Free Contractor Invoice Template in Word Format for Easy Billing

Managing finances and keeping track of payments is an essential part of any business. Having an efficient method to request compensation for services rendered can save time and reduce errors. When done properly, this process not only ensures timely payments but also reflects professionalism and attention to detail. For those offering freelance or project-based services, using a well-structured document can make all the difference in maintaining a smooth workflow.

Automated billing solutions are a great way to eliminate the need for manual calculations and formatting. With customizable files, you can easily adjust terms, rates, and other details according to the specifics of each project. By adopting a simple yet effective approach, you can present clear and precise requests for payment that leave no room for confusion.

Creating a professional document from scratch doesn’t have to be a complicated task. With the right resources, you can create a polished, easy-to-understand record that meets legal standards and simplifies communication with clients. Whether you’re a seasoned professional or just starting out, mastering the art of financial documentation is a crucial step toward business success.

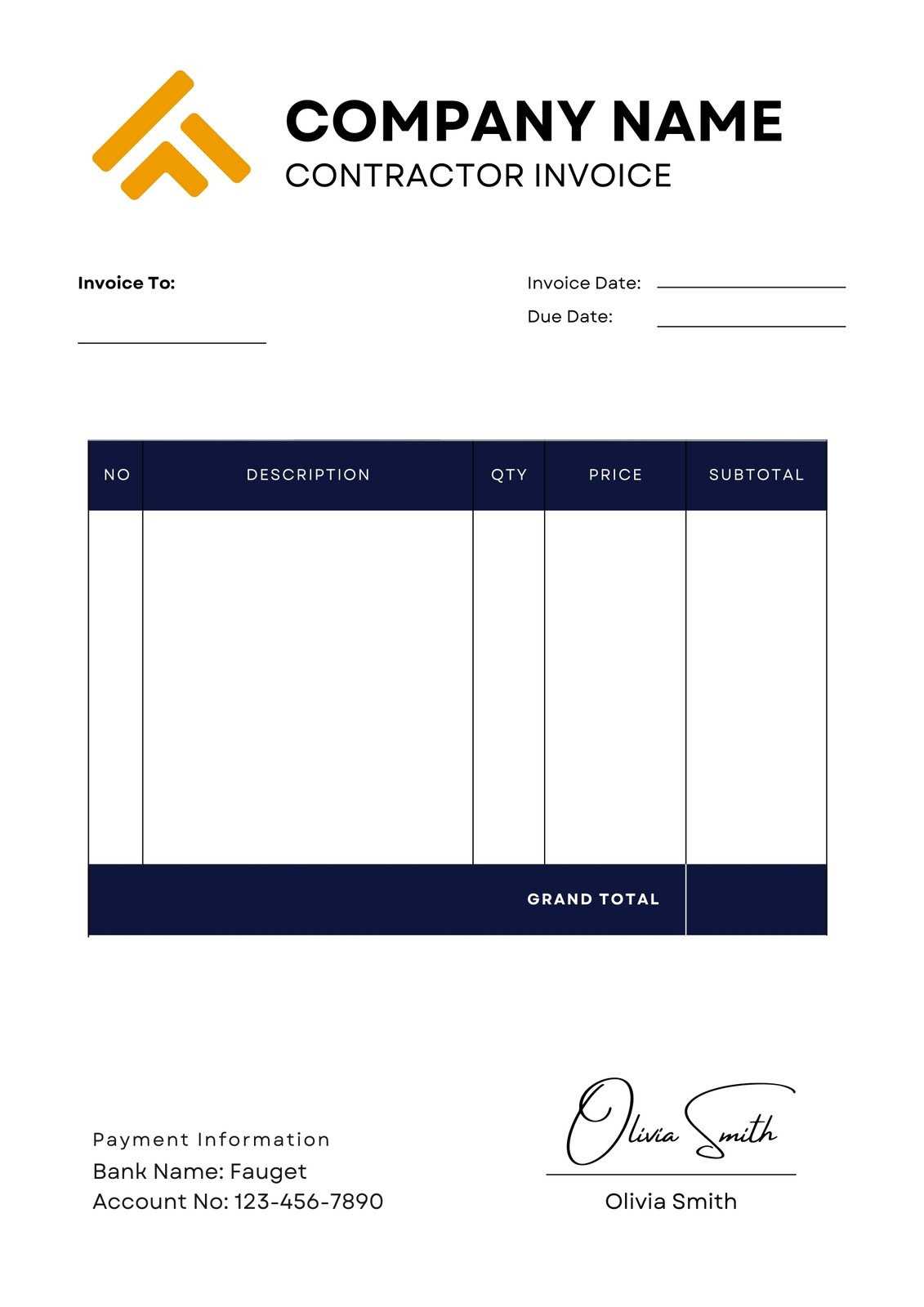

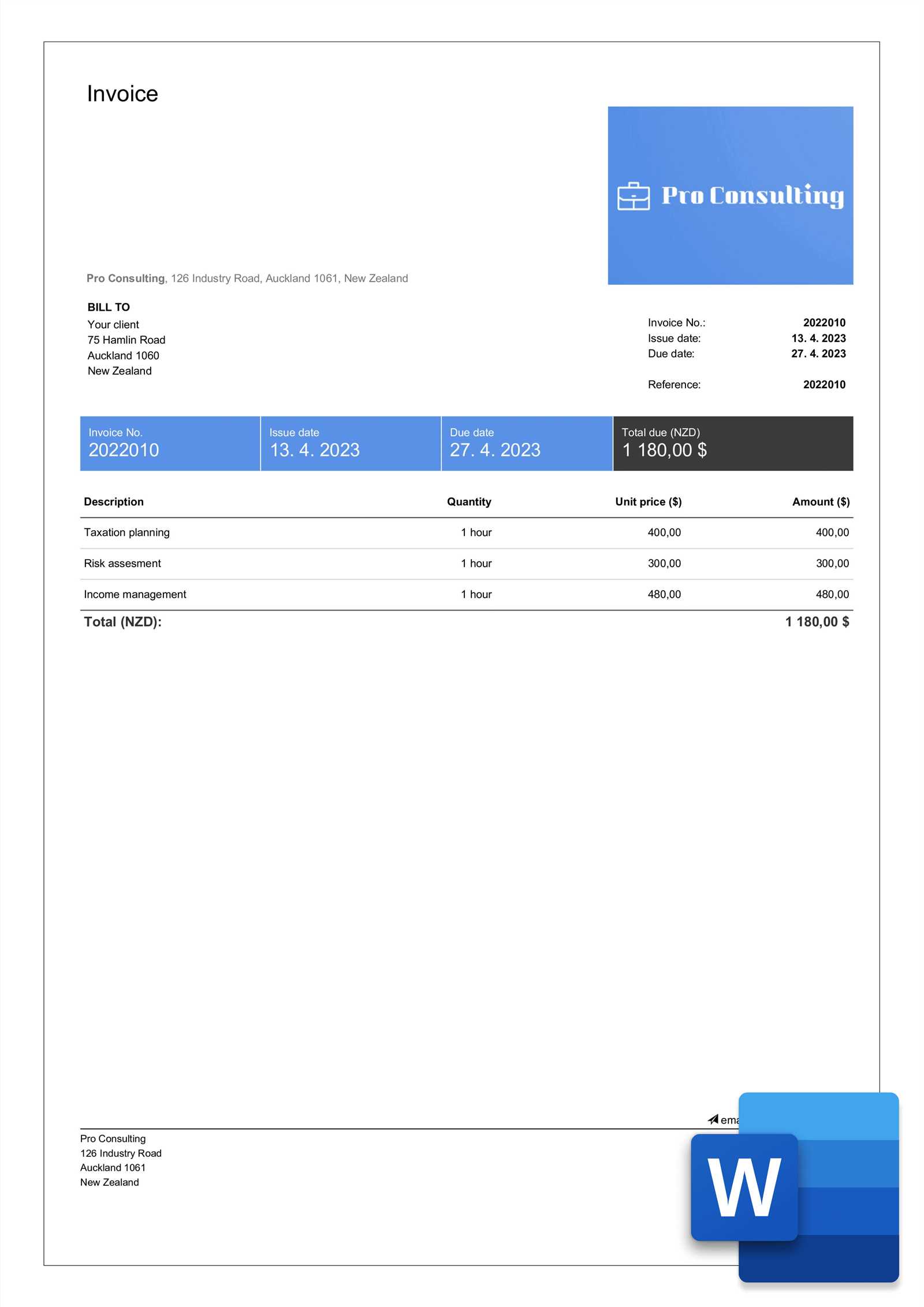

Free Contractor Invoice Template in Word

When it comes to handling payments for services provided, having a professional and organized document is key. A well-structured payment request can streamline communication with clients, minimize misunderstandings, and ensure that all necessary details are clearly presented. Using a pre-designed, customizable file allows you to focus on the work itself rather than worrying about formatting or calculations.

One of the simplest ways to create an effective billing record is to use an editable document that can be easily personalized to suit the specific needs of each transaction. With such a format, you can quickly adjust payment terms, itemize services, and include necessary legal information in a manner that is both professional and efficient.

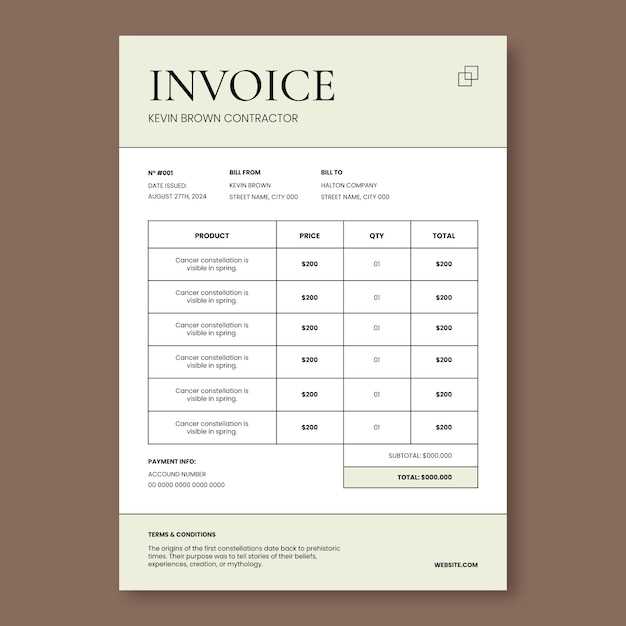

| Description of Services | Rate | Quantity | Total |

|---|---|---|---|

| Consultation | $50/hour | 3 | $150 |

| Project Management | $75/hour | 5 | $375 |

| Final Report | $100 | 1 | $100 |

| Total | $625 |

This straightforward method makes it easy to maintain clarity, track the scope of work, and ensure all parties are on the same page regarding payment expectations. With the right file, you can create a personalized request in no time, leaving a lasting, professional impression.

Benefits of Using Invoice Templates

Using a pre-designed document for requesting payments can significantly improve the efficiency and professionalism of your financial operations. Rather than starting from scratch each time, an editable format ensures consistency, accuracy, and clarity in every transaction. By incorporating essential elements in a clear and structured manner, you avoid the risk of missing key details, reducing the chances of errors and misunderstandings.

Time-saving: The primary advantage of adopting such a format is the time saved. Instead of manually formatting each bill, you can quickly input the relevant details and generate a professional document. This allows you to focus on other aspects of your business while ensuring that clients receive their payment requests promptly.

Consistency and professionalism: When you use a standard, polished document for each transaction, it helps to maintain a consistent and professional image. Clients will appreciate the clear and organized presentation, and it can reinforce trust in your business practices. This is especially important when working with multiple clients or handling large volumes of work.

Customization: Another key benefit is the ability to customize the document according to your specific needs. You can easily adjust payment terms, itemize services, add taxes, or include specific notes related to a particular project. This flexibility makes it suitable for a wide range of industries and client types.

Legal compliance: A properly structured document ensures that you are adhering to basic legal requirements, such as listing your business details, tax information, and payment terms. This helps protect both parties and can prevent potential disputes.

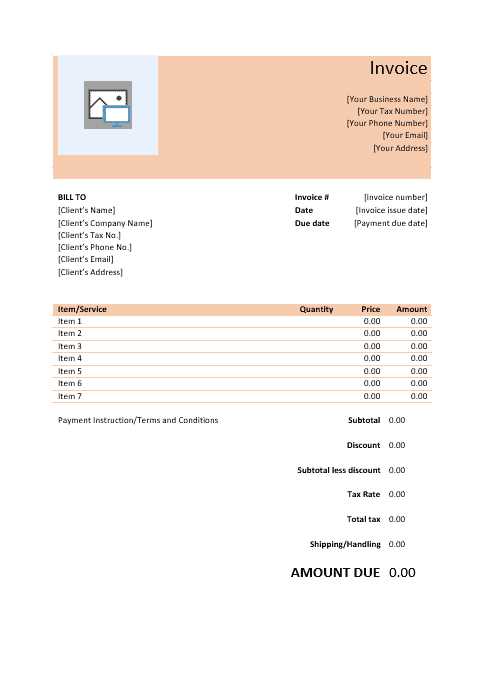

How to Customize Your Invoice

Personalizing your payment request document allows you to tailor it to your business needs, ensuring that all relevant details are included and clearly presented. By adjusting the layout, terms, and other elements, you can create a polished, professional record that matches your brand and provides clients with the necessary information. Customizing your billing record is a straightforward process that can significantly improve both clarity and professionalism.

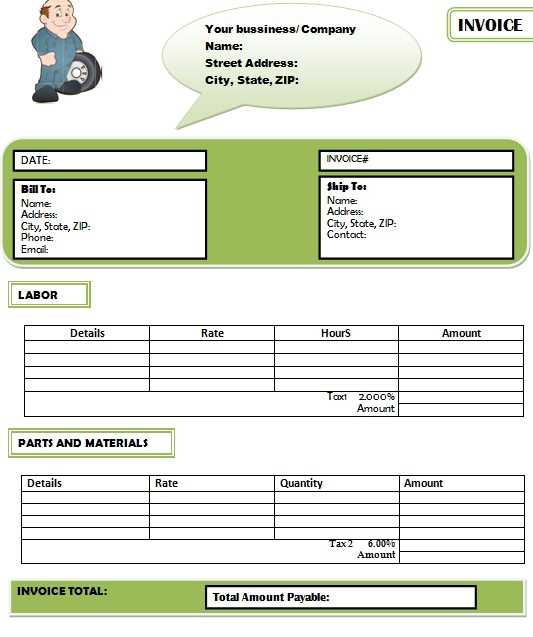

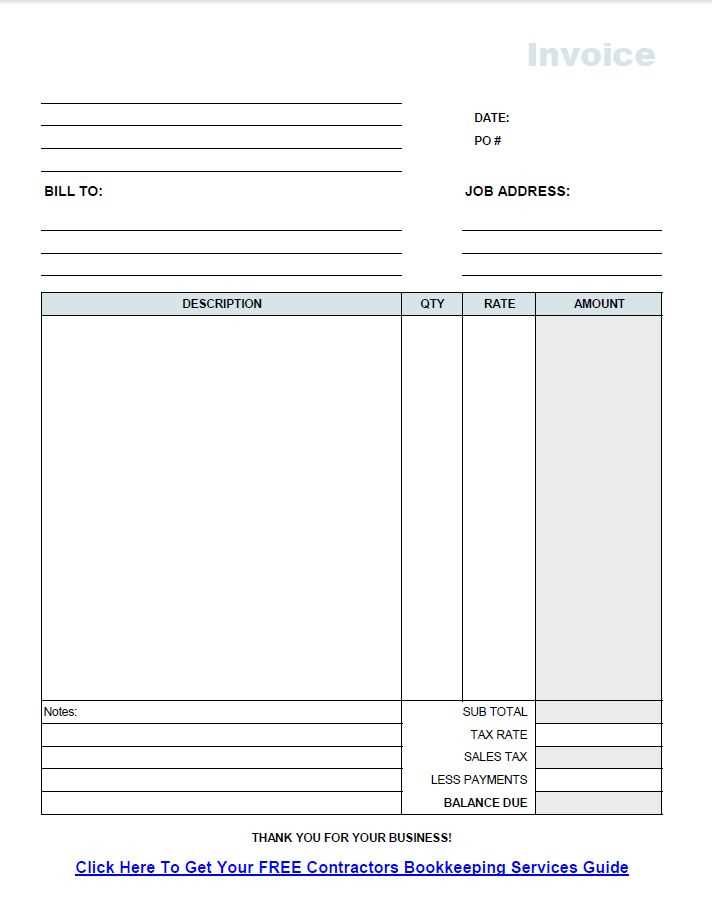

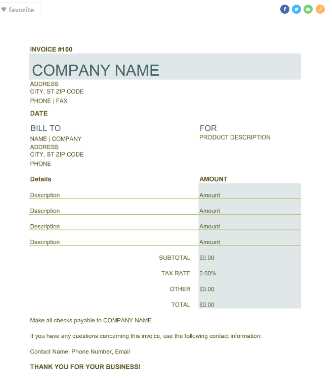

Key Sections to Modify

- Header Information: Include your business name, logo, and contact details to make your document look official and professional.

- Client Details: Personalize the document by adding your client’s name, address, and contact information.

- Itemized Services: Clearly list the services rendered, including quantities, rates, and totals to ensure transparency.

- Payment Terms: Specify payment methods, due dates, and any applicable late fees or discounts.

- Tax Information: Include any relevant taxes or fees that need to be applied to the total amount.

Formatting and Design Tips

- Use Consistent Fonts: Choose easy-to-read fonts and ensure consistency throughout the document.

- Align Your Text: Proper alignment and spacing make the document easier to follow and more visually appealing.

- Highlight Important Details: Use bold or italics to emphasize key information such as total amounts or deadlines.

- Stay Organized: Use tables or bullet points to clearly separate sections, making it easier for clients to understand.

By customizing each section according to your specific needs, you create a document that not only reflects your business but also provides clients with a clear and concise summary of the services provided and payment expectations. Personalization adds value and enhances the overall experience for both parties involved.

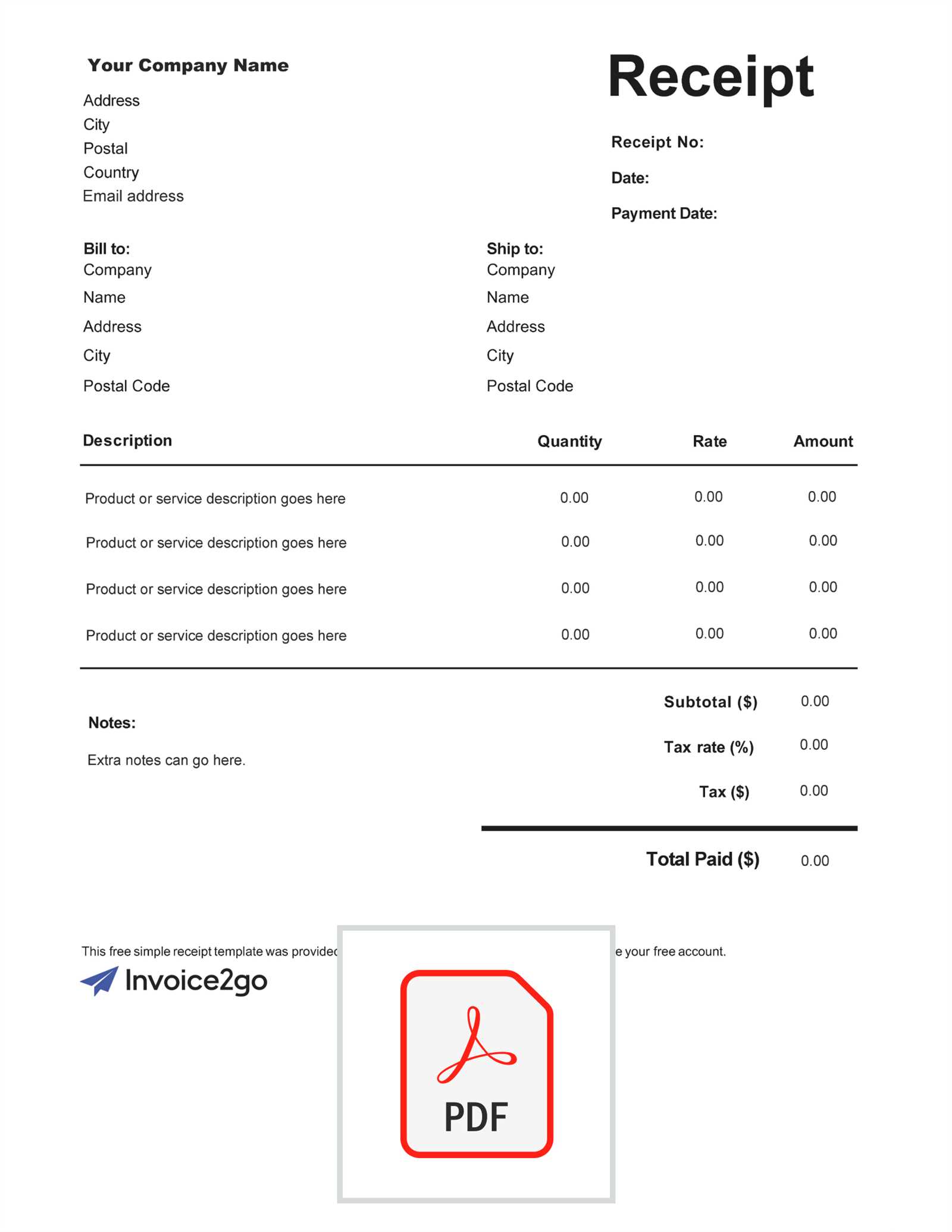

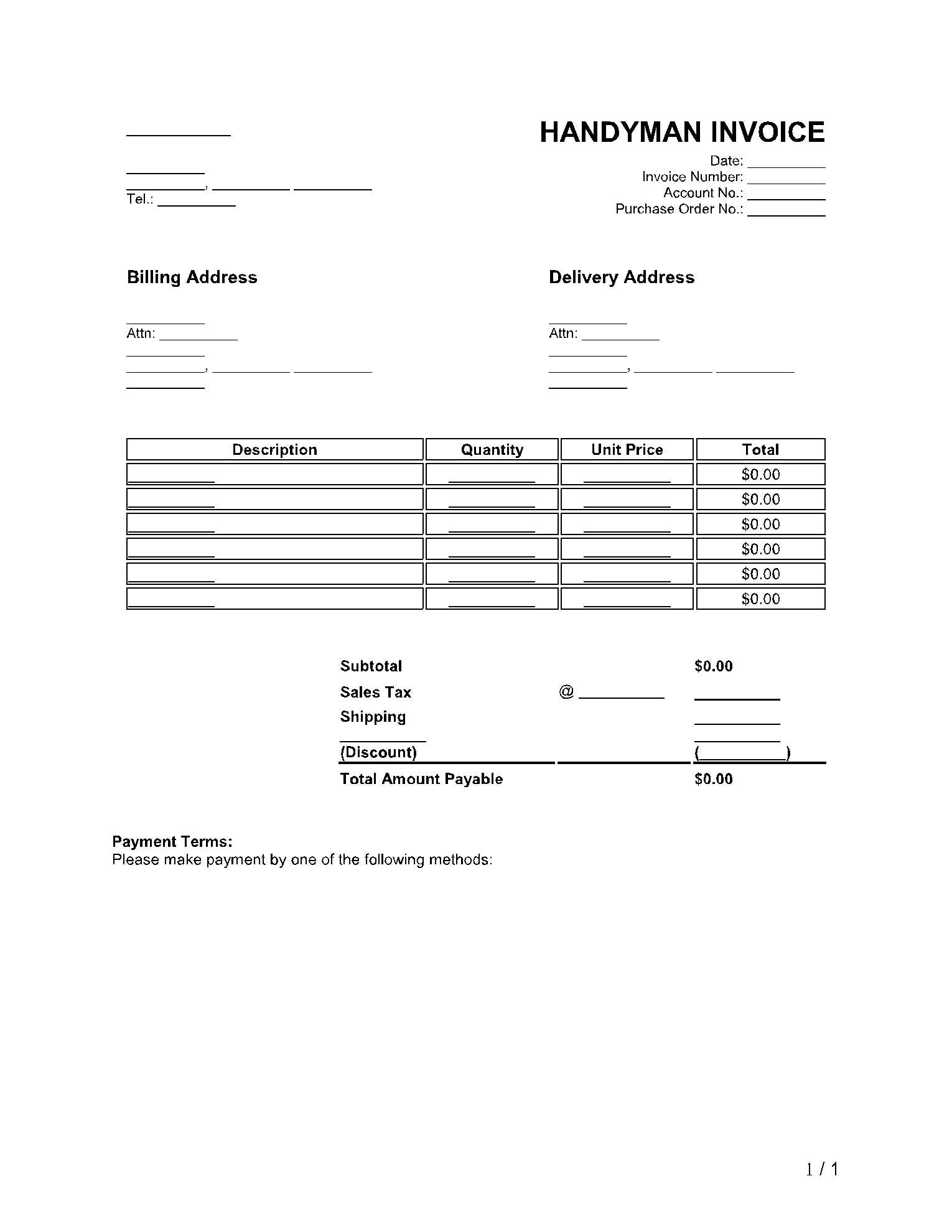

Steps to Download a Free Template

Downloading a pre-designed document for requesting payments is a quick and easy process that can save time and effort. Whether you’re a small business owner or a freelancer, having access to a ready-made structure allows you to create professional records without starting from scratch. The following steps will guide you through the process of obtaining and using a customizable file that suits your needs.

Once you find a reliable source for downloading your file, follow these simple steps:

- Choose a Trusted Website: Look for reputable websites that offer editable documents. Make sure they provide secure download options and free or affordable access.

- Select the Right Format: Many sites will offer different formats. Make sure to choose one that works well with your preferred software, such as a .docx file or similar editable format.

- Download the File: Click on the download link to save the document to your computer or device. Ensure that the download completes fully before proceeding.

- Open and Edit: Once downloaded, open the file with your preferred word processing software. Begin customizing the fields with your details, payment terms, and any other necessary information.

- Save and Use: After making your adjustments, save the file with a new name and use it for all future transactions. You can also keep a copy as a master document for easy access.

This simple process allows you to have a fully functional, professional-looking record that you can quickly update and send to clients without the hassle of creating a new document each time.

| Step | Action |

|---|---|

| 1 | Choose a trusted website for downloading. |

| 2 | Select the preferred file format. |

| 3 | Download and save the document. |

| 4 | Open and customize

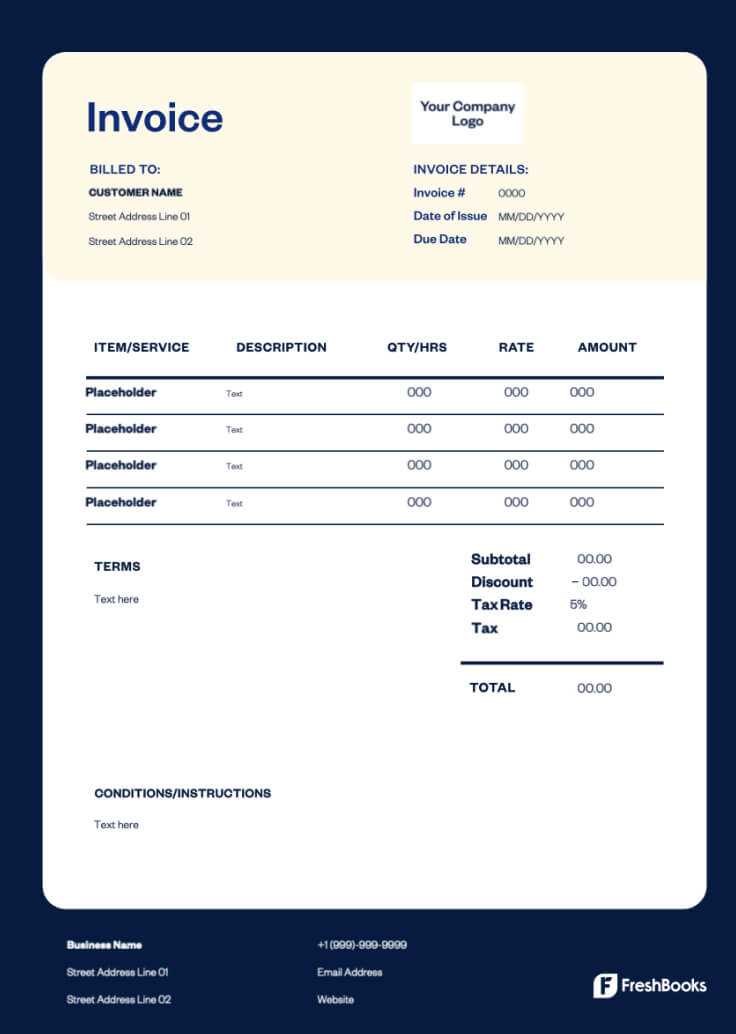

Why Choose Word for Invoices

When it comes to creating professional payment requests, the choice of software plays a crucial role in both ease of use and flexibility. Many people opt for text processing programs due to their wide range of features that allow for customization, accessibility, and compatibility with other formats. These programs are ideal for crafting clear, formal documents that can be tailored to fit various business needs. Ease of CustomizationFlexibility is one of the main reasons to choose a text editor for preparing your payment requests. You can easily modify layouts, fonts, colors, and alignments to match your business branding or personal preferences. Whether you need to add a logo, adjust spacing, or create a more detailed breakdown of services, the software offers numerous options to fit your specific requirements. Universal AccessibilityConvenience is another benefit that comes with using a popular text editing tool. Most users are already familiar with the interface and basic functions, which minimizes the learning curve. Documents created on these platforms are easily shared, saved, and converted into various formats, making them suitable for email, print, or even cloud storage access. Additionally, these programs are compatible with a wide variety of devices and operating systems, ensuring that your documents can be opened and edited on almost any platform without issues. This versatility is particularly helpful for small business owners or freelancers who need to create and send records quickly and efficiently from different devices. Key Elements of a Payment Request DocumentWhen creating a formal request for payment, it’s essential to ensure that all the necessary components are included for clarity, transparency, and professionalism. A well-structured record should contain specific details that allow both parties to quickly understand the services provided, the amount due, and any important terms. These elements not only help in accurate financial tracking but also serve as an official agreement between you and your client. Essential InformationThe first thing to include in your document is your business identity, which should include your company name, address, contact details, and any relevant registration information. This gives your request a professional appearance and ensures that your client knows exactly who the document is from. Client Details are just as important. Be sure to include the client’s full name, address, and contact information. This helps avoid confusion and ensures that the correct individual or company is billed for the services provided. Detailed Breakdown of ServicesNext, a clear description of services is critical. List each service provided, the associated rate or cost, and the amount of time spent or quantity delivered. This gives transparency to the pricing structure and helps clients understand exactly what they are being charged for. You should also include any payment terms, such as due dates and accepted payment methods, to avoid misunderstandings regarding when the payment should be made and how it should be processed. Finally, make sure to include a total amount due and clearly outline any taxes or additional fees that apply. This will prevent confusion and ensure that both you and your client are aligned on the final amount. How to Add Tax and DiscountsIncluding taxes and discounts in a payment request ensures that both you and your client have a clear understanding of the final amount due. It’s important to apply these elements correctly, as they impact the total payment and help maintain transparency in the billing process. Whether you need to apply a local sales tax or offer a special discount for a loyal client, the process can be streamlined to save you time and avoid confusion. Adding TaxTo apply tax to the amount due, you first need to know the applicable tax rate for your region or business. Once you have this information, multiply the taxable amount by the tax rate percentage. For example, if your subtotal is $500 and the tax rate is 8%, you would multiply 500 by 0.08, resulting in a $40 tax charge. This amount should be clearly displayed on the document, usually in a separate line, labeled as “Sales Tax” or “VAT” depending on your location. For clarity, you can use the following formula: Tax Amount = Subtotal × Tax Rate. Applying DiscountsDiscounts are often used to encourage early payment or to reward repeat customers. To apply a discount, simply calculate the discount amount based on the original total. If you are offering a 10% discount on a $500 subtotal, the calculation would be: Discount Amount = Subtotal × Discount Percentage For this example, it would be $500 × 0.10, resulting in a $50 discount. The discount should be listed separately and clearly labeled, such as “Early Payment Discount” or “Loyalty Discount”, to avoid any confusion. Once the tax and discount have been added or subtracted, ensure the final amount is clearly visible at the bottom of the document as the total due. Best Practices for Professional Invoices

Creating a well-structured and professional payment request not only ensures clarity but also builds trust with your clients. By following best practices, you can streamline the process, reduce errors, and make a positive impression that reflects the quality of your work. Consistency, accuracy, and professionalism should be at the core of your billing practices, regardless of the size of your business. Clarity and SimplicityKeep it simple and easy to understand. Avoid cluttering the document with unnecessary information. A clear and concise structure helps your clients quickly identify what they are being charged for and what is expected of them. Use bullet points, headings, and organized sections to separate the key details, such as services, payment terms, and totals. Use Professional Design ElementsEnsure that your payment request looks polished and well-organized. Use a clean, professional layout that includes your logo, business name, and contact details. This not only strengthens your brand identity but also conveys a sense of reliability and attention to detail. Make use of consistent fonts, colors, and spacing to ensure that your document is visually appealing and easy to read. Accurate Details

Accuracy is essential in all financial documents. Double-check the numbers, dates, and services listed to ensure that everything matches the actual work completed and the agreed-upon terms. Correctly applying taxes, discounts, and payment deadlines can help avoid confusion and ensure that there are no disputes later on. Clear Payment TermsClearly outline your payment terms, including due dates, acceptable payment methods, and any penalties for late payments. Being upfront about payment expectations helps set the tone for professional interactions and reduces the likelihood of delays. Make sure the client knows how to pay you and the timeline for doing so. Maintain Consistency

Use the same structure and design for every payment request. This not only makes it easier for you to create new records but also helps clients become familiar with your billing process. Consistency in your documents demonstrates that you are organized and professional, making your financial communication more reliable. How to Track Payments EfficientlyTracking payments effectively is essential for maintaining a healthy cash flow and ensuring that all outstanding amounts are settled on time. By keeping an organized record of payments and due amounts, you can avoid confusion, prevent errors, and make informed financial decisions. Implementing a systematic approach to managing transactions helps ensure that no payments are missed or overlooked. Steps to Track Payments

Tools and Techniques for Efficient Tracking

By staying organized and consistent with your tracking methods, you can manage your financial records with confidence and ensure timely follow-ups on any overdue payments. Formatting Tips for Clear Payment RequestsWhen creating a formal document for billing clients, clarity is key. Proper formatting ensures that all details are easy to read, understand, and reference. A well-organized layout helps avoid confusion and provides a professional appearance, making it more likely that clients will pay on time. Whether you are sending a document digitally or in print, following some simple formatting guidelines can make a significant difference in the effectiveness of your payment requests. Essential Formatting Tips

Other Formatting Considerations

By following these formatting tips, your billing document will not only look professional but will also be functional, making it easy for clients to quickly understand their responsibilities and make payments promptly. Common Mistakes to AvoidWhen preparing formal payment requests, small errors can lead to confusion, delayed payments, or misunderstandings with clients. By being aware of the most common mistakes, you can ensure that your records are accurate, professional, and easy to process. Taking the time to double-check your work can save you from unnecessary complications and improve your reputation as a reliable business partner. Frequent Errors in Payment Requests

Other Important Pitfalls

Avoiding these common mistakes will ensure that your payment requests are clear, professional, and more likely to be processed on time. Taking a few extra minutes to check your work can save you a How to Send Payment Requests to ClientsEffectively sending payment requests is as important as creating them. The method you choose for delivering these documents can impact the speed and clarity of communication with your clients. Whether you’re using email, physical mail, or an online platform, it’s essential to choose the right approach to ensure your client receives, understands, and processes the request in a timely manner. Methods of Sending Payment Requests

Best Practices for Sending Payment Requests

By choosing the right method and adhering to best practices, you can ensure that your payment requests reach clients efficiently and are easy for them to process. This will help maintain smooth cash flow and professional relationships with your clients. Benefits of Digital Invoicing

Switching from traditional paper billing to electronic methods offers numerous advantages for businesses of all sizes. Digital methods provide enhanced speed, convenience, and accuracy, making the billing process more efficient for both you and your clients. Embracing technology not only saves time but also reduces the risk of human error and ensures more secure transactions. Key Advantages of Digital Invoicing

Streamlining Your BusinessWith the ability to automate, track, and manage your billing processes electronically, digital invoicing offers a level of convenience that paper methods cannot match. Adopting this approach helps streamline your operations, improve cash flow, and ensure smoother, more efficient transactions with clients. How to Create Recurring Payment RequestsFor businesses that provide ongoing services or products, setting up recurring billing can save time and ensure steady cash flow. Recurring payment requests are ideal for subscription-based models, retainer agreements, or regular maintenance services. By automating this process, you can reduce administrative work and focus on other areas of your business, while ensuring that clients are billed on time. Steps to Create Recurring Payment Requests

Tools to Streamline Recurring Billing

By creating recurring payment requests, you can streamline your revenue collection process, maintain consistent cash flow, and reduce administrative work. Automating this task will not only save time but also help build a stronger relationship with your clients by ensuring they are billed promptly and correctly. Legal Requirements for Contractor Billing DocumentsWhen creating formal payment requests, it’s important to comply with legal regulations to ensure the document is valid and enforceable. Different regions and countries have specific legal requirements that dictate what information must be included in a payment request to protect both the service provider and the client. Failing to meet these standards could result in disputes or delays in payment, so understanding the requirements is essential for maintaining a professional and legally sound billing process. Essential Information to Include

Additional Considerations

Complying with these l How to Handle Late Payments

Late payments are a common challenge faced by many businesses, regardless of size or industry. While it’s understandable that clients may occasionally face delays, it’s essential to have a strategy in place to handle these situations professionally. Timely collection of payments is crucial for maintaining cash flow and keeping operations running smoothly, but it’s equally important to maintain a positive relationship with clients while addressing overdue amounts. The key to managing late payments effectively lies in communication, clear terms, and a consistent follow-up process. Establishing a clear payment policy from the outset can help mitigate late payment issues, but when they do arise, there are several steps you can take to resolve them in a way that is fair and professional for both parties. Here are some tips on how to handle overdue payments efficiently:

By having a system in place to address late payments, you can minimize the financial impact of overdue amounts and maintain a positive professional relationship with your clients. The goal is to en Why Invoices Are Crucial for ContractorsFor professionals providing services on a project basis, creating formal payment requests is an essential practice for several reasons. These documents not only facilitate payment collection but also serve as a record of the work completed and the agreed-upon terms. Having a clear, structured billing system ensures that businesses remain financially organized and legally protected. Without proper billing documentation, disputes can arise, payment delays become more common, and it can be difficult to track revenue. Moreover, properly issued payment requests help professionals present themselves as serious and credible, fostering trust and reliability in client relationships. Below are some reasons why formal billing documents are indispensable for service-based businesses: Importance of Proper Billing for Service Providers

By using structured payment documents, professionals protect their business interests, maintain client trust, and ensure smooth financial operations. It is essential to make this practice a standard part of your workflow to avoid misunderstandings and improve overall business efficiency. |