Download Free Car Sales Invoice Template and Customize for Your Business

When conducting vehicle transactions, having a clear and professional document to record the exchange is essential. A well-organized receipt serves not only as proof of the agreement but also ensures both parties are on the same page regarding the terms of the deal. Creating this type of document from scratch can be time-consuming, but thankfully, there are simple solutions available that make the process much easier.

Customizable document formats are widely accessible, allowing you to quickly tailor the necessary details to fit your specific needs. With the right tool, you can eliminate the guesswork and ensure all critical elements are covered accurately. From buyer and seller information to item specifics and payment terms, a well-prepared form ensures that nothing important is overlooked.

By utilizing the right resources, you can save time and reduce the likelihood of errors, ultimately providing both peace of mind and professionalism in your business dealings. Whether you’re a small dealer or an individual selling a vehicle, using a pre-designed document can help you maintain organized records and build trust with your clients.

Free Car Sales Invoice Template Overview

When finalizing a vehicle transaction, having a clear and structured document to confirm the exchange can simplify the entire process. This document serves as a formal record that outlines the key details of the agreement, ensuring both parties are aligned on the terms. By using a pre-designed form, individuals and businesses can avoid mistakes, save time, and maintain a professional approach to transactions.

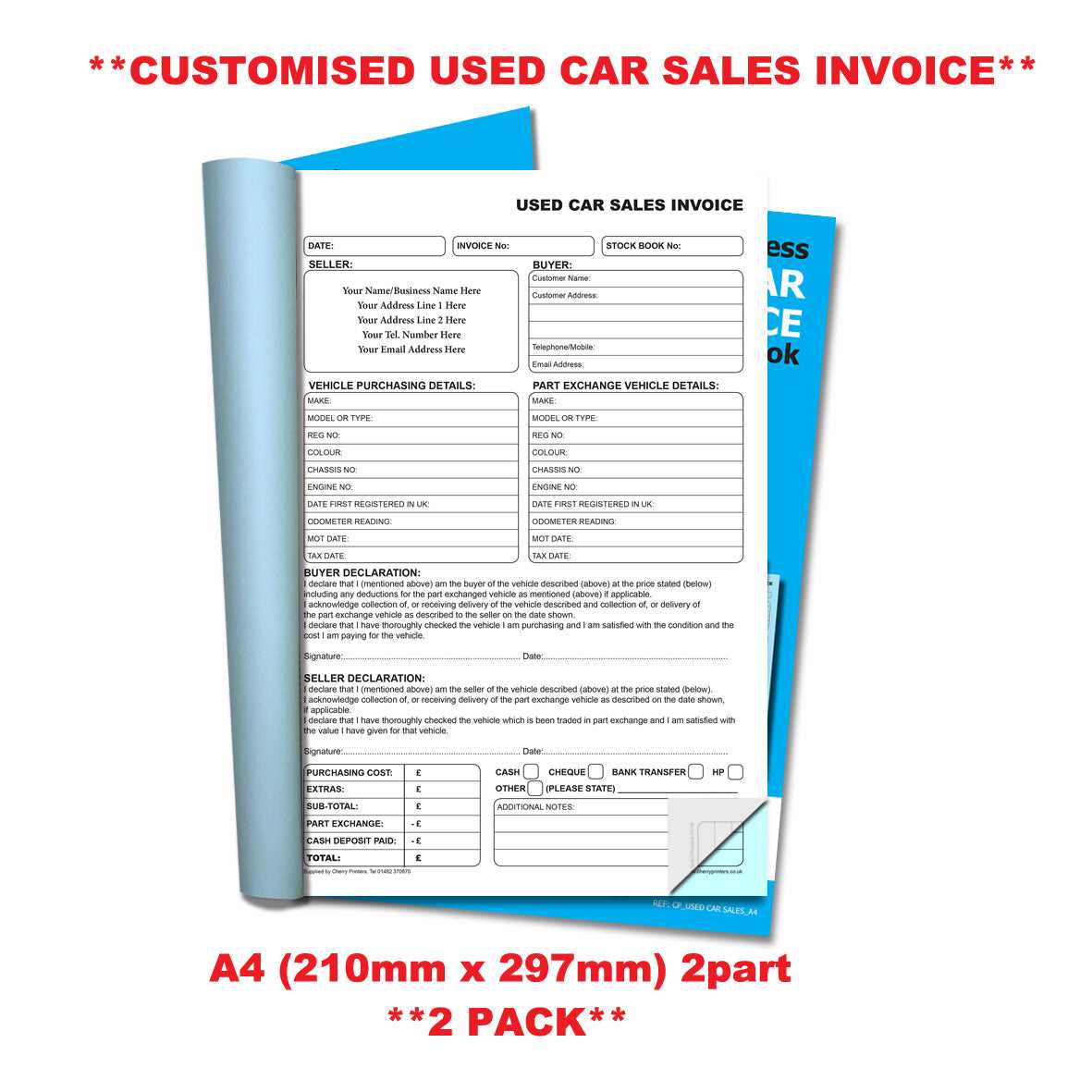

Such a document typically includes several essential sections that need to be filled out accurately. These sections help to organize information clearly, making it easier to refer back to later if needed. Here are some key components usually found in these documents:

- Seller and Buyer Information: Includes names, addresses, and contact details for both parties.

- Vehicle Details: Information such as the make, model, year, VIN, and mileage of the vehicle being sold.

- Transaction Amount: The agreed price for the vehicle, including any deposits or additional fees.

- Payment Terms: Details of how the payment is to be made, including the payment method and any installment plans.

- Signatures: Both buyer and seller need to sign the document to confirm the terms of the agreement.

Having this structure in place ensures that all critical information is captured and can help prevent misunderstandings or disputes down the road. Using a ready-made form offers convenience and consistency, making the document generation process much faster and more reliable for anyone involved in vehicle transactions.

How to Use a Car Sales Invoice

Creating a formal record of a vehicle transaction is an essential part of ensuring both buyer and seller have a clear understanding of the terms. Using a structured document to record all relevant details simplifies the process and provides a useful reference for both parties in the future. Below is a step-by-step guide on how to effectively utilize such a form when completing a transaction.

Step 1: Gather Required Information

Before filling out the document, make sure you have all the necessary details about the transaction. This includes personal information, vehicle specifics, and payment terms. Be sure to verify that all facts are correct to avoid any errors later on.

- Personal Details: Both buyer and seller’s names, addresses, and contact information.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), mileage, and condition of the vehicle.

- Price and Payment Terms: Agreed sale price, any down payment, and the method of payment.

Step 2: Fill Out the Document

Once you have all the required details, start entering them into the document. Ensure that each section is completed accurately and that no key information is left out. Here are the typical sections you should focus on:

- Transaction Summary: Briefly describe the vehicle and the agreed terms.

- Payment Method: Clearly indicate whether the payment is made in full, via installments, or through another arrangement.

- Signatures: Both parties should sign the document to confirm that they accept the outlined terms.

Once the document is complete, review it for accuracy. Both the buyer and seller should sign and keep a copy of the document for their records. This ensures that all parties have agreed to the terms, providing legal protection in case of disputes or misunderstandings.

Top Features of a Car Sales Invoice

When creating a document for a vehicle transaction, there are several key elements that ensure the agreement is clear, professional, and legally sound. These features not only protect both parties involved but also streamline the process of documenting the exchange. Below are the top attributes that should be included to make this document effective and comprehensive.

| Feature | Description |

|---|---|

| Buyer and Seller Information | This section includes full names, addresses, and contact details for both parties involved in the transaction. |

| Vehicle Details | Key information about the vehicle being sold, such as make, model, year, VIN, mileage, and condition, should be clearly stated. |

| Transaction Amount | Clearly outlines the agreed price for the vehicle, including any additional charges, deposits, or fees. |

| Payment Terms | Specifies how payment will be made (e.g., full payment, installment plan) and includes due dates, amounts, and payment methods. |

| Signatures | Both buyer and seller must sign the document to confirm that they agree to the terms and conditions outlined in the agreement. |

By including these key elements in the document, both parties can feel confident that the transaction has been formally recorded and all necessary details are captured. Whether you are handling a one-time sale or a recurring transaction, these features ensure that the process remains transparent and secure for everyone involved.

Why You Need a Sales Invoice Template

Having a pre-designed document for vehicle transactions is crucial for ensuring smooth, clear, and legally binding agreements between buyer and seller. Instead of creating one from scratch, using a structured form saves time, reduces errors, and provides a professional touch to every deal. Below are several reasons why adopting such a resource can benefit anyone involved in vehicle exchanges.

Efficiency and Consistency

Using a ready-made format allows you to quickly fill in the necessary details without worrying about layout or important information being omitted. It ensures that every transaction is documented consistently, which is especially important for business owners or anyone who handles multiple deals.

Legal Protection and Clarity

A well-structured form can help clarify the terms of the deal for both parties. It serves as a legal record of the transaction, which can be invaluable if disputes arise. Having all the details in writing, including the agreed price, payment method, and vehicle specifics, helps protect both the buyer and seller.

| Benefit | Explanation |

|---|---|

| Time Savings | A pre-made document eliminates the need for manual formatting and ensures all necessary details are included automatically. |

| Accuracy | By using a standardized form, there is less chance of missing key information that could lead to confusion or legal issues. |

| Professionalism | Having a neat, consistent document creates a positive impression, reflecting well on your business or individual transactions. |

| Dispute Prevention | A clearly written agreement reduces misunderstandings and helps both parties avoid potential conflicts down the road. |

Incorporating a pre-designed document into your transactions is an easy way to stay organized, save time, and ensure that everything is documented clearly and professionally. Whether you’re managing a large business or handling a personal sale, this tool provides peace of mind and legal protection.

Benefits of Customizing Your Invoice

Customizing your transaction document offers several advantages that can improve both the efficiency and professionalism of your business or personal dealings. By tailoring the document to reflect your specific needs, you can ensure that all relevant information is included, and the process flows smoothly. Here are some of the key benefits of customizing your transaction record.

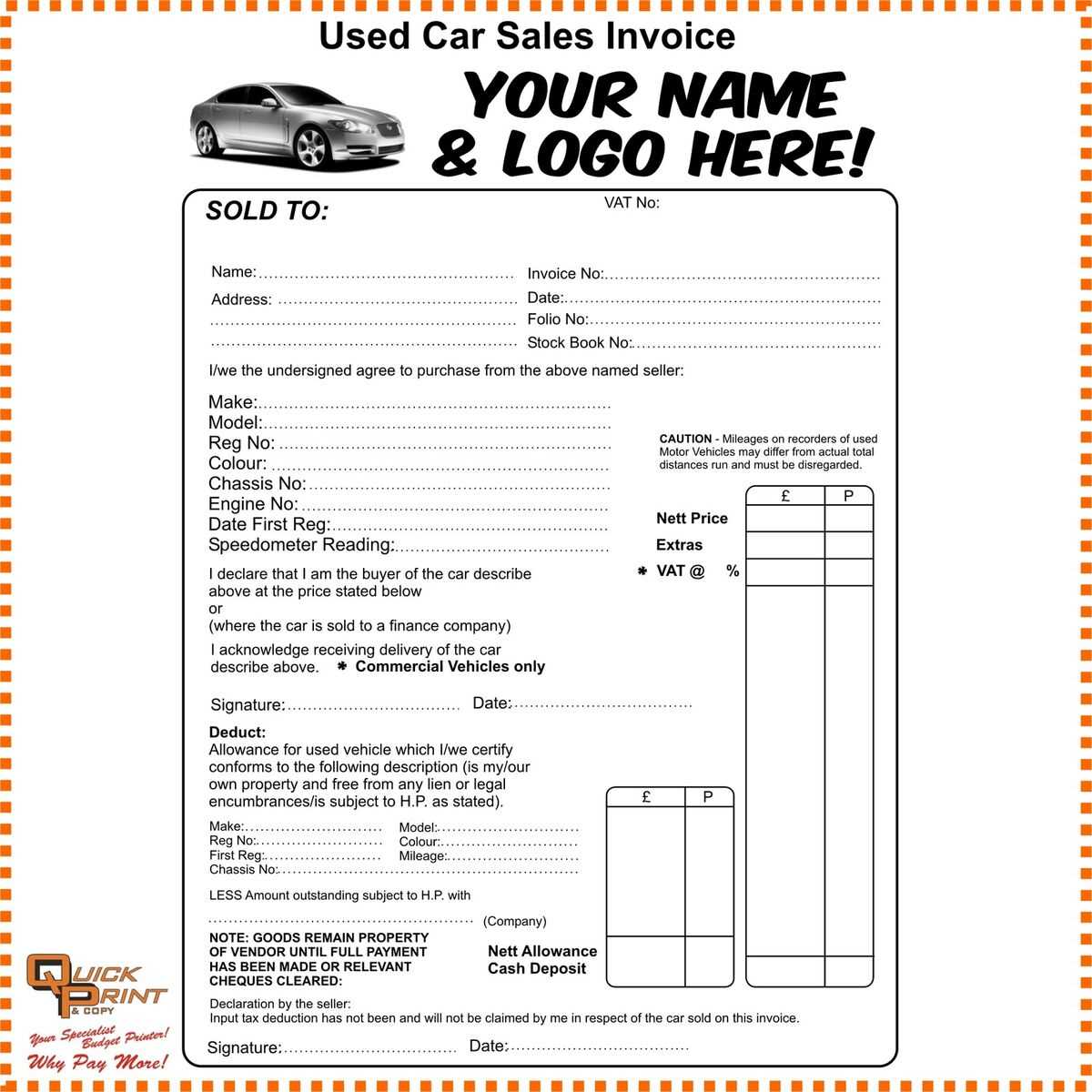

Enhancing Professionalism

Having a personalized document with your business logo, contact details, and specific terms can make a significant difference in how your transactions are perceived. A custom form gives off a more professional image, helping to build trust with your clients and making the deal feel more formal and official.

Improved Accuracy and Clarity

Customizing your document allows you to add or remove specific sections based on your unique needs, ensuring no important details are left out. It enables you to tailor the content to match the nature of the transaction, which can reduce confusion and enhance clarity for both parties.

- Specific Fields: Include fields that are relevant to your business or type of transaction, such as additional charges or specific payment schedules.

- Customized Layout: Design the document layout to suit your preferences, making it easier to read and understand for both the buyer and seller.

- Personalized Branding: Adding your business logo and brand colors to the document creates a sense of consistency and reinforces your professional image.

Streamlined Transactions

By customizing your document, you can ensure that the process of completing each transaction is faster and more efficient. Having a template that fits your specific needs reduces the time spent on paperwork and allows you to focus on the core aspects of the deal.

- Faster Completion: With predefined sections and fields, filling out the document becomes a quicker task, saving time for both parties.

- Minimized Errors: Customizing the form to match your typical transaction process minimizes the chances of overlooking important details.

Ultimately, customizing your transaction document ensures that it aligns with your business requirements while providing clear, accurate, and professional communication between both parties involved.

How to Download a Free Invoice

Downloading a pre-designed document for vehicle transactions is an efficient way to streamline your process. It allows you to quickly access a professional layout that you can customize with your own details. Whether you’re managing a business or handling a personal sale, this resource can save you time while ensuring all necessary information is captured accurately.

Step-by-Step Process for Downloading

To get started, follow these simple steps to download the document. Most platforms offer easy-to-use options that make the process straightforward and quick.

- Choose a Trusted Source: Select a website or platform that offers reliable and secure document downloads.

- Select Your Document: Browse the available formats and choose one that suits your needs–whether it’s for a one-time transaction or for multiple uses.

- Download the File: Click the download button, and the document will be saved to your computer or device.

- Customize Your Document: Once downloaded, open the file using compatible software and fill in the necessary details such as names, transaction amount, and vehicle information.

File Formats and Compatibility

There are different formats available for downloading, making it easy to work with the document regardless of your preferred software. Here’s a breakdown of the most common options:

| Format | Description |

|---|---|

| Portable Document Format, widely used for professional documents and compatible with most devices. | |

| Word (.docx) | Ideal for easy editing and customization using Microsoft Word or similar programs. |

| Excel (.xlsx) | Useful for more detailed tracking or managing multiple transactions in a spreadsheet format. |

Once you’ve downloaded the file in the format that suits your needs, you can quickly fill it out, save it, and print it as needed for your transaction. Having this document ready ensures that you’re always prepared, whether you’re dealing with one sale or many.

Understanding Key Elements of an Invoice

When creating a document for recording a vehicle transaction, it’s important to include certain key pieces of information that ensure clarity, accuracy, and legal validity. Each section serves a distinct purpose, from identifying the parties involved to detailing the financial terms. Below, we’ll break down the essential components of this type of document to help you understand what to include and why it’s necessary.

Essential Sections to Include

A well-structured document will typically contain the following sections to cover all aspects of the deal:

- Seller and Buyer Information: This includes the full names, addresses, and contact details of both parties, ensuring there’s no confusion about who is involved in the transaction.

- Vehicle Details: A thorough description of the vehicle being transferred, including its make, model, year, mileage, VIN (Vehicle Identification Number), and any other pertinent characteristics.

- Transaction Amount: Clearly stating the agreed-upon price for the vehicle, any deposits made, and final payment terms.

- Payment Method and Terms: Details of how the payment will be made, whether it’s a lump sum or installments, including due dates and amounts if necessary.

- Signatures: Both parties must sign the document to confirm they have agreed to the terms set out in the document.

Why These Elements Matter

Each of these elements plays a crucial role in ensuring that the transaction is legally binding and transparent. The buyer and seller can refer to the document in case of disputes or future questions regarding the sale. A properly filled-out form not only protects both parties but also provides a clear, indisputable record of the transaction that can be useful for future reference or legal purposes.

Designing an Effective Car Sales Invoice

Creating a well-organized and easy-to-read document is essential for ensuring both parties in a vehicle transaction have a clear understanding of the deal. A well-designed record not only improves the professionalism of the transaction but also makes it easier to keep track of important details for future reference. Here’s how you can create an effective document that captures all the necessary information and looks professional at the same time.

Key Design Elements to Consider

An effective document should have a clean, logical layout that highlights the most important information. Below are some key design elements to keep in mind when creating this type of form:

| Element | Importance |

|---|---|

| Header | Clearly displays your business or personal name, logo, and contact details for easy identification. |

| Transaction Details | Ensure fields like transaction amount, payment terms, and due dates are easily noticeable and well-organized. |

| Clear Section Titles | Use distinct section headers (e.g., “Buyer Details,” “Vehicle Description”) to divide the document logically and make information easier to find. |

| Signature Section | A space for both parties to sign ensures that the document is legally binding and the terms are accepted. |

Best Practices for Layout and Readability

The layout of your document should prioritize clarity and ease of use. Here are some tips for creating a clean and readable design:

- Use Consistent Fonts: Choose professional, easy-to-read fonts and maintain consistency throughout the document.

- Leave Plenty of White Space: Avoid cluttering the page with too much information in one area; spread it out to make it more visually appealing.

- Align Information Properly: Ensure text and fields are aligned correctly to create a neat, structured appearance.

- Highlight Key Information: Use bold or larger font sizes to emphasize the most important details, such as the total price or payment terms.

By focusing on these key design elements and best practices, you can create a document that is both professional and functional, making the transaction process more e

Common Mistakes to Avoid in Invoices

While creating a formal document for vehicle transactions, it’s easy to overlook small details that can lead to confusion or disputes. These mistakes can range from minor errors to major omissions that affect the legality or clarity of the transaction. Avoiding common pitfalls ensures that both parties have a clear understanding of the agreement and that the process runs smoothly. Below, we will highlight some of the most frequent mistakes and how to prevent them.

Key Mistakes to Watch Out For

To ensure that the document serves its purpose effectively, it’s crucial to be mindful of potential errors that can arise during the creation process. The following table outlines common mistakes and tips for avoiding them:

| Mistake | How to Avoid It |

|---|---|

| Missing or Incorrect Contact Information | Ensure that both parties’ names, addresses, and contact details are accurate and up to date. |

| Incomplete Vehicle Details | Double-check that all key information, such as the make, model, year, VIN, and mileage, is correctly listed and complete. |

| Omitting Payment Terms | Clearly outline how payment will be made, including the amount, due dates, and payment method, to avoid confusion. |

| Not Including Signatures | Make sure both parties sign the document to confirm agreement on the transaction terms. |

| Inconsistent or Ambiguous Language | Use clear, precise language to describe terms and conditions, ensuring both parties fully understand the document. |

Other Potential Issues

In addition to the most common mistakes, there are other factors to consider when drafting the document. These include:

- Incorrect Date: Always include the correct date of the transaction to avoid any confusion regarding the timing of the agreement.

- Unclear Payment Structure: If there are installments or specific payment arrangements, be sure to list all relevant details and schedules.

- Missing Terms of Sale: Don’t forget to include any additional conditions or warranties that may apply to the deal.

By being aware of these common mistakes and taking the time to carefully review all the details, you can ensure that the transaction document is accurate, clear, and legally binding, preventing any potential misunderstandings in the future.

How to Include Tax Information on an Invoice

When documenting a transaction, it’s crucial to properly account for taxes to ensure compliance with local regulations and to avoid any future misunderstandings. Including tax information clearly on the transaction record helps both parties understand the full cost of the deal. Whether you’re required to charge sales tax or simply need to indicate tax-exempt status, it’s important to list this information in a clear, accessible manner.

Key Steps for Including Tax Information

To accurately reflect taxes in the document, follow these steps to ensure everything is correctly reported:

- List the Tax Rate: Clearly specify the tax rate that applies to the transaction. This could be a percentage or a fixed amount, depending on local tax laws.

- Indicate the Taxable Amount: Identify the total value of the goods or services being exchanged before tax is applied. This helps to separate the tax from the base price.

- Show Tax Amount Separately: Make sure to calculate and display the tax amount clearly, showing how much tax is being added to the total cost.

- Provide Total Amount: After calculating the tax, include the total amount that the buyer will need to pay, including the base price plus tax.

Example of Tax Breakdown

Here is an example of how to format the tax details in the document:

| Description | Amount |

|---|---|

| Item Cost | $10,000 |

| Sales Tax (5%) | $500 |

| Total Due | $10,500 |

By following these guidelines, both the buyer and seller can easily understand how taxes affect the total cost of the transaction. This transparency ensures a smoother, clearer process and helps maintain compliance with tax laws.

Formatting Tips for Car Sales Invoices

Creating a well-formatted document for vehicle transactions is essential for clarity, professionalism, and ensuring that all key details are easy to locate. A properly structured document makes it easier for both parties to review terms, prevent confusion, and ensure that everything is in order. Below are some formatting tips to help you design an effective and easy-to-read record.

Key Formatting Principles

When designing a document, it’s important to follow basic formatting principles to make sure it’s organized and clear. Here are some tips to ensure readability and professionalism:

- Use Consistent Font Styles: Choose a simple, professional font like Arial or Times New Roman and use it consistently throughout the document. Avoid fancy fonts that can detract from the document’s clarity.

- Keep Sections Well-Defined: Use headings or bold text to separate sections such as “Seller Information,” “Buyer Details,” and “Payment Terms.” This improves readability and ensures key sections stand out.

- Leave White Space: Avoid overcrowding the document. Proper spacing between sections and text helps to prevent visual clutter and makes the document more comfortable to read.

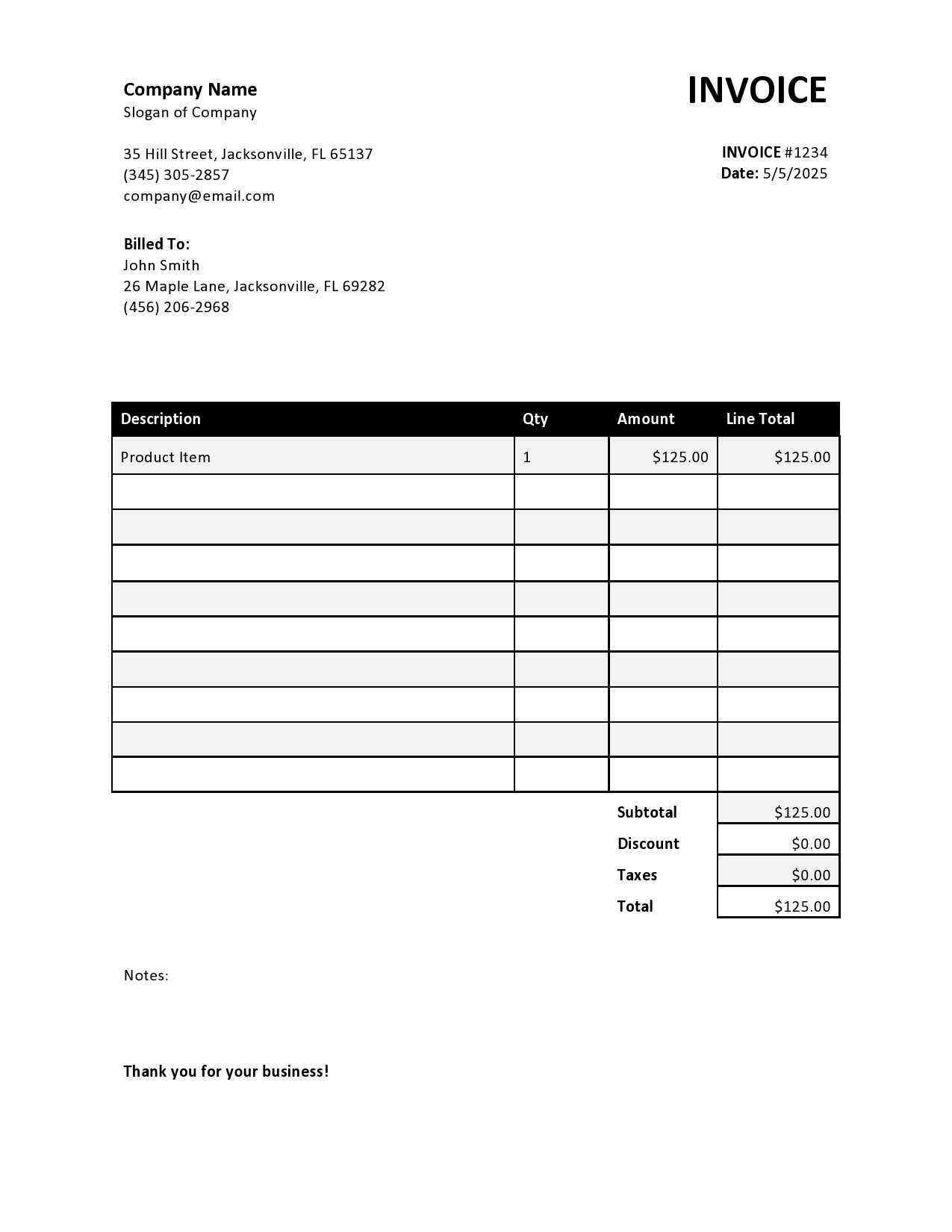

- Use Tables for Clear Breakdown: For financial or itemized details, use tables to organize the information clearly. This makes it easier to track individual items and costs.

Example of a Well-Formatted Document

The following is an example of how to format important details using a table. This layout helps both the buyer and seller easily see key elements of the transaction.

| Description | Amount |

|---|---|

| Base Price | $12,000 |

| Tax (6%) | $720 |

| Total Amount Due | $12,720 |

By organizing information in tables and using consistent formatting throughout the document, you can ensure that the transaction record is both professional and easy to understand. These simple formatting tips help reduce errors and make the entire process more transparent.

Legal Requirements for Car Sales Invoices

When documenting a vehicle transfer, it is essential to ensure that all necessary legal elements are included in the record. A legally compliant document protects both the buyer and the seller, providing clarity and serving as a proof of transaction if any issues arise in the future. Understanding the legal requirements for this document is crucial to ensure that it meets all regulatory standards and safeguards both parties’ interests.

Essential Legal Elements to Include

To create a document that fulfills legal obligations, be sure to include the following critical information:

- Parties Involved: The names, addresses, and contact details of both the buyer and the seller must be clearly listed to identify the individuals or entities involved in the transaction.

- Detailed Vehicle Information: A complete description of the vehicle, including its make, model, year, VIN (Vehicle Identification Number), mileage, and condition, is essential for accurate identification.

- Transaction Amount: The total price agreed upon for the transfer must be clearly stated, along with any applicable taxes, fees, or additional charges.

- Payment Terms: The document should specify whether the payment is to be made in full or in installments, along with the payment method (e.g., cash, check, bank transfer) and due dates.

- Signatures: Both parties should sign the document to acknowledge the agreement and validate the terms, making the document legally binding.

Regulations and Compliance

Depending on your location, there may be additional legal requirements such as specific tax rates, licensing requirements, or additional documentation that must accompany the transfer. For example, certain regions require proof of the vehicle’s legal status (e.g., no outstanding fines or liens) to be included in the transaction record. Always ensure that your document adheres to local laws and industry regulations.

By including the required legal elements and understanding the relevant regulations, you can create a document that serves as a clear, binding agreement between the parties and reduces the risk of disputes in the future.

Free Templates vs Paid Templates

When deciding between using a no-cost or a paid version for creating formal documents, there are several factors to consider. Both options have their advantages and limitations depending on your needs, expertise, and the specific requirements of the transaction. Choosing the right option can impact the quality, customization, and ease of use when drafting the necessary paperwork.

Advantages of Free Options

No-cost options are often appealing due to their accessibility and lack of initial investment. They are generally suitable for individuals or businesses that are just starting out or those who need a simple, no-frills solution. Some benefits of free versions include:

- Cost-Effective: The most obvious benefit is that no money is required upfront, making it a great option for those on a budget.

- Easy to Access: Free options are often readily available on various websites and can be downloaded or accessed instantly.

- Basic Functionality: They provide the basic elements needed for a straightforward transaction record without additional complexity.

Benefits of Paid Options

On the other hand, paid solutions often offer more advanced features and greater customization. These options tend to be more polished and can cater to businesses with specific needs. Some advantages of opting for a paid version include:

- Customization: Paid versions often allow you to fully tailor the document to your brand or transaction specifics, offering greater flexibility in design and content.

- Advanced Features: These may include automatic tax calculations, integration with accounting software, or the ability to store and track records over time.

- Professional Support: Many paid services come with customer support, helping you resolve any issues or questions you might have while creating or using the document.

Ultimately, the choice between a free or paid option depends on your specific needs, budget, and how much customization you require. If you’re looking for a quick and simple solution, a free version may be sufficient, but if you need a more tailored, professional tool with additional features, a paid option might be the better choice.

How to Save Time with Templates

When managing paperwork for transactions, efficiency is key. Using pre-designed documents can save valuable time and reduce errors. Instead of starting from scratch each time, customizable formats allow you to quickly enter details and produce professional-looking records. By leveraging these ready-made structures, you can streamline your workflow and ensure consistency across all your documents.

Time-Saving Benefits of Pre-Made Documents

Utilizing ready-made documents provides several advantages that can help speed up the process:

- Pre-Formatted Structure: Ready-made documents come with all the necessary sections, so you don’t need to design the layout yourself. This eliminates the need to spend time on formatting.

- Quick Customization: Most documents allow for easy editing, where you can simply fill in specific details such as names, amounts, and terms. This saves you from having to write everything from scratch.

- Consistency: Using the same structure each time ensures that all your documents look uniform and contain the required information. This reduces the chance of forgetting essential details.

Examples of How Templates Speed Up the Process

Here are a few examples of how templates help save time:

- Automatic Calculations: Some pre-designed formats allow you to input numbers, and they automatically calculate totals or taxes, cutting out manual work.

- Easy Updates: When you need to make changes, a template makes it simple to adjust without redoing the entire document. You can update information and reuse the format with minimal effort.

- Less Risk of Error: Since the structure is already set, there is less room for missing critical sections or making mistakes in formatting, which could otherwise delay the process.

By incorporating pre-designed formats into your workflow, you can save both time and effort, ensuring that your documentation is efficient, accurate, and consistent every time.

Ensuring Accuracy in Sales Invoices

Ensuring precision in your transaction documents is critical to avoid errors that could lead to confusion, disputes, or financial discrepancies. Accurate records not only help in maintaining trust between parties but also ensure compliance with legal and tax obligations. By paying attention to detail and following a structured approach, you can prevent common mistakes and create documents that reflect the true terms of the agreement.

Key Steps for Accurate Documentation

There are several essential steps to take in order to ensure the information in your document is accurate:

- Double-Check Buyer and Seller Information: Always verify that the names, addresses, and contact details of both parties are correctly listed. Mistakes in these details can lead to confusion later on.

- Confirm Transaction Details: Ensure the description of the goods or services is accurate, including quantities, model numbers, and other identifiers. Any ambiguity here can lead to misunderstandings.

- Check Financial Figures: Double-check the price, tax calculations, and any discounts applied. Make sure that the total amount due is correct before sending the document.

- Review Payment Terms: Clarify the payment due date, method of payment, and any installment plans. This helps avoid disputes about when and how payments should be made.

Tools and Best Practices for Accuracy

Using tools and following best practices can further reduce the risk of errors:

- Use Automated Calculations: Many software solutions can automatically calculate totals, taxes, and discounts, helping you avoid manual calculation errors.

- Review Before Sending: Always take a moment to carefully review the document before finalizing it. This final check can catch minor mistakes that might have been overlooked earlier.

- Consistency in Format: Keep a consistent format for all your records. This ensures that you don’t accidentally leave out important sections or repeat unnecessary ones.

By following these practices and making accuracy a priority, you can create reliable documents that reflect the true terms of your transactions and prevent unnecessary issues down the line.

Best Practices for Managing Invoices

Effective management of transaction records is essential for any business. Proper organization and tracking ensure timely payments, smooth operations, and reduce the risk of errors or disputes. By implementing a few key practices, you can streamline the process and ensure that all financial documents are handled efficiently and professionally.

One of the first steps in managing transaction records is establishing a clear system for creating, organizing, and tracking each document. This includes assigning unique reference numbers to each record, keeping detailed logs of all transactions, and storing documents in a well-organized digital or physical filing system. Proper documentation ensures that important details are easy to find and can be referenced at any time.

Additionally, maintaining a consistent format across all records can greatly improve efficiency. A standardized approach helps both internal staff and external partners easily understand and process the details, ensuring that no key information is overlooked. Regular reviews and audits of your documentation can also help identify areas for improvement and ensure that the process remains compliant with relevant regulations.

By adhering to these best practices, businesses can create a solid foundation for smooth financial transactions, improve cash flow management, and reduce administrative burden. Keeping records organized and up to date is a simple yet effective way to stay on top of operations and avoid potential issues down the road.