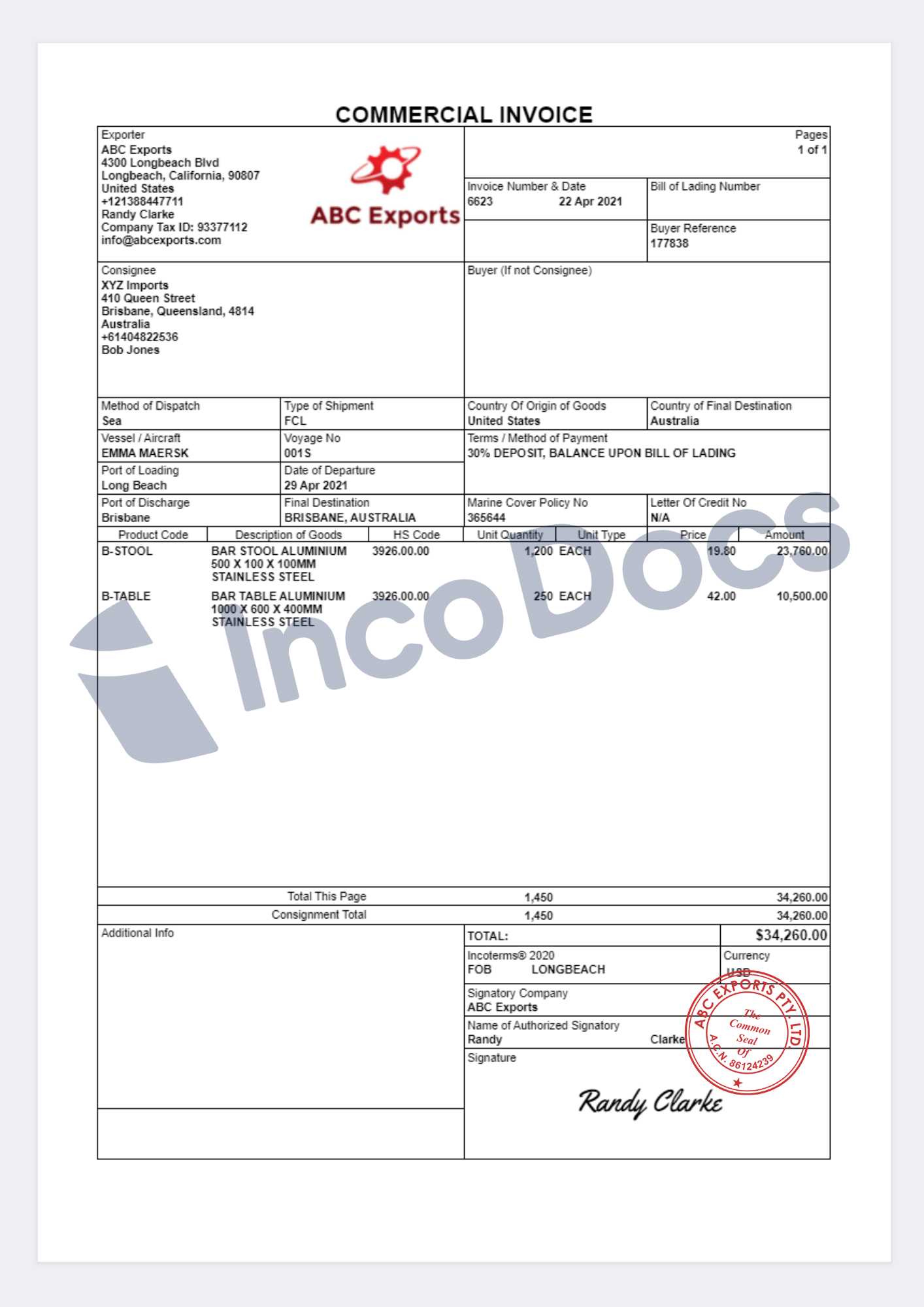

There are several important details typically included in this form. Here are some of the key components:

| Field | Description |

|---|---|

| Seller Information | Details of the company or individual selling the goods or services |

| Buyer Information | Details of the recipient of the goods or services |

| Product Description | Clear and accurate descriptions of the items being sold |

| Quantity | The number of units being sold |

| Price | The agreed-upon cost of the items, often listed per unit or total |

| Terms of Payment | How the buyer will pay, including deadlines or installments |

| Shipping Information | Details on the delivery method, costs, and expected delivery date |

By including these essential elements, the document helps to streamline the entire business transaction process, ensuring that all necessary details are captured and properly communicated to both parties and relevant authorities.

Why You Need an Invoice Template

Having a standardized document for each business transaction is crucial for maintaining accuracy and consistency. It helps to ensure that both parties involved have the same understanding of the terms, costs, and expectations. A well-structured document can save time, minimize errors, and streamline the overall process of cross-border trade.

Here are several reasons why using a pre-designed form can be highly beneficial:

- Consistency: A uniform structure across all transactions helps ensure that no essential information is overlooked.

- Accuracy: A clear format guides you to enter the correct details, reducing the risk of mistakes or misunderstandings.

- Time-saving: With a ready-to-use structure, you don’t have to create a new document from scratch each time you engage in a transaction.

- Compliance: Certain fields, such as customs declarations, are often required for regulatory purposes, and a standardized document ensures all necessary information is included.

- Professionalism: A well-organized document reflects positively on your business and builds trust with clients and suppliers.

By using such a tool, you can focus more on growing your business rather than worrying about the technicalities of each transaction. It also allows you to stay organized and prepared for future dealings with minimal effort.

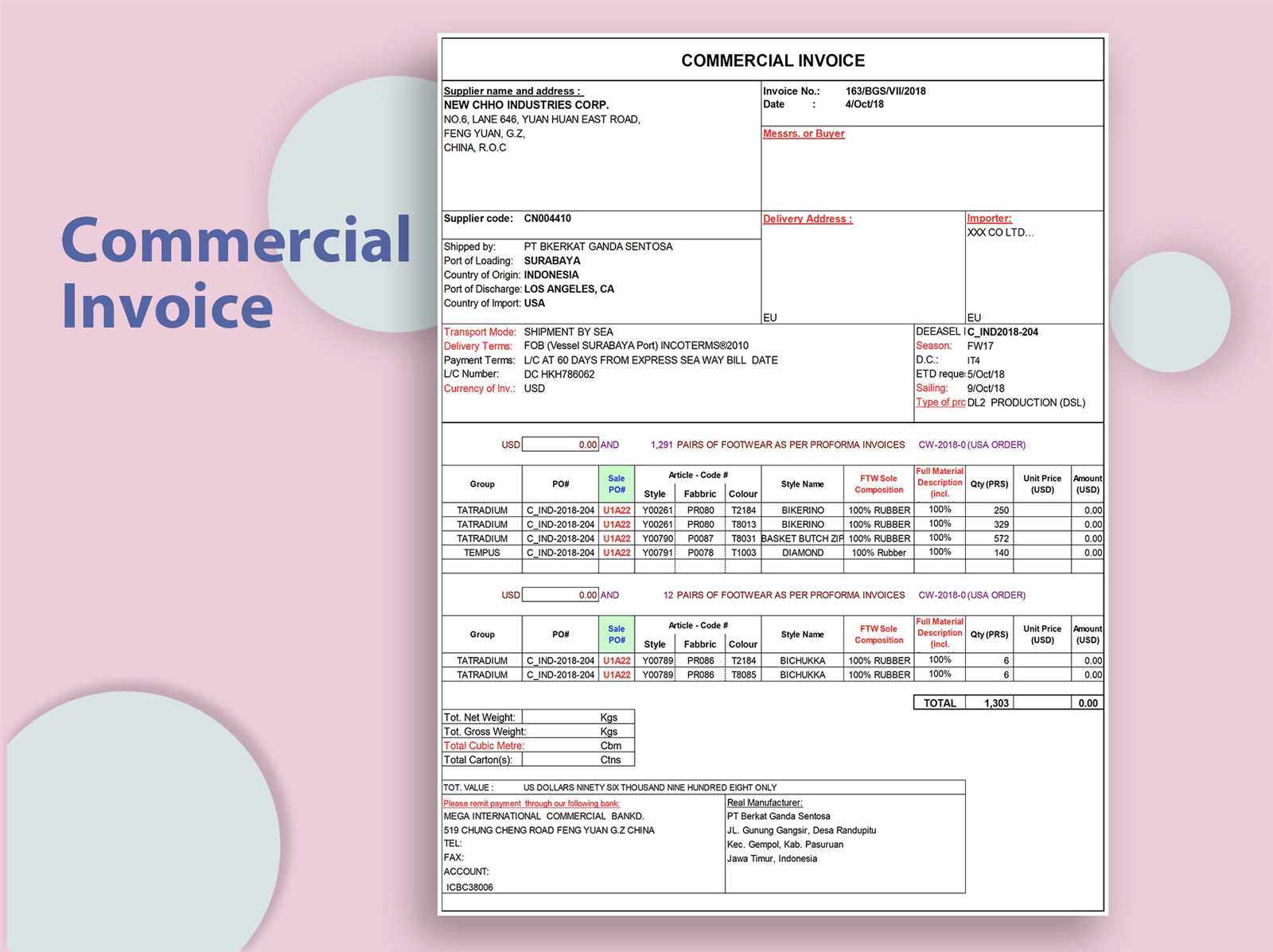

Key Features of a Commercial Invoice

When creating a formal document for a business transaction, there are several essential elements that must be included to ensure clarity and accuracy. These features help not only to confirm the details of the sale but also to ensure that the goods or services can pass through customs and other regulatory bodies without delays. A well-structured document is crucial for maintaining smooth operations and transparency in any cross-border deal.

Essential Information for Buyers and Sellers

One of the most important aspects of this form is providing clear and accurate details about both the buyer and the seller. This typically includes names, addresses, and contact information. This section ensures that there is no confusion about who is involved in the transaction and how to reach them in case of any issues.

Transaction Details and Pricing

Another key feature is outlining the specifics of the transaction, including a detailed description of the products or services being exchanged, the quantities, and the agreed-upon prices. This section should also cover any applicable taxes, fees, or discounts. It ensures that both parties are in agreement about the terms and that payment can be easily processed once the goods are delivered.

Additional Features may include the following:

- Shipping Information: This includes the delivery method, shipping costs, and the expected delivery date.

- Terms of Payment: Defines how and when the payment is expected to be made.

- Customs Details: For international shipments, this section includes necessary codes, product classifications, and any other relevant customs information.

- Unique Identification Number: A reference number or order ID that helps track the transaction for future reference.

Including all of these elements ensures that the transaction is well-documented, minimizing the risk of errors or misunderstandings, while also helping businesses comply with regulations in different countries.

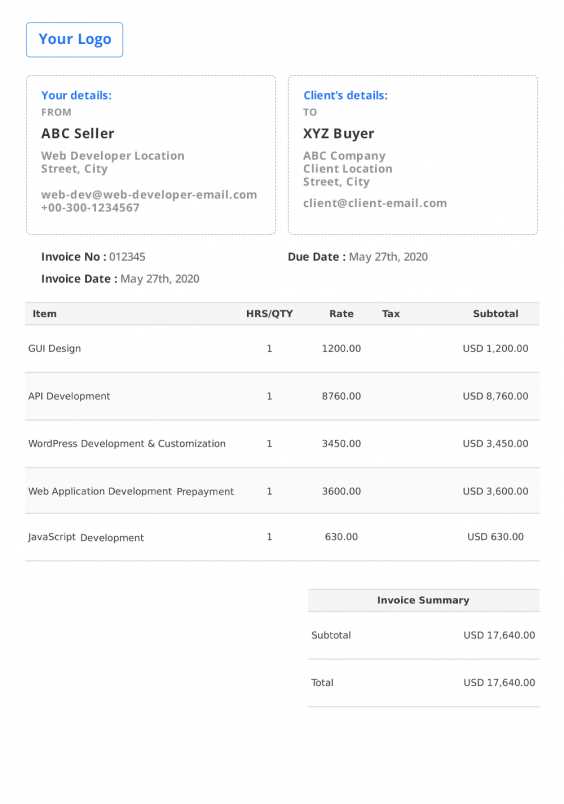

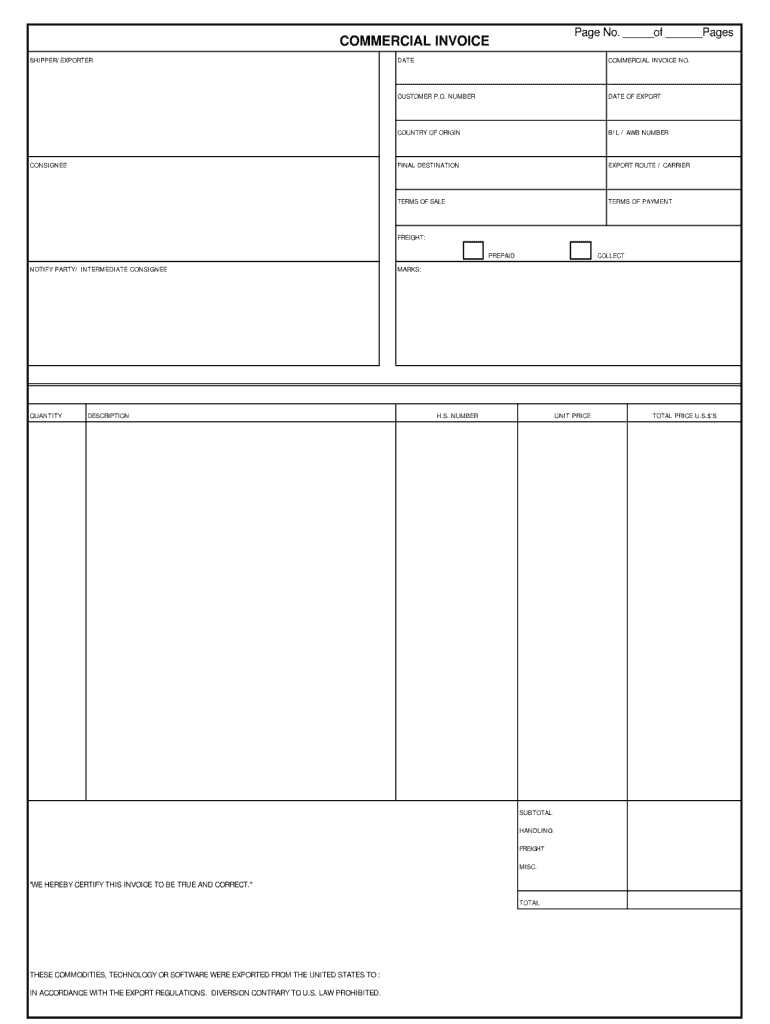

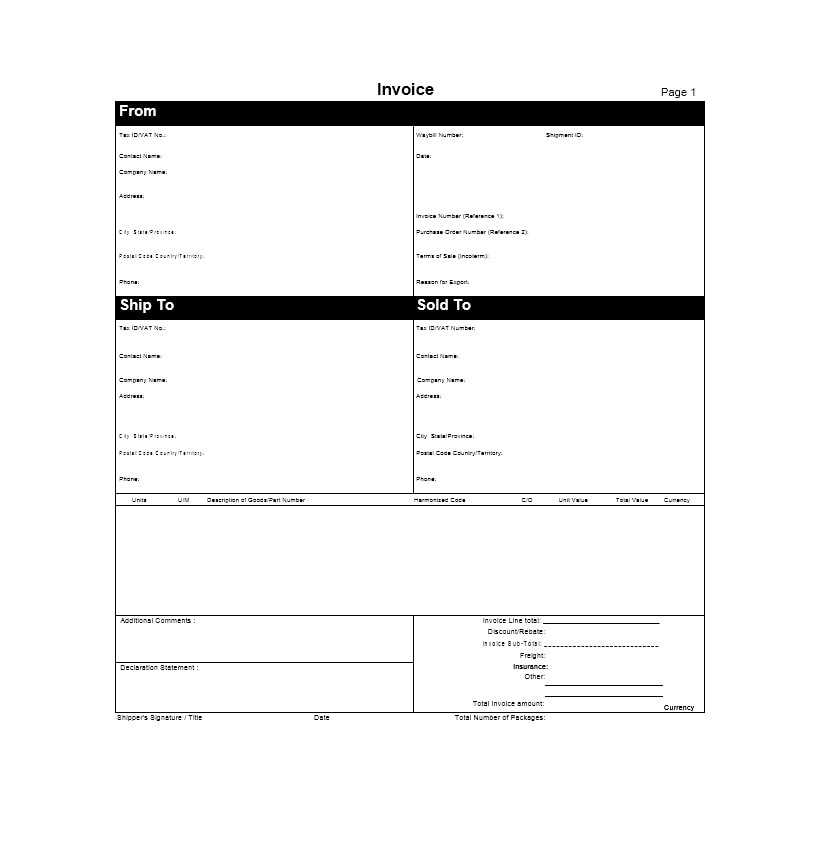

How to Fill Out the Template Correctly

Properly completing a transaction form is essential for ensuring that all details are accurately recorded and compliant with regulatory requirements. A well-filled document helps avoid delays, confusion, and legal issues. To ensure everything is properly captured, it is important to follow a clear process and include all necessary information in the correct format.

Here’s a step-by-step guide on how to correctly fill out the document:

- Step 1: Enter Seller and Buyer Information – Start by providing the names, addresses, and contact details of both parties involved. This ensures that both the seller and the buyer are clearly identified.

- Step 2: Describe the Goods or Services – Accurately describe the products or services being exchanged. Include details such as the type, quantity, model, and any relevant specifications. Be as precise as possible to avoid misunderstandings.

- Step 3: Specify the Pricing – Clearly outline the agreed-upon price for each item or service, as well as the total cost. Include any applicable discounts or fees, and make sure to account for taxes and other charges.

- Step 4: Include Shipping Information – Provide the method of delivery, shipping cost, and estimated delivery date. This section is crucial for both parties to understand how and when the goods will arrive.

- Step 5: Set Payment Terms – Specify the terms of payment, such as the payment method (bank transfer, credit, etc.), deadlines, and any relevant instructions.

- Step 6: Double-Check for Accuracy – Before finalizing, review the document to ensure all fields are filled out correctly. Check for spelling mistakes, incorrect numbers, or missing information that could lead to confusion or delays.

Pro Tip: If you are using a pre-designed structure, ensure that each field is properly customized to match the specifics of your business transaction. Templates provide a framework, but it’s your responsibility to ensure that the details you enter are correct and complete.

By following these simple steps, you can ensure that your document is filled out correctly and efficiently, helping to prevent costly mistakes and streamline the process of completing international transactions.

Benefits of Using Pre-designed Documents

Using a pre-made document structure can significantly streamline the process of recording business transactions, especially for companies dealing with cross-border sales. These ready-to-use formats allow businesses to save time, avoid mistakes, and ensure compliance with various regulations. Instead of creating a document from scratch, you can simply fill in the necessary information, making the whole process more efficient and reliable.

Time Efficiency

One of the most significant advantages of using pre-designed forms is the amount of time saved. By avoiding the need to start from scratch, businesses can quickly generate the required documentation without worrying about the layout or missing important fields. This allows you to focus more on other critical aspects of the transaction, such as communication with clients or arranging shipments.

Consistency and Accuracy

Pre-designed documents help ensure consistency across all transactions. With a standardized format, you can be confident that all the necessary details are included and properly formatted. This reduces the likelihood of errors, such as forgetting key information or making mistakes when inputting data. A consistent approach not only improves efficiency but also fosters a professional image with clients and partners.

Additional Benefits:

- Cost-Effective: Many ready-to-use solutions are available at no cost, allowing businesses to access quality resources without incurring additional expenses.

- Flexibility: Pre-designed documents can usually be customized to suit specific needs, ensuring that the structure works for different types of transactions.

- Compliance: These forms often include fields that meet legal and regulatory requirements, helping businesses ensure they are following necessary protocols.

Overall, using pre-made solutions can simplify your operations, increase productivity, and minimize the risk of costly errors. Whether you’re new to global trade or an experienced business owner, taking advantage of such resources can make the documentation process much more efficient and less stressful.

Understanding Invoice Terms and Conditions

In any business transaction, the terms and conditions included in the official document are crucial for establishing the rules that both parties must follow. These terms outline important aspects of the deal, such as payment deadlines, delivery methods, and responsibilities. Understanding these elements helps both the buyer and the seller avoid misunderstandings and ensures that the exchange is conducted smoothly and fairly.

Key Elements of Terms and Conditions

The terms and conditions should be clear and specific to ensure both parties are fully aware of their obligations. Some of the key elements typically included are:

- Payment Terms: This specifies the amount due, when it’s due, and the acceptable methods of payment. Common payment terms include “Net 30” (due 30 days after the transaction) or “Cash on Delivery” (COD).

- Shipping and Delivery: Details about how the goods will be delivered, including the method, cost, and estimated delivery time.

- Tax Responsibilities: This section outlines who is responsible for any taxes, duties, or fees associated with the transaction, including customs charges for international shipments.

- Late Fees and Penalties: This clause specifies what will happen if the payment is not made on time, such as interest charges or additional fees.

Importance of Clear Terms

Having clear terms and conditions ensures that both parties understand their responsibilities and what to expect throughout the process. This transparency helps to build trust, prevents disputes, and ensures the smooth flow of goods or services. Additionally, these terms serve as a legal reference in case any issues arise after the transaction is complete.

By clearly stating all the relevant terms, businesses can ensure that all expectations are aligned and both the buyer and seller are protected under the agreement.

Common Mistakes in Invoice Creation

Creating accurate documentation for business transactions is essential, but mistakes are common, especially when dealing with complex or international sales. Errors in these documents can lead to payment delays, legal issues, and misunderstandings between parties. Being aware of common pitfalls can help ensure that every transaction goes smoothly and that the terms are clear and well-understood by both sides.

Here are some of the most frequent mistakes businesses make when creating formal transaction records:

- Missing or Incorrect Contact Information: Failing to include accurate names, addresses, or contact details for either the buyer or the seller can cause confusion and delays in communication or shipment.

- Omitting Important Transaction Details: Not including a complete description of the products or services, quantities, or prices can lead to disputes over the terms of the deal.

- Incorrect Payment Terms: Misstating payment terms, such as due dates or accepted methods of payment, can result in late payments or disputes over financial obligations.

- Failure to Account for Taxes and Fees: Not including applicable taxes, shipping fees, or customs duties can lead to confusion and extra costs for either party later on.

- Inconsistent or Missing Dates: Not specifying the correct date of issue or expected delivery can cause misunderstandings regarding deadlines, which could lead to late shipments or payment issues.

- Incorrect Currency or Unit of Measurement: When dealing with cross-border transactions, failing to use the correct currency or measurement units (like weight or volume) can lead to costly errors and confusion.

Pro Tip: Always double-check the document for any missing or incorrect details before sending it. Using a consistent format or structure can help prevent mistakes and ensure all relevant information is included.

By avoiding these common mistakes, businesses can maintain professionalism, avoid costly errors, and ensure the transaction is smooth for both the buyer and the seller.

How Templates Simplify Cross-Border Trade

When engaging in global commerce, the complexity of international transactions can be overwhelming. With varying regulations, languages, and customs requirements, it’s easy to make mistakes that could delay shipments or cause legal issues. Using a pre-designed document structure can simplify the process by ensuring all necessary details are included, reducing the chances of errors and ensuring smooth trade across borders.

Streamlining Documentation

One of the most significant benefits of using a structured format is that it ensures all essential information is clearly presented. By providing fields for everything from buyer and seller details to customs codes and payment terms, these documents reduce the likelihood of leaving out critical data. This consistency makes it easier for customs officials, shipping companies, and buyers to understand and process the transaction efficiently.

Ensuring Compliance with Regulations

Different countries have different rules regarding what information must be included in business documentation. A pre-made structure often contains the necessary fields to comply with both local and international regulations, such as product descriptions, tax identification numbers, and shipping codes. By using a format tailored to global trade, businesses can ensure they meet compliance standards without the risk of missing something important.

Additional Benefits:

- Faster Processing: With all required details already included, your documents are less likely to be flagged for review, speeding up the entire process.

- Improved Communication: Clear and consistent documentation helps all parties involved understand their responsibilities, reducing confusion and miscommunication.

- Cost Savings: By avoiding mistakes and delays, businesses can save money on fines, penalties, and shipping costs associated with incorrect or incomplete forms.

In summary, using a ready-made structure not only ensures that all necessary information is captured but also reduces the chances of costly delays, errors, and confusion. This streamlined approach makes cross-border trade easier and more efficient for businesses of all sizes.

Choosing the Right Template for Your Business

Selecting the right document structure for your business transactions is crucial to ensure both efficiency and accuracy. The proper format not only helps to streamline your operations but also guarantees that all legal and regulatory requirements are met. With various options available, it’s important to choose a solution that suits your specific needs and the type of transactions you frequently handle.

When evaluating a pre-designed document format, consider the following factors:

- Industry Specificity: Different industries may require specific fields or details in their records. For example, a format for shipping goods may need to include customs codes, while a service agreement might focus more on payment terms and milestones. Make sure the structure includes all relevant sections for your industry.

- Ease of Customization: Choose a format that allows you to modify it easily to fit different types of transactions or client requirements. Flexibility is important, as your needs may change depending on the size of the deal or the complexity of the shipment.

- Compliance Features: If you operate internationally or across state lines, the structure should meet the necessary legal standards. Ensure that the format includes all mandatory information such as tax numbers, product descriptions, or shipment tracking details that may be required by authorities.

- User-Friendliness: The document should be straightforward to fill out, with clear sections and guidance on what information is required. A format that’s easy to use reduces the likelihood of mistakes and saves time when processing transactions.

Choosing the right structure is essential for maintaining professionalism and smooth operations. The right document can help you save time, avoid errors, and ensure that every transaction is documented correctly, giving both you and your clients confidence in the process.

Customizing Your Commercial Invoice Template

Every business has unique needs when it comes to documenting transactions. While a pre-designed document format provides a solid foundation, tailoring it to fit your specific requirements can make the process more efficient and aligned with your business model. Customization allows you to add necessary fields, adjust the layout, and include any specific terms that are important for your operations.

Adjusting the Layout and Structure

One of the first steps in customizing a document structure is ensuring that the layout fits the way your business works. You may want to rearrange sections to make the most important information stand out or add additional rows or columns for specific details, such as item specifications or serial numbers. A clear and well-organized structure makes it easier for both parties to understand the terms and prevents the omission of key data.

Adding Specific Business Information

Every business has unique requirements that should be reflected in the documentation. Here are some aspects you may want to customize:

- Branding: Add your company logo, colors, and contact information at the top of the document to create a professional, branded look.

- Payment Instructions: If you offer multiple payment options or specific terms, include detailed instructions on how payments should be processed.

- Tax and Duty Information: If you deal with specific tax codes or need to include certain duties for international transactions, ensure these fields are clearly marked and easy to fill out.

- Custom Fields: For specialized industries or transactions, you may need to include additional fields, such as part numbers, product classifications, or legal disclaimers.

Pro Tip: Customize the document for each customer or transaction type to ensure all relevant information is included, reducing the need for follow-ups and avoiding mistakes.

By customizing your document format, you can better meet your business needs, maintain professionalism, and ensure that every detail is captured correctly. A well-tailored structure not only enhances efficiency but also improves the overall client experience.

How to Download a Free Template

Accessing a pre-designed document structure can be an excellent way to streamline your transaction processes. Whether you’re new to the business or looking to save time, downloading a ready-made solution is simple and can save you a lot of effort. Below is a step-by-step guide on how to find and download a reliable document format for your business needs.

Step 1: Search for Trusted Sources

The first step is finding a reputable website that offers downloadable business documents. Look for platforms with positive reviews and clear instructions, as they are more likely to provide quality resources. Many online platforms, such as business websites or document-sharing services, offer templates specifically designed for commercial transactions.

Step 2: Choose the Right Format

Once you’ve found a trusted source, browse through the available options. You may find a variety of formats that suit different transaction types. Select the one that best fits your business requirements. Some formats come in popular file types like PDF, Excel, or Word, so choose the one that’s easiest for you to work with and edit as needed.

Step 3: Download and Save

After selecting the correct format, look for a “Download” button or link. Click on it, and the document will begin downloading to your device. Ensure you save it in a location where you can easily access it later. You may want to create a dedicated folder for business documents to stay organized.

Pro Tip: Double-check the downloaded file to ensure it meets your requirements. If necessary, customize the document before using it for transactions to include your company details and specific terms.

By following these steps, you can easily download a pre-designed structure that will help simplify your business transactions and keep everything organized and professional.

Legal Requirements for International Invoices

When engaging in cross-border transactions, it’s essential to understand the legal requirements for documenting business exchanges. Different countries have specific rules and regulations regarding what must be included in transaction records to ensure compliance with tax laws, customs procedures, and international trade agreements. Failing to meet these requirements could result in delays, fines, or even legal disputes.

Key Legal Elements to Include

To ensure that your documentation meets legal standards, certain elements must be included. While these may vary depending on the destination country, some of the most common legal requirements include:

- Seller and Buyer Information: Complete details of both parties involved in the transaction, such as names, addresses, and contact information, are necessary for identification and communication.

- Description of Goods or Services: A detailed description of the items or services being sold, including quantity, price, and unit of measure, is crucial for customs and tax calculations.

- Currency and Payment Terms: Clearly state the agreed-upon currency and the terms for payment, including deadlines and accepted methods.

- Tax Identification Numbers: Many countries require the inclusion of tax ID numbers or VAT registration numbers for both the buyer and the seller to ensure proper tax reporting.

- Country of Origin: Some nations require a declaration of the product’s country of origin for customs duties and tariffs purposes.

- Shipping Details: Information about the shipment, including shipping method, delivery terms (such as Incoterms), and expected delivery dates, may be legally required for certain transactions.

Why Compliance Matters

Ensuring your transaction records comply with legal requirements is critical to avoid unnecessary delays at customs or disputes over payment. Inaccurate or incomplete documentation can result in your goods being held at customs, additional taxes or fines, or even the cancellation of the shipment. Additionally, failing to include the correct legal information could damage your reputation and result in penalties for tax evasion or non-compliance.

Pro Tip: It’s advisable to consult with a legal professional or customs expert when preparing documentation for cross-border transactions to ensure all the necessary details are included according to local laws and international trade regulations.

Saving Time with Pre-made Invoice Templates

Efficient business operations often depend on how quickly and accurately transactions can be documented and processed. Using pre-designed formats for creating transaction records can save considerable time, ensuring that all the necessary information is included without having to start from scratch every time. These ready-to-use structures can streamline your workflow and minimize errors that might arise from manually creating new documents each time.

Here are some ways pre-made documents can help save time and boost productivity:

- Pre-filled Sections: Many pre-designed formats come with essential sections already set up, such as buyer and seller details, payment terms, and product descriptions. This reduces the time spent organizing and formatting each record from the ground up.

- Consistency and Accuracy: With a consistent structure, there’s less room for missing important information or making formatting errors. You can quickly fill in the blanks, knowing that all required details are already included.

- Easy Customization: Pre-made formats are often customizable to suit specific business needs. You can quickly adjust the document for different transaction types without worrying about layout or design, saving time on each individual deal.

- Faster Processing: When using a standard format, both you and your customers are familiar with the structure. This helps to reduce back-and-forth communication and speed up approvals, payments, and other processes.

- Reusable Documents: Once a template is customized for your business, it can be reused repeatedly, reducing the need for starting fresh every time. This consistency leads to faster generation of new records and smoother transaction management.

By incorporating ready-made documents into your business practices, you can significantly reduce the time spent on administrative tasks, allowing you to focus on more important aspects of running your business.

Ensuring Compliance in Different Countries

When conducting business across borders, it is essential to understand and adhere to the unique rules and regulations of each country. What is acceptable in one region may not be compliant in another, leading to delays, penalties, or even legal issues. Ensuring your transaction documents are fully compliant with the laws of both the seller’s and buyer’s countries helps avoid these risks and facilitates smooth and efficient exchanges.

Key Areas of Compliance to Consider

Different countries have specific requirements when it comes to documenting transactions, especially for cross-border trade. Here are some of the main areas where compliance must be ensured:

- Tax and Duty Regulations: Many countries require detailed tax information, including VAT numbers, tax identification, and specific tax rates applicable to goods and services. Failing to include accurate tax details could result in delays or penalties.

- Customs Declarations: Certain goods may need to be declared for customs clearance, and documentation must include specific codes or classifications (such as HS codes) to prevent customs from holding or rejecting shipments.

- Legal and Financial Terms: Payment terms, warranties, and other financial conditions must comply with local laws. It is important to clearly state payment deadlines, currency preferences, and acceptable payment methods to avoid future disputes.

- Product and Service Descriptions: Some countries may have stringent rules regarding how goods and services must be described, especially when it comes to regulated items. Providing clear and accurate descriptions helps ensure compliance with import/export restrictions.

- Language Requirements: In many countries, official documentation must be provided in the local language or accompanied by certified translations. This helps ensure that all parties can clearly understand the terms of the transaction.

How to Stay Compliant

To ensure your documents comply with local laws in different countries, consider the following strategies:

- Research Local Laws: Before entering a new market or shipping goods to another country, familiarize yourself with the local legal requirements for documentation and transactions.

- Consult with Legal Experts: Working with legal professionals who specialize in international trade can help ensure that your documents meet the necessary standards.

- Use Country-Specific Formats: Some countries have specific formats or guidelines for documenting business transactions. Utilizing country-specific structures can help ensure compliance.

- Update Documentation Regularly: International laws and trade regulations change frequently, so it’s important to stay updated on any new compliance requirements that may impact your business.

By understanding the specific requirements of each country and ensuring your records meet those standards, you can reduce the risk of penalties, delays, and other issues that might arise from non-compliance.

Best Practices for International Invoicing

When engaging in cross-border business, creating accurate and professional transaction records is essential for maintaining smooth operations and ensuring timely payments. Adhering to best practices not only minimizes the risk of errors but also helps establish trust with clients, reduces delays, and prevents potential legal or financial complications. Implementing these practices can simplify the process and improve your overall business efficiency.

1. Include All Necessary Information

One of the most important practices in international transactions is ensuring that all required information is clearly included. Each transaction document should contain the following:

- Contact Information: Include both the seller’s and buyer’s full names, addresses, and contact details.

- Clear Product or Service Description: Detail what was purchased, including item descriptions, quantities, unit prices, and any relevant codes or classifications.

- Payment Terms: Be explicit about the payment method, due dates, and currency. Mention any applicable taxes, fees, or duties.

- Shipping and Delivery Terms: Include the shipping method, expected delivery dates, and any relevant Incoterms that define the responsibilities of both parties regarding the delivery.

2. Stay Compliant with Local Regulations

Different countries have varying requirements when it comes to documenting transactions, especially for cross-border sales. Some common legal aspects to consider are:

- Tax Identification Numbers: Ensure that both parties’ tax IDs (like VAT numbers) are included in the document, as required by certain jurisdictions.

- Customs Declarations: Some goods may require specific codes or classifications for customs clearance. Always check for any special documentation needed for the type of product you are exporting.

- Language Requirements: In many regions, it’s mandatory to provide documents in the local language, or provide an official translation alongside the original document.

3. Be Clear and Transparent

To avoid misunderstandings and potential disputes, it’s essential to be transparent in your transaction documents. Make sure your terms are unambiguous and easy to understand, particularly around payment deadlines, delivery expectations, and product specifications. This reduces the chances of any confusion or delays caused by vague terms or incomplete details.

4. Double-Check for Accuracy

Even small mistakes in your transaction records can lead to costly errors, delays in payment, or customs issues. Always review the document carefully before finalizing it to ensure that:

- All details are accurate, including the buyer’s and seller’s information, item quantities, pricing, and payment terms.

- Any tax calculations or shipping costs are correctly calculated.

- The document format is clear and easy to navigate, with no missing or illegible sections.

5. Use Secure Payment Methods

In

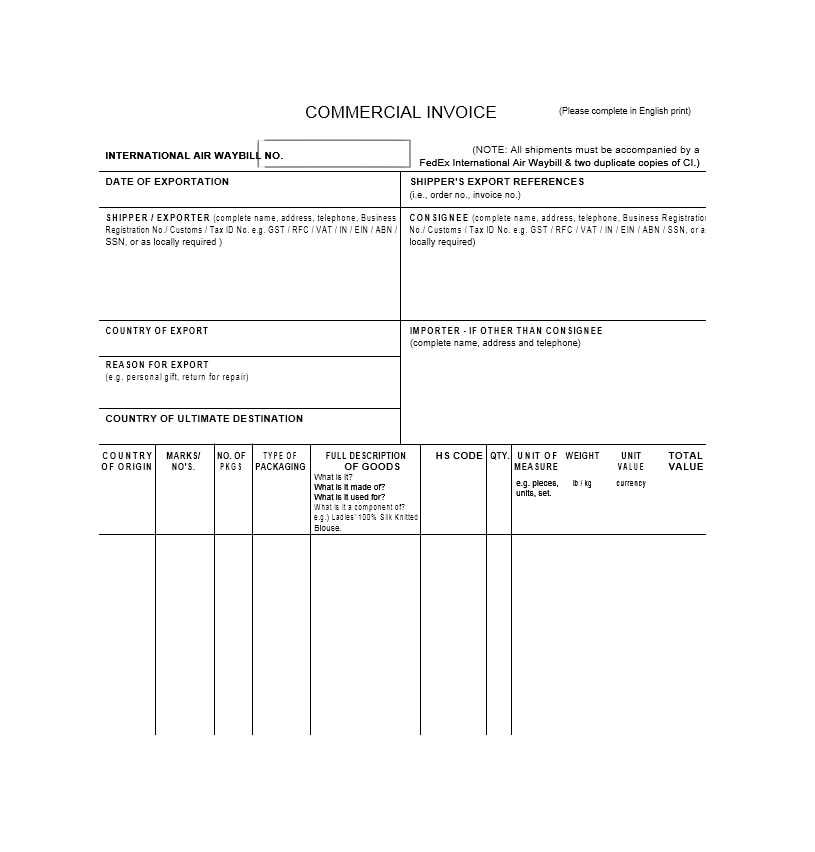

How to Use the Invoice for Customs

When shipping goods across borders, proper documentation is critical to ensuring smooth customs clearance. The transaction record you provide plays a vital role in customs procedures by providing officials with the necessary details about the goods being imported or exported. Without accurate and complete information, your shipment could face delays, fines, or be rejected. Understanding how to properly use this document for customs purposes is key to avoiding such issues.

Key Information for Customs Clearance

To ensure that your transaction document serves its purpose during customs processing, it must contain all the necessary information to allow customs officers to assess the shipment correctly. Key details include:

- Product Description: Provide a clear and precise description of the goods, including what they are, their material composition, and their intended use. This helps customs classify the items correctly for tariff purposes.

- HS Codes (Harmonized System Codes): These codes are used internationally to identify specific goods for customs purposes. Each product category has a unique code that must be included to ensure proper classification.

- Value of Goods: Customs requires an accurate valuation of the goods being shipped. This includes the cost of the items, any additional fees, and the total value of the transaction in the correct currency.

- Country of Origin: Indicating where the goods were manufactured or produced is necessary for customs to determine whether any tariffs or import restrictions apply.

- Quantity and Weight: Clearly state the quantity and total weight of the items being shipped. This information helps determine shipping costs and is necessary for proper tariff assessment.

How to Present the Document to Customs

When submitting your transaction document for customs clearance, follow these steps to ensure a smooth process:

- Provide Copies: Always have multiple copies of the document available. Customs may require the original as well as additional copies for their records.

- Attach to the Shipment: Ensure that the transaction record is attached to the outside of the shipment or included with the shipping label. It should be easily accessible to customs officers for inspection.

- Complete and Accurate Information: Double-check the document for any errors before submission. Incorrect or incomplete details could result in delays or fines.

- Electronic Submission (if applicable): Many countries now allow or require digital submissions of documents. Ensure that any electronic versions of the document are formatted correctly and submitted through the proper channels.

By following these guidelines, you can ensure that your shipment moves smoothly through customs without unnecessary delays or complications. Proper documentation not only helps you comply with legal requirements but also ensures a more efficient and cost-effective international shipping process.