Free Digital Invoice Template for Quick and Easy Billing

Managing financial transactions efficiently is crucial for any business, whether small or large. Creating accurate and professional-looking documents for each payment ensures smooth operations and helps maintain a trustworthy relationship with clients. With the right tools, this process can be both quick and straightforward.

In today’s fast-paced environment, many business owners prefer using ready-made solutions to handle their payment requests. These customizable documents allow you to focus more on growing your business while ensuring that all financial details are organized and clearly presented. They can be easily adapted to meet the unique needs of your company or clients.

Whether you’re a freelancer or running a larger operation, leveraging these customizable forms can save you time, reduce errors, and improve the overall professionalism of your billing. With a few clicks, you can generate a polished statement that covers all the necessary information, from client details to payment terms.

Free Digital Invoice Template Benefits

Using ready-made documents for payment requests offers a wide range of advantages for business owners and freelancers alike. These customizable solutions simplify the billing process and make it easier to manage financial transactions efficiently. With minimal effort, you can create professional-looking statements that save both time and resources.

One of the key benefits is the time-saving aspect. Instead of starting from scratch, you can quickly fill out pre-designed formats with the necessary details, reducing the amount of manual work. This allows you to focus on other important aspects of your business, such as client relations or product development.

Additionally, these tools help maintain a high level of accuracy. By using structured documents, the chances of forgetting essential information, such as payment terms or itemized charges, are minimized. This reduces errors and ensures clear communication with clients, preventing potential disputes.

Professionalism is another significant advantage. Presenting well-organized and polished payment requests boosts your company’s image and builds trust with clients. A consistent format for all transactions reflects positively on your business and ensures you are seen as organized and detail-oriented.

Lastly, the ability to quickly track payments is a huge benefit. With easy-to-use documents, you can stay on top of outstanding balances, due dates, and payment history without needing complex software or additional tools. This level of organization helps you manage your cash flow more effectively and maintain financial stability.

Why Use a Digital Invoice Template

Utilizing pre-designed documents for billing is an efficient solution for businesses seeking to streamline their financial processes. These ready-made formats offer several compelling reasons to choose them over manually created alternatives, especially when it comes to saving time and ensuring accuracy.

- Efficiency: Pre-made structures allow you to generate statements in a fraction of the time compared to creating them from scratch. This can significantly reduce the administrative burden on business owners and employees.

- Consistency: Using a standard design for all your payment requests ensures uniformity, making your documents instantly recognizable and professional.

- Accuracy: Structured formats minimize the risk of errors, ensuring that all essential details such as pricing, terms, and dates are included correctly.

Another key benefit is customizability. Even though the documents are pre-made, you can modify them according to your business needs, tailoring them for different clients or services. Whether it’s adjusting the layout, adding your branding, or including specific payment details, these tools offer flexibility.

Additionally, using such solutions ensures professionalism and credibility. Well-organized and clear payment requests create a positive impression on clients, which is essential for maintaining strong business relationships and trust.

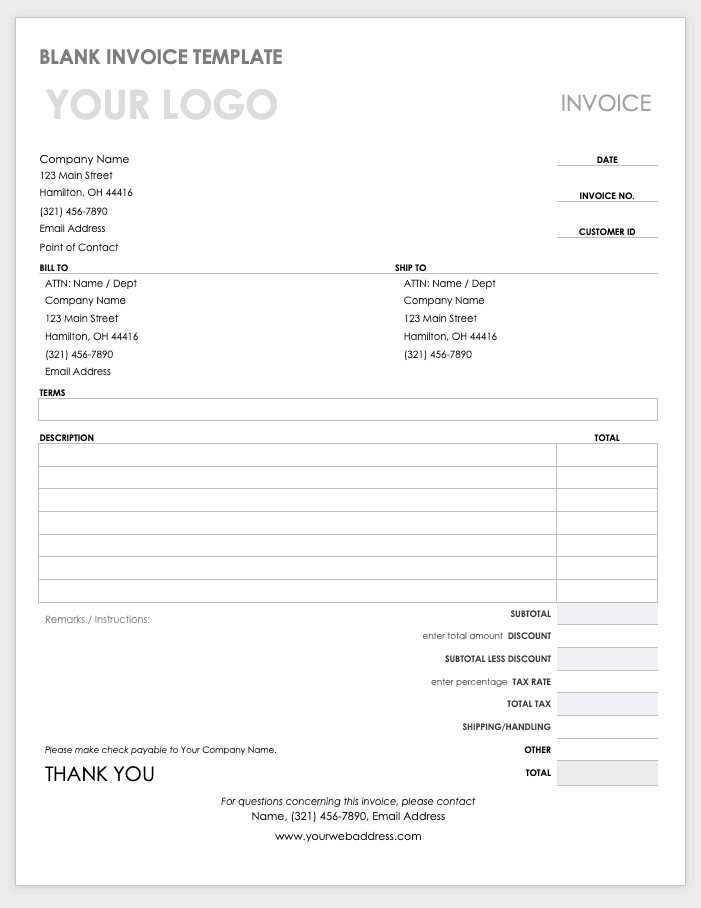

How to Customize Your Invoice Template

Customizing your billing documents allows you to personalize them to fit your business needs and client expectations. This process involves adjusting the layout, adding your company’s branding, and ensuring all relevant information is clearly presented. Below are the steps to tailor a pre-made billing document effectively:

| Step | Description |

|---|---|

| 1. Select a Design | Choose a layout that suits your business style, whether it’s formal or casual. Consider how it reflects your brand image. |

| 2. Add Business Information | Include your company name, logo, contact details, and address at the top of the document to make it identifiable. |

| 3. Include Client Details | Ensure the client’s name, address, and contact information are clearly visible, so they can easily reference the document. |

| 4. Adjust Payment Terms | Modify payment deadlines, method options, and any discounts or late fees according to your agreement with the client. |

| 5. Personalize with Additional Fields | Add custom fields such as purchase order numbers, service descriptions, or itemized charges based on the nature of your business. |

Once you’ve made these adjustments, review the document for accuracy. Ensuring all necessary fields are included and presented clearly will help avoid confusion and build trust with your clients. Customizing billing documents is a simple yet effective way to present a professional image and ensure that your communications are aligned with your brand’s identity.

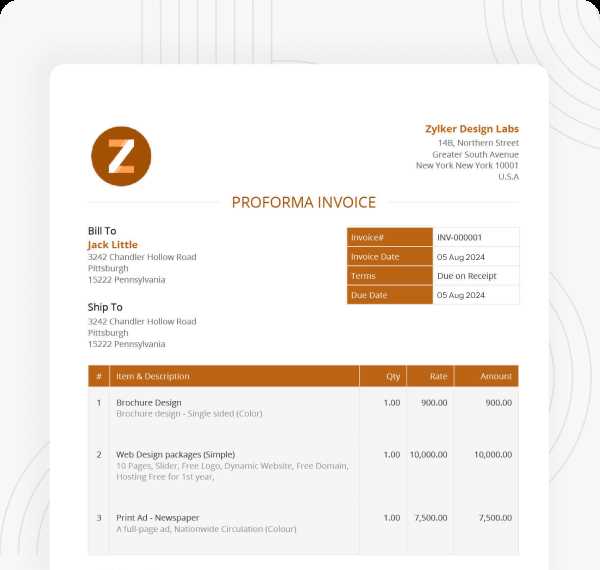

Top Features of Free Invoice Templates

When choosing a ready-made document for your billing needs, it’s essential to understand the key features that make these tools effective. A well-designed billing format should offer a range of functions that streamline your financial operations and ensure clarity for both you and your clients. Here are some of the most important attributes to look for:

- Customizability: A good billing document allows you to adjust the design and content to suit your business’s specific needs. You can add your company logo, adjust the color scheme, and modify sections to reflect your services or products.

- Itemized Lists: Clear, detailed breakdowns of charges are crucial for transparency. Pre-designed documents allow you to list items, services, or hours worked along with their respective costs, providing clarity for clients.

- Automatic Calculations: Many templates come with built-in formulas to automatically calculate totals, taxes, and discounts, saving you time and reducing the risk of errors.

- Professional Design: A polished, clean layout ensures that your billing statements look professional, enhancing your business’s reputation. A well-organized format makes it easier for clients to understand the charges and terms.

- Payment Terms Section: Having a dedicated space for payment due dates, methods, and conditions is vital. It ensures your clients are clear about when and how to make payments.

- Client and Business Information: Pre-built spaces for both your details and your client’s information make it easy to customize and update each document for individual transactions.

These features combine to create an efficient, clear, and professional billing solution. By using a ready-made format, you ensure that your financial documentation meets industry standards, while saving valuable time and effort.

Easy Ways to Generate Invoices Online

Creating billing documents online has become increasingly simple with the availability of various tools and platforms. These online solutions provide businesses with quick, efficient ways to generate professional-looking statements, all while reducing the need for manual calculations and formatting. Below are a few methods to help you get started with generating your payment requests online.

1. Use Online Invoice Generators

Online generators allow you to create customized billing documents in minutes. Most platforms provide a variety of designs and styles that can be easily personalized with your business details, client information, and payment terms. Simply fill in the required fields, and the system will automatically format the document for you.

| Step | Description |

|---|---|

| 1. Choose a Platform | Select an online tool or service that fits your needs. Popular options include invoicing software or website generators. |

| 2. Enter Business Details | Input your company name, logo, contact information, and payment terms to personalize the document. |

| 3. Add Client Information | Include your client’s name, address, and other relevant details to complete the document. |

| 4. Customize Services | Specify the services or products, their prices, and any applicable taxes or discounts. |

| 5. Generate and Download | Once all fields are filled out, generate the document and download it in your preferred format, such as PDF or Word. |

2. Use Spreadsheet Software

If you prefer more control over the design, spreadsheet software like Excel or Google Sheets can be a great option. With built-in formulas and customizable cells, you can easily create your own billing layout. Many online tutorials provide step-by-step instructions on how to design a professional document from scratch using these programs.

Whichever method you choose, generating billing documents online saves time, improves accuracy, and ensures a polished result that can be sent quickly to clients.

How to Download a Free Invoice Template

Downloading a pre-designed document for billing is a simple process that can save you valuable time and effort. These ready-made solutions are easily accessible online and can be downloaded to your device in just a few steps. Here’s a guide on how to quickly obtain a customizable document for your business needs.

- Step 1: Search for a Reliable Source

- Step 2: Select the Right Design

- Step 3: Click on the Download Button

- Step 4: Save the Document

- Step 5: Customize and Use

Begin by finding a trustworthy website that offers free downloadable billing formats. Many websites specialize in providing various document designs, so ensure you choose a reputable source with good user reviews.

Browse through the available options and choose the design that best suits your business. Consider the style, layout, and features of the document, ensuring it includes all the elements you need, such as payment terms, client details, and itemized lists.

Once you’ve found the ideal format, look for the download button or link. Most platforms will offer multiple file types, such as PDF, Word, or Excel, allowing you to choose the format that is most compatible with your system.

After clicking the download link, the document will be saved to your device. Ensure you save it in an easily accessible location for future use, and remember to name the file appropriately for easy identification.

After downloading the document, open it in your chosen software and begin customizing it with your company details, client information, and transaction specifics. This will allow you to quickly generate billing requests for your clients.

Downloading pre-made documents is a quick, efficient way to ensure that your financial communications are professional and organized. With just a few simple steps, you can create polished payment requests without needing advanced software or design skills.

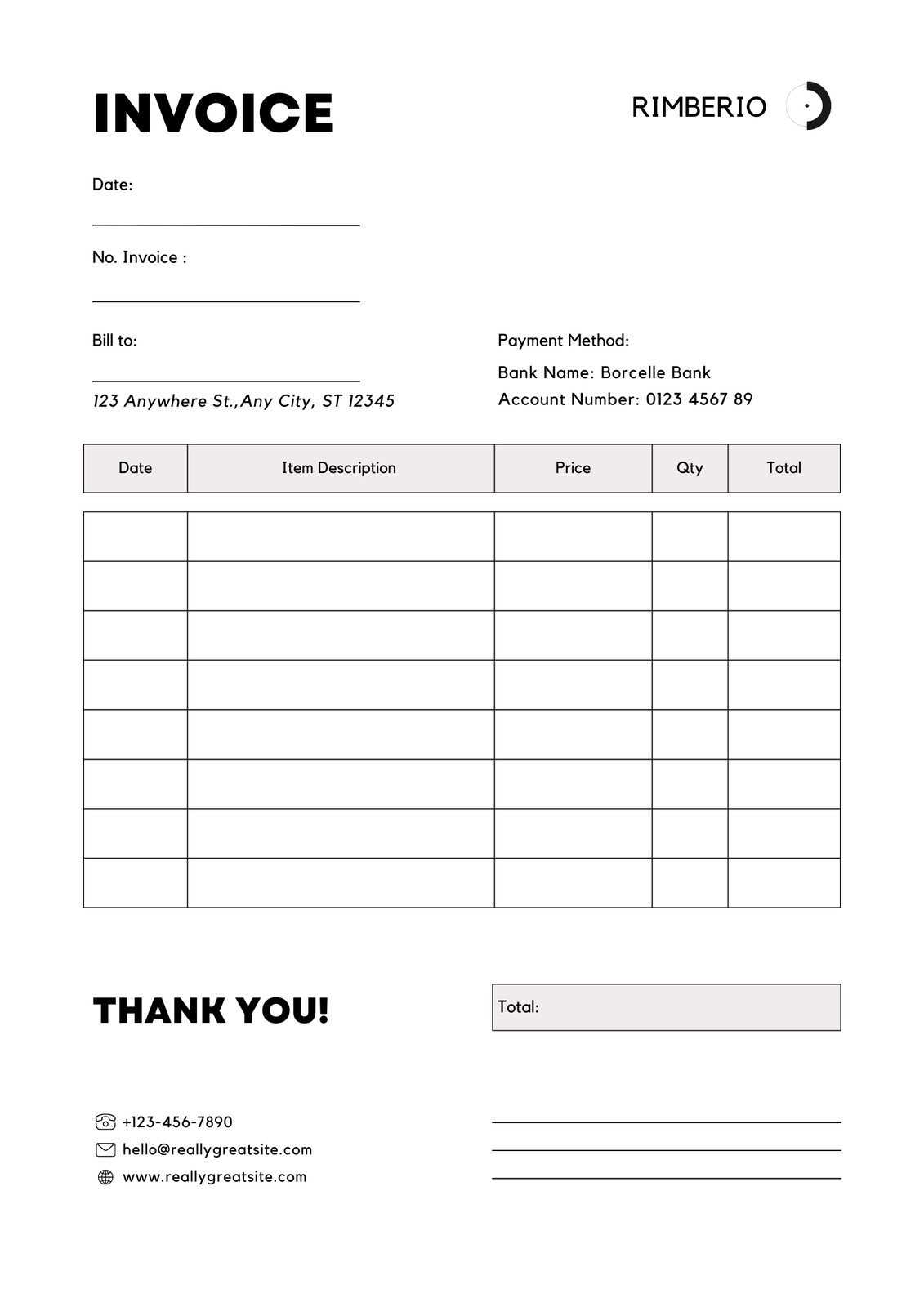

Choosing the Best Template for Your Business

Selecting the right pre-designed document for your billing needs is essential for maintaining professionalism and organization in your financial operations. The ideal format should align with your business style, meet the specific requirements of your industry, and provide a clear structure that enhances client communication. Below are several factors to consider when choosing the best format for your business.

1. Consider Your Business Type

The first step in selecting the right format is understanding your business needs. Different industries have varying requirements when it comes to billing. For example:

- Service-Based Businesses: Choose a format that includes sections for hourly rates, service descriptions, and time tracking.

- Product-Based Businesses: Look for a document that offers itemized lists with unit prices, quantities, and total costs.

- Freelancers and Consultants: Opt for a simple, clean design that clearly states the scope of work and payment terms.

2. Look for Customizability and Flexibility

Choose a format that allows you to easily customize the layout, colors, and fonts to match your branding. You should also ensure it has the ability to adjust key fields such as:

- Business Information: The document should allow you to input your company name, address, and contact details.

- Client Details: Ensure space for entering client names, billing addresses, and payment terms.

- Payment Details: Check if the format lets you customize fields for due dates, payment methods, and taxes.

By selecting a customizable design, you can tailor your billing requests to fit your needs and present a consistent, professional image to clients.

3. Choose a Format with Built-In Calculations

If you regularly issue statements that involve multiple charges or taxes, selecting a format with built-in calculations can save time and reduce errors. Look for one that can:

- Automatically calculate totals, taxes, and discounts

- Provide real-time updates when information is added or adjusted

- Offer a breakdown of calculations for transparency

These features will streamline your billing process and ensure accuracy, especially when dealing with complex transactions.

Ultimately, the best format for your business should balance functionality with professionalism. It should be easy to use, customizable, and aligned with your specific needs, helping you save time while creating clear, detailed billing documents.

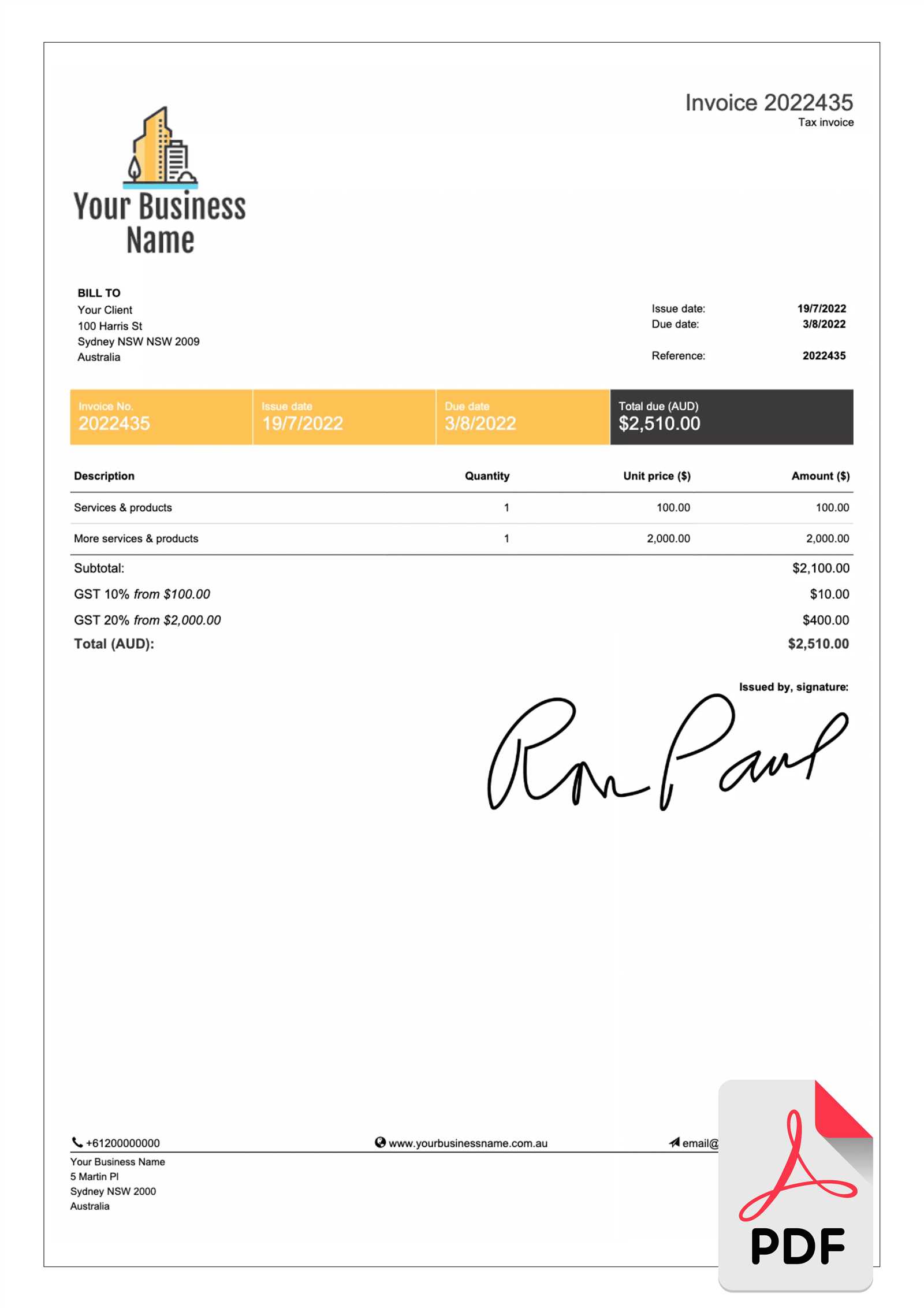

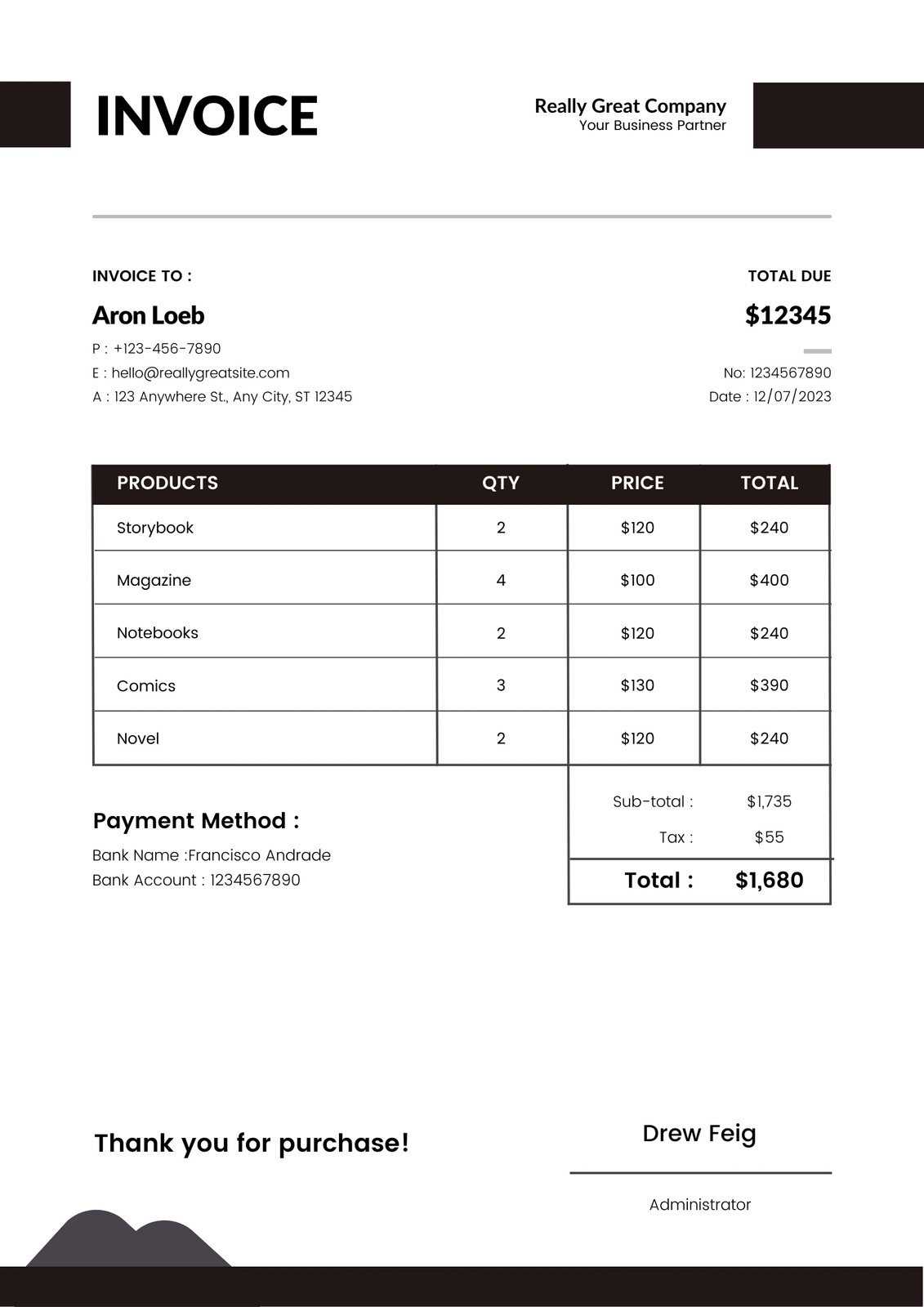

Key Elements of an Effective Invoice

Creating a well-structured payment request is crucial for maintaining professionalism and ensuring smooth transactions between you and your clients. An effective document should clearly present all necessary information, making it easy for clients to understand the charges and take appropriate action. Below are the essential elements that should be included in every billing document to ensure clarity and accuracy.

- Business Information: At the top of the document, include your company’s name, address, phone number, and email address. This ensures that clients can easily contact you if they have any questions or concerns.

- Client Information: Clearly list the client’s name, company (if applicable), address, and contact details. This helps avoid any confusion regarding which client the payment request is for.

- Unique Identification Number: Each document should have a unique reference number for tracking purposes. This helps both you and your client stay organized and makes it easier to find specific records if needed.

- Itemized List of Services or Products: Provide a detailed breakdown of the goods or services being billed. This should include descriptions, quantities, unit prices, and any applicable taxes or discounts. Transparency in this section builds trust with clients.

- Payment Terms: Clearly state the terms of payment, including the due date, acceptable payment methods, and any late fees or early payment discounts. This section ensures that there are no misunderstandings regarding when and how payment should be made.

- Total Amount Due: After all the charges are listed, summarize the total amount due, ensuring it includes taxes, discounts, or any additional fees. This makes it easy for the client to see the full payment required.

- Notes or Additional Information: You may want to include a section for any special instructions, notes, or references to agreements or contracts. This can be useful for providing context or highlighting any important details not covered elsewhere.

By including these key elements, you ensure that your payment requests are clear, professional, and easy for your clients to understand. This not only helps facilitate faster payments but also reduces the chance of errors or disputes, ensuring smoother business transactions overall.

Free Templates vs Paid Invoice Software

When deciding how to manage your billing process, you may face the choice between using pre-designed documents or investing in specialized software. Both options have their benefits, but the right choice depends on the complexity of your business needs and how much time and effort you’re willing to invest. Below, we’ll compare the key differences between using ready-made documents and paid invoicing software.

| Feature | Pre-designed Documents | Paid Invoicing Software |

|---|---|---|

| Cost | Free or low-cost | Requires a subscription or one-time payment |

| Ease of Use | Simple and easy to use, no technical skills required | May have a steeper learning curve, but offers advanced features |

| Customization | Basic customization, such as adding logos and text | Highly customizable with advanced features like recurring billing and automated reminders |

| Automated Features | No automation; manual entry required for each document | Automated calculations, reminders, and recurring billing options |

| Time Savings | Quick to generate, but manual input required for each transaction | Time-saving automation; invoices are generated and sent with minimal input |

| Reporting | No built-in reporting or tracking features | Offers reporting features like income tracking, tax summaries, and payment history |

While pre-designed documents are an excellent solution for small businesses or freelancers with simple billing needs, paid software offers a comprehensive suite of tools that can save time and reduce errors, especially for larger operations. If you frequently issue invoices or need additional features like tracking, automation, and recurring billing, investing in invoicing software may be worthwhile. However, if your needs are minimal, ready-made solutions can be just as effective and cost-efficient.

Free Templates vs Paid Invoice Software

When deciding how to manage your billing process, you may face the choice between using pre-designed documents or investing in specialized software. Both options have their benefits, but the right choice depends on the complexity of your business needs and how much time and effort you’re willing to invest. Below, we’ll compare the key differences between using ready-made documents and paid invoicing software.

| Feature | Pre-designed Documents | Paid Invoicing Software |

|---|---|---|

| Cost | Free or low-cost | Requires a subscription or one-time payment |

| Ease of Use | Simple and easy to use, no technical skills required | May have a steeper learning curve, but offers advanced features |

| Customization | Basic customization, such as adding logos and text | Highly customizable with advanced features like recurring billing and automated reminders |

| Automated Features | No automation; manual entry required for each document | Automated calculations, reminders, and recurring billing options |

| Time Savings | Quick to generate, but manual input required for each transaction | Time-saving automation; invoices are generated and sent with minimal input |

| Reporting | No built-in reporting or tracking features | Offers reporting features like income tracking, tax summaries, and payment history |

While pre-designed documents are an excellent solution for small businesses or freelancers with simple billing needs, paid software offers a comprehensive suite of tools that can save time and reduce errors, especially for larger operations. If you frequently issue invoices or need additional features like tracking, automation, and recurring billing, investing in invoicing software may be worthwhile. However, if your needs are minimal, ready-made solutions can be just as effective and cost-efficient.

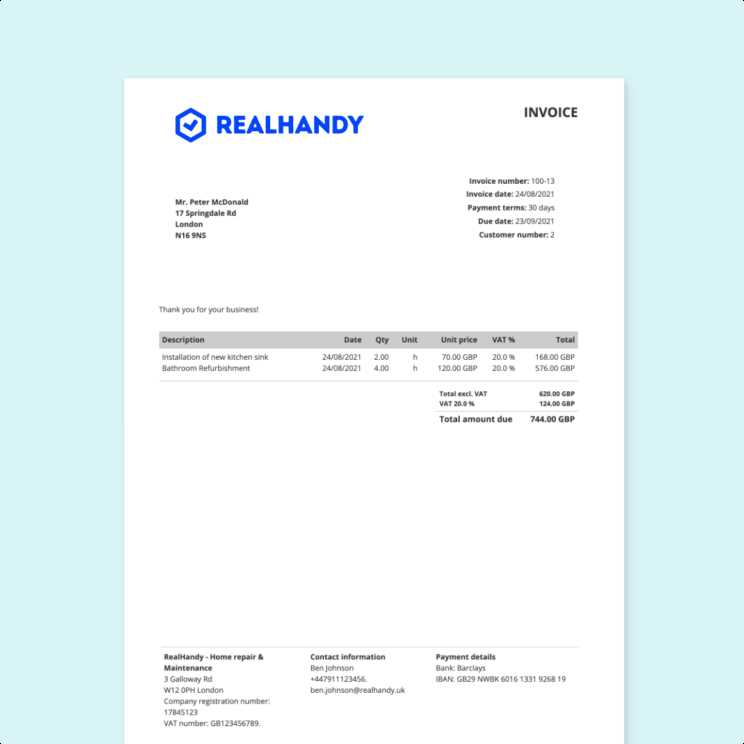

How to Create a Professional Invoice

Creating a polished and professional payment request is essential for any business. A well-crafted document not only ensures that your clients understand the charges but also enhances your company’s credibility and helps to streamline the payment process. Below are the key steps to take when preparing a professional billing document.

1. Start with a Clean Layout

The first step in crafting a professional document is ensuring a clean, organized layout. Your document should be easy to read and visually appealing. Begin by clearly separating key sections such as your business information, client details, itemized charges, and payment terms. Consistent font usage, adequate spacing, and clear headings will help guide the reader’s attention to important areas.

2. Include Essential Information

For your billing document to be effective, it must contain all the necessary details. Make sure you include the following:

- Your Business Details: Company name, logo, address, contact number, and email address should be prominently displayed at the top.

- Client Information: Include the client’s name, business name (if applicable), address, and contact details.

- Unique Reference Number: Assign a unique number to each document for easy tracking and referencing.

- Itemized List of Products or Services: Provide a detailed breakdown of what the client is being charged for, including quantities, rates, and any applicable taxes or discounts.

- Payment Terms: Clearly outline payment due dates, acceptable payment methods, and any late fees or discounts for early payments.

- Total Amount Due: Display the total amount clearly, including a breakdown of costs, taxes, and discounts.

Incorporating these elements ensures that your payment requests are comprehensive, reducing the chance of confusion or disputes later on.

Once you’ve completed your document, double-check for any errors or missing information. Ensuring accuracy and professionalism will not only help facilitate timely payments but will also reinforce your business’s reliability in the eyes of your clients.

Top Mistakes to Avoid with Invoices

When preparing billing documents, small errors can lead to big problems. From delays in payment to client misunderstandings, these mistakes can disrupt cash flow and damage professional relationships. To ensure that your payment requests are clear and efficient, it’s important to avoid some common pitfalls. Below are the most frequent errors to watch out for and how to prevent them.

1. Missing or Incorrect Client Information

Accurate client details are essential for ensuring that your document reaches the right person and that the payment is properly processed. Common mistakes include:

- Incorrect or outdated client contact information

- Missing client address or email

- Failure to include the client’s company name or business ID (if applicable)

Tip: Always double-check your client’s details before sending out the request. Keeping a client contact list updated can save time and prevent errors.

2. Failing to Include Clear Payment Terms

One of the most common sources of confusion is not clearly stating the payment terms. Clients should never be left guessing about:

- When the payment is due

- What payment methods are accepted

- Whether there are any late fees or early payment discounts

Tip: Be explicit about your payment terms and ensure they are prominently displayed on your document. This will help avoid delays and misunderstandings.

3. Lack of Detailed Descriptions

Vague or insufficient descriptions of the products or services you provided can lead to confusion or disputes. Clients should understand exactly what they are paying for. Common mistakes include:

- Only listing a product or service without details on quantity, rate, or description

- Forgetting to include tax calculations or applicable discounts

Tip: Provide a clear, itemized list of what was delivered. Include all relevant details such as quantities, prices, taxes, and discounts for transparency.

4. Incorrect Calculations

Mathematical errors can cause unnecessary delays and may lead to distrust. Make sure the total amount due is calculated correctly, including taxes, discounts, and additional fees. Errors like these can lead to clients questioning the accuracy of your charges.

Tip: Double-check all calculations before sending the document. If possible, use automatic calculation features to ensure accuracy.

5. Failing to Use a Unique Reference Number

Not assigning a unique reference number to each document can make it difficult to track payments and organize records. This can cause confusion for both you a

How Digital Invoices Improve Accuracy

One of the main advantages of using electronic billing systems is the increased accuracy they provide. Traditional methods of creating payment requests are prone to human error, whether it’s due to miscalculations, incorrect data entry, or formatting issues. By switching to automated systems, businesses can significantly reduce the risk of mistakes, ensuring that clients receive clear, error-free statements. Below are the key ways in which electronic billing solutions enhance accuracy.

1. Automated Calculations

With traditional paper-based systems, manual calculations can lead to mistakes, especially when dealing with multiple items, taxes, or discounts. Using automated software or electronic forms ensures that:

- Subtotal calculations are done instantly, reducing the risk of adding or subtracting incorrectly.

- Tax rates are automatically applied based on predefined settings, ensuring accuracy in tax amounts.

- Discounts and special offers are applied correctly, avoiding missed or incorrect deductions.

Automating calculations eliminates the possibility of human error and guarantees that your totals are always correct.

2. Reduced Manual Data Entry

Manual data entry is time-consuming and error-prone. When using electronic forms, much of the information can be auto-filled based on pre-existing client records. This helps ensure that:

- Client details (such as name, address, and contact information) are consistently entered correctly.

- Product or service descriptions are consistent and accurate, avoiding misspellings or incorrect entries.

By minimizing the need for repetitive data entry, you reduce the risk of input errors, making your billing documents more reliable.

3. Integration with Other Business Systems

Many electronic billing solutions integrate with accounting software or customer relationship management (CRM) tools. This integration ensures that:

- All relevant data is synchronized, including customer information, pricing, and previous transactions.

- Financial records are up-to-date and accurate across all systems, reducing the risk of discrepancies.

Integration helps streamline the billing process, ensuring that the data you are working with is consistent and accurate throughout your business systems.

By embracing automated and integrated solutions, businesses can significantly improve the accuracy of their billing process, ensuring timely and precise transactions while also reducing administrative errors and the potential for disputes with clients.

How to Manage Multiple Invoices Easily

Managing a high volume of payment requests can quickly become overwhelming, especially when you’re juggling various clients, due dates, and amounts. However, by adopting the right strategies and tools, you can streamline the process and keep track of all your transactions with ease. Here are some practical tips for efficiently managing multiple payment requests.

1. Use Automated Systems

One of the most effective ways to handle multiple transactions is by using automated systems that can generate, track, and send documents without manual intervention. Automated solutions help by:

- Reducing manual work: Automatically create and send out requests based on predefined templates and client information.

- Tracking payments: Monitor which payments have been received, which are pending, and which are overdue.

- Sending reminders: Set up automated reminders to notify clients of upcoming or overdue payments.

Automation not only saves time but also minimizes the risk of forgetting a payment request or misplacing an important document.

2. Organize Your Files and Records

Having a structured and easily accessible filing system is essential when dealing with multiple payment requests. Whether you choose a digital or physical method, consider the following tips:

- Use folders: Group your records by client, project, or due date to keep everything organized and easy to locate.

- Label your documents: Give each request a unique reference number and ensure it is clearly labeled with the client’s name and payment date.

- Digital tools: Use cloud storage or accounting software to store and manage all your records in one place, making it easy to retrieve any document when needed.

Organized records help you stay on top of payments and avoid confusion when dealing with multiple transactions.

3. Set Up Clear Payment Terms

When managing several clients, it’s crucial to ensure that your payment terms are clear and consistent. This helps prevent misunderstandings and ensures that clients know exactly when and how to pay. Consider the following:

- Standardize due dates: Set a fixed due date for all payment requests or create a system to easily track varying due dates for each client.

- Payment methods: Specify which payment methods you accept and ensure clients are aware of the options available.

- Late fees: Outline any penalties for overdue payments, ensuring clients are aware of the consequences of missing deadlines.

Clearly communicated terms will prevent confusion and make it easier for both you and your clients to adhere to agreed-upon

Tracking Payments with Invoice Templates

Keeping track of payments is essential for maintaining healthy cash flow and avoiding payment disputes. Using well-structured billing documents not only ensures accuracy in your requests but also provides an organized way to monitor when payments are made, overdue, or still pending. Here are several effective ways to track payments using structured billing forms.

1. Assign Unique Reference Numbers

One of the simplest ways to track payments is by assigning a unique reference number to each document. This number acts as an identifier for both you and your clients, ensuring that each transaction is easily traceable. By including:

- A unique number for every transaction

- A sequential numbering system to avoid duplication

- Clear references in communication with clients

Using reference numbers makes it easier to monitor payment status and retrieve specific transactions when needed.

2. Set Payment Due Dates

Clearly stating a payment due date on each document helps keep both parties accountable. This date should be prominently displayed and easily accessible. Benefits include:

- Reducing confusion about payment timelines

- Providing a clear benchmark for follow-ups

- Allowing clients to plan their payments accordingly

Setting a due date ensures that both you and your client have a shared understanding of when payment should be made.

3. Use Payment Status Indicators

Including a payment status section in your forms allows you to quickly see which transactions have been completed, which are pending, and which are overdue. Some useful status labels are:

- Paid: The payment has been received and processed.

- Pending: The payment is yet to be made, but the due date hasn’t passed.

- Overdue: The payment is past the due date and requires attention.

Having these indicators helps you easily track the payment journey and makes it easier to follow up with clients when necessary.

4. Record Partial Payments

For clients who make partial payments, it’s important to note the amount received and update the balance due. This can be done by:

- Tracking the amount paid and deducting it from the total

- Indicating the remaining balance clearly on future documents

- Noting the dates of each partial payment

Record

Best Practices for Using Digital Templates

Using pre-designed forms for billing or other business processes can significantly improve efficiency and reduce the likelihood of errors. However, to maximize their effectiveness, it’s important to follow a set of best practices. These practices ensure that your forms are clear, accurate, and aligned with your business needs. Below are key tips to get the most out of using these ready-made solutions.

1. Customize for Your Branding

One of the key benefits of using pre-made forms is the ability to customize them to reflect your business’s branding. This includes incorporating your company’s logo, colors, and contact information. Customization can enhance professionalism and make your communication stand out. Here’s how to do it:

- Ensure your logo is placed prominently at the top of the form.

- Use your company’s color scheme to make the document visually cohesive with other business materials.

- Include your full contact information, including phone number, email, and physical address, to make it easy for clients to reach you.

Personalizing your forms not only reinforces your brand but also makes them more recognizable to your clients.

2. Maintain Consistency Across Documents

For smooth operations, it’s important to keep your documents consistent. This applies to both formatting and content. Consistency helps prevent confusion and makes it easier for clients to understand the details of each transaction. Some tips for maintaining consistency include:

- Use the same layout for every form, ensuring that all essential information is easy to find.

- Standardize the language used for terms, payment details, and descriptions.

- Maintain the same numbering or reference system across all documents for easy tracking.

Consistency builds trust and professionalism, and it ensures that clients know exactly what to expect each time they receive a document from you.

3. Keep Your Forms Updated

It’s essential to regularly review and update your forms to ensure they stay relevant and accurate. Outdated forms can lead to confusion and even legal issues if they include inaccurate or incomplete information. Make sure to:

- Check your contact details and company information to ensure they are up to date.

- Review payment terms and update them as necessary to reflect changes in pricing, policies, or regulations.

- Periodically assess the design of your forms to make sure they remain modern and user-friendly.

Updating your documents ensures that all information is accurate and that clients alw