Free Business Invoice Templates for Professional and Easy Billing

Managing payments and maintaining a smooth flow of finances is crucial for any entrepreneur. Ensuring that invoices are clear, accurate, and professional can help build trust with clients and streamline the process of getting paid. However, creating these documents from scratch each time can be both time-consuming and prone to errors.

Thankfully, there are various resources available to simplify the process. By using pre-designed formats, you can save valuable time while ensuring that all necessary details are included in a clean and organized manner. These pre-made structures can be customized to fit the needs of your specific industry or personal preferences, offering flexibility without compromising professionalism.

Efficiency and accuracy are key when managing payments. Adopting ready-made designs not only reduces the chance of mistakes but also ensures consistency in every document you send out. Whether you’re a freelancer, consultant, or a small enterprise owner, these solutions make billing an effortless task, allowing you to focus more on growing your work.

Free Business Invoice Templates

When managing payments and keeping track of client transactions, having a well-structured document is essential. Instead of starting from scratch each time, many resources provide ready-to-use designs that can be quickly adapted to your needs. These documents not only save time but also ensure that all necessary information is presented clearly and professionally, reducing the chance of mistakes or confusion.

Benefits of Using Pre-Made Designs

Utilizing ready-made formats allows you to focus more on delivering quality services rather than spending time on administrative tasks. Customization options ensure that each document can still reflect your unique branding and style, while maintaining a standard format that clients expect. Consistency in your billing practices builds trust and professionalism, which can have a positive impact on your client relationships.

Where to Find Reliable Resources

There are many online platforms offering a wide variety of formats that cater to different industries and requirements. Whether you need a simple layout or a more detailed one with advanced features, these resources can accommodate various preferences. Many platforms even allow you to download and personalize the designs at no cost, ensuring you get a polished document without spending extra money.

Why You Need Invoice Templates

Effective billing is a cornerstone of managing any operation, whether small or large. Creating a clear and organized document for each transaction helps ensure timely payments, avoids misunderstandings, and establishes credibility with clients. Instead of manually drafting a new document for every transaction, using a structured format allows you to save time while maintaining consistency and professionalism.

Streamlining Your Workflow

With a ready-made structure, the process of issuing statements becomes faster and more efficient. You don’t need to worry about missing essential details or formatting issues. Simply fill in the necessary information and you’re done. This simplicity allows you to focus more on your core activities, improving productivity and reducing administrative overhead.

Ensuring Accuracy and Consistency

Having a predefined layout means you won’t forget important elements like tax rates, payment terms, or contact details. These designs are created to ensure all critical information is included, helping you avoid common errors and discrepancies. With consistent use of such structures, clients will receive professional-looking documents every time, enhancing your reputation and reducing the likelihood of disputes.

How to Choose the Right Template

Selecting the right structure for your payment requests is crucial for ensuring clarity and professionalism. The format you choose should not only reflect your business identity but also suit the nature of your transactions. A well-chosen design makes it easier to organize essential details and helps your clients quickly understand the terms, leading to smoother communication and fewer payment delays.

Consider Your Industry and Clientele

Different sectors have varying expectations when it comes to financial documentation. For example, a freelancer working in creative fields may prefer a more visually engaging layout, while a consultant in a formal industry may need something more understated and professional. Take into account your target audience and the level of formality required when making your selection.

Check for Flexibility and Customization

It’s essential to pick a structure that can be easily personalized. Whether you need to adjust payment terms, add a logo, or include specific notes, the layout should allow for straightforward edits. Look for options that offer flexibility while maintaining a clean and organized appearance. This ensures that your documents will always look polished and accurately represent your brand.

Benefits of Using Free Templates

Utilizing pre-designed formats for your billing and financial documents offers several advantages. Not only does it save you time, but it also ensures that your statements are consistent, professional, and error-free. By choosing ready-made designs, you eliminate the need to manually create a new document from scratch, allowing you to focus on more important tasks. These structures help streamline the process, whether you’re handling a few transactions or managing ongoing client relationships.

Time and Cost Efficiency

One of the key advantages of using pre-made formats is the significant time and cost savings. Creating a layout from the ground up can be a lengthy process, especially if you’re not familiar with design principles. With an established structure, you can quickly input your details and generate a document in just minutes, without needing to invest in expensive software or spend hours on customization.

Consistency and Professionalism

Another major benefit is the consistency it brings to your documentation. Having a standardized layout ensures that each document you send out looks professional, enhancing your credibility and helping clients feel more confident in your work. Whether you’re dealing with large contracts or smaller, one-time services, your clients will appreciate the clarity and neatness of a well-organized statement.

| Benefit | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Time-Saving | Quickly create and customize documents without starting from scratch. | ||||||||

| Cost-Effective | No need for paid software or design services. | ||||||||

Prof

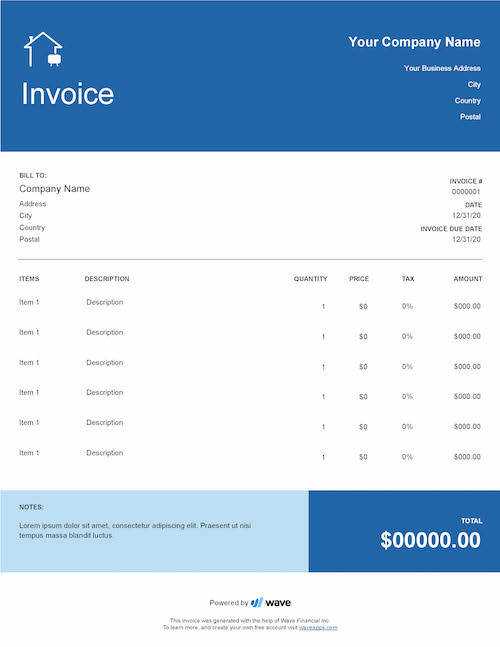

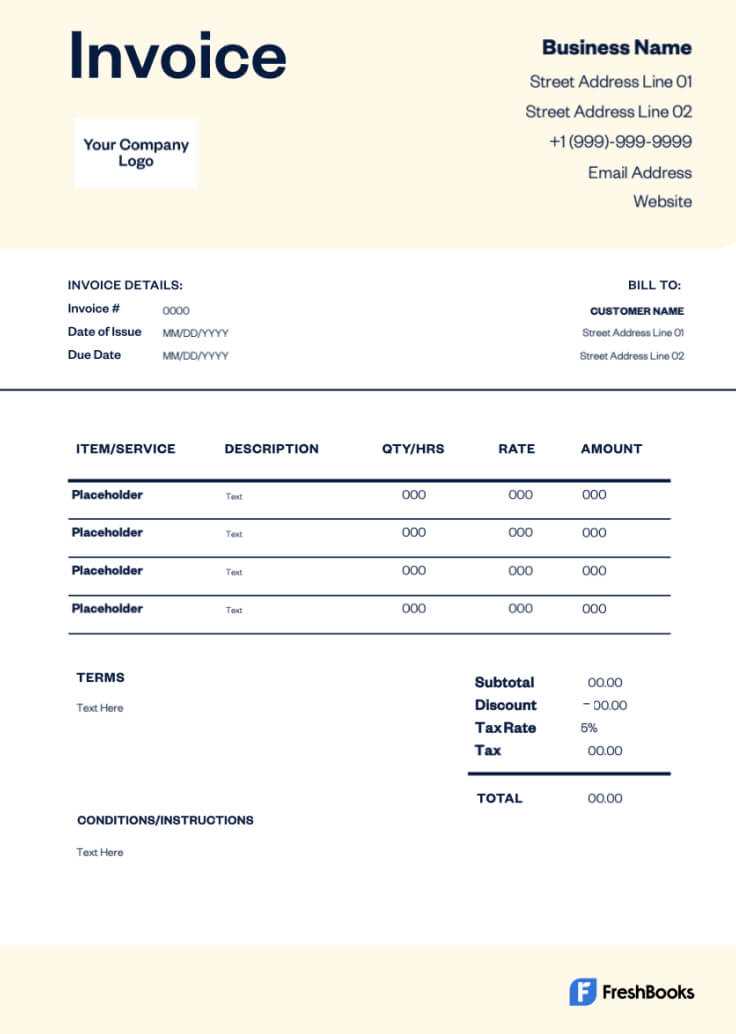

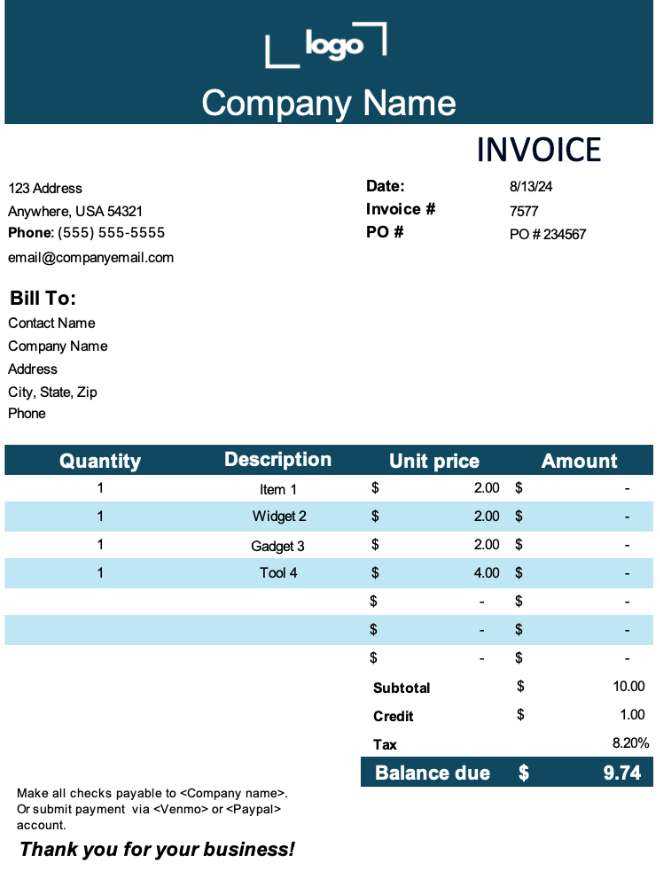

Best Free Invoice Template WebsitesWhen it comes to managing financial transactions, having a well-structured document for recording payments and purchases is essential. The internet offers numerous platforms where you can access high-quality forms designed to meet various professional needs. These resources provide an efficient way to create polished documents quickly, often with customizable options that cater to different industries and service types. Some websites stand out for offering intuitive tools that allow for easy editing and personalization, making it simple to adapt the design to specific requirements. Whether you need a minimalistic layout or something more detailed, these platforms provide flexibility and functionality to help you stay organized and professional. Here are a few platforms that are popular for their diverse selection of downloadable resources: 1. Canva – A widely-used design tool that offers an array of editable templates. Canva provides an intuitive drag-and-drop interface, allowing users to easily customize text, colors, and logos to fit their needs. 2. Invoice Generator – A straightforward website that offers simple yet professional forms for creating various types of documents. The platform is user-friendly, with quick setup and easy export options for both digital and printed formats. 3. Zoho Invoice – Known for its comprehensive suite of services, Zoho also offers easy-to-use tools to create professional forms. The platform integrates with other business management tools, which can streamline accounting tasks and reporting. 4. Microsoft Office Templates – For those who prefer to use traditional software, Microsoft offers a wide range of downloadable layouts that can be edited in Word or Excel. The templates are customizable and ideal for those who need a simple yet reliable option. 5. FreshBooks – Although it’s a paid service, FreshBooks offers a limited number of templates available for free. The templates are clean, modern, and easy to adjust, making them a great option for those just starting out. Customizing Your Invoice TemplateTailoring your document to reflect your brand’s identity and meet specific requirements is an important step in ensuring clarity and professionalism. Personalization can help improve the aesthetic appeal and functionality of the form, ensuring that all necessary details are easily accessible to your clients or partners. Customization goes beyond just adding your logo; it involves adjusting the structure, colors, and information flow to create a cohesive and user-friendly layout. Designing the LayoutOne of the first things to consider when personalizing your form is the overall layout. The format should be clean and well-organized to help both parties quickly identify key information. Ensure that sections such as payment details, client information, and services rendered are clearly separated, either through spacing, borders, or background shading. A logical flow from top to bottom or left to right is essential in guiding the reader’s eye through the document. Adding Your BrandingIncorporating your brand elements, such as colors, logos, and fonts, helps reinforce your professional identity. Make sure that your logo is prominently displayed, ideally in the header, while choosing fonts and colors that align with your overall brand style. Consistency in design not only builds trust but also creates a cohesive experience for your clients, whether they are receiving the form digitally or in print. Additional Features to Consider:

How to Save Time with Templates

Utilizing pre-designed documents can significantly streamline your workflow, reducing the need to start from scratch each time. By using ready-made structures, you can focus on the essential details, ensuring that you don’t waste valuable time formatting or re-entering repetitive information. These tools are designed to help you quickly generate professional forms, allowing you to meet deadlines without compromising quality. Quick Setup and CustomizationOne of the biggest advantages of using pre-made structures is the ability to customize them in minutes. Instead of manually adjusting every aspect of the document, you can simply input the necessary data, adjust a few fields, and instantly create a professional-looking record. Most platforms allow you to save your adjustments for future use, enabling faster turnaround times for subsequent projects. Consistency Across DocumentsMaintaining consistency in your documents is crucial for a professional appearance. Pre-designed formats help ensure that every document you create follows the same structure, layout, and design principles. This consistency not only saves time but also enhances your brand identity, as clients or customers will quickly recognize your forms and become familiar with their structure. Additional Time-Saving Tips:

|