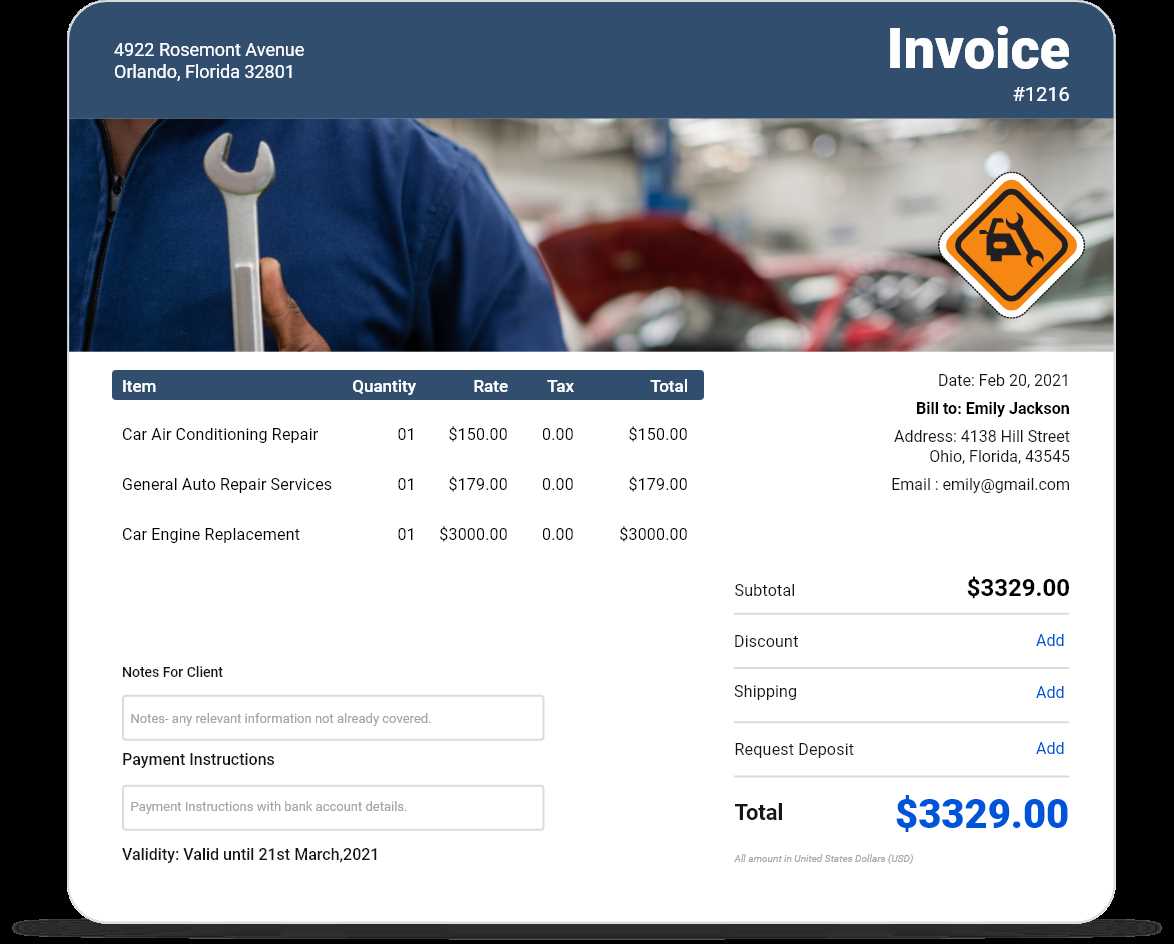

Free Car Repair Invoice Template for Easy Customization

When managing an automotive service business, keeping track of transactions is crucial for both organizational and legal purposes. A well-structured document helps ensure clarity in communication with clients and simplifies financial record-keeping. This kind of document can serve as proof of services rendered and a clear breakdown of costs involved in the job.

Using a professionally designed document not only helps streamline your workflow but also enhances your credibility. Having an organized, easy-to-read format allows customers to quickly understand the work performed and the associated charges. It’s a simple yet effective tool for maintaining a positive relationship with clients and ensuring prompt payments.

With the availability of various resources, creating such documents has become easier than ever. By choosing the right format and customizing it to fit your business needs, you can save valuable time and improve your operational efficiency. Whether you’re handling repairs, installations, or routine maintenance, the right document ensures that all the details are captured accurately.

Free Car Repair Invoice Template Overview

For any auto service business, creating clear and professional documentation is essential to maintaining trust with clients and ensuring smooth financial transactions. These documents serve not only as a record of the work done but also as a means to clearly communicate costs and terms. Having access to a customizable, easy-to-use format simplifies this process and ensures consistency across all your transactions.

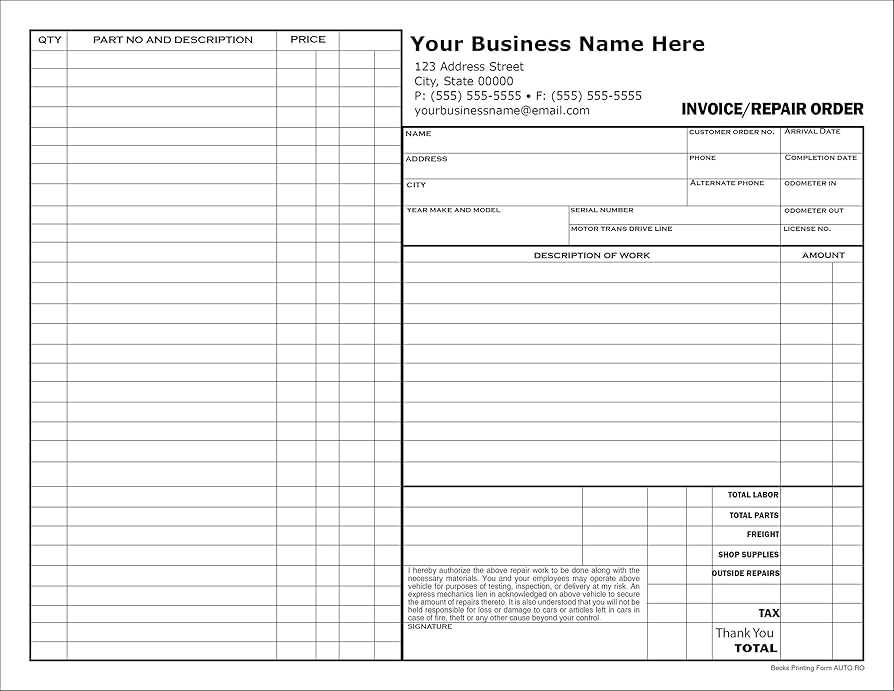

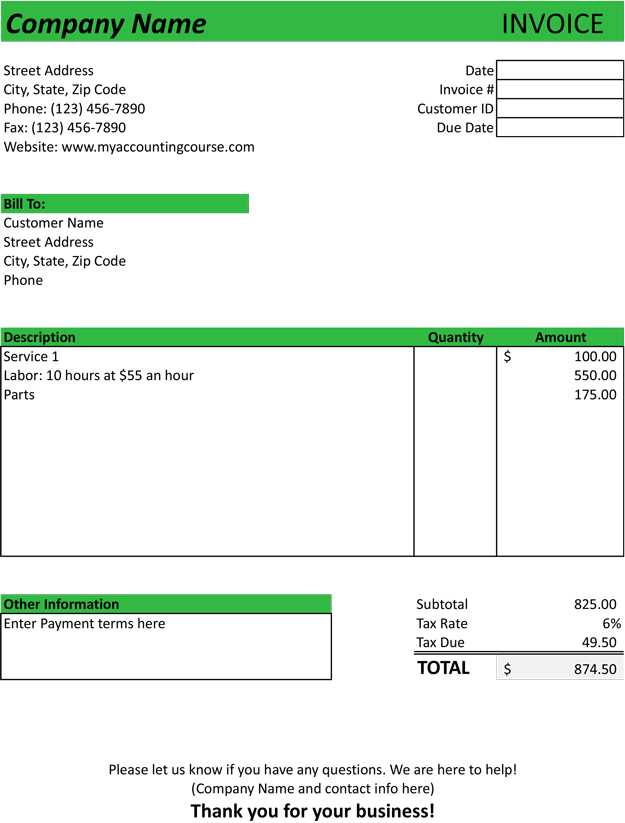

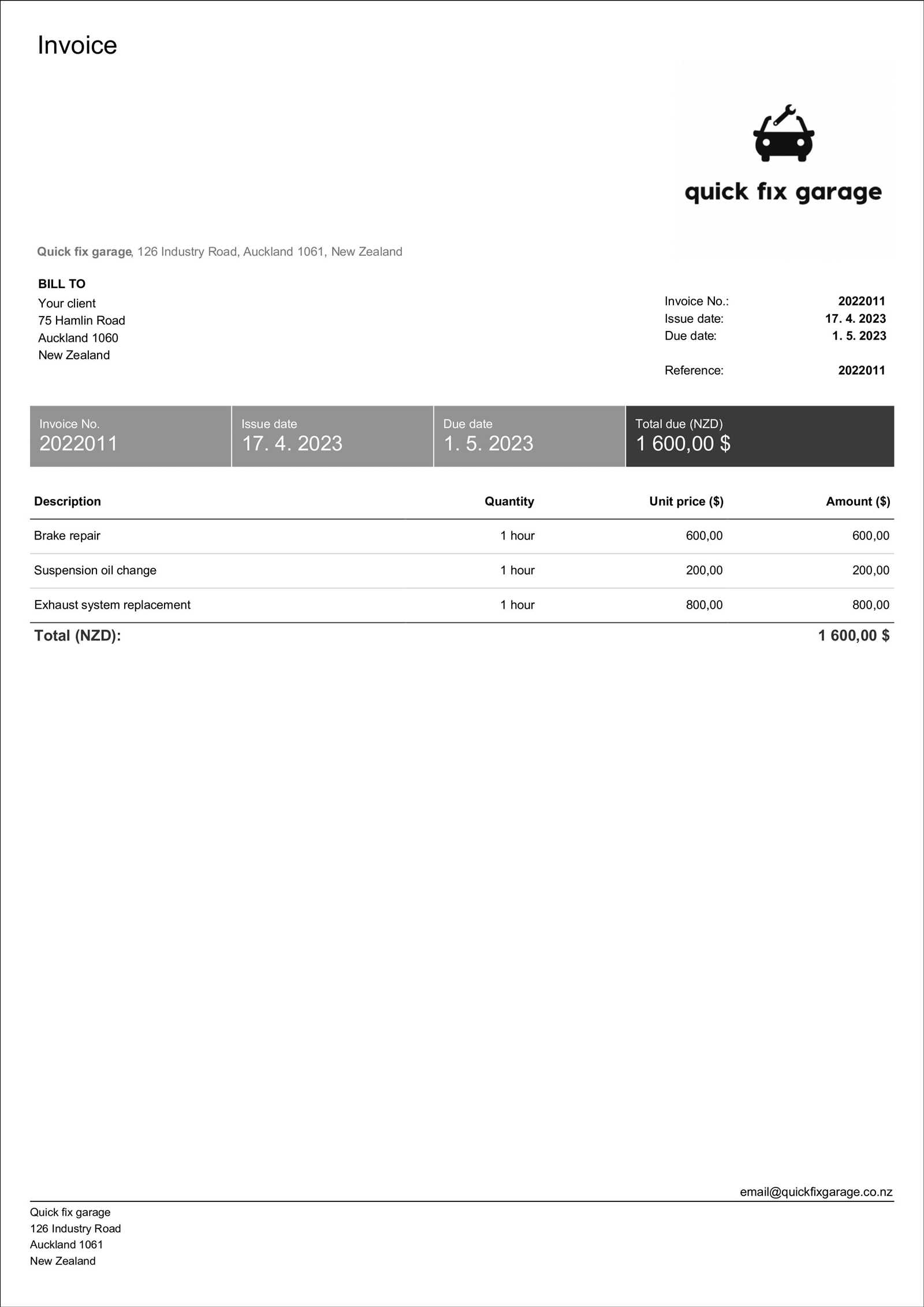

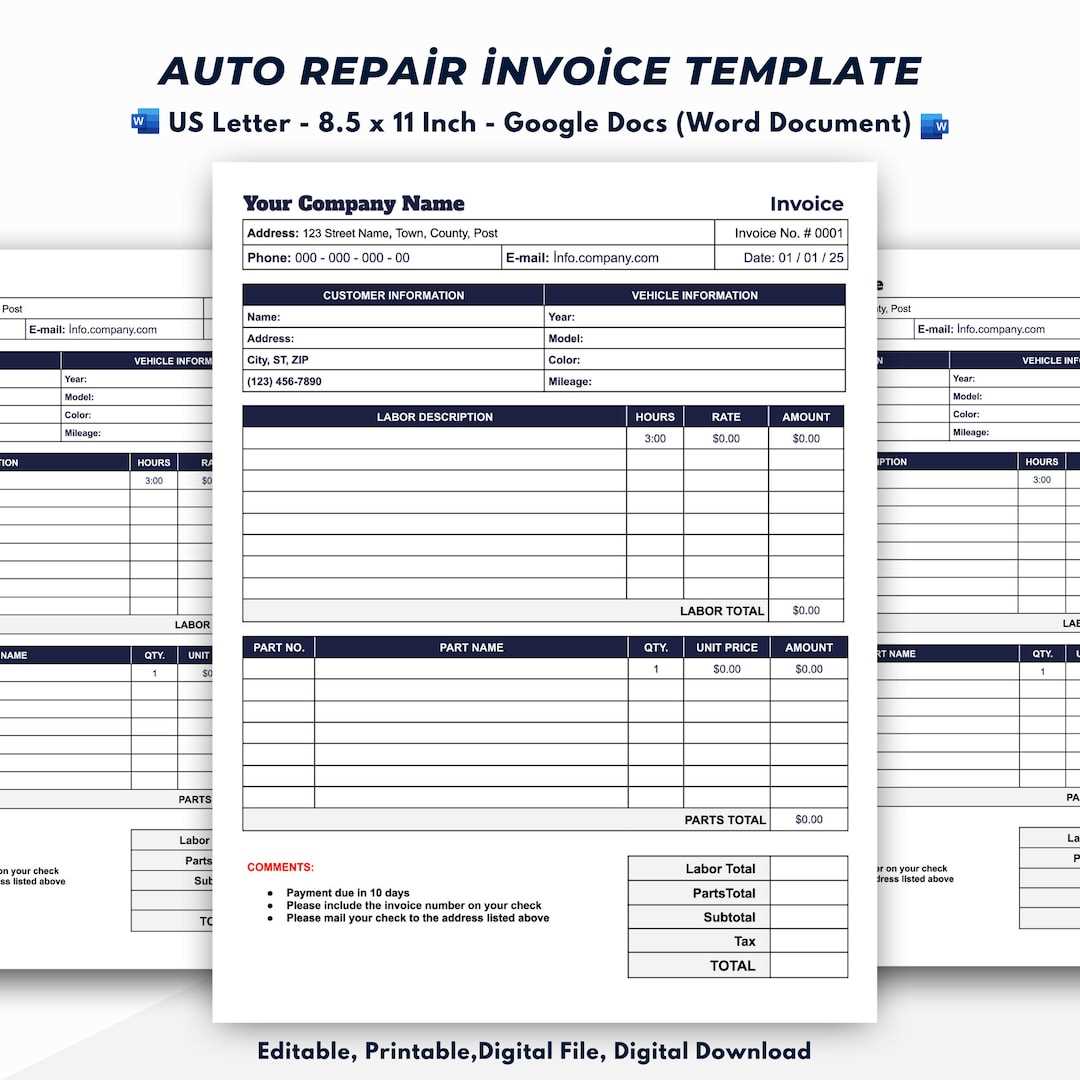

Key Elements to Include

An effective document should include several key pieces of information. First, client details and a clear description of the services provided must be present. Next, it’s important to outline the costs involved, including labor, parts, and any other charges. This structure ensures that both you and your clients understand the breakdown of expenses. Payment terms and due dates should also be clearly stated to avoid any confusion or delays.

How a Customizable Format Helps

The ability to modify the structure and content of your document gives you flexibility and control over your business operations. Customization allows you to adjust the layout to better reflect your branding and business style. Additionally, having a pre-made structure saves time while ensuring you don’t miss any important details when preparing these documents for your clients.

Why Use a Car Repair Invoice

Using a well-structured document for your auto service transactions provides numerous advantages that contribute to better business management and customer satisfaction. These records not only serve as proof of services rendered but also help establish clear communication regarding pricing and payment terms. A reliable system for issuing such documents is an important tool for both the service provider and the customer.

- Clarity and Transparency: Providing a detailed breakdown of the work done, including labor and parts, ensures that clients understand exactly what they are paying for. This reduces misunderstandings and fosters trust.

- Legal Protection: In case of disputes or misunderstandings, having a properly documented record of services and agreed charges can act as a legally binding reference.

- Efficient Record-Keeping: Maintaining organized records of completed services helps with accounting and tax preparation, making it easier to track revenue and expenses over time.

- Professionalism: Presenting a formal, well-organized document adds a professional touch to your business, making it appear more trustworthy and reliable in the eyes of clients.

- Faster Payments: Clear terms and itemized costs can help clients quickly understand their obligations, reducing the time it takes to settle accounts.

By utilizing a structured document, service providers can ensure smoother business operations and improve client relations. A professional approach to billing can lead to better client retention and increased satisfaction, ultimately benefiting the growth of your business.

Why Use a Car Repair Invoice

Using a well-structured document for your auto service transactions provides numerous advantages that contribute to better business management and customer satisfaction. These records not only serve as proof of services rendered but also help establish clear communication regarding pricing and payment terms. A reliable system for issuing such documents is an important tool for both the service provider and the customer.

- Clarity and Transparency: Providing a detailed breakdown of the work done, including labor and parts, ensures that clients understand exactly what they are paying for. This reduces misunderstandings and fosters trust.

- Legal Protection: In case of disputes or misunderstandings, having a properly documented record of services and agreed charges can act as a legally binding reference.

- Efficient Record-Keeping: Maintaining organized records of completed services helps with accounting and tax preparation, making it easier to track revenue and expenses over time.

- Professionalism: Presenting a formal, well-organized document adds a professional touch to your business, making it appear more trustworthy and reliable in the eyes of clients.

- Faster Payments: Clear terms and itemized costs can help clients quickly understand their obligations, reducing the time it takes to settle accounts.

By utilizing a structured document, service providers can ensure smoother business operations and improve client relations. A professional approach to billing can lead to better client retention and increased satisfaction, ultimately benefiting the growth of your business.

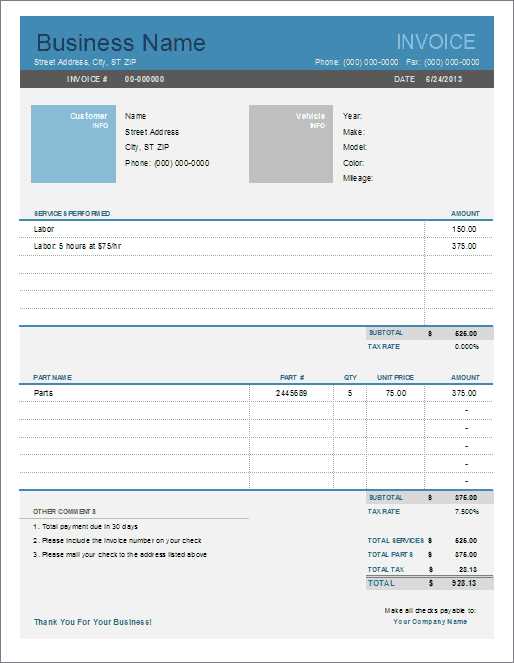

Key Features of a Good Template

A well-designed document for automotive services should include essential elements that ensure clarity, professionalism, and efficiency. The structure of the document must allow both the service provider and client to easily understand the details of the work performed and the associated costs. A good format not only saves time but also contributes to better communication and smoother transactions.

Essential Information to Include

To make sure the document is comprehensive and useful, certain key elements must always be present. These elements help outline the services, costs, and terms in a clear, organized manner. Below is a breakdown of the most important features:

| Feature | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Clearly list the client’s name, contact details, and service address to ensure proper identification and communication. | ||||||||||||||||

| Service Description | Provide a detailed account of the work performed, including parts used, labor, and any additional services provided. | ||||||||||||||||

| Cost Breakdown | Include an itemized list of charges for labor, materials, and any other relevant fees to avoid confusion. | ||||||||||||||||

| Payment Terms | State the total amount due, due date, and any applicable late fees or discounts for early payment. | ||||||||||||||||

| Legal and Warranty Information | Include any terms related to wa

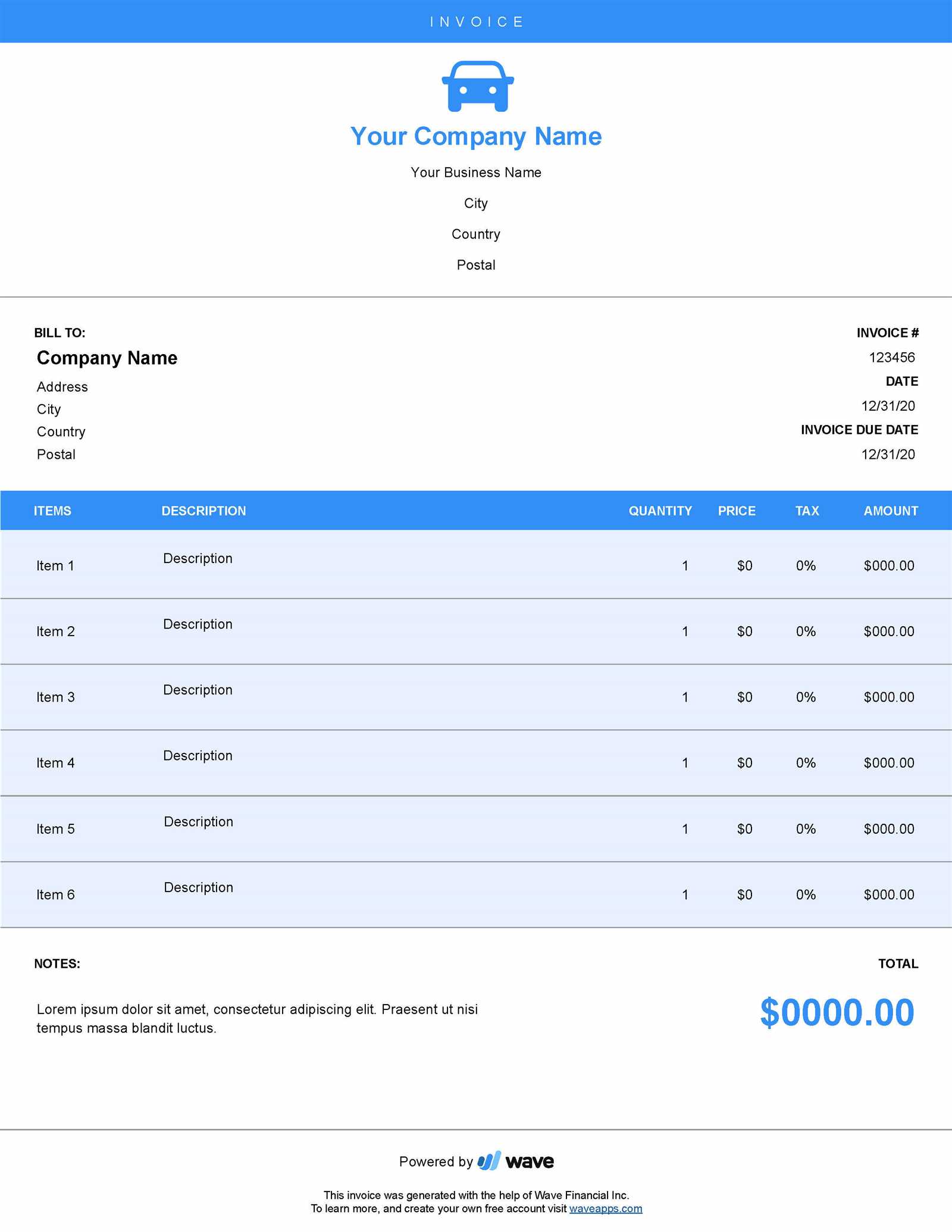

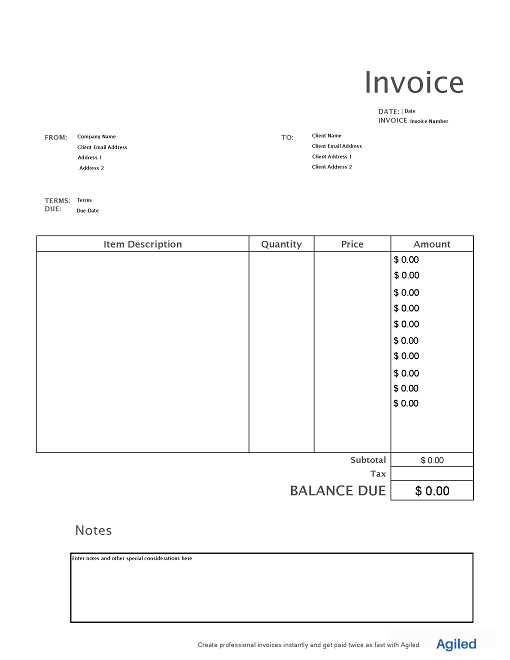

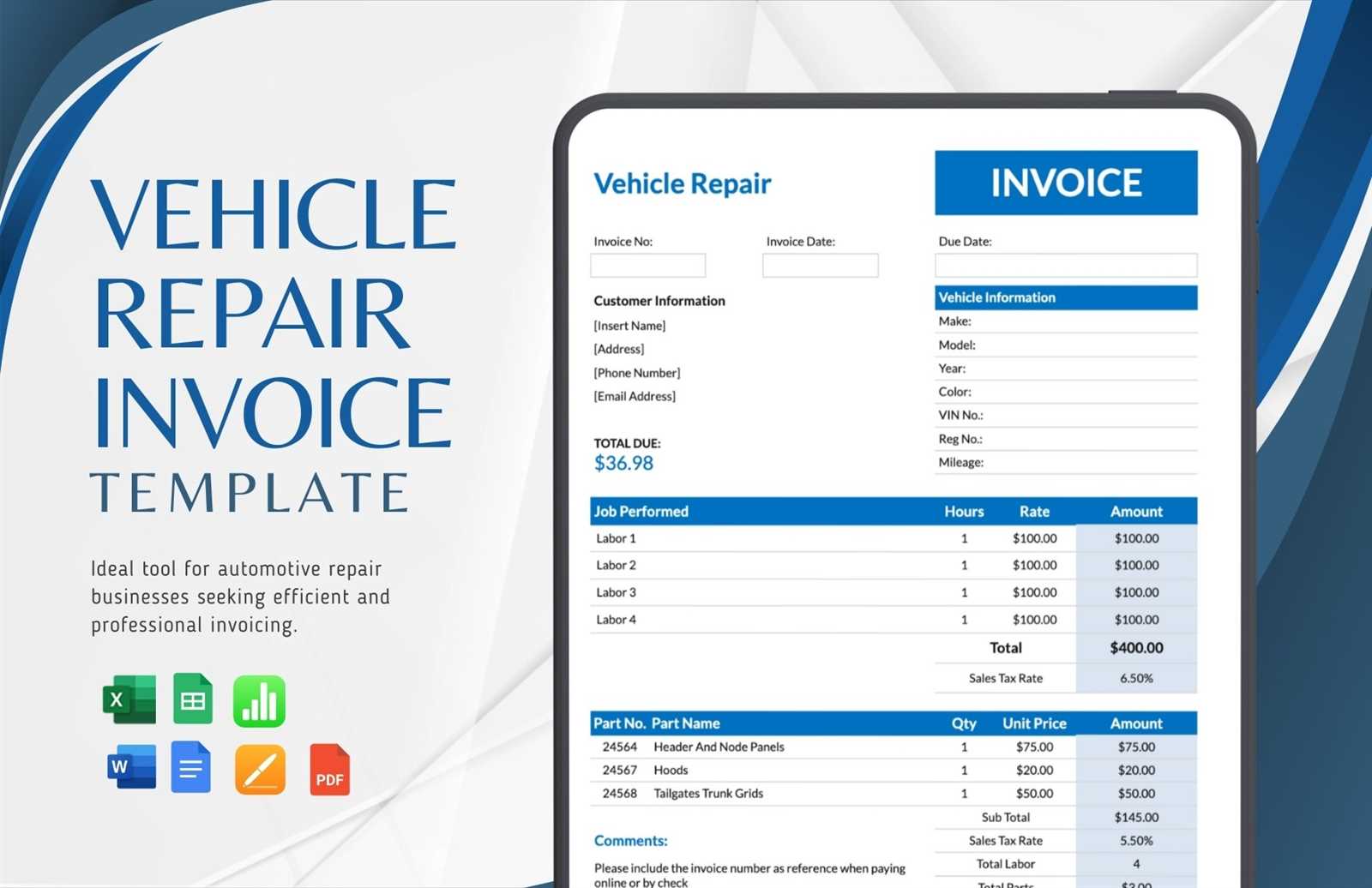

How to Download a Free TemplateGetting access to a ready-made, customizable document for your automotive services is simple and can save you significant time. The process of obtaining a suitable format is straightforward and typically involves finding a reliable source that offers a range of options. These documents are often available in popular formats that are compatible with various software, making it easy to edit and adapt them to your specific needs. Step 1: Choose a Trusted SourceBegin by selecting a reputable website that specializes in business forms and documentation. Ensure that the platform offers high-quality resources that can be tailored to your business requirements. Many of these sites provide free access to downloadable files, so be sure to check the credibility of the source before proceeding. Step 2: Download and Save the DocumentOnce you’ve chosen the right document, simply click the download link to obtain the file. It’s important to save it in a location where you can easily access it for future use. Most formats are available as PDF, Word, or Excel files, which can be opened with standard software. Tip: Always check the file for compatibility with your operating system and the software you use to ensure seamless editing and use. After downloading, you can customize the document with your company’s details, pricing structure, and specific terms of service. With this simple process, you can quickly get a professional-looking document that will improve your workflow and client communication. Choosing the Right Format for You

Selecting the right format for your business documents is an important decision that can impact both your efficiency and professionalism. The format should not only be easy to use but also align with the way you operate. Depending on your preferences and workflow, certain file types might offer distinct advantages, from ease of editing to better compatibility with other tools.

Consider how you plan to use the document–whether it’s for quick edits, professional presentation, or detailed financial tracking. Each format has its strengths, and selecting the right one can help streamline your operations and keep your work looking polished. Step-by-Step Guide to Editing InvoicesCustomizing a pre-made document to fit your specific needs is a simple process that ensures each transaction is accurately documented and presented professionally. Editing such a document allows you to tailor the information, ensuring it reflects the exact details of the services provided and the agreed-upon costs. Follow these steps to easily modify a pre-built form and create a document that meets your business needs.

|