Free Construction Invoice Template PDF for Easy and Professional Billing

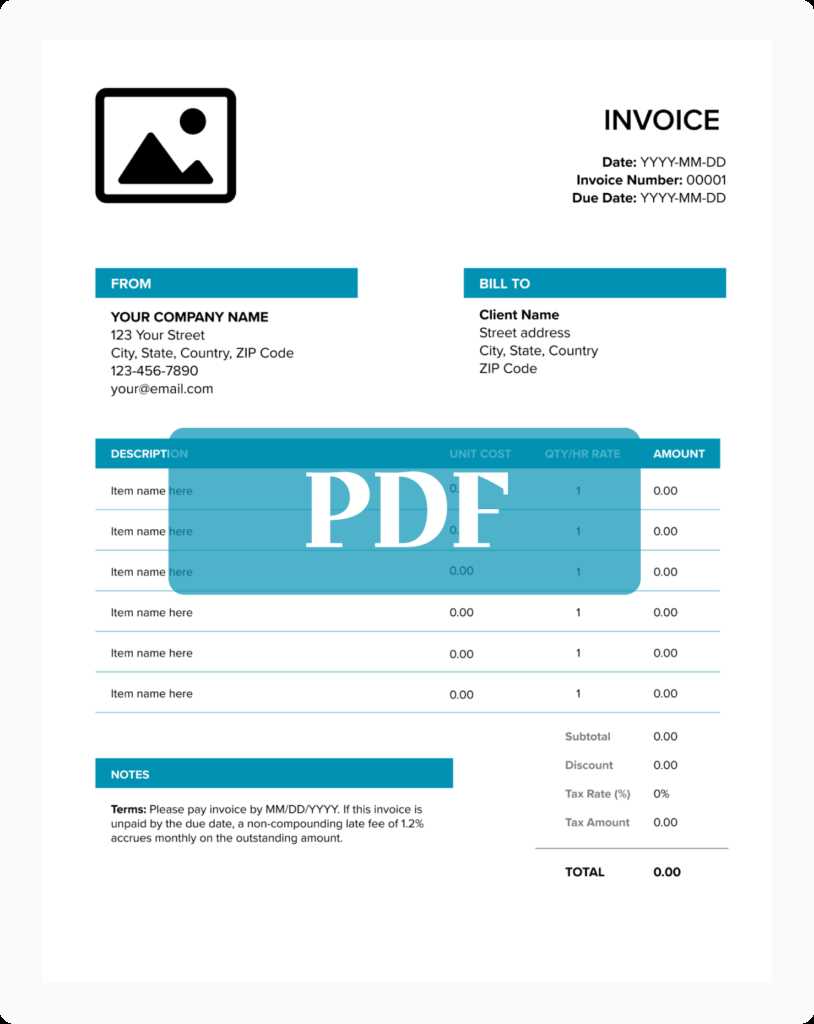

Managing financial transactions effectively is a cornerstone of any successful business, particularly in industries where project-based work is the norm. Whether you’re a contractor, freelancer, or service provider, having a consistent method for billing clients is crucial for maintaining cash flow and professional relationships. Proper documentation not only ensures you’re paid promptly but also helps prevent misunderstandings over payments and services rendered.

One of the most efficient ways to handle this is by utilizing standardized documents that outline the specifics of each job, the agreed-upon rates, and payment terms. These tools allow for quick adaptation to different projects while maintaining accuracy and clarity in every detail. Using structured forms can save you time and reduce errors, helping you focus on what truly matters–delivering high-quality work.

In this guide, we’ll explore how to access and use a reliable billing form that can be easily adapted to suit your needs. These resources are designed to ensure that every transaction is documented professionally, keeping your records clear and your clients satisfied. By streamlining the billing process, you also improve your workflow, making administrative tasks simpler and less time-consuming.

Free Construction Invoice Template PDF

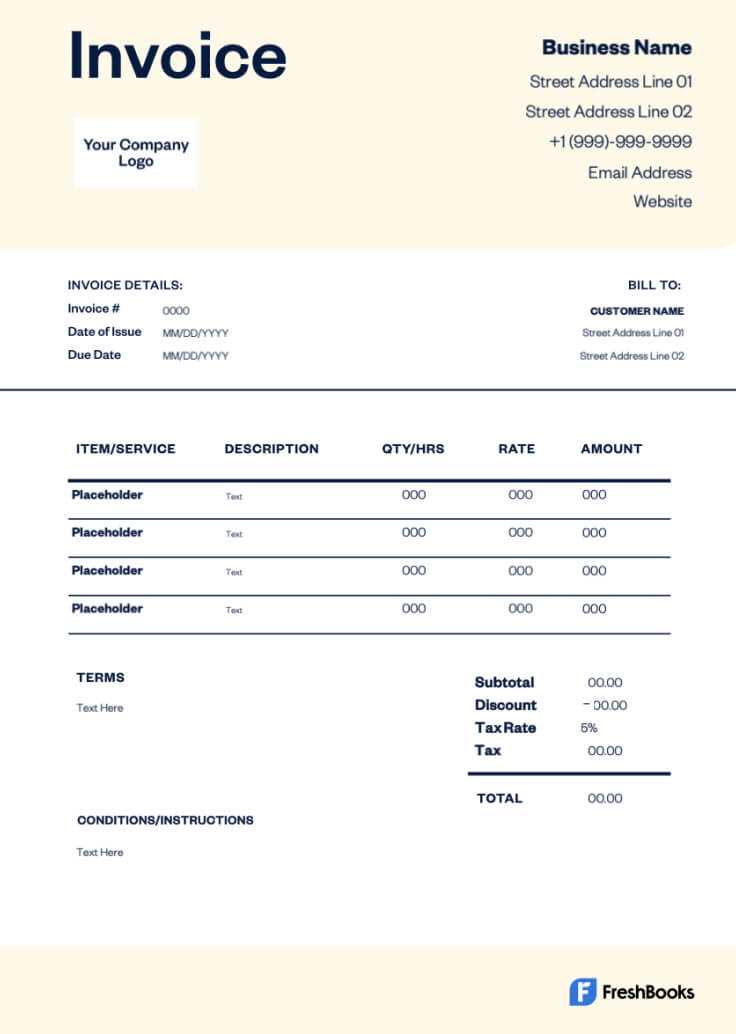

When it comes to keeping your business organized and ensuring timely payments, having a well-structured document to outline project details is essential. Such documents help you stay professional and make the billing process much smoother. By using a downloadable, ready-to-use form, you can save time on administrative tasks and focus more on the work at hand.

These forms can be easily customized to suit the specifics of each job. You simply need to fill in the relevant information, such as services provided, rates, and terms of payment. This approach helps avoid errors, making the process of requesting payment more straightforward for both you and your client.

Key Advantages of Using a Standardized Billing Document

Standardized forms provide consistency across all your client interactions, improving your credibility and efficiency. Some benefits include:

- Quick completion for every project

- Reduction of errors and misunderstandings

- Ability to track payments and outstanding balances

- Increased professionalism and client trust

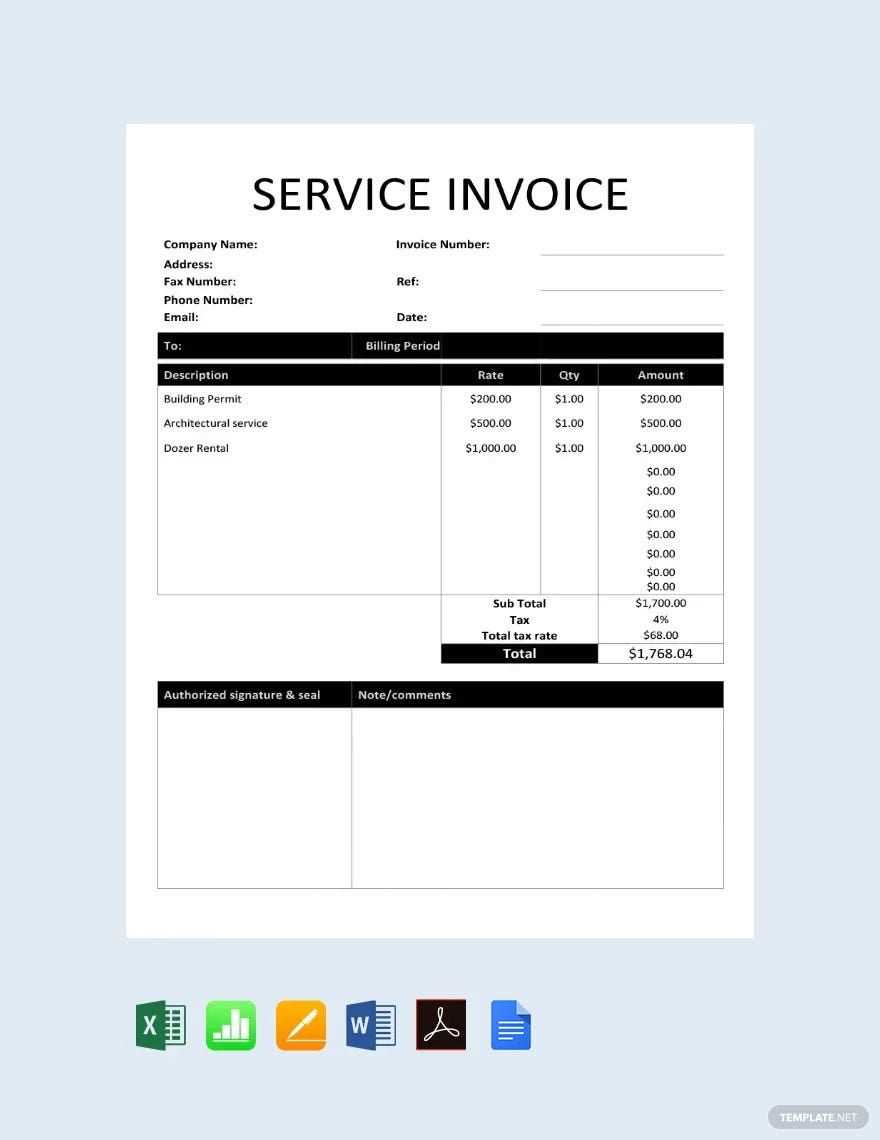

How to Customize and Use the Form

Once you’ve downloaded the appropriate document, it’s important to make sure it fits your specific business needs. Here are the basic sections you’ll encounter and how to adjust them:

| Section | What to Include | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Name, address, and contact details of the client | ||||||||||||||||||||||||||||||||||||||||

| Job Description | Details about the work performed or mate

Why Use a Construction Invoice TemplateHaving a well-organized document for requesting payment is essential for maintaining a smooth workflow and ensuring clear communication with clients. By utilizing a structured form, you can streamline the process of billing, ensuring that no important details are missed. This not only saves time but also enhances the professionalism of your business transactions, leading to better client relationships and faster payments. Instead of creating a new document from scratch for every job, a standardized form can be easily adapted to suit each unique project. With all the necessary fields in place, it simplifies the process of entering key details such as the scope of work, payment terms, and itemized costs. This helps avoid confusion and errors, ensuring you’re paid accurately and promptly.

|