Free Catering Invoice Template for Quick and Easy Billing

Managing finances can be one of the most time-consuming tasks for any service provider. When it comes to charging clients, having a well-organized and professional approach is essential for smooth operations. By using the right tools, you can simplify the entire process, save time, and avoid errors that could affect your cash flow.

For those in the food and event planning industries, accurate financial documentation is key to maintaining a good relationship with clients. Whether you’re managing small events or large gatherings, it’s important to ensure that your payment requests are clear, detailed, and easy to understand. This is where a customizable and pre-designed document becomes an invaluable asset.

With the right solution, you can quickly generate professional statements that reflect all the necessary details of the services provided. By streamlining this aspect of your business, you allow yourself more time to focus on what matters most: delivering excellent service to your clients.

Free Billing Document for Your Business

Having a well-structured document for tracking payments is essential for every service-oriented business. Whether you’re working with clients for private events, corporate functions, or other special occasions, a clear and professional payment statement is crucial to ensure transparency and timely compensation. This tool not only enhances your credibility but also streamlines your business operations.

Using a pre-designed, customizable document can save you valuable time. Instead of starting from scratch with every new client, you can focus on the specifics of the service provided, while the framework of the document handles all the necessary details. With just a few modifications, you’ll be able to create accurate and professional payment requests that reflect your brand’s standards.

Why Use a Structured Document?

- Efficiency: Reduces the time spent on billing and reduces the chances of errors.

- Professionalism: Ensures consistency and builds trust with clients.

- Customizability: Allows you to adapt it to different service offerings and client needs.

- Tracking: Helps you keep accurate records of payments and due amounts.

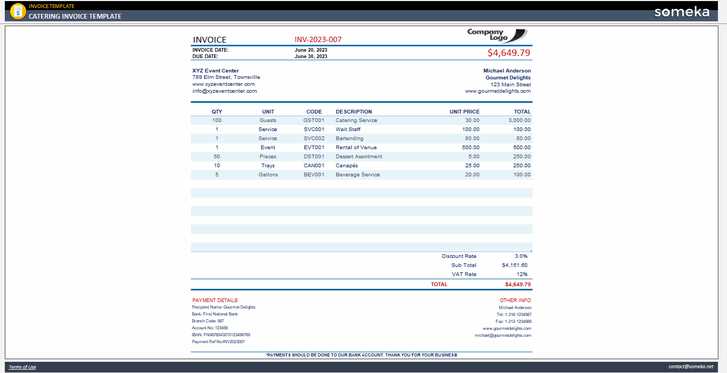

Key Features of an Effective Billing Document

- Client Information: Clearly includes the client’s name, address, and contact details.

- Service Description: Lists all services provided with detailed descriptions and quantities.

- Payment Terms: States the agreed-upon payment due date and any late fee policies.

- Total Amount: Displays a detailed breakdown of costs, including taxes and discounts if applicable.

- Easy Customization: Fields for adjusting details based on specific client needs.

By utilizing a ready-made document, you can quickly generate the necessary paperwork for any event or service, ensuring that your clients are billed accurately and professionally. With just a few edits, you’ll have everything you need to streamline your accounting process and improve overall efficiency in your business.

How to Create Billing Documents Easily

Generating professional and accurate billing statements for your clients doesn’t have to be a complicated or time-consuming task. With the right approach and the right tools, you can create clear, detailed financial documents in just a few simple steps. This will not only help you save time but also improve your business’s efficiency and professionalism.

By using a structured format, you can easily input the necessary information and ensure that every detail is accounted for. The process can be simplified significantly, especially when you have a framework that allows for quick adjustments. This way, you can focus more on providing excellent services and less on administrative work.

Step-by-Step Guide to Creating Billing Statements

- Step 1: Gather client details including name, address, and contact information.

- Step 2: List the services provided, specifying quantities and individual prices.

- Step 3: Include payment terms, such as due dates and any late fee policies if applicable.

- Step 4: Calculate the total amount due, factoring in any discounts or additional charges.

- Step 5: Review the document for accuracy before sending it to your client.

Using Pre-Made Tools for Faster Creation

- Pre-designed Formats: Use ready-mad

Why You Need a Billing Document Framework

Managing finances in a service-based business can become overwhelming without the proper tools. Having a structured approach to creating financial statements is essential for maintaining accuracy and professionalism. When you’re handling multiple clients and events, a ready-made document can simplify the process, ensuring that you stay organized and efficient in your operations.

Without a well-designed framework, it’s easy to overlook crucial details, such as pricing, client information, or payment terms. Using a pre-structured solution minimizes the risk of errors and guarantees that all necessary information is included every time you generate a payment request. This not only improves your workflow but also fosters a sense of trust with clients, as they will appreciate the clear and consistent documentation.

Benefits of Having a Structured Document

- Consistency: A standardized approach ensures every client receives the same professional presentation.

- Time-Saving: Eliminate the need to create a new document from scratch for each client.

- Accuracy: With predefined fields, it’s easier to capture all relevant details and avoid mistakes.

- Professionalism: A polished document reflects well on your business and enhances your reputation.

How It Helps with Client Relationships

- Transparency: Clearly shows all charges and services provided, reducing misunderstandings.

- Trust: Clients appreciate receiving clear and organized payment requests.

- Easy Tracking: Helps you monitor outstanding payments and keep accurate records for your business.

In the long run, using a well-organized document not only improves efficiency but also boosts client satisfaction, ensuring that your business runs smoothly and professionally.

Benefits of Using a Billing Document Framework

Adopting a standardized financial document for your business offers numerous advantages that help streamline processes and maintain professionalism. By using a pre-designed structure, you can ensure that every statement you send is clear, consistent, and free of errors. This not only saves you valuable time but also helps you manage your finances more effectively.

With a well-organized system in place, you reduce the risk of overlooking important details and provide your clients with accurate, transparent information. The simplicity and ease of use offered by a pre-designed framework can transform how you handle payments and documentation, leading to smoother operations and improved customer satisfaction.

Key Advantages of Using a Pre-Designed Document

- Time Efficiency: Quickly generate statements without starting from scratch for each client.

- Consistency: Ensure a uniform appearance and structure for every financial document you send out.

- Accuracy: Easily include all necessary details, reducing the chance of errors or missing information.

- Professional Image: A polished document helps reinforce your business’s credibility and fosters trust with clients.

How It Simplifies Financial Management

- Clear Tracking: Helps you monitor payments and due dates, making follow-ups easier and more efficient.

- Easy Adjustments: Quickly modify or update information for each client, whether it’s a new service or an updated rate.

- Less Administrative Work: Spend less time on paperwork and more time focusing on your core services.

In the long run, using a structured approach to creating financial documents allows your business to run more smoothly, ensuring that clients are billed accurately and on time. This leads to fewer payment issues and better relationships with your clients, enhancing both efficiency an

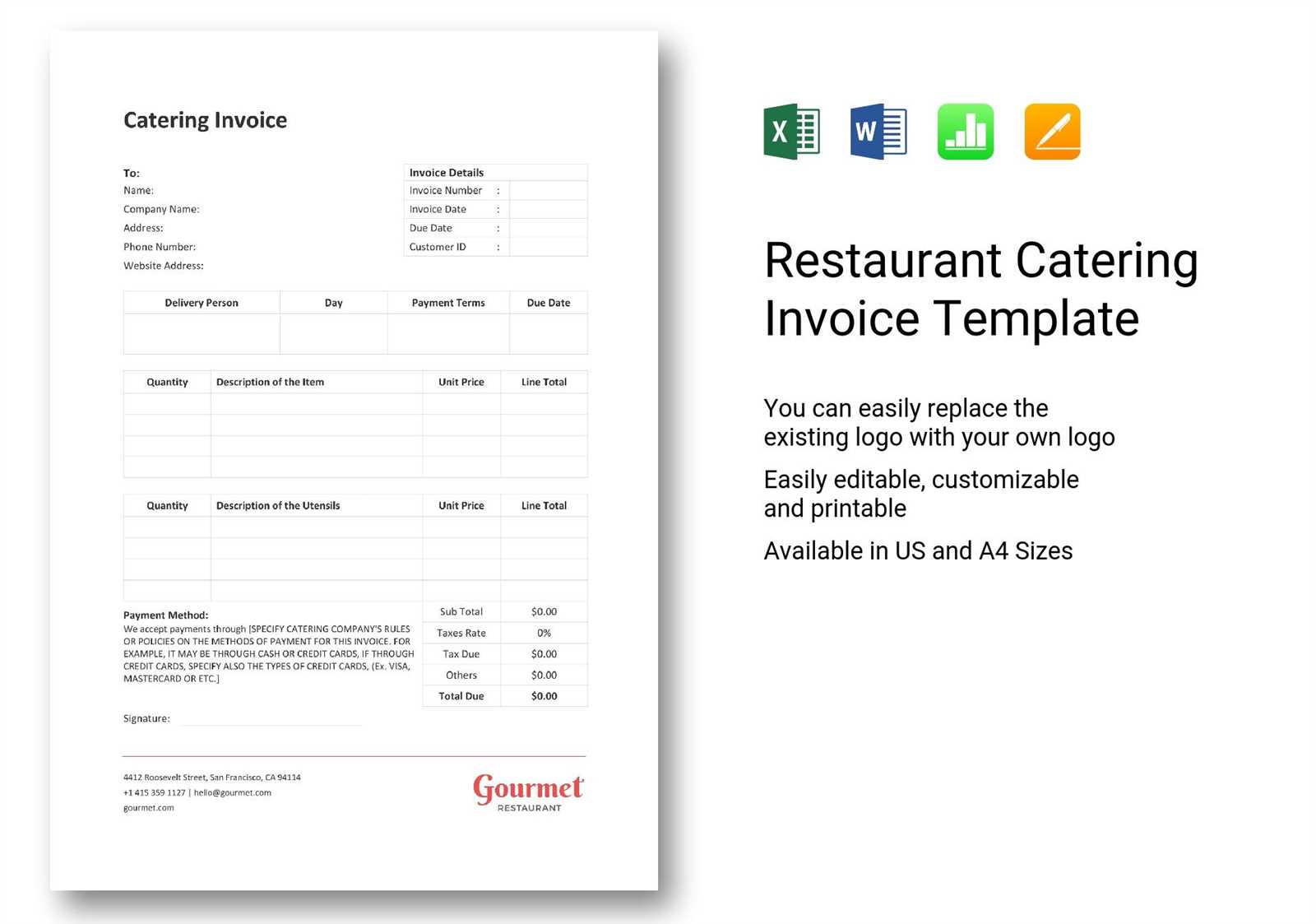

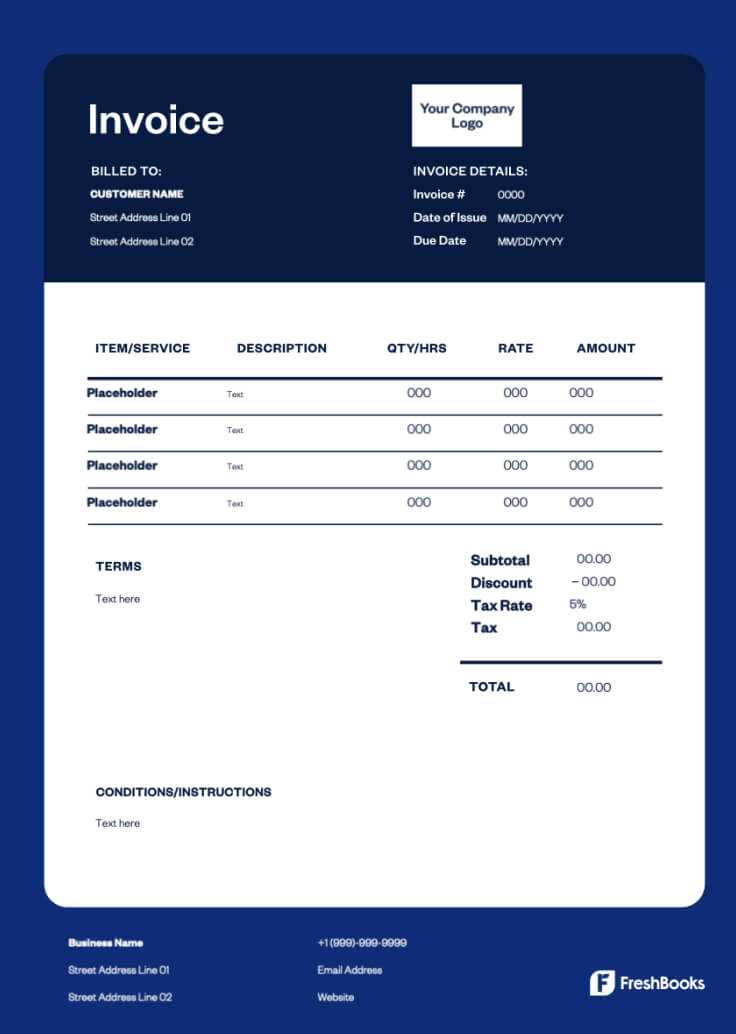

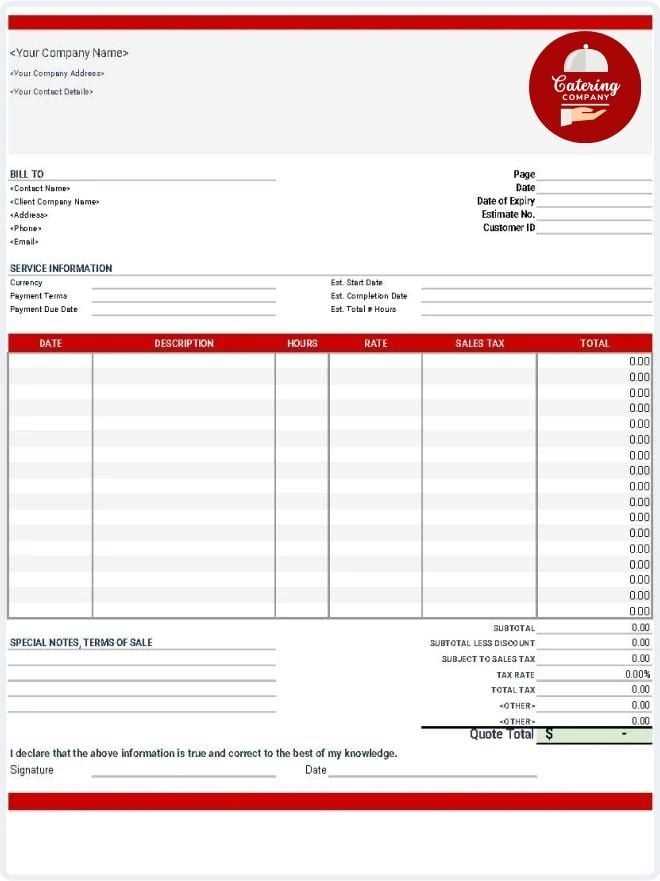

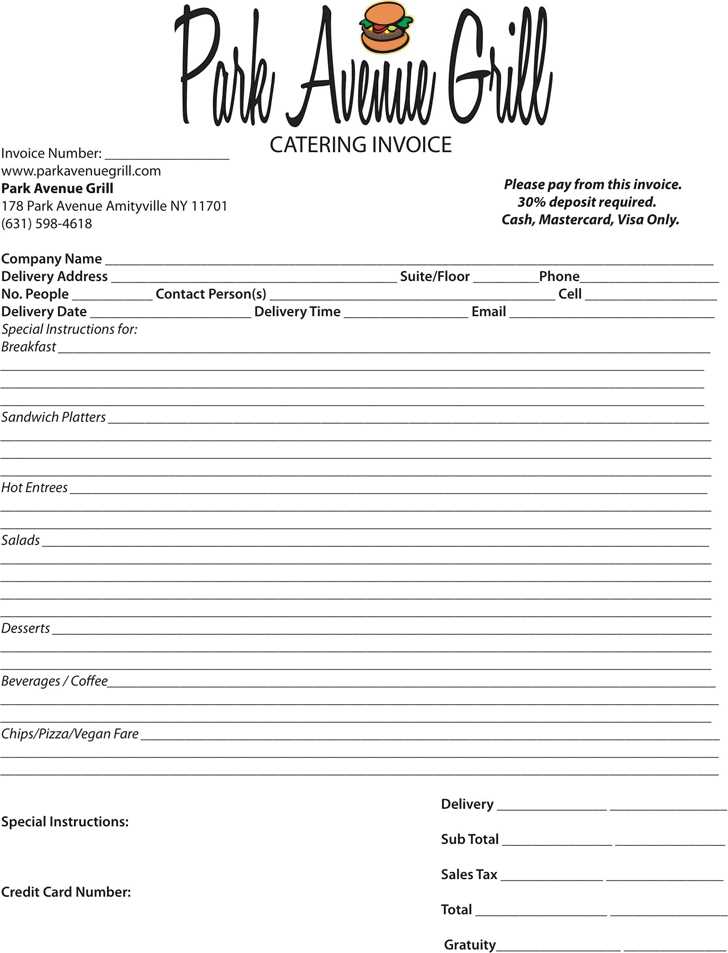

Customize Your Billing Document Framework

Every business has its unique needs, and your financial documents should reflect that. Customizing your payment statements ensures that they align with your specific services, branding, and client expectations. With a flexible structure, you can easily modify key elements to fit the nature of each job, while maintaining a consistent and professional appearance.

Personalization goes beyond simply adding your business name. It allows you to include important details such as special pricing for certain clients, additional service charges, or unique payment terms. This level of customization not only helps improve the client experience but also ensures that your documents are tailored to your specific business operations.

What You Can Customize

- Client Information: Adjust fields to include more detailed contact information or specific instructions for each client.

- Service Descriptions: Add or remove services as needed, with clear descriptions and prices for each.

- Payment Terms: Modify payment deadlines, discount structures, or late fees to reflect your business agreements.

- Branding: Customize colors, fonts, and logos to match your business identity and create a cohesive look.

How Customization Benefits Your Business

- Professional Appeal: A personalized document creates a stronger impression and showcases attention to detail.

- Client Clarity: Clearly defined terms and services help avoid confusion, ensuring your clients know exactly what to expect.

- Flexibility: Adapt the document to suit different types of services or special promotions you may offer.

By customizing your billing documents, you can create a more seamless and professional experience for both you and your clients, improving efficiency and reinforcing your brand’s image.

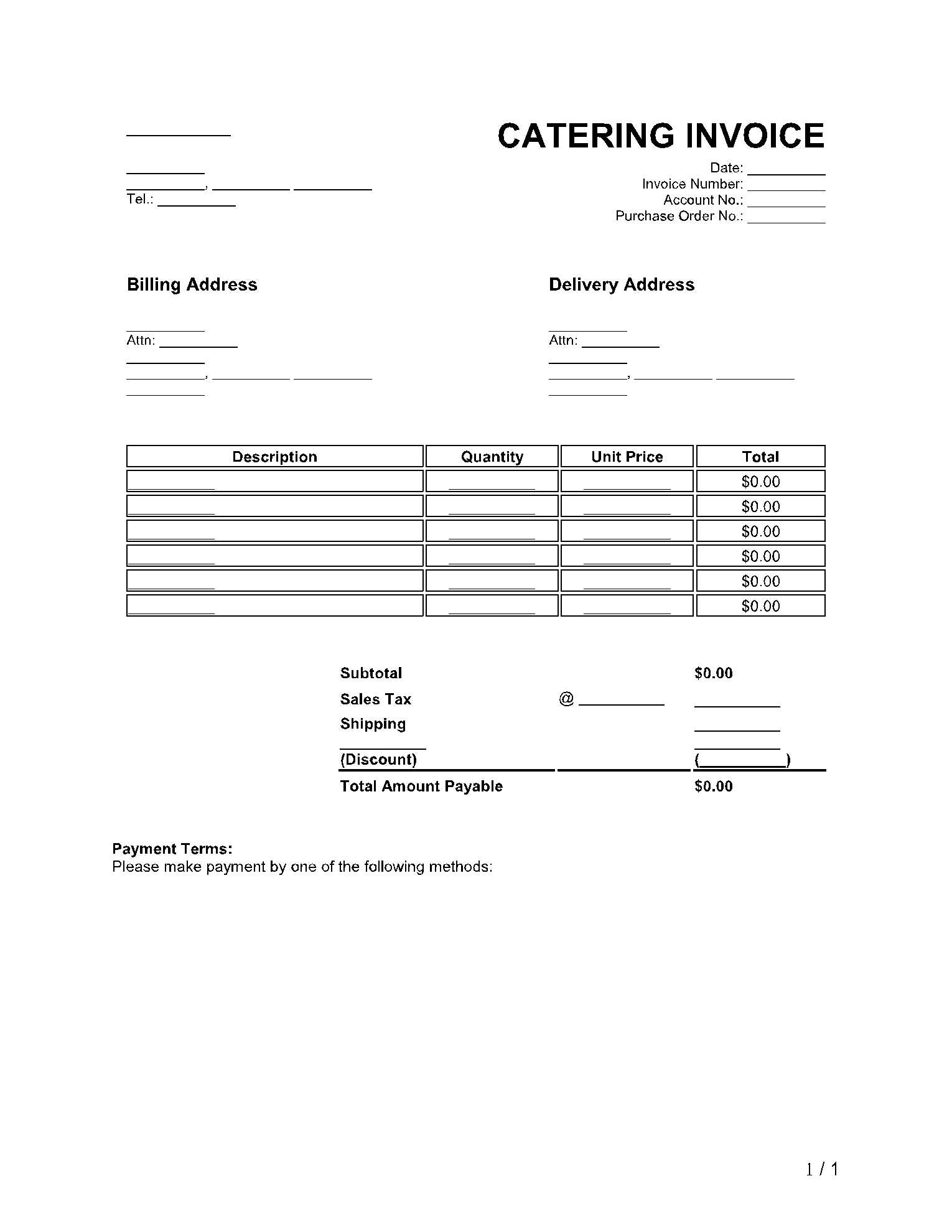

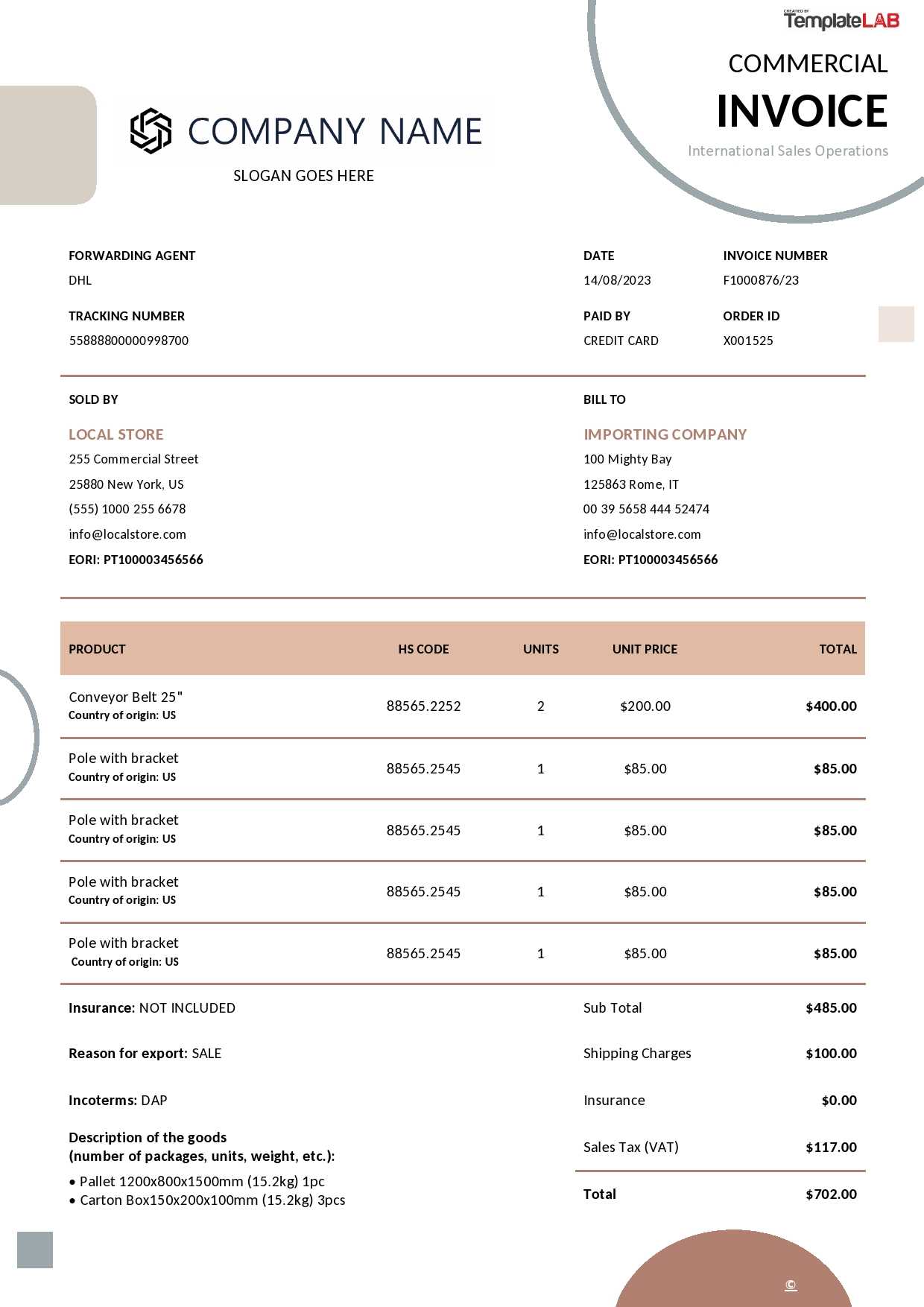

Essential Elements of a Billing Statement

To ensure that your financial documents are complete and effective, it’s important to include all necessary details that help both you and your clients understand the charges and services provided. A well-structured payment request not only facilitates smooth transactions but also helps maintain transparency and professionalism in your business dealings.

Each section of your statement should be clear and precise, making it easy for clients to review the charges, payment terms, and other important information. By including the right components, you can ensure that all aspects of the service are accurately represented and that the client knows exactly what to expect.

Key Components to Include

- Business Information: Include your company name, address, phone number, and email to ensure the client knows how to contact you.

- Client Details: Make sure the client’s name, address, and contact information are clearly stated for identification and future reference.

- Service Breakdown: List the services rendered, along with descriptions and prices, so that each charge is transparent.

- Payment Terms: Clearly define the due date, accepted payment methods, and any penalties for late payments.

- Total Amount Due: Ensure the total sum is easy to find, with a clear breakdown of the individual charges, taxes, and any discounts applied.

Why These Elements Matter

- Clarity: Detailed descriptions and itemized costs help prevent confusion and disputes over charges.

- Professionalism: A complete document with all the necessary components gives your business a polished and reliable image.

- Timely Payments: Clear payment terms and due dates ensure that your clients know when and how to settle their accounts.

By including these essential components in your financial statements, you can enhance both your efficiency and your client relationships, ensuring that every transaction is smooth and well-documented.

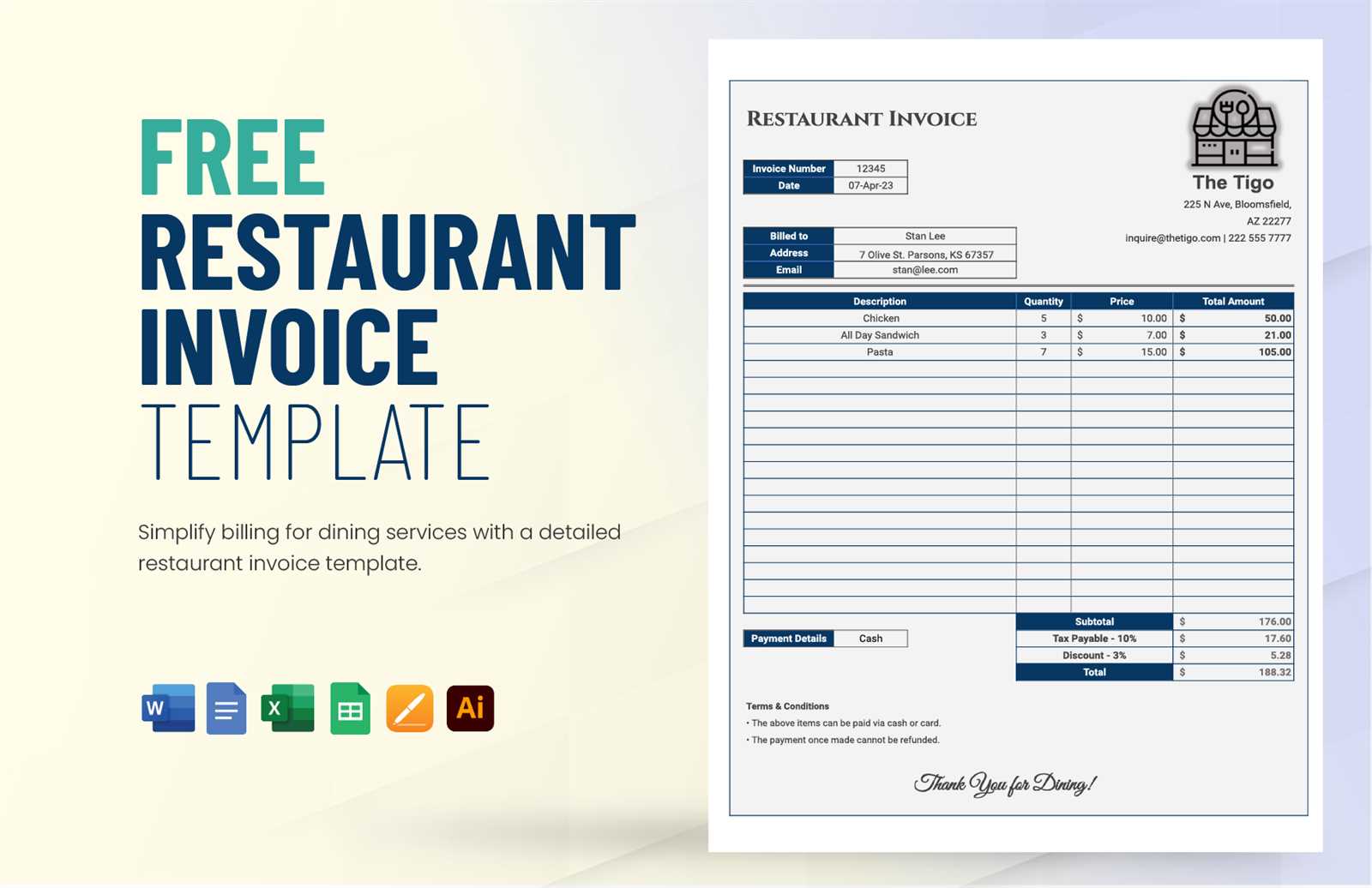

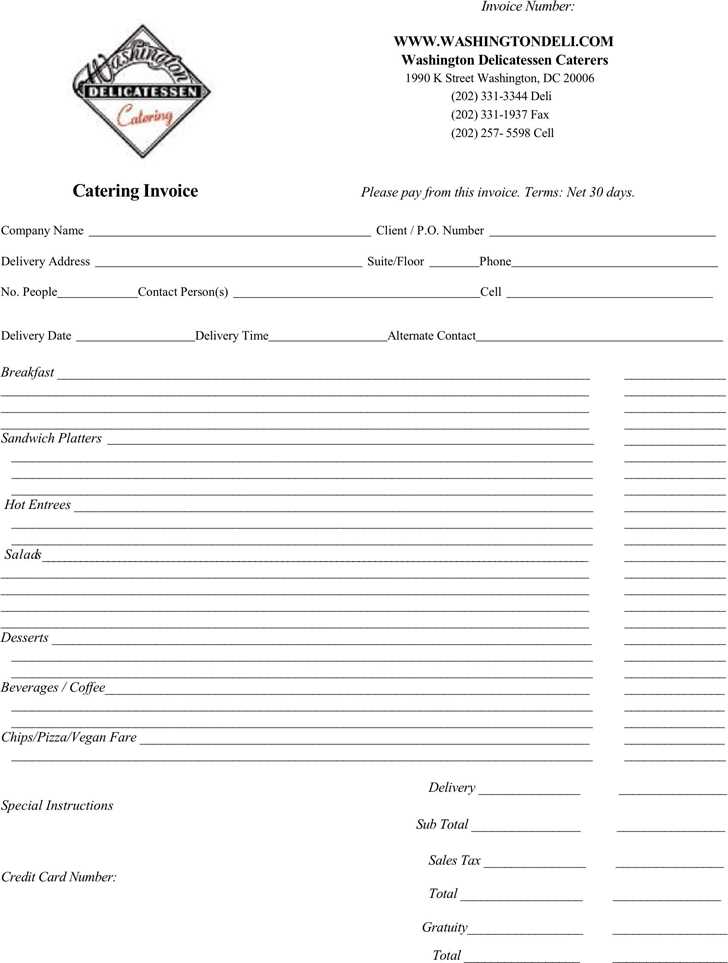

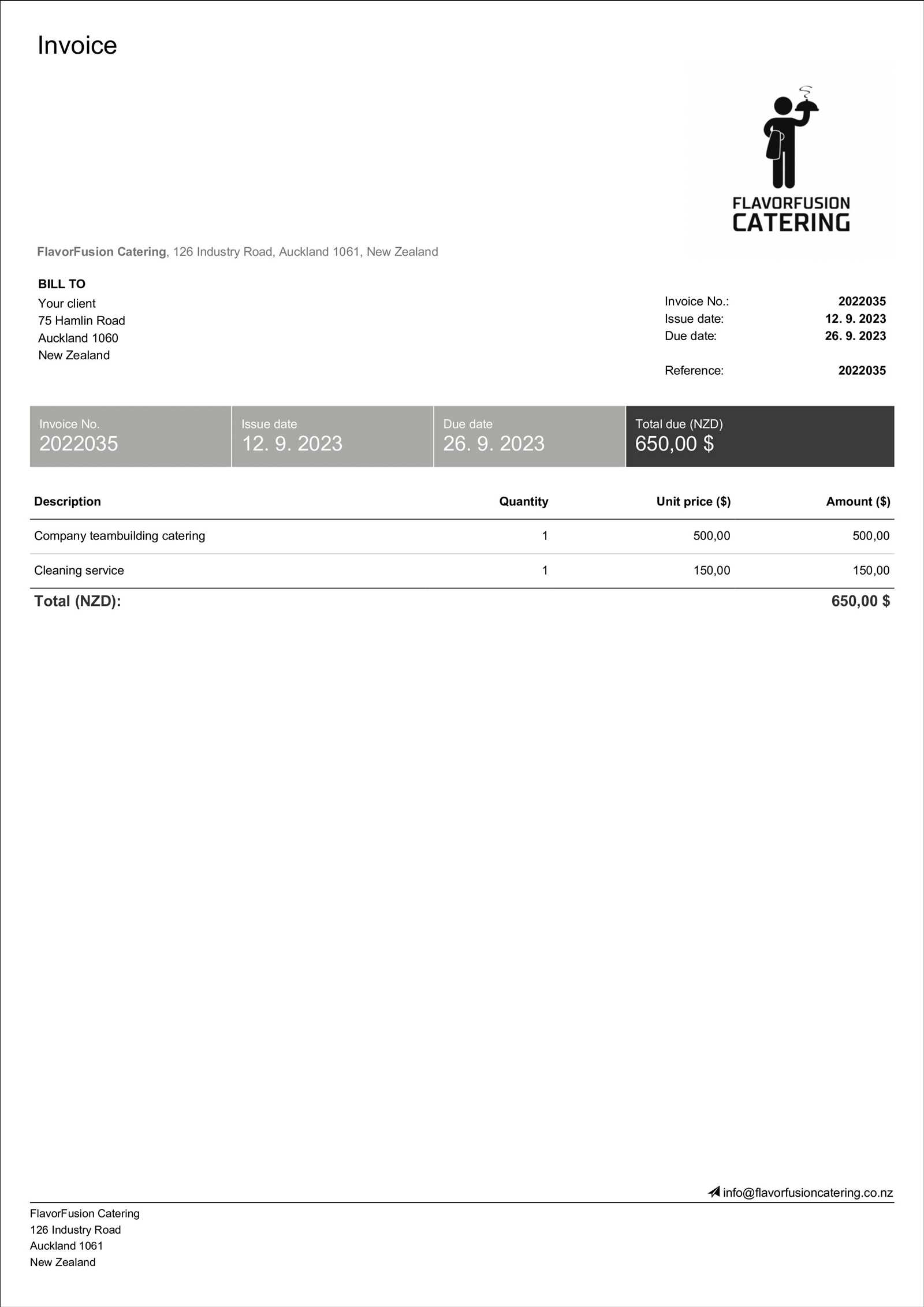

Download a Ready-to-Use Billing Document Now

If you’re looking to streamline your payment process and save valuable time, downloading a pre-designed billing document is an excellent solution. With a well-structured and customizable framework at your disposal, you can easily generate accurate and professional statements for your clients without starting from scratch. This will allow you to focus more on your core services while ensuring that your financial documentation is clear and consistent.

By having an efficient, ready-made tool, you can quickly input the necessary details for each job and have a polished document ready to send in minutes. Whether you’re handling one-time events or recurring services, a reliable structure will ensure your business operates smoothly and professionally.

Getting started is simple–just download the document, fill in your specific details, and you’re all set to begin using it for your next transaction. No need to worry about formatting or missing elements–everything you need is already in place to ensure your documents are both comprehensive and easy to understand.

Tips for Accurate Billing Statements

Creating accurate financial documents is essential for maintaining a smooth workflow and healthy client relationships. Even minor errors in payment requests can lead to misunderstandings and delayed payments. To ensure your documents are flawless, it’s important to follow a few best practices that will help you capture every detail correctly and avoid common mistakes.

By paying attention to key elements and taking time to review your documents before sending them out, you can maintain professionalism and ensure your clients have all the information they need to process payments quickly and without confusion.

Best Practices for Accuracy

- Double-check Client Information: Ensure that the client’s name, contact details, and address are correct to avoid any miscommunication.

- Clearly List Services: Provide a detailed breakdown of each service provided, including quantities and unit prices to prevent confusion over charges.

- Verify Payment Terms: Make sure the payment deadline, accepted methods, and any late fees are clearly stated and accurate.

- Review the Total Amount: Ensure that all calculations–taxes, discounts, and the total due–are correct before finalizing the document.

- Proofread for Errors: Take the time to read through the entire document, checking for spelling mistakes, incorrect figures, or missing details.

Additional Tips for Streamlining the Process

- Use Pre-Formatted Documents: Starting with a consistent structure ensures that no essential information is missed, and saves time when creating each new statement.

- Incorporate Clear Payment Instructions: Include clear steps for how the client can pay, especially if you offer multiple payment methods.

- Stay Consistent: Use the same format for every statement to help both you and your clients become familiar with the document layout, making it easier to spot discrepancies.

By following these simple guidelines, you can create precise and professional financial documents that help avoid confusion and promote timely payments from clients.

How to Avoid Common Billing Mistakes

When it comes to financial documentation, even small errors can have significant consequences, leading to delayed payments or client dissatisfaction. Ensuring accuracy in your statements is crucial to maintaining a professional image and streamlining your business operations. By identifying and avoiding common billing mistakes, you can create more effective documents and improve your client relationships.

Many errors stem from overlooking key details or rushing through the process. However, with careful attention to each component and a systematic approach, you can easily avoid these issues and create flawless financial records every time.

Common Mistakes to Watch Out For

- Incorrect Client Information: Always double-check the client’s name, address, and contact details before finalizing the document to prevent miscommunication.

- Missing Service Descriptions: Failing to provide detailed descriptions of the services provided can lead to confusion. Be specific about what was delivered, including quantities, pricing, and any additional charges.

- Errors in Calculations: Simple math mistakes can undermine the accuracy of your document. Always verify the totals, including taxes, discounts, and final charges, before sending it to the client.

- Unclear Payment Terms: Avoid ambiguity when outlining payment deadlines, accepted methods, and late fees. Clients should have a clear understanding of when and how to make payments.

- Failure to Proofread: Skipping the review process can result in overlooked errors. Always take the time to proofread your documents before submission, checking for spelling mistakes, inconsistent formatting, or missing information.

How to Ensure Accurate Billing Every Time

- Use a Structured Format: A consistent layout will help you include all necessary details and avoid forgetting important sections.

- Automate Calculations: Consider using software or tools that automatically calculate totals and taxes, reducing the chances of manual errors.

- Set a Standard Review Process: Implement a checklis

Streamline Your Payment Process

Efficient payment management is essential for maintaining smooth business operations and ensuring timely compensation for services rendered. By simplifying the way you handle financial transactions, you can save time, reduce errors, and improve overall client satisfaction. A streamlined process allows you to focus more on delivering great service and less on chasing payments or dealing with complicated billing procedures.

To optimize your payment workflow, it’s important to have a system that clearly defines all aspects of the transaction. This includes providing clients with clear, professional payment requests, setting up easy-to-follow payment terms, and using tools that automate key aspects of the process. With these strategies in place, you can minimize the risk of delays and errors, making the entire experience more efficient for both you and your clients.

Steps to Simplify Your Payment Process

- Use Clear, Consistent Billing: Ensure your payment requests are easy to understand, with a consistent format that clients can quickly review and process.

- Set Defined Payment Terms: Clearly communicate payment due dates, accepted payment methods, and late fee policies from the outset to avoid confusion.

- Automate Reminders: Set up automated reminders for clients to pay before the due date, helping ensure timely payments and reducing administrative effort.

- Offer Multiple Payment Options: Provide various methods for clients to pay, including online transfers, credit card payments, or checks, to make the process more convenient for them.

Benefits of a Streamlined Process

- Improved Cash Flow: Timely payments help maintain a steady cash flow, which is vital for keeping your business running smoothly.

- Reduced Administrative Time: By automating key steps, you save time on manual tracking and follow-ups.

- Enhanced Client Satisfaction: A simple and transparent payment process creates a better experience for your clients, building trust and fostering long-term relationships.

By adopting these strategies, you can streamline your payment process, improve business efficiency, and maintain positive relationships with your clients. A smoother payment cycle benefits everyone involved and allows your business to thrive with fe

Why Pre-Designed Documents Save Time for Service Providers

Time is one of the most valuable resources in any business, and finding ways to optimize workflows is essential for efficiency. For service-oriented businesses, especially those handling multiple clients and events, having a pre-designed structure for financial documents can drastically reduce the time spent on administrative tasks. By using a ready-made format, providers can quickly generate accurate and professional statements without having to start from scratch each time.

When you rely on a standardized document, you eliminate the need for repetitive formatting, calculations, and inputting the same details over and over. This allows you to focus more on delivering quality service and less on creating paperwork. The result is a more efficient business with less room for error and a quicker turnaround on every transaction.

How Pre-Designed Documents Save Time

- Eliminates Redundant Work: With a set format, you only need to fill in specific details for each client, saving time on repetitive tasks.

- Pre-Formatted Fields: Essential fields such as client information, service descriptions, and payment terms are already in place, reducing the time spent on formatting and calculations.

- Consistent Structure: A ready-to-use layout ensures that every document is organized the same way, reducing the time spent on reformatting or checking for missing information.

- Quick Adjustments: If there are any changes to pricing or services, you can easily modify the relevant fields without starting from scratch, speeding up the process.

Additional Benefits of Using Pre-Designed Documents

- Increased Productivity: Less time spent on paperwork means more time available for actual service delivery, leading to higher overall productivity.

- Fewer Errors: A consistent structure reduces the chance of missing or incorrect information, ensuring greater accuracy.

- Faster Client Billing:

Creating Professional Billing Documents

When providing services to clients, delivering accurate and professional payment requests is essential for building trust and ensuring smooth transactions. A well-crafted financial document not only communicates the details of the services provided but also reflects the professionalism of your business. Creating a polished and clear document that includes all the necessary information can make a significant difference in how your business is perceived and help speed up the payment process.

By following a few key principles, you can create billing records that are not only accurate but also convey a professional image. These documents should be easy to read, transparent in terms of charges, and clear in terms of payment instructions. This approach helps clients understand the terms and reduces the likelihood of disputes or confusion.

Key Elements of a Professional Billing Record

- Clear Client Information: Include the client’s name, contact details, and address so they can easily identify the bill and reach out if needed.

- Detailed Service Descriptions: List each service or product provided with a clear explanation, quantity, and price, so the client knows exactly what they are paying for.

- Payment Terms: Clearly outline the payment due date, acceptable payment methods, and any late fees to avoid confusion.

- Consistent Branding: Use your company’s logo, colors, and fonts to ensure the document aligns with your brand’s identity, promoting a professional image.

Tips for Ensuring Accuracy and Professionalism

- Double-Check All Information: Before sending out your billing document, review all the details carefully to ensure there are no errors in client information, services, or pricing.

- Use a Consistent Format: Stick to a uniform layout and structure for all your documents to maintain consistency and avoid confusion.

- Stay Organized: Keep track of all transactions and their associated details so that you can quickly create a comprehensive and accurate billing record for each client.

By following these guidelines, you can create professional payment requests that not only meet your client’s needs but also enhance your business’s reputation for reliability and organization.

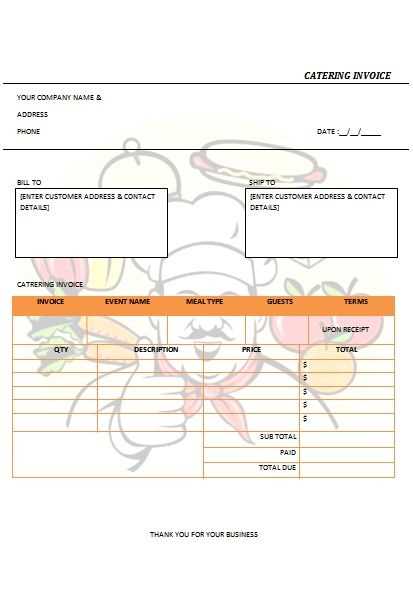

Payment Documents for Small Service Providers

For small businesses offering event planning, food services, or other personalized offerings, having a reliable method for creating clear and professional payment records is essential. Using pre-designed structures can help simplify the billing process, making it quicker and more consistent. This is particularly useful for small businesses that may not have dedicated administrative staff, allowing business owners to focus on their core services while ensuring financial transactions are handled smoothly.

By utilizing ready-made formats, small businesses can create organized payment requests without spending time on design or formatting. This ensures that the necessary details are included and reduces the risk of missing important information. These documents not only help in maintaining a professional image but also speed up the payment collection process, helping your business maintain a steady cash flow.

Benefits of Using Pre-Formatted Payment Records

- Efficiency: Save time by quickly filling in the necessary details rather than formatting each document from scratch.

- Consistency: Using a consistent format for every client creates a uniform experience, making it easier for clients to understand their charges.

- Professional Appearance: A well-organized payment document reflects your business’s professionalism and can help build trust with your clients.

Key Features to Look for in Pre-Designed Documents

- Clear Service Breakdown: Ensure that each service or product is listed with an itemized description and price.

- Simple Payment Instructions: Include clear instructions on how and when the payment should be made, with available methods.

- Customizable Fields: Choose a document structure that allows you to easily edit and adjust details like client information, pricing, and taxes.

By using efficient and customizable payment documents, small businesses can save time, reduce errors, and ensure their clients have all the information needed to make timely payments. This streamlined process can lead to better business operations and an improved client experience.

How to Track Payments with Billing Statements

Managing payments efficiently is essential for maintaining a healthy cash flow in any business. By using properly structured financial documents, business owners can easily keep track of outstanding balances, monitor payments received, and ensure that they are promptly paid for their services. A clear and organized record system makes it much easier to follow up on overdue payments, track partial payments, and manage any discrepancies that may arise.

When using these documents to track payments, it is important to ensure that each transaction is properly documented, payment terms are clearly stated, and all necessary details are included. This will allow you to quickly assess the status of any payment and take action if needed. Below are several best practices that will help streamline the process and ensure accurate tracking of all financial exchanges.

Best Practices for Tracking Payments

- Include Payment Dates: Always document when a payment is made and which method was used. This allows you to track the timing and method of payment for each client.

- Record Partial Payments: If a client pays in installments, note the amount paid and the remaining balance on each document to avoid confusion.

- Use Unique Reference Numbers: Assigning a reference number to each transaction helps you quickly identify and cross-check payments and documents in your accounting system.

- Update Payment Status Regularly: Regularly update the payment status to reflect whether the balance is fully paid or if there are outstanding amounts. This helps avoid errors and ensures accurate financial reporting.

- Send Reminders for Overdue Payments: If a payment is overdue, follow up with polite reminders, and make sure your document clearly states the consequences of late payments.

How to Organize Payment Tracking

- Maintain a Digital Record: Use accounting software or spreadsheets to track payments digitally. This will help reduce paperwork and simplify tracking.

- Keep a Separate Payment Log: For easy access, create a dedicated document or spreadsheet where all payment details, including dates and amounts, are recorded in one place.

- Match Payments to Statements:

Why Digital Billing Documents Are the Best Option

In today’s fast-paced business environment, efficiency and convenience are key. Transitioning from paper-based billing to digital records offers significant advantages for both business owners and clients. Digital financial documents not only streamline the process of creating and sending payment requests but also improve accuracy, reduce administrative burdens, and speed up payment cycles. Whether you’re a small business owner or a large company, digital records provide a more organized and sustainable way to manage financial transactions.

Beyond just convenience, digital systems also offer enhanced security and easier access to past transactions. With the ability to store and retrieve documents instantly, business owners can eliminate the risk of lost paperwork and ensure that important records are always available for review or auditing. Additionally, digital tools can automate tasks like reminders, making it easier to stay on top of outstanding payments.

Key Benefits of Digital Billing Documents

- Faster Processing: Sending and receiving digital files eliminates the delay of postal mail, enabling quicker delivery of payment requests and faster responses from clients.

- Improved Accuracy: Digital documents reduce the risk of human error that can occur with manual entry or calculations, ensuring the details are correct every time.

- Cost Savings: By reducing the need for paper, postage, and manual filing systems, businesses can save money in the long term.

- Easy Storage and Retrieval: Digital files can be easily stored, organized, and searched, making it simple to locate past transactions whenever needed.

How Digital Billing Documents Improve Workflow

- Automation: With digital systems, you can automate repetitive tasks such as sending reminders for overdue payments or generating recurring bills.

- Real-Time Updates: Digital tools allow for real-time tracking of payments, helping you stay on top of outstanding balances and identify potential issues more quickly.

- Environmental Impact: Reducing paper usage is not only cost-effective but also environmentally friendly, contributing to a more sustainable business model.

Overall, digital billing documents offer an efficient, secure, and eco-friendly alternative to traditional paper-based methods. By making the switch, businesses can enjoy smoother operations, faster payments, and improved organization–all of which contribute to greater success in today’s competitive market.