Free Commercial Invoice Template for Efficient Billing

Managing financial transactions accurately and promptly is essential for maintaining smooth operations in any business. Having the right documents in place helps ensure that payments are processed correctly and that you maintain clear records. With the right tools, you can streamline your billing process and save valuable time.

Creating well-organized payment documents is crucial, and digital solutions provide the flexibility to customize and adapt these documents for different business needs. Whether you’re handling a small order or dealing with multiple clients, using structured forms can help you avoid common errors and delays.

By using pre-designed formats, businesses can ensure consistency across transactions, while also reducing the chance of mistakes. These tools offer a professional appearance and ensure that all necessary details are included, making the billing process both efficient and reliable.

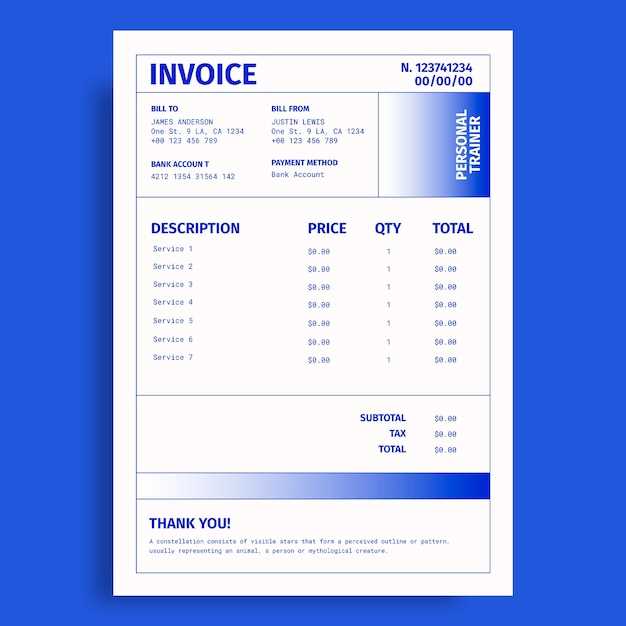

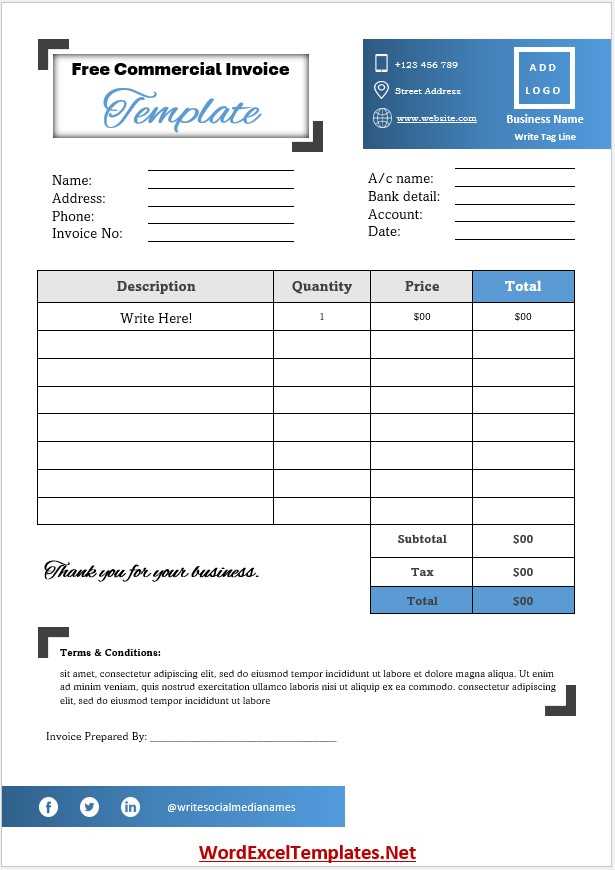

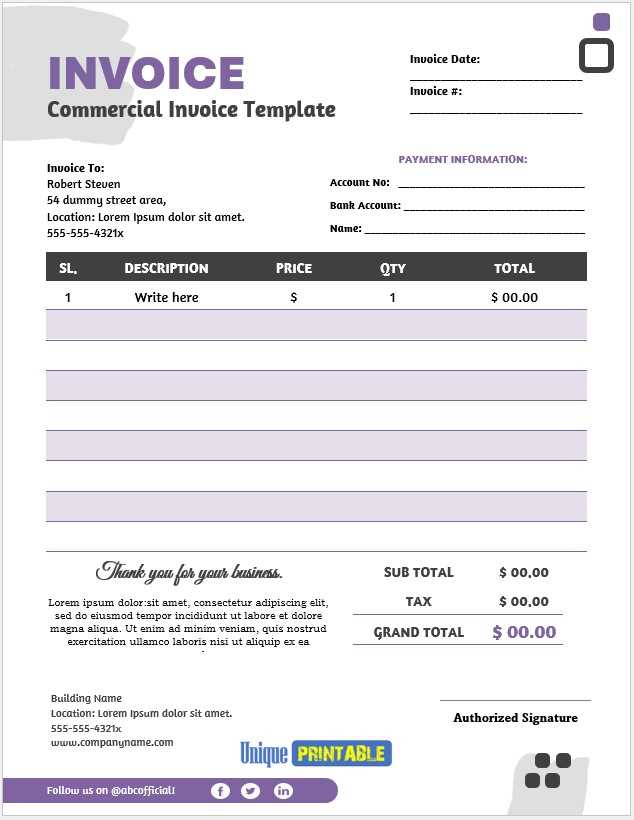

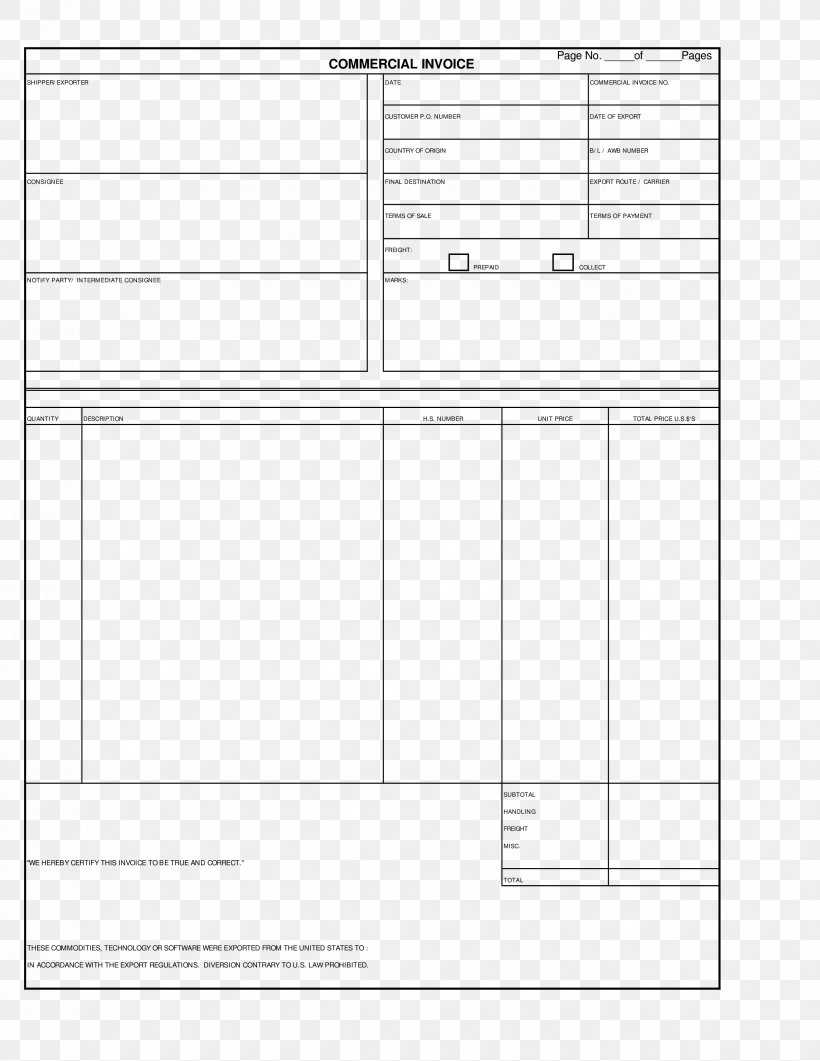

Free Commercial Invoice Template

Having access to the right documentation tools can significantly simplify the billing process for any business. Utilizing pre-formatted documents allows for quick adjustments and consistent organization across transactions. These forms provide the necessary structure for invoicing, ensuring that all essential details are included to avoid confusion and delays in payment.

Using a well-designed structure offers several advantages:

- Consistency in record keeping

- Reduction of errors in financial documents

- Time-saving customization options

- Professional appearance for clients

- Easy tracking of payment terms and amounts

By implementing these structured documents, businesses can focus more on their core operations while ensuring their financial records are clear, accurate, and compliant with legal requirements. Adopting such solutions helps businesses remain organized, ultimately improving cash flow and client relations.

Why Use a Commercial Invoice Template

Adopting structured billing documents provides a streamlined approach to managing transactions, ensuring that all necessary details are included and formatted consistently. Using pre-designed documents reduces the risk of mistakes and saves valuable time, allowing businesses to focus on core activities rather than spending time creating documents from scratch.

Here are some reasons to consider using structured forms:

- Efficiency: Ready-to-use formats allow for quick creation, saving time on repetitive tasks.

- Accuracy: Pre-defined sections help ensure that all essential information is included, minimizing errors.

- Consistency: Standardized formats maintain uniformity across all billing records, promoting professionalism.

- Legality: Ensures compliance with legal requirements for business transactions and record-keeping.

- Ease of Use: Simple to customize for different clients and services, making it adaptable to various business needs.

Incorporating these documents into your business operations will not only enhance the professionalism of your communication but also improve the efficiency of your financial processes.

Key Features of Invoice Templates

Using structured billing documents offers a range of benefits that can improve the accuracy and professionalism of business transactions. These documents typically include various essential features that help businesses organize and present payment information clearly, while ensuring compliance with industry standards.

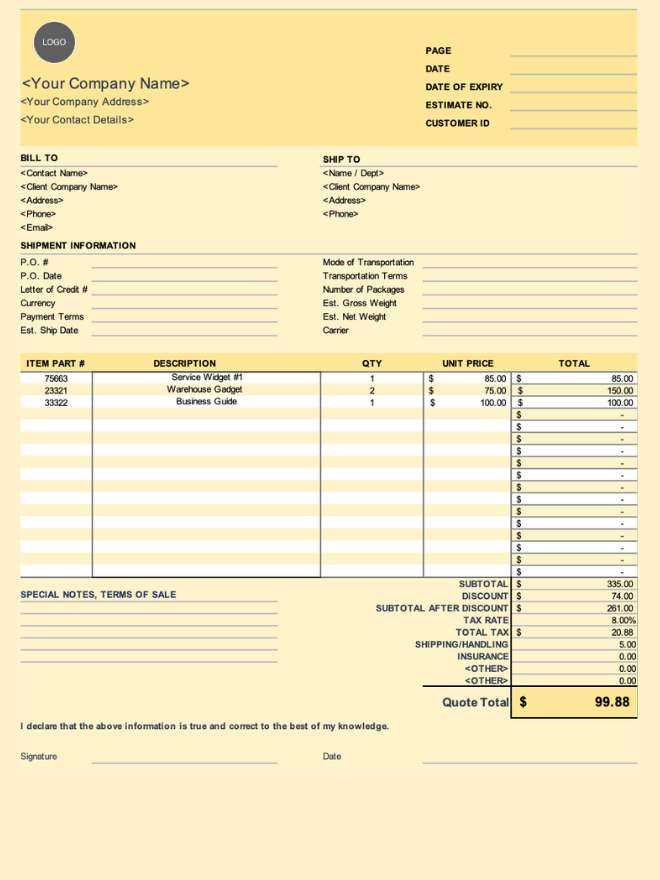

Here are the key features commonly found in these pre-designed forms:

- Predefined Sections: Clear fields for item descriptions, quantities, prices, and totals ensure that all relevant details are captured.

- Customizable Design: The ability to adjust sections and layouts based on specific needs makes the document adaptable to different business models.

- Automatic Calculations: Some forms include built-in calculation tools, allowing automatic totals and taxes to be applied, reducing manual errors.

- Professional Formatting: A polished, easy-to-read layout presents a professional image to clients, contributing to business credibility.

- Payment Terms and Due Dates: Clearly stated terms, including payment deadlines, help set expectations and promote timely payments.

These features not only help streamline the billing process but also provide clarity and consistency, ensuring that both businesses and clients are aligned in their expectations and transactions.

How to Customize Your Invoice

Customizing your billing document is essential for tailoring it to your specific business needs. Whether you need to add your company logo, adjust the layout, or modify sections for different services, the ability to personalize your forms ensures that all important information is presented clearly and professionally. Customization also allows you to incorporate any unique business requirements, such as specific payment terms or delivery details.

Here are some key areas to consider when adjusting your billing document:

- Company Details: Include your business name, address, and contact information at the top of the document.

- Client Information: Ensure there is space to add the client’s name, address, and contact details to maintain accurate records.

- Item Descriptions: Adjust the format to fit different types of goods or services you’re offering, ensuring each line item is clearly described.

- Payment Terms: Specify your preferred payment methods, deadlines, and any late fees to make payment expectations clear.

- Branding: Incorporate your company logo, colors, or fonts to create a consistent look and reinforce your brand identity.

By customizing your document, you ensure it meets your business’s unique needs, all while maintaining a professional appearance and promoting smooth, organized transactions.

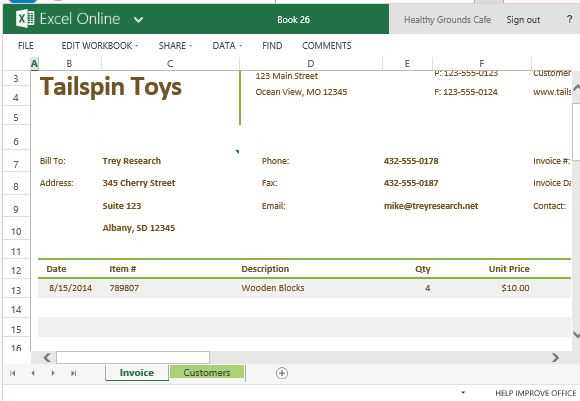

Benefits of Digital Invoicing Tools

Switching to digital tools for creating and managing payment documents can bring significant advantages to businesses of all sizes. These tools streamline the billing process, reduce manual effort, and ensure more accurate record-keeping. The ability to generate, send, and track transactions electronically offers numerous time-saving benefits that contribute to overall efficiency and professionalism.

Time and Cost Savings

Using digital tools can help businesses save both time and money. By automating tasks like calculation and formatting, these tools eliminate much of the manual effort involved in creating traditional documents. Additionally, electronic delivery reduces postage costs and the time spent waiting for paper-based communication.

Improved Accuracy and Organization

Automated systems significantly reduce the chances of human error. Digital tools often include built-in checks for common mistakes, such as incorrect pricing or missing fields. With clear and organized layouts, businesses can easily store and retrieve past documents, ensuring that records are maintained in a more systematic way.

Here are some other advantages of digital invoicing tools:

- Easy Customization: Quickly adjust the document to meet specific needs without starting from scratch.

- Faster Payment Processing: Clients can receive and process bills instantly, speeding up payment cycles.

- Better Tracking: Monitor payment status and follow up on overdue amounts more efficiently.

- Environmental Impact: Reducing the use of paper contributes to sustainability efforts.

- Security: Digital documents can be encrypted and stored securely, minimizing the risk of loss or fraud.

Incorporating digital tools into your billing process enhances the overall operation, offering a more reliable and efficient approach to managing finances.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s important to avoid certain common errors that could lead to confusion or delays in payment. Simple mistakes can cause misunderstandings with clients, disrupt cash flow, and even affect business reputation. By being mindful of these issues, you can ensure that your financial records are accurate and professional.

Here are some common mistakes to watch out for:

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s contact details are accurate. Incorrect addresses or phone numbers can delay communication and payments.

- Unclear Payment Terms: Not clearly stating payment deadlines or methods can lead to delays. Specify exactly when payment is due and any penalties for late payments.

- Incomplete Descriptions: Failing to clearly describe products or services can cause confusion. Provide a detailed list with clear terms to avoid misunderstandings.

- Errors in Pricing: Double-check that prices and totals are correct before sending. Miscalculations can damage trust with clients and lead to disputes.

- Neglecting Taxes: Forgetting to add applicable taxes can result in an incomplete or incorrect final amount. Always ensure that all taxes are included where applicable.

Avoiding these simple errors helps maintain professionalism and ensures smooth, timely payments from your clients.

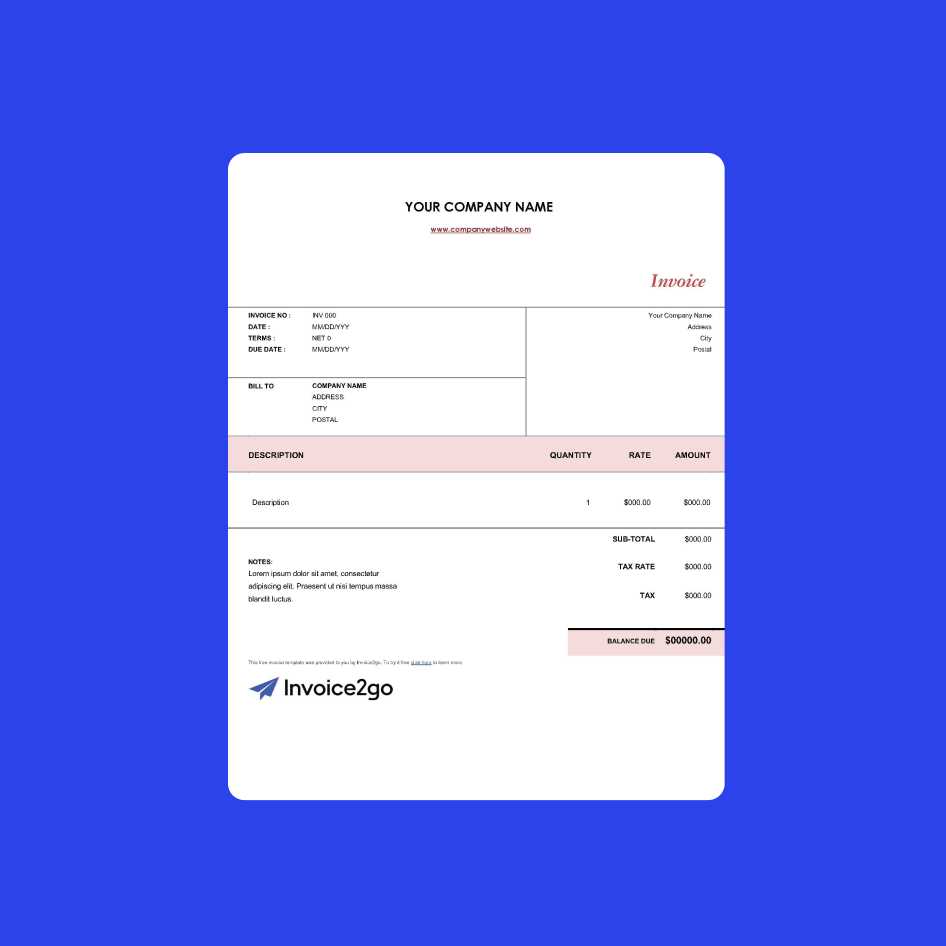

How to Include Taxes on Invoices

Including taxes correctly in billing documents is crucial for maintaining compliance with tax laws and ensuring transparency in business transactions. Accurately calculating and displaying taxes can help avoid misunderstandings with clients and ensure that the correct amounts are paid. It is important to clearly indicate tax rates and the total amount charged, so both parties are on the same page.

Understanding Tax Rates

Before including taxes on a billing document, you need to understand the applicable tax rates for your products or services. Tax rates vary by location, industry, and the type of goods or services being sold. Once the correct rate is identified, it can be easily calculated and added to the final total.

How to Display Taxes

There are various ways to display taxes on a billing document. The most common approach is to list the tax amount as a separate line item, showing both the rate applied and the total tax amount charged. This method provides clarity and helps clients understand how the tax was calculated.

| Description | Amount |

|---|---|

| Product/Service | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total | $110.00 |

By including the tax information in this format, clients can quickly see the base price, the applicable tax, and the total amount due. This transparency builds trust and ensures that both businesses and clients are clear on the charges involved.

Understanding Payment Terms in Invoices

Payment terms are an essential aspect of any billing document, as they outline the expectations and conditions under which payments are to be made. Clearly defined payment terms help set the tone for business transactions, ensuring that both the service provider and the client understand when and how payments should be processed. Establishing these terms upfront reduces misunderstandings and helps avoid delays in receiving payment.

Common Payment Term Options

Different businesses may use a variety of payment terms based on their needs and industry practices. Below are some common terms:

- Net 30: This means payment is due 30 days from the date of the document. It is one of the most common terms used in business transactions.

- Due Upon Receipt: Payment is expected immediately upon receiving the document. This is often used for one-time transactions or when working with new clients.

- Advance Payment: The client is required to pay a portion or the full amount before any services are rendered or goods are delivered.

- Installments: Payment is split into multiple parts, typically over an agreed period of time. This is commonly used for large or ongoing projects.

Why Payment Terms Matter

Setting clear payment terms ensures that both parties are aware of their obligations. For the business, it helps maintain steady cash flow and reduces the risk of late payments. For the client, it provides transparency and clarity on when they need to make payments and what penalties (if any) may apply for late payment.

Clearly communicating these terms in billing documents is crucial to ensure that business transactions proceed smoothly and professionally, fostering positive relationships between businesses and clients.

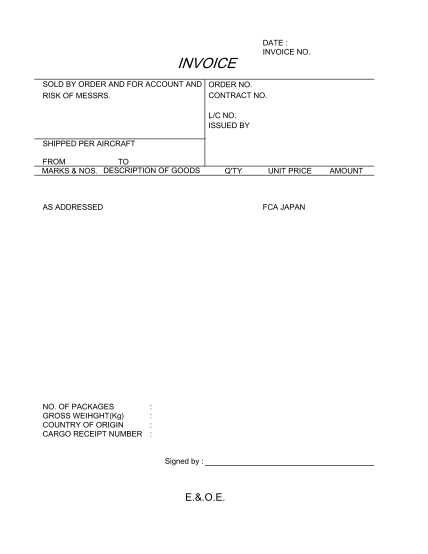

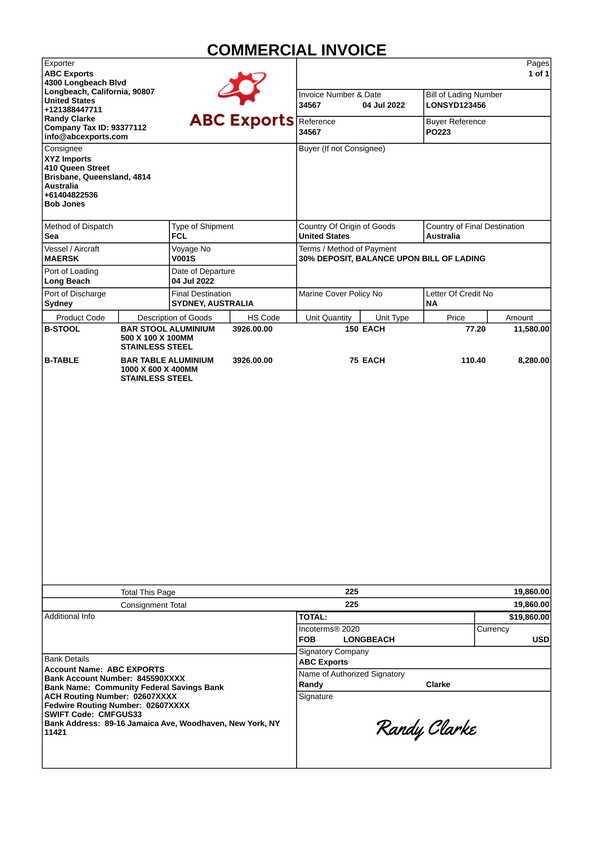

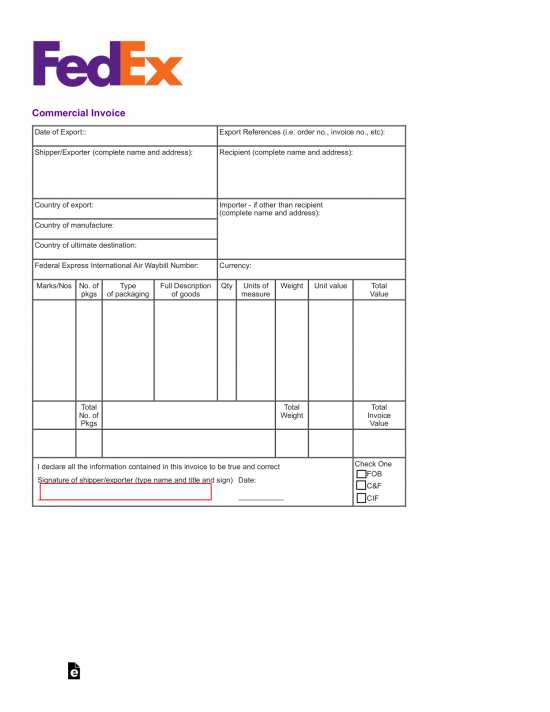

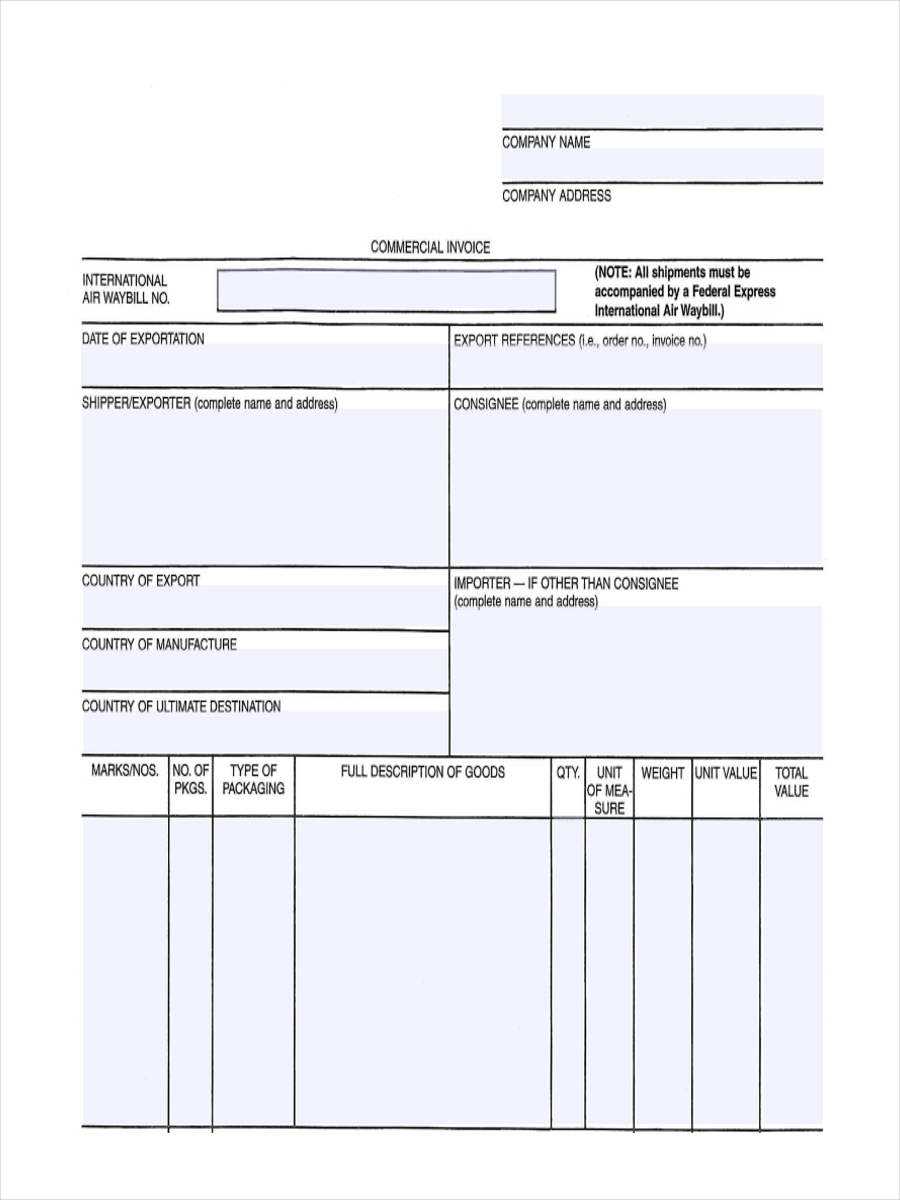

Legal Requirements for Commercial Invoices

Every business transaction requires certain legal details to be included in the billing document to comply with local and international laws. These details ensure that both parties are protected and that the transaction is legally binding. Understanding these legal requirements is essential for avoiding disputes, fines, and ensuring that your business operations follow established regulations.

In most cases, businesses are required to include specific information in their documents, such as the names and addresses of both the seller and the buyer, a description of the goods or services provided, and the agreed payment terms. The presence of this information helps clarify the nature of the transaction, establishes the obligations of each party, and allows for proper record-keeping for taxation and legal purposes.

Additionally, certain regions or industries may have specific laws regarding the format, language, or even currency to be used in official billing documents. Businesses that deal internationally must also ensure that their documents comply with customs regulations and provide adequate details for cross-border transactions.

How to Save Time with Templates

Using pre-designed formats for creating business documents can significantly speed up your workflow, saving you both time and effort. Instead of starting from scratch every time, templates allow you to focus on key details, streamlining the creation process. By providing a structured format, these tools eliminate the need to repeatedly enter the same information, making the process more efficient.

Efficiency Through Standardization

By using a consistent format, you can quickly adapt to various situations without needing to redesign each document. This standardization not only ensures that all necessary information is included but also reduces the chance of mistakes, as the structure remains the same every time. Whether you’re sending invoices, estimates, or contracts, having a reliable format allows you to work faster and with greater accuracy.

Customizable for Different Needs

Templates can be tailored to fit specific business requirements, ensuring that they meet your unique needs while saving you time on customization. Whether you need to add client details, payment terms, or product descriptions, these formats provide flexibility. Once a template is set up, it can be reused for various transactions, making it a time-saving tool that grows with your business.

By utilizing a pre-designed structure, you can streamline repetitive tasks and maintain a high level of consistency across all your business documents. This not only saves valuable time but also helps to maintain a professional appearance in all your dealings.

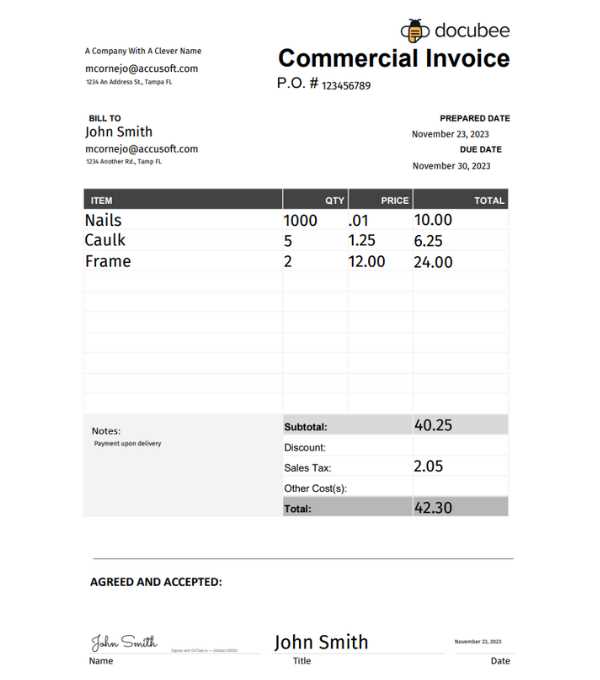

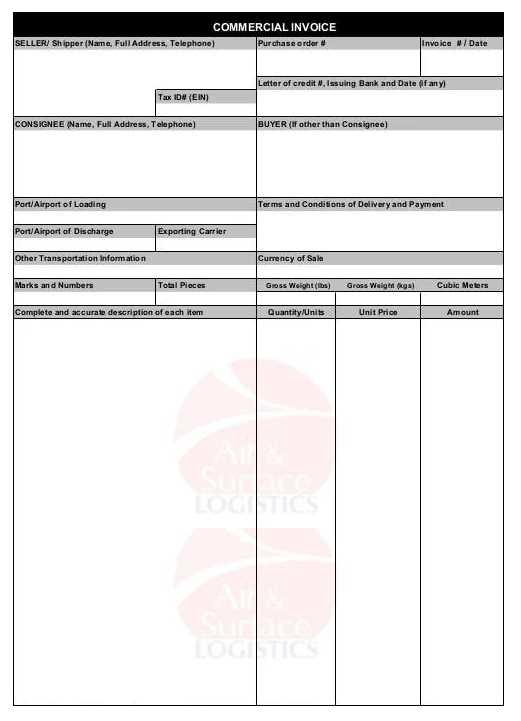

Best Practices for Invoice Formatting

Properly formatting business documents ensures clarity, professionalism, and smooth transactions. When the layout is well-structured, it helps both the sender and recipient quickly locate important information, such as amounts due, payment terms, and contact details. Clear formatting can also reduce confusion and disputes, ensuring that both parties are on the same page regarding the transaction.

Following best practices for document structure includes organizing information logically and using consistent styling throughout. The goal is to create a clean, easy-to-read document that clearly conveys all necessary details. Here are some key guidelines to follow:

| Section | Best Practice |

|---|---|

| Header | Include your business name, logo, and contact information at the top for easy identification. |

| Client Information | Ensure the recipient’s details, such as name, address, and contact information, are clearly listed. |

| Details of Products/Services | Clearly describe the products or services provided, including quantities, rates, and totals for each item. |

| Amount Due | Provide a clear breakdown of the total amount due, including any taxes, discounts, and the final balance. |

| Payment Terms | State the due date, payment methods accepted, and any penalties for late payment. |

By following these best practices, you can ensure that your documents are not only professional but also functional, making the entire transaction process smoother for both parties involved.

How to Send an Invoice Professionally

Sending a business document in a professional manner is crucial for maintaining positive relationships with clients and ensuring timely payments. The way you send your billing statement reflects on your business practices and sets the tone for the transaction. Ensuring that your message is clear, polite, and properly formatted can improve the likelihood of prompt payment and enhance your professional image.

To send your document professionally, start by choosing the right delivery method. Whether via email, postal service, or an online platform, ensure that your communication is secure and easy to access. Accompany your document with a courteous message that includes a brief explanation of the charges, payment instructions, and the due date.

Additionally, double-check that all the necessary details are included, such as your company’s contact information, the client’s details, a clear breakdown of charges, and the total amount due. This makes it easier for the recipient to review and process the payment without unnecessary delays.

Finally, always follow up if the payment is not received by the due date. A polite reminder can go a long way in ensuring that your accounts remain up-to-date and your business continues to operate smoothly.

Using Templates for Multiple Clients

When dealing with numerous clients, it can be time-consuming to create individual documents from scratch each time. Utilizing pre-designed structures for your business transactions can greatly simplify this process. By using a flexible format, you can easily adapt the details for each client without losing consistency or accuracy in your communications.

These ready-made formats allow you to maintain professionalism while saving time on repetitive tasks. You can quickly input the specific details such as the client’s name, the products or services provided, and the agreed payment terms. This streamlined approach helps you manage a large volume of transactions efficiently.

Moreover, using these formats ensures that all necessary information is included in every document. This consistency not only reduces the risk of errors but also reinforces your company’s professional image. By adapting the format for multiple clients, you can quickly generate accurate and clear records without needing to customize the layout each time.

Whether you’re working with small or large businesses, the flexibility of these tools ensures that your billing process remains efficient, organized, and consistent across all transactions.

How to Track Payments Efficiently

Keeping track of payments is essential for maintaining healthy cash flow and ensuring that your business runs smoothly. Efficient tracking helps you stay organized, avoid overdue payments, and manage your finances effectively. By implementing a structured approach, you can quickly identify outstanding amounts and take action when necessary.

To track payments effectively, start by recording all transactions in a centralized system. Whether using accounting software or a simple spreadsheet, ensure that each payment is logged with important details such as the amount, payment date, client name, and any reference numbers. This will provide you with an easy-to-access record for future reference.

Another important aspect is to set clear payment terms and reminders for clients. When a payment is due, make sure to send polite reminders in advance. If a payment is delayed, follow up promptly to maintain a professional relationship and encourage timely settlement.

By regularly reviewing your payment records and using automated tools, you can significantly reduce the risk of missed payments and improve your financial management processes.

Free Templates vs Paid Options

When choosing a structure for your business documents, you may encounter both free and paid options. Both types have their own advantages, but understanding the key differences can help you decide which option best suits your needs. While free resources might seem like an easy choice, paid options often offer enhanced features and greater flexibility for long-term use.

Advantages of Free Structures

Free formats can be a great starting point for businesses just getting off the ground or those with limited budgets. They are easy to access and typically require little to no cost. Some benefits include:

- Cost-effective: No financial investment required.

- Simple to use: Basic features that meet the needs of smaller businesses.

- Quick setup: Immediate access to a range of ready-made designs.

Benefits of Paid Structures

Paid solutions, on the other hand, can provide a more comprehensive set of tools, with customization options and better support. For businesses with more complex needs or those looking for professional-level functionality, these options offer several key advantages:

- Customization: More flexibility to tailor the design to your specific requirements.

- Advanced features: Tools for tracking, automatic calculations, and integration with other software.

- Customer support: Access to professional assistance if you encounter issues.

Ultimately, the choice between free and paid options depends on the complexity of your business needs, the frequency of use, and the importance of customization in your documents. While free options may work well for startups or small operations, paid solutions can provide valuable features for growing businesses or those with specific requirements.

Invoicing Tips for Small Businesses

For small businesses, efficient billing is a crucial part of maintaining a healthy cash flow. Proper documentation of sales and services helps ensure that payments are received on time and with minimal confusion. By adopting effective strategies and avoiding common mistakes, businesses can streamline their payment processes and reduce financial stress.

Keep Your Documents Clear and Professional

One of the key elements of successful billing is ensuring that your documents are easy to read and understand. A well-structured record not only looks professional but also helps avoid delays caused by confusion. Include all the essential details such as:

- The name and contact information of your business

- Your client’s information

- A clear description of the goods or services provided

- The total amount due and payment terms

Set Clear Payment Terms

Establishing clear payment terms is essential to avoid misunderstandings with clients. Specify when payments are due, whether there are late fees for overdue amounts, and any early payment discounts. You may also want to include accepted payment methods, such as bank transfers, credit cards, or online platforms. This reduces the likelihood of delays and keeps the relationship with your client professional.

By staying organized, clear, and transparent with your billing practices, small businesses can ensure smoother transactions and improved cash flow management.

Choosing the Right Template for Your Business

Selecting the appropriate document format for your business needs is essential to ensure efficient transactions and professional communication with clients. The right layout can simplify the billing process, maintain consistency, and reflect your brand’s identity. Whether you are just starting out or looking to refine your approach, it’s important to choose a structure that aligns with your business type and customer expectations.

Consider Your Business Needs

Before selecting a layout, assess the specific needs of your business. Different industries may require different fields or sections. For example, a service-based business may need to detail labor hours, while a product-based business may focus more on item descriptions and quantities. Think about what information is most important for your clients to understand and ensure that the layout accommodates it clearly.

Customization and Flexibility

Look for a design that allows for customization and adaptability. The ideal structure should be flexible enough to accommodate any special terms, discounts, or multiple currencies if needed. It should also be easy to update and edit as your business evolves, ensuring you can keep everything up to date without hassle. A clean, professional layout combined with the ability to tailor it to your requirements will help maintain smooth operations in your billing process.

Ultimately, choosing the right format is about finding a balance between functionality and professionalism. By selecting the best-suited structure, you ensure that your business communicates clearly with clients and keeps the financial aspects running smoothly.