Free Influencer Invoice Template for Easy and Professional Billing

Managing payments and keeping track of your earnings is a crucial part of maintaining a successful partnership with brands or clients. Whether you’re a content creator, social media personality, or anyone offering services online, having a well-organized system for handling financial transactions can save time and reduce stress. A structured document to request payments can enhance your professionalism and make the entire process smoother.

Using a ready-made structure for your payment requests allows you to focus on your work while ensuring that all necessary information is included. These forms help avoid misunderstandings and ensure that you get paid on time. With the right format, you can customize the details to suit your specific needs and preferences, making the task of billing straightforward and hassle-free.

In this article, we’ll explore various tools and formats that help professionals in creative industries create detailed, clean, and effective payment requests. From key components to design tips, you’ll learn how to craft documents that reflect your professionalism and ensure timely compensation.

Free Influencer Invoice Template Overview

When it comes to handling payments for your services or collaborations, having a standardized document is essential for clarity and professionalism. This kind of document helps outline the agreed-upon amounts, services rendered, and terms of payment, ensuring all parties are on the same page. A well-organized structure not only facilitates smooth transactions but also reduces the chances of disputes or misunderstandings.

For many creators, working with brands or clients means managing multiple agreements and deadlines. By using an organized format, you can efficiently keep track of each payment request and ensure all necessary information is included. Whether you’re a content creator, consultant, or social media personality, the ability to send clear and professional requests for compensation can make a significant difference in how you’re perceived by your clients.

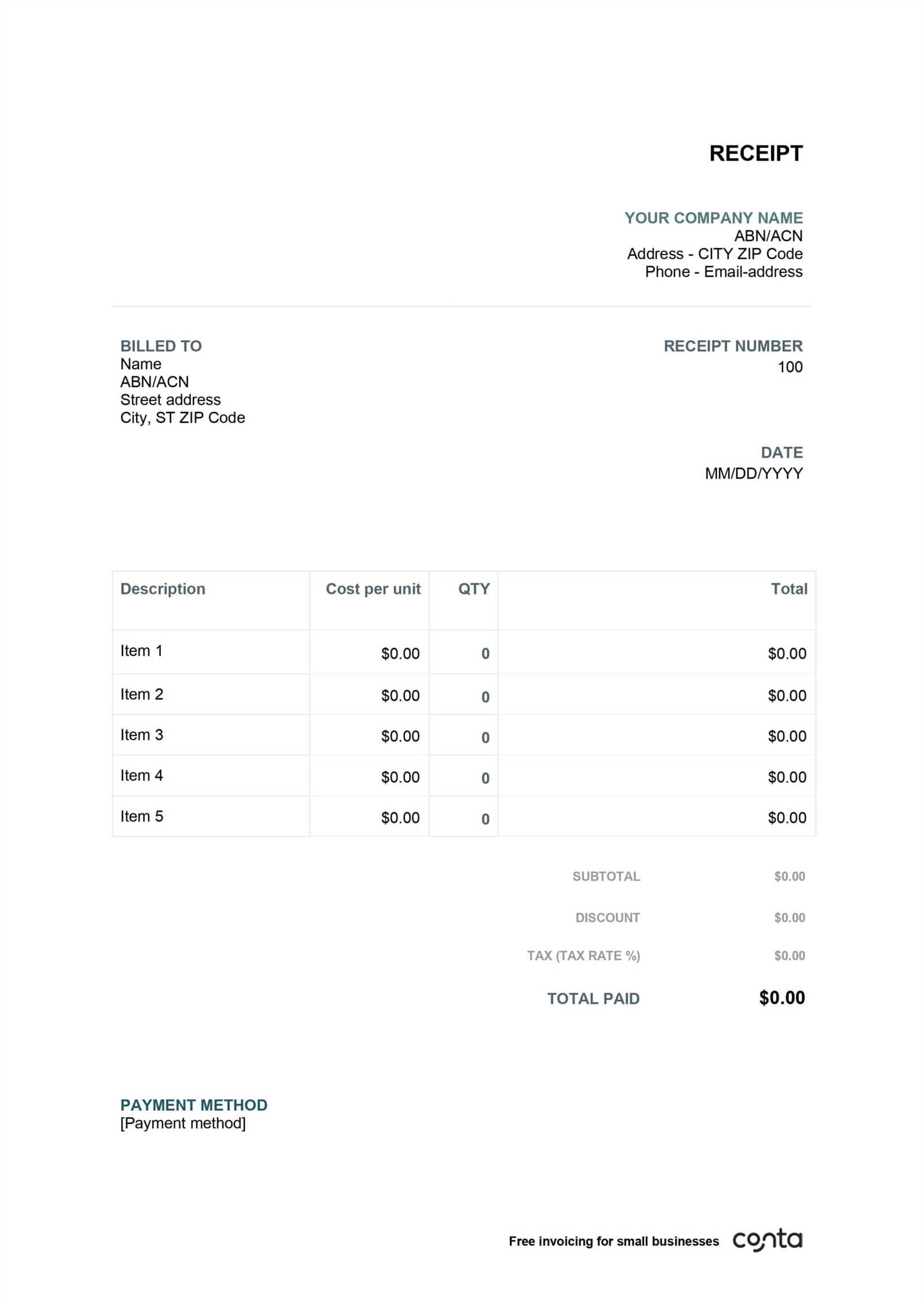

The following table outlines the essential components that should be included in a typical document for requesting payment:

| Section | Description |

|---|---|

| Personal Information | Your name, business name (if applicable), and contact details. |

| Client Information | Name and contact details of the brand or person you’re working with. |

| Service Description | A brief summary of the work completed, including any relevant project details. |

| Payment Amount | The agreed-upon payment for the completed work, including any applicable taxes or fees. |

| Payment Terms | Information on when and how the payment should be made, including due dates and preferred payment methods. |

| Invoice Number | A unique identifier for each payment request, making it easier to track. |

By using a document with these components, you can streamline your payment process and ensure b

Why You Need an Influencer Invoice

When engaging in any type of business agreement or collaboration, having a formal document to request compensation is essential. This type of document serves as a professional record of your work and provides both you and your client with a clear understanding of payment terms. Without such a structure, it can be difficult to track what has been agreed upon, potentially leading to missed payments or confusion over the terms.

For anyone in the creative space, especially those working on multiple projects with different clients or brands, it’s crucial to stay organized. A structured request for payment not only helps you get paid on time but also reinforces your professionalism. Without it, you risk leaving room for miscommunication or delays, which could impact your reputation or your cash flow.

The following table explains some of the key reasons why having a formal payment request is necessary:

| Reason | Explanation |

|---|---|

| Clear Record of Work | Helps both parties keep track of the services rendered and agreed-upon terms. |

| Ensures Timely Payment | Sets clear expectations for when and how you will be compensated. |

| Professional Appearance | Demonstrates that you take your work seriously and helps build trust with clients. |

| Prevents Disputes | A formal document reduces the risk of confusion or disagreements over payment details. |

| Legal Protection | In case of non-payment, a record of the agreement can help resolve issues legally. |

Having a clearly outlined document not only simplifies your financial transactions but also shows clients that you are committed to professionalism. It is an important step in managing your business relationships and ensuring that you are paid fairly and on time.

How to Create an Effective Invoice

Creating a well-structured document to request payment is an essential skill for any professional working with clients or brands. A properly crafted request ensures that all necessary details are clear and that both parties understand the terms of the agreement. The key to an effective payment request lies in presenting the information in a simple yet comprehensive manner that leaves no room for confusion.

To start, it’s important to include basic information, such as your contact details, those of your client, and a brief description of the work provided. This helps establish the context for the transaction and allows for easy identification later on. Additionally, outlining the agreed-upon amount and payment terms is crucial to avoid misunderstandings.

Consider the following steps to ensure your payment request is clear and professional:

| Step | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Include Your Information | Provide your full name or business name, contact details, and any relevant tax information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2. Add Client’s Details | Clearly state the name, address, and contact information of the person or company you are working with. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3. Detail the Work Done | Describe the services provided, specifying the scope and any milestones or deliverables achieved. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4. Set the Payment Amount |

Benefits of Using Invoice TemplatesUtilizing a pre-designed structure for payment requests offers significant advantages for professionals looking to streamline their financial transactions. These ready-made formats not only save time but also ensure that all necessary details are consistently included. By adopting a standardized approach, you can avoid errors and improve the efficiency of your billing process. One of the key benefits of using a structured format is the time saved in creating each request. Instead of drafting a new document from scratch, you can quickly input the relevant details and send it off. Additionally, using a consistent design improves your professional image and makes it easier for clients to process payments. This also helps ensure that you do not miss important information, such as payment terms or due dates. The table below outlines some of the key advantages of using a structured billing format:

By using a ready-made format, you gain not only efficiency but also a higher level of organization and professionalism, which can contribute to smoother business relationships and timely payments. Whether you’re managing a few projects or many, the benefits of using structured documents are undeniable. Key Elements of an Influencer InvoiceCreating a clear and professional request for payment involves including several key details to ensure that both you and your client understand the terms of the transaction. A well-structured document provides all the necessary information to avoid confusion and facilitate timely payments. Each component plays a vital role in presenting the terms and ensuring that no critical data is overlooked. While the specific content may vary depending on the nature of the project, there are several essential elements that should always be included. These details help organize the transaction and provide a transparent overview of the work completed and the amount due. The table below outlines the critical components of a well-organized document for requesting payment:

In Customizing Your Invoice for ClientsWhen requesting payment for your work, it’s important to tailor the document to each individual client or project. Customization not only adds a personal touch but also ensures that the specific details of your agreement are clearly reflected. By adapting your billing request to suit each situation, you help foster a professional relationship and demonstrate attention to detail. Personalizing your request for payment involves more than just changing the client’s name. You may need to adjust the description of the services provided, the payment terms, or the due date to match the unique needs of each client. The more accurately you reflect the terms of your agreement, the smoother the payment process will be. Here are some key areas to customize when creating a payment request:

Customizing each payment request helps avoid confusion, ensures both you and the client are on the same page, and allows you to maintain a high level of professionalism. By making small adjustments based on the specifics of each project, you create a better experience for both parties and streamline the payment process. Top Platforms to Use TemplatesWhen it comes to creating professional documents for payment requests, using a reliable platform can save time and ensure that all necessary components are included. Many online services provide customizable formats that make it easy to generate well-organized documents, without the need for designing one from scratch. These platforms offer flexibility, ease of use, and a range of features that can streamline the entire process. 1. Microsoft WordMicrosoft Word is a popular choice for creating various documents, including payment requests. With its vast selection of pre-designed formats, users can easily modify sections to suit their needs. You can adjust everything from the layout to the content, ensuring that each document is tailored to your specific project. Word’s compatibility with both Windows and Mac systems makes it an accessible option for most professionals. 2. Google DocsGoogle Docs is another excellent platform for creating professional documents. It offers the advantage of being cloud-based, meaning you can access and edit your work from any device with an internet connection. Google Docs also provides a range of customizable designs that can be used for crafting payment requests. The real-time collaboration feature makes it ideal if you need to share the document with a client or colleague for review before sending it out. Using a trusted platform to create and manage your payment requests not only saves you time but also ensures that each document is polished and consistent. These tools offer various templates that are easy to modify, making it simple to generate professional-looking documents without needing advanced design skills. How to Add Payment Terms to InvoicesIncluding clear and detailed payment terms in your billing document is crucial to ensure both parties are on the same page regarding the expectations of the transaction. Payment terms define when and how payment should be made, outlining everything from due dates to any penalties for late payments. These terms help reduce misunderstandings and can prevent delays in receiving compensation for your work. To add effective payment terms, it’s essential to clearly state the due date, the acceptable payment methods, and any conditions for late fees or discounts. Specifying these details helps set expectations and encourages timely payment. Here are some key components to include when defining payment terms:

By clearly outlining these terms in your document, you help ensure a smooth transaction process. Providing this information upfront also minimizes the risk of disputes and demonstrates professionalism in managing financial matters. Clear payment terms are not just about getting paid on time–they also help build a trustworthy and transparent relationship with your clients. How to Calculate Your FeesDetermining how much to charge for your work can be a challenging but essential task. Setting the right fee ensures that you are compensated fairly for the value you provide while maintaining competitive pricing. Calculating your fees involves considering multiple factors such as the scope of the project, your expertise, the client’s budget, and industry standards. Understanding these elements will help you arrive at a rate that reflects your skills and the effort required for the project. Here are some key factors to consider when calculating your rates:

Once you’ve accounted for these factors, you can establish a pricing structure that works for you. Whether you charge a flat fee, hourly rate, or project-based price, make sure it reflects the value you’re providing and aligns with the effort required. Having a clear understanding of your fees not only helps you stay organized but also shows clients that you are professional and transparent about your pricing. Design Tips for Professional InvoicesCreating a well-designed document for payment requests is not only about aesthetics–it’s also about ensuring clarity and professionalism. A clean, organized layout can make the information easier to read, help prevent misunderstandings, and give clients a positive impression of your business practices. Thoughtful design choices, such as fonts, spacing, and color schemes, contribute to the overall effectiveness of the document. When designing a payment request, it’s important to focus on simplicity and functionality. The document should be visually appealing yet easy to navigate. Keep in mind that the goal is to present key details–such as the amount due, payment terms, and work description–in a clear and concise manner. Below are some design tips to help you create a polished and professional document:

By following these design tips, you can create a payment request that is not only functional but also reflects your professionalism and attention to detail. A well-designed document can help build trust with clients, encourage timely payments, and contribute to the smooth operation of your business. Invoice Template Examples for InfluencersWhen creating a payment request, it’s essential to ensure that the document is clear, professional, and tailored to the specific nature of the services provided. There are various ways to structure these documents, depending on the complexity of the work and the type of client. Whether you’re working on a single project or an ongoing partnership, having a well-organized document helps you present your work in a professional light and ensures that both parties are aligned on payment expectations. Simple Payment Request ExampleA basic payment request is ideal for straightforward projects or one-time services. This type of document includes essential details such as the total amount due, payment methods, and due date. Here’s an example of a simple payment request format:

Detailed Payment Request ExampleIf the project is more complex or involves multiple services, a more detailed request may be necessary. This format breaks down each task and assigns a corresponding rate, providing a clearer picture of how the total amount was calculated. Below is an example:

|