Free Roofing Invoice Template Download for Easy Billing

When running a construction or repair business, ensuring that financial transactions are handled smoothly is crucial. One of the most important aspects of this process is creating clear and professional documents that outline the work performed and the costs associated with it. These documents serve as a formal agreement between you and your clients, making accurate billing an essential part of maintaining positive relationships and timely payments.

Having a ready-made document to fill in your details can save time and reduce errors. With the right tool, creating accurate records becomes much easier, allowing you to focus on delivering quality service. The ability to quickly generate clear, organized billing statements benefits both you and your clients, ensuring transparency and trust.

Whether you’re managing a small team or working independently, adopting an efficient system for your paperwork will streamline your operations. This guide will explore various solutions that help simplify the billing process, providing you with a valuable resource to enhance your business’s financial management.

Free Roofing Invoice Template for Contractors

For contractors in the construction industry, having an organized and professional way to bill clients is essential for maintaining smooth business operations. Using a standardized document not only ensures clarity but also helps avoid misunderstandings about charges and payments. By utilizing a pre-made structure, contractors can quickly generate accurate records that reflect the services provided, making it easier to track payments and maintain financial accuracy.

Benefits of Using a Ready-Made Document

Utilizing a structured document for billing has several advantages. It allows contractors to focus on their work while ensuring the paperwork is handled efficiently. Moreover, a consistent format helps create a professional image and makes it easier for clients to understand the costs involved. A clear and easy-to-read record also reduces the likelihood of disputes, facilitating faster payments.

Key Elements to Include in Your Billing Statement

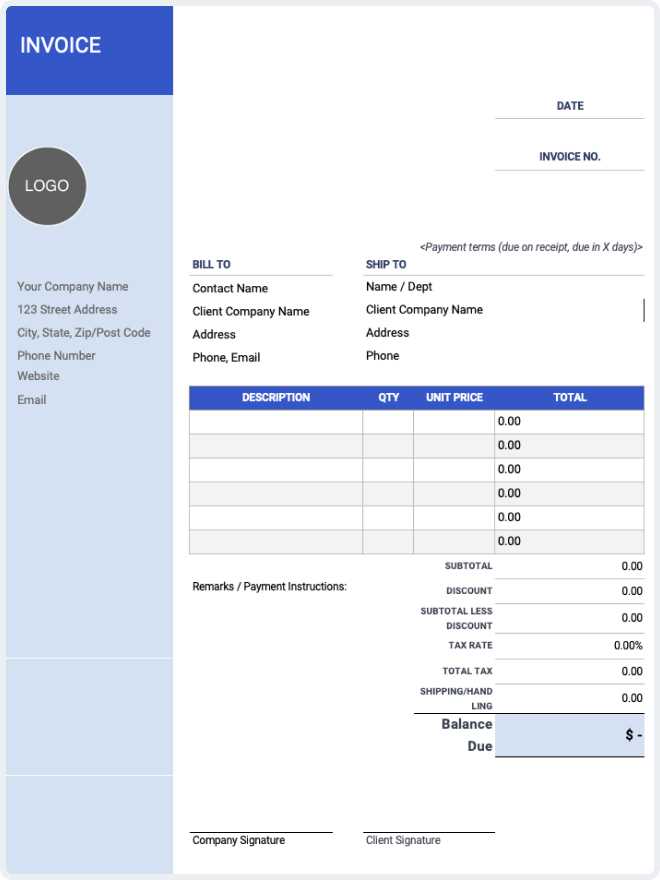

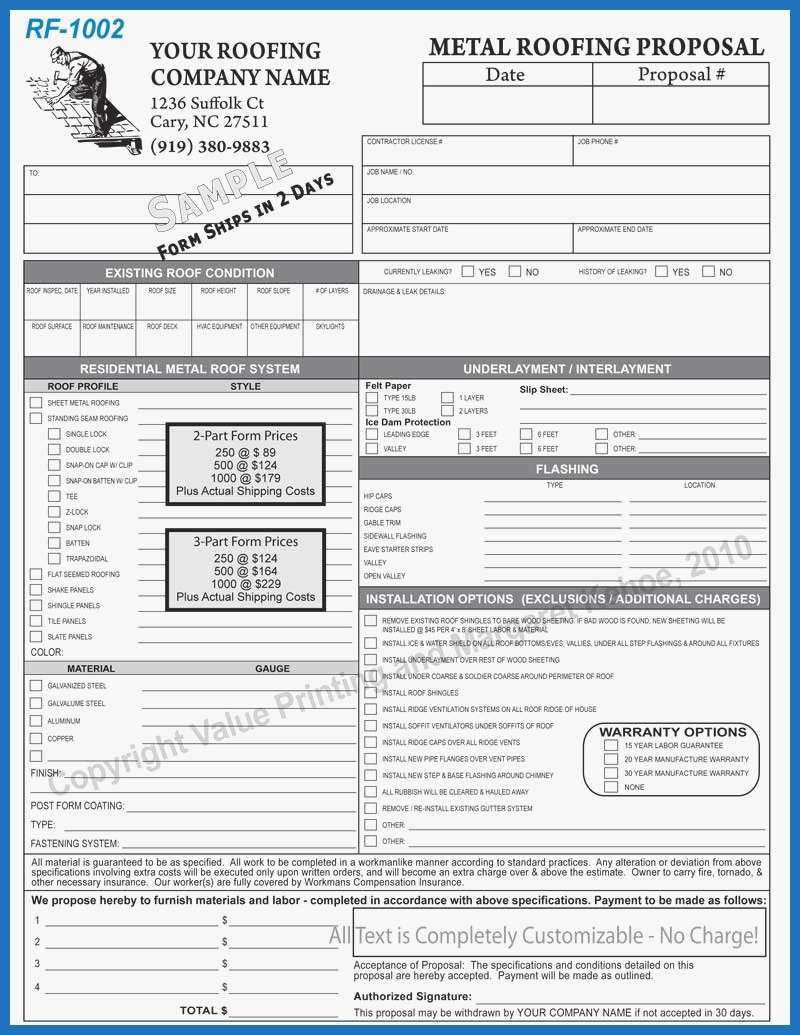

When crafting a billing statement, it’s important to include several key details to ensure both parties are on the same page. The following table outlines the most common components of a well-organized statement:

| Component | Description |

|---|---|

| Client Information | Include the name, address, and contact details of the client. |

| Work Description | List the services provided in detail to ensure transparency. |

| Costs | Break down the total costs, including labor and materials. |

| Payment Terms | Specify the due date and any late payment penalties if applicable. |

| Company Information | Provide your business name, contact details, and licensing information. |

Why You Need an Invoice Template

For any business, having a standardized system for documenting financial transactions is crucial. A clear and consistent approach to billing helps maintain professionalism and ensures both the service provider and client have a mutual understanding of the charges involved. Without a structured method to present costs and services, confusion can arise, potentially leading to payment delays or disputes. By adopting a pre-designed structure, you can streamline the entire process, saving time and avoiding costly errors.

Having a ready-made structure for creating your financial documents ensures accuracy and clarity, both of which are essential for smooth business operations. A properly formatted record serves as both a reminder and a formal agreement, reducing misunderstandings and setting clear expectations for both parties.

Advantages of Using a Pre-Designed Billing Structure

Here are some key reasons why it’s important to utilize a structured document for your business transactions:

| Benefit | Description |

|---|---|

| Time Savings | Creating clear records quickly becomes easier when using a pre-structured document, freeing up time to focus on other tasks. |

| Consistency | Using the same format for all clients ensures uniformity and helps avoid errors in the billing process. |

| Professional Appearance | A clean, organized bill reflects well on your business, demonstrating professionalism and attention to detail. |

| Improved Accuracy | By following a consistent format, you reduce the chance of missing important details or making mathematical mistakes. |

| Legal Protection | Well-documented financial records can help protect your business in case of disputes or legal matters regarding payments. |

Benefits of Using a Roofing Invoice

Having a formalized document for billing is essential for maintaining transparency and ensuring smooth financial transactions between contractors and their clients. By using a consistent and clear format to itemize services and costs, you can avoid confusion and keep both parties on the same page. Such records provide clarity, streamline the payment process, and help safeguard against potential disputes or misunderstandings.

Clear Communication of Services and Costs

One of the key advantages of using a professional billing document is that it allows you to clearly outline the services provided, along with their associated costs. This helps clients easily understand what they are paying for and how the charges were calculated. Transparency in this area builds trust and ensures that clients are fully aware of the scope of work and the costs involved. The more detailed and organized the statement, the fewer the chances of confusion or questions arising down the line.

Improved Cash Flow and Payment Management

Another significant benefit of using a formalized document is the ability to track payments and manage cash flow more effectively. A well-structured bill helps clients understand their financial obligations and encourages prompt payment. Additionally, clear payment terms such as due dates or penalties for late payments can be included, which further helps in maintaining steady cash flow. Efficient management of financial transactions ultimately leads to a more organized business operation and reduces the risk of delayed payments.

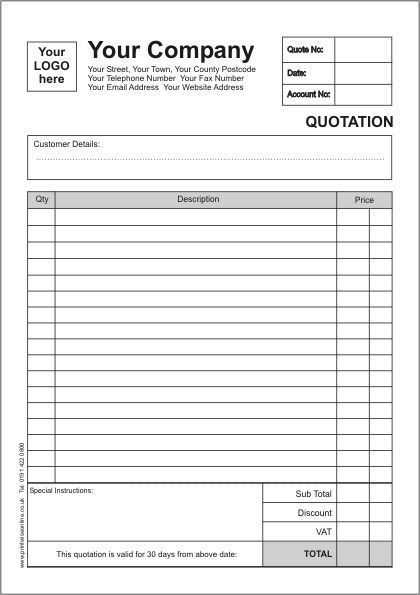

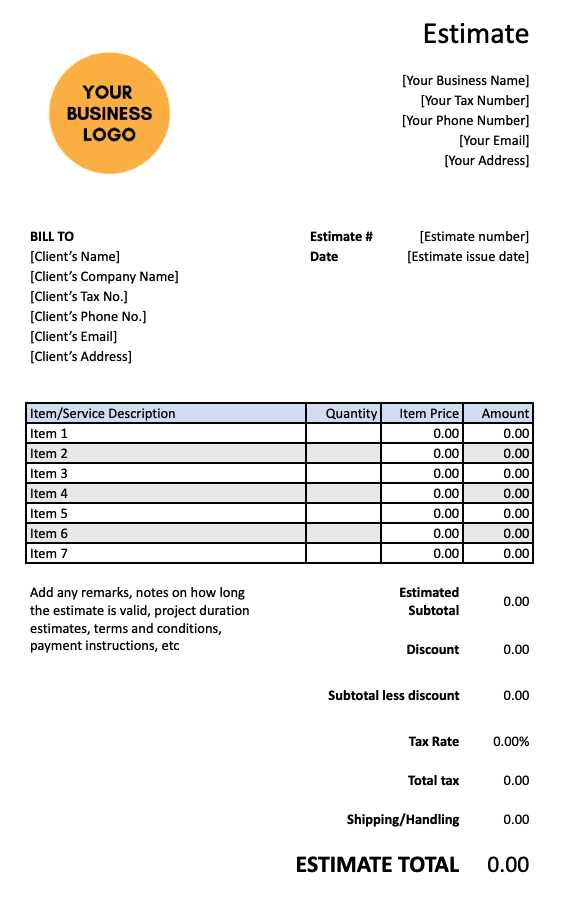

How to Customize Your Invoice Template

Personalizing your billing documents allows you to tailor them to the specific needs of your business and your clients. A customized structure not only reflects your brand but also helps ensure that all relevant details are captured in a clear and professional manner. Customizing your billing format gives you control over how information is presented, ensuring it aligns with your business practices and provides clarity for clients.

Here are some key elements you can customize when creating your own billing document:

| Element | Customization Options |

|---|---|

| Business Information | Add your company’s name, address, contact details, and logo to make the document reflect your brand identity. |

| Client Details | Input the client’s full name, address, and contact information to ensure accuracy and proper tracking of payments. |

| Work Description | Modify the section where you outline the services provided, including specifics such as hours worked, materials used, or other relevant details. |

| Payment Terms | Adjust the payment schedule, including due dates, late fees, or discounts for early payment, based on your preferred terms. |

| Logo and Branding | Incorporate your company logo or adjust the color scheme to reflect your branding, providing a professional appearance. |

By making these adjustments, you ensure that each document is not only accurate but also tailored to meet your specific needs and those of your clients. Customization also helps foster a sense of professionalism and trust, making the overall experience smoother for both parties.

Top Features of Roofing Invoice Templates

When creating billing documents for construction work, certain features can significantly enhance their usefulness and clarity. A well-structured document not only helps convey the necessary information but also ensures that the process remains efficient and professional. The following features are essential for any document used in the construction industry, offering both practicality and a polished appearance.

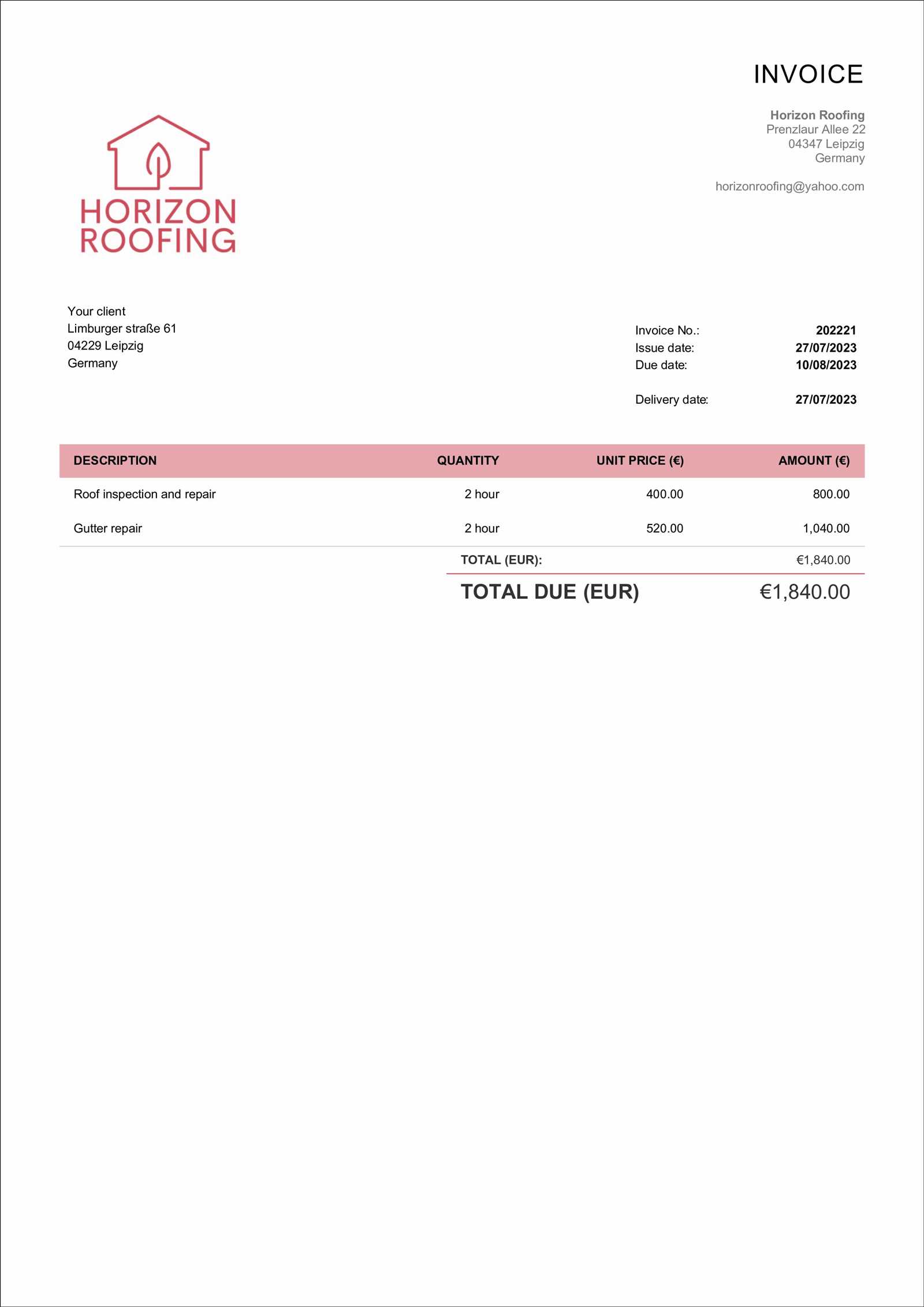

Clear Breakdown of Services

A key feature of any billing statement is the clear breakdown of services provided. This allows both the contractor and client to understand exactly what has been done and how much each service costs. Detailing the tasks performed, along with associated costs, minimizes confusion and sets expectations for both parties. Such transparency helps build trust and reduces the chances of disputes later on.

Customizable Payment Terms

Having the option to include specific payment terms is crucial. These can be tailored to suit the nature of the agreement, including due dates, late fees, or discounts for early settlement. Customizable payment terms ensure that both the contractor and client are clear on expectations, fostering a smooth financial transaction process. This feature also supports efficient cash flow management and helps avoid delays in payments.

Professional Design and Branding

Another important feature is the ability to incorporate professional design elements, such as your company logo, colors, and contact information. A well-branded document gives a professional touch, making the billing process more formal and reinforcing your business identity. This not only impresses clients but also establishes your business as reliable and organized.

Where to Access Free Billing Documents

There are several online resources where you can access pre-made billing structures that can be customized for your business needs. These resources provide a convenient way to quickly generate professional documents without the need for advanced design skills or complicated software. Whether you’re a small business owner or a freelancer, these platforms offer templates that can be tailored to reflect your brand and streamline your financial processes.

Many websites provide free options with a variety of formats, including Word documents, Excel spreadsheets, and PDF files, allowing you to choose the one that best fits your workflow. Some of these platforms even offer additional features such as tracking capabilities and cloud storage, making it easier to manage your records and streamline your accounting system.

By utilizing these resources, you can save time and focus on growing your business, knowing that your financial documentation is both professional and efficient. Look for trusted websites with a reputation for providing high-quality, customizable documents to ensure the best results for your business.

Understanding Invoice Structure for Roofing Services

Creating a clear and detailed billing document is essential when providing construction or repair services. A well-organized bill ensures that clients understand the breakdown of costs and services, which helps avoid misunderstandings. The structure of such a document typically follows a straightforward format that can be customized to suit specific project needs. Below are the key elements that should be included in any such document for clarity and professionalism.

Key Components of a Billing Document

To ensure accuracy and transparency, here are the essential elements to include in your construction billing statement:

- Business Information: Include your company name, address, phone number, email, and website to make it easy for clients to contact you.

- Client Information: Include the client’s full name, address, and contact details to ensure correct identification and communication.

- Work Description: Clearly outline the services provided, including materials used and labor performed. The more detailed this section, the better.

- Cost Breakdown: Itemize the costs for each service, including labor rates, materials, and any additional charges. This transparency helps clients understand exactly what they are paying for.

- Payment Terms: Specify due dates, late fees, and any other conditions related to payment. It’s crucial that both parties agree on these terms upfront to avoid disputes.

- Payment Instructions: Provide clear instructions on how the client can make payments (e.g., bank transfer, check, online payment). You can also include your payment details here.

Additional Details to Include

In addition to the basic components, there are other important aspects to consider when structuring your document:

- Discounts or Promotions: If you are offering a discount, state it clearly so the client understands how the price was reduced.

- Project Timeline: Include the start and end dates of the project to provide context for the services rendered.

- Company Branding: Add your company logo and use your brand colors to maintain a professional appearance.

By including these elements, you can ensure that your billing document is comprehensive, clear, and easy to understand, creating a smooth experience for both you and your client.

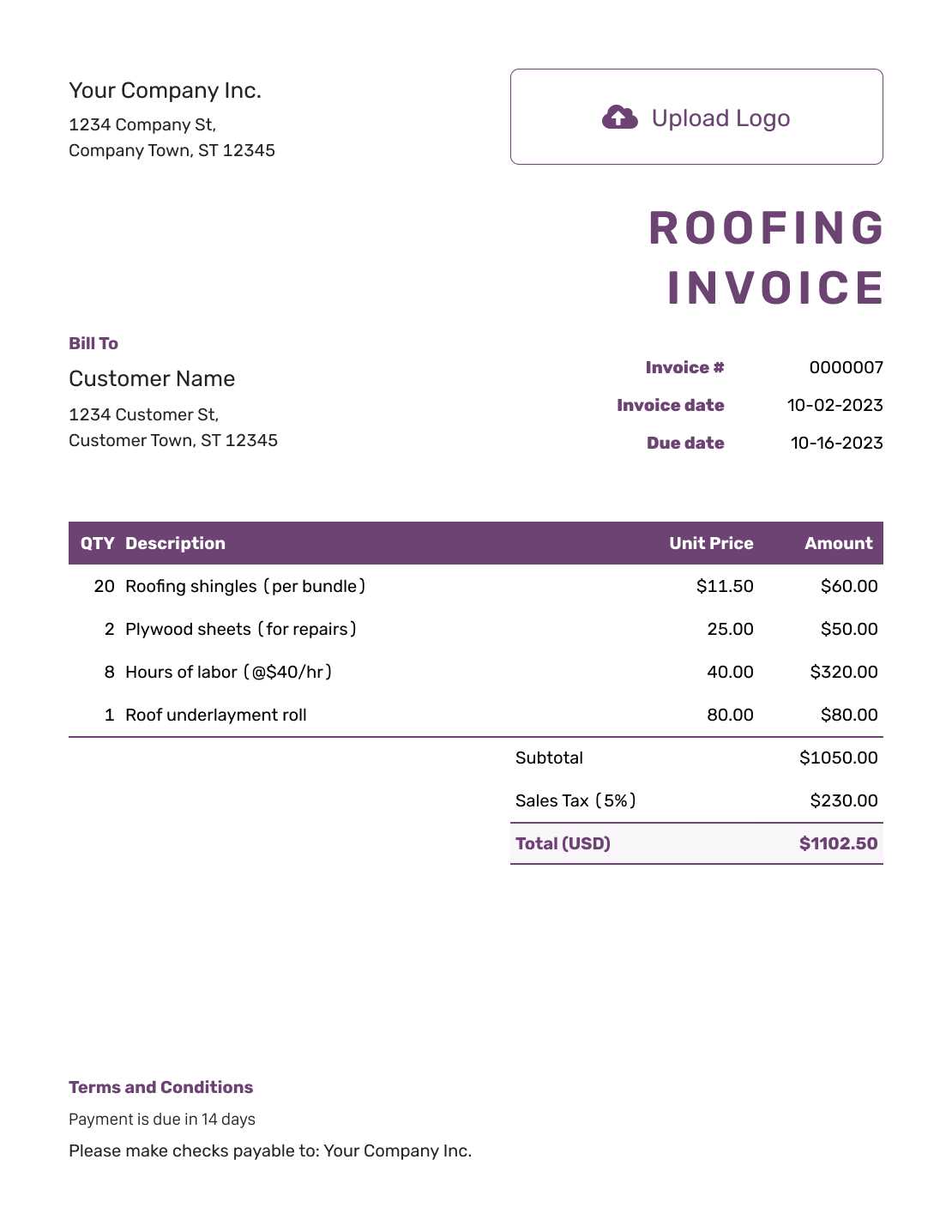

Choosing the Right Invoice Format for Roofing Jobs

Selecting the appropriate format for your billing documents is crucial to ensuring smooth transactions and maintaining professionalism in your business operations. The right format helps both you and your clients stay organized, streamlining the payment process. Whether you’re working on a small repair project or a larger construction task, choosing a format that suits the nature and scale of the job can save you time and prevent errors. Understanding the different types of formats available will help you make an informed choice based on your specific needs.

Factors to Consider When Choosing a Format

When selecting a format for your financial documentation, several factors should influence your decision:

- Project Size and Complexity: For larger projects, a more detailed structure might be necessary to break down various aspects of the work, such as labor costs, materials, and additional fees. For smaller jobs, a simpler format may be sufficient.

- Ease of Use: Choose a format that is easy for both you and your client to understand. If the document is complicated or overly technical, it could lead to confusion or delays in payment.

- Customization Needs: Select a format that allows for flexibility in terms of adding or removing sections, depending on the specific needs of each project.

- Professional Appearance: Opt for a format that is clean, organized, and visually appealing. A well-structured document creates a better impression of your business and boosts client confidence.

Types of Formats to Consider

There are various formats available for your billing documents, each with its own benefits:

- Word Documents: Ideal for those who prefer working with text editors. These are highly customizable and easy to edit, but may not offer advanced features like automatic calculations.

- Excel Spreadsheets: Best for contractors who need to include detailed calculations, such as material costs and labor hours. Spreadsheets can automate basic math, reducing the risk of errors.

- PDF Files: A popular choice for businesses looking to provide a professional-looking, fixed format. Once finalized, PDFs can be sent electronically and are difficult to alter, providing security and clarity.

By understanding the features and limitations of each format, you can choose the one that best meets your needs and enhances your billing efficiency.

Common Mistakes in Roofing Invoices

Creating a billing document might seem straightforward, but small errors can lead to confusion, delays in payments, or even disputes with clients. Even experienced contractors can overlook key details when preparing these documents. Recognizing common mistakes is the first step in ensuring that your billing is accurate and professional, helping you avoid complications down the line.

Frequent Errors to Watch Out For

Here are some of the most common mistakes that contractors make when preparing financial records for their services:

- Missing Client Information: Failing to include the client’s full name, address, and contact details can lead to confusion or payment delays. Always verify the accuracy of this information.

- Unclear Work Descriptions: Vague descriptions of the services provided can cause misunderstandings. Be specific about the tasks completed, materials used, and any additional services provided.

- Not Breaking Down Costs: Clients appreciate a clear breakdown of charges. If you don’t separate labor costs, material costs, and additional fees, it may create doubts about the accuracy of your charges.

- Omitting Payment Terms: Always include payment due dates, any late fees, or discounts for early payments. Lack of clear payment terms can delay or complicate the payment process.

- Incorrect Calculations: Errors in math, especially when calculating totals or taxes, can damage your credibility. Double-check all figures before sending out a document.

- Not Including Your Contact Information: If your client has any questions or needs clarification, it’s essential that your contact information is easy to find. Always include your business name, phone number, and email address.

Additional Considerations

Beyond the basic mistakes, here are a few other important details that are often overlooked:

- Forgetting to Include Dates: Always include the date the work was completed and the date the document is issued. This helps keep records organized and clarifies the timeline for both parties.

- Failure to Proofread: Typos, formatting errors, or missing details can detract from your professionalism. Take the time to proofread your document carefully before sending it out.

- Not Using a Consistent Format: A consistent structure not only helps with organization but also makes it easier for clients to read and understand your documents. Using different formats for each client or project can create unnecessary confusion.

By avoiding these common mistakes, you can ensure that your financial documents are clear, accurate, and professional, leading to faster payments and a more efficient business operation.

How to Use a Template for Fast Billing

Using a pre-designed document structure can significantly speed up the process of creating financial records for your services. By having a standard format ready, you can quickly input specific details about the work completed, saving time and reducing the chances of making mistakes. This method is especially helpful for contractors who need to generate multiple bills in a short period, ensuring both efficiency and consistency.

Steps for Quick Billing with a Pre-Formatted Document

Follow these simple steps to make the most of a pre-designed structure and generate accurate billing records faster:

- Choose the Right Format: Select a document structure that suits your business and project needs. Whether it’s a Word document, Excel spreadsheet, or PDF, choose one that allows easy editing and customization.

- Fill in Basic Information: Start by entering your business name, contact details, and logo. Then, input the client’s name, address, and other relevant information. This information should remain consistent across all your documents.

- Detail the Services Provided: Quickly add descriptions of the services you’ve completed. A well-structured format will have predefined sections for labor, materials, and other charges. Simply update these sections with the specific details of the job.

- Input Payment Information: Add the payment terms, including the total amount, due date, and any applicable taxes or discounts. Be sure the payment methods are clearly stated to avoid any confusion.

- Review for Accuracy: Double-check all entered details for correctness. Ensure the calculations are accurate, and the service descriptions reflect what was completed.

- Save and Send: Once the document is complete, save it in your desired format and send it to your client. Having a pre-designed document structure means this step can be done quickly and consistently every time.

Benefits of Using a Pre-Formatted Billing Document

- Speed: Reduce the time spent creating each record, allowing you to focus on other important tasks.

- Consistency: Maintain a consistent and professional appearance across all your financial records, which builds trust with clients.

- Accuracy: Minimize errors by using a structure that already includes all necessary sections and calculations.

- Customization: Even with a pre-designed format, you can still easily adjust each document to suit the specifics of each project or client.

By following these steps, you can quickly generate professional, accurate billing records that ensure both you and your clients are on the same

Legal Requirements for Roofing Invoices

When it comes to providing billing documents for services rendered, there are certain legal obligations that businesses must adhere to. These requirements ensure that all transactions are properly documented and that both the service provider and the client are clear on the terms of the agreement. Understanding these legal elements can help contractors maintain compliance with tax regulations, avoid disputes, and create a more professional relationship with clients.

Essential Legal Information to Include

Every billing document should include key information to meet legal and tax requirements. Below are the main elements that should be present:

- Business Details: Include the name, address, and contact information of your company, as well as your tax identification number (TIN) or business registration number if required by your local jurisdiction.

- Client Information: Clearly list the full name, address, and contact details of the client receiving the services. This helps ensure proper record-keeping and accuracy in case of future inquiries.

- Description of Services: Provide a detailed breakdown of the work completed, including the type of service, labor hours, and materials used. This is crucial for tax purposes and avoids ambiguity.

- Tax Information: Ensure that applicable taxes, such as sales tax or VAT, are clearly noted on the document. Indicate the tax rate applied and the amount, ensuring compliance with local tax laws.

- Total Amount Due: List the total cost of services, including any taxes, fees, or discounts. This helps avoid confusion and ensures that clients are aware of the exact amount due.

- Payment Terms and Due Date: Include a due date for payment and any terms regarding late fees or early payment discounts. This helps to establish clear expectations for both parties.

Additional Considerations for Legal Compliance

Besides the basic legal requirements, there are other aspects that may be required depending on your location or the size of the project:

- Contractual Agreements: For larger or more complex jobs, it’s advisable to include reference to any contracts or agreements that outline the scope of work and payment terms.

- Proof of Work: In some jurisdictions, proof of completed work or inspections may need to be submitted along with billing documents to ensure that services were rendered as agreed.

- Digital Signatures: Depending on your business’s location, you may be required to include digital signatures or other forms of verification for electronic billing documents.

By ensuring your billing documents meet these legal standards, you can protect your business, maintain transparency with clients, and comply with local regulations, minimizing the risk of disputes or fines.

Tips for Organizing Your Billing Records

Effective organization of financial documents is essential for any business, especially for contractors handling multiple projects. Proper organization not only helps streamline your workflow but also ensures that you can quickly access and review billing details when needed. By keeping your records in order, you can reduce errors, avoid missed payments, and maintain a professional approach in managing your business finances.

Strategies for Streamlining Your Billing Process

Here are several strategies to help you keep your financial documents organized and easily accessible:

- Use Digital Filing Systems: Storing documents electronically makes it easier to keep track of all transactions. Use cloud-based storage platforms or digital folders to categorize documents by project, date, or client.

- Label Files Clearly: Ensure each file is clearly labeled with essential information, such as the client’s name, project type, and date. This will make it easier to search for specific records when needed.

- Keep Consistent Naming Conventions: Create a system for naming documents consistently, such as including the project number, client name, and date in the filename. This can help you quickly identify the relevant files.

- Maintain Backup Copies: Keep backup copies of all your financial documents, either in an external hard drive or a cloud backup service. This ensures that you never lose important records due to technical issues or accidental deletions.

- Organize by Payment Status: Organize documents based on payment status–whether paid, pending, or overdue. This helps you track outstanding payments and follow up with clients in a timely manner.

Best Practices for Regular Review and Updates

Regularly reviewing and updating your financial records is crucial to maintaining organization. Here are some tips to ensure your documents stay in order:

- Review Documents Monthly: Set aside time each month to review your billing records, ensuring that all payments are up to date and that no documents are missing or outdated.

- Keep Detailed Notes: Add notes to each document about any relevant conversations or adjustments to the billing details, so you have a clear record of any changes or discussions with the client.

- Use Accounting Software: Consider using accounting software that integrates with your billing process. These tools can help you automate the organization of documents, track payments, and generate reports.

By implementing these strategies, you can keep your financial documents organized, reduce administrative tasks, and ensure smooth business operations. Staying on top of your billing records will save time and reduce stress when it comes to managing client payments.

Saving Time with Pre-Made Billing Documents

Using pre-designed billing structures can significantly reduce the time spent on administrative tasks. These ready-to-use formats come with all the necessary sections and calculations already set up, allowing you to focus on the details of the work completed rather than starting from scratch each time. By eliminating the need to manually create a document for every project, you can increase your efficiency and free up time for other important tasks.

How Pre-Made Documents Improve Efficiency

Here are some key ways that using pre-designed billing formats can save you time:

- Quick Setup: Instead of manually entering each section, simply fill in the specifics of your latest project. The basic structure, including client information, services, and pricing, is already laid out for you.

- Consistent Layout: Using a consistent layout for all your financial documents ensures that you don’t have to rethink the design each time. This consistency helps you maintain a professional appearance while also speeding up the creation process.

- Reduced Errors: Pre-made documents usually contain built-in formulas or sections for automatic calculations, reducing the chances of mathematical mistakes and ensuring accuracy in billing.

- Standardized Process: When you use a set format, the billing process becomes standardized, making it easier to manage multiple projects at once and track payments over time.

Key Features of Time-Saving Billing Formats

Some of the most useful features of pre-designed billing structures include:

- Pre-filled Sections: Many formats come with standard sections for labor, materials, taxes, and payment terms, making it easy to customize for each job.

- Automated Calculations: Built-in formulas can automatically calculate totals, taxes, or discounts, eliminating the need for manual calculations and reducing errors.

- Professional Appearance: The layout is often polished and ready for use, which enhances the overall presentation of your documents and saves you time spent on design.

By utilizing these pre-made billing formats, you can complete your administrative tasks faster, improve the consistency of your paperwork, and spend more time on your core business activities.

Invoice Template Tips for Accurate Payment Tracking

Effective payment tracking is crucial for ensuring that you receive the payments you are owed in a timely manner. By using a structured format for your financial records, you can easily keep track of what’s been paid, what’s overdue, and what’s yet to be invoiced. A well-designed billing document not only simplifies the process but also helps prevent confusion and potential disputes with clients.

Key Tips for Better Payment Tracking

Here are some useful tips for improving your payment tracking with the help of a structured billing document:

- Include Clear Payment Terms: Always specify payment deadlines, late fees, and any other important payment terms. This will help both you and your client stay on the same page about when the payment is due and what to expect if it is delayed.

- Use Invoice Numbers: Assign a unique number to every billing document. This helps you quickly identify and reference a specific record, making it easier to track outstanding payments and resolve disputes.

- Track Payment Status: Add a section for tracking whether a payment is pending, paid, or overdue. This can be manually updated or automatically calculated if using accounting software, keeping you organized and up-to-date.

- List Payment Methods: Clearly indicate the accepted methods of payment (such as bank transfer, check, or credit card) on the document. This provides clients with clear options for how to settle the balance, reducing confusion and potential delays.

- Include a Detailed Breakdown: Ensure that all charges are clearly outlined, including labor costs, materials, taxes, and any other fees. This transparency helps prevent disputes and ensures that clients understand exactly what they are paying for.

- Set Up Payment Reminders: Use the document to set up periodic reminders for clients who are overdue. Regular follow-ups help you maintain a steady cash flow and encourage timely payments.

How to Stay on Top of Payments

To stay organized and maintain an accurate record of payments, consider these additional strategies:

- Maintain Digital Records: Store your billing documents in an organized digital system, categorizing them by date, client, or project. This allows for quick access and easy reference when following up on payments.

- Regularly Update Payment Status: After receiving a payment, mark the invoice as paid and update any outstanding balance. Keeping this information up-to-date ensures that you can easily assess your financial status at any given time.

- Review Payments Monthly: At the end of each month, review your payment records to ensure there are no outstanding issues. This helps prevent late payments from slipping through the cracks.

By following these tips and using a well-organized billing document, you can track payments more effectively, reduce the likelihood of errors, and keep your business running smoothly.

How to Share Billing Documents with Clients

Sharing financial records with clients in a clear and efficient manner is essential for maintaining transparency and ensuring smooth transactions. Whether you’re sending a detailed bill for services or requesting payment for a completed project, it’s important to choose the right method to deliver these documents. By selecting an appropriate sharing process, you can enhance communication, ensure timely payments, and reduce the risk of misunderstandings.

There are several methods for sharing billing details with clients, and the best choice often depends on the preferences of both parties and the scale of the project. Below are some of the most common and effective ways to deliver these documents:

- Email: Sending billing documents via email is one of the quickest and most professional methods. Attach the file as a PDF or Word document to ensure the client receives a secure, easily accessible version of the record. Email also allows you to include a personalized message, offering clarity on payment terms or any follow-up instructions.

- Client Portals: For ongoing projects or long-term clients, setting up a secure client portal can be a practical option. Through the portal, clients can access all their billing records, track payments, and even pay directly online. This method enhances convenience and ensures that the client has immediate access to all relevant documents.

- Physical Mail: While less common in today’s digital world, some clients may prefer to receive hard copies of their billing documents. If this is the case, ensure that the documents are printed clearly and sent via a reliable mail service. For large payments or important contracts, consider using certified mail for added security.

- Online Payment Platforms: If you use an online payment system (like PayPal or Stripe), most platforms allow you to generate and send billing documents directly through their service. This method not only delivers the document but also makes it easy for clients to complete the transaction immediately after receiving it.

Regardless of the method you choose, always ensure that the billing document is clear, accurate, and professionally formatted. Consider including contact information in case the client has any questions or needs clarification. By sharing your financial records in a way that’s convenient for your clients, you can foster better communication and encourage prompt payment.

Best Practices for Sending Billing Documents

Sending billing records in a timely and professional manner is key to ensuring that your clients pay promptly and without confusion. A clear, well-structured document not only enhances your professional image but also helps avoid disputes and ensures smooth transactions. Implementing best practices when sending these documents can save you time, reduce errors, and maintain a strong relationship with your clients.

Ensure Accuracy and Clarity

Before sending any billing document, double-check for accuracy. This includes verifying client details, service descriptions, amounts, and payment terms. A document with incorrect or missing information can lead to delays or disputes. Here are some essential points to consider:

- Include Clear Descriptions: Break down the services provided with detailed descriptions to ensure the client understands exactly what they are being charged for.

- List Accurate Payment Terms: Always include clear payment terms, including the due date, any late fees, and acceptable methods of payment.

- Proofread for Errors: Ensure there are no typographical errors, miscalculations, or incorrect client details. A well-reviewed document is more likely to be taken seriously and result in faster payment.

Choose the Right Delivery Method

When it comes to sending your financial documents, the method you choose can affect the speed and clarity of the transaction. Here are some tips for choosing the most efficient delivery options:

- Email with Attachments: For most clients, email is the fastest and most efficient method. Attach your billing document as a PDF or other easily accessible file format. This ensures that your client has a clear copy that they can refer to at any time.

- Client Portals: If your business uses an online portal, upload the billing document there. This offers clients easy access to all their documents and payment details in one place.

- Follow Up with Reminders: If payments are due soon or if a payment has been missed, send polite reminders. These follow-ups can be automated or done manually and are essential in maintaining cash flow.

By following these best practices, you can streamline your billing process, reduce delays, and improve your relationship with clients, all while ensuring timely payments.

Free Billing Formats for Small Construction Businesses

For small construction companies, managing billing can often be a time-consuming task. Having a structured format for financial documents can simplify the process, ensuring accurate records and quick payments. A ready-made document can help business owners focus on their core services, knowing that the financial side of things is organized and professional. Many options are available that cater specifically to small businesses, offering an easy way to stay on top of payments and client communication.

These pre-built billing solutions offer numerous benefits, especially for smaller companies that might not have the resources to develop their own custom formats. Here are a few reasons why using a structured billing document can be incredibly helpful for your business:

- Professional Appearance: Even if you are a small operation, presenting well-organized billing documents enhances your professional image and builds trust with clients.

- Streamlined Process: With a ready-made format, you can quickly input the details of the work completed, allowing you to issue bills more quickly and focus on other tasks.

- Improved Accuracy: A well-structured document reduces the chances of errors, ensuring that all amounts and details are clearly stated and calculations are correct.

Small construction businesses, especially those handling multiple projects at once, can benefit greatly from using a simple yet effective system for invoicing. These formats are typically easy to customize, allowing you to add specific project details while maintaining a consistent style and structure for all your clients. Whether you’re just starting out or looking to streamline your current process, these solutions can help make the billing process more efficient and professional.