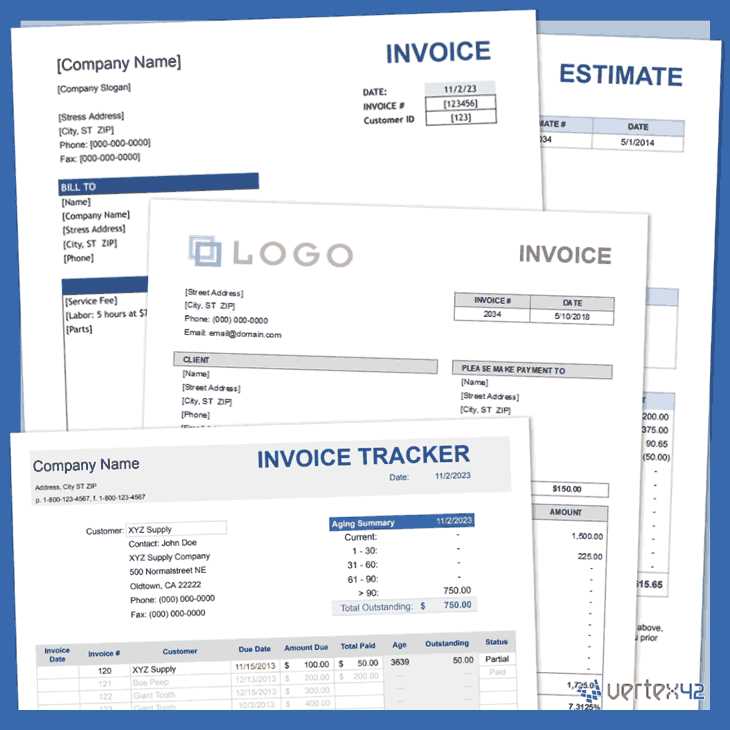

Free Consultant Invoice Template for Excel

In the realm of business, effective financial documentation plays a crucial role in maintaining professionalism and ensuring timely payments. A well-structured billing document not only reflects the services rendered but also establishes trust between service providers and clients. This is where utilizing organized and visually appealing formats becomes indispensable.

Many professionals seek user-friendly solutions that simplify the billing process while enhancing clarity and consistency. Leveraging software that offers versatile design options can streamline the creation of such documents, allowing users to focus on their core activities without being bogged down by tedious administrative tasks. This resource will guide you through the various options available for crafting your financial statements, ensuring you can efficiently manage your business’s financial aspects.

Understanding Invoice Templates

Effective financial documentation is vital for any business, ensuring clarity and professionalism in all transactions. A structured format serves as a foundational tool for communicating services provided and payments due. By utilizing such formats, professionals can streamline their billing processes and enhance their overall business operations.

Key Features of Billing Formats

Several essential elements contribute to the effectiveness of these financial documents:

- Clear Identification: Including both the service provider’s and client’s information to establish accountability.

- Detailed Descriptions: Outlining services rendered, rates, and any applicable taxes to prevent confusion.

- Payment Terms: Specifying due dates and accepted payment methods to facilitate timely transactions.

Advantages of Structured Billing Formats

Utilizing a standardized format for financial documentation offers numerous benefits:

- Enhances professionalism and credibility.

- Simplifies the billing process, saving time and reducing errors.

- Improves cash flow management through timely payments.

- Facilitates easy record-keeping for both parties involved.

By comprehending the significance and components of these financial documents, professionals can ensure smoother transactions and maintain positive relationships with their clients.

Benefits of Using Invoice Templates

Employing structured billing formats offers numerous advantages for professionals seeking efficiency and clarity in their financial dealings. These organized documents not only streamline the billing process but also enhance the overall professionalism of communications with clients. Understanding the benefits can significantly improve business operations and financial management.

Streamlined Workflow

Utilizing organized formats helps in simplifying the entire billing process. Key benefits include:

- Time Efficiency: Ready-made designs reduce the time spent on creating documents from scratch.

- Consistency: A standardized approach ensures uniformity across all billing statements, reducing the risk of errors.

- Quick Customization: Easy-to-edit formats allow for swift adjustments to suit various client needs.

Enhanced Professionalism

Using structured financial documents can significantly boost a business’s image. Consider the following:

- Clarity: Clearly presented information fosters trust and transparency with clients.

- Branding: Customizable formats can incorporate logos and colors, reinforcing brand identity.

- Improved Communication: Detailed and well-organized documents facilitate better understanding between parties.

Incorporating these organized documents into business practices not only improves operational efficiency but also strengthens client relationships through enhanced professionalism.

How to Create an Invoice

Developing a structured billing document is a straightforward process that can significantly enhance the efficiency of your financial transactions. By following a systematic approach, professionals can ensure that all necessary details are included, leading to clearer communication and faster payments. Below is a step-by-step guide to assist in creating an effective billing statement.

| Step | Description |

|---|---|

| 1 | Begin with your contact information, including your name, address, phone number, and email. |

| 2 | Add the recipient’s details, ensuring accuracy for timely delivery. |

| 3 | Assign a unique identifier to the document to differentiate it from others. |

| 4 | Clearly list the services provided, including dates, descriptions, and rates. |

| 5 | Specify any applicable taxes or additional charges to avoid confusion. |

| 6 | Indicate the total amount due and include payment terms, such as due dates. |

| 7 | Finish with a professional closing statement and your signature if necessary. |

By following these steps, you can create a comprehensive billing document that not only meets professional standards but also facilitates smooth financial transactions with your clients.

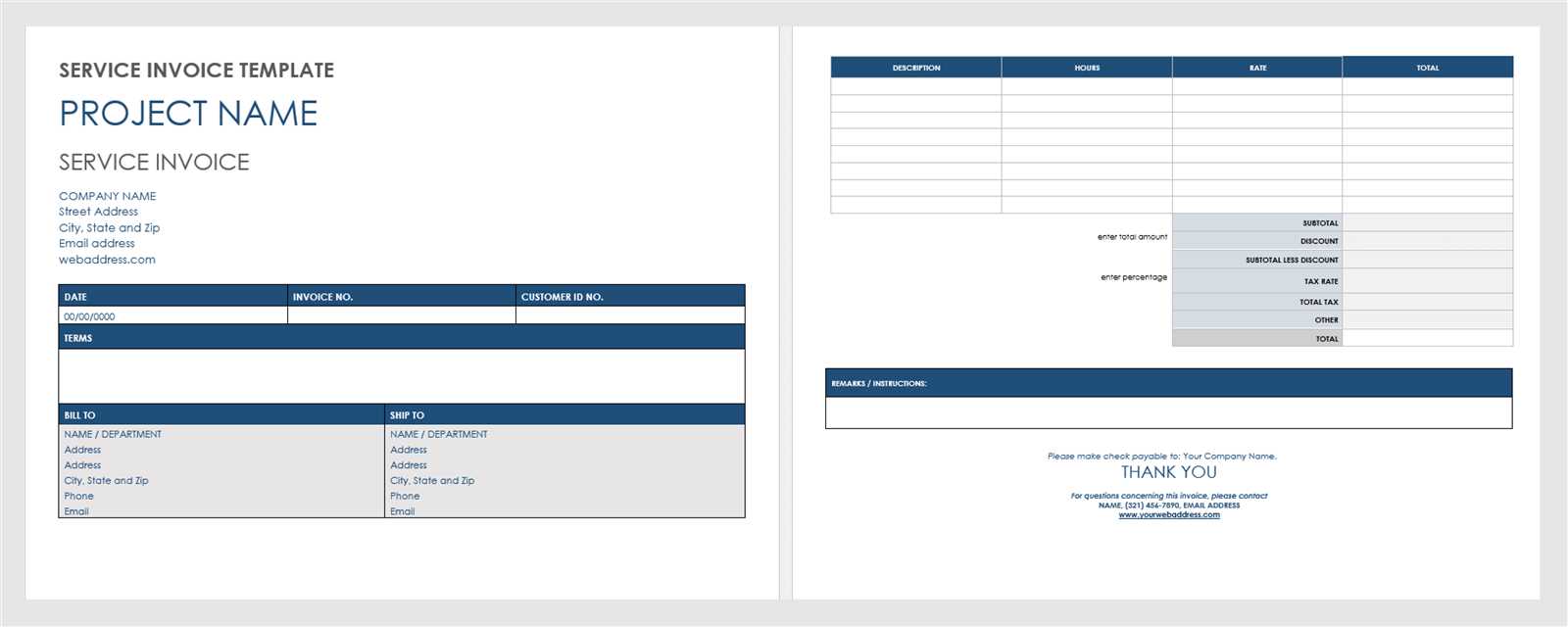

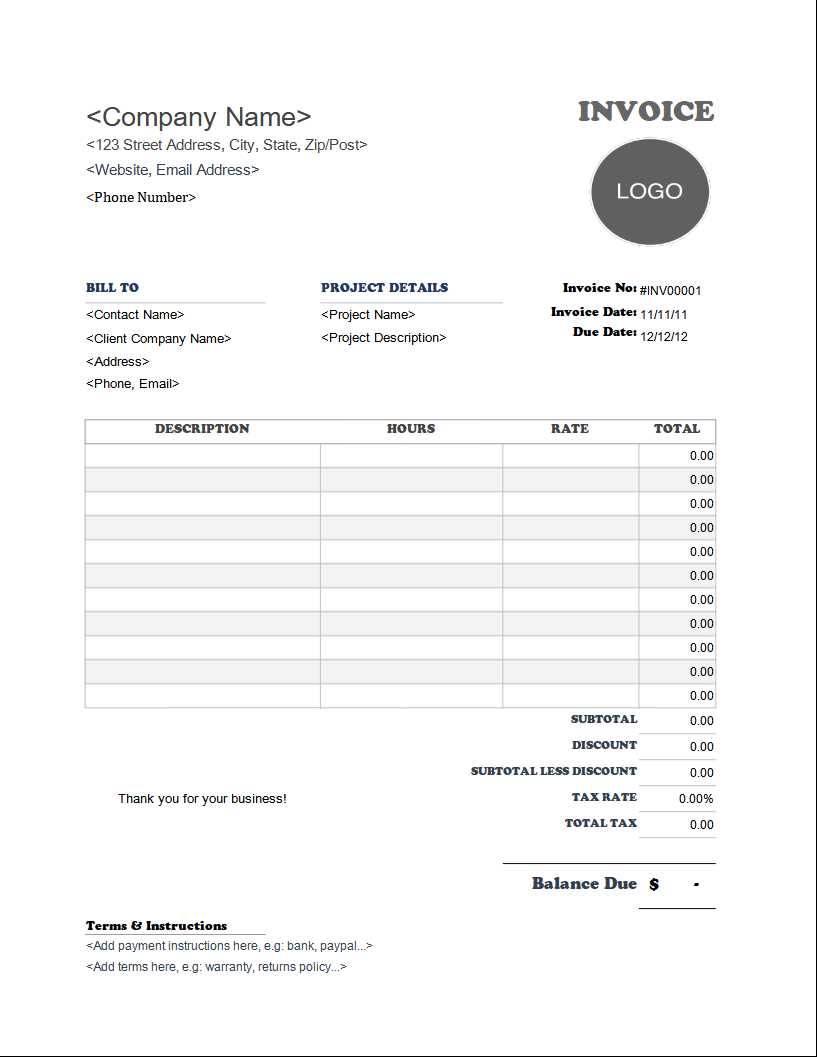

Key Components of an Invoice

A complete and well-structured billing document includes several essential elements that ensure clarity and accuracy. These components are fundamental for effective communication between service providers and clients, helping to prevent misunderstandings and facilitating prompt payments.

Contact Information: Begin by providing the business’s contact details, including the name, address, phone number, and email. This information establishes clear communication channels for any follow-up questions.

Client Details: Include accurate details for the recipient, such as name, company (if applicable), and address. Precise information helps avoid delays and ensures the document reaches the correct party.

Document ID: Assign a unique identifier to each billing statement, such as a reference number or code. This identifier simplifies tracking and organizing records.

Description of Services: Clearly list all services provided, with descriptions that explain the scope of work, dates, and rates. This

Choosing the Right Format

Selecting an appropriate structure for billing documents can significantly impact both clarity and ease of use. The ideal choice depends on factors like the nature of the work, client expectations, and the level of detail required. Ensuring the format aligns with these needs helps facilitate smoother transactions and better client satisfaction.

Simplicity and Readability: A straightforward layout allows clients to quickly grasp essential information. Choose a structure that balances detail with readability, ensuring all key elements are presented clearly without overwhelming the recipient.

Customization Options: Opt for a format that allows easy modifications, like adding branding elements or adjusting item descriptions. Flexibility in design helps the document reflect the professionalism and unique style of your business.

Accessibility: Consider whether clients can easily open and review the document. Common formats that are compatible across devices and software make it simpler for clients to access the information, reducing potential delays.

By selecting a format that prioritizes clarity, customization, and accessibility, businesses can e

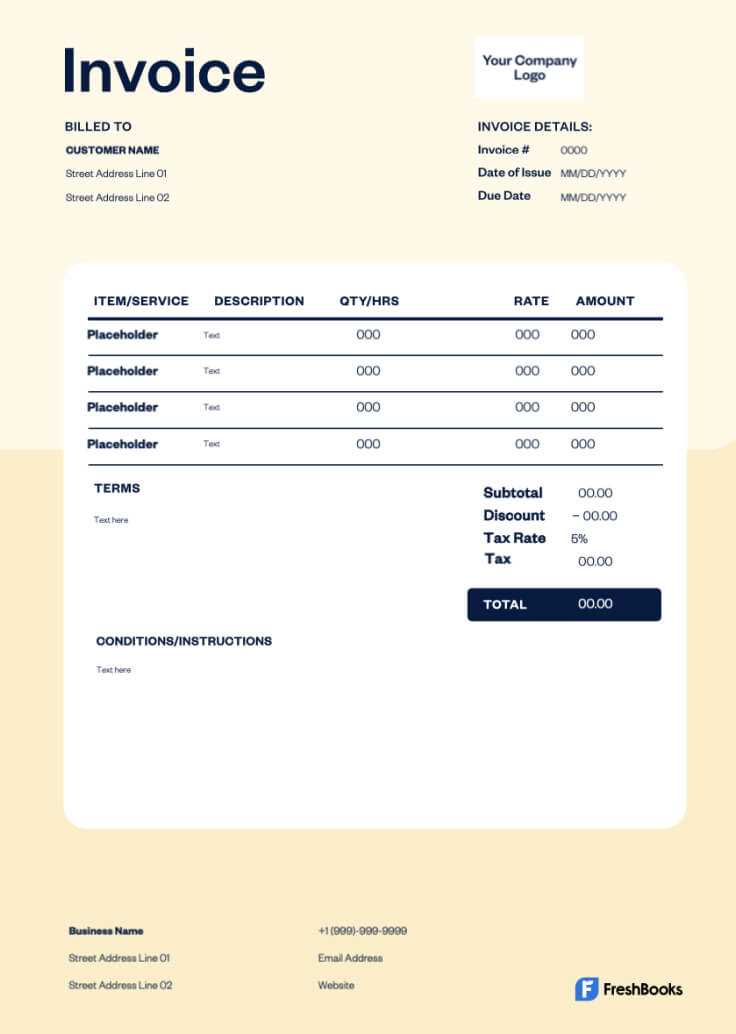

Customizing Your Invoice Template

Personalizing a billing document to reflect your business’s unique style and requirements can leave a lasting impression on clients. Tailoring the structure and design not only enhances brand recognition but also improves the document’s clarity and functionality. This section explores essential adjustments that can make your financial paperwork more professional and customized.

Add Your Branding Elements

Incorporating elements such as your company’s logo, preferred colors, and fonts gives a professional touch and reinforces brand identity. This not only sets your paperwork apart but also builds trust with clients by making the document look polished and consistent with your business image.

Adjust Layout to Highlight Key Information

Consider adjusting the layout to emphasize the most important details, like contact information, itemized services, and the total amount due. Using bold text or section headers can guide the reader’s eye to these areas, ensuring no critical details are overlooked. A well-organized layout also makes the document easier to scan, which can lead to quicker client responses.

Include Customizable Sections for notes, specific terms, or payment

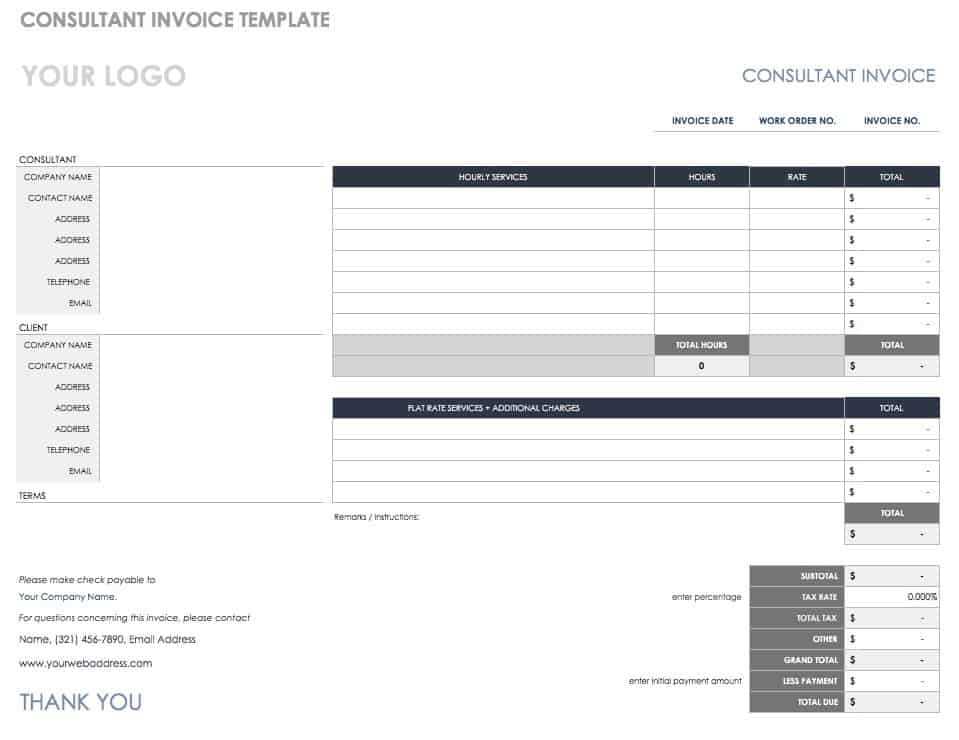

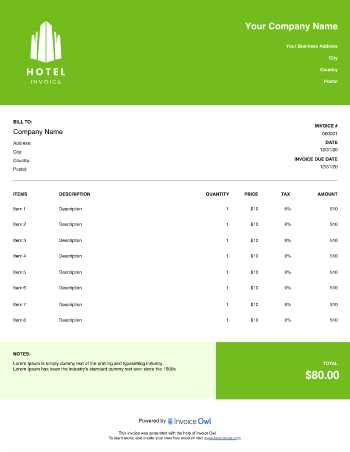

Using Excel for Invoicing

Creating financial documents in a spreadsheet program can be a powerful way to organize and customize details with precision. This approach allows for easy calculations, flexible design, and tracking of data, making it a practical choice for both new and established businesses. Here’s how to set up an organized and efficient document for tracking payments and services.

Start by setting up a basic structure that includes essential sections, such as client information, service descriptions, and total charges. Using formulas within cells can streamline calculations, automatically updating totals and taxes. Here’s a sample layout for a structured, easy-to-follow design:

| Item | Description | Quantity | Unit Price | Total | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Service A | 2 | $50.

Using Excel for InvoicingCreating financial documents in a spreadsheet program can be a powerful way to organize and customize details with precision. This approach allows for easy calculations, flexible design, and tracking of data, making it a practical choice for both new and established businesses. Here’s how to set up an organized and efficient document for tracking payments and services. Start by setting up a basic structure that includes essential sections, such as client information, service descriptions, and total charges. Using formulas within cells can streamline calculations, automatically updating totals and taxes. Here’s a sample layout for a structured, easy-to-follow design:

In this setup, each row represents a separate item or service, with columns for quantity, unit price, and a calculated total. The subtotal, tax, and final amount fields automatically update as entries change, reducing manual calculations and minimizing errors. With a few adjustments, this type of document can be saved and reused, making it a flexible option for efficient financial management. Tips for Professional InvoicesCreating a well-organized financial document not only promotes timely payments but also enhances your business’s credibility. Ensuring that these documents are clear, concise, and visually appealing can make a significant difference in client interactions. Below are some practical suggestions for refining and elevating your billing approach. Keep Layouts Simple and OrganizedPresenting information in a structured, clean format helps clients quickly understand charges and details. Use well-defined sections and avoid clutter to keep the layout readable and professional. Ensure essential information stands out, such as contact details, total amounts, and payment terms. Include Essential DetailsIn a clear financial document, specific elements are crucial for transparency and completeness. Ensure your document includes the following:

|

||||||||||||||||||||||||||||||||||||||||||