Free Editable and Printable Invoice Template for Easy Customization

Running a business involves a lot of paperwork, and one essential document that you’ll constantly need is a billing statement. This form of communication between you and your clients ensures that payments are processed smoothly and accurately. Having a well-designed and flexible format allows you to present charges clearly and professionally, making it easier for customers to understand what they owe and why.

Instead of creating such documents from scratch each time, many business owners choose to use pre-designed layouts that can be tailored to fit their needs. With the right structure, these documents can be customized to match your company’s branding, include necessary information, and ensure legal compliance. They offer an efficient way to manage your finances and maintain a professional image.

In this guide, we will walk through the key elements of creating your own custom billing sheets. You’ll learn how to adapt existing formats, incorporate your business details, and generate a document that suits your specific needs–all while saving time and effort in the process.

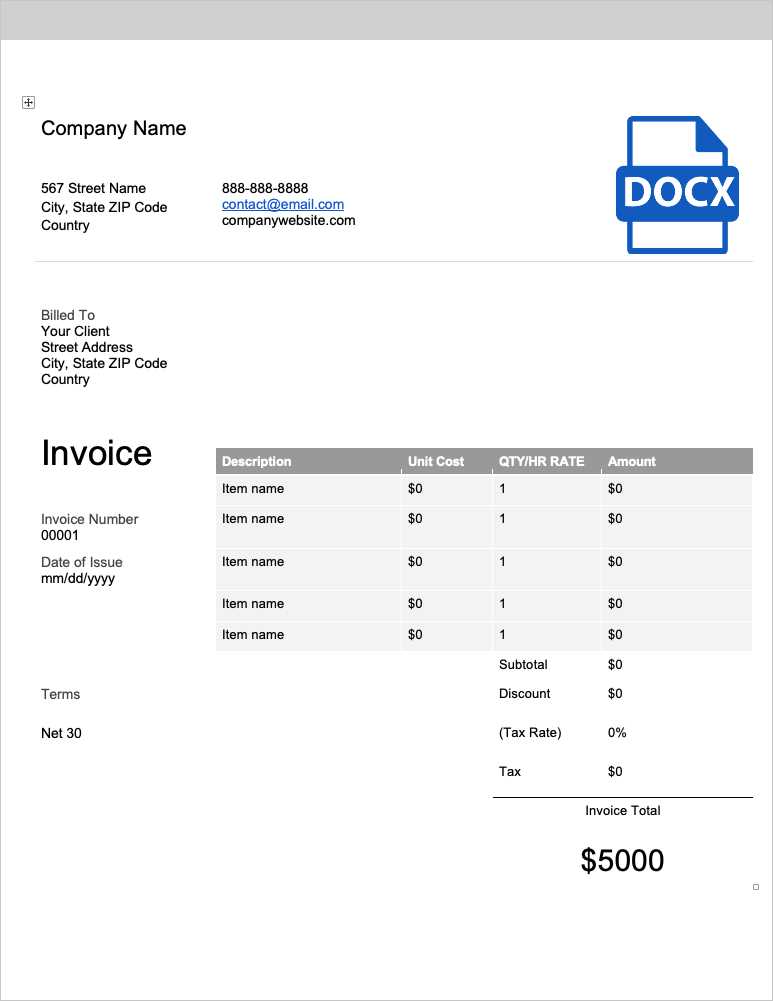

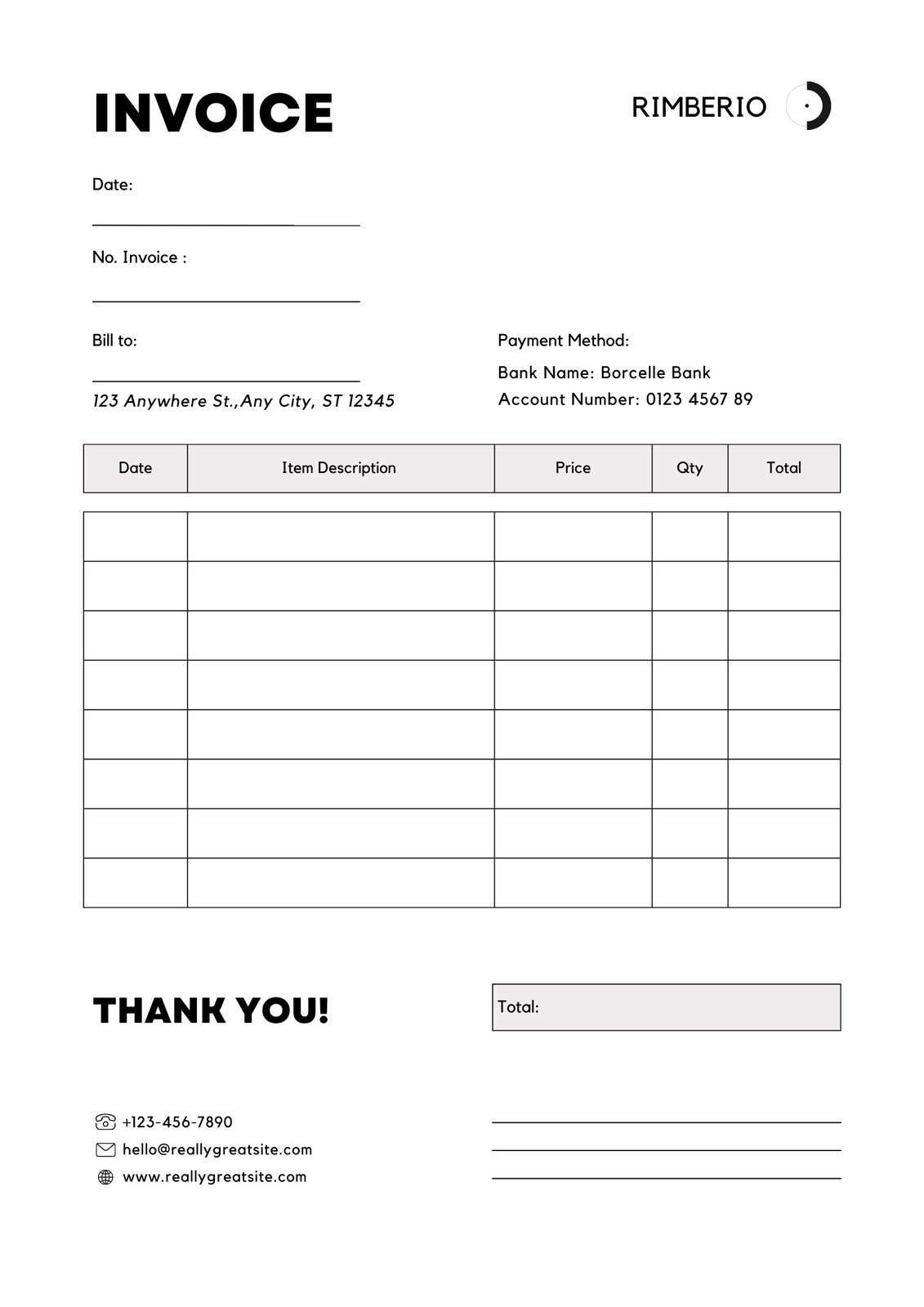

Free Editable Printable Invoice Template

For any business, having a standardized way to request payments is essential. The right document allows you to quickly issue bills, whether you’re offering services, products, or both. These forms can be customized to meet your specific needs, ensuring that you maintain a professional image while keeping your financial records organized and clear.

Choosing the Right Format

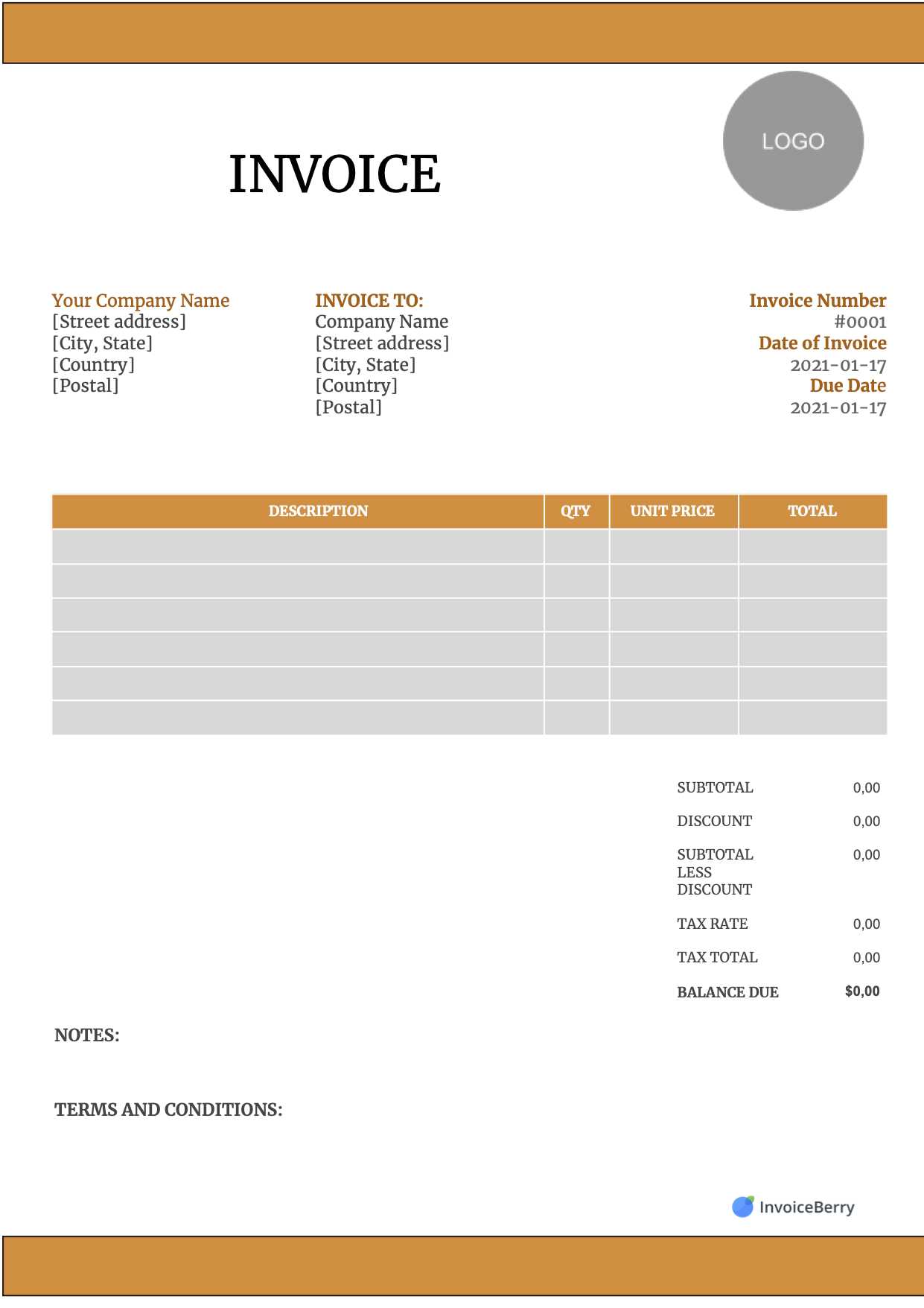

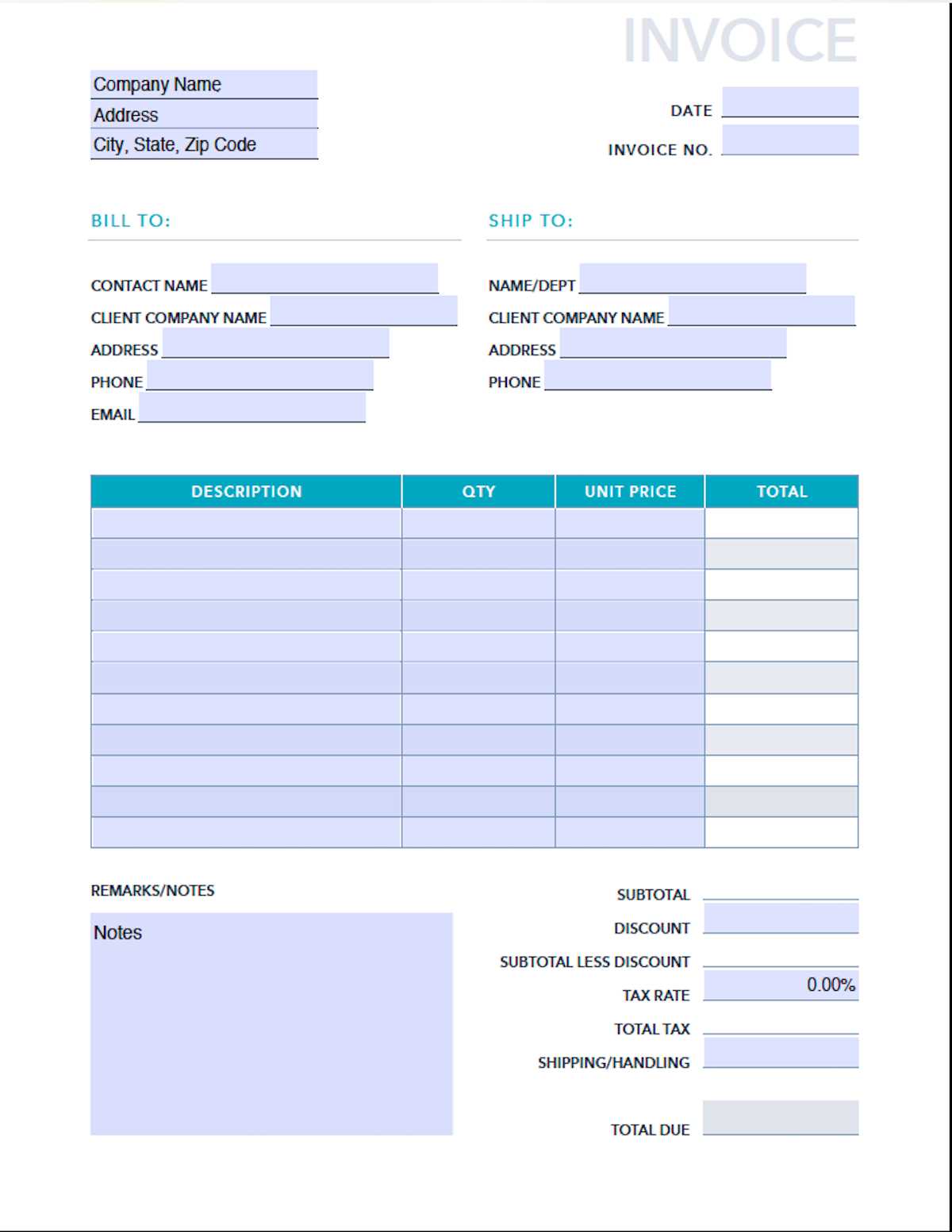

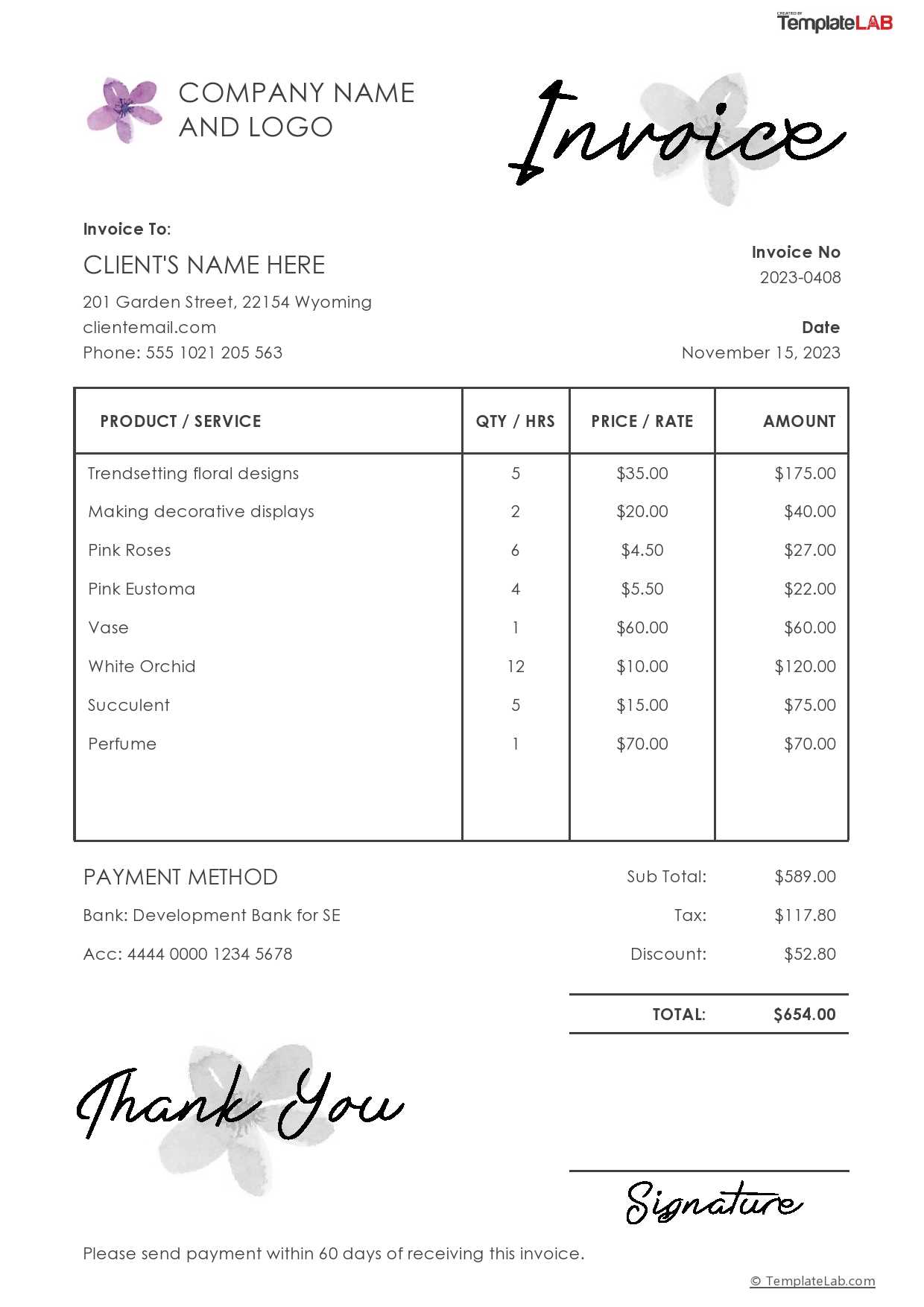

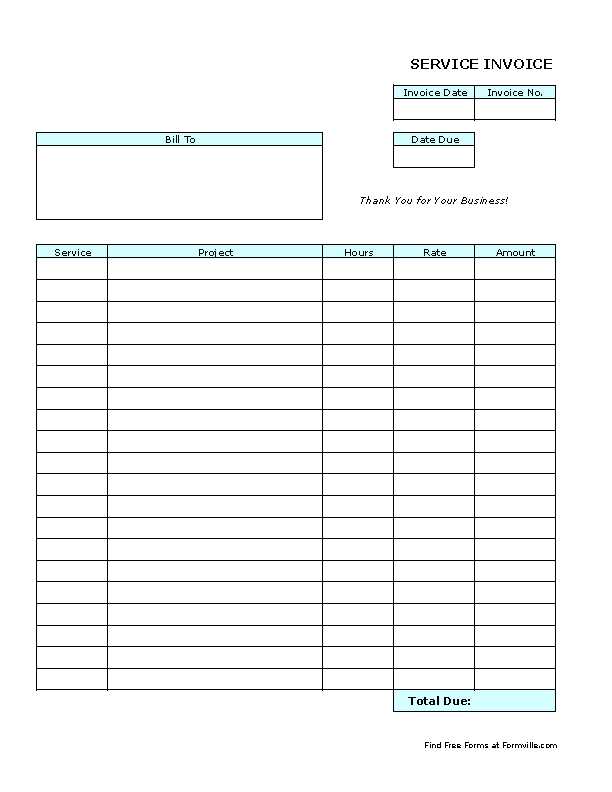

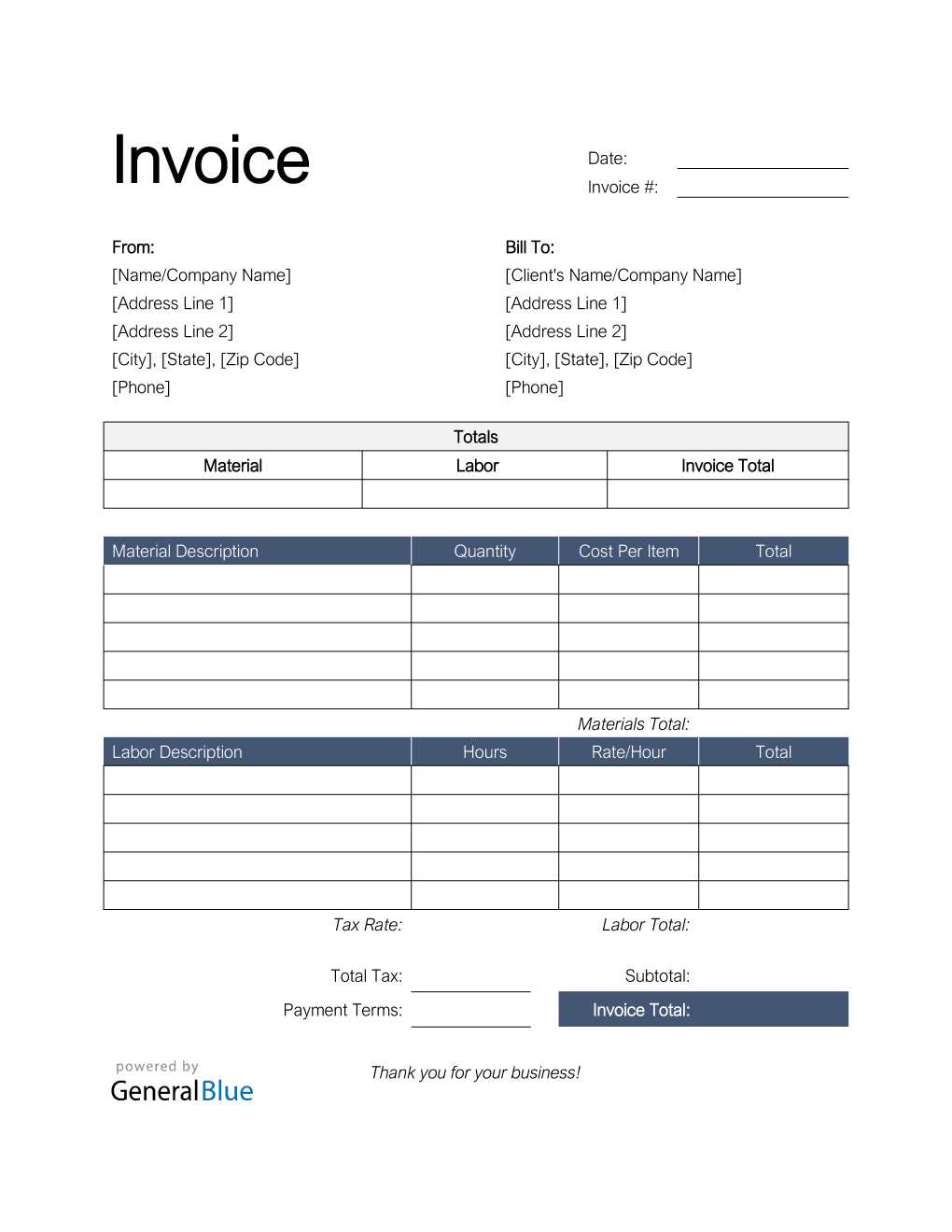

Selecting the right layout is the first step in creating a functional billing document. It should include all necessary information, such as your company details, client information, itemized charges, and payment instructions. A clean and simple structure not only helps in providing clarity but also ensures your client has all the relevant details needed to process the payment without confusion.

Customizing for Your Business

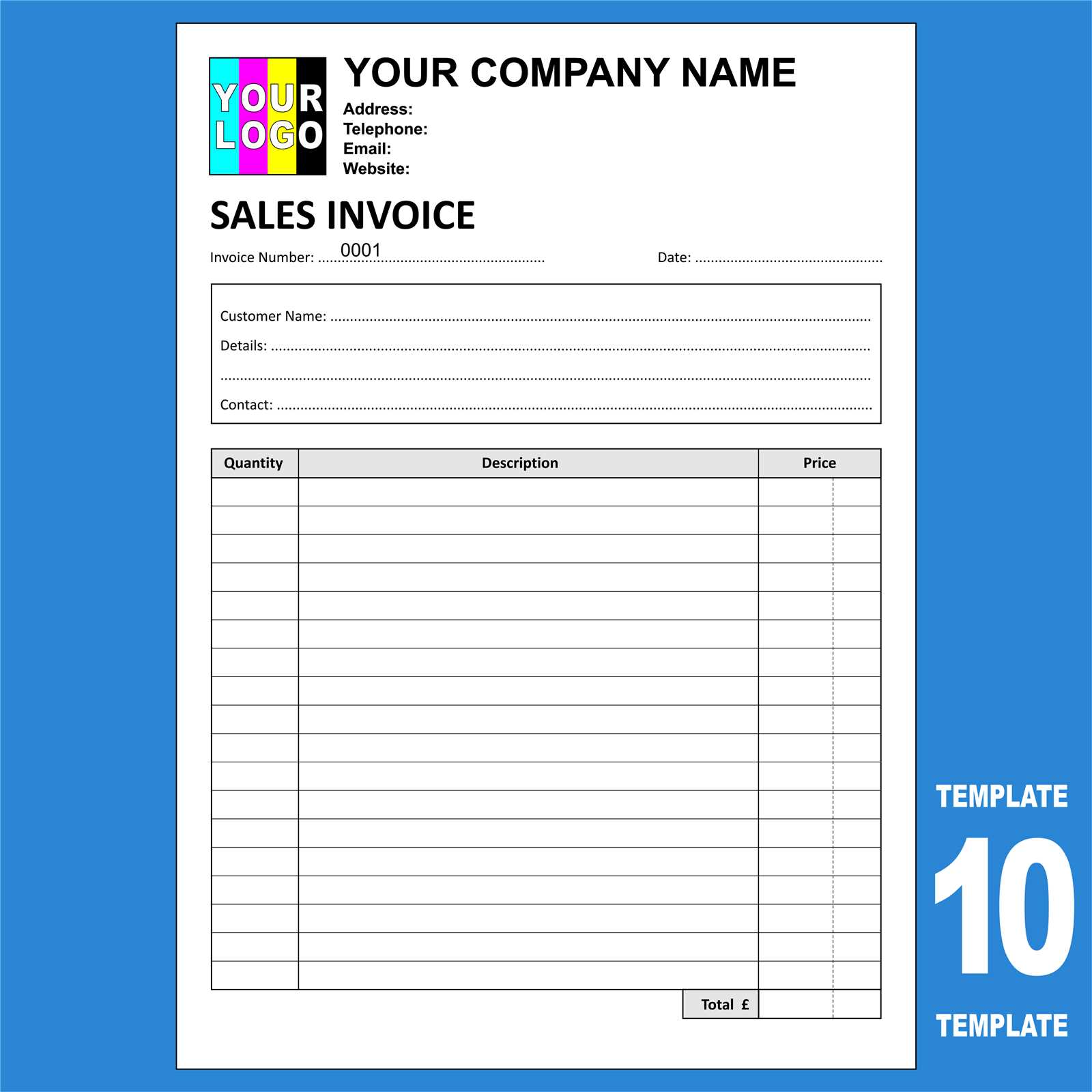

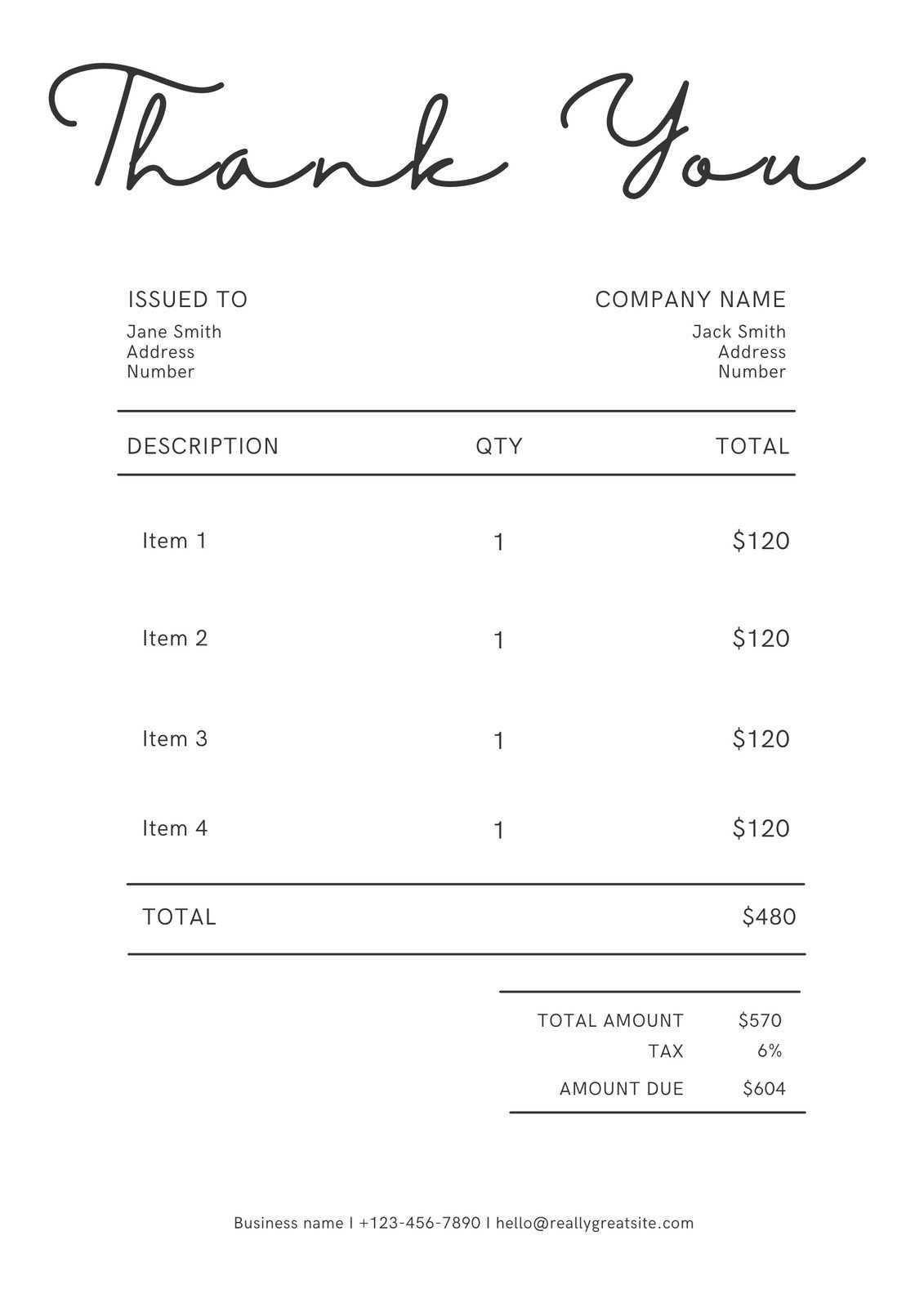

While a generic layout can be useful, personalizing the design to reflect your brand is key. Adding your company logo, using the appropriate color scheme, and tailoring the language to suit your business can make your billing document not only functional but also a marketing tool that reinforces your brand identity. Make sure to update fields such as payment terms, due dates, and service descriptions to match your business practices.

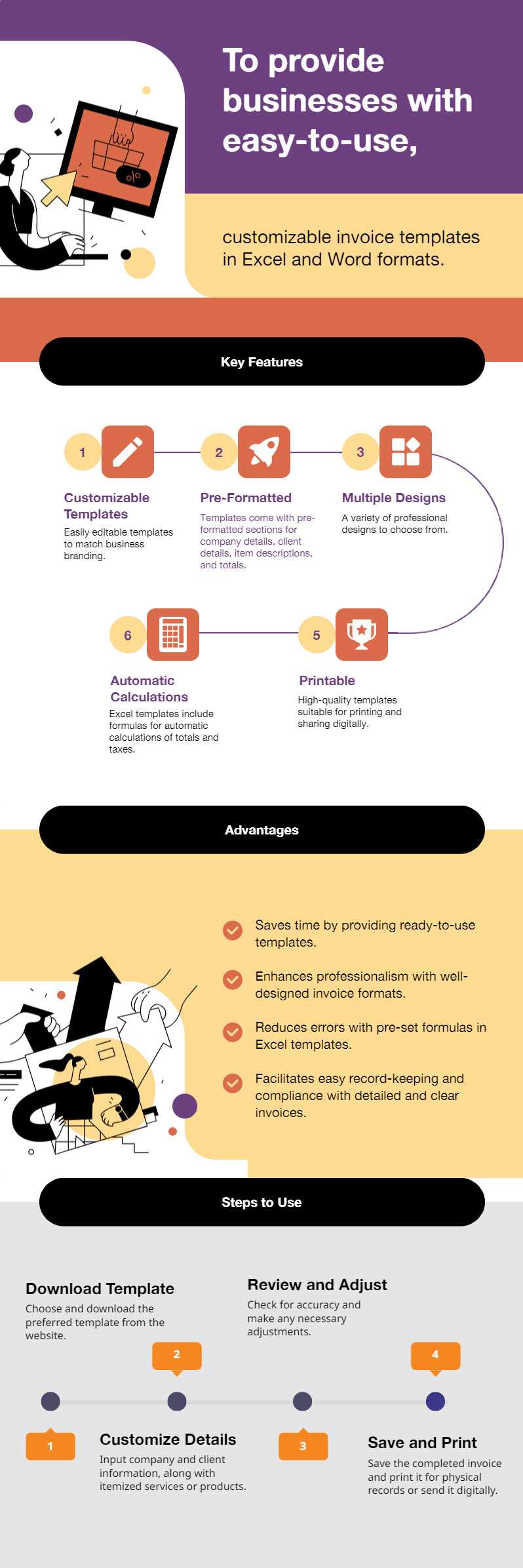

Why Use an Invoice Template?

Having a pre-designed structure for generating billing statements offers numerous advantages. It saves time, ensures consistency, and enhances the overall professionalism of your business communications. By using a ready-made format, you eliminate the need to start from scratch each time you need to request payment, allowing you to focus more on delivering value to your clients.

Here are some key reasons why businesses should use a ready-to-use format for generating payment requests:

- Time Efficiency: With a set layout, you can quickly fill in the necessary details, avoiding the need to redesign the document each time you need to send a bill.

- Consistency: A uniform style ensures that every document looks the same, reinforcing your brand identity and making it easier for clients to recognize your business.

- Professional Appearance: A polished, well-structured document builds trust with clients, presenting your business as organized and reliable.

- Accuracy: Using a consistent format helps reduce the risk of errors, ensuring that all essential information is included and presented clearly.

- Easy Customization: A flexible design allows you to modify specific details, ensuring that each statement meets your business’s unique requirements.

Ultimately, using a pre-designed format streamlines the billing process, helps maintain a professional image, and provides a more efficient way to manage your business’s finances. Whether you’re a freelancer or a small business owner, this simple tool can make a big difference in how you handle payments.

Benefits of Customizing Your Invoice

Personalizing your billing documents offers several advantages that go beyond just the functionality of requesting payments. By tailoring your statements to match your business identity, you can enhance your professional image and streamline your operations. Customization allows you to ensure that each document aligns with your specific needs, helping you communicate more effectively with your clients.

Brand Consistency and Professionalism

Customizing your billing forms provides an opportunity to reinforce your brand. Including your company logo, brand colors, and specific fonts on every document strengthens your identity and builds recognition. This professional touch not only boosts your credibility but also makes your business appear more polished and trustworthy to clients.

Clear Communication and Accurate Details

Tailoring each document allows you to include all the necessary details relevant to your transactions. You can adjust the layout to ensure that important information, such as payment terms, itemized charges, and contact information, stands out clearly. This clarity helps prevent confusion and ensures that your clients understand exactly what they are being charged for and when payment is due.

Moreover, custom documents enable you to integrate specific features that suit your business model, such as offering discounts or highlighting recurring payments. These adjustments make the process more efficient and client-friendly, reducing the chance of disputes or payment delays.

How to Download a Free Template

Getting started with a well-designed billing document doesn’t have to be complicated. Many online platforms offer ready-made formats that you can easily access and download for immediate use. These resources help simplify the process of creating professional payment requests without needing advanced design skills or software.

To obtain a ready-to-use structure, follow these simple steps:

- Search for Reliable Sources: Look for trusted websites or business resource platforms that offer high-quality downloadable documents. Many of these sites provide various options tailored to different business types.

- Choose the Right Design: Browse through the available options and select a layout that suits your needs. Make sure the design matches your company’s image and includes all necessary fields.

- Download the File: Once you’ve selected your preferred layout, simply click the download button. Depending on the platform, you may receive a file in different formats such as PDF, Word, or Excel, allowing you to choose what works best for you.

- Save and Open: After downloading the file, save it to a convenient location on your computer or cloud storage. Open the document in the relevant software (e.g., Word or Excel) to begin customizing it with your specific information.

By following these steps, you can quickly access a well-structured document that meets your business needs and can be easily adapted as required. The ability to download these formats saves time and ensures you always have a professional-looking payment request ready when you need it.

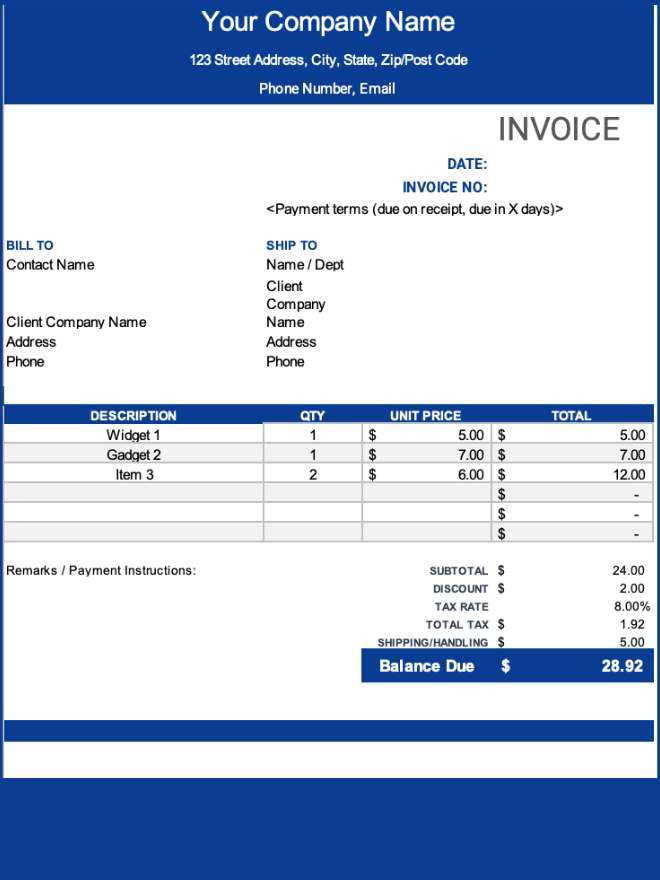

Best Formats for Printable Invoices

Choosing the right format for your billing documents is essential to ensure they are clear, professional, and easy to use. Different formats offer various advantages depending on the nature of your business and how you plan to manage the documents. By selecting the most suitable format, you can streamline your workflow and improve the client experience.

Here are some of the best formats commonly used for generating payment requests:

- PDF: Portable Document Format is one of the most popular choices for creating finalized billing statements. It ensures that the document maintains its design across all devices and platforms, and it’s easily accessible for both you and your clients.

- Excel: Excel spreadsheets offer great flexibility, particularly if you need to track multiple line items or require more complex calculations. This format is ideal for businesses that frequently update pricing or services.

- Word: A simple Word document is another excellent choice, especially for businesses that need to make occasional modifications without complex calculations. It allows easy editing and is commonly used for customized communication with clients.

- Google Docs/Sheets: Cloud-based options, such as Google Docs or Sheets, are convenient for collaboration and sharing in real-time. These formats also allow you to store documents online, making them accessible from any device with internet access.

Each of these formats offers its own set of advantages, depending on your business needs. Whether you’re seeking a simple design or more advanced features, selecting the right option can help you create efficient and professional billing statements.

Simple Design Tips for Invoices

A well-designed payment request not only helps convey professionalism but also makes it easier for your clients to understand the charges and process the payment. By keeping the layout clean and organized, you can ensure that all essential details are easy to find. A simple, functional design helps to maintain clarity while ensuring that your document remains visually appealing.

Here are some key design tips to consider when creating your billing documents:

- Use Clear Headings: Organize the document with clear headings to separate different sections, such as client details, services provided, and payment terms. This makes the information easy to scan quickly.

- Keep it Clean and Uncluttered: Avoid overloading the document with unnecessary elements. A minimalist design ensures the key details stand out, making the billing process smooth and professional.

- Choose Legible Fonts: Use simple, readable fonts for the text. Stick to one or two font styles to maintain consistency. Fonts like Arial, Helvetica, or Times New Roman are good choices for clarity.

- Include Your Logo: Adding your company logo at the top reinforces your brand’s identity and adds a professional touch to the document. It also helps make your statement easily recognizable.

- Highlight Important Information: Use bold text or subtle color to emphasize key details, such as payment due dates, amounts owed, or contact information. This ensures your client can quickly identify what’s most important.

- Keep the Layout Balanced: Align your content neatly, using margins and spacing to create a visually balanced document. This prevents the form from feeling crowded and gives it a polished look.

By following these simple design tips, you can create a functional and aesthetically pleasing payment request that not only looks professional but also ensures your clients can easily understand and act on the information provided.

How to Edit an Invoice Template

Customizing your billing documents allows you to tailor them to your business’s needs, ensuring that all the relevant details are included and presented professionally. Whether you’re adjusting a pre-made layout or creating one from scratch, editing these documents is a straightforward process. With the right tools, you can easily update sections, add new information, and maintain consistency with your brand’s identity.

Follow these steps to edit your payment request document:

- Open the Document: Start by opening the document in the relevant program (such as Microsoft Word, Excel, or Google Docs). Most platforms offer user-friendly interfaces for making changes quickly.

- Modify Company Information: Update the header with your business name, logo, and contact details. This is essential for establishing your company’s identity on every statement.

- Adjust Client Information: Enter your client’s name, address, and other relevant details. Be sure the contact information is accurate to avoid any confusion when they receive the statement.

- Edit the Line Items: Update the list of products or services provided. Modify the description, quantity, price, and any applicable taxes or discounts. Ensure each item is clear and easy to understand.

- Update Payment Terms: Make sure your payment terms are current, including the due date, accepted payment methods, and late fee policies if applicable.

- Save Your Changes: Once you’ve made all the necessary changes, save the document in your preferred format. It’s always a good idea to keep a master copy for future use.

By following these steps, you can quickly customize your billing statements, making them accurate and professional every time. With just a few simple edits, your documents will align perfectly with your business’s needs and maintain a consistent look for all your transactions.

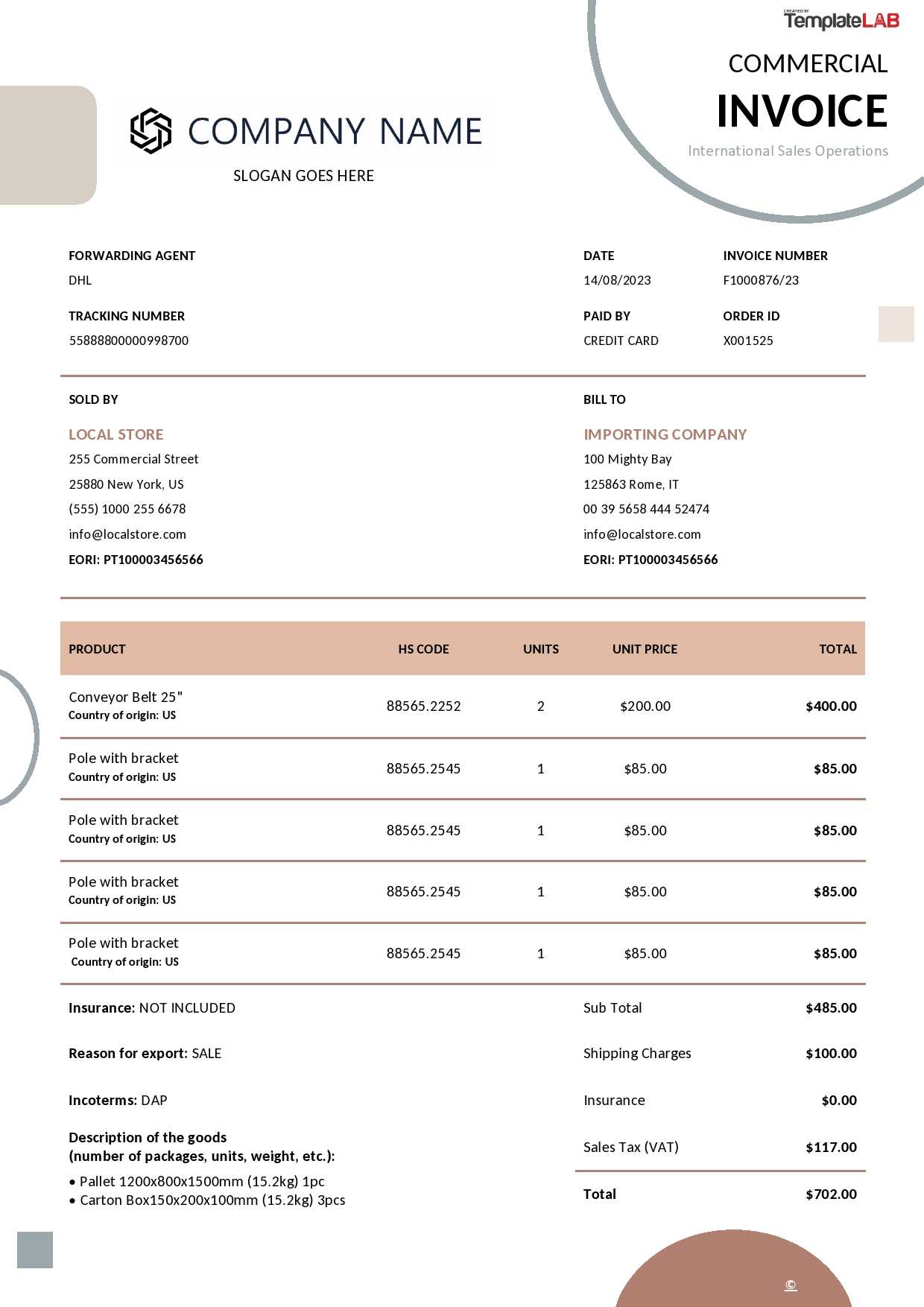

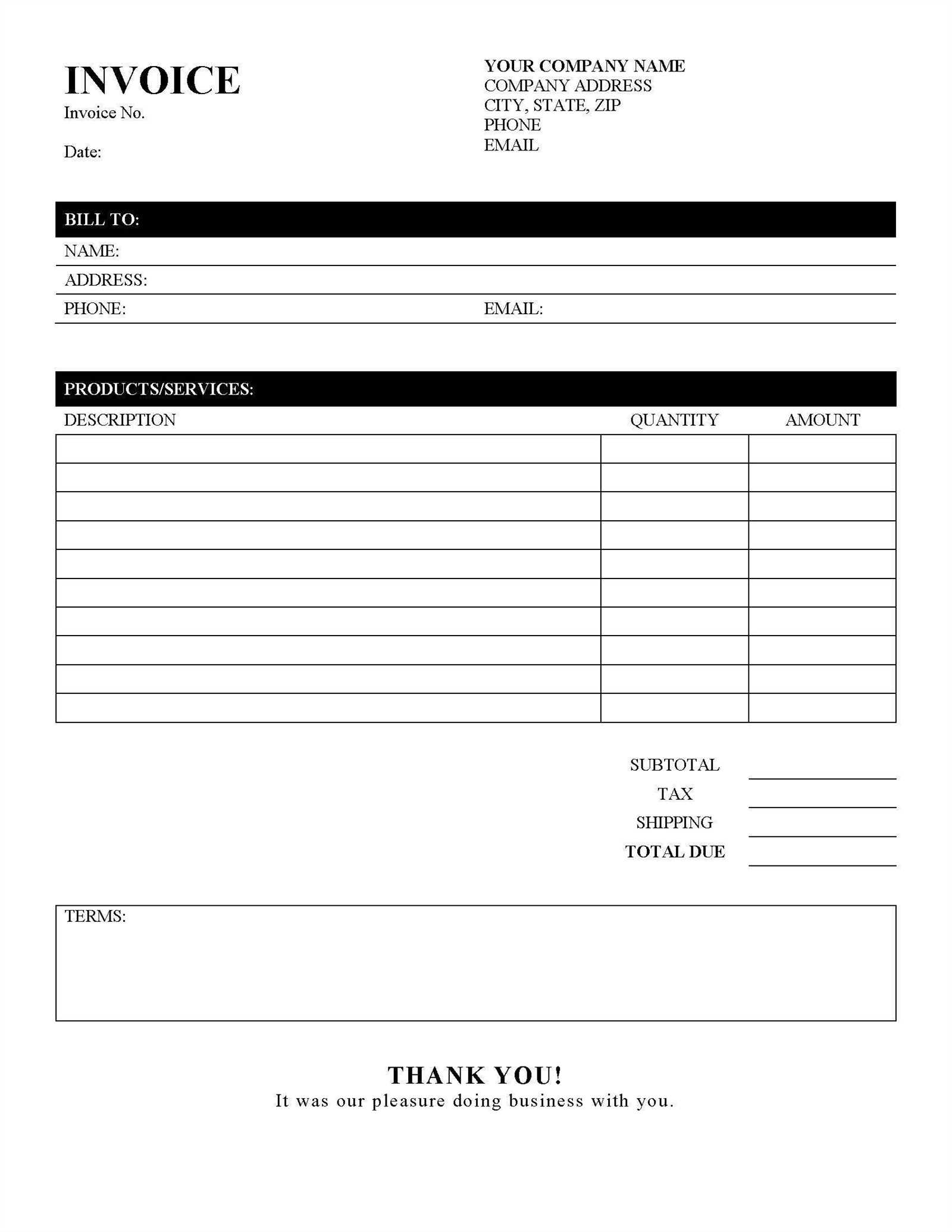

Essential Information for Your Invoice

To ensure that your billing document is both clear and professional, it’s crucial to include all the necessary information that will help both you and your client understand the terms of the transaction. A well-structured payment request provides the details required for smooth processing and reduces the risk of confusion or disputes. Below are the key elements that should be included in every payment document.

Key Details to Include

- Your Business Information: Make sure your company name, address, phone number, email, and website (if applicable) are clearly listed at the top. This allows clients to contact you easily if they have questions.

- Client’s Information: Include the client’s full name or business name, address, and contact details to ensure the payment reaches the right recipient.

- Unique Reference Number: Assign a unique number to each payment request. This helps in tracking and organizing records for both you and your client.

- Detailed Description of Products or Services: List the goods or services provided, including quantities, unit prices, and brief descriptions. This helps clients understand exactly what they are being charged for.

- Subtotal, Taxes, and Discounts: Clearly break down the costs, including any applicable taxes or discounts, to ensure full transparency on the total amount due.

- Payment Terms and Due Date: Specify the payment terms, including the due date, acceptable payment methods, and any penalties for late payment. This ensures that both parties are aligned on when and how payment should be made.

- Additional Notes or Instructions: Include any other relevant information, such as shipping details, special instructions, or warranties, to provide further clarity for the client.

Why These Details Matter

Including all of this information not only ensures that both parties are on the same page but also helps establish a professional and organized image for your business. Clear, well-organized documents make it easier for clients to process payments quickly, reducing delays and potential errors. Moreover, these details may be important for tax reporting and financial records.

By taking the time to include all the necessary information, you’ll ensure that your documents are effective, accurate, and aligned with professional standards.

Creating Professional Invoices Quickly

Generating professional payment documents doesn’t need to be a time-consuming task. With the right tools and process in place, you can create polished, accurate billing statements in just a few minutes. Streamlining your workflow ensures you maintain a consistent and professional image without wasting valuable time on administrative tasks.

Here are some tips for creating professional payment requests quickly:

- Use Pre-designed Layouts: Start with a ready-made structure that already includes all necessary fields and a clean design. This way, you only need to fill in the relevant details rather than starting from scratch.

- Automate Common Entries: Set up default information, such as your business name, logo, and payment terms. This will save you time by avoiding repeated entry of the same data every time you create a document.

- Utilize Software or Online Tools: Leverage accounting or document management software that allows you to create, edit, and store payment requests quickly. Many tools also offer features like automatic calculations for taxes and totals.

- Stay Organized with Client Information: Keep a contact list with frequently used client details, so you can quickly add them to the payment document without having to search for each customer’s information manually.

- Set a Standard Layout: Create a uniform design that you can use for all documents. This reduces the time spent on formatting and ensures consistency across all your communications.

- Proofread Before Sending: Before finalizing any document, quickly review the details for accuracy. This helps avoid errors that might lead to delays or confusion later.

By following these steps, you can produce professional billing statements in no time, allowing you to focus on growing your business rather than getting bogged down by paperwork. The more efficient your process, the faster you’ll be able to send out payment requests and keep your cash flow moving smoothly.

Common Invoice Mistakes to Avoid

Even small errors in your billing documents can lead to confusion, delayed payments, or even lost revenue. It’s essential to ensure that every detail is accurate and clear. Simple mistakes can affect your professionalism and may even damage relationships with clients. By being aware of common pitfalls, you can take steps to avoid them and create documents that reflect well on your business.

Here are some of the most common mistakes to watch out for when preparing payment requests:

- Missing or Incorrect Contact Information: Ensure that both your company’s and your client’s contact details are correct. Missing phone numbers or incorrect email addresses can delay communication and payment processing.

- Unclear Payment Terms: Always specify the due date and payment method. If these terms are vague, clients may be uncertain about when and how to pay, potentially delaying the process.

- Not Including Itemized Charges: Failing to clearly list the goods or services provided can lead to misunderstandings. Be sure to include a description, quantity, unit price, and total cost for each item or service.

- Wrong Calculations: Double-check all numbers, including quantities, prices, taxes, and totals. A simple math error can undermine the professionalism of the document and delay payment.

- Not Using a Unique Reference Number: Each payment request should have a unique number for easy tracking and reference. Without one, it can be difficult for both you and your client to manage or look up past transactions.

- Omitting Late Fees or Discounts: If applicable, include any discounts or late fees clearly in the document. Not mentioning these upfront can lead to confusion or disputes down the line.

- Overcomplicated Design: A cluttered, hard-to-read layout can make it difficult for clients to process the information. Keep the design simple and organized, with a clear hierarchy of information.

Avoiding these mistakes will not only help you maintain professionalism but also ensure that your billing process is smooth and efficient. By taking a little extra time to check your documents, you can save yourself from headaches and ensure timely payments from your clients.

Customizing Colors and Fonts in Templates

One of the simplest ways to make your billing documents stand out and align with your brand is by customizing their colors and fonts. By making thoughtful design choices, you can ensure your documents reflect your business’s unique identity and make a lasting impression on clients. Using the right combinations of colors and fonts not only enhances the aesthetic appeal but also ensures that the document is clear and easy to read.

Here are some guidelines for effectively customizing the colors and fonts in your billing documents:

Choosing the Right Colors

- Match Your Brand Colors: Incorporating your company’s colors into the design helps strengthen brand recognition. Use your logo’s colors for headings, borders, or highlights to keep a consistent look.

- Maintain Readability: Make sure there is enough contrast between the text and the background. Light text on a dark background or dark text on a light background is easiest to read.

- Use Colors Sparingly: While it’s tempting to use bright colors, stick to a limited color palette. Too many colors can make the document look chaotic and unprofessional.

- Highlight Key Information: Use a distinct color to draw attention to important details, such as the total amount due or payment terms, making them easy to find.

Selecting the Right Fonts

- Choose Readable Fonts: Opt for clear and simple fonts that are easy to read, even at small sizes. Popular choices include Arial, Calibri, and Times New Roman.

- Use Consistent Font Styles: Stick to one or two fonts throughout the document. Using too many font styles can create visual clutter and reduce professionalism.

- Vary Font Weights for Emphasis: Instead of using multiple fonts, consider using bold or italics to emphasize key information, such as headings or totals.

- Avoid Decorative Fonts: While stylish fonts may look appealing, they can be difficult to read. Keep the design simple to maintain clarity and professionalism.

By carefully selecting and customizing colors and fonts, you can create a billing document that is visually appealing, professional, and aligned with your brand. The right design choices will ensure that your clients can easily navigate and understand the information, leading to a smoother and more effective payment process.

Where to Find Free Invoice Templates

When you’re starting out or need a quick solution, finding a reliable source for pre-designed billing documents can save you valuable time. There are many places where you can access these resources without any cost, offering both simple and sophisticated designs that can be customized to fit your needs. Whether you are using them occasionally or on a regular basis, these sources provide easy-to-use documents that can streamline your business processes.

Online Platforms Offering Ready-to-Use Documents

- Google Docs: Google Docs offers several free pre-made documents that are easy to customize. These can be edited online, making them convenient for businesses that need to access and modify documents from different locations.

- Microsoft Office Templates: Microsoft offers a variety of customizable forms through Word and Excel. These documents are available for free and include options for both basic and more complex designs.

- Canva: Canva provides a selection of professional-looking designs that can be tailored to fit your branding. Their drag-and-drop interface makes it easy for anyone to create a personalized document.

- Template.net: This site offers a wide range of free downloadable documents for different business needs. The designs are straightforward, allowing for quick customization without requiring advanced skills.

Other Useful Resources

- Zoho Invoice: Zoho offers a free billing tool with customizable layouts that are perfect for small businesses. The platform also integrates with accounting tools, which can streamline financial management.

- HubSpot: HubSpot offers various business document templates, including simple and professional options for billing. You can download and customize these documents for free.

- Invoice Generator: This is a simple online tool that allows you to create and download billing documents instantly. It’s free to use and doesn’t require you to sign up or create an account.

These resources provide an easy and efficient way to create professional billing documents without having to start from scratch. With just a few clicks, you can find a template that suits your needs and quickly customize it for your business, ensuring a streamlined and professional approach to managing payments.

Incorporating Your Brand into Invoices

Your business documents serve as a direct representation of your brand. Incorporating your brand’s visual elements into payment requests not only adds a level of professionalism but also strengthens brand recognition. From colors and fonts to logos and taglines, every detail counts when it comes to making your documents uniquely yours. This consistency helps create a cohesive experience for clients and reinforces your company’s identity.

Key Elements to Include for Brand Consistency

Here are a few important elements to consider when incorporating your branding into billing documents:

- Logo: Include your company’s logo at the top of the document. This instantly identifies your business and adds a professional touch.

- Brand Colors: Use your company’s primary colors in the document’s design, such as for headings, borders, and highlights. This creates a strong visual connection to your brand.

- Custom Fonts: Choose fonts that align with your brand’s typography. Using the same fonts across all business documents ensures consistency.

- Tagline or Slogan: If applicable, include your business’s tagline or slogan. This reinforces your message and adds a personal touch to the document.

Example of a Branded Payment Request

Here’s an example of how incorporating branding elements can enhance your documents:

| Element | How It Enhances Your Document |

|---|---|

| Logo | Promotes your brand’s identity and helps clients recognize your business instantly. |

| Brand Colors | Creates a cohesive, visually appealing layout that aligns with your business’s visual identity. |

| Custom Fonts | Maintains a professional and uniform appearance across all your documents and marketing materials. |

| Tagline | Reinforces your brand message and makes the document feel more personalized and engaging. |

By integrating your branding into payment requests, you ensure that all client-facing documents reflect your company’s professionalism and visual identity. These small details can go a long way in reinforcing trust and recognition among your clients.

How to Save and Print Your Invoice

Once you’ve completed creating your billing document, it’s important to know how to save and print it correctly to ensure it’s ready for delivery to your clients. Properly saving the file ensures that you can access and update it later, while printing it out requires a few simple steps to ensure it appears crisp and professional. Here’s how you can manage both tasks effectively.

Saving Your Document

- Select the Right File Format: Most business documents are saved in PDF format, as it preserves the layout and ensures that the file can be opened across different devices. If you plan to make future edits, save it in a format like Word or Excel.

- Choose an Organized Folder: Save your document in a clearly labeled folder on your computer or cloud storage. This makes it easier to find and manage past transactions when needed.

- Name the File Appropriately: Use a naming convention that includes the client’s name or the project number, along with the date. For example, “ClientName_Invoice_2024-10-30.pdf” helps you quickly identify the document.

- Back It Up: Consider storing a copy in the cloud or using an external drive. This protects your files in case of technical issues and ensures that you have a backup available at all times.

Printing Your Document

- Check Page Layout: Before printing, ensure that the document is formatted correctly for the page size. Check for any unnecessary margins or spacing that might cause the document to look misaligned.

- Print Preview: Always use the print preview option to check how the document will appear once printed. This helps identify any issues like cut-off text or improper formatting.

- Choose the Right Printer: Select a high-quality printer to ensure that the text is sharp and the document looks professional. Inkjet or laser printers work best for business documents.

- Paper Selection: Use standard printer paper, preferably 20 lb weight or higher, for a professional finish. Avoid using paper that is too thin or too thick, as it may affect the quality of printing or the feel of the document.

- Print in Color or Black & White: If your document includes colors like your brand’s logo or other important details, choose the color print option. For simpler documents, black and white printing will suffice.

By following these steps for saving and printing your billing documents, you ensure that every transaction is properly recorded and professionally presented to your clients. Taking these extra moments to format and review the document will contribute to a more streamlined workflow and stronger client relationships.

Legal Requirements for Invoices

When preparing billing documents, it’s crucial to ensure that they meet the necessary legal requirements. Different countries and jurisdictions have specific regulations regarding what information must be included in business transactions. Failing to comply with these legal requirements could lead to delays in payment, disputes with clients, or even legal penalties. Understanding the basic components of a legally compliant document can help you avoid common mistakes and maintain professionalism.

The following table outlines key legal requirements that should be included in your billing documents depending on your location and business type:

| Required Element | Description |

|---|---|

| Unique Document Number | A unique reference number is essential for tracking and organizing transactions. This number should be sequential and unambiguous to avoid confusion. |

| Business Information | Include your full business name, address, and contact details. In some regions, you may also need to provide your tax ID or business registration number. |

| Client Information | Clearly state the client’s name, address, and contact information. In certain cases, you may need to include the client’s tax ID or VAT number. |

| Transaction Date | The date when the goods or services were provided, or the date when the payment is due, must be clearly indicated. |

| Description of Goods or Services | Provide a detailed list of the items or services rendered, including quantities, prices, and any relevant references (e.g., purchase order numbers). |

| Amount Due | The total sum owed should be clearly listed, with a breakdown of individual costs, taxes, and any applicable discounts. |

| Tax Information | Include applicable taxes, such as VAT or sales tax, and make sure they are calculated correctly. This is particularly important for businesses that deal with cross-border transactions. |

| Payment Terms | Clearly state the payment deadline, acceptable payment methods, and any late fees or penalties if applicable. |

| Legal Disclaimer | Depending on your location and industry, you may need to include specific legal disclaimers or notices, such as refund policies or compliance statements. |

By adhering to these legal requirements, you ensure that your documents are not only compliant but also clear and transparent. This reduces the likelihood of errors or disputes with clients, helping to maintain a smooth and professional relationship. It’s always a good idea to consult with a local accountant or legal advisor to ensure your documents meet specific legal standards in your region.

Tracking Payments with Invoice Templates

Effectively managing payments is crucial for maintaining a smooth cash flow and ensuring that all transactions are properly recorded. By using organized documents that track payments, you can easily monitor outstanding amounts, due dates, and payment statuses. Tracking payments helps prevent missed or delayed payments and provides both you and your clients with a clear record of transactions. This is essential for maintaining financial transparency and managing your business’s finances efficiently.

Key Features to Include for Payment Tracking

- Payment Status: Always include a section where you can mark the payment status as “Paid”, “Pending”, or “Overdue”. This allows for quick identification of which transactions still need to be settled.

- Due Dates: Clearly indicate when the payment is due. This helps both you and your client track payment timelines and reduces the chances of missed payments.

- Payment Method: Record the payment method used, such as bank transfer, credit card, or cash. This provides an extra layer of clarity and can help resolve any disputes related to payment methods.

- Partial Payments: If applicable, include a section that tracks partial payments, ensuring that both the total amount and any outstanding balance are clearly visible.

- Payment Reference Number: Including a reference number or transaction ID for each payment can be useful for record-keeping and reconciliation with your bank statements.

Using Digital Tools to Track Payments

While manual tracking can work for smaller businesses, digital tools can greatly simplify the process of managing payments. Many online platforms offer automatic payment reminders, real-time payment status updates, and integrations with accounting software. By adopting these tools, you can streamline your payment tracking process and reduce human error.

- Accounting Software: Tools like QuickBooks or FreshBooks offer built-in features that automatically track the status of your transactions, generate reminders, and even send follow-up emails for overdue payments.

- Payment Gateways: Payment processing platforms like PayPal or Stripe provide transaction history and status updates, making it easy to track whether payments have been successfully received.

- Custom Dashboards: Create a custom dashboard in Excel or Google Sheets to track multiple transactions in one place. This can give you an at-a-glance view of payment statuses across all clients.

By integrating

How to Use Invoices for Tax Purposes

Proper documentation is essential when it comes to taxes, and detailed records of business transactions play a significant role in ensuring compliance with tax laws. Well-structured payment requests can help you track revenue, manage expenses, and calculate taxes accurately. By using organized records, you can avoid potential tax issues and streamline the process during tax season. These documents provide proof of transactions and help you meet the requirements of tax authorities.

Here’s how using your billing documents effectively can help during tax reporting:

- Track Revenue: Every payment request you send represents income. By keeping accurate records, you can easily track all incoming payments, which is essential for reporting your total revenue during tax filing.

- Calculate Deductions: These documents also help identify allowable business expenses. For instance, if you purchase goods or services that are tax-deductible, documenting them in your payment records allows you to track and calculate the expenses properly.

- Document Sales Tax: If your business is required to collect sales tax, including the tax amount on each transaction is vital. Detailed records of taxes collected make it easier to file your sales tax returns accurately.

- Provide Proof of Transactions: Should you need to prove your income or expenses to tax authorities, having a comprehensive set of records ensures that you can back up your claims with the necessary documentation.

- Meet Legal Requirements: In many jurisdictions, businesses must retain certain financial records for a number of years. By maintaining a clear and organized record of all transactions, you ensure that you comply with tax retention laws and avoid any potential audits.

By treating these records as official documents for your tax filings, you not only stay compliant with tax laws but also build a solid foundation for future audits or financial reviews. If you’re unsure about tax-specific requirements, it’s always a good idea to consult a tax professional to make sure your records meet the necessary legal standards.

Choosing the Right Invoice Template for Your Business

When running a business, selecting the right document for billing is crucial for professionalism and efficiency. The correct format not only ensures that all essential information is included but also reflects your brand’s identity. Whether you are a freelancer, a small business owner, or a large corporation, tailoring your documents to suit the nature of your business can help streamline your accounting processes and enhance your reputation with clients.

Consider the Type of Business You Operate

The first step in choosing the right billing format is understanding your business needs. Different industries have unique requirements, and your documents should reflect those specificities. For example:

- Freelancers & Consultants: If you provide professional services, a simple yet formal document with clear payment terms and a breakdown of services may be sufficient.

- Retail Businesses: If you sell products, your document should include a detailed list of items sold, including product names, quantities, and individual prices.

- Subscription-Based Services: For businesses with recurring billing, it’s important to include clear payment schedules and renewal information.

Key Features to Include

Regardless of your industry, there are key elements that should be part of any billing document:

- Clear Branding: Incorporate your company’s logo and contact details to give a professional look and make it easy for clients to get in touch.

- Itemized Breakdown: List the goods or services provided in detail, including quantities, unit prices, and any applicable taxes.

- Payment Terms: Specify due dates, late fees, and accepted payment methods to avoid confusion and set clear expectations with clients.

- Legal Information: Depending on your location, you may need to include tax identification numbers, business registration numbers, or VAT details.

By taking into account your business’s nature and incorporating these important elements, you can choose the best document style to fit your needs and ensure that your billing process is as smooth as possible.