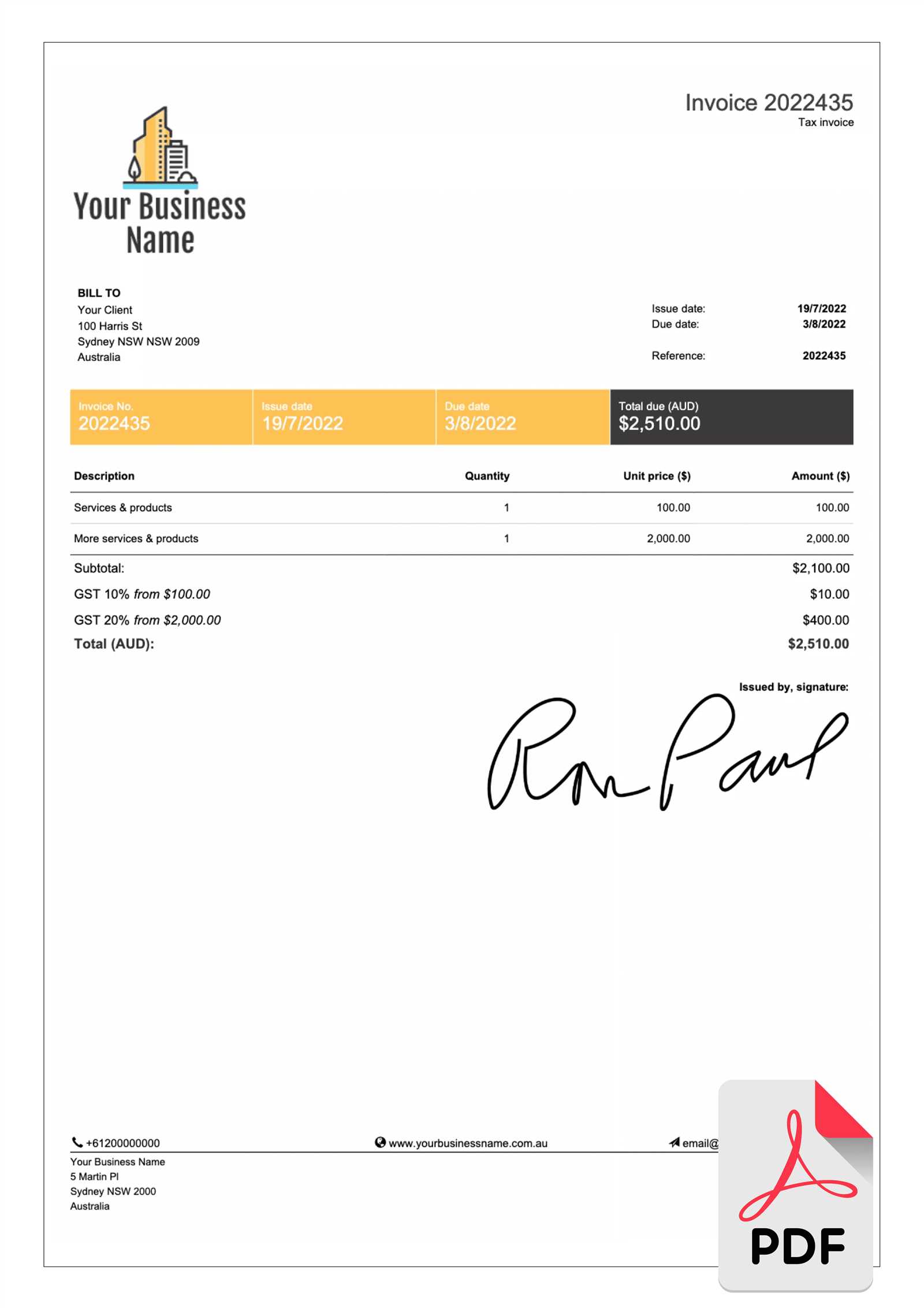

Free Invoice Template PDF Download for Easy Billing

Efficiently managing payments is a key aspect of any business. Having the right tools can save valuable time and help maintain professionalism in financial transactions. Whether you’re a freelancer or run a small business, using pre-designed documents for billing ensures you stay organized and avoid errors in your records.

With just a few simple modifications, these ready-made files can be tailored to suit your specific needs. They allow you to easily input customer details, list services, and track amounts due without the hassle of creating everything from scratch each time you need to send a bill.

By utilizing digital forms, you can ensure consistency in your transactions and reduce the chances of overlooking important information. These documents can be stored, shared, and printed with ease, making them ideal for busy professionals seeking a reliable and effective billing solution.

Free Invoice Template PDF for Business

For any business, simplifying the payment process is crucial. Using a structured document that outlines all the necessary billing details helps keep transactions smooth and professional. Whether you’re providing services, selling products, or managing projects, having a standardized format for payment requests ensures consistency and accuracy in all your dealings.

Advantages of Using Pre-Designed Billing Documents

Opting for a pre-made billing solution offers several advantages:

- Saves Time: You won’t have to create new documents from scratch every time you need to issue a bill.

- Professional Appearance: A well-organized and clear format enhances your business image and helps build trust with clients.

- Reduces Errors: Using a consistent structure minimizes mistakes, ensuring all important details are captured correctly.

- Easy Customization: You can quickly adjust fields like the amount, due date, and service description to meet your specific needs.

Key Features to Look for in a Billing Document

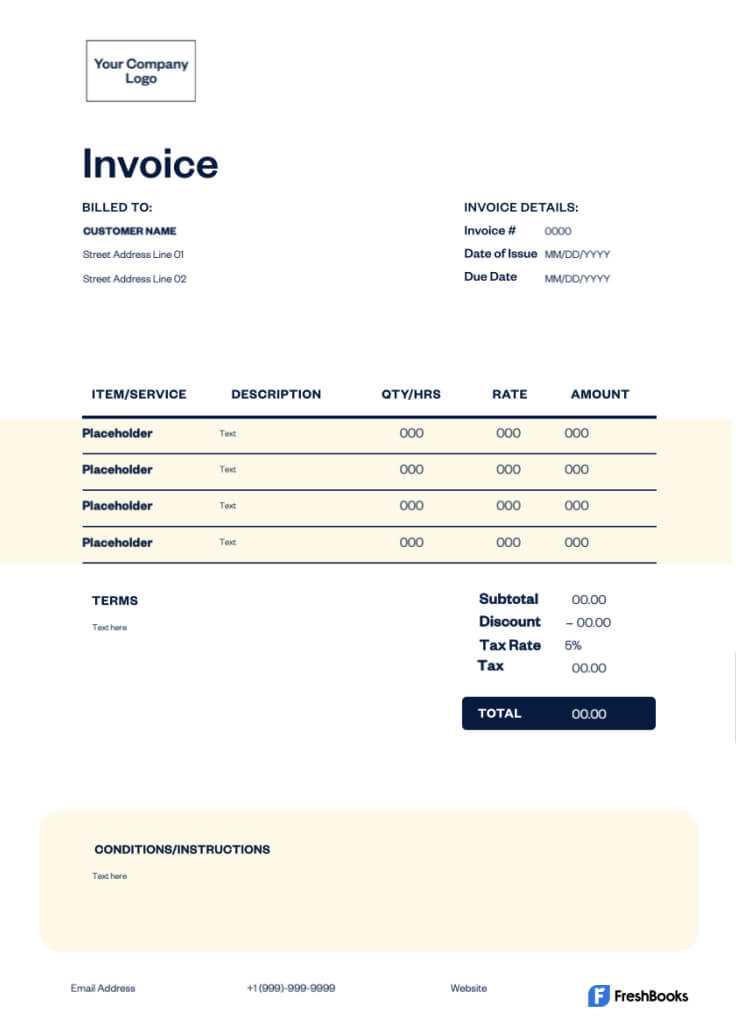

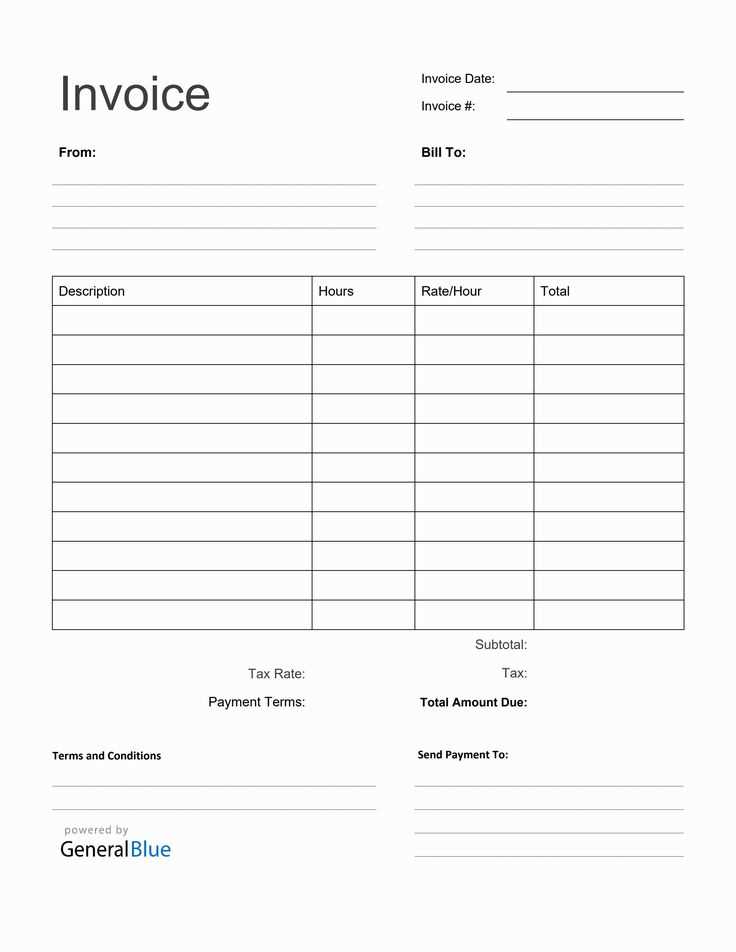

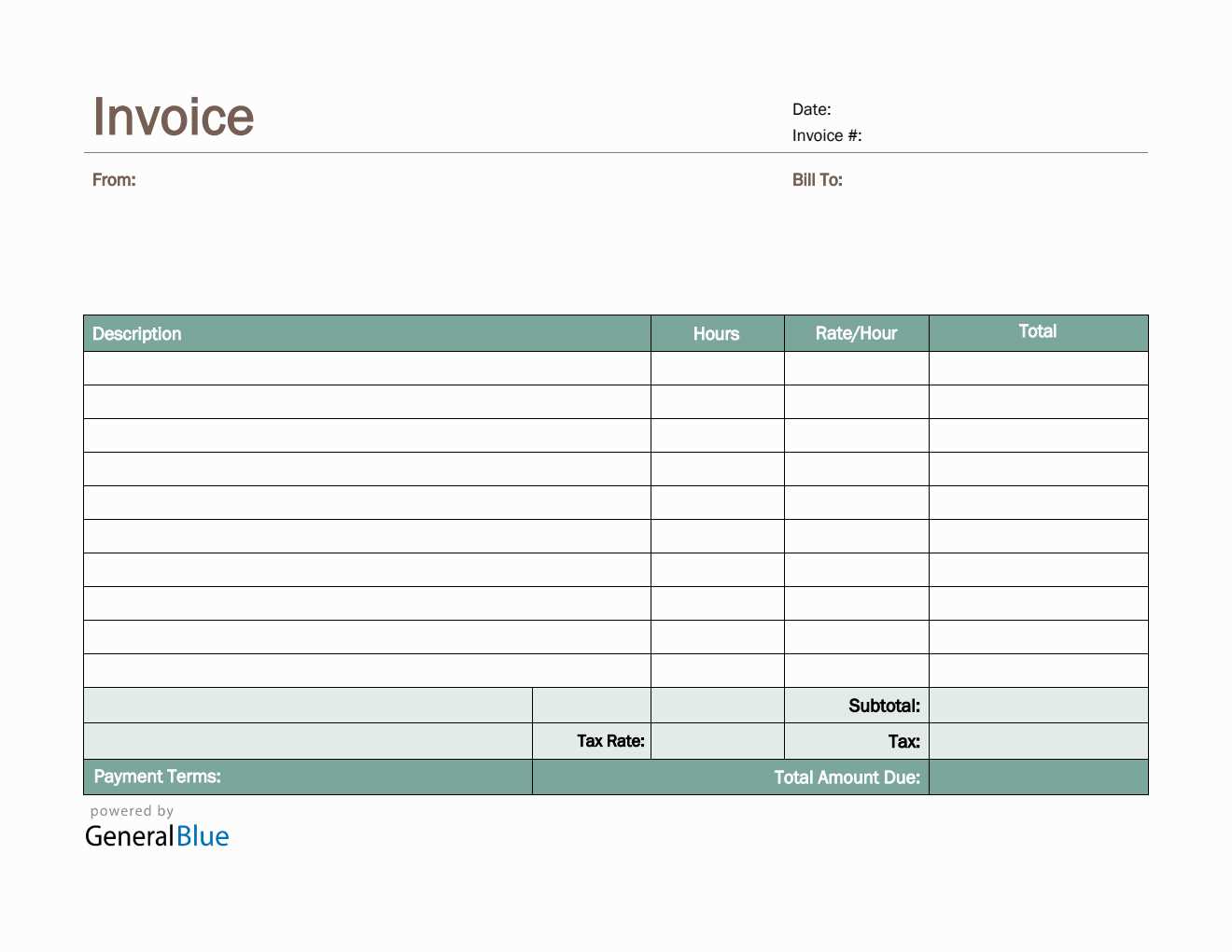

When selecting a suitable document for your business, consider these important features:

- Clear Breakdown of Costs: The document should include a detailed list of products or services provided along with their respective prices.

- Payment Terms: Clearly define payment methods, due dates, and any late fees if applicable.

- Your Branding: Include your business logo, contact information, and other branding elements to maintain a professional look.

- Compatibility: Ensure the document can be easily shared or printed in formats that work across different devices and platforms.

By using a well-structured billing document, your business can ensure smoother operations, maintain professionalism, and get paid faster.

Why You Need an Invoice Template

In any business, properly documenting transactions is essential for maintaining accurate financial records. Having a standardized format for requesting payments not only makes the process smoother but also ensures consistency across all your billing communications. A reliable structure helps eliminate confusion and ensures both parties are on the same page when it comes to payments.

Importance of Using a Standardized Format

Using a pre-structured format for payment requests offers several benefits:

- Efficiency: Reduces the time spent creating each payment document from scratch.

- Accuracy: Ensures that all the necessary information is included and clearly presented.

- Consistency: Helps maintain a professional appearance across all financial dealings.

Key Components of a Well-Structured Document

To ensure your payment requests are clear and complete, certain elements should always be included. The table below shows a basic structure that every billing document should follow:

| Section | Description |

|---|---|

| Sender Information | Your business name, contact details, and address. |

| Recipient Information | Client’s name, contact information, and address. |

| Itemized List of Services | A breakdown of the products or services provided, with prices. |

| Total Amount Due | The sum of all items/services, including any applicable taxes. |

| Payment Terms | Due date, payment methods, and any additional payment instructions. |

By following this structure, you can ensure that your billing documents are complete, professional, and easy for your clients to understand. A well-organized document not only improves your chances o

Top Benefits of Using PDF Invoices

Choosing the right format for financial documents plays a significant role in streamlining communication and ensuring secure transactions. Opting for a universally accepted digital format offers numerous advantages, making it the preferred choice for businesses worldwide. These digital files are designed to maintain their formatting across all devices and platforms, ensuring consistency in every communication.

Why Digital Documents Are Ideal for Billing

There are several compelling reasons why many businesses choose digital files for billing purposes:

- Universal Compatibility: Digital files can be opened and viewed on almost any device, regardless of operating system.

- Professional Appearance: These documents retain their layout and design, ensuring that the presentation is always clean and easy to read.

- File Security: Digital formats allow for encryption and password protection, ensuring that sensitive information remains secure.

- Easy to Store and Access: Digital records can be stored in cloud-based systems, making them easy to retrieve and manage over time.

How PDF Documents Enhance the Billing Process

Using a digital format for your financial documents improves the overall billing experience, benefiting both the sender and the recipient. Below are some specific advantages:

- Cost-Effective: No need for printing, paper, or postage, reducing overall expenses.

- Time-Efficient: Quickly send payment requests via email or other digital communication methods, eliminating postal delays.

- Environmentally Friendly: Reducing the use of paper helps your business go green and contribute to sustainability efforts.

- Easy Customization: These documents can be easily updated to reflect different payment terms, pricing, or business branding without additional overhead.

By adopting digital files for your payment requests, you can streamline your processes, protect your data, and maintain a profess

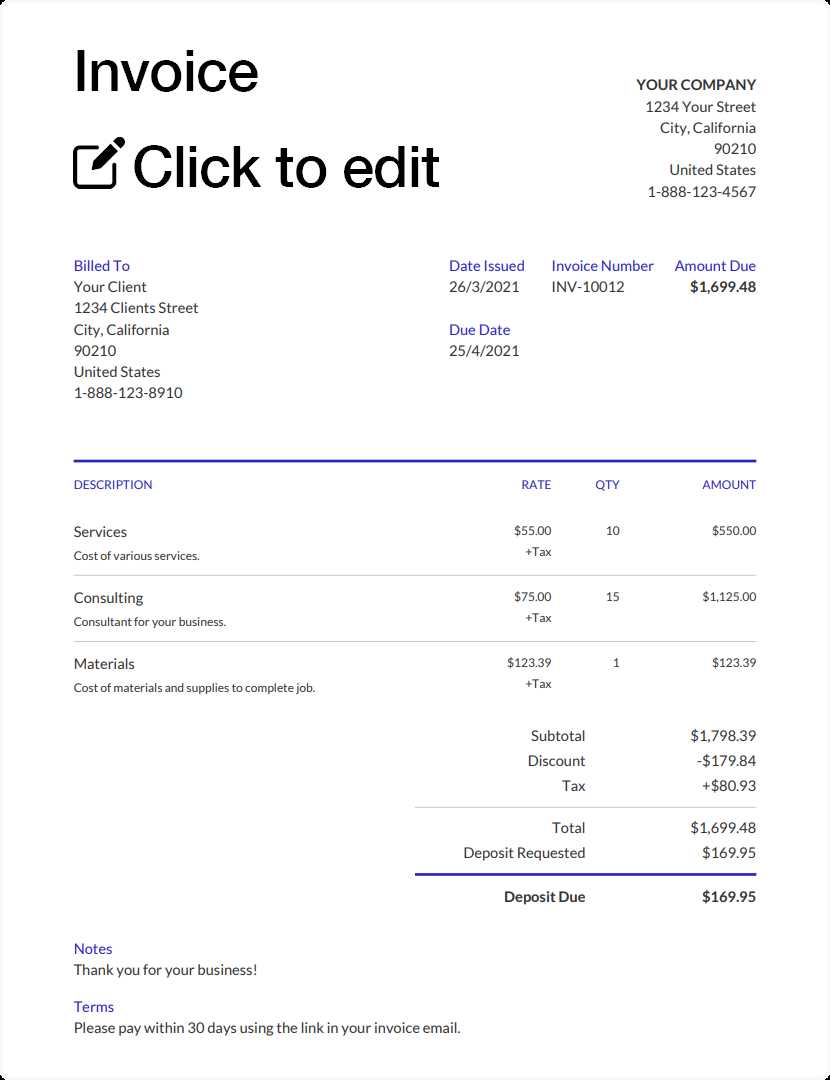

How to Customize Your Invoice Template

Customizing your billing documents allows you to personalize them according to your business’s unique needs and branding. By making small adjustments, you can ensure that every payment request reflects your company’s identity while maintaining a professional and consistent appearance. The key is to include the necessary details while making sure the layout is clear and easy to understand for your clients.

Here are some steps to follow when adjusting the structure of your payment request document:

- Add Your Branding: Incorporate your company logo, business name, and contact information at the top. This adds a professional touch and makes the document easily recognizable.

- Personalize the Layout: Adjust the arrangement of sections to suit your preference. You can place the amount due, payment terms, and itemized list in different sections for better readability.

- Include Additional Fields: Depending on your business needs, you may want to add custom fields like purchase order numbers, project names, or client reference codes.

- Modify Payment Instructions: Tailor the payment details to reflect the preferred methods for your business, such as bank transfer, credit card, or online payment platforms.

- Adjust the Color Scheme: Use colors that match your brand’s style to make the document visually appealing while maintaining clarity.

By making these changes, you can create a more personalized experience for your clients, improve your business’s branding, and ensure a smooth and professional payment process every time.

Best Websites for Free Invoice Templates

When it comes to managing billing documents, having access to ready-to-use resources can save valuable time and effort. Many websites offer a wide range of digital solutions for businesses to create professional-looking payment requests quickly and without hassle. These platforms allow you to customize and personalize your documents to match your business needs.

Top Platforms for Billing Documents

Here are some of the best platforms where you can find ready-made options to create your own payment requests:

| Website | Features | Customization Options |

|---|---|---|

| Zoho Invoice | Professional designs, automatic calculations, and multi-currency support. | Can add logos, modify colors, and customize field names. |

| Invoice Simple | User-friendly interface with quick setup for both personal and business use. | Basic customization with the ability to modify text and payment terms. |

| PayPal Invoicing | Integrated with PayPal for easy payment collection, easy to use. | Customizable with your branding and payment instructions. |

| FreshBooks | Comprehensive invoicing system with time tracking and expense management features. | Full customization for invoices and reports. |

| Wave | Free invoicing, accounting, and receipt management software. | Simple customization for logos, colors, and payment options. |

How to Choose the Right Platform

When selecting the right platform for creating your documents, consider the following factors:

- Ease of Use: Choose a platform that offers a simple and intuitive interface, especially if you don’t have experience with design software.

How to Download PDF Invoice Templates Accessing ready-made billing documents online can streamline the process of creating professional payment requests for your business. Many platforms offer customizable options, allowing you to create and save documents that can be used repeatedly for client transactions. These digital files are easily accessible and can be stored for future use with just a few clicks.

Here’s how to easily access and save your customized financial documents:

Step Description Step 1 Visit a trusted website that offers customizable billing options. Look for platforms that provide easy-to-use tools for editing and personalizing your documents. Step 2 Choose the type of document you need and select a format that works for your business. Most platforms will offer a variety of options based on industry and use case. Step 3 Customize the fields to match your business details, including your logo, contact information, and payment terms. Be sure to check that all required fields are filled in. Step 4 Once you’re satisfied with the layout, look for a “save” or “export” button. You can typically choose to save the document as a high-quality digital file for easy sharing or printing. Step 5 Save the file to your computer or cloud storage for future use. Make sure you label the file properly for easy identification and organization. By following these simple steps, you can easily access professional billing documents whenever you need them, ensuring a smooth payment process with clients.

Creating Professional Invoices in Minutes

Generating well-organized and clear payment requests doesn’t have to be time-consuming. With the right tools, you can create a professional document in just a few minutes. These tools provide pre-designed structures that allow you to focus on the content, such as adding client details, services provided, and payment terms, while the layout is taken care of for you.

Steps to Create a Professional Payment Request

Follow these easy steps to create a polished billing document quickly:

- Choose a Platform: Select an online tool or software that offers customizable payment documents. Many platforms allow you to fill in your business and client information directly.

- Enter Details: Input essential information, including your business name, the client’s details, a breakdown of services or products, and the amount due.

- Set Payment Terms: Specify the payment method, due date, and any additional instructions, such as late fees or discounts for early payment.

- Review and Customize: Double-check for accuracy, ensure the format is clear, and make any necessary design adjustments to match your brand.

- Save and Send: Once the document is finalized, save it in a suitable format and send it directly to the client via email or other digital channels.

Advantages of Quick Creation Tools

Using online platforms for generating payment documents offers several advantages:

- Speed: You can create a payment request in just a few minutes without the need for complex design software.

- Accuracy: Pre-designed formats help reduce the likelihood of missing key information or formatting errors.

- Customization: Even with a quick process, you can personalize the document with your branding, payment terms, and any specific notes for the client.

With the right tools, creating professional and well-structured billing documents can be done in no time, helping you stay organized and efficient in managing your business finances.

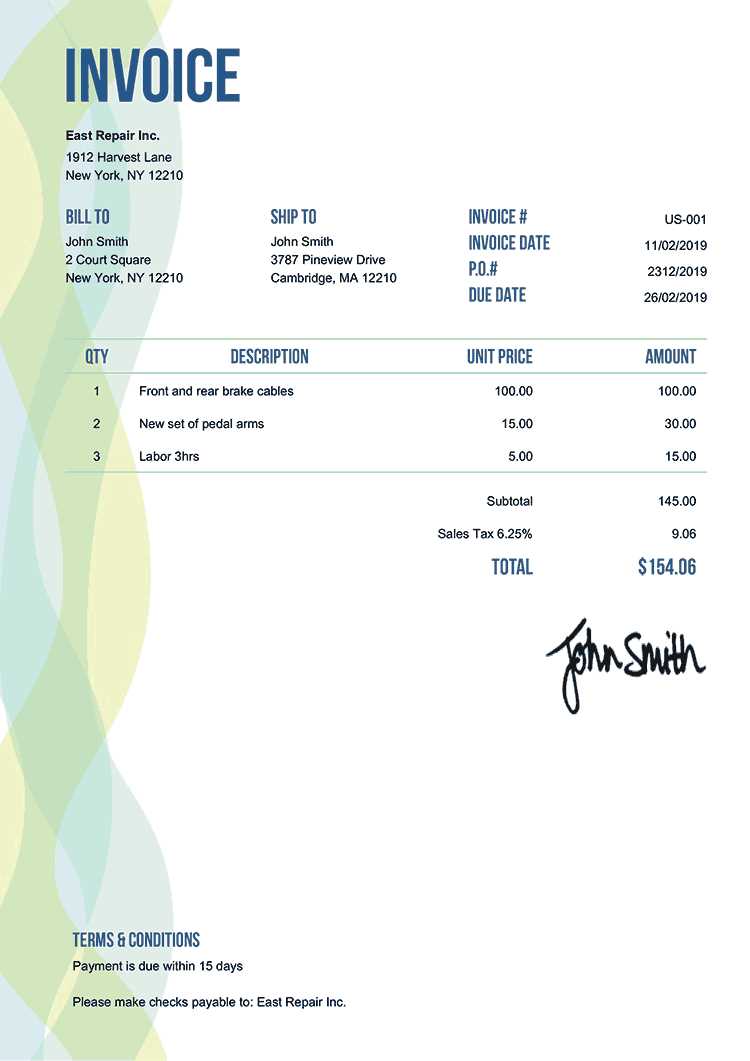

Understanding Invoice Formatting and Structure

Having a clear and consistent format for your billing documents is essential for both professional presentation and accurate record-keeping. A well-structured document not only ensures all necessary information is included, but also makes it easy for your clients to review and process payments. Understanding how to organize the content and where to place key details is crucial for maintaining clarity and avoiding errors.

When creating a payment request, the layout should follow a logical flow. Each section should be easy to identify and contain specific details that help both you and the client understand the terms of the transaction. From basic contact information to the breakdown of services or goods, every element plays a role in ensuring transparency and professionalism.

Key Elements of a Well-Structured Billing Document

Here are the essential components of a well-formatted payment request:

- Business Information: The top of the document should include your business name, logo, contact details, and address. This ensures the client knows exactly who the payment is for and how to reach you if needed.

- Client Information: Include the recipient’s name, address, and contact details. This helps ensure the document is directed to the right person and company.

- Unique Identification Number: A reference number or code for each payment request helps you track transactions and makes the document more organized.

- Itemized List: A detailed breakdown of the services or products provided, including quantities, unit prices, and total amounts. This transparency helps avoid confusion and questions from the client.

- Subtotal and Total Amount: Clearly indicate the subtotal, any taxes or discounts, and the final amount due. This helps clients easily calculate how much they owe.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees or early payment discounts. This ensures both parties understand when and how the payment should be made.

- Notes or Additional Information: If necessary, you can include additional instructions, such as the terms of delivery or specific conditions tied to the payment.

Why Consistency in Formatting Matters

Maintaining a consistent layout and style across all your billing documents contributes to your business’s professionalism. It also helps your clients easily find the in

How to Add Taxes to Your Invoice

When issuing a billing document, including applicable taxes is essential for both legal compliance and transparency. Taxes vary by location and industry, so it’s important to know the correct rate and how to calculate it based on the products or services being sold. Properly including taxes in your payment requests ensures that your clients understand the total amount due and helps you maintain accurate financial records.

Here’s a step-by-step guide to adding taxes to your billing document:

Step Description Step 1 Identify the Tax Rate: Research the applicable tax rate for your region or industry. Rates may differ based on local laws, the type of service or product, and whether you’re selling to businesses or consumers. Step 2 Calculate the Tax Amount: Multiply the total value of the items or services by the tax rate to find the amount due in taxes. Step 3 Include the Tax in the Document: After calculating the tax, clearly list it in a separate line item or section on your billing document. Make sure to specify the rate and the total tax amount. Step 4 Provide the Total Due: After adding the tax amount, update the total due to reflect the full amount including both the cost of the products/services and the taxes. Step 5 Ensure Compliance: Double-check that the tax calculation is correct and complies with all local tax laws to avoid issues later on. By following these steps, you can ensure that taxes are added correctly and clearly to your billing documents, providing transparency to your clients and maintaining accuracy in your accounting records.

Incorporating Your Business Branding

Presenting your brand consistently across all documents, including billing statements, reinforces your business identity and enhances professionalism. By including elements of your company’s branding in your financial documents, you create a cohesive and recognizable experience for your clients. Whether it’s through colors, logos, or specific fonts, these small touches can help distinguish your business and leave a lasting impression.

Here are a few effective ways to incorporate your business branding into your payment requests:

Branding Element How to Incorporate Logo Place your company logo at the top of the document, preferably near the header. This instantly identifies the document with your brand. Colors Use your company’s primary color scheme for headings, borders, and background accents. This creates visual consistency with other materials. Typography Incorporate your brand’s fonts for headers, subheaders, and body text. This maintains consistency with other company documents and marketing materials. Tagline or Slogan If your business has a tagline, consider adding it at the bottom or top of the document for a more personalized touch. Contact Information Ensure that your company’s address, phone number, website, and email are clearly displayed, typically in the footer or header, following your brand’s style guide. By including these branding elements in your payment requests, you not only make the documen

Free Invoice Templates for Freelancers

For freelancers, managing finances is a critical part of running a successful business. To ensure timely payments and maintain professionalism, having access to customizable billing documents is essential. Many platforms offer ready-to-use options that allow freelancers to quickly generate professional payment requests, saving time and reducing the hassle of creating one from scratch.

Here’s how freelancers can benefit from using customizable billing options:

Advantages of Using Ready-Made Billing Documents

- Time-Saving: Pre-designed documents allow you to quickly fill in essential details like the amount due, payment terms, and services rendered.

- Professional Appearance: Ready-to-use formats ensure that your payment requests are visually appealing and follow industry standards, helping you maintain a professional image.

- Customization Options: Many platforms allow you to tailor your payment requests with your own branding, contact information, and payment terms.

- Consistency: Using the same format for all your billing documents provides consistency, making your business appear more organized and dependable.

- Easy Record-Keeping: By using a standardized format, you can easily track payments, identify outstanding balances, and stay on top of your financial records.

How to Choose the Best Billing Option for Freelancers

When selecting a platform or tool for creating your payment requests, consider the following factors:

- Ease of Use: Look for a platform that is simple to navigate, especially if you are new to generating financial documents.

- Customization Features: Choose an option that allows you to add your logo, adjust the layout, and include your unique business details.

- Integration with Payment Systems: Some platforms offer the ability to link your billing documents with payment processing tools, allowing for easy transaction management.

- Compliance with Tax Regulations: Ensure that the platform you choose allows you to includ

Creating a Template for Recurring Payments

For businesses with regular clients or subscription-based services, creating a standardized document for recurring payments can save valuable time and ensure consistency. By establishing a recurring payment structure, you can set clear expectations for both your clients and your business. This template allows you to automate much of the process, reducing the effort required for each new billing cycle while ensuring accurate and timely transactions.

Here’s a step-by-step guide to help you create an efficient billing document for recurring payments:

Key Components of a Recurring Payment Document

When creating a billing document for ongoing payments, make sure to include the following elements:

Component Description Billing Cycle Clearly state the frequency of the payment (weekly, monthly, quarterly, etc.). This helps clients know exactly when to expect the charges. Payment Amount Include the exact amount due for each billing cycle, ensuring clients understand what they are being charged for each period. Service Period Define the start and end dates of the billing period. This helps clients see exactly what they are being billed for and when the next payment will be due. Payment Method Indicate the payment methods accepted, such as credit card, bank transfer, or online payment platforms. Make it easy for clients to process their payment. Auto-Renewal or Cancellation Terms Outline the terms regarding the continuation or cancellation of the service. This could include an automatic renewal option and any required notice period for cancellations. Benefits of Using Recurring Billing Documents

Once you create a recurring payment structure, several advantages become apparent:

- Consistency: A standardized document helps maintain a consistent format and structure for every billing cycle, improving professionalism.

- Time Efficiency: By using a recurring billing setup, you don’t need to create a new payment request each time, saving time on administrative tasks.

- Reduced Errors: With predefined fields for each client, there is less chance of missing critical information or making mistakes in the calculation.

- Better Cash Flow Management: Recurring billing helps businesses predict and plan for future revenue, which can assist with financial forecasting and stability.

Creating a recurring payment structure benefits both the business and the client by promoting a transparent, reliable, and efficient billing process. With the right approach, businesses can automate payments, reduce administrative overhead, and focus more on delivering quality services.

How to Use Invoice Templates in Excel

Microsoft Excel is a powerful tool for managing business finances, and it can be used effectively to create structured payment requests. By using pre-designed layouts, you can quickly generate professional billing documents without needing advanced design skills. Excel’s grid system makes it easy to organize information such as client details, product/service descriptions, and payment terms, streamlining the invoicing process and ensuring accuracy.

Here’s how to use Excel to create a clear and efficient payment document:

Step-by-Step Guide to Using Excel for Payment Requests

Follow these simple steps to customize and use Excel layouts for your billing documents:

- Choose a Pre-Built Layout: Excel offers various built-in formats that you can access by searching for “invoice” in the template gallery. These templates often include placeholders for your business and client information, items, amounts, and tax rates.

- Customize the Details: Replace the placeholders with your own information, including your company’s name, contact details, and your client’s data. Make sure to include a unique reference number for easy tracking.

- Add Services and Amounts: List the products or services you provided, along with their unit prices, quantities, and total amounts. Ensure that all entries are clear and easy to understand.

- Calculate Taxes and Discounts: Excel allows you to easily apply formulas to calculate tax amounts or discounts based on your business rules. Use Excel’s built-in functions to calculate the subtotal, tax, and final total automatically.

- Include Payment Terms: In the footer section, specify your payment terms, including the due date, preferred payment methods, and any late fees or discounts for early payment.

- Save and Send: Once the document is complete, save it in your desired format, such as Excel or PDF, and send it to your client via email or another communication channel.

Benefits of Using Excel for Payment Requests

Using Excel offers several advantages for generating billing documents:

- Flexibility: Excel allows you to modify every aspe

Common Mistakes to Avoid in Invoices

Creating accurate billing documents is essential for maintaining professionalism and ensuring prompt payments. Even minor errors can lead to confusion, delayed payments, or disputes with clients. It is important to be mindful of common mistakes that can occur when preparing these documents. Understanding and avoiding these errors helps to streamline the payment process and build stronger relationships with clients.

Here are some of the most common mistakes to watch out for when preparing your payment requests:

- Incorrect or Missing Client Information: Always double-check that your client’s name, address, and contact details are correct. A simple typo can cause delays in payments or communication issues.

- Failure to Include a Unique Reference Number: Every billing document should have a unique identifier, such as an invoice number or reference code. This makes it easier for both you and your client to track and manage payments.

- Missing or Incorrect Dates: Ensure the issue date and payment due date are clearly stated. Failing to include these can cause confusion about when the payment is due, which may result in late payments.

- Vague Descriptions of Services or Products: Be specific about what is being charged for. A vague description can lead to misunderstandings and disputes. List the services or goods with clear, detailed descriptions, including quantities and rates.

- Not Including Payment Terms: Clearly state the payment methods accepted and any terms regarding late fees, discounts, or installment payments. This helps to set expectations upfront.

- Inaccurate Calculations: Always double-check your math. Mistakes in calculating totals, taxes, or discounts can lead to confusion and disputes, and could damage your credibility.

- Not Accounting for Taxes: Depending on your location, taxes may need to be included. Ensure the correct tax rate is applied and itemized in the document. Neglecting this can result in legal and financial issues.

- Neglecting to Include Your Business Details: Your business contact information should always be included. This includes your business name, address, phone number, and email, so clients

Legal Requirements for Invoices

When creating billing documents, it’s important to adhere to legal regulations to ensure compliance with local laws and avoid any potential disputes with clients or tax authorities. Different regions may have specific requirements regarding the information that must be included on a payment request. Understanding these legal requirements can help protect your business and ensure that your financial documents are both valid and professional.

Here are some key legal elements that should be included in your billing documents:

- Clear Identification of the Seller: The document should include the full name or business name, address, and contact details of the business issuing the request.

- Client’s Information: Include the recipient’s full name, company name (if applicable), address, and contact details to ensure the request is properly directed.

- Unique Document Number: Every billing document must have a unique reference number to allow for easy tracking and management. This helps both parties stay organized and ensures that each document is distinct.

- Issue Date: The date when the payment request was issued is crucial for setting clear expectations regarding payment deadlines.

- Payment Due Date: A clearly stated due date is essential for defining when payment is expected, helping avoid any confusion or disputes.

- Itemized List of Goods or Services: A detailed breakdown of the items or services provided, including the quantity, description, and individual price, is often required by law. This ensures transparency and prevents misunderstandings.

- Tax Information: Many countries require businesses to include tax rates and the total amount of tax applied to the goods or services provided. This should be clearly indicated on the document.

- Total Amount Due: The final amount to be paid, including any taxes, discounts, or additional charges, should be clearly visible and easy to understand.

- Payment Methods: Specify the methods by which the client can settle the payment, such as bank transfer, credi

How to Track Payments with Invoices

Efficiently tracking payments is crucial for maintaining healthy cash flow and ensuring that all transactions are accurately recorded. By keeping a well-organized system for monitoring payments, businesses can avoid overdue accounts, reduce the risk of errors, and maintain positive relationships with clients. Proper documentation of payments received also simplifies accounting and financial reporting.

Here’s how you can effectively track payments using your billing documents:

Key Steps to Track Payments

Follow these essential steps to stay on top of your financial records:

- Assign a Unique Reference Number: Ensure each payment document has a unique identifier. This makes it easier to reference and track specific transactions in your records.

- Record Payment Details: When a payment is made, be sure to document the payment amount, method (e.g., credit card, bank transfer), and date of payment. This ensures transparency and accuracy in your records.

- Update Your Records Regularly: As payments are received, update your system immediately to avoid confusion or missed payments. This helps you maintain a real-time overview of outstanding amounts and paid balances.

- Link Payments to Specific Documents: For clarity, always link each payment to the original billing request. This creates a clear connection between the transaction and the services or products delivered.

- Monitor Payment Due Dates: Keep track of the due dates on each document and regularly check for overdue payments. This will help you follow up with clients promptly and avoid delays.

Using a Tracking System

Utilizing a tracking system, whether manual or software-based, helps you manage payments more effectively. A digital system or accounting software can automate many of the tasks, such as flagging overdue accounts or generating reports on paid and outstanding balances. Here’s an example of a simple payment tracking table:

Reference Number Client Name Amount Due Amount Paid Payment Method Payment Date Status #1001 Jo Invoice Templates for Different Industries

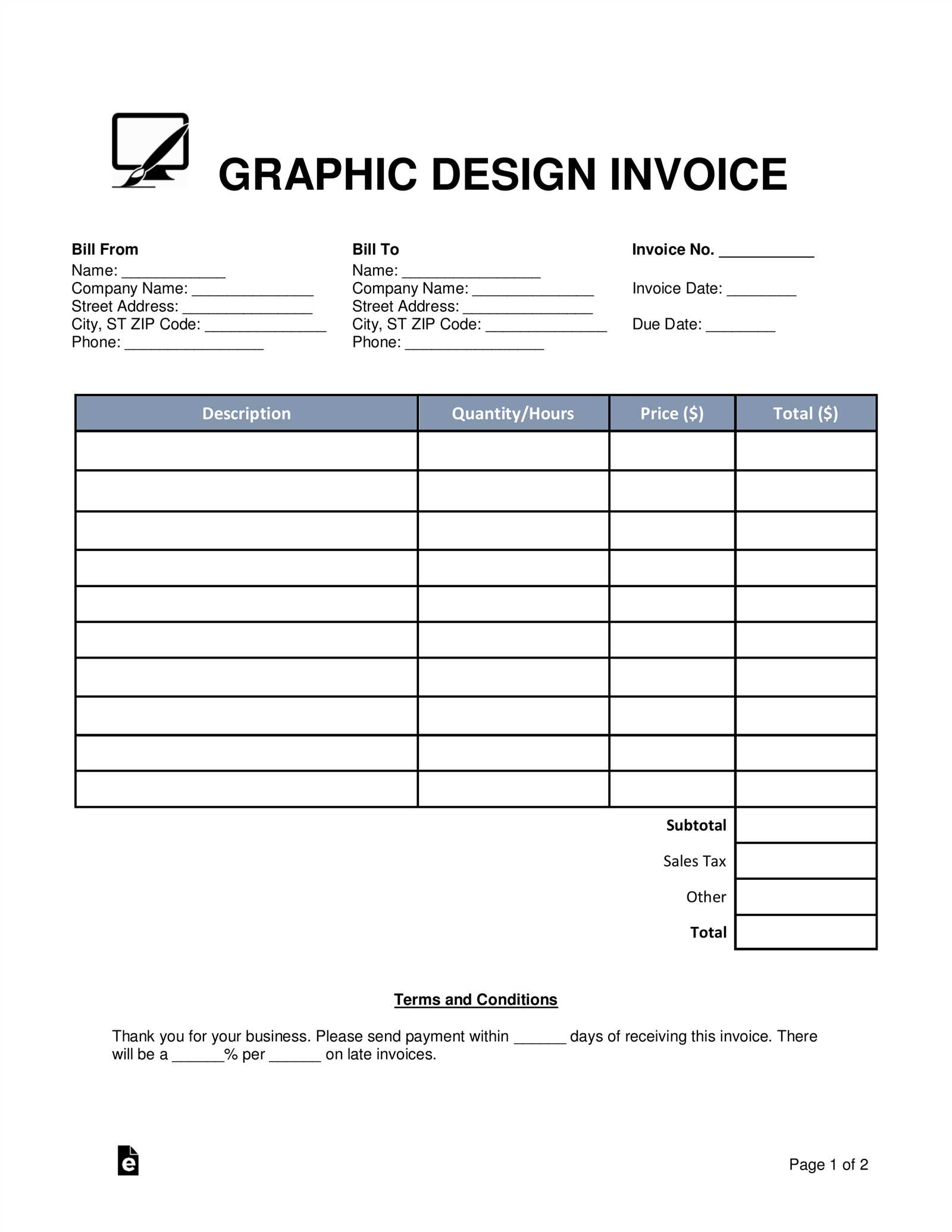

Each industry has its own set of requirements when it comes to documenting transactions and requesting payment. While the basic structure of a payment document may remain similar across sectors, the specific details and features may vary depending on the type of business. For example, a freelancer in creative fields may need to include different elements compared to a construction contractor or a retail store owner. Understanding the unique needs of your industry can help you create accurate and professional documents tailored to your business type.

Below are some examples of how different industries may need to customize their payment documents:

1. Creative and Freelance Services

For freelancers in creative fields, such as graphic design, writing, or web development, it’s essential to include a detailed breakdown of services rendered. These documents often need to capture hours worked, project milestones, or specific deliverables, as well as payment terms.

- Project Details: A brief description of the project or work completed.

- Hourly Rate or Fixed Fee: Specify whether the work is billed by the hour or on a flat fee basis.

- Payment Milestones: If the work is being paid in stages, include the terms and amounts due for each milestone.

2. Construction and Contracting

In the construction industry, payment documents often include not just labor and material costs, but also additional elements such as change orders or project timelines. Accurate tracking of completed phases and expenses is crucial for this sector.

- Material Costs: Clearly itemize the materials used for the project.

- Labor Charges: Include hourly rates or flat fees for work performed.

- Work Phases: Break down the work into stages or phases with payment requirements for each stage completed.

3. Retail and E-commerce

Retail businesses and e-commerce sellers typically require payment documents that include details on product purchases, shipping, and taxes. These businesses often deal with high volumes of transactions, so clear and concise documentation is vital.

- Product Descriptions: Include a detailed list of the products sold, including item numbers or SKUs.

- Shipping Charges: Be sure to list any shipping or handling f

Why PDF Is the Best Format for Invoices

When it comes to preparing and sharing payment requests, selecting the right format is essential for clarity, security, and ease of use. One format stands out for its versatility and reliability across various devices and operating systems: the document format. This option is favored by businesses of all sizes for its ability to preserve the original layout, maintain consistency, and ensure that the content cannot easily be altered by recipients.

Here are several reasons why this format is ideal for managing payment requests:

- Universal Compatibility: This format can be opened on any device, whether a PC, Mac, tablet, or smartphone. You don’t need specialized software to view it, making it accessible for both business owners and clients alike.

- Document Integrity: One of the key benefits is that it preserves the original layout, fonts, and graphics exactly as intended. This ensures that your billing documents appear professional and are not altered by recipients.

- Security Features: With built-in encryption and password protection options, this format provides a higher level of security. You can restrict access or editing to ensure sensitive financial information remains protected.

- Easy to Print: Whether you’re sharing documents electronically or need physical copies, this format ensures high-quality prints without distortion. This makes it perfect for businesses that require both digital and printed versions of payment requests.

- Compact File Size: Unlike some other formats, the document format compresses files effectively without sacrificing quality. This makes it easier to send large files through email without overwhelming inbox limits.

- Long-Term Archiving: Due to its non-editable nature, documents in this format are ideal for record-keeping. They can be stored for long periods without the risk of being altered or corrupted, which is essential for accounting and tax purposes.

For these reasons, businesses looking for a simple, secure, and professional way to manage and send payment requests often choose this format. It offers the perfect balance of ease of use, protection, and compatibility, ensuring that important financial documents are always handled wit