Free Contractor Invoice Template Excel for Quick and Easy Billing

For freelancers and small business owners, managing payments and keeping track of financial transactions can be a time-consuming task. Whether you’re working on a one-off project or a long-term engagement, having a reliable system in place is essential for maintaining professional relationships and ensuring timely compensation. A well-organized financial document can streamline your operations and help you stay on top of your earnings.

Organizing your billing process doesn’t have to be complicated. With a few simple tools, you can create a streamlined system that not only saves you time but also ensures you get paid promptly. By using an editable document, you can easily track your work, include all necessary details, and even make adjustments when needed, all while maintaining a polished and professional appearance.

Setting up your billing structure from the start can also reduce errors and misunderstandings with clients. Clear payment terms, accurate pricing, and a straightforward format help ensure there are no surprises for either party. Whether you’re just starting out or looking to refine your existing process, having a solid document at your disposal can make all the difference in running your freelance business smoothly.

Free Contractor Invoice Template Excel

Managing payments and ensuring accurate billing is a vital aspect of any business, especially for self-employed professionals and small enterprises. One of the most efficient ways to handle this task is by utilizing a document designed to keep track of work completed, pricing, and due payments. With the right structure, you can maintain clear communication with clients while simplifying the administrative process.

Having a customizable billing sheet makes it easy to organize your financial details, from the services provided to the payment terms and final amounts. This approach not only reduces the chance of errors but also helps present a professional image to clients, which can build trust and improve client satisfaction. By using a document that suits your specific needs, you can save time and avoid unnecessary back-and-forth regarding payment details.

Benefits of Using a Structured Document

One of the main advantages of using a pre-designed file for tracking payments is that it allows you to avoid starting from scratch each time. These documents come with essential fields already set up, such as service descriptions, rates, taxes, and total amounts due, making it easy to quickly input data and create a final record. As a result, you can focus more on your work rather than spending time on paperwork.

How Customization Can Improve Efficiency

Customizing your billing record to match your specific business needs is essential for maximizing its potential. Adjusting fields such as payment terms, project details, and client information allows for greater flexibility. By tailoring the layout to your preferences, you ensure that every document produced is perfectly aligned with your operational processes and professional standards.

What is a Contractor Invoice Template?

When running a freelance or independent business, one of the most important tasks is ensuring accurate payment for services rendered. A well-organized billing document serves as a clear record of the work completed, payment terms, and the amount due. This document acts as a professional request for payment, providing clients with the necessary details to process and settle the amount owed.

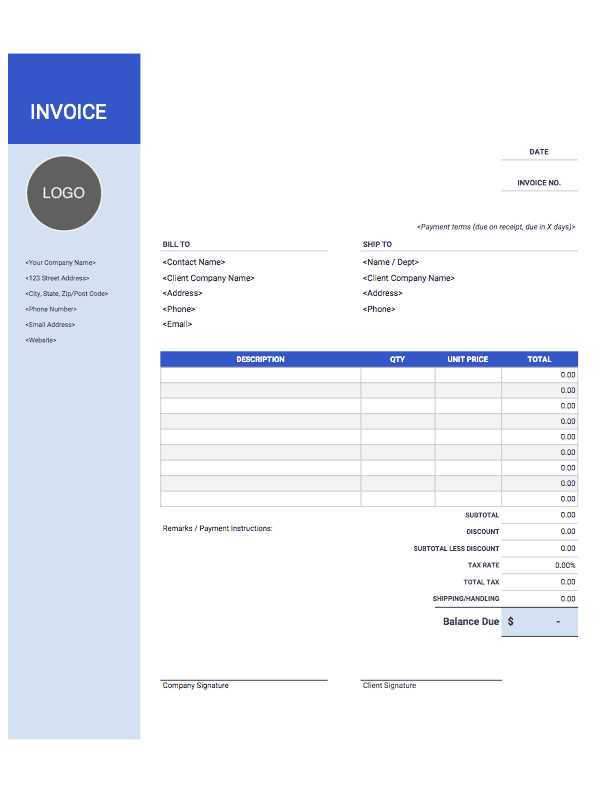

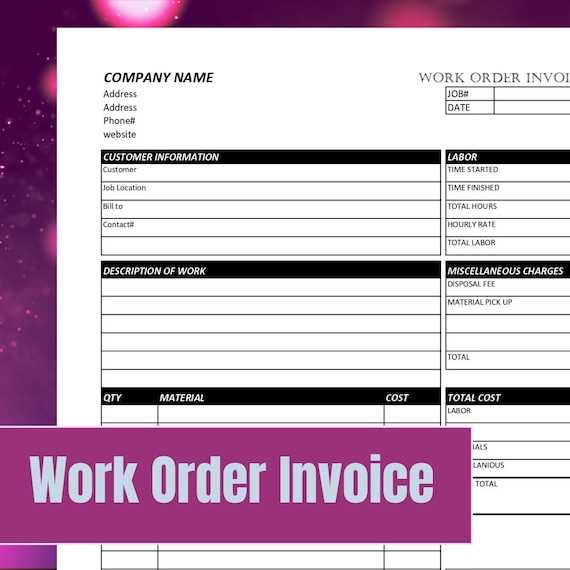

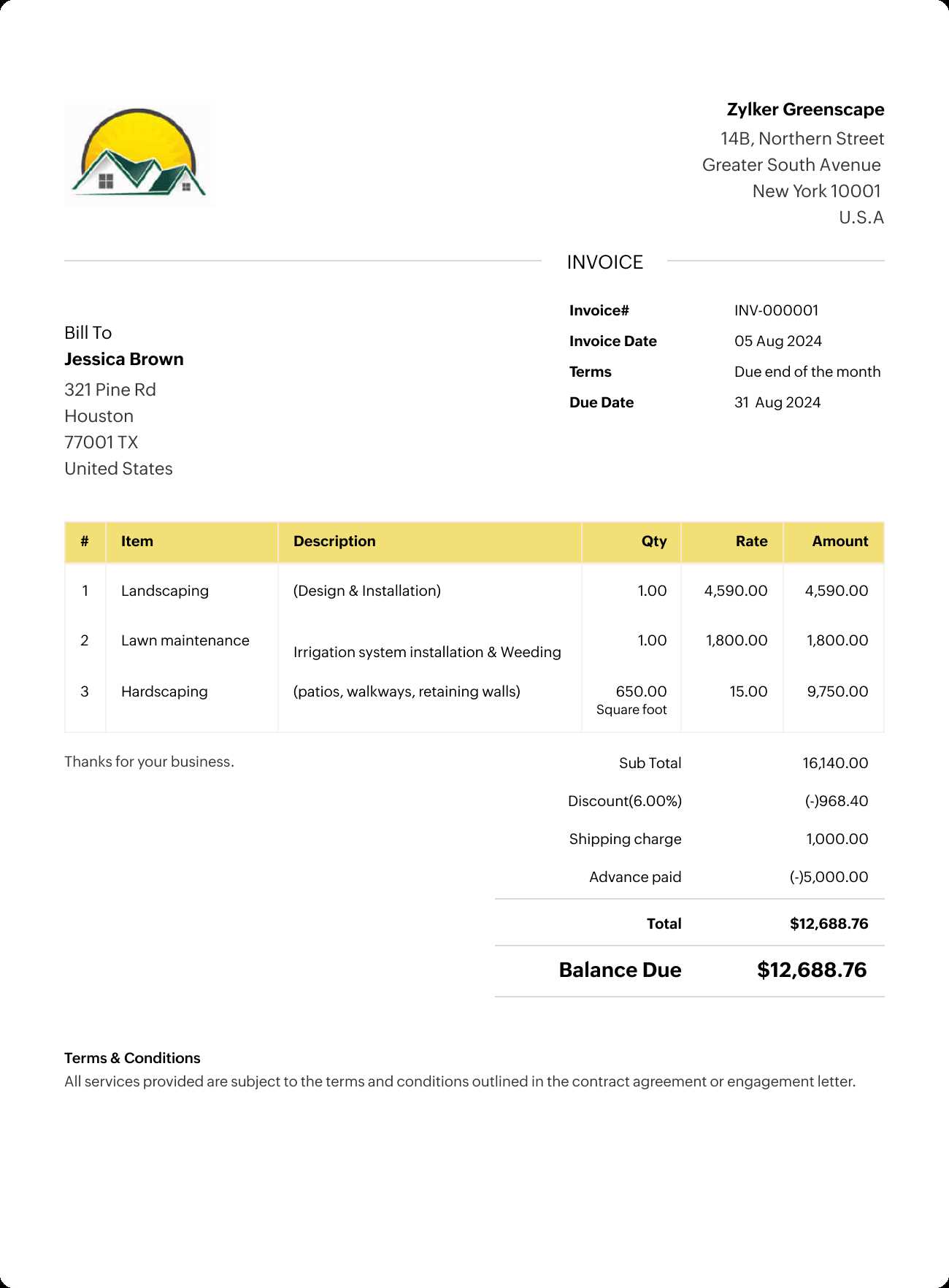

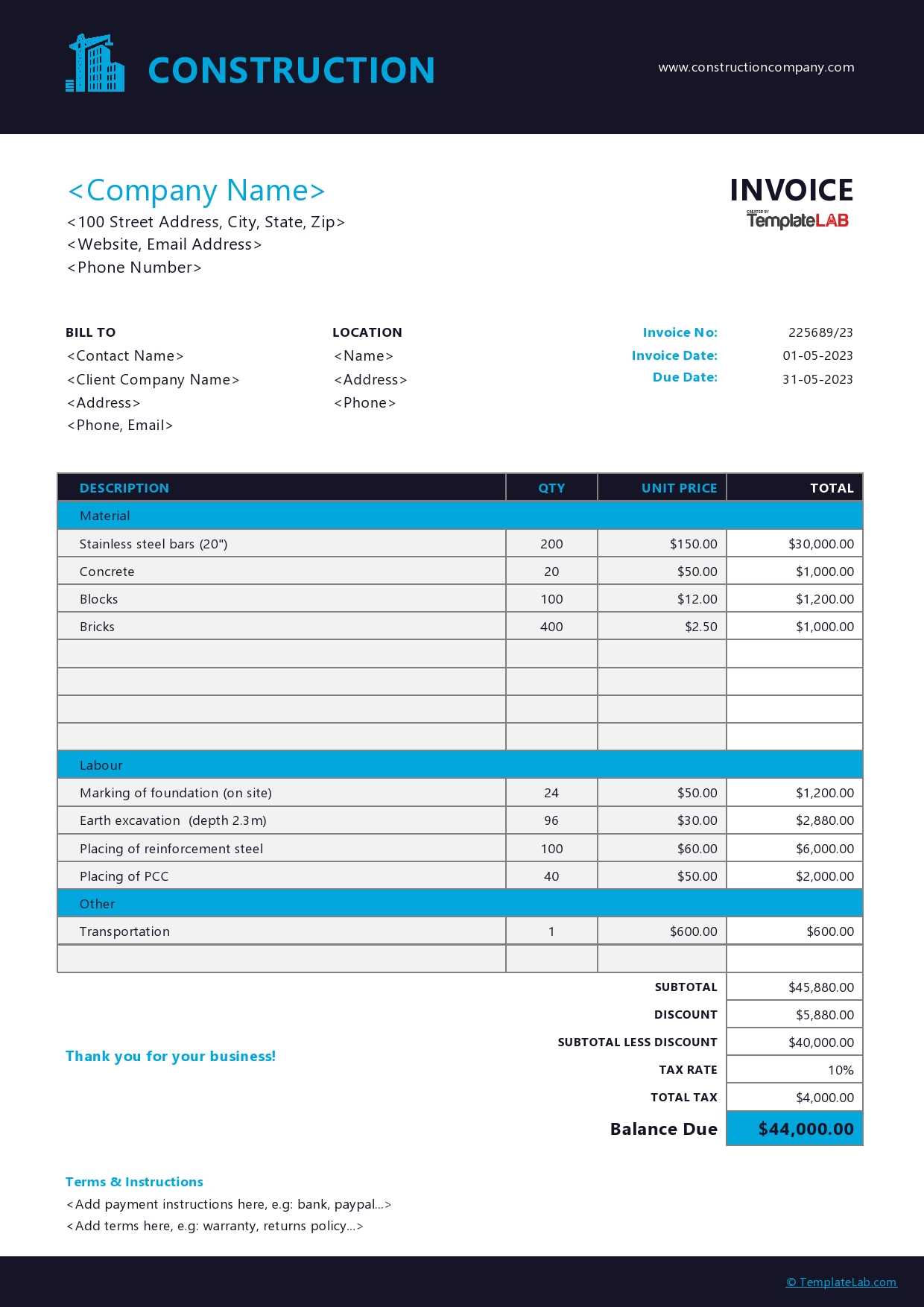

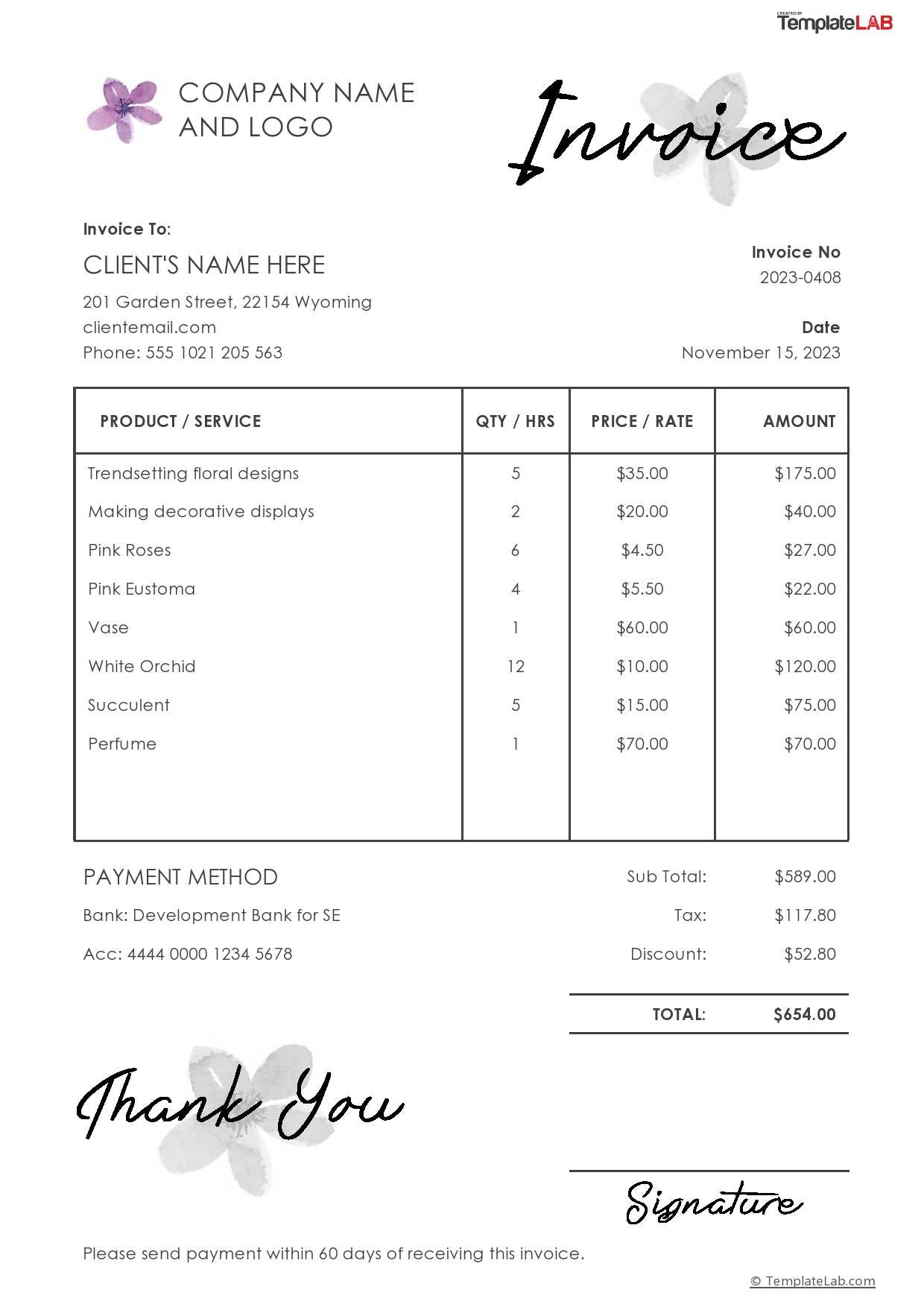

This type of billing document typically includes key information such as the description of services, payment amount, due date, and any applicable taxes or fees. Having a standard format in place makes it easier for the business owner to generate accurate records consistently, reducing the likelihood of errors and misunderstandings. It also helps maintain professionalism, as clients are more likely to respond positively to a clean, organized payment request.

Key Components of a Billing Document

A typical record will contain several important sections. These include the business name, contact information, payment terms, and an itemized list of the services provided. Additionally, the total amount due and the due date should be clearly stated to ensure prompt payment. Many professionals also include payment instructions or methods at the bottom of the document for convenience.

Why You Need a Structured Format

Using a predefined structure to generate your billing documents offers several advantages. It saves time, ensures consistency, and makes it easier to keep track of payments. By reducing manual work, you can focus more on your core tasks and avoid the administrative burden. Whether you’re dealing with one client or many, a standardized document simplifies the entire process and minimizes errors.

Why Use Excel for Invoicing?

For small business owners and freelancers, choosing the right tool to manage billing can significantly impact efficiency and accuracy. Using a spreadsheet program offers numerous advantages, making it a popular choice for many professionals who need to keep track of payments and transactions. The flexibility and range of features available can simplify the entire process, from creating records to managing finances.

One of the main reasons to use a spreadsheet application for billing is its ability to easily organize and calculate financial data. With built-in formulas, it automatically handles tasks like summing totals, applying taxes, and adjusting amounts based on variable rates. This can save a significant amount of time compared to manual calculations and reduce the chances of errors.

Advantages of Using a Spreadsheet

- Easy to Customize: You can modify the structure of the document to suit your specific needs, including adding or removing fields as required.

- Automatic Calculations: Built-in functions allow for quick calculations, such as totals, taxes, or discounts, reducing the risk of mistakes.

- Efficient Data Management: Spreadsheet programs offer simple ways to store and manage multiple records, making it easy to track payments and outstanding balances.

- Professional Appearance: A well-organized spreadsheet can be formatted to look polished and professional, helping to build trust with clients.

- Cost-Effective: Many spreadsheet tools are either free or low-cost, providing an affordable solution for small businesses and independent professionals.

How Spreadsheets Streamline the Billing Process

By using a spreadsheet program, you can quickly generate a detailed record for each client. It eliminates the need for manually writing or formatting documents, and any updates or changes can be made with just a few clicks. Additionally, da

Benefits of Free Invoice Templates

Using a ready-made document to track payments and manage financial records offers several key advantages, especially for small business owners and freelancers. These pre-designed resources can help simplify the administrative tasks associated with billing, ensuring that every payment request is accurate, professional, and easy to create. By relying on these ready-to-use solutions, individuals can save time and reduce the risk of mistakes in their financial documentation.

One major benefit is that these resources are often customizable, allowing users to adapt them to their specific business needs. Whether you need to adjust the layout, add additional fields, or change the language of the terms, these documents provide the flexibility to tailor each record to your requirements. This adaptability ensures that the document will match your business style and make a good impression on clients.

Another advantage is the significant time savings. With a predefined structure, you don’t have to start from scratch each time you need to generate a payment request. You can quickly input the necessary details, calculate totals, and even include applicable taxes with minimal effort. This streamlined process helps you stay organized and focused on the work that matters most.

Additionally, using a well-organized document helps ensure consistency across all client interactions. The professional layout and clear format not only make it easier for clients to understand the payment terms, but they also reflect positively on your business, enhancing your credibility. By reducing confusion and misunderstandings, these resources can improve client relationships and make the payment process smoother for both parties.

How to Customize Your Template

Tailoring your document for specific needs is an essential step in ensuring it works perfectly for your business or project. Whether you’re dealing with different clients, services, or payment terms, having a personalized layout can save you time and help maintain professionalism. Customizing this type of document allows you to reflect your brand identity, enhance clarity, and streamline communication with recipients.

Start with the Basics: Begin by adjusting the basic fields such as the recipient’s information, your details, and any relevant dates. Ensuring accuracy in these sections helps avoid misunderstandings. You can easily input your company’s name, address, and contact details in the header section. Similarly, make sure the customer’s name and relevant information are clearly visible in the body.

Modify the Design: One of the simplest ways to make the document more unique is by customizing the visual elements. Adjust fonts, colors, and spacing to match your branding guidelines. You can add your logo, change the text style, or use a more distinct color scheme to create a polished look that aligns with your business’s tone and style.

Adjust Payment Details: Each project may come with different payment structures. Be sure to include sections that outline specific terms, such as hourly rates, project milestones, or deadlines for payment. Having a customizable table or list that allows you to clearly display these details helps set the right expectations and ensures smooth transactions.

Include Additional Notes: Depending on the nature of your work, you may want to add extra notes or terms. Customize the footer or an additional section to outline policies, discounts, or important reminders that are specific to each job. This flexibility allows you to create a document that can adapt to different situations without starting from scratch every time.

Save and Reuse: Once you’ve personalized the layout to suit your needs, save it as a reusable format. This way, you can quickly make adjustments for future clients or projects without going through the entire customization process again. Over time, you’ll have a streamlined document ready for any task.

Step-by-Step Guide to Creating Invoices

Creating a professional billing document involves several key steps to ensure all necessary details are included and clearly presented. The process can be straightforward if you follow a logical structure and pay attention to accuracy. By breaking down the steps, you can ensure consistency and efficiency for every client or project.

- Start with Your Details: The first step is to clearly list your business or personal information. This should include your name, address, phone number, email, and any other relevant contact details. Place this at the top of the document for easy reference.

- Enter the Client’s Information: Next, add the recipient’s name and contact details. This ensures that the document is directed to the correct person or company and facilitates smooth communication. You may also want to include the client’s company name, address, and phone number.

- Assign an Unique Identifier: Create a unique reference number for each billing document. This is especially useful for record-keeping and future reference. You can set up a sequential numbering system to stay organized.

- Specify the Date: Clearly state the date when the document is created, as well as the due date for payment. Including these details ensures that both parties are aware of the timeline for settlement.

- Describe the Services Rendered: List each service or product provided, including a brief description, quantity, and unit price. For added clarity, break down complex services into smaller, easily understood tasks. This helps the client see exactly what they are paying for.

- Calculate the Total Amount: Add up all the amounts for each item or service. Make sure to include any applicable taxes, fees, or discounts. If necessary, provide a clear breakdown of how the final total was calculated.

Essential Information for Contractor Invoices

When preparing a billing document for services rendered, including the right information is crucial for clarity, professionalism, and effective payment processing. The more detailed and precise the content, the smoother the transaction will be. Key details help both parties stay aligned on the expectations and prevent any confusion during the payment process.

- Your Business Information: Always start by providing your full name (or business name), address, phone number, and email address. This ensures the recipient can contact you if needed and properly identify who the charges are coming from.

- Client Information: Include the name and contact details of the person or company being billed. This is important for proper identification and ensures the document reaches the correct individual or department.

- Document Number: Assign a unique reference number to each document. This number helps both you and the client track and manage the transaction easily. A sequential numbering system can improve organization over time.

- Issue and Due Dates: Clearly state when the document was created and the date when payment is due. This allows for better financial planning and ensures both parties are aware of timelines for settlement.

- Description of Services or Products: Itemize each service or product provided, including a detailed description, quantity, and individual cost. This transparency helps the client understand exactly what they are being charged for.

- Total Amount Due: Provide a sum of all services rendered or products delivered, along with any taxes or additional fees. This figure should be easy to find, typically at the bottom of the document, so the recipient can quickly assess the amount due.

- Payment Terms: Outline the payment conditions, such as accepted methods (bank transfer, credit card, check, etc.), and any penalties for late payments. This ensures both parties agree to the same terms and avoid any potential disputes.

- Additional Notes: If necessary, include any special instructions, terms of service, or policies related to the payment. This section could also include a thank-you note or reminder about future work or services.

How to Save Time with Excel Templates

Using pre-built documents can significantly speed up repetitive tasks, helping you focus on more important aspects of your business. With the right setup, you can quickly fill in relevant details without having to start from scratch each time. This method ensures consistency, reduces errors, and streamlines your workflow, saving you valuable time in the long run.

Here are a few ways you can save time when using pre-designed documents in spreadsheet software:

- Automated Calculations: Pre-built formulas allow for instant calculations of totals, taxes, and discounts, minimizing the need for manual entry. This reduces the risk of errors and speeds up the process.

- Standardized Layout: A consistent format ensures that all necessary information is included in a logical and easy-to-understand order. This eliminates the need to rearrange or reformat every time you create a new document.

- Customizable Fields: You can personalize sections with specific client details, services, and pricing without having to manually adjust each item. With a customizable framework, filling in your document becomes a quicker task.

- Reuse and Replicate: Once you’ve created a document you’re happy with, you can easily save it as a master version and use it repeatedly. This reduces the amount of time spent redesigning and allows for a more efficient workflow.

For example, a simple table setup can make the task more efficient:

Service Description Quantity Unit Price Total Web Design 1 $500 $500 SEO Optimization 3 $100 $300 Total $800 With this structure in place, you only need to adjust the fields such as the service description or quantity, and the totals will automatically update. This quick process helps save both time and effort for every new client or project.

Common Mistakes to Avoid When Invoicing

Creating accurate and professional billing documents is crucial for ensuring timely payments and maintaining good client relationships. However, even experienced individuals can sometimes make simple errors that can lead to confusion or delayed payments. Avoiding these common mistakes will help you streamline the process and reduce the risk of miscommunication.

- Missing Contact Information: Always ensure that both your details and the client’s information are clearly listed. This includes names, addresses, phone numbers, and email addresses. Missing or incorrect contact information can cause delays in processing or result in your document being overlooked.

- Failure to Include a Unique Reference Number: Every document should have a unique identifier, whether it’s a reference number or a code. This helps both you and the client keep track of the transaction, especially if there are multiple projects or payments happening at once.

- Not Specifying Payment Terms: Be clear about when the payment is due and any accepted payment methods. Failure to outline these details can lead to confusion or delays. It’s also a good idea to state any late fees or penalties if payments are not received on time.

- Vague Descriptions of Services: Avoid general terms or vague descriptions of what was provided. Be specific about the work performed, including quantities, hours worked, and individual prices. Lack of clarity can cause disputes over what the charges are for.

- Incorrect or Missing Calculations: Double-check all the math before sending the document. Errors in totals, taxes, or discounts can lead to trust issues with clients and delay payments. Use automatic calculations when possible to avoid mistakes.

- Not Including Relevant Dates: Be sure to specify both the issue date and the due date clearly. Without these, clients might not know when the payment is expected, and this could result in delays.

- Overlooking Additional Charges: If there are extra costs, such as shipping, travel, or materials, ensure they are listed separately and explained. Failing to include additional fees can lead to misunderstandings or disputes.

- Leaving Out a Thank You Note: While not strictly necessary, including a brief thank-you note or message of appreciation can help maintain positive relationships with clients. It’s a small touch that can go a long way in fostering goodwill.

By paying attention to these details, you can avoid common pitfalls that may complicate the billing process and ensure smoother transactions with your clients.

Managing Multiple Projects with One Template

Handling several projects simultaneously can be overwhelming, but using a well-organized document can simplify the process. By customizing a single document, you can keep track of various tasks, payments, and deadlines without the need to start from scratch each time. This approach enables you to efficiently manage multiple clients and projects, ensuring consistency while saving time.

Creating Separate Sections for Each Project

To keep everything in order, start by setting up distinct sections or tabs within your document for each individual project. This allows you to clearly differentiate between them, even if the structure remains the same. For each project, include a brief description, client details, and any specific terms or conditions. This method helps you avoid confusion and ensures that each project gets the attention it needs without mixing up important details.

Using Automatic Calculations and Totals

One of the key benefits of using a digital document is the ability to automate calculations. For each project section, you can set up formulas that automatically calculate totals, taxes, and discounts based on the services or products provided. This reduces the risk of human error and ensures accuracy across multiple projects. Additionally, you can use summary sections to calculate the grand total across all projects, giving you a quick overview of your overall income or expenses.

By utilizing a single document for all your ongoing projects, you can maintain a high level of organization and ensure that each client’s information is managed efficiently. With a little customization, this method can greatly reduce the time spent on administrative tasks and allow you to focus more on delivering quality work.

How to Calculate Taxes in Excel

Calculating taxes for a transaction can be a complex task, especially when dealing with varying rates and different types of charges. However, spreadsheet software makes it easy to automate these calculations, ensuring accuracy and efficiency. By using formulas, you can quickly calculate the correct tax amount based on the total cost of goods or services, without needing to manually do the math each time.

Step 1: Identify the Tax Rate

Before performing any calculations, make sure you know the applicable tax rate for your region or the specific product or service. Tax rates are often expressed as percentages (e.g., 8%, 15%). This rate will be used in your formula to determine the amount due.

Step 2: Use the Formula for Tax Calculation

To calculate tax, you will need to multiply the total amount by the tax rate. For example, if your total is $500 and the tax rate is 10%, the calculation would be:

Tax = Total Amount × Tax Rate

In this case, it would be $500 × 10% = $50.

In a spreadsheet, you would input the total amount in one cell (let’s say cell B2), and the tax rate in another cell (say, cell B3). Then, in the cell where you want the tax to appear (e.g., B4), you would use the following formula:

=B2*B3

This will automatically calculate the tax based on the values you input for the total and tax rate.

Step 3: Add Tax to the Total Amount

Once the tax has been calculated, you may want to add it to the original amount to show the full total due. To do this, use the following formula:

Total Amount Due = Original Amount + Tax

In your spreadsheet, you can set this up as follows:

=B2 + B4

This will give you the total amount that includes both the base price and the tax, making it easy to present the final amount due to the client or customer.

By using these simple formulas, you can automate the process of calculating taxes in your documents, saving time and ensuring accurate billing every time.

Creating a Professional Invoice Design

Designing a polished and clear document is key to making a strong impression on your clients. A well-structured layout not only reflects professionalism but also ensures that all important information is easy to find and understand. By focusing on clean design elements, readable fonts, and logical organization, you can create a document that enhances your brand image and builds trust with your clients.

Start with a simple, clean layout. Avoid cluttering the page with excessive graphics or information that doesn’t add value. Use ample white space to separate sections, making it easier for your client to follow the details. Include clearly labeled sections, such as your business name and contact information, client information, a breakdown of services or products, and the total amount due. Organizing the content this way helps your client quickly locate what they need.

Typography plays a significant role in readability. Choose professional and legible fonts like Arial, Calibri, or Times New Roman. Use larger font sizes for headings and important details (e.g., the total amount due), and smaller sizes for descriptions and additional information. Make sure to use bold or italic styles sparingly to highlight key sections, such as payment terms or due dates, without overwhelming the document.

Adding your logo and consistent color scheme can further strengthen your brand identity. Make sure your logo is placed prominently at the top, but not so large that it detracts from the document’s readability. Stick to two or three complementary colors throughout the design to maintain a professional appearance, using them for headings, borders, or background shading in moderation.

Finally, ensure the document is structured logically and flows well. Group similar items together, such as services provided or product descriptions, and make sure that each section is clearly separated. This approach makes the information easy to follow, while ensuring that no critical details are overlooked.

Tracking Payments with Excel Templates

Keeping track of payments is essential for maintaining cash flow and ensuring that all transactions are accounted for. By using a structured document, you can easily monitor which payments have been made, which are still pending, and when to expect future payments. This system helps you stay organized and avoid overlooking important financial details, ensuring timely follow-ups and smooth business operations.

Setting Up a Payment Tracker: Start by creating a simple table that includes key columns such as the client name, project or service description, the amount due, payment status, and due date. This will give you a quick overview of all outstanding payments and help you keep track of what’s been paid and what’s still pending. Organizing these details in a clear and consistent way ensures that you can always stay on top of your finances.

Using Payment Status Indicators: In your document, consider adding a “Payment Status” column where you can mark payments as “Paid,” “Pending,” or “Late.” This allows you to quickly filter or sort your list based on payment status, helping you identify which clients still owe money and which payments are overdue. You can also use color-coding to visually distinguish between different statuses, making the process even more intuitive.

Adding Payment Dates: Include a column for the payment date to keep track of when funds were received. This will help you monitor whether payments are being made on time and allow you to quickly identify any delays. You can also add a “Payment Method” column to note whether the payment was made via bank transfer, credit card, or other methods. This provides an additional layer of detail that can be useful for accounting purposes.

Calculating Outstanding Balances: Set up a column that calculates the outstanding balance for each entry. Using simple formulas, subtract the amount paid from the total amount due to get the remaining balance. This helps you stay on top of what clients owe and ensures you are never uncertain about how much money is still pending.

By using a well-organized document to track payments, you can gain better control over your finances, avoid errors, and ensure that all transactions are properly documented. Regularly updating this document will help you maintain a clear record of all incoming funds and improve your overall financial management.

How to Update Your Invoice Template

Adapting your document layout periodically ensures that it meets evolving business requirements and keeps information organized and easy to read. Here, we’ll guide you through simple steps to make adjustments to your document structure, whether for aesthetic purposes or functional improvements.

1. Review and Redesign Your Document Sections

Start by analyzing the structure and contents of your document. Ask yourself what elements are essential for your current needs and consider adding or removing details accordingly. You may want to make updates to sections like:

- Company information and contact details

- Product or service descriptions

- Totals and summaries

- Legal disclaimers or terms of service

2. Update Formatting for Enhanced Readability

Ensure your document

Free vs Paid Invoice Templates: Which to Choose?

Choosing the right document format for billing depends on your business needs, budget, and desired level of customization. Each option has its own set of advantages, which can impact efficiency, functionality, and the overall presentation of your financial records.

Advantages of No-Cost Options

No-cost document formats are often suitable for small businesses or individuals with straightforward requirements. They are accessible and can be quickly customized with basic software tools. Key benefits include:

- Easy access without extra fees

- Basic layout suitable for simple transactions

- Compatibility with popular software applications

Benefits of Premium Options

Premium versions generally offer advanced features and a more polished appearance, which can be beneficial for businesses that require specific functionalities or branding. Consider optin

Best Practices for Sending Invoices

Ensuring a smooth and professional billing process not only supports timely payments but also helps maintain clear communication with your clients. Here, we outline some effective strategies to improve the delivery and clarity of your billing documents.

1. Choose the Right Timing

Sending your billing document promptly after completing the work can encourage faster payments. For recurring services, establish a regular schedule–such as the beginning or end of each month–to set clear expectations. This consistency helps clients anticipate and prepare for payments, reducing delays.

2. Provide Clear and Detailed Descriptions

Avoid misunderstandings by including a concise breakdown of the work completed or products delivered. Use clear descriptions for each item, service, or project phase, and specify quantities, rates, and any applicable taxes. Consistency in format and detail helps clients quickly review and approve the charges.

Additional Tips for Professional Delivery:

- Double-check for accuracy:

Where to Find Free Contractor Invoice Templates

Locating a reliable and user-friendly billing format for professional services can simplify your accounting process and enhance your business’s appearance. Here are some popular online resources where you can download various styles to fit your needs.

1. Office Software Websites

Many well-known office software providers offer a variety of downloadable document formats for professionals. These options are generally customizable and compatible with common spreadsheet or word processing tools, allowing you to make adjustments as needed for specific clients or projects.

2. Online Business Resources and Blogs

Business-focused blogs and websites frequently provide downloadable resources that are designed to meet common accounting standards. These resources often cater to small business needs, and they offer versatile formats that can be tailored to different industries. Additionally, some sites may provide guidance on how to fill out and organize your documents effectively.

By exploring these platforms, you can find a layout that suits