Free Editable Invoice Template PDF for Easy Customization

Managing financial transactions and ensuring smooth cash flow is crucial for any business. The right tools can make all the difference when it comes to creating clear, professional records for payments and services. Customizable forms that allow easy modifications are an excellent way to save time and present a polished image to clients and partners.

With the ability to tailor key details like payment terms, contact information, and amounts, these documents help you maintain consistency while adapting to specific needs. Whether you’re a freelancer, a small business owner, or a large enterprise, having access to a tool that supports effortless customization can enhance efficiency and prevent errors in financial correspondence.

Easy-to-use documents also provide a way to maintain a uniform look across your business communications. With a simple setup, you can have all necessary elements in place, from itemized lists to taxes, ensuring that every transaction is clearly documented for both you and your clients. This streamlined process reduces the chances of confusion, improving both client satisfaction and financial clarity.

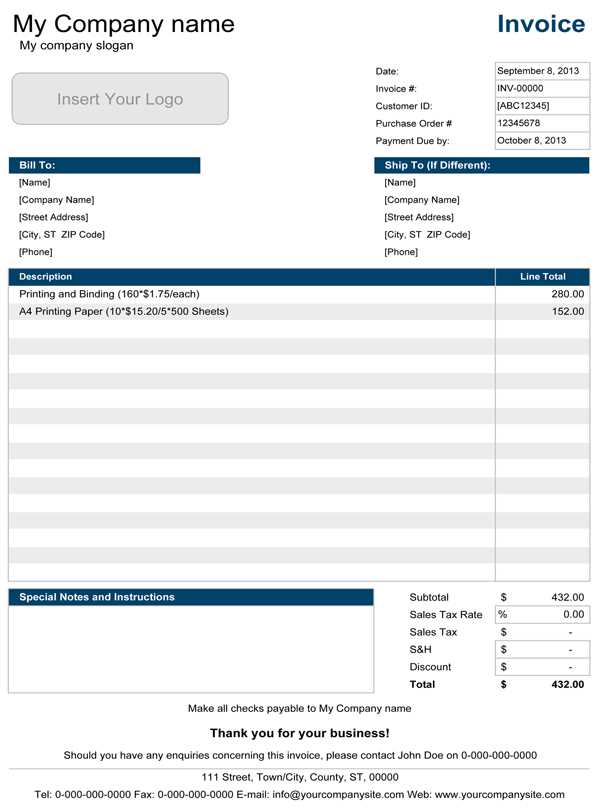

Free Editable Invoice Template PDF

When managing your business finances, it’s essential to have a system that allows you to quickly generate and personalize documents that record transactions. Accessible tools that let you adjust key details without starting from scratch can save you significant time. These customizable forms offer an efficient way to handle billing, ensuring that each document is tailored to your specific requirements.

Having the option to modify the content and format of these files makes it easy to include all necessary information, such as service descriptions, pricing, and contact details. You can ensure that each document meets your branding needs while maintaining a professional and consistent layout. Whether you’re invoicing for services rendered or products sold, these flexible solutions can be adapted to various business types.

Customized billing forms are especially useful for those who handle multiple clients or projects at once. With quick adjustments, you can personalize each document for a different customer, saving time while maintaining accuracy. These tools are perfect for freelancers, small business owners, or anyone looking to streamline their financial workflow.

What is an Editable Invoice Template?

In the world of business, keeping financial records organized is crucial. Having a document that can be easily customized for each transaction simplifies the process of managing payments. These adaptable files allow users to change key details, such as dates, amounts, and service descriptions, without needing to create a new file from scratch each time. With such a document, businesses can ensure consistency across all their communications while saving time on administrative tasks.

Benefits of Customizable Billing Documents

One of the main advantages of using a flexible billing solution is the ability to tailor it to meet specific needs. Whether you are dealing with different pricing models, customer information, or varying services, these documents can be modified to reflect any changes. This ensures that each file is accurate and aligned with the unique circumstances of the transaction. Customization allows businesses to maintain control over the structure and content of their financial communications.

Why Use a Customizable Solution?

For business owners and professionals, using a customizable solution minimizes the risk of errors that often come with manual entry. Instead of starting from scratch each time, users can adjust the pre-made structure, adding or removing details as needed. This makes it easier to ensure that all required information is included, improving the accuracy of the final document. Efficiency is key when managing multiple transactions, and these files provide a practical way to streamline the process.

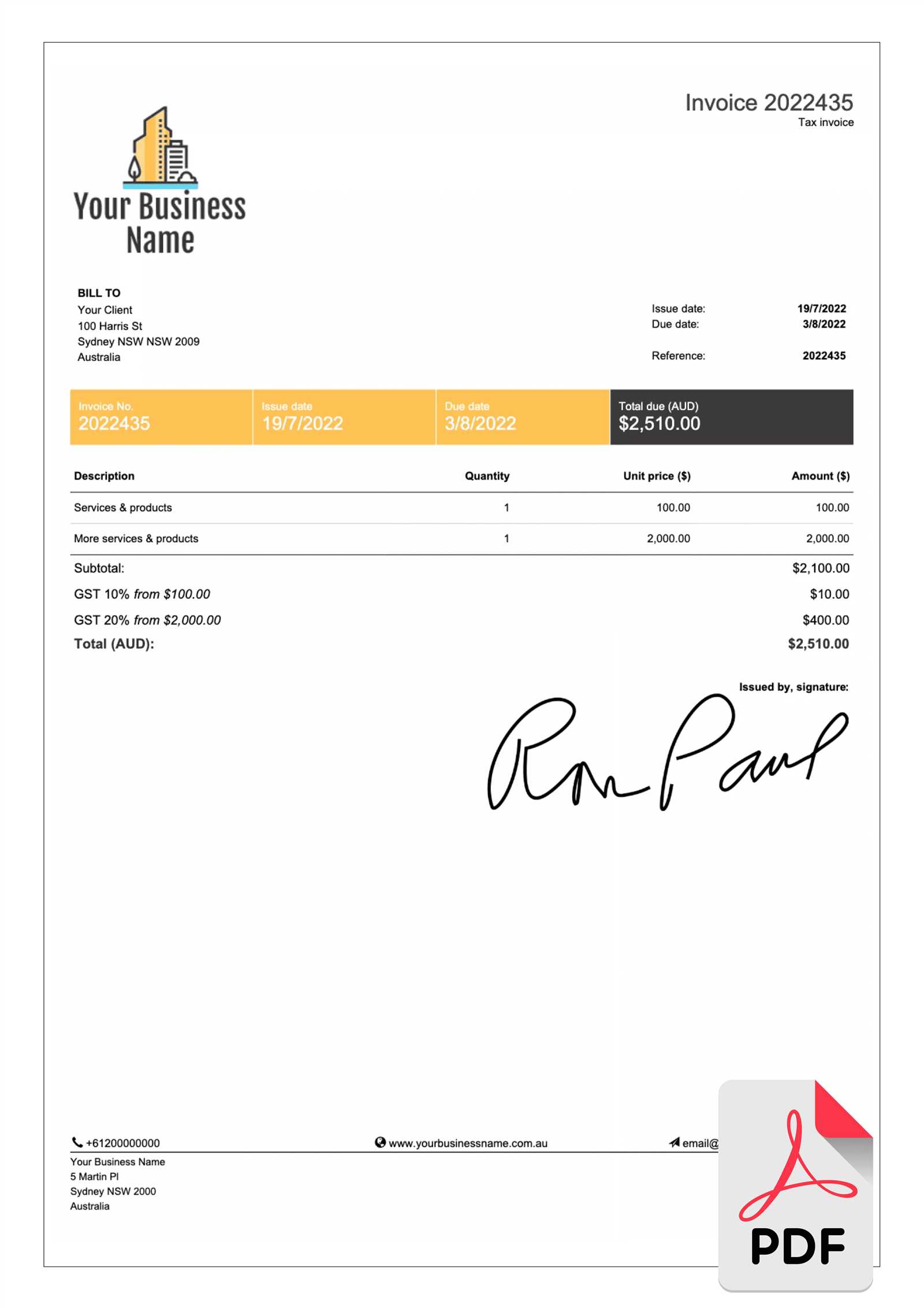

Why Use a PDF Invoice Template?

In business, creating clear and professional records of transactions is essential for maintaining credibility and ensuring accurate accounting. Choosing a reliable format for these documents is just as important. One such format is the portable document format, which offers several advantages when managing financial paperwork. Below are some key reasons why this format is widely used for business transactions.

- Universal Compatibility: Files in this format can be opened on almost any device without losing their original formatting. This ensures that clients, vendors, and partners will always see the document as intended, regardless of their operating system or software.

- Security: Documents saved in this format are more secure because they can be password-protected or encrypted. This adds an extra layer of protection when sharing sensitive information like payment details or business terms.

- Professional Appearance: These files maintain a clean, polished look across all devices. The layout is fixed, so no matter where or how it’s opened, the document will appear the same, ensuring consistency and professionalism.

- Easy Printing: When it comes time to print or share physical copies, the formatting remains intact. This makes printing and distribution much easier without worrying about text shifting or misalignment.

- Efficient Sharing: Files in this format are often smaller in size compared to other document types, making them quicker to upload, download, and share via email or other digital platforms.

For businesses looking to streamline their financial processes, this format offers a reliable and efficient way to ensure consistency, security, and professionalism with every transaction.

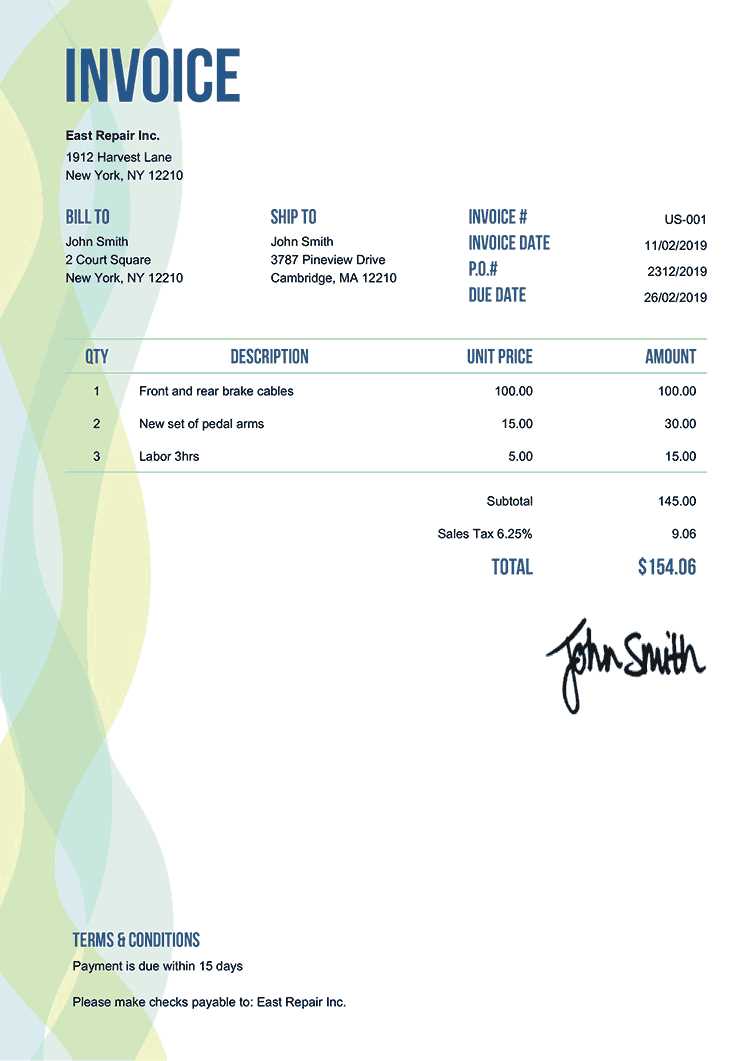

Benefits of Customizing Invoice Templates

Tailoring your billing documents to suit the specific needs of your business provides several advantages. Customization allows you to create more professional, clear, and effective records for every transaction, while also improving communication with clients. By adjusting various elements, such as layout, content, and branding, businesses can make sure that every document aligns with their brand identity and operational needs.

Key Advantages of Customizing Billing Documents

- Brand Consistency: Personalizing your forms with your company logo, colors, and fonts ensures that each document reinforces your brand’s identity. This contributes to a professional and cohesive appearance across all customer communications.

- Flexibility: Modifying the structure of your documents allows you to adapt them to different clients or projects. You can easily adjust fields for varying services, pricing, and terms, making it easier to manage different types of transactions.

- Improved Client Communication: By customizing your documents to include specific details like payment instructions or service descriptions, you can ensure that your clients have all the information they need in a clear, concise format.

- Enhanced Efficiency: Customizable records streamline your process by reducing the time spent on repetitive tasks. Once you’ve set up a personalized format, you can quickly adapt it for future use, saving both time and effort.

- Accuracy: Customizable forms help eliminate errors by allowing you to easily update details like prices, taxes, and terms. This ensures that all relevant information is accurate and up to date for each transaction.

Practical Benefits for Small Businesses

- Cost-Effective: Customizing your own forms rather than outsourcing the task or purchasing expensive software saves money in the long run.

- Control: By creating your own format, you retain complete control over the structure and content of your documents, ensuring that all necessary fields are included and easy to update when needed.

Incorporating customization into your billing system makes it easier to stay organized, professional, and client-focused, ultimately improving your business operations.

How to Edit PDF Invoice Templates

Modifying pre-made documents to meet your specific needs is a straightforward task with the right tools. Whether you’re adjusting a bill, receipt, or financial statement, the process of customization can be quick and efficient if you follow a few simple steps. Understanding the basics of how to manipulate the structure and content of these forms is key to achieving professional results.

To begin, you will need software that allows you to open and alter the content of the document. Many programs provide options for text editing, image insertion, and layout modification. Once you open the file in a suitable program, focus on sections that require changes, such as client information, payment details, or the overall design elements.

When editing, it’s important to ensure that the formatting remains intact. Be cautious when adjusting text sizes, font styles, or layout alignment to avoid disrupting the overall appearance. For more advanced modifications, such as adding new fields or sections, use the tool’s features to insert forms or additional text boxes.

Once you’ve made the necessary alterations, always double-check your work. Make sure that the final version of the document is accurate, clear, and professionally presented. Save the updated version in the appropriate format to ensure it can be shared or printed as needed.

Top Features to Look for in Invoice Templates

When selecting a document for creating business statements, it’s essential to ensure that it has the right set of features to streamline your work and maintain professionalism. The best documents not only allow for easy customization but also include essential elements that help in clear communication with clients and smooth processing of payments. Understanding these key features will make it easier to choose the most suitable option for your needs.

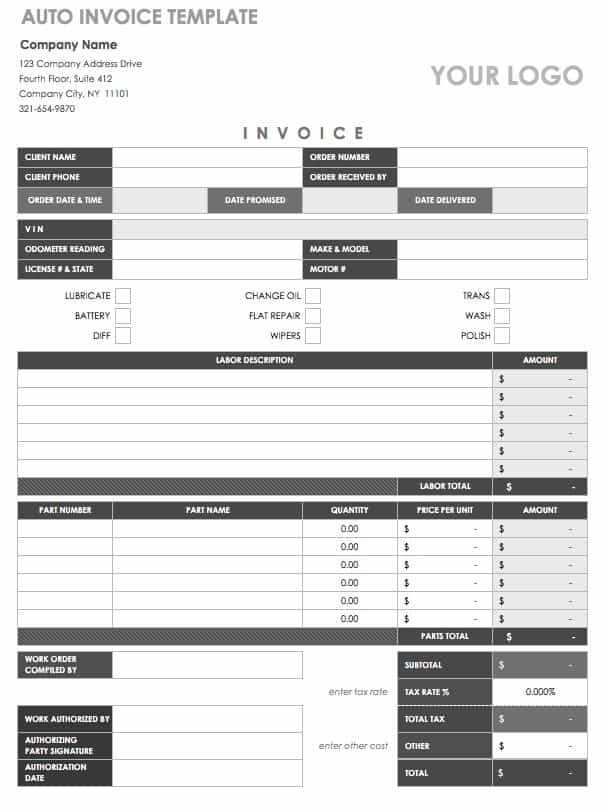

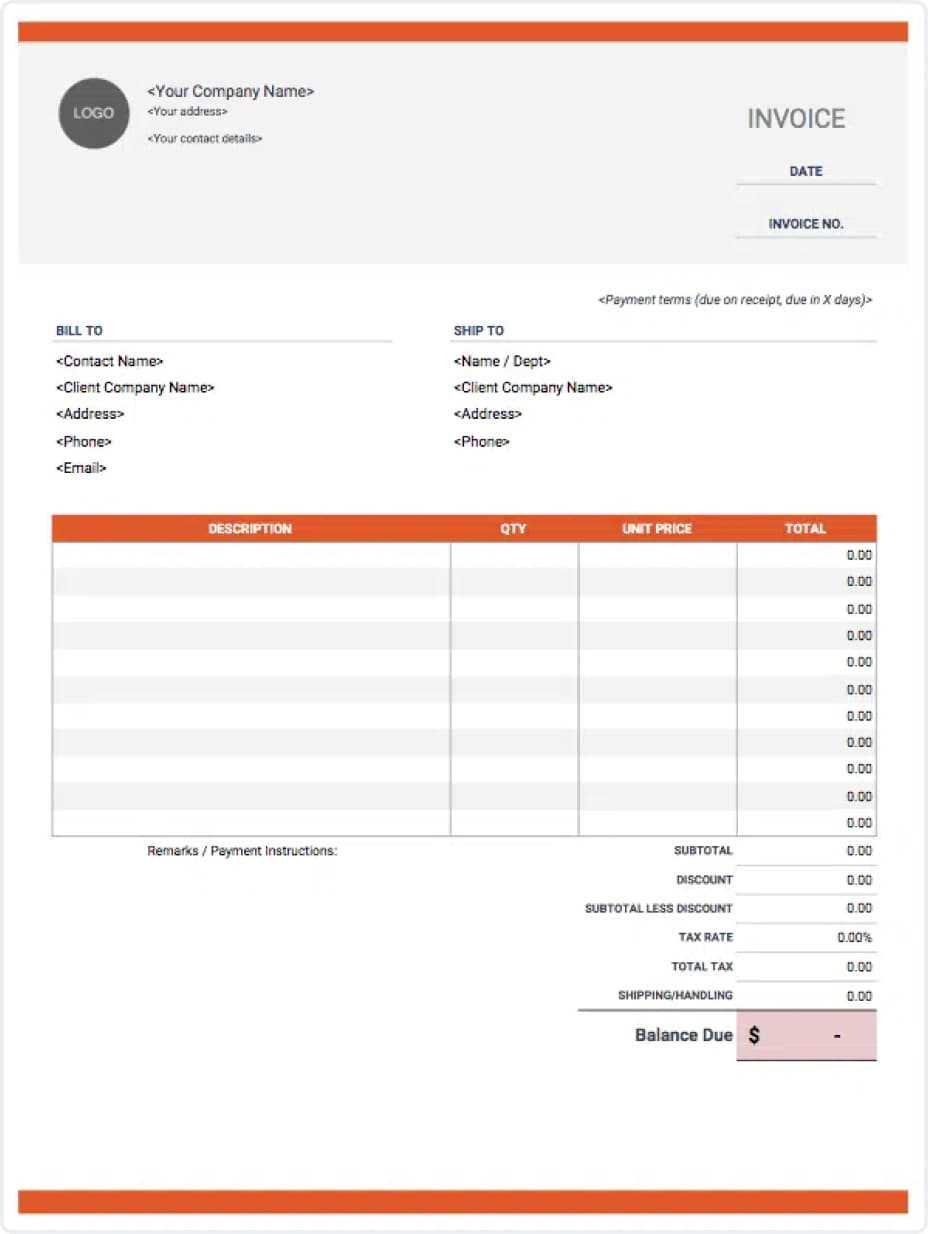

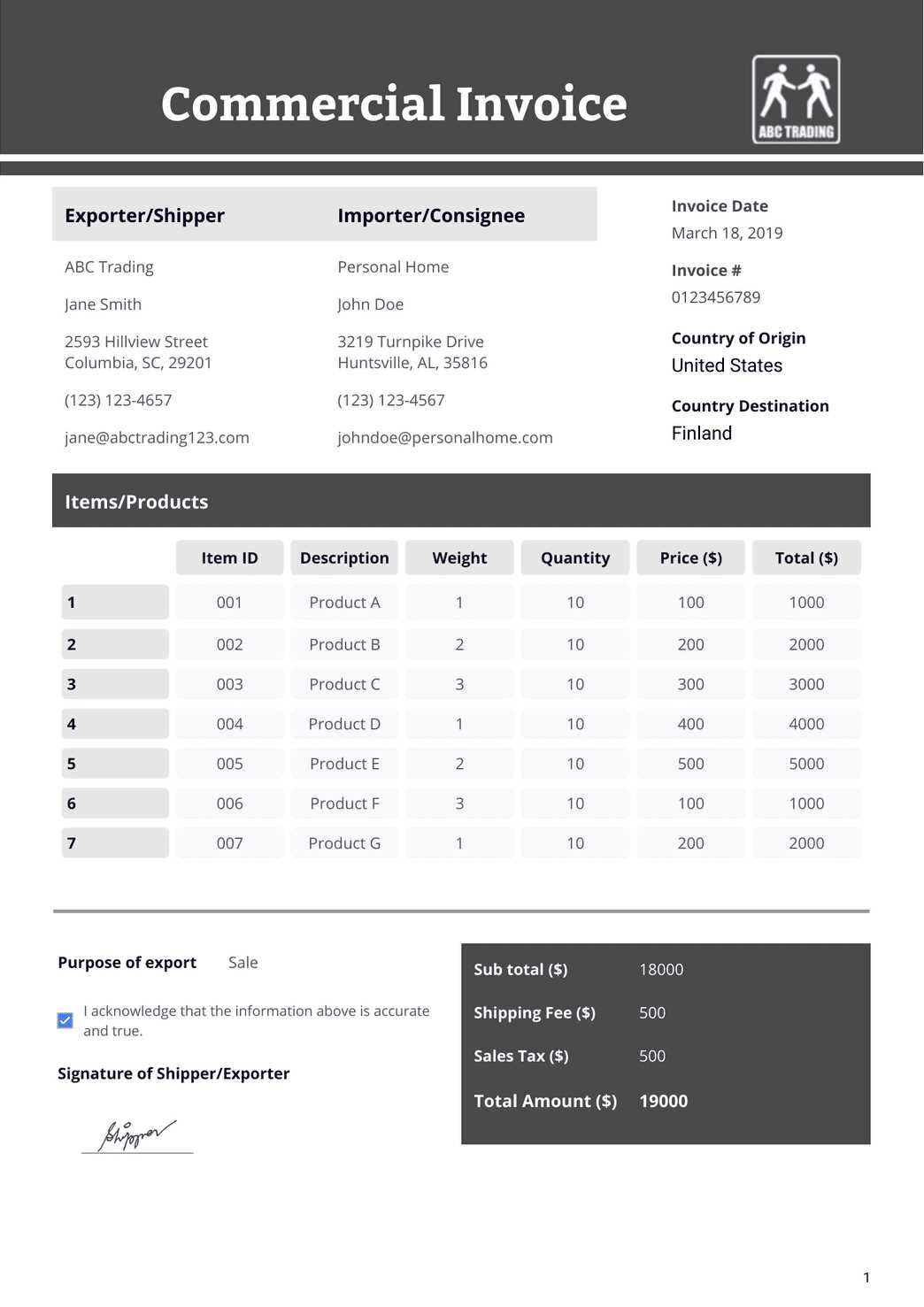

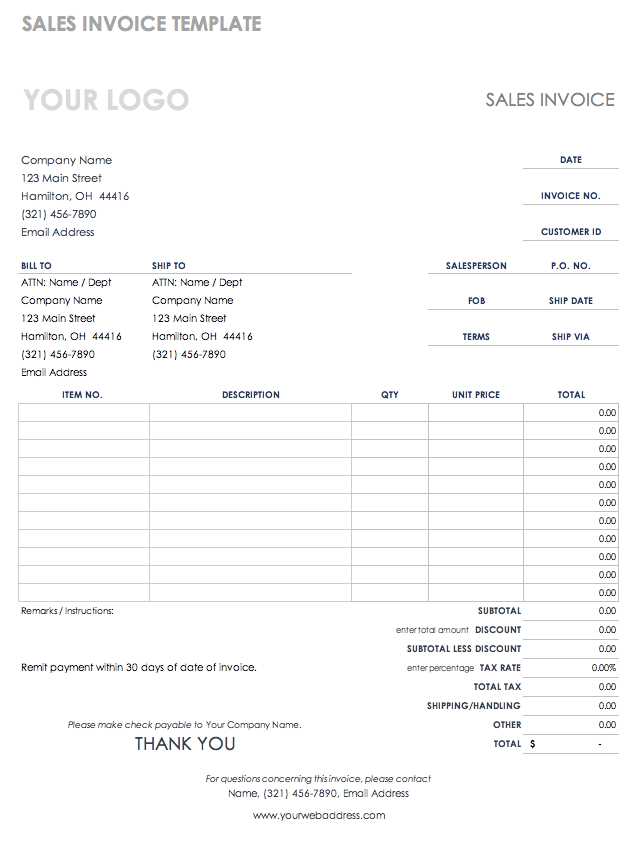

Clear Layout and Design – The structure of the document should be clean and intuitive, making it easy to navigate. A well-organized design with distinct sections for details such as dates, amounts, and descriptions ensures the information is easy to follow. A clutter-free layout helps in minimizing confusion and keeps the focus on important details.

Customizable Fields – A good document should allow for adjustments, such as adding client names, payment terms, and itemized lists. The ability to modify these sections ensures flexibility, enabling you to tailor the form to the specific transaction you’re handling.

Professional Appearance – A polished and professional look helps in building trust with clients. Features like a company logo, proper alignment, and the right choice of fonts contribute to the overall aesthetic and help create a formal impression.

Comprehensive Information Sections – Make sure the document provides ample space for key details, such as payment instructions, taxes, and due dates. Sections for terms and conditions or notes can also be beneficial, ensuring that all necessary information is included in one place.

Compatibility and Ease of Use – The best documents are easy to work with across various platforms. Whether you’re using online software or offline tools, compatibility with your preferred program or device is crucial for a smooth experience.

Best Websites for Free Invoice Templates

If you’re looking for reliable platforms to download or customize business documents for billing and payments, there are several websites that offer an array of options to fit various professional needs. These resources provide user-friendly interfaces and a wide selection of styles, making it easy to create the necessary paperwork without the hassle of designing from scratch.

Microsoft Office Templates – Known for its diverse collection of professionally designed documents, Microsoft offers an extensive selection of files that can be used for financial and business purposes. Whether you need something simple or more elaborate, this site allows you to quickly access and modify documents that are compatible with Word and Excel.

Canva – Canva offers a wide range of designs suitable for business correspondence. It’s an online tool that allows you to personalize your forms easily. With an intuitive drag-and-drop interface, you can adjust text, colors, and even add your branding elements to create personalized documents.

Zoho – Zoho provides an online platform with customizable forms, allowing you to generate documents and send them directly to clients. With its straightforward design and functionality, Zoho is an ideal choice for small businesses and entrepreneurs who want quick results.

Invoicely – A highly rated site for small businesses, Invoicely gives access to multiple document designs, including those tailored for different industries. This platform offers simple customization features, helping users create clear and professional-looking papers in no time.

Google Docs – Google Docs also offers a range of downloadable and editable business document formats. The benefit here is easy integration with other Google tools, enabling seamless updates and sharing across teams and clients.

How to Save Your Edited Invoice

Once you have customized your business document to your satisfaction, it’s essential to save it properly to ensure that all your changes are preserved and the file is ready for distribution or printing. The process of saving the document involves a few key steps, depending on the tool you’re using. Below are general guidelines on how to save your work efficiently.

- Choose the Correct File Format – Make sure to select a format that is widely accepted and compatible with most devices and platforms. Common formats include Word (.docx), Excel (.xlsx), or a static format such as .jpg or .png for images, and .txt for plain text files.

- Save Locally or in the Cloud – Decide whether you want to store the file on your computer or in a cloud-based service. Saving locally gives you direct access without needing an internet connection, while saving in the cloud allows for easy access from any device and facilitates sharing with others.

- Use Clear and Descriptive Naming Conventions – Name your file clearly, using relevant identifiers such as client names or dates, so that you can easily locate it later. For example, “John_Doe_Invoice_2024_10_07” can help you avoid confusion if you need to revisit or share the document later.

- Ensure Proper Version Control – If you make multiple changes over time or work with others on the same document, keeping track of versions is crucial. You can save incremental versions like “Invoice_v1,” “Invoice_v2,” etc., or use file history features in cloud storage tools for versioning.

- Double-Check for Saving Options – If you’re using specific software, check for any special saving options or prompts. For example, you might be prompted to save a copy for archiving, or the tool may suggest exporting in a different file format suited to sharing or printing.

By following these steps, you can ensure that your document is properly saved, easily retrievable, and ready to be sent to clients or partners without any issues.

Common Mistakes to Avoid with Invoices

When preparing business documents for payments, it’s essential to ensure accuracy and clarity to avoid delays or misunderstandings with clients. Even small mistakes can cause significant issues, affecting cash flow or damaging professional relationships. Being aware of common errors and taking steps to avoid them can help ensure smooth transactions and prompt payments.

1. Missing or Incorrect Client Details

One of the most frequent mistakes is neglecting to include the correct client information. Always double-check that the recipient’s name, address, and contact details are accurate. Incomplete or inaccurate details can lead to confusion, delays in payment, or even the document being rejected. Ensure the client’s full legal name and correct billing address are included to avoid issues.

2. Failing to Specify Payment Terms

Clearly outlining payment terms is crucial for both parties. Failing to mention deadlines, late fees, or accepted payment methods can result in misunderstandings or disputes. Always specify when the payment is due, what forms of payment are acceptable, and any penalties for late payments. This creates transparency and sets clear expectations.

3. Incorrect Amounts or Calculations

Errors in pricing, tax rates, or total amounts are easily avoidable but can be costly if overlooked. Always double-check that the listed quantities, unit prices, and any applied taxes are correct. A simple mistake in calculations could lead to a client disputing the total or delaying payment.

4. Forgetting to Include Itemized Lists

Providing a detailed breakdown of services or products is vital for both transparency and record-keeping. Not including an itemized list may make it difficult for the client to understand the charges, leading to questions or delays. Ensure every charge is listed with its description, quantity, unit price, and total amount clearly shown.

5. Ignoring Proper Formatting and Layout

A disorganized or cluttered document can make it difficult for your client to find the relevant information. Ensure your document is clean, well-organized, and visually easy to navigate. Use headings, sections, and appropriate spacing to guide the reader through the details smoothly. A professional-looking document helps build trust and promotes timely payment.

By avoiding these common errors, you can ensure that your financial documents are accurate, professional, and effective in securing timely payments. Always review your documents carefully befo

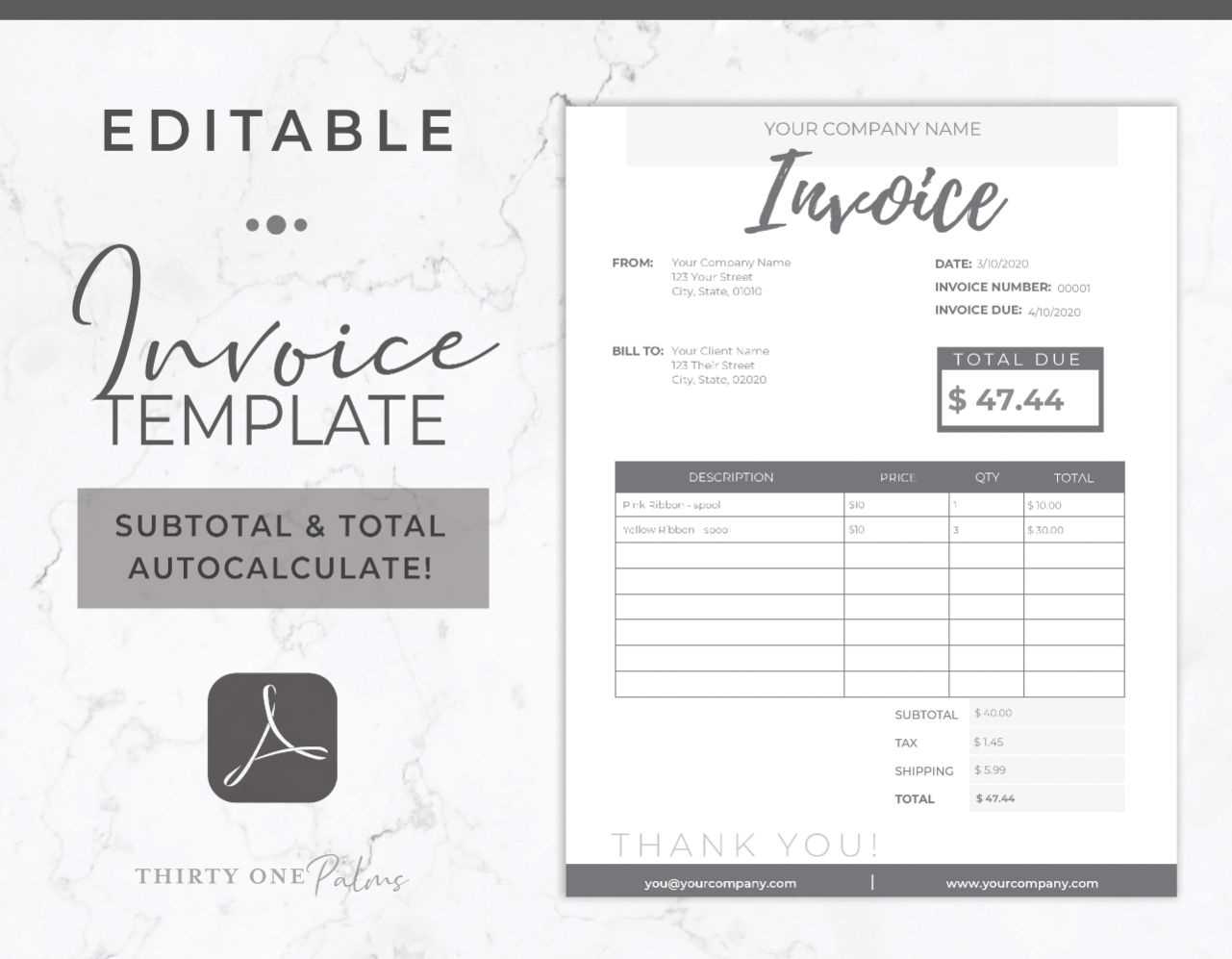

How to Add Your Branding to Invoices

Incorporating your brand identity into your business documents is an essential way to create a cohesive and professional image. Adding personalized elements such as your logo, brand colors, and fonts not only helps reinforce your business’s presence but also builds trust with clients. Customizing your forms with these details ensures consistency across all client interactions and enhances your overall branding strategy.

1. Include Your Logo – The most prominent feature of your brand is often your logo. Placing it at the top of your document, typically in the header, helps to immediately establish your business identity. Make sure the logo is clear, appropriately sized, and placed in a way that doesn’t overwhelm the content.

2. Use Your Brand Colors – Incorporating your business’s color palette into the document design can reinforce your brand’s look. Apply these colors to headings, borders, and other key elements of the layout. Be mindful not to overdo it–use colors sparingly to maintain readability while still reflecting your brand style.

3. Select Brand Fonts – Choose fonts that align with your brand’s typography guidelines. If your business has specific typefaces that are part of your identity, ensure these are reflected in your documents. This adds a professional touch and ensures consistency across all your communications.

4. Customize the Layout – Adjusting the layout to match your brand’s visual style can make a big difference. You can modify the document’s structure, such as using custom headers or section dividers, to match your branding guidelines. Consistency in design helps clients immediately recognize your business style.

5. Add a Personalized Message or Tagline – Including a short tagline or a personalized message at the bottom of the document can also reinforce your brand’s personality. A brief line that conveys your mission, values, or a simple “thank you” note can leave a lasting impression on clients.

By carefully adding these elements to your documents, you can make your business more memorable and professional in the eyes of your clients. Custom branding not only enhances your documents visually but also creates a unified experience across all interactions with your customers.

Creating Professional Invoices with Templates

When managing your business finances, presenting a polished and well-organized document is crucial for maintaining professionalism. Utilizing pre-designed forms can significantly streamline the process, allowing you to focus on the details without worrying about formatting or layout. These ready-made structures offer a framework where you can easily input your specific details while ensuring a consistent and clean presentation.

1. Choose the Right Structure – Selecting a form that suits your business type is the first step in creating a professional-looking document. Whether you’re providing services, products, or consulting, ensure the design you choose reflects the nature of the transaction. A simple, clear layout with sections for dates, amounts, and descriptions will help convey information accurately and effectively.

2. Customize Key Elements – While the form provides a base, it’s important to tailor it to your specific needs. Replace placeholder text with relevant client information, payment terms, and itemized lists. Make sure that any custom details–such as tax rates, discounts, or additional fees–are clearly outlined, helping your client understand the full scope of the charges.

3. Maintain Consistent Branding – Even when using a pre-designed structure, it’s essential to integrate your business’s branding elements. This includes your logo, b

Creating Professional Invoices with Templates

When managing your business finances, presenting a polished and well-organized document is crucial for maintaining professionalism. Utilizing pre-designed forms can significantly streamline the process, allowing you to focus on the details without worrying about formatting or layout. These ready-made structures offer a framework where you can easily input your specific details while ensuring a consistent and clean presentation.

1. Choose the Right Structure – Selecting a form that suits your business type is the first step in creating a professional-looking document. Whether you’re providing services, products, or consulting, ensure the design you choose reflects the nature of the transaction. A simple, clear layout with sections for dates, amounts, and descriptions will help convey information accurately and effectively.

2. Customize Key Elements – While the form provides a base, it’s important to tailor it to your specific needs. Replace placeholder text with relevant client information, payment terms, and itemized lists. Make sure that any custom details–such as tax rates, discounts, or additional fees–are clearly outlined, helping your client understand the full scope of the charges.

3. Maintain Consistent Branding – Even when using a pre-designed structure, it’s essential to integrate your business’s branding elements. This includes your logo, brand colors, and selected fonts. Personalizing the document with these elements ensures that your correspondence remains cohesive with other materials and reinforces your business identity.

4. Proofread for Accuracy – After customizing the document, review all sections carefully for any mistakes. Ensure that client details, financial amounts, and other data are accurate before sending the document. Even small errors can lead to confusion or payment delays, so double-checking your work is a necessary step in the process.

5. Save and Export the Final Document – Once you’ve made all necessary edits, save the document in a widely accessible format, such as Word or Excel, or export it to a static format for easy sharing. Make sure to store your customized documents in a secure location, whether on your local drive or in the cloud, for future reference.

Using pre-designed forms can simplify the billing process while ensuring that your documents look professional and are easy to understand. By following these steps, you can create business communications that are not only efficient but also reflect the professionalism of your brand.

Creating Professional Invoices with Templates

When managing your business finances, presenting a polished and well-organized document is crucial for maintaining professionalism. Utilizing pre-designed forms can significantly streamline the process, allowing you to focus on the details without worrying about formatting or layout. These ready-made structures offer a framework where you can easily input your specific details while ensuring a consistent and clean presentation.

1. Choose the Right Structure – Selecting a form that suits your business type is the first step in creating a professional-looking document. Whether you’re providing services, products, or consulting, ensure the design you choose reflects the nature of the transaction. A simple, clear layout with sections for dates, amounts, and descriptions will help convey information accurately and effectively.

2. Customize Key Elements – While the form provides a base, it’s important to tailor it to your specific needs. Replace placeholder text with relevant client information, payment terms, and itemized lists. Make sure that any custom details–such as tax rates, discounts, or additional fees–are clearly outlined, helping your client understand the full scope of the charges.

3. Maintain Consistent Branding – Even when using a pre-designed structure, it’s essential to integrate your business’s branding elements. This includes your logo, brand colors, and selected fonts. Personalizing the document with these elements ensures that your correspondence remains cohesive with other materials and reinforces your business identity.

4. Proofread for Accuracy – After customizing the document, review all sections carefully for any mistakes. Ensure that client details, financial amounts, and other data are accurate before sending the document. Even small errors can lead to confusion or payment delays, so double-checking your work is a necessary step in the process.

5. Save and Export the Final Document – Once you’ve made all necessary edits, save the document in a widely accessible format, such as Word or Excel, or export it to a static format for easy sharing. Make sure to store your customized documents in a secure location, whether on your local drive or in the cloud, for future reference.

Using pre-designed forms can simplify the billing process while ensuring that your documents look professional and are easy to understand. By following these steps, you can create business communications that are not only efficient but also reflect the professionalism of your brand.

Legal Considerations for Invoice Templates

When preparing business documents for transactions, it’s important to ensure that they meet legal requirements to avoid any disputes or complications. Certain elements must be included to comply with local laws, tax regulations, and contractual agreements. Understanding these legal considerations can protect both you and your clients, ensuring that all aspects of the transaction are transparent and legally binding.

Below are some key legal requirements and considerations to keep in mind when creating these types of documents:

| Element | Description |

|---|---|

| Business Information | Ensure that your company’s full legal name, address, and registration number (if applicable) are clearly visible. This helps establish the authenticity of the document and provides a point of contact in case of disputes. |

| Client Information | Always include accurate details about the recipient, including their full name or company name and address. This ensures that the document is properly attributed to the correct party. |

| Unique Identification Number | A unique reference number is crucial for record-keeping and tracking. This number helps identify the document in case of future questions or disputes and ensures that you can easily locate it for accounting purposes. |

| Payment Terms | Clearly state payment due dates, accepted payment methods, and any penalties for late payments. This provides clarity for both parties and helps to enforce the agreed-upon terms. |

| Taxes and Fees | Depending on your location and the nature of the transaction, taxes may need to be included. Ensure the correct tax rate is applied and stated explicitly to avoid legal issues related to tax compliance. |

| Dispute Resolution Clause | Include a statement outlining how disputes will be handled, whether through arbitration, mediation, or legal action. This helps set expectations should any issues arise in the future. |

By ensuring that all these elements are properly included and compliant with local regulations, you can protect your business and maintain a professional reputation. Always review your documents carefully to ensure they are legally sound and consult with a legal expert if you are unsure about any specific requirements in your jurisdiction.

Legal Considerations for Invoice Templates

When preparing business documents for transactions, it’s important to ensure that they meet legal requirements to avoid any disputes or complications. Certain elements must be included to comply with local laws, tax regulations, and contractual agreements. Understanding these legal considerations can protect both you and your clients, ensuring that all aspects of the transaction are transparent and legally binding.

Below are some key legal requirements and considerations to keep in mind when creating these types of documents:

| Element | Description |

|---|---|

| Business Information | Ensure that your company’s full legal name, address, and registration number (if applicable) are clearly visible. This helps establish the authenticity of the document and provides a point of contact in case of disputes. |

| Client Information | Always include accurate details about the recipient, including their full name or company name and address. This ensures that the document is properly attributed to the correct party. |

| Unique Identification Number | A unique reference number is crucial for record-keeping and tracking. This number helps identify the document in case of future questions or disputes and ensures that you can easily locate it for accounting purposes. |

| Payment Terms | Clearly state payment due dates, accepted payment methods, and any penalties for late payments. This provides clarity for both parties and helps to enforce the agreed-upon terms. |

| Taxes and Fees | Depending on your location and the nature of the transaction, taxes may need to be included. Ensure the correct tax rate is applied and stated explicitly to avoid legal issues related to tax compliance. |

| Dispute Resolution Clause | Include a statement outlining how disputes will be handled, whether through arbitration, mediation, or legal action. This helps set expectations should any issues arise in the future. |

By ensuring that all these elements are properly included and compliant with local regulations, you can protect your business and maintain a professional reputation. Always review your documents carefully to ensure they are legally sound and consult with a legal expert if you are unsure about any specific requirements in your jurisdiction.

Understanding Invoice Numbering Systems

Properly organizing business documents is essential for maintaining accurate records and ensuring smooth transactions. One key aspect of organization is the numbering system used for these forms. A clear and consistent numbering system helps in tracking payments, managing records, and preventing confusion. Whether you’re dealing with a small number of transactions or handling large volumes, implementing a structured approach to document numbering is crucial for both legal and administrative purposes.

Here are some important aspects to consider when setting up a numbering system for your business forms:

- Sequential Numbering – One of the simplest and most common systems is sequential numbering, where each new document is assigned the next number in the sequence. For example, the first document could be labeled “001,” the next “002,” and so on. This method is easy to manage and helps in tracking the order of transactions.

- Chronological Numbering – Another approach is to base the numbering on the date of issuance. For instance, the first document issued in 2024 could be numbered “2024-001,” the next “2024-002,” and so on. This method helps to quickly identify when the document was created, which is useful for record-keeping and sorting documents by date.

- Client-Based Numbering – In this system, each client or project receives a unique prefix followed by a sequential number. For example, documents for Client A might start with “A001,” “A002,” etc., while Client B’s documents would be labeled “B001,” “B002,” and so on. This helps organize documents by client and simplifies retrieval of specific transactions.

- Custom Numbering – For larger businesses with more complex needs, you may create a custom numbering system that includes information such as the year, department, or project code. For example, a document related to a specific project could be labeled “PRJ123-2024-001.” This method provides additional context and helps in organizing and categorizing documents effectively.

Whichever system you choose, it’s essential to maintain consistency throughout your business processes. A well-structured numbering system helps to avoid duplication, reduces errors, and improves overall document management. Additionally, a clear system can also make it easier for clients and employees to re

Understanding Invoice Numbering Systems

Properly organizing business documents is essential for maintaining accurate records and ensuring smooth transactions. One key aspect of organization is the numbering system used for these forms. A clear and consistent numbering system helps in tracking payments, managing records, and preventing confusion. Whether you’re dealing with a small number of transactions or handling large volumes, implementing a structured approach to document numbering is crucial for both legal and administrative purposes.

Here are some important aspects to consider when setting up a numbering system for your business forms:

- Sequential Numbering – One of the simplest and most common systems is sequential numbering, where each new document is assigned the next number in the sequence. For example, the first document could be labeled “001,” the next “002,” and so on. This method is easy to manage and helps in tracking the order of transactions.

- Chronological Numbering – Another approach is to base the numbering on the date of issuance. For instance, the first document issued in 2024 could be numbered “2024-001,” the next “2024-002,” and so on. This method helps to quickly identify when the document was created, which is useful for record-keeping and sorting documents by date.

- Client-Based Numbering – In this system, each client or project receives a unique prefix followed by a sequential number. For example, documents for Client A might start with “A001,” “A002,” etc., while Client B’s documents would be labeled “B001,” “B002,” and so on. This helps organize documents by client and simplifies retrieval of specific transactions.

- Custom Numbering – For larger businesses with more complex needs, you may create a custom numbering system that includes information such as the year, department, or project code. For example, a document related to a specific project could be labeled “PRJ123-2024-001.” This method provides additional context and helps in organizing and categorizing documents effectively.

Whichever system you choose, it’s essential to maintain consistency throughout your business processes. A well-structured numbering system helps to avoid duplication, reduces errors, and improves overall document management. Additionally, a clear system can also make it easier for clients and employees to reference past transactions and track payments or deliveries.

In summary, selecting the right numbering approach for your documents depends on your business’s needs and volume. It’s important to ensure that your system is scalable, simple to manage, and easy to understand to maintain organized records and streamline your administrative tasks.

How Editable PDFs Improve Invoice Management

Efficient document handling plays a crucial role in streamlining business processes, especially when it comes to financial records. Digital tools allow for seamless interaction with documents, enabling businesses to easily create, modify, and share important files with minimal effort. This modern approach to documentation significantly reduces manual work and enhances overall productivity.

One of the primary advantages of working with these adaptable files is the ability to quickly modify content without needing to recreate entire documents. This flexibility means that businesses can adjust details like dates, amounts, and client information on the fly, ensuring that everything remains accurate and up to date.

- Time-Saving: Modifying documents directly without having to generate new ones saves valuable time, reducing the chances of errors.

- Consistency: Templates offer a standardized structure, maintaining a consistent appearance and format for all business communications.

- Accuracy: The ability to easily adjust numbers and terms reduces human error, ensuring that all financial data remains correct.

- Cost-Effective: Eliminating the need for printing and mailing physical documents cuts down on overhead costs.

In addition, having the ability to adjust and personalize financial documents instantly helps businesses stay agile. Changes can be made quickly based on client requests or business needs, without waiting for a new version to be manually created or sent. This responsiveness strengthens client relationships and ensures that transactions proceed smoothly.

Finally, the ease with which these documents can be shared–whether by email or through secure cloud services–further accelerates workflow and improves communication with clients and partners, making overall management more efficient and streamlined.